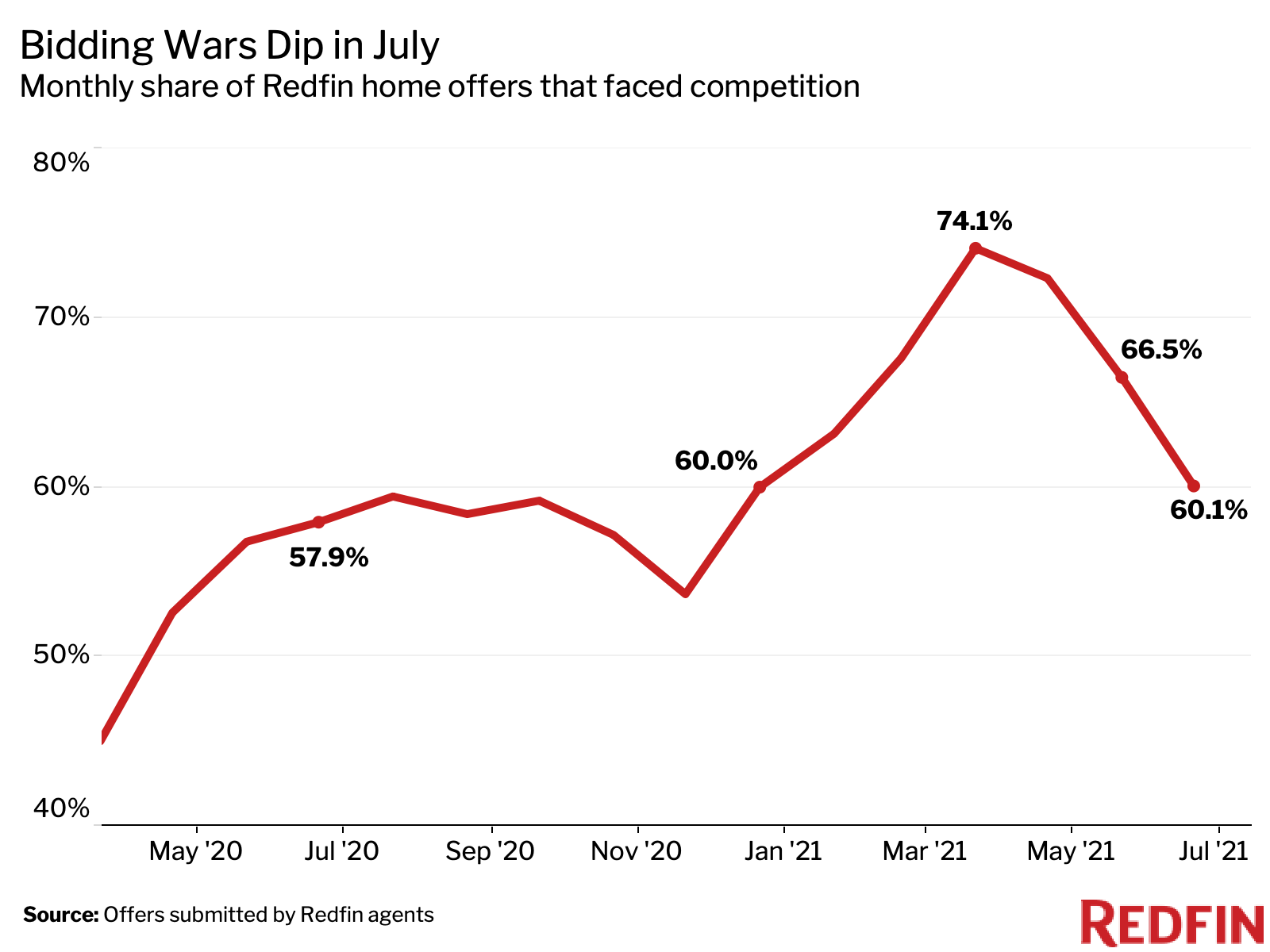

In July, 60.1% of home offers written by Redfin agents faced competition, down from a revised rate of 66.5% in June and a pandemic peak of 74.1% in April. While July’s bidding-war rate was the lowest since January, it was still higher than the 57.9% bidding-war rate we saw in July 2020, when the housing market was recovering following a shutdown caused by pandemic restrictions.

An offer is considered part of a bidding war if a Redfin agent reported that it faced at least one competing bid. This data is subject to revision.

Homebuying conditions have been improving this summer following months of fierce competition and soaring prices that were driven by an intensifying housing shortage, a pandemic moving spree made possible by remote work and historically low mortgage rates. Home prices are stabilizing amid an increase in housing supply. Increased supply gives buyers more options to choose from, which helps reduce competition.

It’s also typical for competition to ease in the summer following the spring homebuying season, so seasonality is another factor at play.

“Competition has started to slow in the last three weeks. We’re now seeing five to eight offers on homes instead of 25, and they’re coming in $5,000 to $10,000 above the listing price instead of $50,000 to $60,000,” said Scott Mercer, a Redfin real estate agent in Sacramento, CA. “Buyers are pushing back. They’ve even started including appraisal contingencies again and making requests for repairs—things that were pretty much unheard of last year.”

Fort Collins, CO—a college town and the state’s fourth-most-populous city—had the highest bidding-war rate of the 47 U.S. metropolitan areas in this analysis, with 77.3% of offers written by Redfin agents facing competition in July. Next came Orlando, FL, at 77%, and Nashville, TN, at 74.6%. Honolulu, HI and Colorado Springs, CO rounded out the top five, with bidding-war rates of 74.1% and 73.2%, respectively.

Sacramento, CA came in sixth place, with a bidding-war rate of 72.9%, down from 77.2% in June.

“A slowdown in the migration of tech workers from the Bay Area is the biggest factor driving the drop in competition in Sacramento,” Mercer said. “Sacramento exploded in popularity among remote workers during the pandemic. People coming from San Francisco were like kids in a candy store here because home prices were so inexpensive in comparison. But we’re no longer seeing as big of an influx of those folks, likely because families can finally travel again and employers are asking people to come back to the office. It will be interesting to see if migration to Sacramento rebounds if the Covid situation continues to worsen.”

Sacramento was still the third-most-popular migration destination in the second quarter. That’s based on net inflow, a measure of how many more Redfin.com home searchers looked to move into a metro than leave. Nationally, migration did slow slightly: 31.1% of Redfin.com users looked to move to a different metro in the second quarter, down from 31.5% a quarter earlier.

Metros must have had at least 20 offers recorded by Redfin agents in both July 2021 and June 2021 to be included in this analysis.

To be included in the table below, metros must have had at least 20 offers recorded by Redfin agents in both July 2021 and June 2021. The table is sorted by highest to lowest bidding-war rates in July 2021. Blank spaces in the July 2020 column represent metros for which there were fewer than 20 offers submitted by Redfin agents that month.