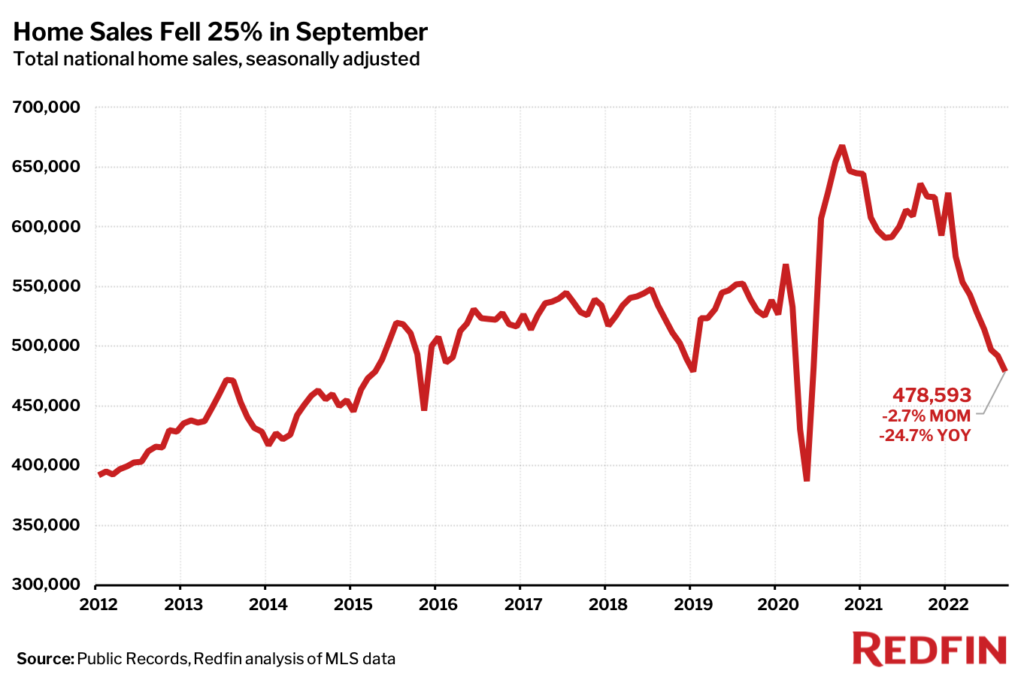

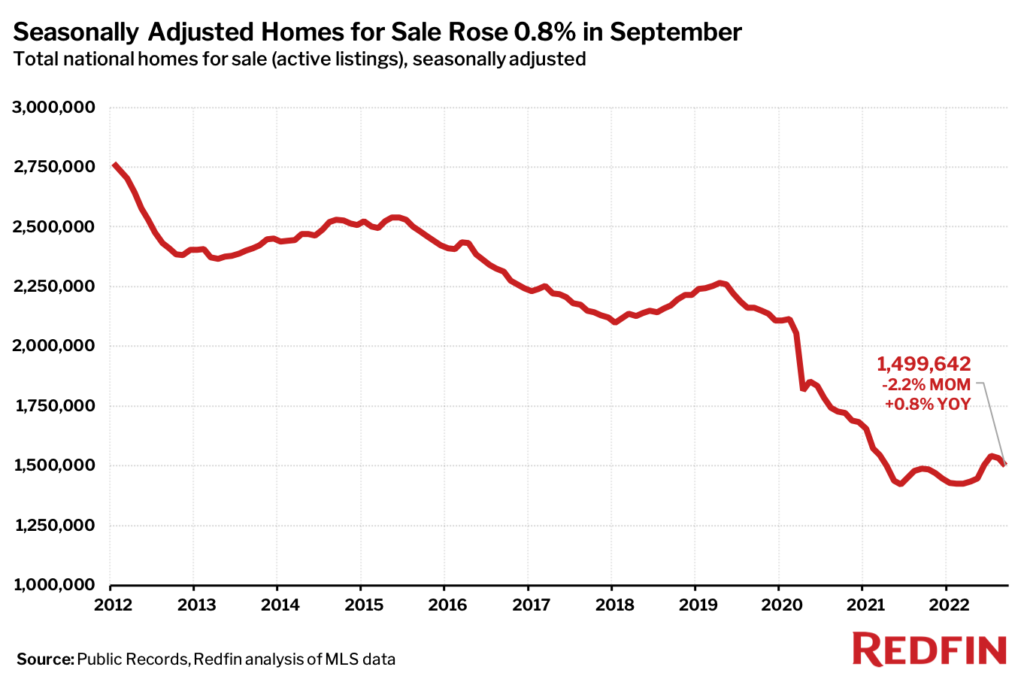

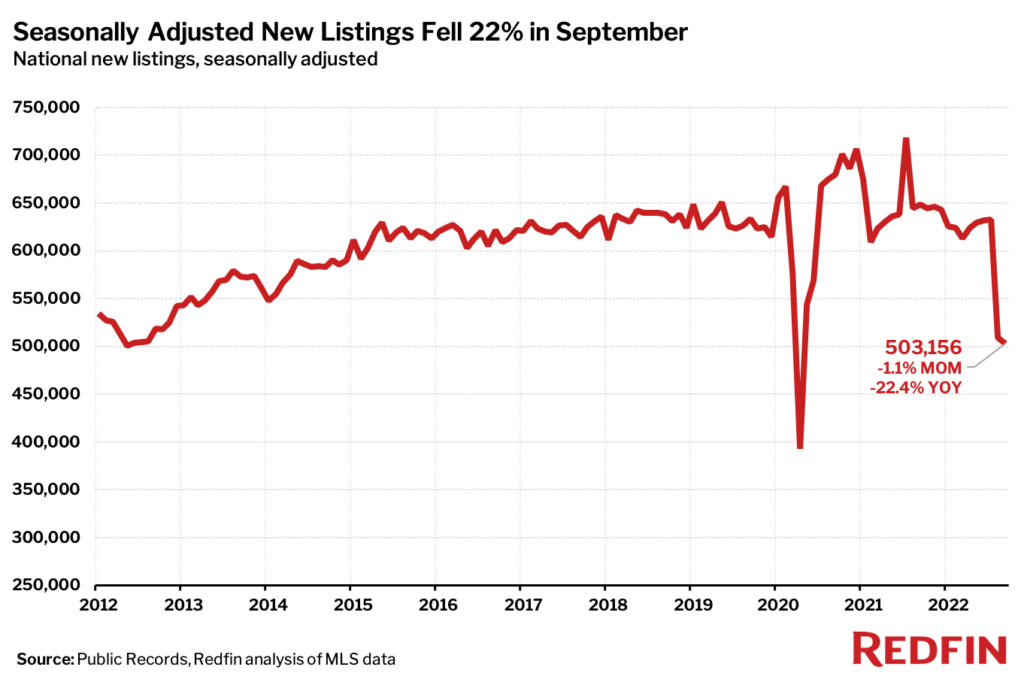

Home sales and listings in September both slumped the most on record with the exception of the early months of the pandemic as rapidly rising mortgage rates prompted both buyers and sellers to stay put. The number of homes sold dropped 25% year over year while new listings fell 22%—the largest declines since May 2020 and April 2020, respectively, when the onset of the pandemic brought the housing market to a near halt.

“The U.S. housing market is at another standstill, but the driving forces are completely different from those that triggered the standstill at the start of the pandemic,” said Redfin Economics Research Lead Chen Zhao. “This time, demand is slumping due to surging mortgage rates, but prices are being propped up by inflation and a drop in the number of people putting their homes up for sale. Many Americans are staying put because they already relocated and scored a rock-bottom mortgage rate during the pandemic, so they have little incentive to move today.”

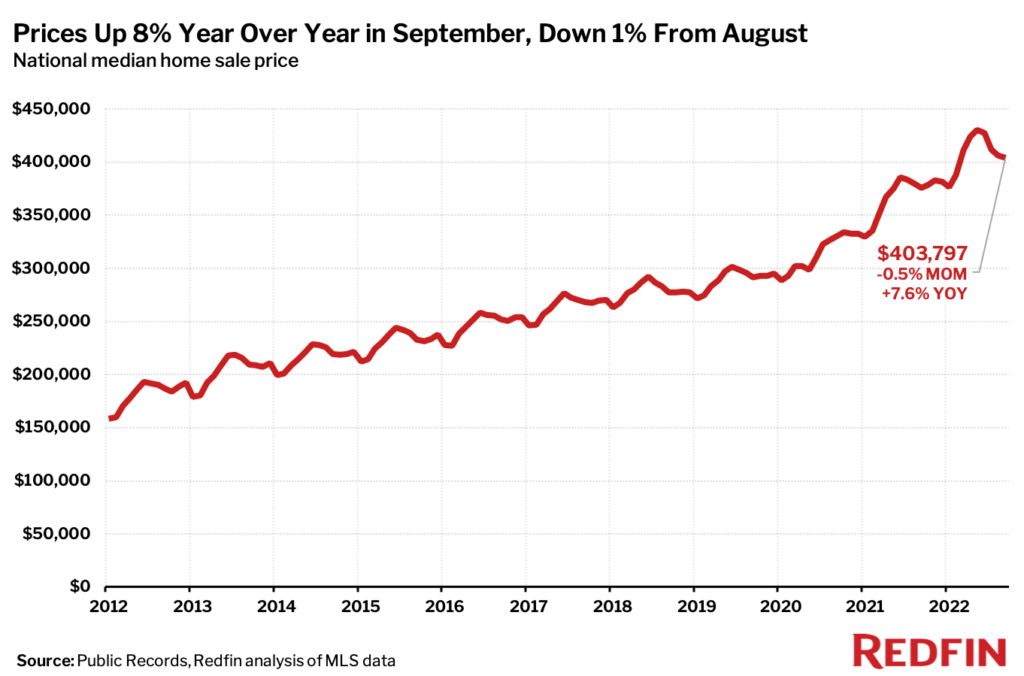

While the median home-sale price was down 0.5% month-over-month in September, it still rose 8% on a year-over-year basis to $403,797.

Zhao continued: “The housing market is going to get worse before it gets better. With inflation still rampant, the Federal Reserve will likely continue hiking interest rates. That means we may not see high mortgage rates—the primary killer of housing demand—decline until early to mid-2023.”

Homebuyers are backing off because mortgage rates are now at the highest level in two decades, which has driven monthly housing payments for buyers up more than 50% year over year. Prospective sellers are backing off because they don’t want to risk losing the low mortgage rate they already have locked in. As a result, deals are increasingly falling through and buyer competition is plunging.

Roughly 60,000 home-purchase agreements were canceled in September, equal to 17% of homes that went under contract that month. That’s the highest percentage on record with the exception of March 2020—the month the World Health Organization declared the coronavirus a pandemic. Fewer than half (46%) of home offers written by Redfin agents faced competition in September, the lowest share since the start of the pandemic.

† – “pp” = percentage-point change

Note: Data is subject to revision

Bulleted rankings below came from a list of the 91 U.S. metro areas that have populations of at least 750,000, with the exception of rankings of bidding-war rates and home-purchase cancellations. The bidding-wars ranking came from a list of 36 metros—those that had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. The home-purchase cancellations ranking came from a list of the 50 most populous metro areas.

For more metro-level trends, head to Redfin’s data center.

Scroll down for national charts and market-by-market breakdowns. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center. Refer to our metrics definition page for explanations of the metrics used in this report.