CORRECTION: A previous version of this report used incomplete inventory data in four cities – Charlotte, Modesto, Sacramento and Stockton. We’ve removed those cities while we correct the data. With 46 instead of 50 markets included in the analysis, the overall share of stale inventory rose from 70.2 percent to 70.9 percent.

Real estate agents and buyers have been fretting over the lack of homes for sale, a phenomenon that’s fueling bidding wars and frustrating house hunters. Even though more properties are starting to come on the market, the total inventory of houses for sale — both fresh and dated listings — actually fell in March from a year ago.

As the spring selling season gets into full swing, Redfin examined 46 markets to see if fresh inventory is growing and whether it’s growing enough. As a whole, new listings shot up 9.2 percent last month, but overall inventory of houses for sale actually shrank 0.7 percent. It was the first year-over-year drop since December 2013. So far, the spring housing bounce hasn’t started.

Take the quality of inventory into account and the picture looks bleak for buyers in many cities. As of March 31, almost 71 percent of houses on the market were stale, meaning they’ve languished unsold for more than a month. A home that’s been sitting for 30 days is more likely to be overpriced, in need of renovation or have other problems that prevent it from selling.

It’s normal for stale listings to make up the bulk of inventory, but now two new things are happening. In some places, both fresh and stale listings are dwindling. And in a handful of cities, fresh listings are becoming a bigger share of inventory as high prices and competition lead would-be homeowners to lower their expectations. That means even hard-to-love homes are finding buyers, who are chipping away at inventory.

The upshot? For buyers, not only are there fewer homes to chose from, there are even fewer good ones — “good” as in priced right, well-maintained and in sought-after locations.

Traditionally, housing inventory ticks up in March in anticipation of the spring selling season, when budding foliage boosts curb appeal and families with children prep for summer break. That seasonal ebb and flow is still evident in many markets, including Baltimore, Minneapolis-St. Paul, Philadelphia and parts of New York.

Nationwide, the total number of unsold homes rose 5.3 percent in March to 2 million, but at the current pace of sales, that supply would be exhausted in only 4.6 months, according to the National Association of Realtors.

What’s causing the inventory crunch? More than 7 million homeowners can’t sell because they’re deeply underwater, according to RealtyTrac, meaning they owe more on their properties than they’re worth. That figure is falling as rising home values put more homeowners into the black, but those same price gains, coupled with weak wage growth and tight credit, are discouraging many from selling and trading up. Builders haven’t kept pace, either. They’re breaking ground on 1.07 million houses, condominiums and apartments a year, but the U.S. requires between 1.6 million and 1.9 million new units just to accommodate population growth and household formation, according to the Harvard Joint Center for Housing.

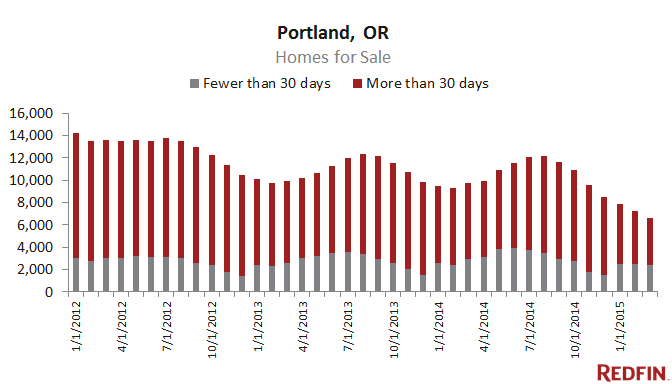

In Atlanta, Seattle, Portland, Allentown, Tacoma and elsewhere, the number of homes for sale is at its lowest in at least three years. In Indianapolis, even a 26.6 percent year-over-year surge in new listings in March wasn’t enough to replenish depleted inventory.

Inventory is so low in Oakland, Denver and Dallas-Fort Worth that fresh listings abnormally accounted for a larger share of inventory last month as buyers whittled away at less-desirable properties and builders raced to keep up with demand. Dallas-Fort Worth added more than 100,000 people between 2013 and 2014. Last month, there were 14,332 fewer properties for sale than in March 2012. New listings fell more than 27 percent.

“All the desirable properties are getting snatched up in three days. The ones that are left become our stale inventory,” Dallas agent Connie Durnal said. “It’s driving the prices up and increasing multiple offers. I don’t see it ending.”

Buyers tend to become “inventory blind” and tune out old listings, but that could be changing as desirable properties get fewer and further between.

“There’s a lot of fighting for that fresh inventory,’’ said Michael Alderfer, a Redfin agent in Washington, D.C. “When new buyers find out they’re going to have to beat other offers on the newer stuff, they adjust and start looking for things on the market 21-plus days.”

Homes For Sale or Homes Gone Stale?

- BY System Admin

- DATE 23/11/2024