While some housing pundits are talking about demand being “overwhelmed by supply” and others are throwing out estimates of an “excess supply” of over 3 million homes, buyers that we are serving across the country keep telling us the same thing over and over this spring: “Selection stinks!”

Worse yet, when they do finally find a home that they want, they often submit an offer only to find that theirs is one of multiple offers that the seller has received—increasingly our agents are reporting bidding wars and multiple offers in numerous markets.

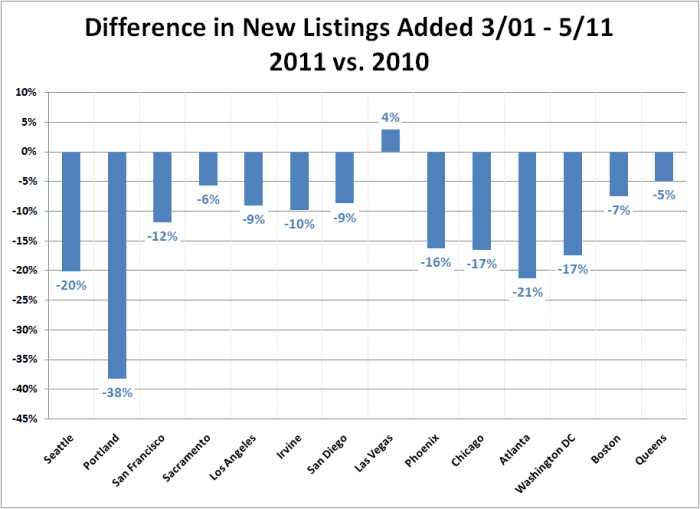

So what’s going on? How can inventory be high but buyers are hitting slim pickings and multiple offers? Well, for starters, although listings may be up from January—which is true every year due to the annual winter hibernation of the housing market—on-market inventory and new listings aren’t actually all that high for this time of year. In fact, in every Redfin market except Las Vegas, new listings are down from last year:

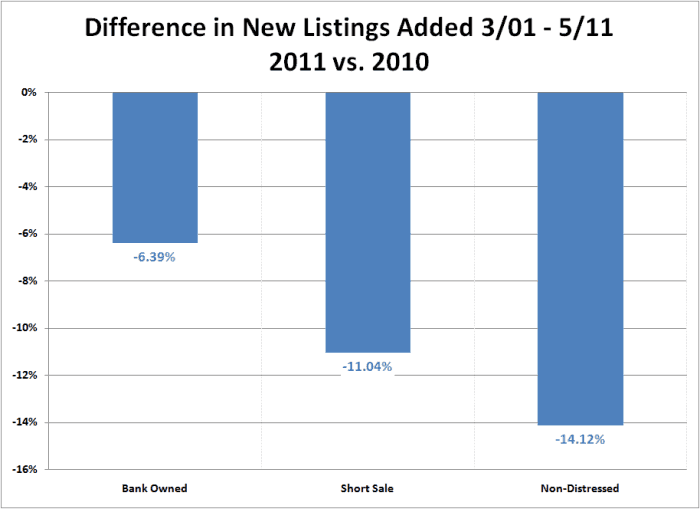

Not only that, but new listings of non-distressed homes, which are more frequently well-kept and owner-occupied (i.e. the kind of home that most non-investor buyers are interested in), are falling over twice as fast as bank-owned (REO) listings:

This result isn’t suprising at all if you’ve spent any time talking with home owners lately. Anyone who doesn’t absolutely need to sell seems to have decided to wait out the market, either hoping for a better opportunity to list their home next year or just renting it out to take advantage of a supposedly increasingly hot rental market.

Of course, if we’re trying to figure out what’s going on in the market today, and where we’re headed, we can’t just pretend that the distressed listings don’t exist.

When it comes to pricing, REOs are selling for 20% to 50% less than similarly-sized non-distressed listings, but the price trends of the two have been moving in the same general direction over the last year (click any of these charts to enlarge):

The overall price trend (both for REOs and non-distressed homes) has been down in most markets over the last year (Boston and Washington DC’s flat prices are two notable exceptions). Meanwhile, sales are slowly clawing their way out of the post-tax-credit gutter, but a decent recovery in sales is currently being held back by a serious lack of quality inventory.

Allow me to illustrate today’s market dynamics by way of a Venn diagram (because who doesn’t love Venn diagrams?):

If we don’t start to see more listings from owners who have the equity to put their homes on the market, prices of increasingly rare non-distressed listings seem likely to stop falling soon, just due to basic supply and demand. Of course, that claim leads to the big question: how soon?

Ultimately, supply and demand are the primary drivers of the real estate market, but prices seem to react to these inputs about as fast as a three-toed sloth. While the bubble was inflating, it took over a year of declining sales and increasing inventory before prices peaked and began to fall. Although on-market inventory has been declining since mid-2008, the slow recovery of sales along with a shift in psychology away from home ownership has delayed the turnaround of prices (oh yeah, there was also that delightful government meddling in the form of a giant handout that paused a true price correction for over a year as well).

Ultimately, supply and demand are the primary drivers of the real estate market, but prices seem to react to these inputs about as fast as a three-toed sloth. While the bubble was inflating, it took over a year of declining sales and increasing inventory before prices peaked and began to fall. Although on-market inventory has been declining since mid-2008, the slow recovery of sales along with a shift in psychology away from home ownership has delayed the turnaround of prices (oh yeah, there was also that delightful government meddling in the form of a giant handout that paused a true price correction for over a year as well).

As Calculated Risk recently pointed out, home prices are not far above their historic lows, although it’s a pretty safe bet that we’ll have a bit of an overshoot on the downside, followed by at least a few years of flat prices (which is down when inflation is factored in).

Foreclosures are still quite high and will likely take three to five years to work through, but growth in both the beginning and the end of the foreclosure pipeline seem to be backing off their 2010 peaks. The worst seems to be behind us on that front.

Every region has different dynamics, but with generally lousy selection, slowly recovering sales, and years worth of foreclosures to work through, where does that put us today, and through the end of this year? Barring some unforseen economic black swan, most of us here at Redfin think prices in most regions will probably stop falling by this time next year, while the more optimistic among us expect prices to end the year higher than where they are today. Sales will continue their sloth-like increases, foreclosures will be slowly but surely absorbed (many by all-cash investors), and hopefully, non-distressed sellers will begin to return to the market.

Is this a bottom call? Not really. Nobody is able to perfectly time the market, including us. No matter where we think the bottom is, we’re probably wrong (just like certain other recent high-profile predictions). Is buying a home today less risky than it was five years ago? Absolutely. Will buying a home ever be a risk-free proposition? Sorry, nope.