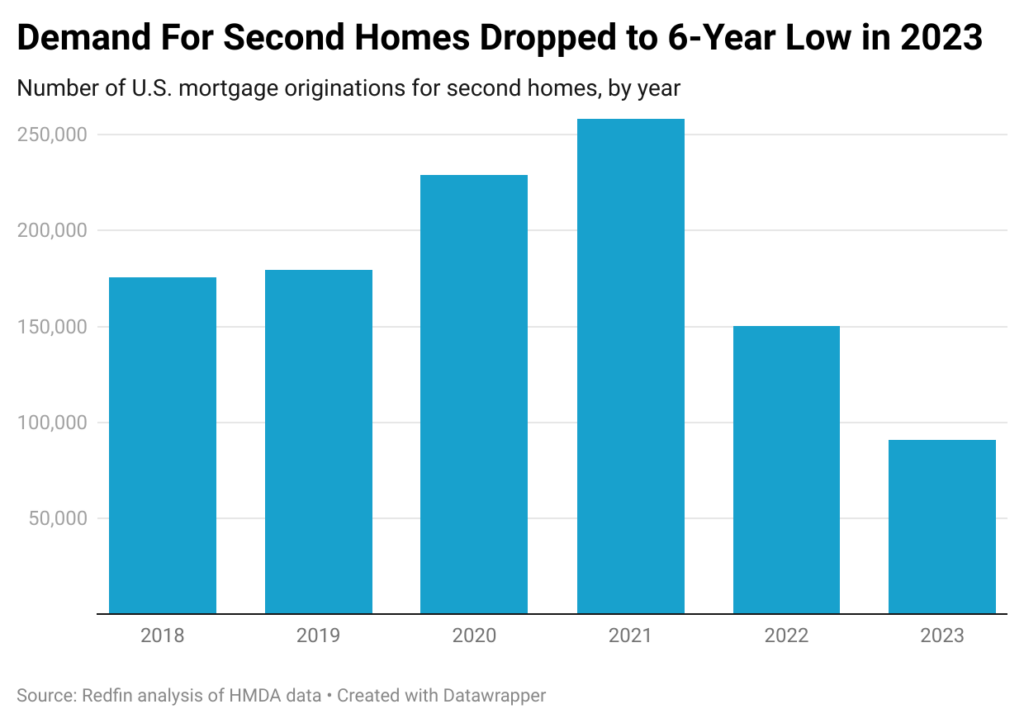

U.S. homebuyers took out 90,772 mortgages for second homes in 2023, down 40% from a year earlier and down 65% from the height of the pandemic housing boom in 2021.

For the sake of comparison, mortgages for primary homes fell at half that rate; they were down 20% year over year in 2023 and down 35% from 2021.

This is according to a Redfin analysis of Home Mortgage Disclosure Act (HMDA) data covering purchases of second homes, primary homes and investment properties from 2018 to 2023. The term “vacation home” is used interchangeably with “second home” in this report.

Home purchases fell across the board last year due to low inventory, high mortgage rates, and high home prices; 2023 was the least affordable year on record. Affordability hasn’t improved in 2024; monthly housing costs are at an all-time high. Mortgages for second homes dropped more than mortgages for primary homes for several reasons:

“Soaring prices pushed down demand for vacation homes last year, both for cash buyers and those getting a mortgage–but the latter pulled back even more because high rates exacerbated high prices,” said Phoenix Redfin Premier agent Heather Mahmood-Corley. “There has been a small uptick in interest in second homes this year, mostly from cash buyers who plan to eventually move in full time. People who would need a mortgage are still sitting on the sidelines, waiting for rates to come down–especially because rates are typically even higher for second homes than primary homes.”

The share of total mortgages that went to second-home buyers also dropped last year: 2.8% of all mortgage originations in 2023 were for second homes, down from 3.6% in 2022 and 5.1% in 2021.

The vast majority of mortgages go to buyers of primary homes: They took out nearly nine in 10 (88.6%) mortgages in 2023, 87.2% in 2022 and 89.2% in 2020. The remainder go to those buying investment properties, with 8.6% of all mortgages taken out in 2023 used for investment properties, compared with 9.2% in 2022 and 5.9% in 2020.

An early look at this year’s data shows that demand for second homes hasn’t picked up in 2024. Mortgage-rate locks for second homes have been sitting near their eight-year low since the beginning of this year, according to a separate Redfin analysis of data from Optimal Blue. They declined 7.3% from a year earlier in April. By comparison, mortgage-rate locks for primary homes declined 1.6%.

Please note that Optimal Blue data is different from the HMDA data used in the rest of this report. Optimal Blue data is a leading indicator because it measures mortgage-rate locks (an agreement between a buyer and a lender that locks in a rate for a period of time; roughly 80% result in home purchases) as opposed to mortgage originations, and it includes a sample of U.S. mortgages rather than all U.S. mortgages.

So, who did buy vacation homes in 2023? We broke the data down by income level, race and age:

High earners: The vast majority of people who took out mortgages for vacation homes in 2023 were–unsurprisingly–high earners. Nearly nine in 10 (86%) second-home mortgages issued last year went to high-income buyers. Just under 3% went to low-income buyers. (The nationwide median household income of home purchasers in the HMDA data is $178,000 for high-income buyers and $65,000 for low-income buyers.)

White people: Nearly four in five (79%) vacation-home mortgages went to white homebuyers in 2023. Asian and Hispanic homebuyers come next, with 6.4% and 6.2% of new vacation-home mortgages, respectively. Buyers who identify as more than one race took out 5.4% of second-home mortgages, and Black buyers took out 2.7%.

Gen Xers: 29.5% of vacation-home mortgages went to 55-64 year olds in 2023, and another 28.6% went to 45-54 year olds (Gen Xers were 43-58 in 2023). Next come 35-44 year olds (21%), 65-74 year olds (11.4%) and people under 35 (6.9%).

Mortgage originations for second homes fell in all major U.S. metros last year. They fell most in Austin, TX, with a 62.5% year-over-year drop in 2023. Austin’s housing market slowed substantially across the board last year as the pandemic migration boom waned and housing costs climbed too high for many locals. The next-biggest declines for second-home mortgages were mostly in expensive coastal cities: San Francisco (-57.6%), New York (-53.9%), Seattle (-53%) and Nashville, TN (-51.3%).

The smallest declines in second-home mortgages were in relatively affordable metros in the middle of the country and on the East Coast: St. Louis (-25.2% year over year), Kansas City, MO (-31.1%), Providence, RI (-31.1%), Montgomery County, PA (-32.1%) and Warren, MI (-32.1%).

Second-home mortgages made up the largest share of all mortgage originations in West Palm Beach, FL, a popular destination for snowbirds and vacationers, in 2023. Just under 7% of all mortgage originations in the West Palm Beach metro last year were for second homes. Next come Orlando, FL (4.1%), Riverside, CA (4%), New Brunswick, NJ (3.9%) and Tampa, FL (3.6%). Even though the share of second-home mortgages was largest in those places of all the major U.S. metros, they were still down at least 37% year over year.

On the other end of the spectrum, second-home mortgages made up a miniscule share (about 0.5%) of total mortgages in Detroit, Montgomery County, PA, Oakland, CA, Cleveland and Dallas.

The 2023 data in this report is from a Redfin analysis of Home Mortgage Disclosure Act (HMDA) data covering purchases of second homes, primary homes and investment properties from 2018-2023. The term “vacation home” is used interchangeably with “second home” in this report. For this report, the median “worth” or “value” of second homes is the median property value from HMDA data itself, which is reported by the mortgage loan originator as either the home’s appraised value or sale price.

The 2024 data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand before, during and after the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. This data is subject to revision. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.