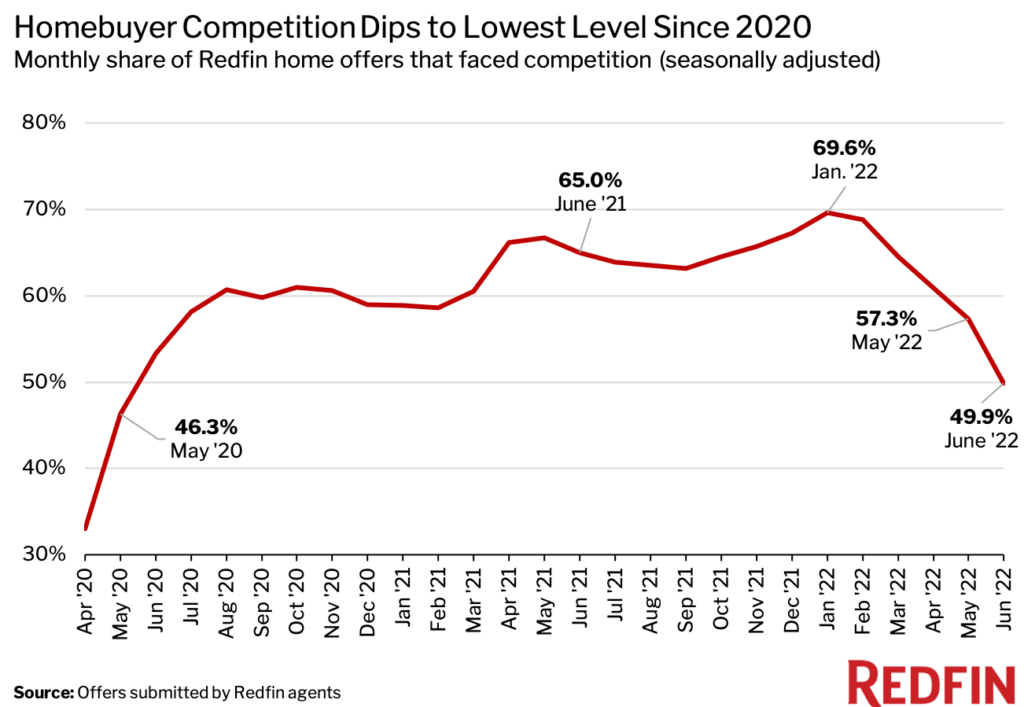

Nationwide, 49.9% of home offers written by Redfin agents faced competition on a seasonally adjusted basis in June. That’s the lowest share since May 2020 and the first time the bidding-war rate has been below 50% since that same month, when the housing market was at a near standstill due to the onset of the coronavirus pandemic. June’s bidding-war rate compares with a revised rate of 65% one year earlier and 57.3% one month earlier, and marks the fifth-straight monthly decline.

On an unadjusted basis, June’s bidding-war rate was 51.5%, down from 66.7% one year earlier and 62.5% one month earlier.

An offer is considered part of a bidding war if a Redfin agent reported that it received at least one competing bid. The statistics in this analysis are subject to revision. Data below on property type and metro area is not seasonally adjusted. Redfin’s bidding-war data goes back through April 2020.

Housing-market competition is declining because higher mortgage rates, high home prices, inflation and a falling stock market have eroded homebuyer budgets, causing some house hunters to drop out of the market. Roughly 60,000 home-purchase agreements were called off in June, equal to 14.9% of homes that went under contract that month. That’s the highest percentage on record, with the exception of the start of the pandemic. The typical monthly mortgage payment for a homebuyer is now $2,387 at the current 5.51% mortgage rate, up 44% from a year ago.

“While the market is cooling, it’s not coming to a crashing halt,” said Shoshana Godwin, a Redfin real estate agent in Seattle. “House hunters who can still afford to buy should consider taking advantage of the slowdown given that there’s way less competition.”

In Riverside, CA, 31.9% of home offers written by Redfin agents faced competition in June, down from 70.5% a year earlier. That 38.6-percentage-point decline was the largest among the 36 U.S. metropolitan areas in this analysis. Next came Raleigh, NC (38.9% vs. 74.1%; -35.2 ppts), Charlotte, NC (48.1% vs. 80%; -31.9 ppts), Seattle (41.4% vs. 71.6%; -30.2 ppts) and Honolulu (38.9% vs. 69%; -30.2 ppts).

To be included in this analysis, metros must have had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. Scroll down to the bottom of this report to see a table with data on all 36 metros.

“Showings have dramatically decreased. Homes that would’ve had 20 showings two months ago are now getting one or even none,” said Jenny Dedrick, a Redfin real estate agent in Minneapolis, where the bidding-war rate fell to 45.7% in June from 65% a year earlier. “I had one seller take his home off the market because it only got one showing. He decided to rent it out instead. He’s moving to Mexico and thought, ‘why not let it sit and keep appreciating?’”

Competition increased on a year-over-year basis in just two of the 36 markets Redfin analyzed. In Colorado Springs, CO, 55.9% of home offers written by Redfin agents faced competition in June, up from 45.9% in June 2021 (+10 ppts). In Providence, RI, the bidding-war rate rose slightly, to 77.6% in June from 77.1% a year earlier.

In Providence, 77.6% of home offers written by Redfin agents encountered competition in June—a higher share than any other metro in this analysis. It was followed by Boston (71.7%), Philadelphia (65.7%), Indianapolis (64.3%) and Worcester, MA (62.7%).

Tampa, FL had the lowest bidding-war rate, at 28.9%. Rounding out the bottom five were Riverside (31.9%), Phoenix (35.3%), Honolulu (38.9%) and Raleigh (38.9%).

Townhouses were more likely than any other property type to encounter bidding wars, with 54.6% of Redfin offers facing bidding wars in June. Next came single-family homes (52.3%), followed by condos/co-ops (47%) and multi-family properties (41.3%).

Some homebuyers have sought out townhouses, which are typically smaller and more affordable, because they’re priced out of the market for single-family homes. The typical home that went under contract in March was 1,720 square feet, down 1.8% from 1,751 square feet a year earlier, a recent Redfin analysis found.

The table below is sorted by lowest to highest bidding-war rate in June 2022.