Get the latest real estate news right here. If you’d like to receive it monthly via email, just sign up.

Howdy Redfinnians!

Here at last is the round up of everything that moved this month in the real estate market. At Redfin, our agents are racing to keep up with all the folks who want to work with us, and our engineers are going deep, to build software to guide customers through home-tour scheduling and the escrow process. We’re hiring as many brilliant people as we can find, and occasionally popping up on talk shows to pick fights and chronicle our growth.

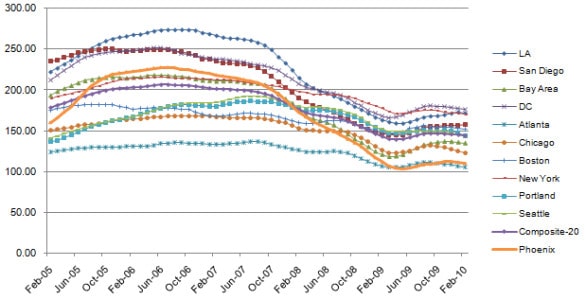

But enough about us. What’s happening in the market? The second dip has arrived! As we predicted in our last newsletter (“The Lull Before the Price Dip“) the Case Shiller update from Tuesday morning showed February home prices declining -0.9%, with the biggest drops coming in Chicago (-2.0%) and

Portland (-2.4%).

Because Standard & Poor’s has reported problems in how it accounts for winter-time lulls in demand, we are no longer using the seasonally adjusted numbers. Even if we had used the seasonally adjusted numbers, we would have seen a price dip — in fact, the first one in ten months for the 20-city index. Real-estate’s bubble bloggers are back in business!

Even as prices dropped in February, sales volume increased in March, because of low prices, but also low mortgage rates and the end of government credit. According to the National Association of Realtors, the number of existing homes that sold this March increased 16.1% over last March, and rose 6.8% over February (even when adjusting for seasonality); in Phoenix and Las Vegas, sales hit a multi-year high.

New home sales were way up too, with an eye-popping jump of 27% in one month. Much of this was due to the federal home-buyer tax credit, which expires today; mortgages for home purchases reached a six-month high this past week. We still expect a big spike in May sales when the California state tax credit kicks in, and may see nationwide prices recover temporarily when the data for April comes out, but otherwise we aren’t too confident that the summer will be as strong as it usually is. If interest rates weren’t so low, we’d be more worried.

Others share our concern. Robert Shiller, the economist who predicted both the real estate and Internet bubbles, believes the housing market will be vulnerable as the government withdraws support for lenders and home-buyers alike. The key question is whether the past three weeks of employment gains can begin to take up where government support leaves off.

A leading indicator for slackening demand is the percentage of Redfin’s offers that involved a bidding war: for homes under $500,000, the number drifted down from a high of 60% in January to 51% in April. The entry-level market is still competitive, with 80% of Southern California offers under $500,000 facing competition, but slightly less so. The funny thing is that, across all our markets, competition is increasing for homes over $500,000. This is almost certainly due to the first big dip in jumbo loan rates that we’ve seen in more than a year.

Even if demand wears itself out, the supply of distressed homes may reach a limit. Yes, the number of foreclosure filings in the U.S. reached record levels in March, a largely seasonal increase we had already anticipated in our February newsletter.

But what is noteworthy about the foreclosure filings is that more are in the final stages of foreclosure, not the early stages, suggesting banks are starting to work through their backlog of distressed inventory.

So we are sticking by our forecast from November that foreclosures will peak in mid-2010; in California we have already seen a decline in foreclosure activity on entry-level homes, only partially offset by more foreclosures on homes above $500,000.

The real change in the market has been in short sales, where a homeowner ducks foreclosure by selling the place and getting the bank to absorb any losses. After years of chaos, the banks are getting better about approving short sales in two or three months, which is why we think 2010 is the year of the short sale. For those concerned about prices, the predominance of short sales over foreclosures is good news; foreclosure can really trash a house, hurting property values across the whole block.

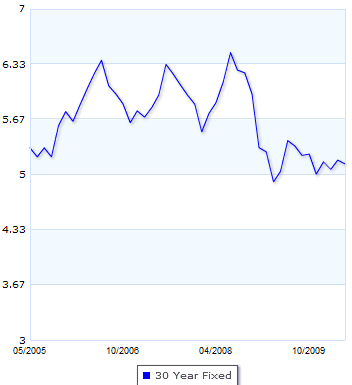

The other big bright spot is interest rates, which remain very low and have dropped slightly — to 5.06% for a 30-year mortgage — mostly because the U.S. government has promised to keep rates low for an “extended period.”

This is a big deal. As we’ve argued before, folks don’t pay enough attention to mortgage rates when thinking about the true cost of a home. We still expect rates to increase in the back half of the year, which would stifle demand. So that’s our take, though of course the truth is that anything can happen.

If you have any questions or comments, just write back or leave a public comment right here.

Best, Glenn