Demand for single-family homes surged during the pandemic—but it surged so much that condos are now all some homebuyers can afford.

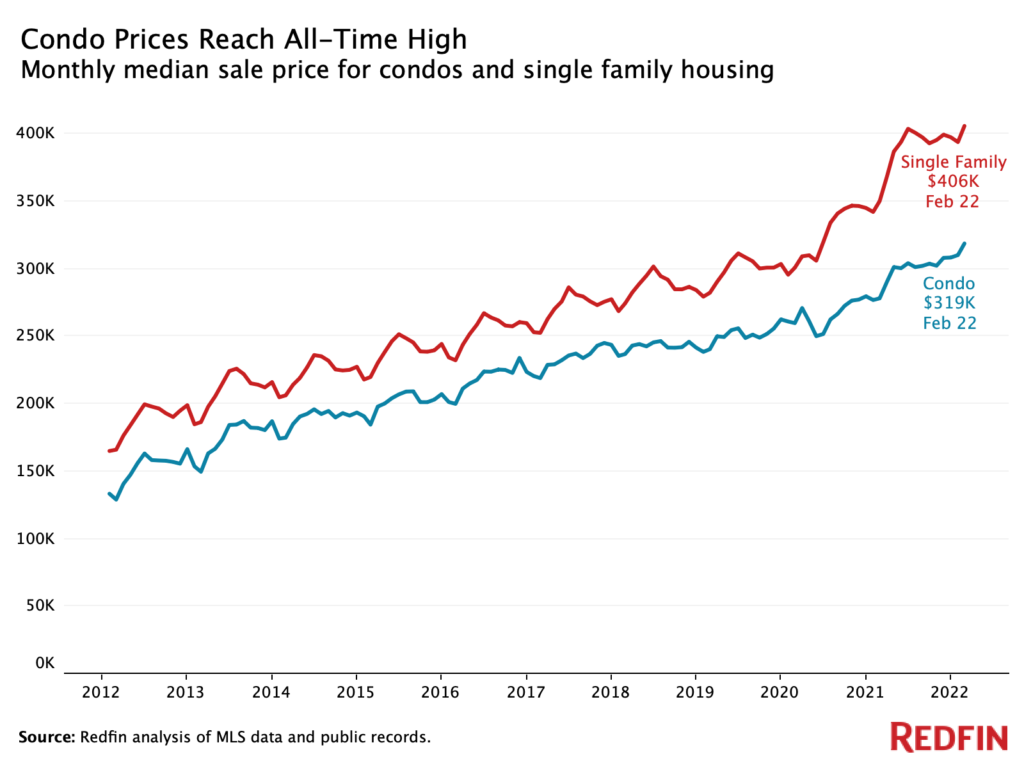

The typical U.S. condo sold for a record $319,000 in February, up 14.6% from a year earlier and 22.7% from two years earlier, just before the pandemic began.

Condos are in demand partly because they’re a comparatively affordable option amid skyrocketing home prices and rising mortgage rates. Single-family home prices hit a record $406,000 in February, up 15.9% year over year and up 34.9% from two years earlier.

Mortgage rates, meanwhile, surpassed 4% for the first time since 2019 this month, up from a record low of 2.65% in January 2021. The typical monthly mortgage payment rose 25% year over year to $2,123 in the four weeks ending March 13.

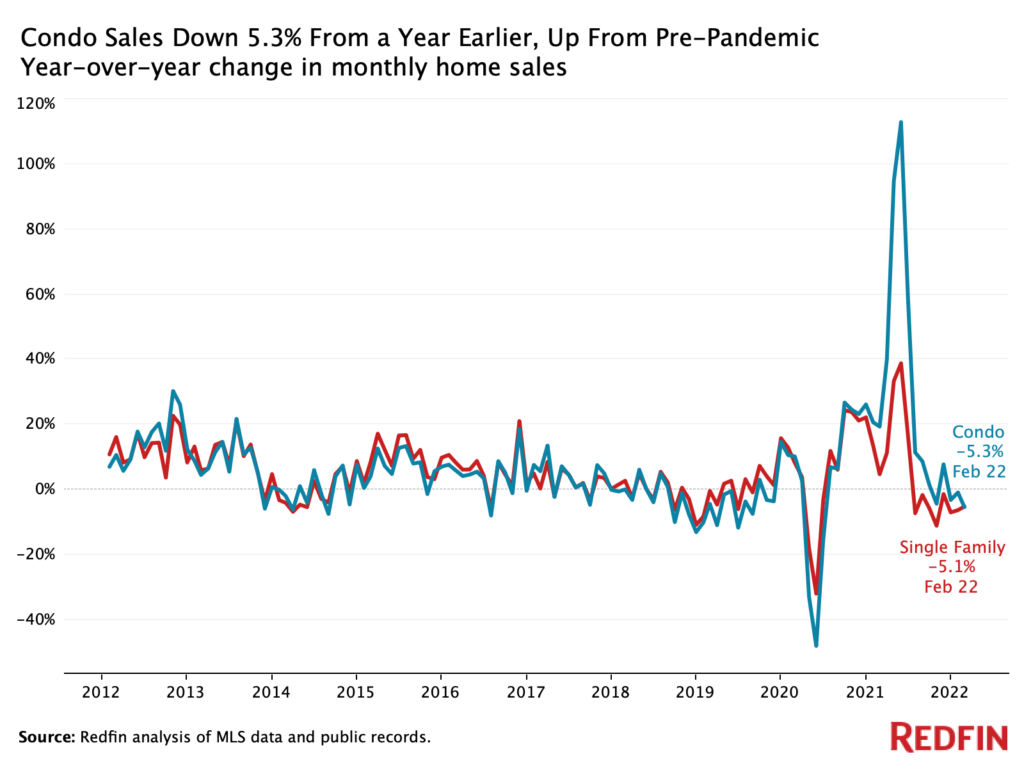

The fact that condos are nearly as hot as single-family homes marks a big shift from the beginning of the pandemic, when remote work and nerves about crowded spaces caused condo sales to plummet a record 48% and prices to drop the most since 2012. Now, with coronavirus cases declining and some Americans returning to the office, condos are an attractive option once again.

“The condo market has bounced back,” said Chance Glover, a Redfin manager in Boston. “People are no longer afraid to live downtown, close to the crowds–and they often prefer it, because they’re close to the office and all the amenities of the city. Rising prices are pushing single-family homes out of reach for a lot of buyers, so condos are affordable in comparison.”

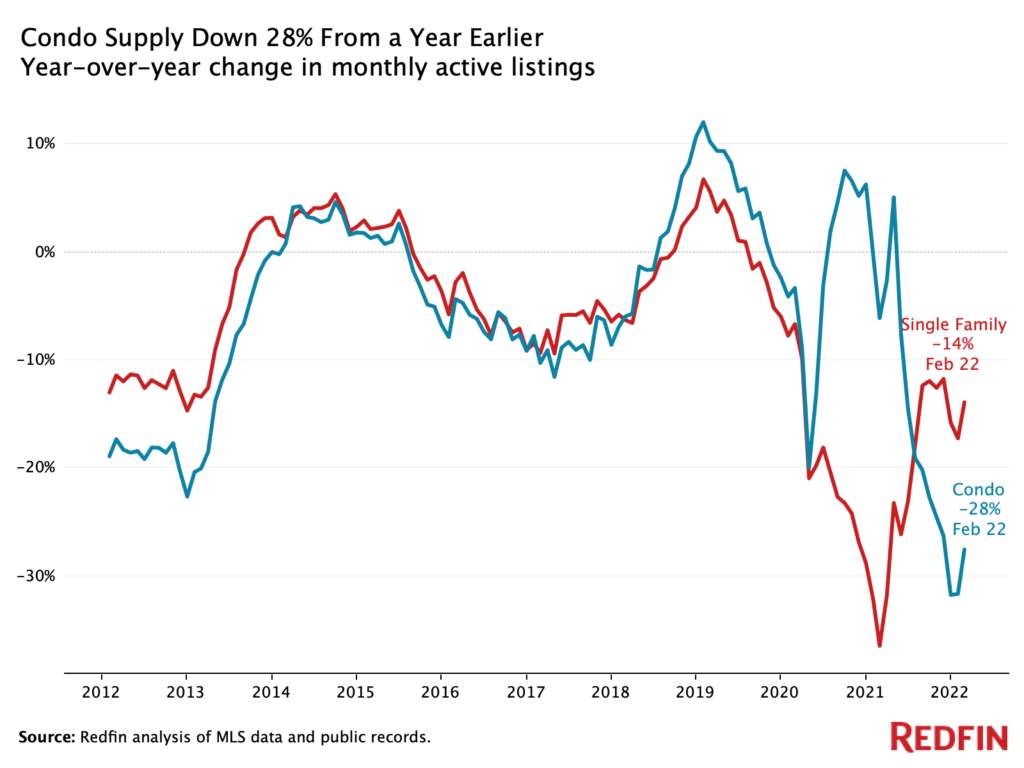

Condo prices have jumped up partly because of the severe inventory shortage and ensuing competition. Condo supply was just shy of a record low in February, down 28% year over year. New condos listings were down 6.1%. Condos are experiencing an even bigger inventory decline than single-family homes, which saw a 14% year-over-year drop and a 2.5% drop in new listings.

The supply shortage held back condo sales, which were down 5.3% year over year, in line with the decline for single-family homes. But condo sales were up 13% from February 2020, while sales of single-family homes were essentially flat over that same period.

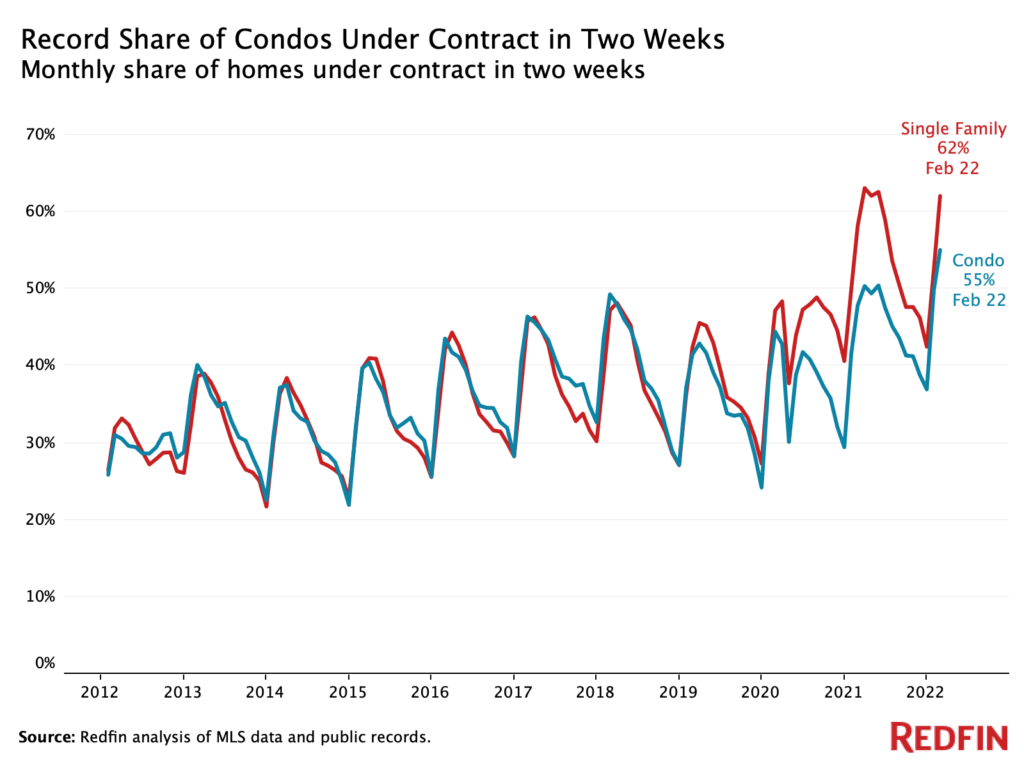

A record 55.1% of condos went off the market within two weeks in February, up from 47.9% a year earlier. The typical condo that sold in February went under contract in 30 days, 13 days faster than a year earlier.

By comparison, 62.1% of single-family homes sold within two weeks (versus 58.2% a year earlier), and the typical single-family home sold in 24 days (seven days faster than a year earlier).

Nearly two-thirds (64.6%) of condo offers written by Redfin agents faced competition in February, up from 49.3% a year earlier. That’s partly due to the lack of supply, with buyers competing for the few condos on the market. By comparison, 72.9% of offers for single-family homes faced bidding wars.

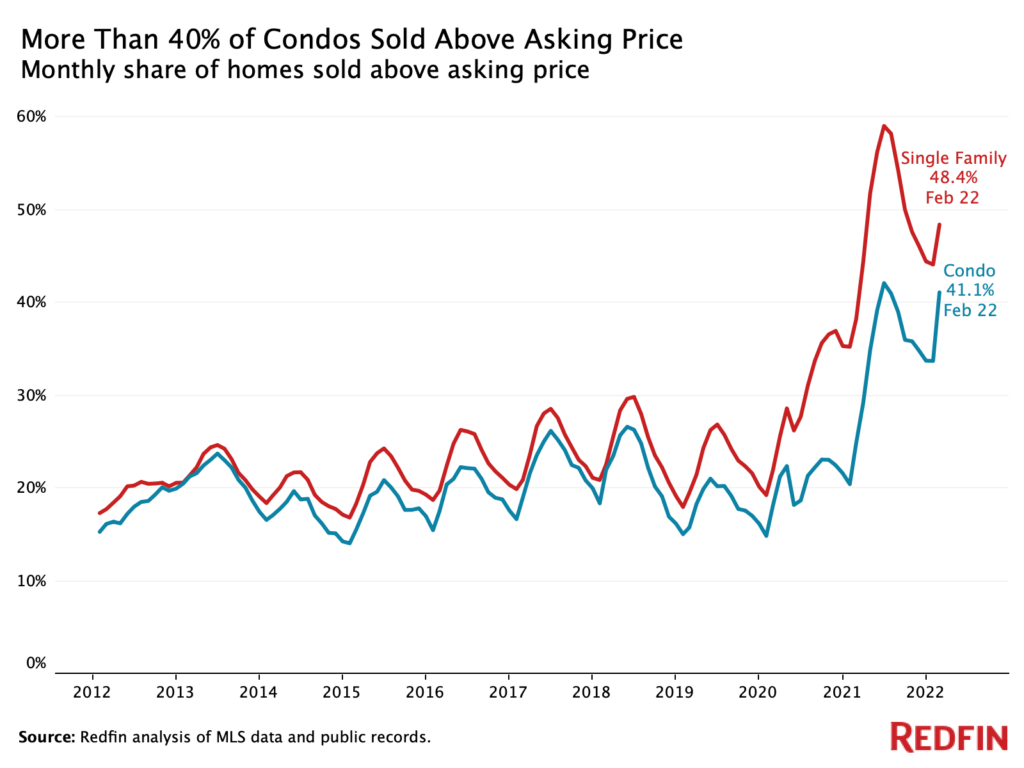

Meanwhile, 41.1% of condos sold above asking price, up from 24.9% a year earlier—another sign of increasing competition. Houses are still a bit more competitive, with 48.4% of single-family homes selling above list price (up from 38.2% a year earlier).

The typical condo sold for 0.6% above its asking price, near the record 0.7% premium set in June 2021. Last May marked the first time on record the typical condo sold for more than its asking price. The typical single-family home sold for 1.4% above asking price.

The ongoing demand for single-family homes is driven by permanent remote work and many Americans growing used to living away from city centers.

“While interest in condos has picked up since the start of the pandemic, a lot of homebuyers are still searching for single-family homes,” said Seattle Redfin agent Shoshana Godwin. “I’ve met with a few potential condo sellers who are worried about a lack of interest until Amazon and other companies are back in the office. Many people haven’t decided where to buy because their work-from-home policies are still indefinite, but I have noticed more buyers looking at condos since the beginning of the year, and many condos are receiving multiple offers.”

The highlights listed below are for the 67 metro areas in this analysis.

Prices

Sales

Supply

Speed

Competition