Inventory—in particular the lack of it—has been a front-page topic this year. We’re back on the topic of inventory today, but with glad tidings: Inventory is finally beginning to recover! Active listings grew 6.4% between March and April and another 4.2% on top of that between April and May. Last year inventory peaked in January and fell almost all year. If the current trend keeps up, we may hit positive year-over-year inventory before the end of the year. The growth in new listings has also been explosive over the same period.

Redfin closely follows inventory, both in our monthly Real-Time Price Tracker data as well as various special reports. In early January we pointed out that “new listings are down nearly a third from 2012’s already weak levels”. In February we told you that “if prices continue to rise, we expect new listings in most markets to move back into the black.” Thankfully, that’s exactly what is happening.

“Lots of homeowners want to sell,” said Redfin CEO Glenn Kelman. “And lots of people want to buy. The problem has just been agreeing on a price. Over the last 12 months, Redfin agents have talked to plenty of homeowners seeking to test the market at a very aggressive price, just so a sale would yield enough money to pay off the mortgage. Those consultations often ended with a decision to wait. What has changed in the last 60 days is that these owners are now listing, selling — and even appraising — at the price they’ve needed to get all along. People who bought near the peak in 2006 and 2007 — only to get buried in the downturn under a mountain of debt — can now, for the first time in years, see daylight. And they’re running for it.”

Increasing home prices are giving more sellers sufficient equity to sell, and sellers who already had equity are being lured into the market after seeing their neighbor’s homes sell in record time and in fierce bidding wars.

More inventory begets more inventory, too. “I have several clients who are ready to take the plunge and list their homes—they’ve even decluttered and we have the listing ready to hit the MLS,” explained Redfin listing specialist Paul Stone. “The sellers are just waiting to get under contract on a home to buy, at which point we’ll pull the trigger and list their current home.”

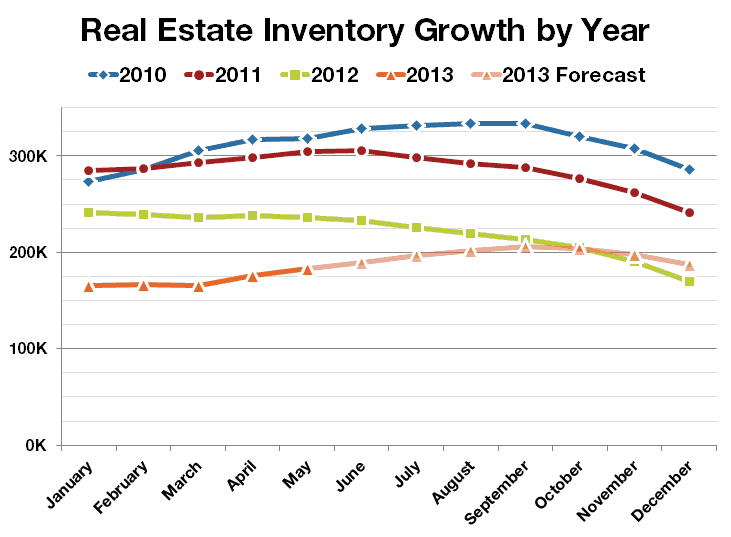

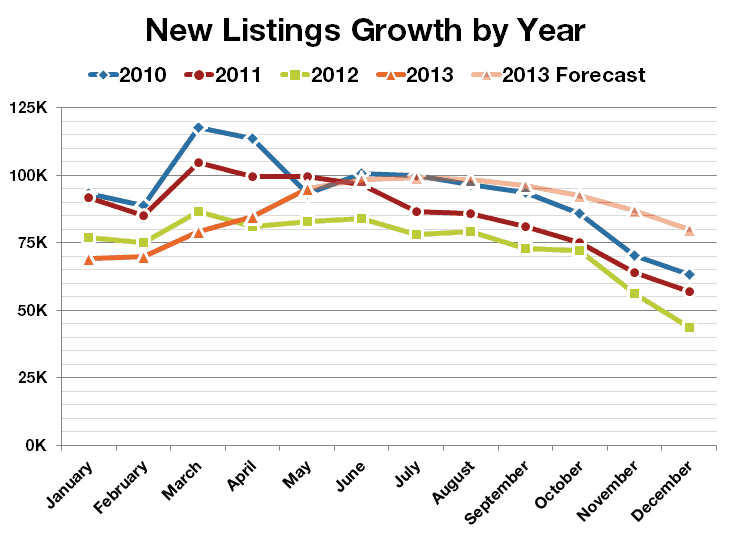

Here’s what the inventory recovery looks like so far, along with a forecast for the rest of the year, should the trend hold:

Total active listings are still down 22% from a year ago as of May, but even that is an improvement compared to the 32% year-over-year drop we experienced in January.

Phoenix is ahead of this trend, already turning in a 14% year-over-year increase in May. Chicago was barely positive as well, gaining half a percent over last year. Los Angeles, California’s Inland Empire, and Boston are lagging behind with listings falling over 40 percent from a year ago in all three markets.

New listings have turned around completely in just four months, from a 10% year-over-year decline in January to a 15% year-over-year increase in May.

Redfin Agent Tonya Nelson is working with one couple who were originally planning to sell their 5-bedroom Arlington, VA home and move out of state in the summer or fall, but accelerated their plans in response to the hot market. “They noticed my listing around the corner, and were surprised to see how much home values had already risen, so they decided to list their home this spring.”

We’ve still got a long ways to go before the market gets to anything resembling a “normal” selection, but these inventory increases in the last two months are great news for buyers who have been frustrated by the severe lack of selection earlier in the year. An increase in the number of homes for sale will drive sales volume and in turn the overall economy. As supply and demand are brought back into balance bidding wars will ease and price gains will moderate.