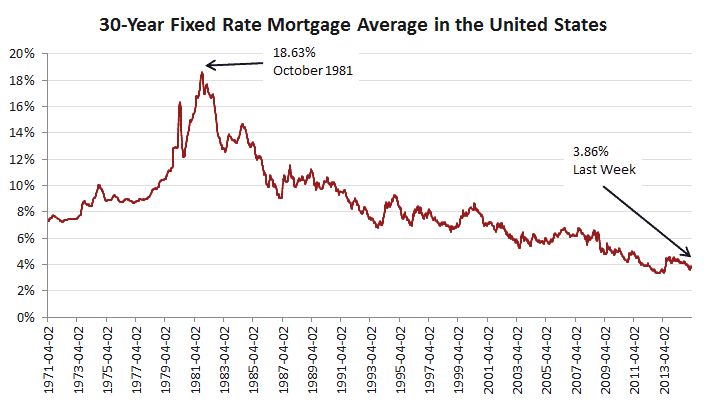

Patience. A lot of would-be buyers have had it in spades as they shop for a home. One reason: Mortgage rates are near historic lows and there’s little reason to think they’re going up. Why rush?

Patience. A lot of would-be buyers have had it in spades as they shop for a home. One reason: Mortgage rates are near historic lows and there’s little reason to think they’re going up. Why rush?

That calculation might be changing. Today, Federal Reserve policymakers opened the door to higher borrowing costs when they dropped the word “patient” from their meeting statement. What that means is short-term borrowing rates could begin to climb as soon as this summer. Maybe.

Or not. Readers of monetary tea leaves vigorously disagree on what the Fed will do, when they’ll do it or what it all means for regular people.

What we do know is the Fed has kept the benchmark rate near zero since December 2008 to boost economic growth, and that’s helped keep mortgage rates low. It’s been a gift to homebuyers, who more than anyone have benefited from cheap borrowing costs. Perversely, however, that long run of low rates has led to some inertia.

The mere risk of higher rates might be enough to get those shoppers off the fence and locked in. While the Fed doesn’t control mortgage rates, we can expect to see some rate volatility. Fear of rising costs could create a sense of urgency among buyers.

When will rates rise? Who knows.

“Just because we removed the word ‘patient’ from the statement doesn’t mean we’re going to be impatient,” Yellen told reporters when asked when the Fed might raise rates. It might not matter – rates are going to bump around while the market figures it all out. Locking in a low rate and signing a contract might become an easier call.

Homebuyers Might Join Fed In Losing Patience

- BỞI System Admin

- Ngày 23/11/2024