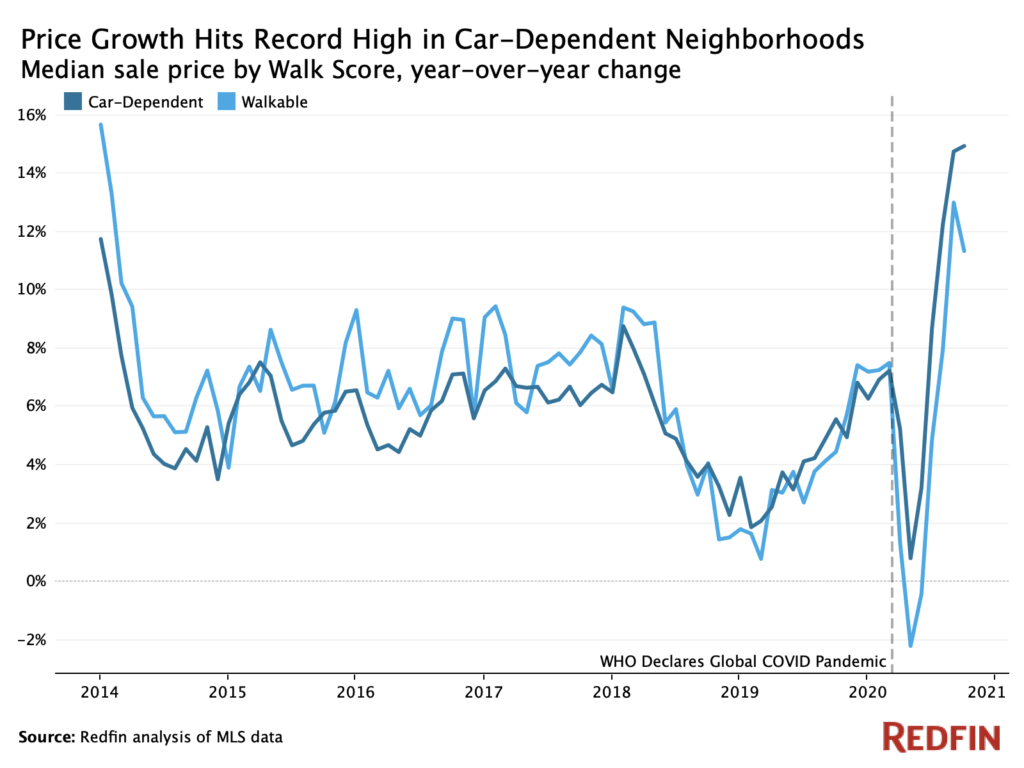

The median home-sale price in car-dependent neighborhoods nationwide rose 14.9% year over year to $345,000 in October, the biggest increase and highest price since Redfin and Walk Score® started tracking this data in 2014. Prices in walkable neighborhoods increased 11.3% year over year to a record $383,000, a sizable increase but smaller than the 13% annual rise in September.

Price growth plummeted to record lows with the onset of the pandemic in both types of neighborhoods, with prices dropping 2.2% year over year in walkable areas in May and rising just 0.8% in car-dependent areas. Since then, price growth has been on the rise in both neighborhood types, with the real estate market remaining red-hot throughout the summer and early fall as remote work drives people to explore homes in new areas.

That’s according to data from Walk Score®, a Redfin company that rates the walkability of neighborhoods, cities and addresses. A place is deemed “walkable” if some or most errands can be accomplished on foot, while “car dependent” means most errands require a car. Urban areas tend to be more walkable, while suburban and rural areas tend to be more car-dependent.

“With restaurants, bars and shops temporarily or permanently closed due to the pandemic, much of what makes walkable neighborhoods so desirable and valuable has been diminished this year,” said Redfin chief economist Daryl Fairweather. “Even though walkable, urban neighborhoods aren’t as hot as suburban and rural places this year, low mortgage rates have continued to fuel voracious homebuyer demand just about everywhere.”

“While I expect proximity to retail and restaurants to be higher on buyers’ priority lists once the pandemic has passed, the landscape of walkability may be forever changed,” Fairweather continued. “New businesses may open in previously unwalkable areas given increased demand for neighborhood restaurants and coffee shops from residents who moved in during the pandemic. That would make suburban and rural places permanently more attractive to buyers seeking walkability.”

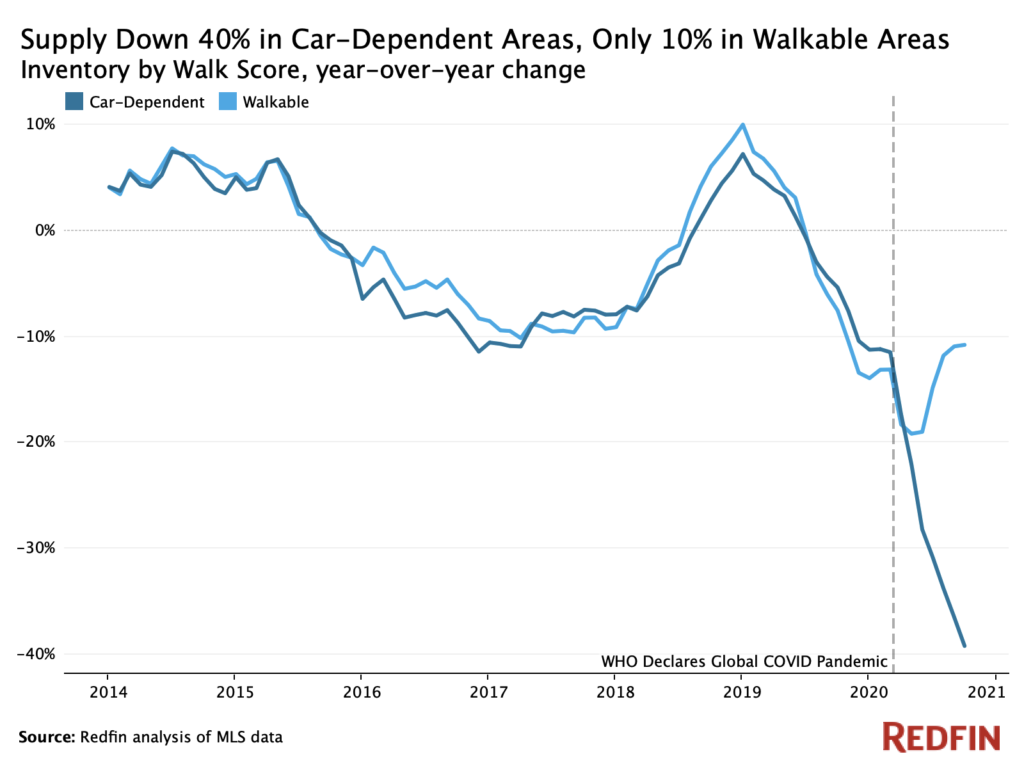

The number of homes for sale in car-dependent neighborhoods plummeted 39.2% year over year in October, nearly quadruple the 10.7% drop in walkable neighborhoods. Housing supply in car-dependent neighborhoods started dropping in July 2019, and has declined by bigger margins every month since the coronavirus pandemic hit in March.

The larger price increase and tighter supply in car-dependent areas this fall is due partly to the pandemic-driven popularity of suburban and rural neighborhoods, as people seek spacious homes for remote work and schooling and place less of an emphasis on commute times. Even before the pandemic, home prices in car-dependent areas had generally been rising faster, a trend that began in November 2018. That’s because many buyers who were priced out of expensive walkable neighborhoods turned to more affordable car-dependent areas. But even though walkable neighborhoods aren’t quite as hot as car-dependent places, prices were up and supply was down by double digits in walkable areas in October.

Homes in both car-dependent and walkable places were significantly more competitive in October than they were last year. The typical home in a car-dependent neighborhood nationwide spent 30 days on the market before going under contract—15 fewer days than the year before—compared with 31 days for homes in walkable neighborhoods, 11 fewer days than last year.

Breaking the housing market down by rural, suburban and urban areas shows a similar trend. Home prices in rural areas nationwide rose 18.3% nationwide in the four weeks ending November 8, versus 14.3% price growth in suburban areas and 15.6% growth in urban areas.

Car-dependent parts of the Miami metro saw home prices increase 14.6% year over year in October, while prices in walkable areas rose 8.2%, the biggest gap of any major metro in the country. In the New York City metro, prices in car-dependent areas rose 14.6% annually versus a 7.3% increase in walkable areas.

San Francisco was the only metro where prices in walkable areas declined, down 1.2%. In San Francisco’s car-dependent neighborhoods, home prices rose 4.9% year over year.

“There has been a migration from heavily urban neighborhoods in San Francisco and Oakland due to remote working, remote learning and public transportation becoming unnecessary for most people,” said Bay Area Redfin agent Suzanne Masella. “People are selling homes in urban places and moving to the suburbs because they’re more interested in single-family homes with yards than condos that are close to offices and urban amenities. Walkability is irrelevant for a lot of buyers right now, as offices, restaurants and shops are either closed or not the same as they used to be. But once the pandemic comes to an end, I expect people to move back into cities—and we’re already seeing the first signs of renewed interest in urban areas.”

Home prices in car-dependent parts of Philadelphia increased 21.1% year over year, a bigger increase than any other metro, followed by Newark, NJ (20.8%) and Pittsburgh (19.4%).

Many metros bucked the national trend and saw prices in walkable neighborhoods rise faster, led by Detroit and Kansas City, though homes in car-dependent parts of those metros still rose by double digits. In Detroit, home prices in walkable neighborhoods increased by 20.6% year over year, compared with 11.1% in car-dependent neighborhoods, and in Kansas City the increase was 23.8% for walkable areas and 14.9% for car-dependent areas.

“The majority of my clients in the last six months have been remote workers moving in from out of state, looking for affordability and a slower pace of life,” said Kansas City Redfin agent Jo Grammond. “People coming from San Francisco or Seattle are used to the convenience of walking to neighborhood shops and restaurants, and they can afford a home in a walkable location here even if they couldn’t in their home state. They’re also prioritizing a sense of community, and that’s easier to find in the center of Kansas City than the suburbs, where homes are typically more spread out and it can be difficult to meet people.”

This report is based on data from Walk Score®, a Redfin company that measures the walkability of addresses. For the purposes of this report, we combined three categories–Somewhat Walkable (ranking of 50-69; some errands can be accomplished on foot), Very Walkable (ranking of 70-89; most errands can be accomplished on foot) and Walker’s Paradise (ranking of 90-100; daily errands do not require a car)—into the “Walkable” category. We combined the two car-dependent categories—(ranking of 0-49; most errands require a car)—into the “car-dependent” category. “Walkable” means some or most errands can be accomplished on foot, while “car dependent” means most errands require a car.

Only metros where at least 1,000 homes in walkable neighborhoods sold in the third quarter were included in this report.