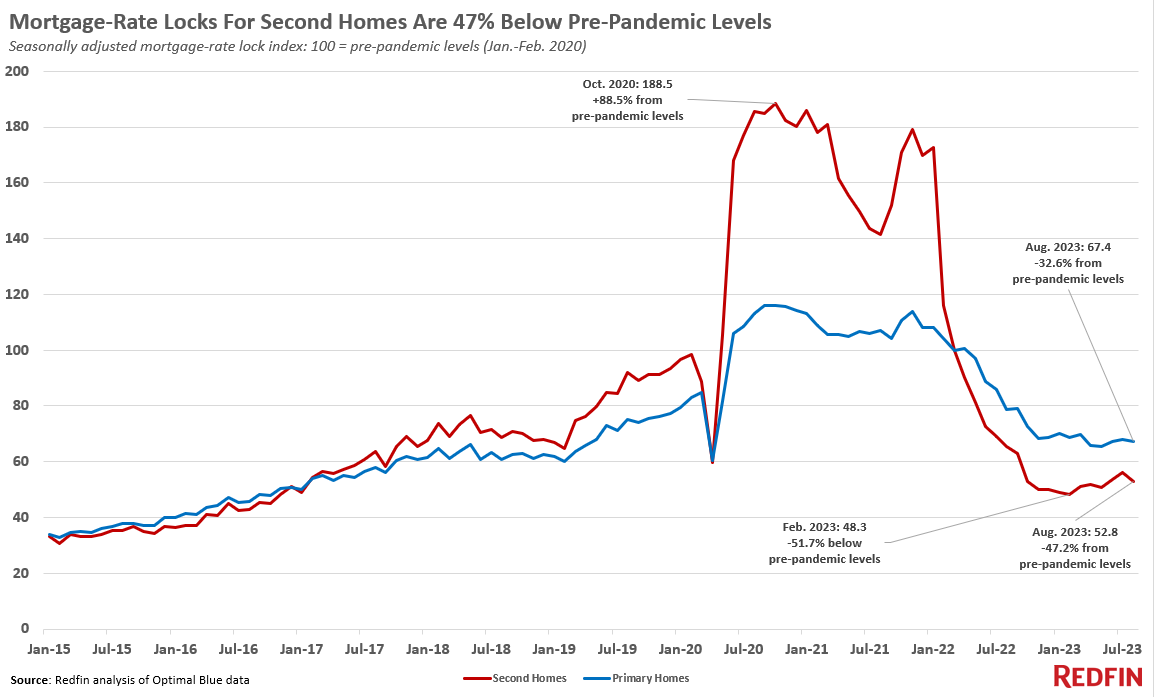

Mortgage rate locks for second homes are down nearly 50% from pre-pandemic levels, compared to a 33% drop for primary homes.

Mortgage-rate locks for second homes were down 47% from pre-pandemic levels on a seasonally adjusted basis in August, compared to a 33% decline for primary homes. August marks the 14th-straight month that second-home demand has hovered at least 30% below pre-pandemic levels, as high housing costs and limited inventory deter would-be buyers. Rate locks for second homes hit a seven-year low in February, dropping to 52% below pre-pandemic levels.

That’s according to a Redfin analysis of Optimal Blue data. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time; roughly 80% of rate locks result in purchases. See the end of this report for more details on methodology.

Demand for second homes is also down from a year ago. Mortgage-rate locks for second homes is down 19% year over year, bigger than the 14% decline for primary homes.

The plunge in mortgage locks for vacation homes comes after they skyrocketed during the pandemic, hitting a peak of 88.5% above pre-pandemic levels in October 2020. Affluent Americans jumped at the chance to snap up second homes with record-low mortgage rates during a time when many of them could work remotely from vacation towns. Demand for primary homes jumped during that time, too, but the increase was much more modest, reaching a peak of 16% above pre-pandemic levels in late 2020.

Mortgage rates rose to a two-decade high in August, keeping demand low for both primary homes and second homes. Still-high home prices, the elevated cost of other goods and services, the uncertain economy, and a lack of new listings are also holding back buyers of both home types.

But the drop in demand for vacation homes is bigger, due to a variety of factors:

Demand for second homes is up slightly from the bottom it hit in the beginning of the year. That’s likely because home prices have come down in some second-home hotspots, including Austin, TX and Phoenix, and some affluent Americans are investing in vacation homes before prices rise.

Interest in second homes first fell below pre-pandemic levels in April 2022, the month the loan-fee increase took effect and several months after mortgage rates started jumping.

The data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. It does not include cash purchases. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand before, during and after the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. We used early 2020 as a comparison point because it provides a baseline for mortgage demand before homebuyer activity fluctuated wildly during the pandemic. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.