We expect home sales to sink to their lowest level in more than a decade in 2023 as high mortgage rates keep housing costs up and prevent people from moving. High homeowner equity and a resilient job market will stave off a wave of foreclosures.

Mortgage rates will take center stage in 2023, with high rates likely to make it the slowest housing-market year since 2011.

Our forecasts for mortgage rates, home sales and home-sale prices account for a range of outcomes for inflation, employment and other macroeconomic factors. As such, our predictions for those key housing metrics lead with the most likely scenario, followed by other possible outcomes that could happen if, for instance, a better-than-expected inflation report results in an earlier- or bigger-than-expected mortgage-rate drop.

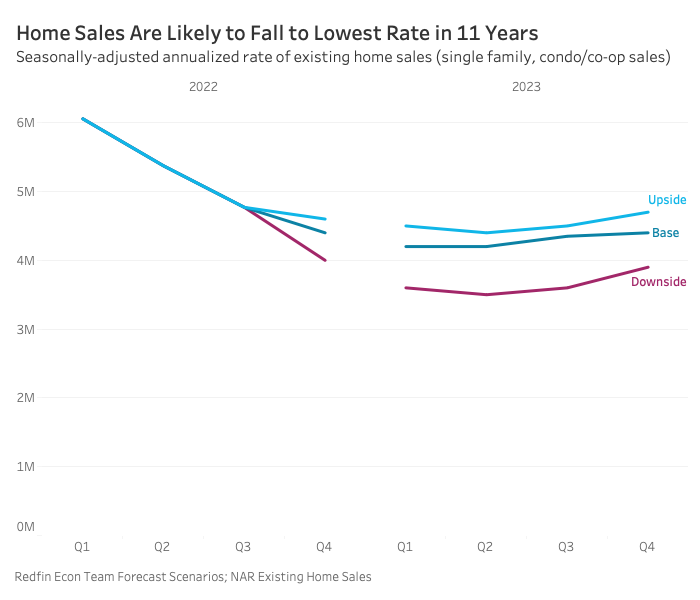

We expect about 16% fewer existing home sales in 2023 than 2022, landing at 4.3 million, with would-be buyers pressing pause due mostly to affordability challenges including high mortgage rates, still-high home prices, persistent inflation and a potential recession. People will only move if they need to.

That’s fewer home sales than any year since 2011, when the U.S. was reeling from the subprime mortgage crisis, and a 30% decline from 2021 during the pandemic homebuying boom. It would also lead to the lowest housing-turnover rate since the early 1980s, with just 32 out of every 1,000 households selling their home in 2023.

Existing home sales will likely fall 31% year over year in the first quarter, followed by smaller annual declines in the second and third quarters. By the fourth quarter, existing home sales will be flat from the year before. Sales will slowly start recovering as rates fall from their peak, but they’ll still post year-over-year declines most of the year. We expect about 20% fewer sales of newly built homes, landing at about 500,000 nationwide.

When buyers don’t want to buy, sellers don’t want to sell. Low demand, plus the “lock-in” effect of homeowners with ultra-low mortgage rates staying put, mean new listings will continue to decline year over year during the first half of 2023.

Another possible existing sales scenario is that they’ll decline by only about 12% in 2023 from 2022, landing at just over 4.5 million. That could happen if inflation consistently slows faster than expected, allowing the Fed to slow its pace of rate hikes and leading to quick mortgage-rate drops. But if inflation persists, sales could drop by up to 27% year over year.

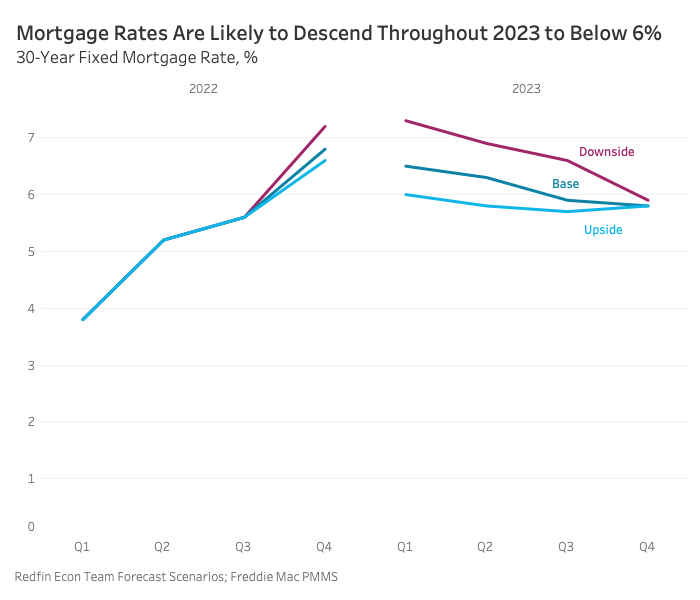

We expect 30-year fixed mortgage rates to gradually decline to around 5.8% by the end of the year, with the average 2023 homebuyer’s rate sitting at about 6.1%.

Mortgage rates dipping from around 6.5% to 5.8% would save a homebuyer purchasing a $400,000 home about $150 on their monthly mortgage payment. To look at it another way, a homebuyer on a $2,500 monthly budget can afford a $383,750 home with a 6.5% rate; that same buyer could afford a $406,250 home with a 5.8% rate. Still, that’s much less affordable than a few years earlier. With a 3% rate, which was common in 2020 and 2021, that same buyer could afford a $517,000 home.

The Fed’s series of interest-rate hikes should cause inflation to continue slowing, which is likely to bring mortgage rates down. How quickly inflation and rates come down depends on a number of factors, including the resilience of the job market.

If inflation cools faster than expected and the job market moderates, rates may decline sooner and/or more, dropping to 6% in the beginning of the year, then settling around 5.8% for the rest of the year. But if inflation proves stubborn, rates are more likely to stay elevated for several months and decline slowly before ending the year just below 6%.

House hunters may need a higher credit score or lower debt-to-income ratio to qualify for a mortgage as lenders tighten credit standards due to rising unemployment. That said, those who do qualify may pay less in closing costs as lenders offer fewer products–which allows them to lower fees–to attract customers during the slowdown.

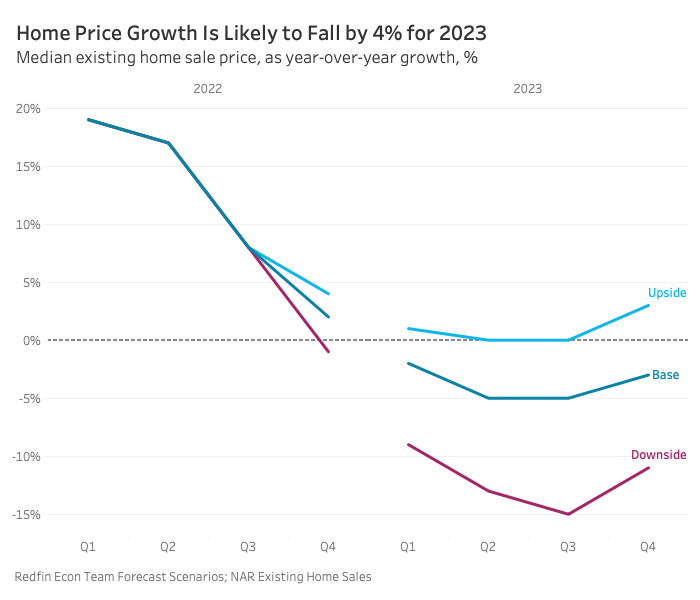

We expect the median U.S. home-sale price to drop by roughly 4%–the first annual drop since 2012–to $368,000 in 2023. That’s due to elevated rates and final sale prices starting to reflect homes that went under contract in late 2022. Prices would fall more if not for a lack of homes for sale: We expect new listings to continue declining through most of next year, keeping total inventory near historic lows and preventing prices from plummeting.

Prices will start their decline in the first quarter, falling by roughly 2% from a year earlier, marking the first year-over-year drop since the beginning of 2012. Home-sale prices will likely fall by about 5% year over year in the second and third quarters, then ease to about a 3% drop by the end of the year as lower rates bring buyers back to the market.

Another possible albeit less likely scenario is that prices will stay mostly flat on a year-over-year basis in 2023. That could occur if mortgage rates and/or new listings fall faster than expected, which would prop prices up. But if inflation remains stubborn, rates stay higher than expected, and/or supply increases more than expected, prices could fall by double digits.

Even with prices falling 4% year over year, homes will be much less affordable in 2023 than they were before the pandemic homebuying boom, making it difficult for prospective first-time buyers to enter the market. Taking next year’s projected prices and mortgage rates into account, the typical homebuyer’s monthly payment will be about 63% higher in 2023 than it was in 2019, just before the pandemic began. Meanwhile, wages will have grown roughly 27% over that period.

Prices remaining elevated above pre-pandemic levels also means a wave of foreclosures next year is highly unlikely. Very few homeowners are likely to see their mortgages fall underwater even with next year’s anticipated price declines. That’s because the homeowners who’ve had their home for at least a few years have fixed low mortgage payments and plentiful home equity after values skyrocketed during the pandemic. Even those who bought recently near the height of the market are likely to have made a sizable down payment and therefore have some equity to land on. Importantly, the jobs market remains resilient; even if there is a recession, economists expect a mild one with a small increase in unemployment, so it’s unlikely that many homeowners will fall behind on their mortgage payments.

Housing markets in relatively affordable Midwest and East Coast metros, especially in the Chicago area and parts of Connecticut and upstate New York, will hold up relatively well, even as the U.S. market cools. Those areas tend to be more stable than expensive coastal areas and they didn’t heat up as much during the pandemic homebuying frenzy.

On the other end of the spectrum, we expect prices to fall most in pandemic migration hotspots like Austin, Boise and Phoenix, largely because the huge increases over the last two years leave a lot of room for prices to decline. Expensive West Coast cities are also likely to see outsized price declines because of stumbling tech stocks and the shift to remote work pushing so many people out of those markets.

We expect U.S. asking rents to post a small year-over-year decline by mid-2023, with drops coming much sooner in some metros. Some large landlords are likely to offer concessions, such as a free month’s rent or free parking, before dropping asking rents.

The rental price declines will be partly due to increasing supply, which has already led to an uptick in vacant units in apartment buildings. Multifamily construction is at a 50-year high, which means hundreds of thousands of new rental units will be available next year. Another factor is reluctance to sell: Many homeowners will rent out their homes rather than sell because they don’t want to lose a low rate. There will be an influx of single-family homes for rent.

Rents have already fallen from a year ago in 11 metros, with the biggest drops in Milwaukee, Minneapolis and Baltimore. We expect to see rents fall soon in places where apartment supply is growing rapidly, including Boise, Phoenix, Charlotte and Raleigh.

Increasing rental supply and declining prices–along with high mortgage rates, limited inventory and other affordability barriers–mean few renters will become buyers next year. Many prospective first-time homebuyers may instead become move-up renters, upgrading from a small urban apartment to a larger apartment or a single-family rental to fit their growing families. Some Gen Zers and young millennials who have saved up some money to buy a home but are able to wait until prices and/or rates come down will focus on financial pursuits other than homeownership next year, like investing in stocks, while they continue renting indefinitely.

Builders will continue to pull back on constructing new homes next year, with year-over-year declines of roughly 25% in building permits and housing starts continuing into 2023.

Builders will back off most from building new single-family homes. Construction of single-family homes surged during the pandemic, which means builders need to offload the homes they have on hand without adding more supply to limit their financial losses. They’ll pull back dramatically in some markets like Phoenix and Dallas, where they built too many homes in anticipation of demand that’s failing to materialize.

Constructing rental units, including apartment buildings and multifamily houses, will make more financial sense for builders next year, as rental demand won’t fall off as much. Rental building activity is likely to fall slightly in 2023, but not as much as construction of single-family homes. Some construction spending will shift to remodels, as many Americans who were hoping to move will instead opt to renovate in the face of high mortgage rates.

Real estate investors will purchase about 25% fewer homes than a year earlier, with purchases likely to bottom out in the spring. Investors’ business model is to buy low and sell–or rent–high, and the cash they borrow to buy homes outright is no longer cheap. Fewer iBuyers in the market–Redfin recently announced plans to shutter its iBuying business–is also a factor in slowing activity. Some investors, especially newer and smaller ones, will bow out of the housing market entirely and others will slow their activity. But if inflation slows and the Fed eases up on rate hikes as expected, investors will likely start buying more homes in the second half of the year, taking advantage of slightly lower home prices.

Listing activity from investors is likely to be lower than the year before, but it won’t decline as much as new listings in the overall market. That’s because while many investors will choose to rent out homes rather than sell while the market is down, some need to offload inventory after buying sprees over the last two years.

Gen Zers are entering into a workforce with more remote-work opportunities than ever before, which means they’ll have more flexibility in where they’ll choose to start their careers than older generations. They can prioritize things like affordability, lifestyle, weather and proximity to family.

Nearly one-third of adult Gen Zers live with relatives, partly because inflation and high housing costs make it hard to afford living alone. That will allow some Gen Zers to save money in the long run and eventually use it to move where they want to. They can choose low-cost-of-living places –or even places that have paid remote workers to move in, like Tucson, AZ or Savannah, GA. Mid-sized, moderately priced places like that will be popular when more Gen Zers age into homeownership–though it will remain difficult for young first-timers to buy homes because prices and rates make it more expensive than it used to be.

Some Gen Zers will still prioritize job hubs like New York and Boston because their employers call them to the office, or because they prefer working alongside experienced colleagues and/or prefer big-city amenities. That could help hold up rental prices in those parts of the country.

We expect the share of Americans relocating from one metro to another will slow to about 20% in 2023, down from 24% this year. That’s still above pre-pandemic levels of around 18%.

In 2023’s slow market, there won’t be a next Austin. Even Austin isn’t Austin anymore: The wave of homebuyers moving into Austin has slowed to a trickle, as many people are now priced out and many remote workers who wanted to relocate have already done so. Plus, some workers, especially 20-somethings starting their careers, will choose to remain near their office as some employers start expecting in-person work, at least part of the time.

But some people will relocate next year, including retirees and remote workers who are still seeking out more affordable areas. For the Americans moving for affordability, places with no state income taxes, like Florida, Texas and Tennessee, will be attractive.

Some Americans will be priced out of climate-risky areas like beachfront Florida and the hills of California because of ballooning insurance costs. We expect disaster-insurance rates to continue rising next year (and beyond), rendering housing in some areas more expensive.

The increasing frequency and intensity of natural disasters has prompted some insurers to stop providing coverage in risky areas altogether, and others to raise rates for flood and fire insurance. Florida property insurance premiums increased 33% year over year in 2022, and they’re expected to rise more after Hurricane Ian wreaked havoc on parts of coastal Florida in September. Americans with FEMA flood insurance–especially those in Florida, Mississippi and Texas–are also starting to see their flood insurance premiums increase after the government agency overhauled its pricing. In California, many private insurers have stopped covering high-fire-risk homes, which means many homeowners and buyers must use a last-resort plan and spend two to three times more on premiums.

Disaster insurance is now a prerequisite for a mortgage in many risky areas. As it becomes harder to come by, those areas are likely to become more concentrated with affluent, all-cash buyers.

More U.S. cities will look to Minneapolis, which in 2019 became the first major city to eliminate single-family-only zoning, for inspiration in keeping rental and home prices under control. Earlier this year, Minneapolis became the first metro area to see rents decline.

Some places have already followed Minneapolis’ example. Portland, OR and California are altering rules to allow for denser housing. Other places, including Alexandria, VA, Cambridge, MA and Gainesville, FL, are also changing policies to allow more affordable housing. Those places are showing that the YIMBY (yes in my backyard) movement is working.

Next year, we expect more local and state governments will eliminate single-family-only zoning, allowing more multifamily buildings, townhouses and ADUs. That helps ease expenses because denser housing is typically less expensive.

Next year’s slow housing market is likely to reverse or at least halt the downward trend in buyers’ agent commissions.

The hot pandemic-era housing market pushed the typical U.S. buyers’ agent commission down to 2.63% of the home’s sale price in 2022, its lowest level since at least 2012. But declines in home prices and sales will prop up buyers’ agent commissions next year. Sellers will also play a part, with some offering to pay higher commission for buyers’ agents to attract bidders.

The number of agents is another factor. There were more real estate agents than homes for sale in the U.S. during the pandemic boom, but the ratio of agents to homes for sale has already begun to fall, and we expect tens of thousands of agents to leave the industry next year. This could push commissions up because the agents who remain will likely be able to charge higher percentages.

“The decline in agent commissions is likely to resume once the market heats up again,” said Joe Rath, Redfin’s director of industry relations. “That’s because the real estate industry is finding new ways to educate consumers on how agents are paid, including a requirement that commissions are publicly displayed. Additionally, the industry is under scrutiny as the Department of Justice looks into how agents are paid and considers whether the commission structure causes limited competition. That probe could result in buyers becoming responsible for paying their own agents, which would likely lead to a drop in commissions.”