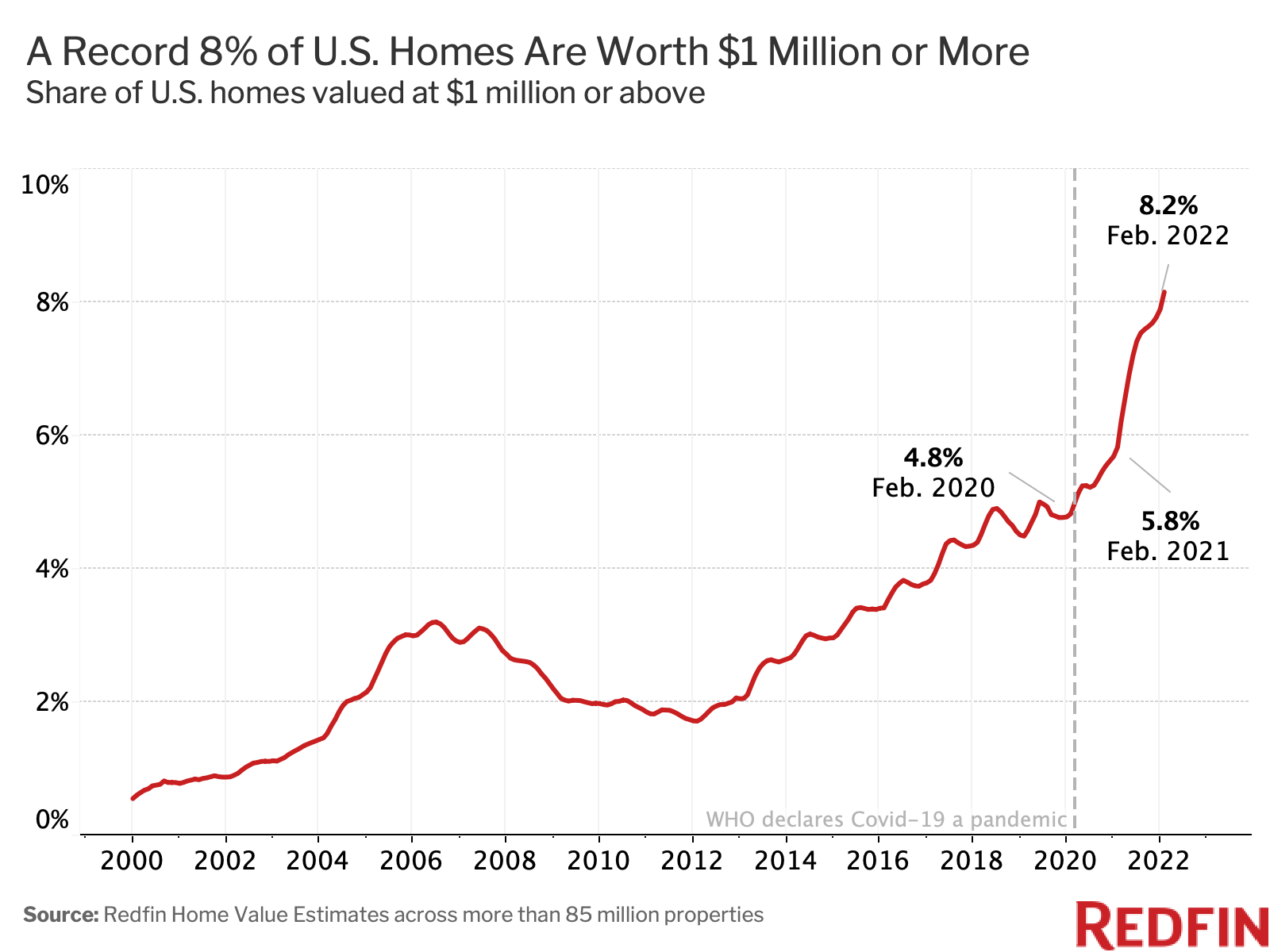

Nationwide, a record 8.2% of U.S. homes (6 million) were valued at $1 million or more in February. That’s up from 4.8% (3.5 million) two years earlier, just before the coronavirus was declared a pandemic. The Bay Area led the way, with nearly nine out of 10 properties in both San Francisco and San Jose falling into the $1 million-plus category. Meanwhile, the biggest increase was in Anaheim, CA, where the share of homes worth at least $1 million nearly doubled to 55%.

This analysis uses the Redfin Housing Value Index—a model that incorporates the Redfin Estimate, public records and MLS data to estimate the current and historical value of more than 85 million properties in the U.S. The figures in this report represent February 2022, unless otherwise noted. See the end of this report for a detailed methodology.

Home values go up over time, so it makes sense that million-dollar homes would take up an increasingly large chunk of the housing stock. But their slice of the pie has grown especially rapidly during the pandemic amid a surge in home prices and buyer competition. Prices have skyrocketed because housing demand has far outpaced supply as scores of Americans have moved to take advantage of record-low mortgage rates and remote work.

During the four weeks ending Feb. 27, the number of homes for sale plummeted 50% from two years earlier to an all-time low of 456,000. That helped fuel a 33% rise in the median U.S. home-sale price, which hit a record high of $363,975.

“The surge in housing values has turned many homeowners into millionaires, but has pushed homeownership out of reach for a lot of other Americans,” said Redfin Deputy Chief Economist Taylor Marr. “Incomes have increased, but not as fast as home prices, which means many people are stuck renting or have to move somewhere more affordable if they want to buy a home.”

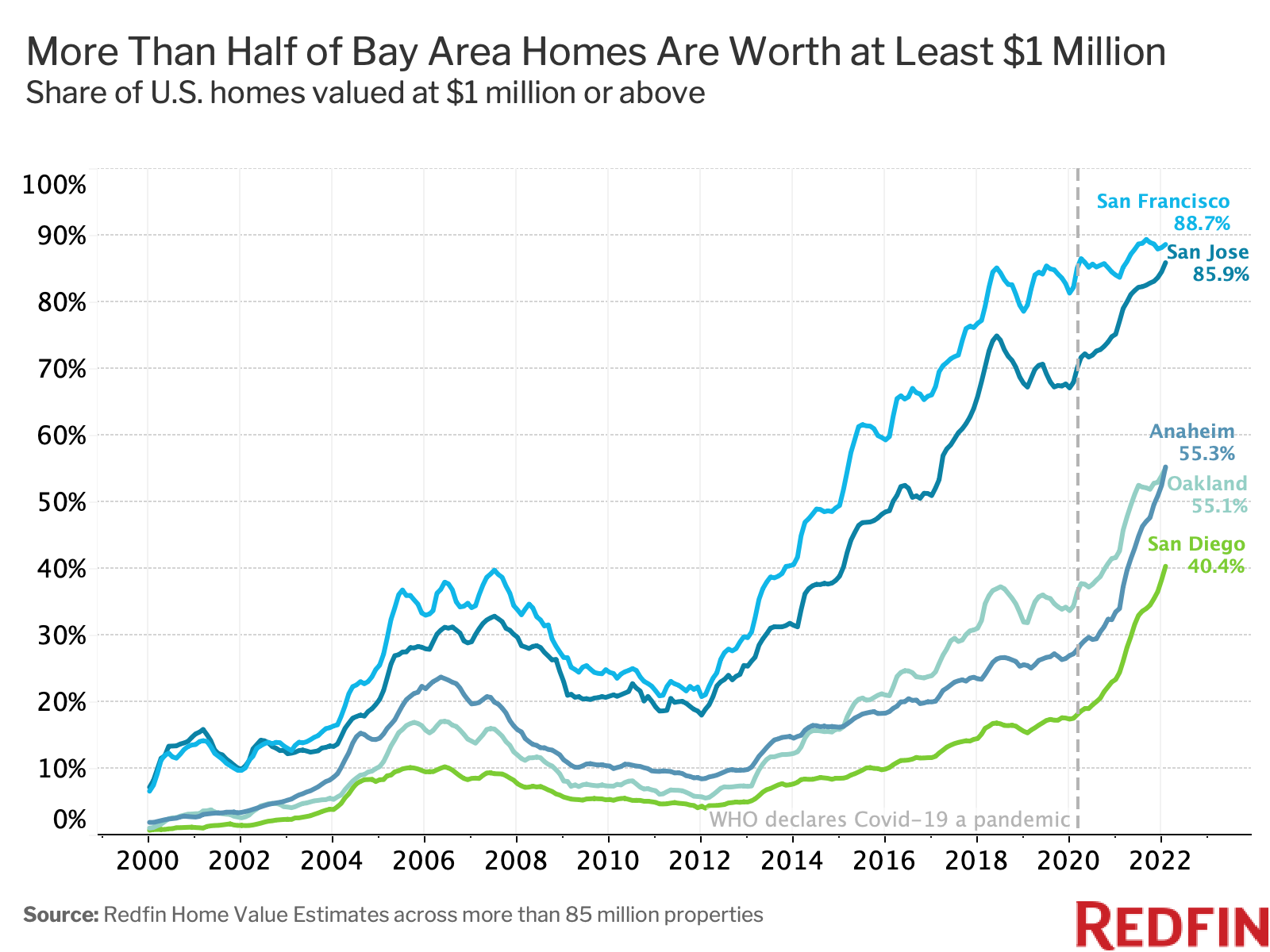

In San Francisco, 88.7% of homes were worth at least $1 million in February—the highest share among the 100 most populous U.S. metropolitan areas. Next came five more California metros: San Jose (85.9%), Anaheim (55.3%), Oakland (55.1%), San Diego (40.4%) and Los Angeles (38.5%). Rounding out the top 10 were Honolulu (37.1%), Seattle (36.5%), New York (32.1%) and Oxnard, CA (31.2%).

Anaheim and Oakland passed the 50% threshold for the first time in 2021 as housing values soared, while Los Angeles, San Diego and Honolulu passed the 33% mark for the first time. Seattle crossed the one-third threshold for the first time in January 2022.

The Bay Area has long been the most expensive place to buy a home in the U.S., and has become even less affordable during the pandemic. The median sale price in both San Francisco and San Jose was $1.4 million as of January, up 5% and 13% year over year, respectively. While prices in San Francisco have climbed at a slower clip than the country as a whole, it’s notable that the area continues to see price gains despite an exodus of residents.

In Elgin, IL, just 0.1% of homes were worth $1 million or more in February, a lower share than any other metro Redfin analyzed. Next came El Paso, TX, Columbia, SC, McAllen, TX, Dayton, OH and Buffalo, NY—all at 0.2%. The other metros where less than 0.5% of homes were valued at $1 million or more were Akron, OH, Gary, IN, Springfield, MA, Rochester, NY, Wilmington, DE, Detroit and Allentown, PA. These are all places with relatively low home prices.

In Anaheim, CA, 55.3% of homes were worth at least $1 million in February, up from 27.2% two years earlier. That 28-percentage-point increase represents a bigger jump than any other metro Redfin analyzed. Next came San Diego (+22.8 ppts), Seattle (+21 ppts), Oakland (+20.7 ppts) and San Jose (+18 ppts).

Many of these places already have median home-sale prices close to $1 million, which is one reason they’ve seen such large increases in the share of $1 million-plus homes. The median sale price in Anaheim, for example, was $959,000 in January. That was up 19.9% year over year, outpacing the 14.2% national gain.

Anaheim has grappled with an especially severe housing shortage, which has contributed to the surge in prices. The number of homes for sale in the metro plummeted 42.5% year over year in January—a larger drop than all but one metro Redfin analyzed. It was also the third most competitive metro based on the share of homes selling above their list price (62.6%).

“House hunters in Anaheim are regularly competing with dozens of other people. In the past month, I helped one buyer compete against 42 bidders and another compete against 26. Low mortgage rates and a lack of inventory are the main factors driving the surge in bidding wars and prices,” said local Redfin real estate agent Linda Tessitore. “This week, one of my buyers offered $1.57 million for a Costa Mesa home listed at $1.5 million. The seller came back and said they’d need to offer at least $1.75 million to compete. My client opted to look elsewhere because they couldn’t afford to go $200,000 over their budget for an 1,100 square-foot home. I’m starting to see buyers widen their searches to cities like Corona, Temecula and Riverside.”

The metros with the highest share of $1 million+ homes in February 2022 are at the top of the table below, while those with the lowest share are at the bottom.

*NOTE: The original version of this table included data for Albuquerque, which was deemed unreliable upon further investigation. The removal of Albuquerque did not impact the national figure.

This analysis uses the Redfin Housing Value Index—a model that incorporates the Redfin Estimate, public records and MLS data to estimate the current and historical value of more than 85 million single-family homes, condos, townhouses and multifamily properties in the U.S.

To calculate current values (February 2022), the Redfin Housing Value Index uses the Redfin Estimate, which is available in most but not all parts of the U.S. To calculate historical values, it uses public records and MLS data on price per square foot trends by zip code (or city, county, or state when zip-code data is insufficient). The Redfin Home Value Index includes both existing homes and new-construction homes, and dates back to the year 2000. Homes are not added to the index until they are first built or sold.