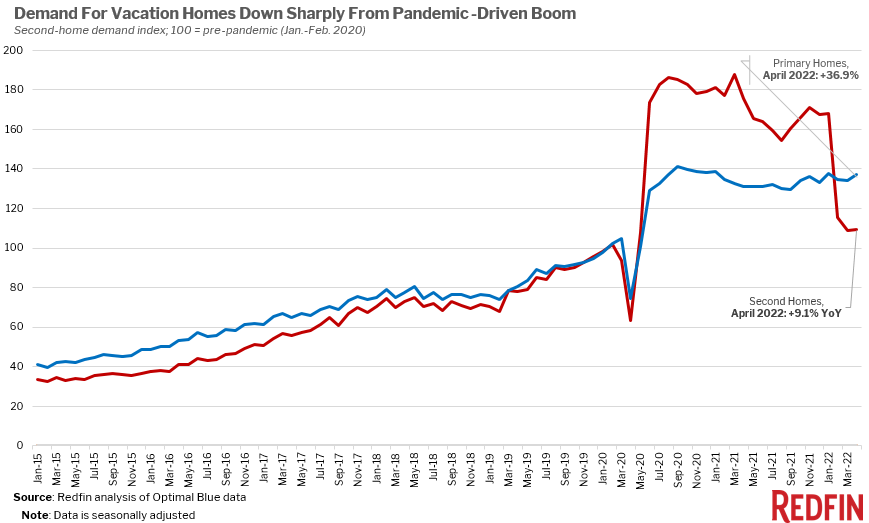

Sky-high prices, loan-fee increases and financial-market weakness are putting a dent in demand for vacation homes, which soared during the pandemic. There’s still more demand for second homes than there was before the pandemic.

Demand for vacation homes is way down after last year’s pandemic-driven boom.

Mortgage-rate locks for second homes were up 9.1% from pre-pandemic levels in April, essentially unchanged from a revised rate of 8.7% in March and down from 15% in February. That’s a drastic dip from the second half of 2020 and 2021, when demand soared as high as 88% above pre-pandemic levels.

The end of the pandemic-driven second-home boom comes as sky-high home prices and fast-rising mortgage rates price many buyers out of the market. Additionally, the federal government hiked loan fees for second homes starting on April 1, adding roughly $13,500 to the cost of purchasing a $400,000 home for the typical buyer.

“As monthly mortgage payments skyrocket, buyers are quicker to back away from second homes than primary homes,” said Redfin Deputy Chief Economist Taylor Marr. “Sky-high prices and soaring mortgage rates were already deterring buyers, and the new loan fees–along with weakness in the financial markets–are an added obstacle. While second homes are still a bit more popular than they were before the pandemic, it’s safe to say the vacation-home boom is over for now. We may see a resurgence in second-home demand when the stock market makes a comeback.”

Growth in demand for primary residences outpaced that of second homes for the third month in a row. Mortgage-rate locks for primary homes were up roughly 37% from pre-pandemic levels in April, a level that hasn’t changed much since mid-2020.

Homebuyer interest in vacation homes dropped sharply in February after a year and a half of intense demand. Interest in vacation homes started soaring in June 2020 with remote work and record-low mortgage rates, with demand hitting 54% or more above pre-pandemic levels for 20 straight months.

Now, the homebuying landscape is different. Some workers are back at the office and mortgage rates have shot up, reaching 5.27% in the beginning of May, up sharply from 3.1% at the beginning of the year.

The data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand during and before the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.