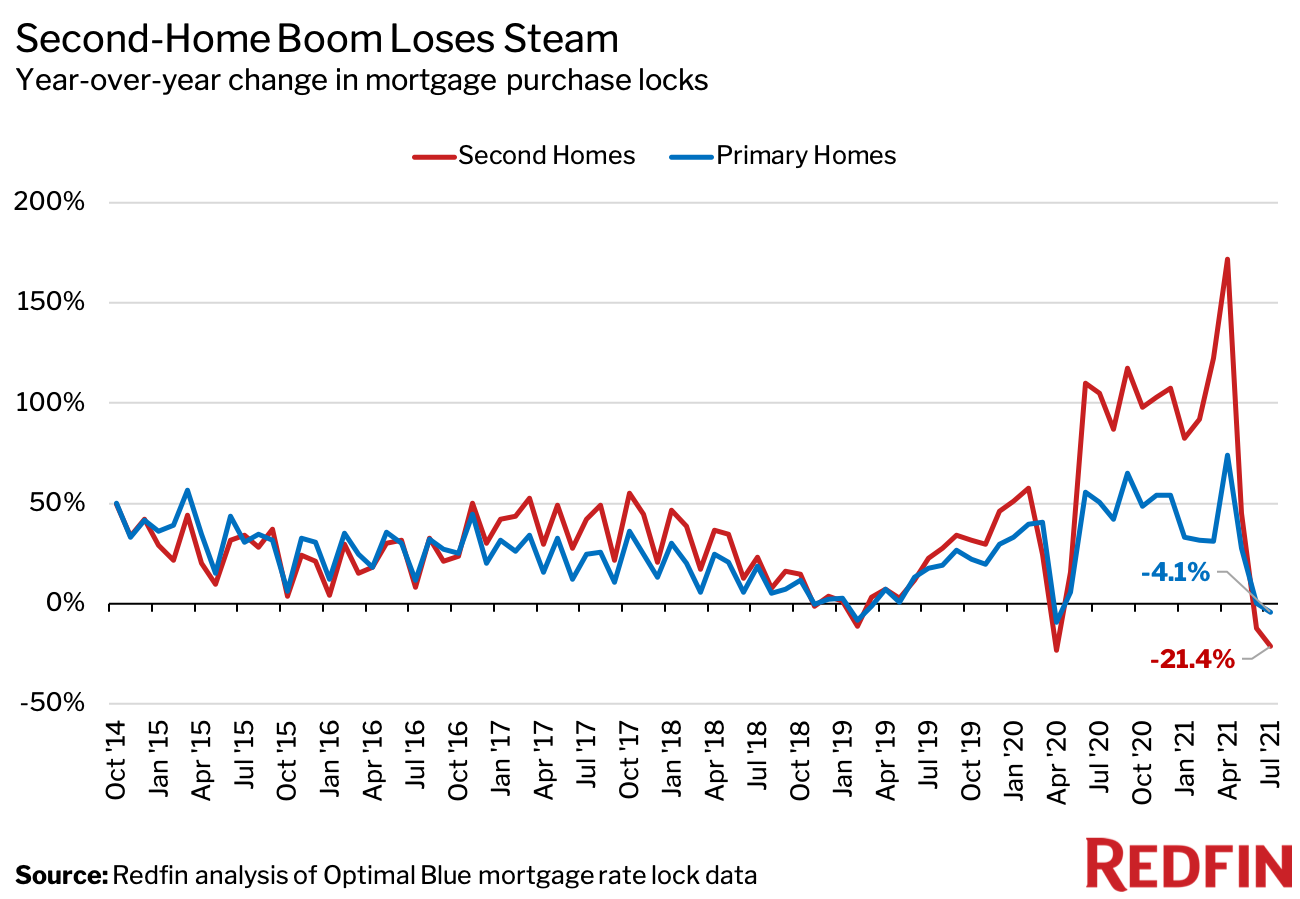

Demand for second homes fell 21% year over year in July, the second consecutive month of annual declines in mortgage-purchase locks. This followed 13 months of surging activity in second-home purchases.

Demand for primary home purchases fell by 4% year over year in July. This was the first time the growth rate for second-home demand fell behind that of primary homes since April 2020.

This is likely because soaring home prices caused some prospective second-home buyers to reconsider their plans. As of June, home prices were up 25% to record highs but have since begun to plateau.

“Demand for second homes remains well above pre-pandemic levels, and we can expect the high level of interest in vacation homes to persist in the new era of remote work,” said Taylor Marr, lead economist at Redfin. “Builders have responded to this increased interest by putting more resources into building homes and less into hotels and lodging. If you build it–amid a historic housing shortage–they will come. I expect vacation homes to remain popular as more homes are built.”

The data in this report is based on a Redfin analysis of mortgage-rate lock data for home purchases from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.