New rules on mortgages take effect today. They’ve been years in the making and inspired much hand-wringing by bankers and real estate professionals. The changes are a big win for homebuyers, but expect some bumpiness for the next few months as we transition.

The Consumer Financial Protection Bureau (CFPB), a government agency created after the housing collapse, has a new set of mortgage rules. It’s called Know Before You Owe or, less elegantly, the TILA-RESPA Integrated Disclosure. That’s TRID for short.

The consumer-protection law empowers buyers by making documents easier to understand (farewell, HUD-1). And it holds mortgage lenders more accountable for the kind of blatant bait-and-switch practices that have largely disappeared since 2009. In effect, TRID is a guardrail to keep us from going off track again.

As of today, when a home buyer applies for a mortgage, the rule applies.

For decades — literally — the housing industry and consumer advocates have tried to make home buying less complicated. If you haven’t had a towering stack of legalese dumped in front of you at closing, you’ve heard horror stories from friends who have. Homebuyers typically sign dozens of pages they never read.

In the Wild West days of real estate, bad guys — some lenders, title companies and, yes, agents — would inflate fees or change loan terms at the last minute, often at the buyer’s expense.

That bait and switch rarely happens anymore, but it should happen even less now. Loan estimates will be easier to read and homebuyers will get their final documents — the closing disclosure — well in advance. You’ll have at least three business days (as opposed to mere hours) to read and understand what you’re signing. Closing should be stress-free.

We’ve never done this before. There are new forms, new deadlines and bigger fines for companies that get it wrong. Prepare for technical glitches, too. Banks and settlement offices have had to build or buy entire software systems to comply with the law’s consumer privacy protections. Everything is untested.

Yes. But banks are freaked out and borrowers will feel their pain. Real estate is messy. Banks worry that even a small problem that’s not their fault, like a mispriced termite inspection, could expose them to fines of between $5,000 and $1 million per day.

Whoa. The average profit on a home loan is only about $1,500, according to the Mortgage Bankers Association. Lenders won’t be taking any chances — even small problems could prompt them to delay your closing.

“We’re scared,” said Rod Alba, a senior vice president at the American Bankers Association. “Be assured, banks are going to create some sort of buffer.”

No. In fact, it will be easier to shop for the best loan. Under the new rules, when you apply for a mortgage, lenders have three days to send you a written offer with lots of detail, including fees.

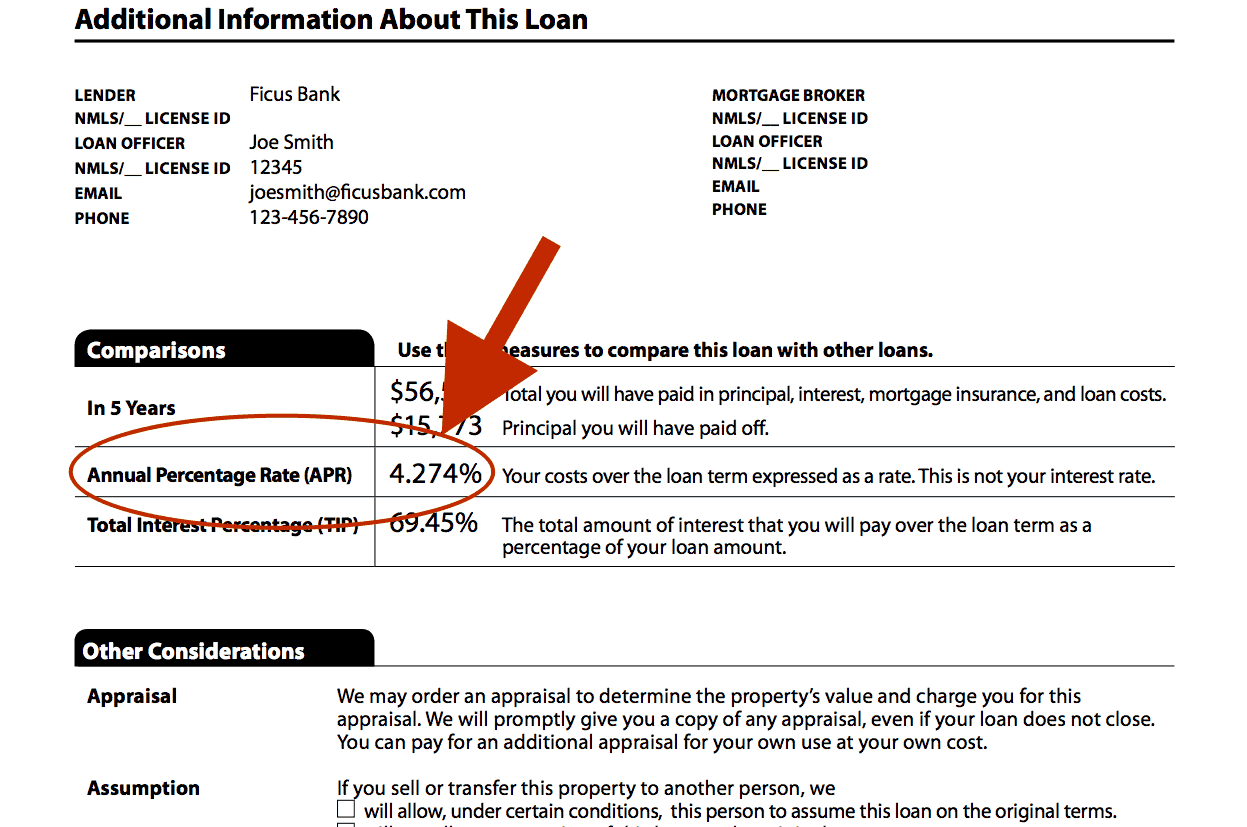

Better still, every loan estimate will look about the same, so you’ll be able to easily compare them. When you get one, look at the last page, where it says “comparisons”. That’s where you’ll find the annual percentage rate, or APR.

The APR isn’t your mortgage rate, it’s what your mortgage costs once points and fees are included. The law doesn’t reduce the line items involved in buying a house (couriers, notaries, surveys), but it will help you cut through the clutter when shopping around.

“Unless you’re a financial whiz, focus on the simple things, like plain-vanilla fixed rates,” said Andrew Pizor, an attorney at the National Consumer Law Center. “Look at the APR. Lower is usually better. If you stop there you’ll be fairly safe. All the other stuff is details.”

No, but until the kinks are worked out it might take longer. The CFPB says three things could trigger a three-day delay after you get your closing disclosure:

“Piddling little changes” won’t create delays, CFPB Director Richard Cordray said. Banks beg to differ, though, and your lender will make the ultimate call.

Things like a broken chimney or empty oil tank could affect APR, banks say. If a problem is discovered, some lenders will re-do your final documents, re-start the three-day clock, and delay closing.

“Each lender has its own policy of what constitutes a change that stops the show,” said Ron Haynie, a senior vice president at the Independent Community Bankers of America, a group of smaller lenders. “Everyone’s going to have to have patience,” real estate agents, buyers and sellers included, he said.

Maybe. Sellers might see offers with 45- or 60-day closings instead of the typical 30 days. Some buyers’ agents will build in extra time to protect their clients from delays, some won’t.

“You have more people touching the documents, more people reviewing the documents, and that’s going to take longer,” said Bill Burding, a board member at the American Land Title Association. On the plus side, “you’re going to have significant more quality control.”

Sellers will need to decide if they want to give buyers leeway. All things being equal, most sellers will give preference to offers with shorter closing times. Strategize with your agent.

Use a lender you trust. Use a lender you know. Use a lender your agent trusts and knows. Lenders, more than real estate agents, will be orchestrating your closing to a greater degree than ever.

If there’s a small mistake in the final closing paperwork, some mortgage companies will swallow the cost to keep your settlement on track. Others will put things on hold until every penny adds up.

“Stick with a local lender who has good reviews and has been in the industry at least three years,” Redfin agent Marcus Fleming said. “Don’t switch lenders once you go under contract. Lower rates could mean a higher risk of delays.”

There will be hiccups, but they shouldn’t last long.

“Industry actually does learn pretty quick,” Alba said. “At the end of the day, folks compete on service.”

Questions? Comments? Lorraine.Woellert@redfin.com