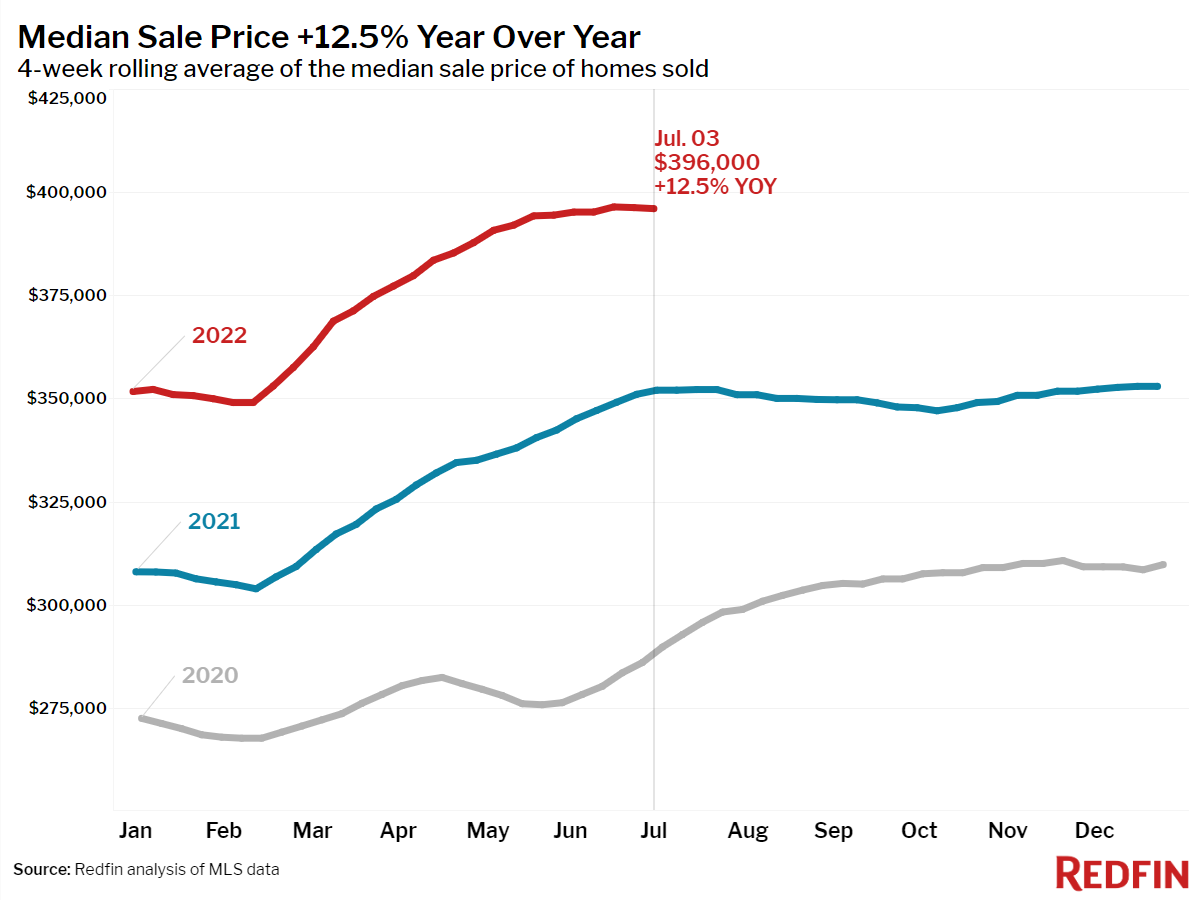

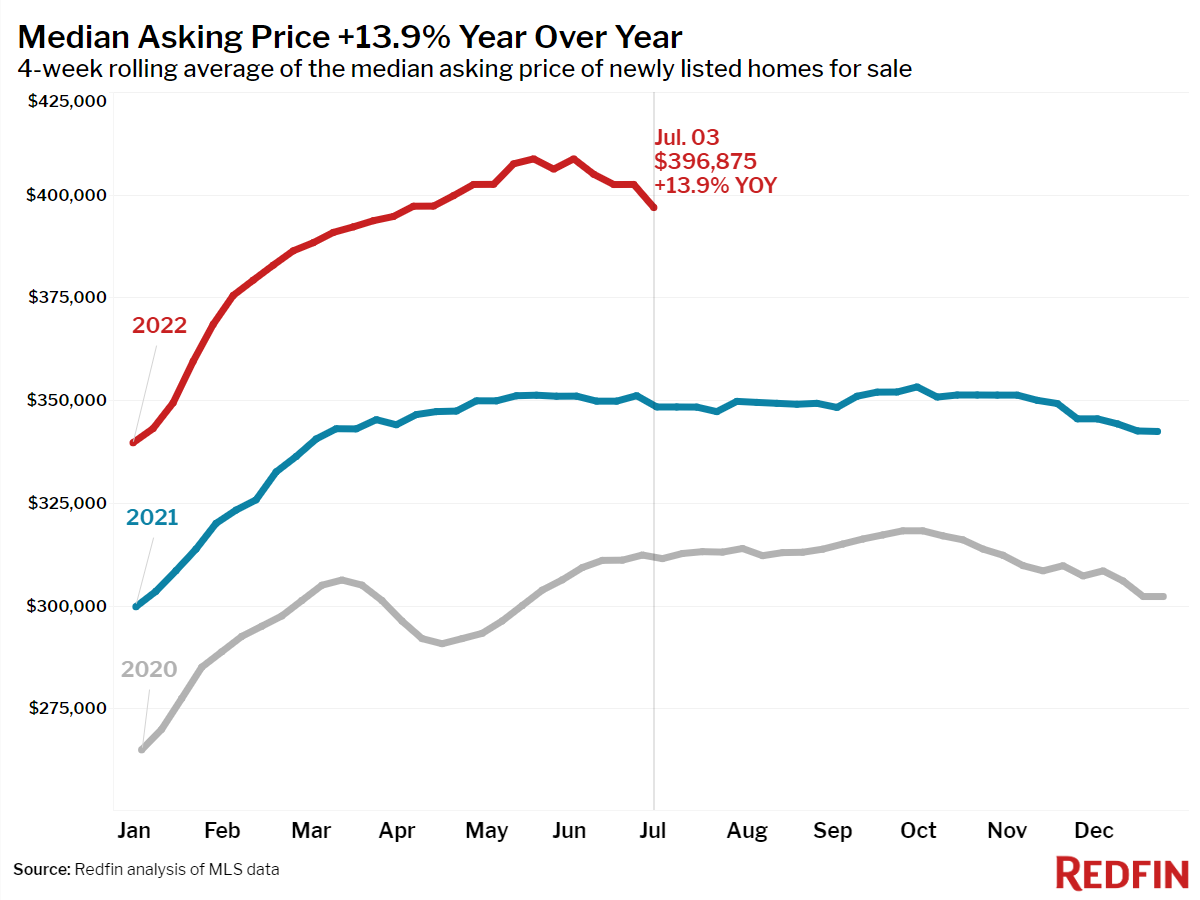

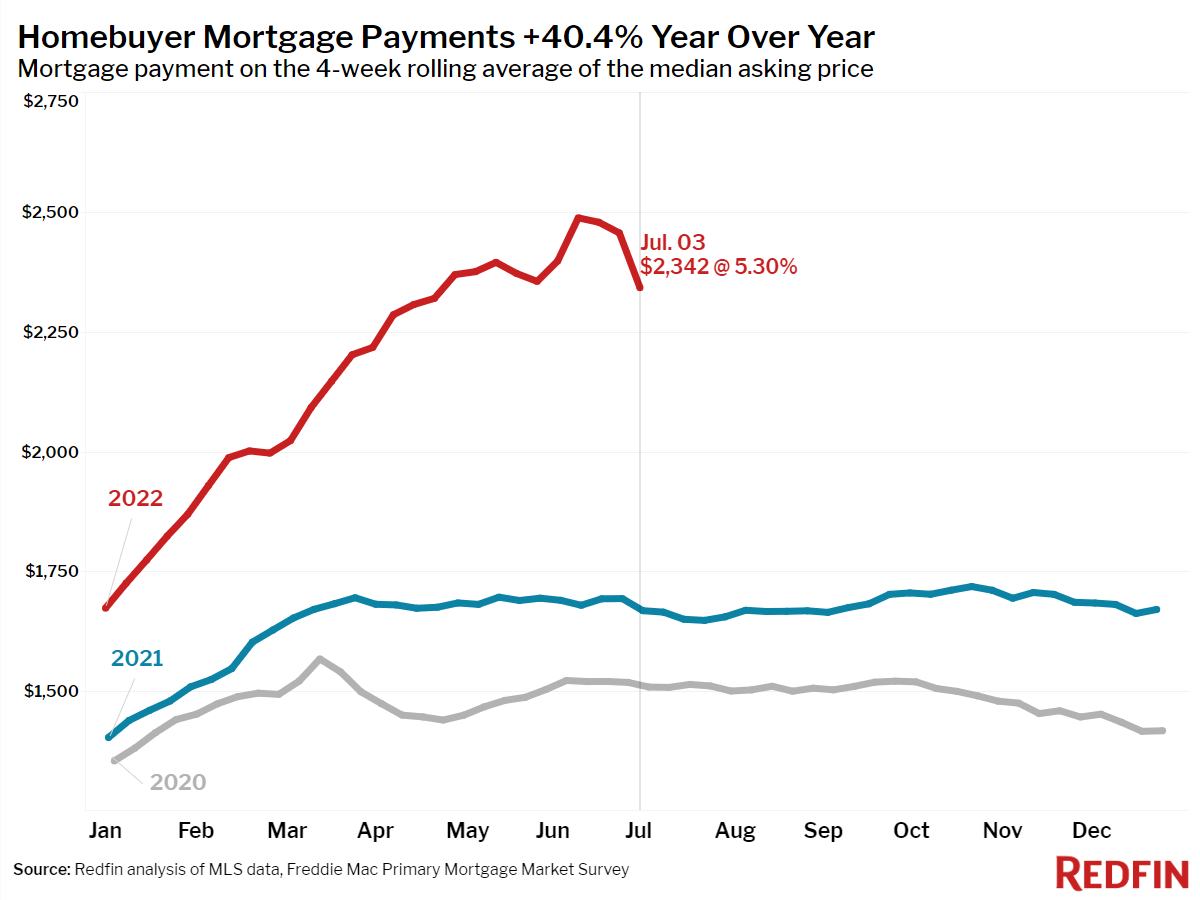

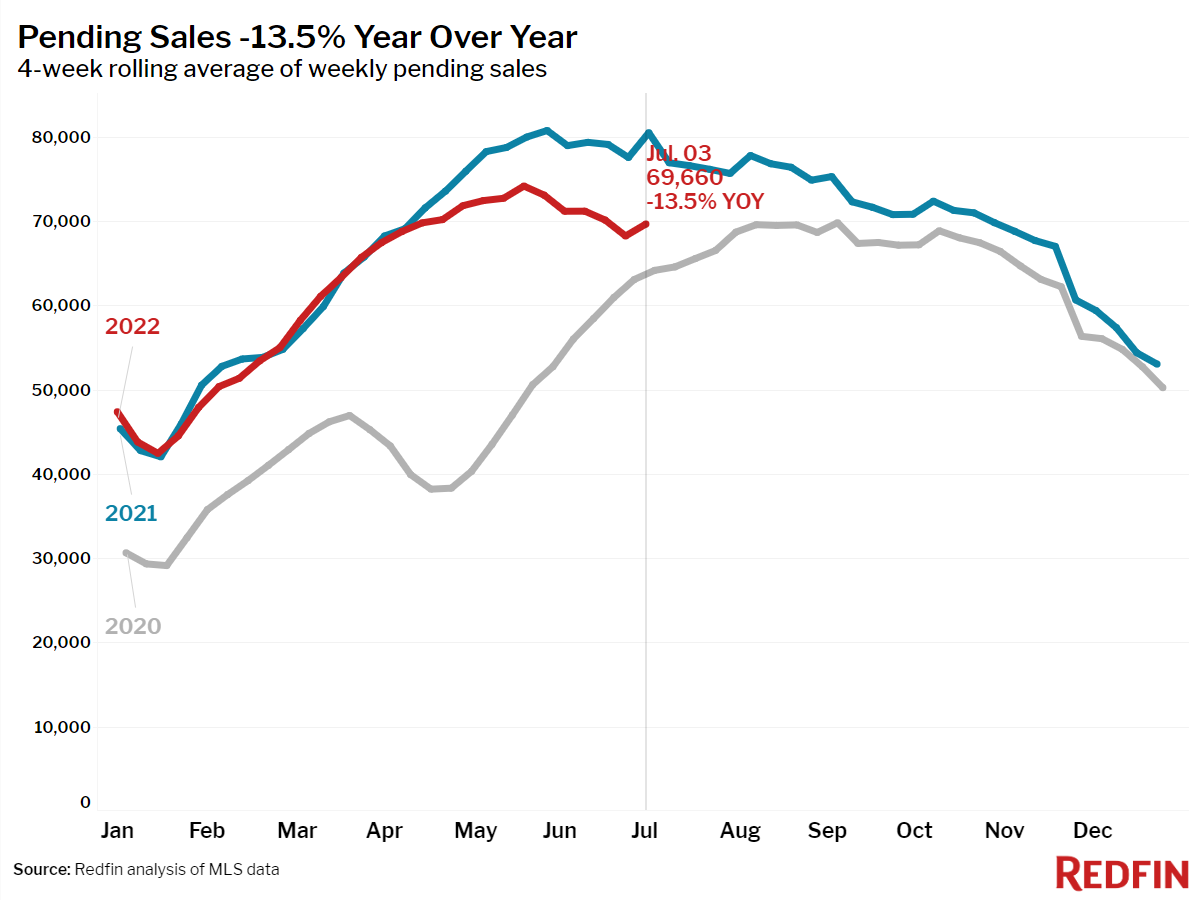

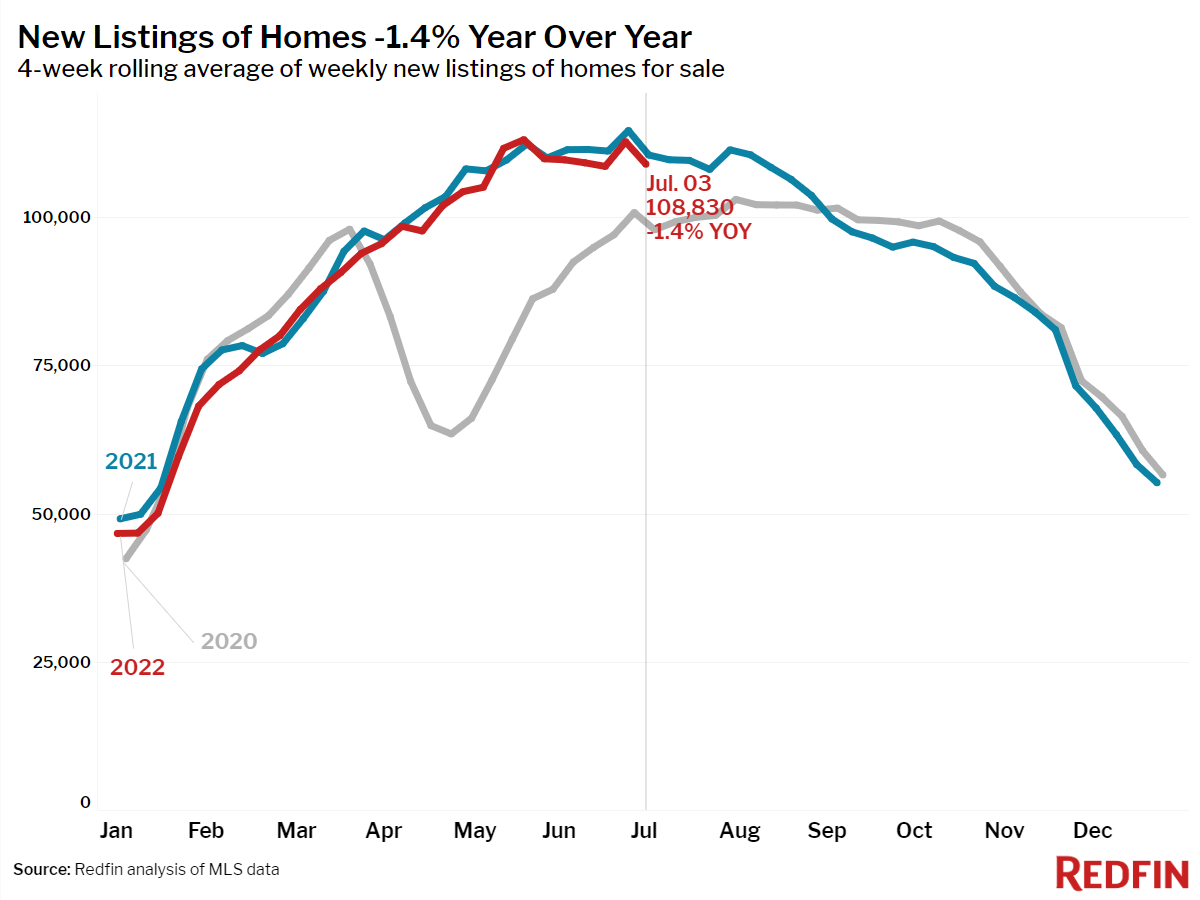

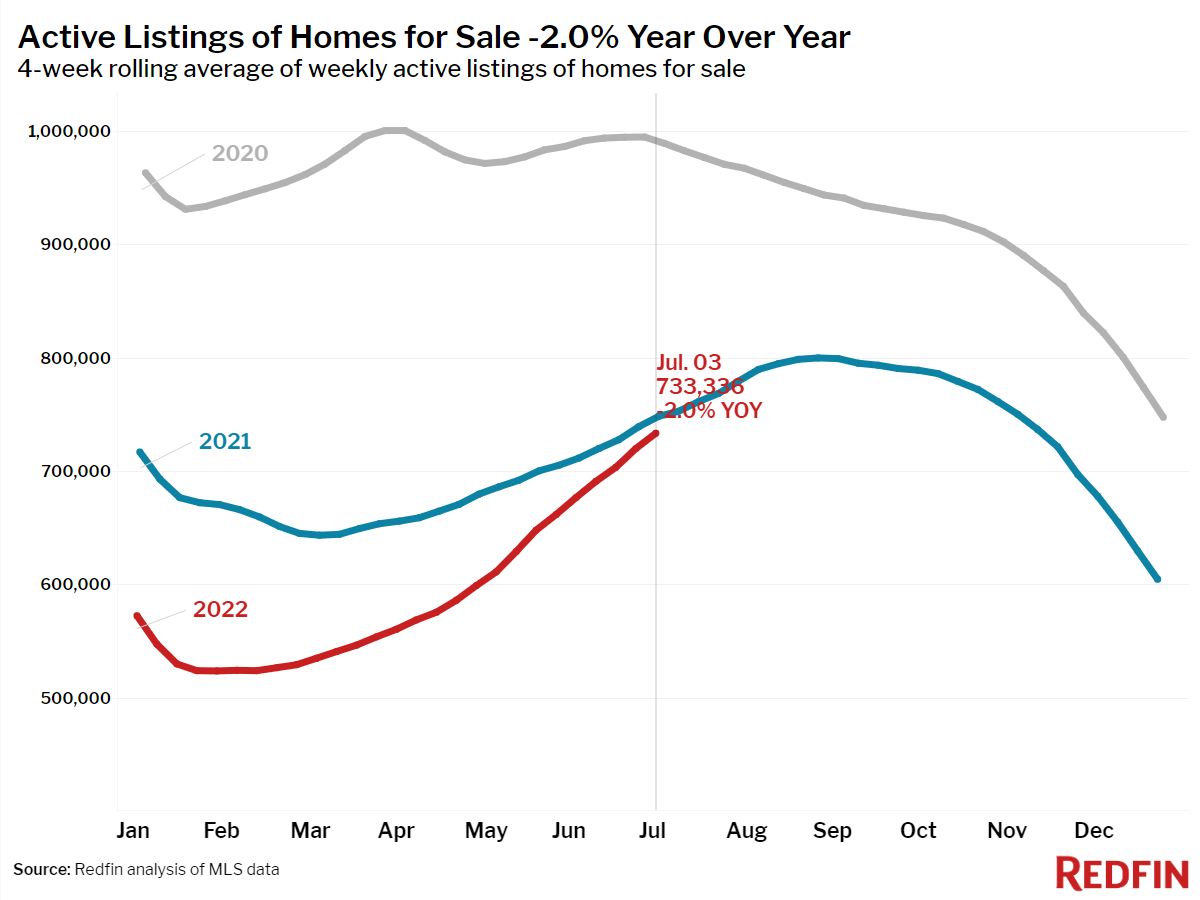

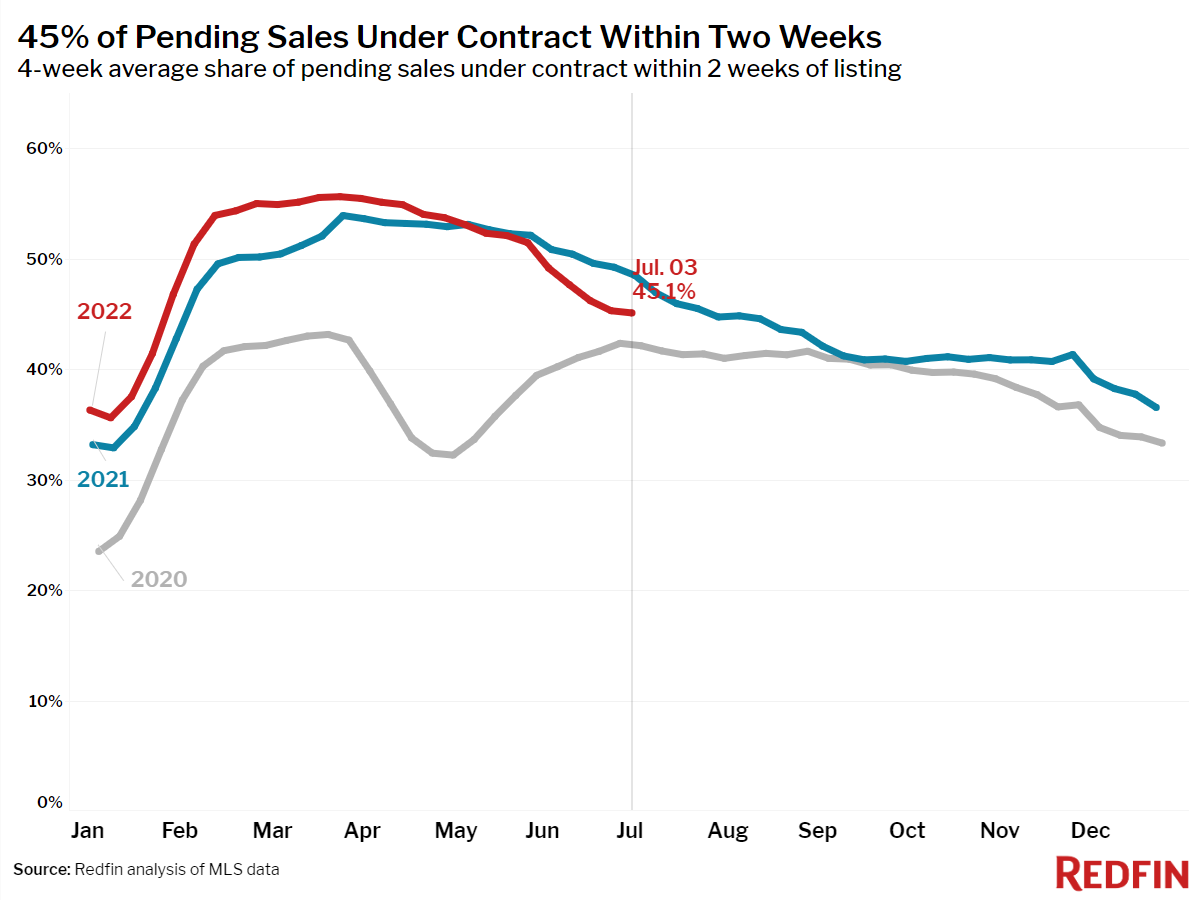

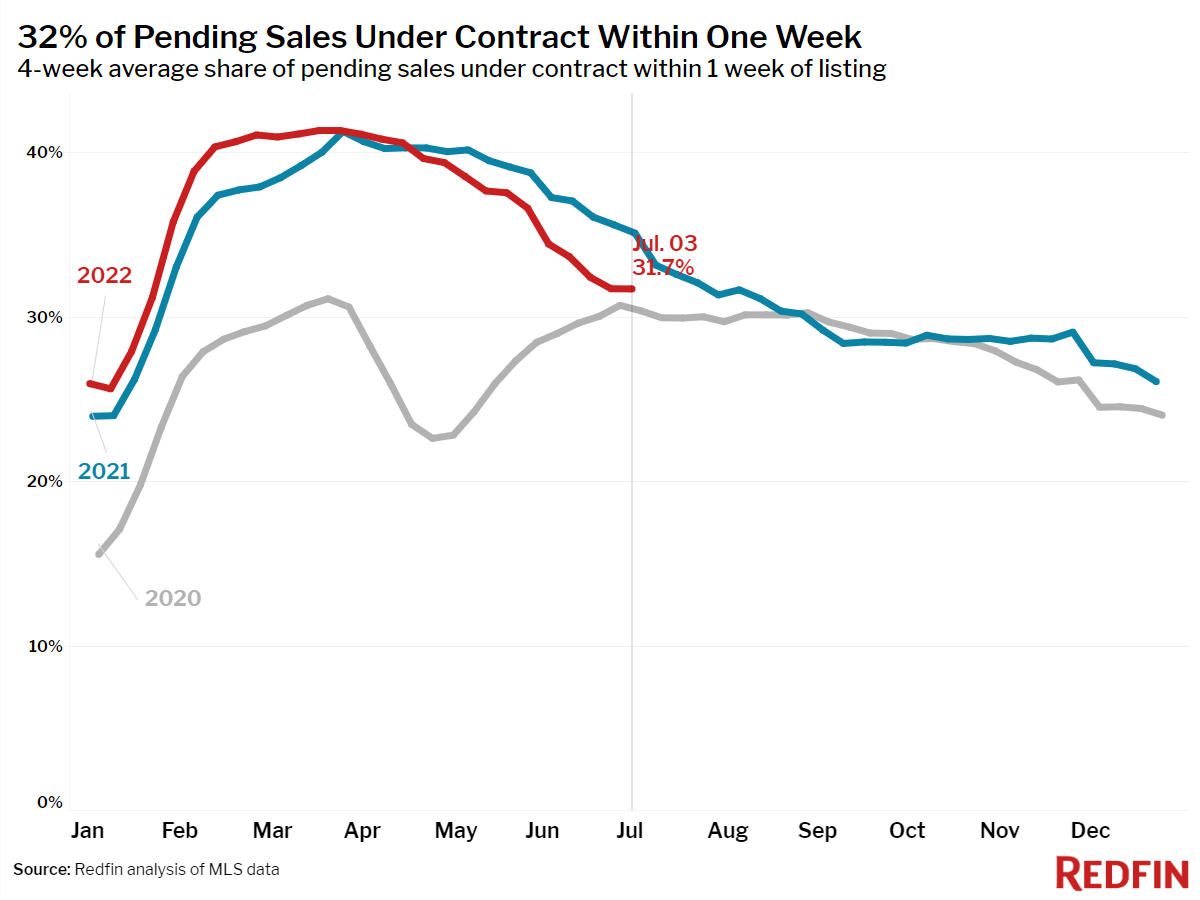

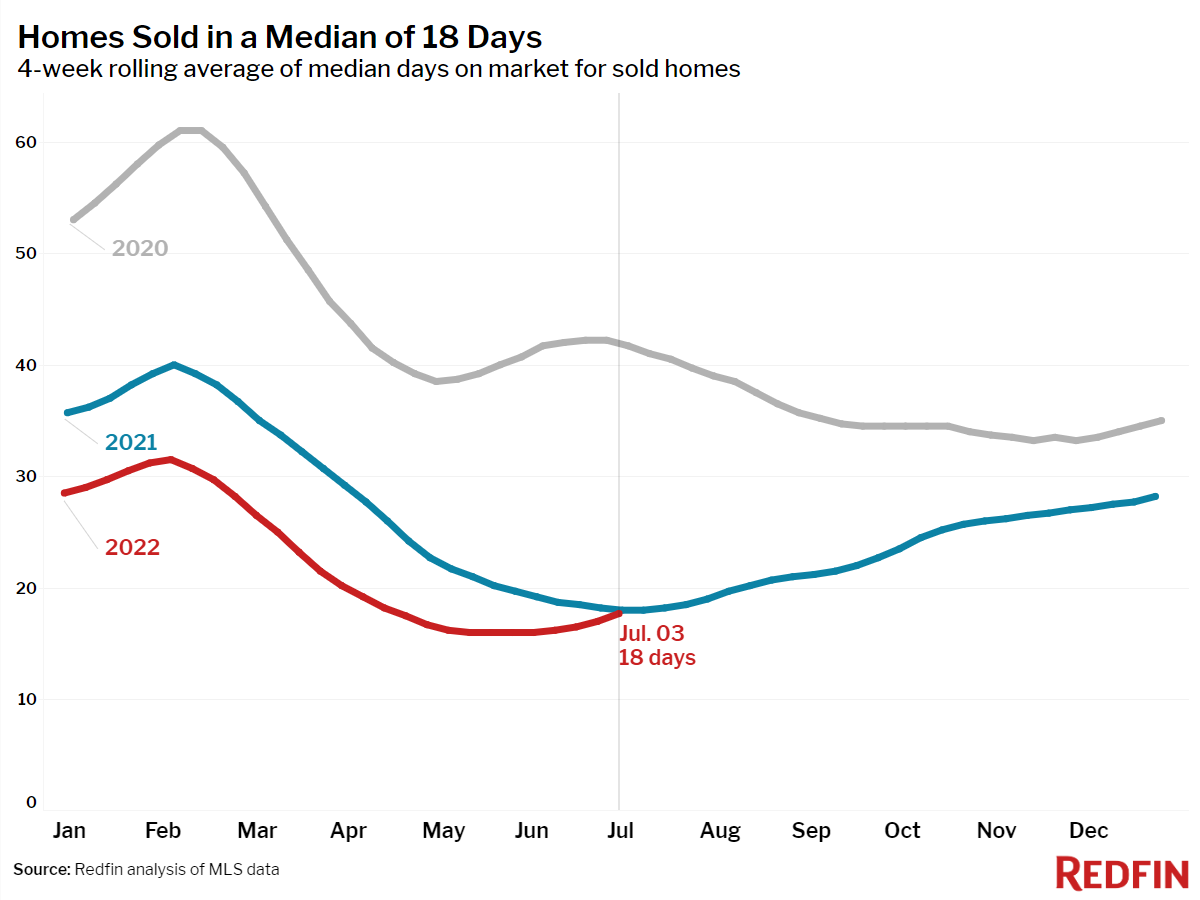

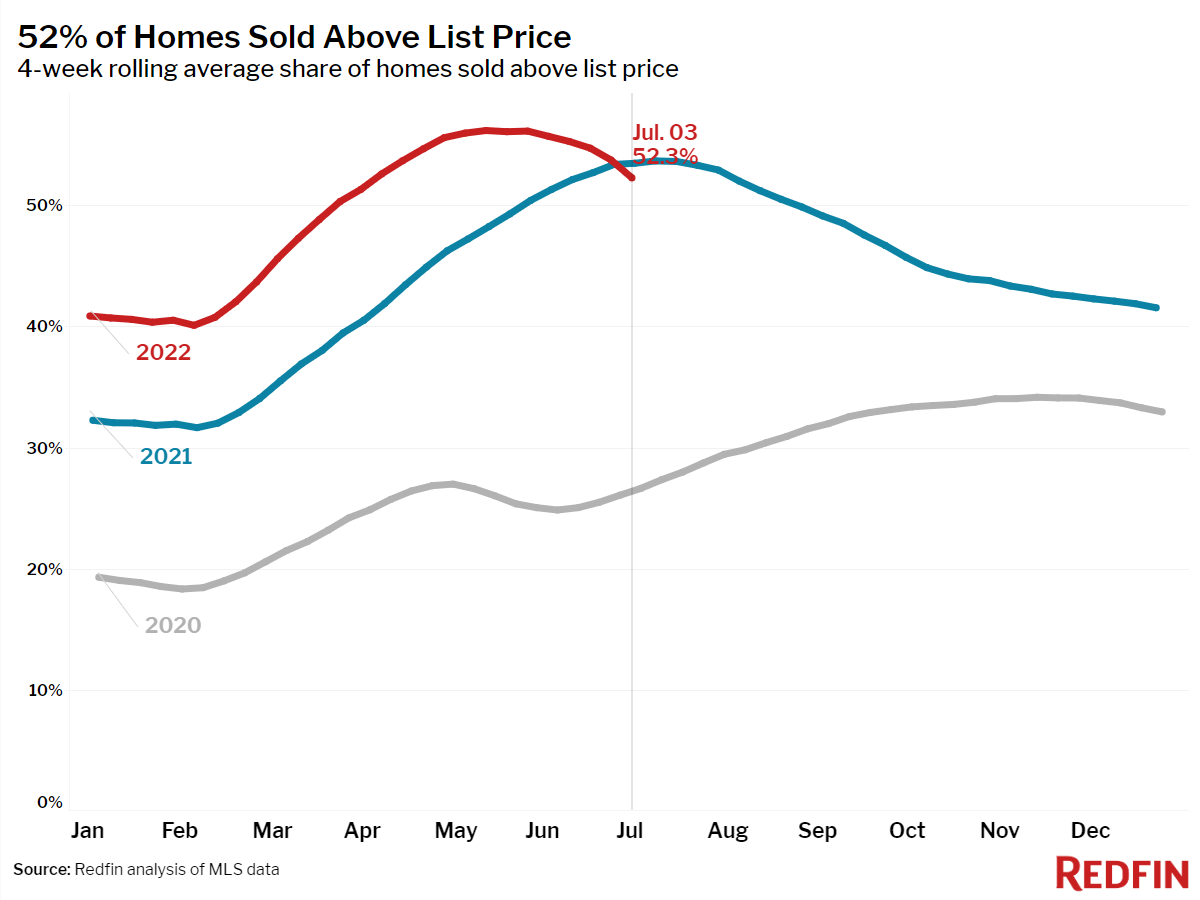

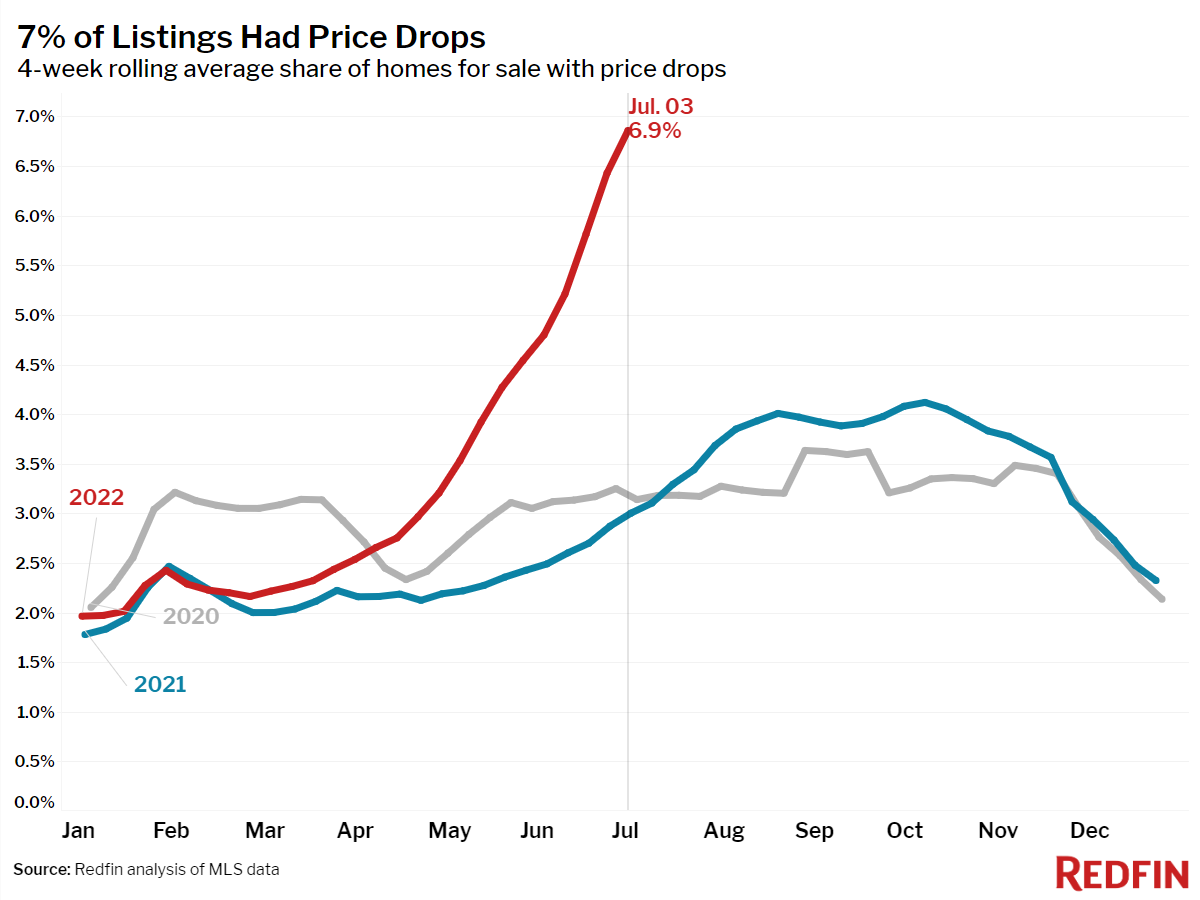

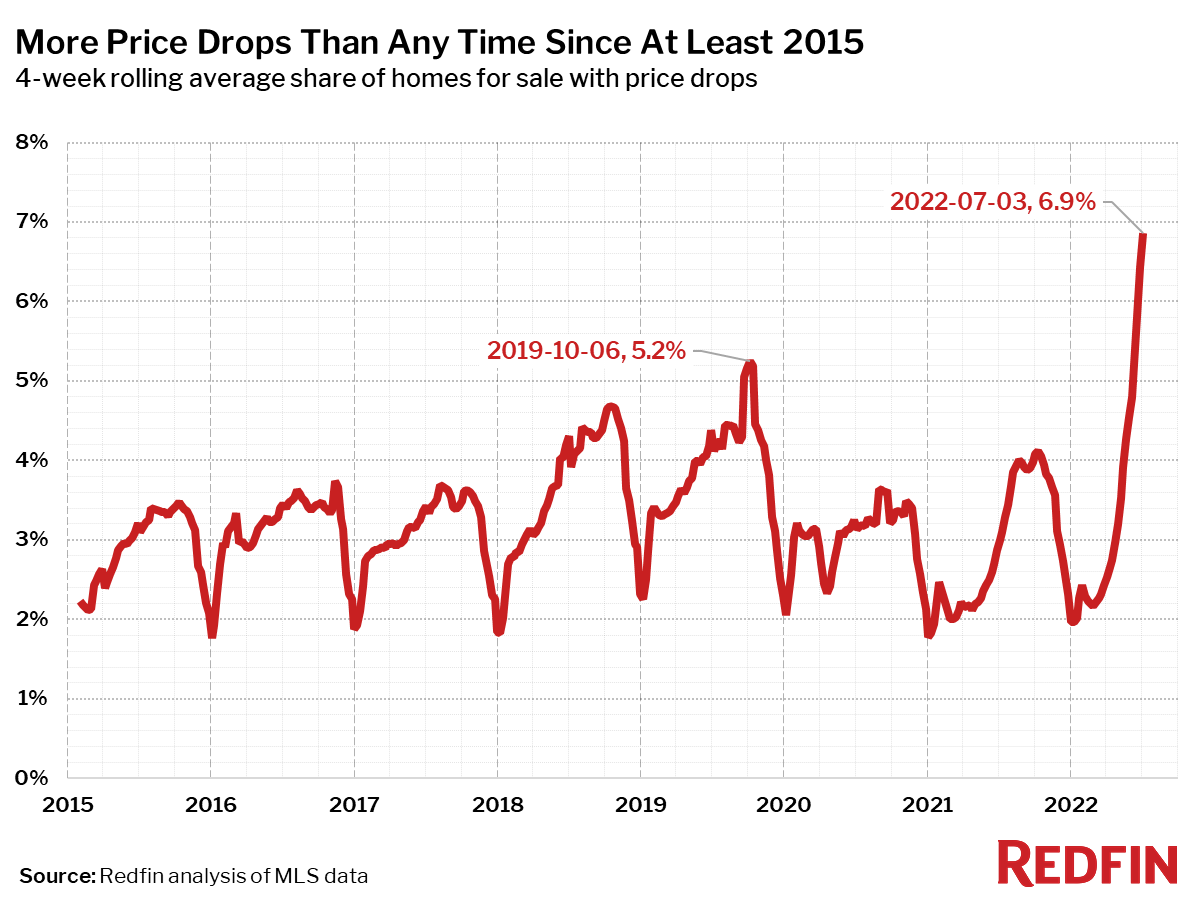

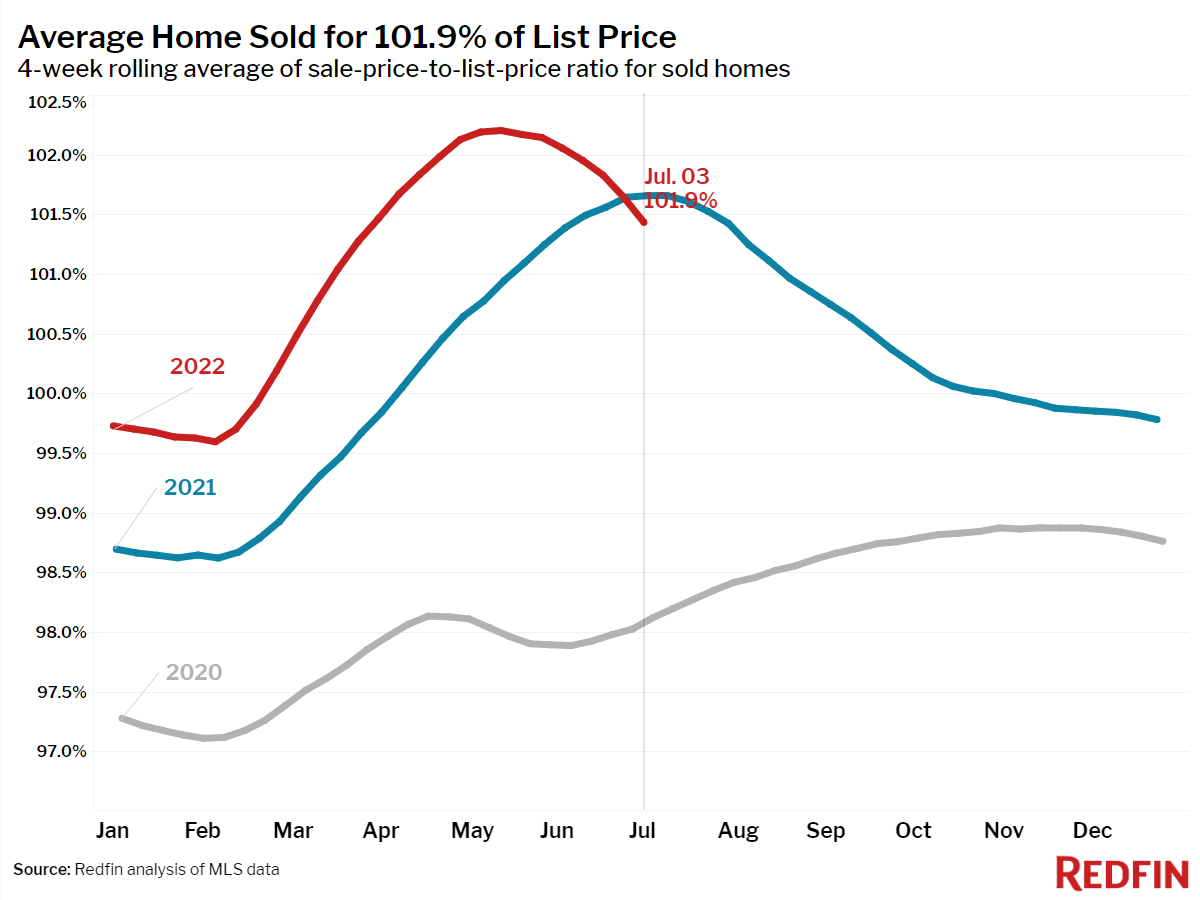

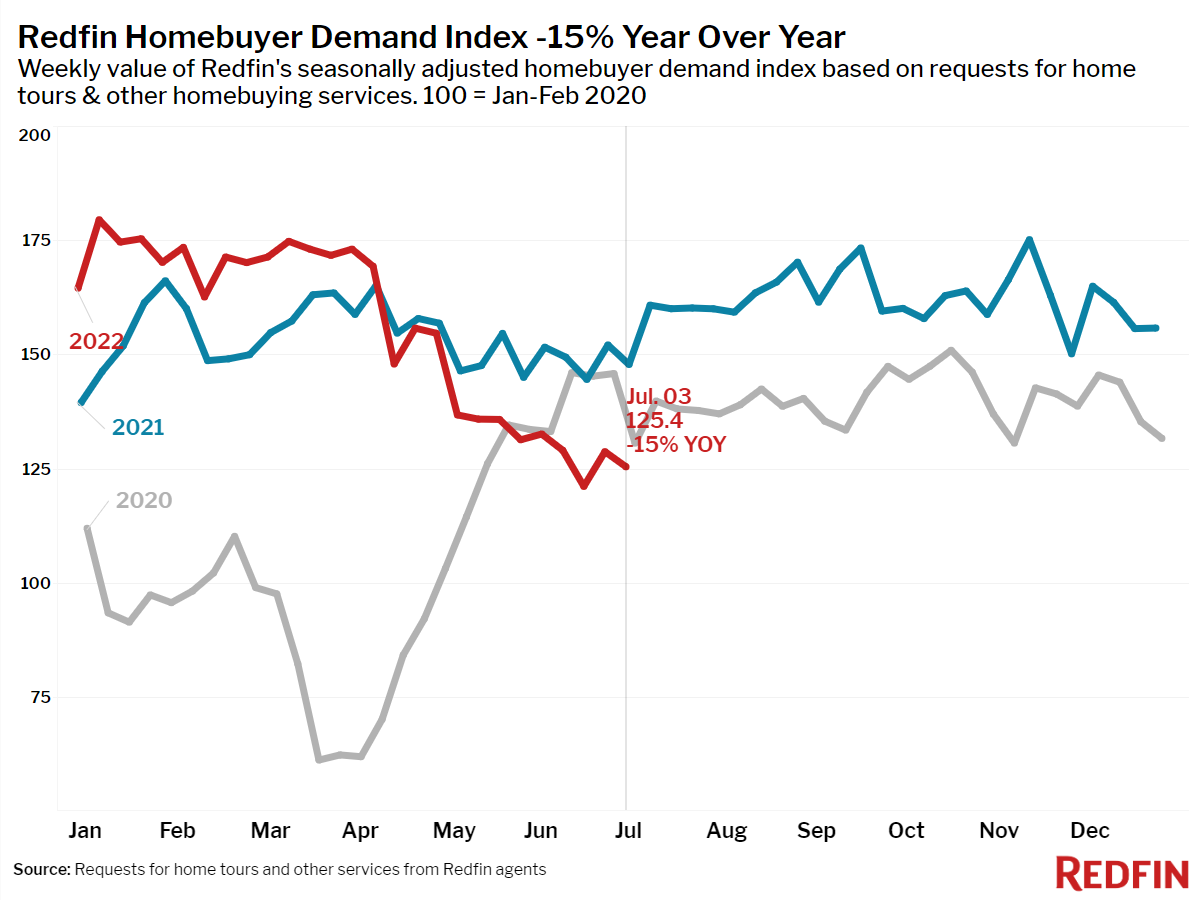

After months of tipping heavily in sellers’ favor, the scales of the housing market are finally balancing out. Soaring housing costs caused many house hunters to drop out in recent months, which is now providing some relief for buyers who remain. Today’s buyers are seeing the housing shortage ease, price growth slow, competition decline and mortgage rates drop from their 2022 high. The share of sellers slashing their asking prices hit a record high during the four weeks ending July 3, and the portion of homes going for above list price fell for the first time since June 2020 as sellers responded to waning homebuyer demand.

“Conditions for homebuyers are improving. Housing remains expensive, but mortgage rates just posted their biggest weekly drop since 2008, which makes buying a home a bit more affordable,” said Redfin chief economist Daryl Fairweather. “One way buyers can take advantage of the shift in the market is seeking concessions from sellers. That could include asking the seller to buy down your mortgage rate, pay for repairs or cover some of your closing costs.”

“The market slowdown is giving buyers more opportunities to negotiate, especially with sellers whose homes have been on the market for a while,” said Columbia, SC Redfin real estate agent Jessica Nelson. “I tell my sellers that they need to price their homes realistically from the get-go. If they don’t, their home may end up sitting on the market and they may have to drop their price—possibly more than once—to attract buyers.”

Unless otherwise noted, the data in this report covers the four-week period ending July 3. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.