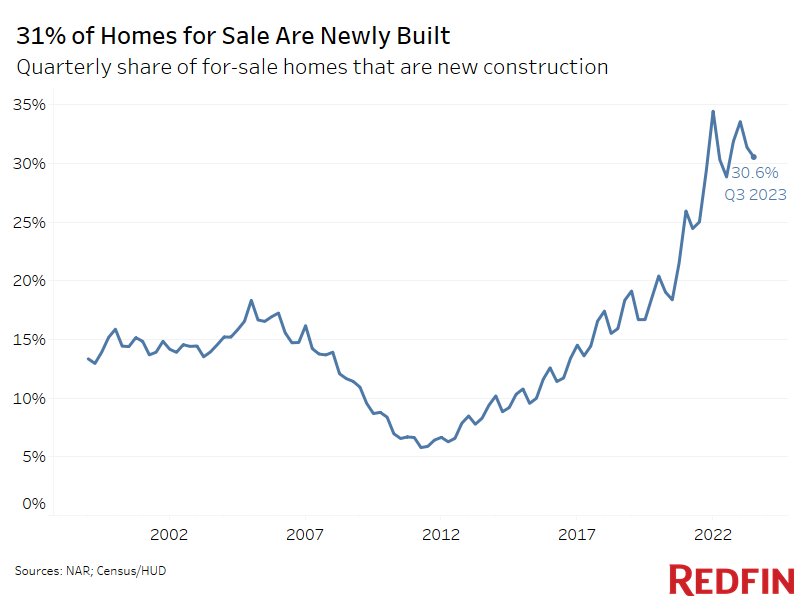

Nationwide, 30.6% of U.S. single-family homes for sale in the third quarter were new construction—the highest share of any third quarter on record. That’s up from 28.9% one year earlier and 25% two years earlier.

Newly built homes have taken up a growing share of for-sale housing inventory partly because homebuilding has increased and partly because the number of existing homeowners putting their houses up for sale has decreased as mortgage rates have surged to a 23-year high of roughly 8%.

High mortgage rates have pushed a lot of buyers to the sidelines, but many of the buyers who are in the market are opting for new construction homes because builders are handing out concessions like mortgage rate buydowns in order to attract bidders and offload inventory. Purchases of new single-family homes jumped 12.3% last month—the fastest pace since early 2022. It’s worth noting that the latest run up in mortgage rates could slow new-home construction.

“Sellers are facing tough competition from homebuilders, who are sometimes offering buyers up to $30,000 worth of concessions,” said Kim Lotz, a Redfin Premier real estate agent in Phoenix. “With that kind of money, a buyer can cover closing costs, home upgrades, and buy down their mortgage rate. In some cases, people who purchased a house from a builder a year ago are selling and competing against that same builder for buyers.”