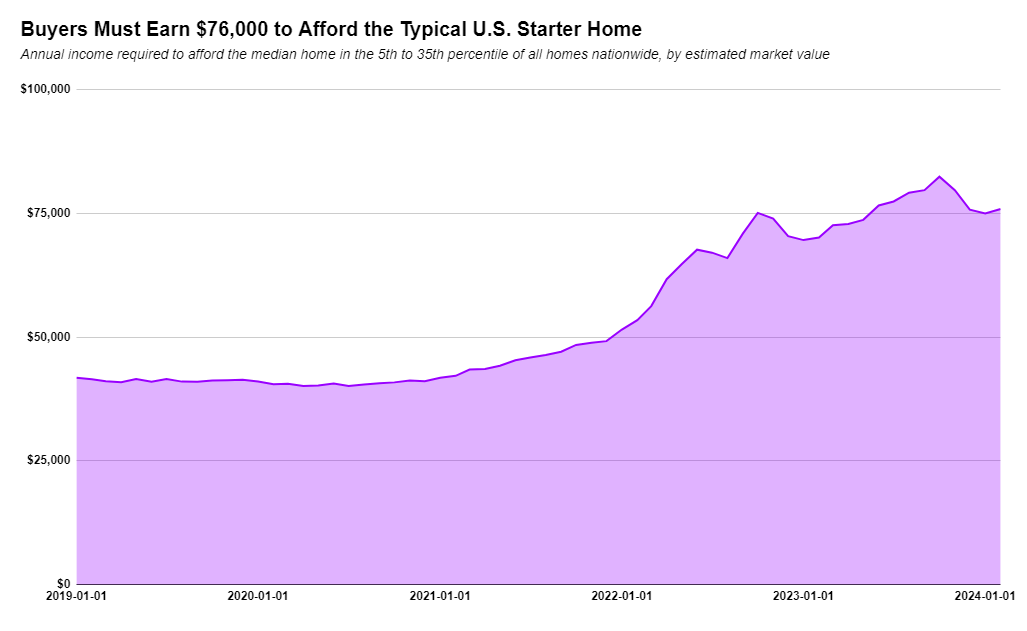

Buyers must earn nearly twice as much as before the pandemic to afford the typical starter home, due to the one-two punch of high prices and mortgage rates. One sliver of hope: Affordability of starter homes is slowly improving after hitting a low point at the end of 2023.

Homebuyers must earn $75,849 annually to afford the typical U.S. starter home, up 8.2% ($5,767) from a year ago.

This is according to a Redfin analysis of estimated U.S. incomes, and median monthly housing payments for starter homes sold in February 2024. We divided all U.S. homes into five buckets based on Redfin Estimates of market values as of February 2024. There are three equal-sized tiers, as well as tiers for the bottom 5% and top 5% of the market. This report is focused on homes whose sale price fell into the 5th-35th percentile, which we define as starter homes. A home is considered “affordable” if a buyer spends no more than 30% of their income on housing, assuming a 3.5% down payment.

The monthly housing payment for the typical U.S. starter home was $1,896 in February, also up 8.2% from a year earlier.

The income necessary to buy starter homes is increasing from a year ago due to rising prices and mortgage rates: The typical starter home sold for $240,000 in February, up 3.4% year over year, and the average 30-year fixed mortgage rate was 6.78%, up from 6.26% a year earlier.

Starter homes are roughly half as affordable as they were before the pandemic. Americans needed to earn $40,465 annually to afford the typical U.S. starter home in February 2020, when the median sale price was $169,000 and the average mortgage rate was about 3.5%.

Incomes are rising, but at less than half the rate of starter-home costs. The typical American household earns an estimated $84,072, up 5.5% from February 2023 (versus the 8.2% increase in income needed to buy a starter home). That means the typical household can afford the $75,849 median-priced starter home, but they have less money left over after housing payments than they used to.

Today, the median household income is just 11% higher than the income needed to buy a starter home. One year ago, the median household income was 14% higher than the income required to buy a starter home, and four years ago, just before the pandemic began, the median income was 63% higher.

Zooming out from starter homes to the overall market, a separate Redfin report found that a homebuyer must earn $114,000 to afford the typical U.S. home, roughly $30,000 more than the median U.S. household income.

In the past, it was often true that people earning less than the median income could afford starter homes in much of the country; starter homes were considered an affordable option for first-time buyers.

Today, someone earning 80% of the median income–$67,258–could not afford the typical U.S. starter home. Before the pandemic real estate boom, someone earning 80% of the median income– roughly $53,000 in early 2020–could afford the typical starter home, which required an annual income of just over $40,000.

First-time buyers looking to purchase starter homes often make lower down payments, which is why this analysis uses a 3.5% down-payment assumption (3.5% is the percentage required for FHA loans, which are attractive to people with lower savings and/or credit scores).

“The pandemic housing-market boom changed the definition of a starter home,” said Redfin Senior Economist Elijah de la Campa. “A decade ago, many people thought of a starter home as a small three-bedroom single-family house. Now that type of home could cost seven figures, especially in expensive parts of the country. The most affordable homes are much smaller and often require a lot of work to make them habitable–which makes them cost even more. Today’s most affordable homes are still hard for the average American to afford, let alone the average first-time buyer who tends to put less money down in exchange for higher monthly payments. Rising prices and mortgage rates are pushing buyers who earn more than the median income to buy starter homes, and often pushing buyers who earn less money out of the market.”

Another challenge for first-time buyers: They’re often competing with all-cash offers for limited inventory of starter homes. More than one-third (36.5%) of the nation’s starter homes were purchased in cash in February, near the highest level in a decade. It’s likely that many of those homes sold to real estate investors, who are turning them into rentals and thus removing them from the stock of for-sale starter homes. Others likely sold to repeat homebuyers using equity from a previous sale.

While the income required to buy a starter home is up from a year ago, it’s down 8% ($6,524) from last October’s all-time high of $82,373. That’s because mortgage rates have come down from their recent high. Mortgage rates are sitting around 6.8%, down from a two-decade high of 7.8% in October 2023. Affordability should continue improving throughout 2024 as mortgage rates gradually decline further.

There are also a few other encouraging signs for first-time buyers:

50 most populous U.S. metros

This is according to a Redfin analysis of estimated U.S. incomes, and median monthly housing payments for starter homes sold in February 2024. Here’s how we define “starter home” for the purposes of this report: Our analysis divides all U.S. properties into five buckets based on Redfin Estimates of homes’ market values as of February 2024. There are three equal-sized tiers, as well as tiers for the bottom 5% and top 5% of the market. This report is focused on homes whose sale price fell into the 5th-35th percentile of the Redfin Estimate tier.

We calculated how much annual income is needed to afford the median-priced starter home by using the rule of thumb that a home is considered “affordable” if a buyer taking out a mortgage spends no more than 30% of their income on their housing payment.

Monthly median housing payments are calculated assuming the buyer made a 3.5% down payment, and take that month’s median sale price and average mortgage-interest rate into account. The national income data in this analysis is adjusted for inflation using the Consumer Price Index. 2024 income is estimated based on projections from the U.S. Census Bureau’s (ACS) 2022 median household income using the 12-month moving average nominal wage growth rate compiled from the Current Population Survey and reported by the Federal Reserve Bank of Atlanta.

The typical housing payments noted in this report include the mortgage principal, interest, property taxes, homeowners’ insurance, and when applicable, mortgage insurance. In this report, the word “homebuyer” is used to refer to someone who is taking out a loan to finance their purchase.