The U.S. housing market is off to a strong start in 2020 as a deepening shortage of homes for sale and surging homebuyer demand are set to push prices up at the fastest rate in years. Buyers may be coming out of winter hibernation early, but so far the sellers are few and far between, which is setting the stage for intense competition even as the year has just begun.

Redfin CEO Glenn Kelman has previously called Super Bowl weekend “the weekend where the housing market either goes crazy or it takes a nap.” This year, we may not need to wait until game time to see how the housing market is playing out. Homebuying demand is spiking in January as many potential homebuyers are turning into active homebuyers well in advance of the typical spring peak homebuying season.

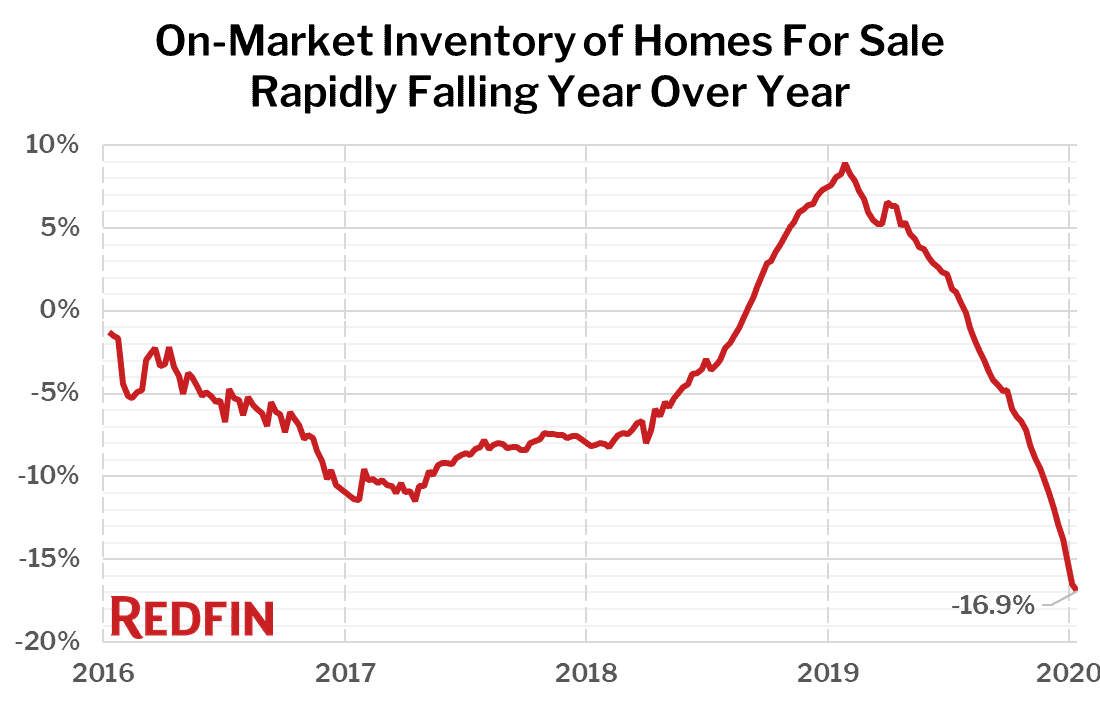

Unfortunately, the supply of homes for sale has so far been unable to keep up with surging demand. Recent data from the National Association of Realtors show December housing inventory at just 1.4 million units—the lowest level in at least 20 years. Low mortgage rates could also be to blame for the shortage of homes for sale, as homeowners are content to sit on their cheap mortgages rather than list their homes, even when they choose to move up to a larger house.

“With every new release of data this year, I’m becoming more and more confident that demand will be strong in 2020—just as strong as, if not stronger than, in 2018 and 2017,” said Redfin chief economist Daryl Fairweather. “The big question for the housing market this year is supply. Will homeowners sit on the sidelines, content with their refinanced loans, or will they want to get in on the action too and move up, move down, or cash out entirely? New construction is beginning to pick up in some markets though, so even without new listings of existing homes there will be some relief for homebuyers hoping for more selection. However, due to the high cost of acquiring and developing land in expensive coastal cities, much of that new construction will be built far away from urban centers or in already affordable metros.”

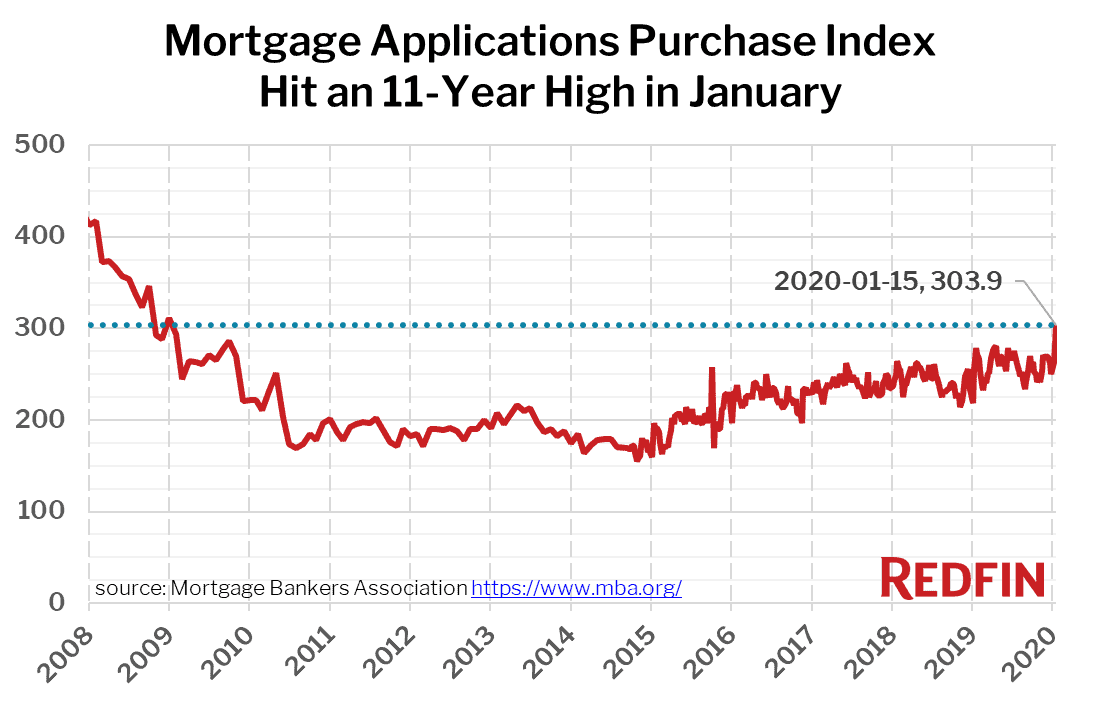

It’s typical to see a spike in early homebuying activity, but this year the jump is unusually large. On January 15, the Mortgage Bankers Association released data showing that their Purchase Index—a measure of how many homebuyers are applying for new mortgages—hit an 11-year high. In addition to public data, like the MBA Purchase Index, internal Redfin data—including the number of Redfin users touring homes with our agents—are also showing big year-over-year gains.

Unless a lot of new housing inventory hits the market soon, the 10-year peak in homebuying demand coupled with a 20-year low in the number of homes for sale will lead the housing market straight into the mother of all inventory crunches. That could result in a sudden and rapid rise in bidding wars and spiking home prices.

“It is busier than I expected this year,” said Redfin Boston listing agent Delince Louis. “My first listing of the new year has already received four offers. Low interest rates and low inventory are fuelling activity, and we are seeing activity now that we normally wouldn’t see until March. 2019 was slow, people were worried about a recession, but this year is back to being competitive. A lot of millennials who put their searches on pause last year are coming back now, and they are coming back early because they want to beat the rush.”

Seattle Redfin agent Shoshana Godwin says 2020 already feels busier than even the craziest times in 2017. “I’m regularly seeing homes with well over a dozen offers that sell for hundreds of thousands above list price, even in the middle of our recent snowy week. In a typical year, I’d say to wait it out and expect more homes for sale in the next few months… but now I’m warning clients prices may only continue to rise and the inventory may not appear.”

If the data continues coming in as strong as it has through the first few weeks of January, 2020 may turn out to be the most robust housing market in a decade. That’s great news for those looking to sell a home, but for homebuyers it will mean increasing competition and rising prices.