Last week, Fannie Mae and Freddie Mac made it a little easier to get a mortgage. This week, climate talks might actually yield something, Janet Yellen gives us her two cents–twice!–and Congress tries to avoid a government shutdown. On Friday, we get the most important jobs report of all time. Also: Cards Against Urbanity.

Every year, regulators for Fannie Mae and Freddie Mac decide whether they should help finance bigger mortgages. Generally speaking, they increase loan sizes only if home prices are up compared to their 2007 peak.

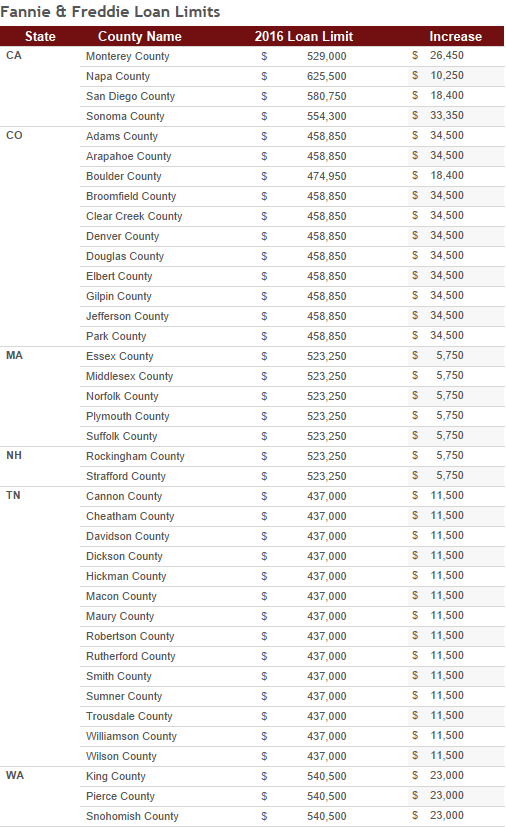

It’s no surprise Fannie and Freddie’s regulator, the Federal Housing Finance Agency (FHFA), hasn’t raised loan limits for the U.S. since the recession. But last week it did nudge some high-cost neighborhoods into a category that allows the mortgage giants to back bigger loans. As a result, homebuyers in 39 counties (out of 3,007 in the country) will be able to borrow more beginning next year.

That tweak to conforming loan limits isn’t a game changer. Loans backed by Fannie and Freddie are still too small to finance most houses in hot markets like Boston and San Francisco. That’s good or bad depending on your point of view. The California Association of Realtors says current loan limits, which are capped at $625,500, are too low and holding back the housing market. But do we want taxpayer-backed Fannie and Freddie to take on the risk of bigger loans? It’s a policy question Congress has been avoiding.

For now, homebuyers in parts of Massachusetts, Tennessee, California, New Hampshire and Washington will be able to get slightly bigger Fannie and Freddie loans. Details here and below.

While we’re at it, here’s another nugget: The FHFA says home prices nationwide are less than 1 percent below their high in March 2007. We’re almost back.

Some cities are beyond back. Denver, Dallas, Boston and Portland are above their pre-crisis peaks.

“Geezer jump”. Nearly 1.4 million households were created in the past year, according to the Census Bureau. Generally, that’s good for the housing market. What’s interesting is the jump wasn’t caused by millennials moving en masse out of mom’s basement. It was driven by adults 65 to 74. Economist Thomas Lawler calls it a “geezer jump”.

Regional inequality. Why don’t people move to where the jobs are? It’s a long story, and high housing costs are one reason. But more and more, geography determines economic fortune. (Geek factor: High)

Fun with architecture. Do you work from home? Your house probably isn’t built for it, but architects are pondering ways to fix that.

Tiny offices. Only 50 square feet, but better than a cubicle.

Forget skyscrapers. Vertical cities are the next big thing. You’ll never guess where they’re building one.

The new niche buyer. Wealthy Chinese. In Texas.

A gift idea for those hard-to-please hipsters. Awesome. (What’s a LEED? Hint: It has something to do with climate change.)

What do you want to know? Lorraine.woellert@redfin.com