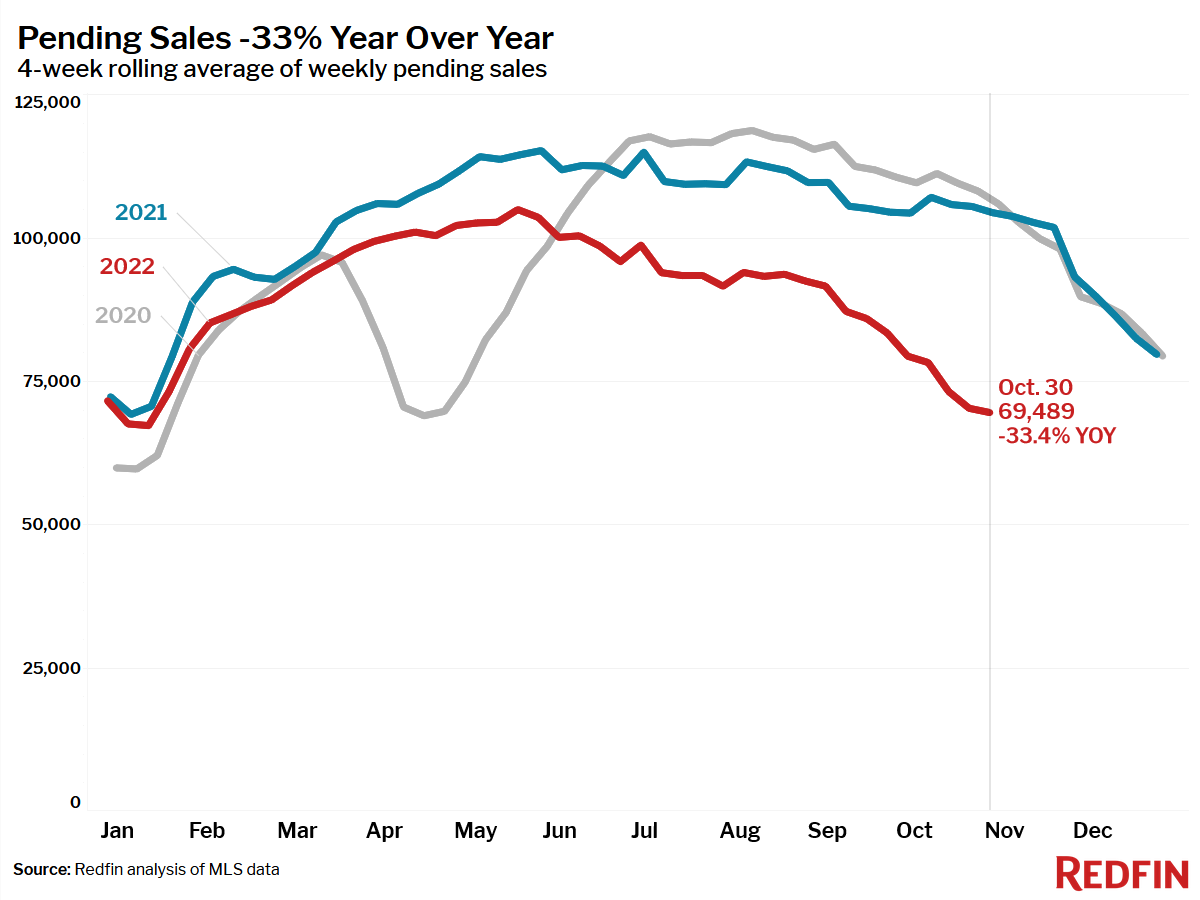

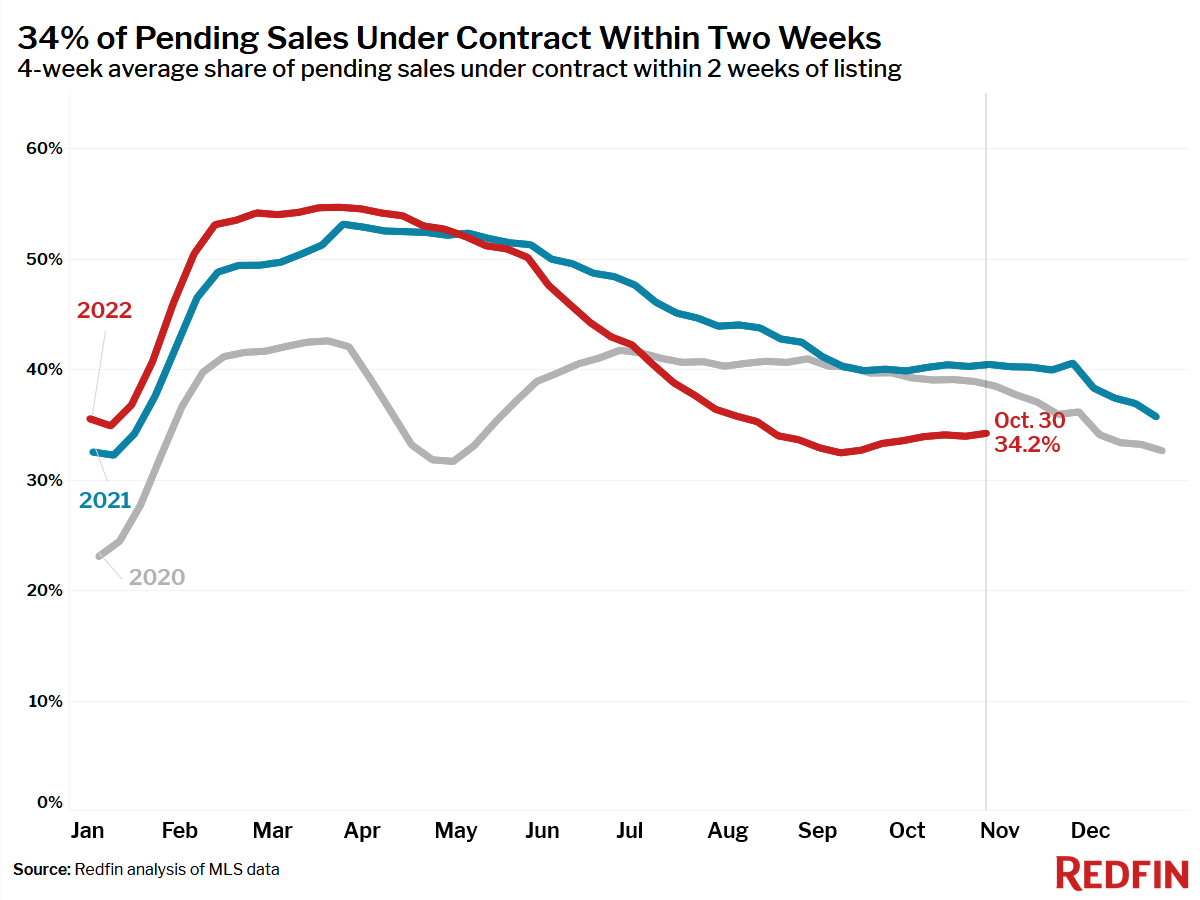

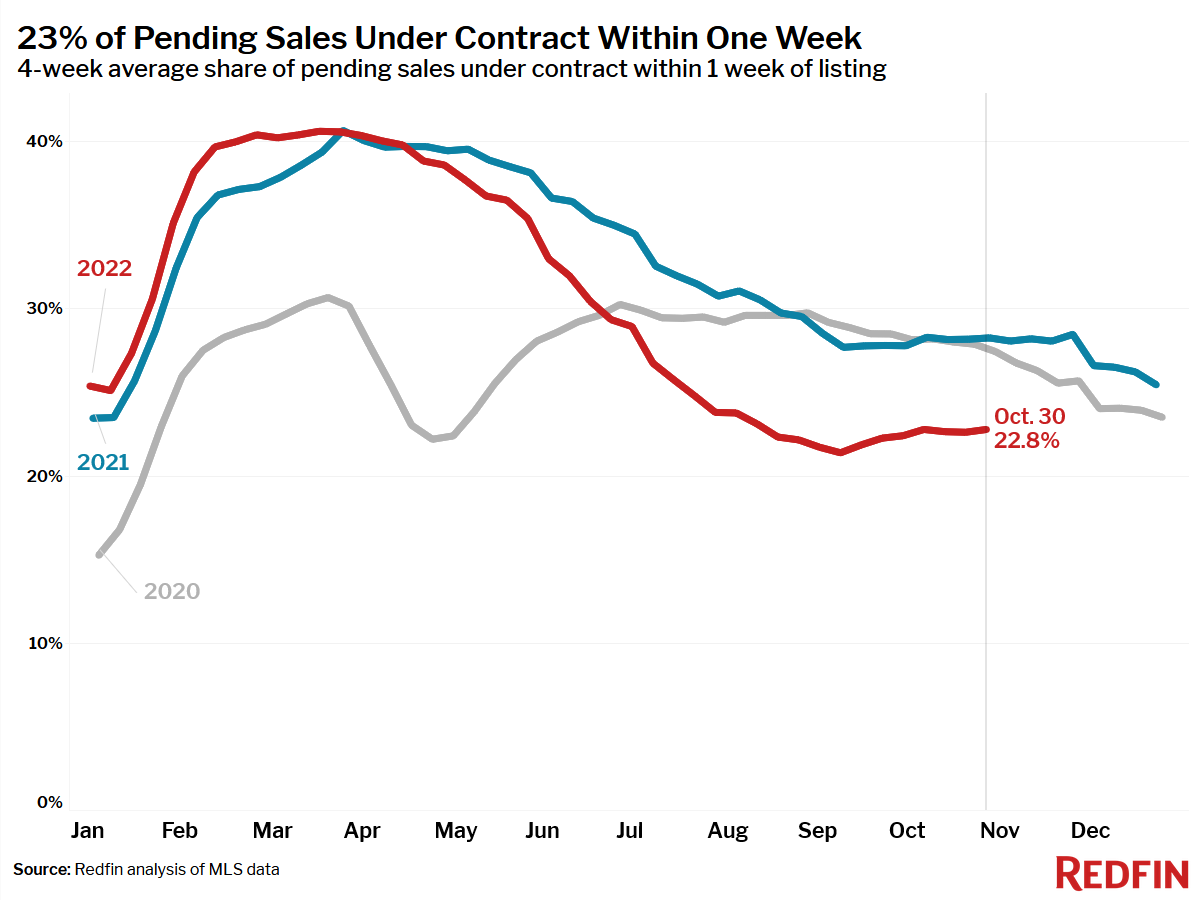

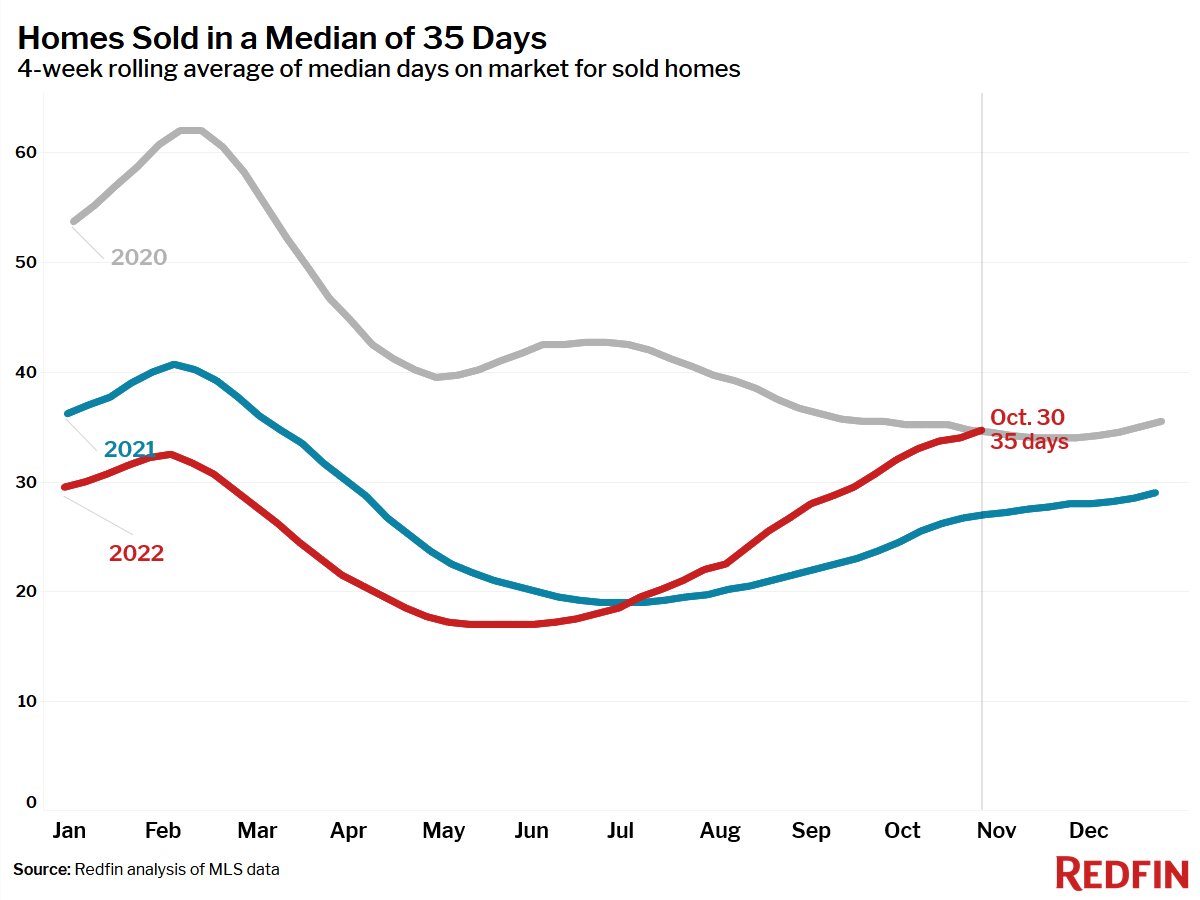

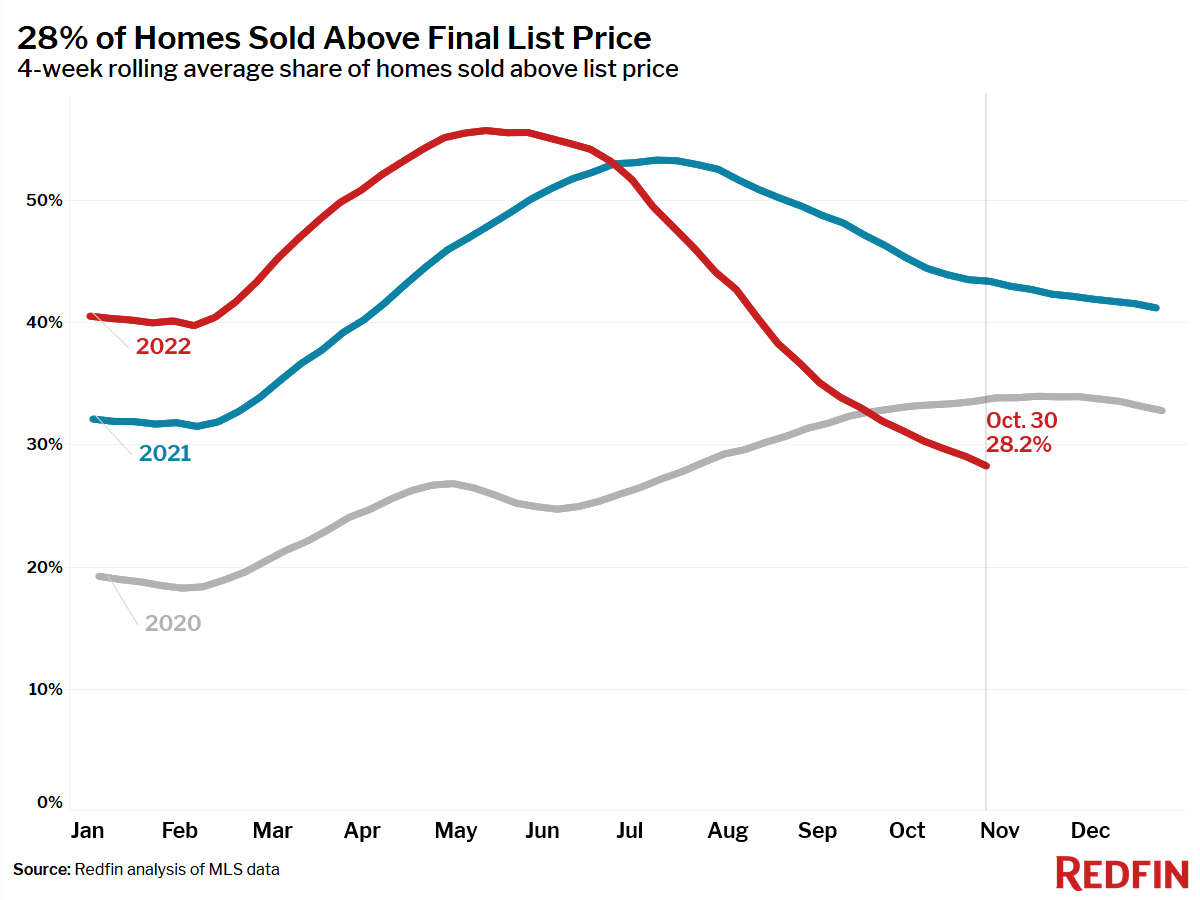

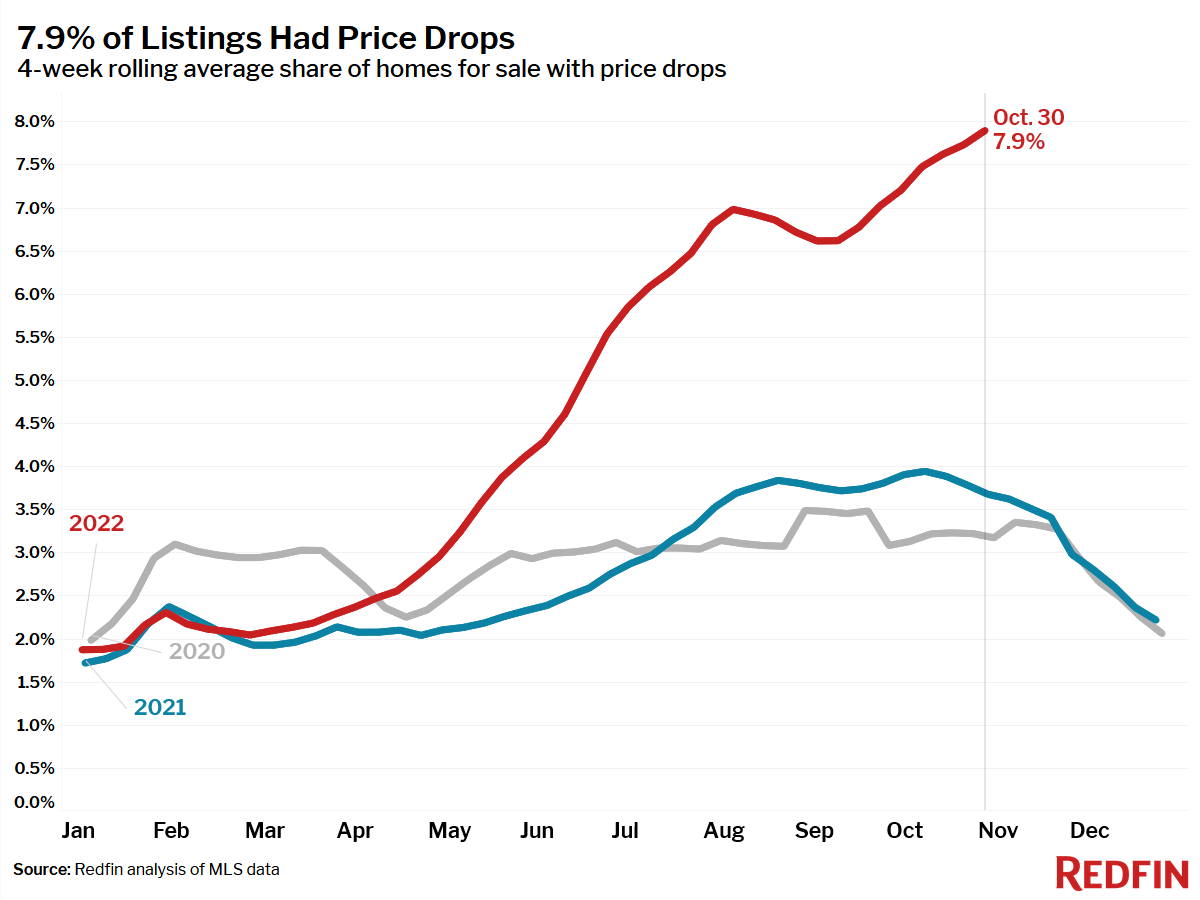

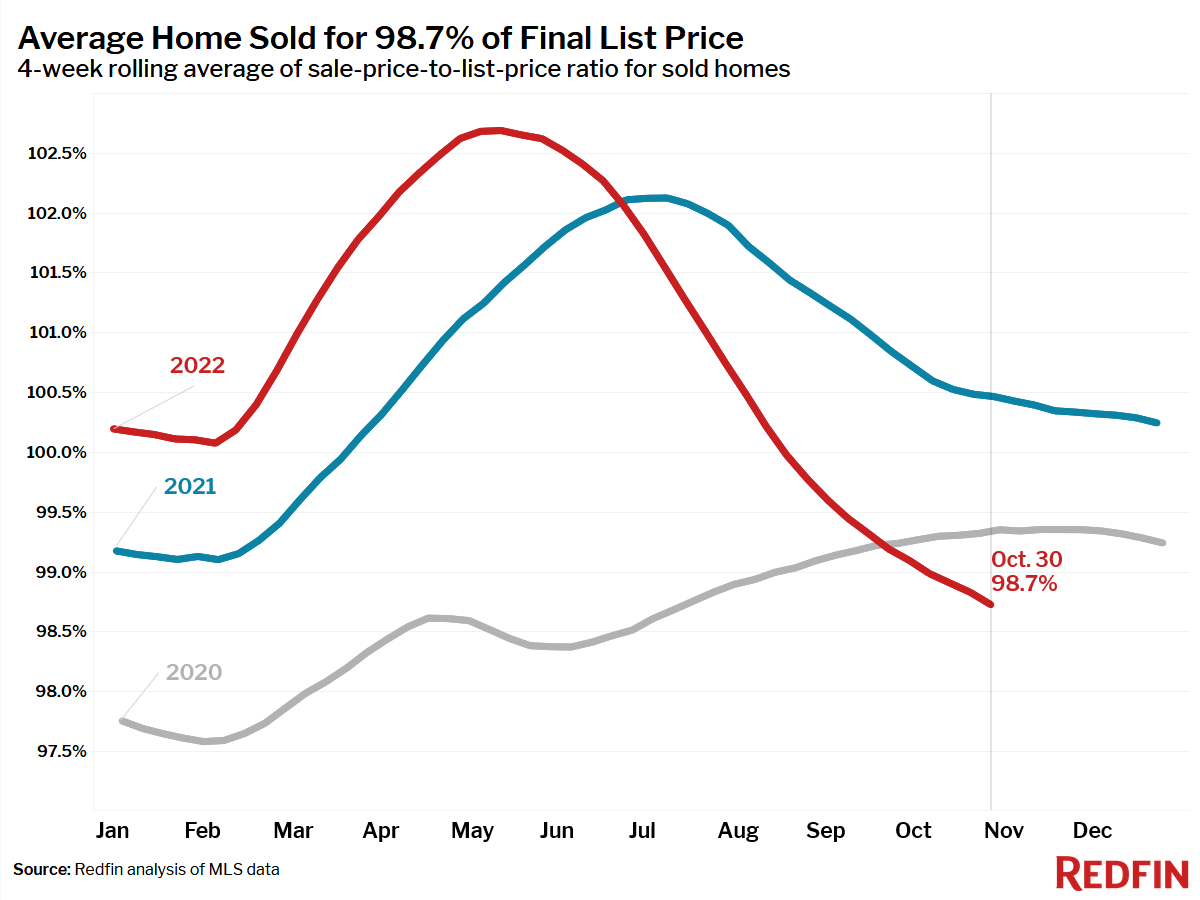

One-third fewer homes went under contract in October than last year, the largest decline since at least 2015, with several pandemic boomtowns including Las Vegas, Miami and Phoenix posting declines of around 50%. Nationwide, a record high share of home sellers dropped their price last month.

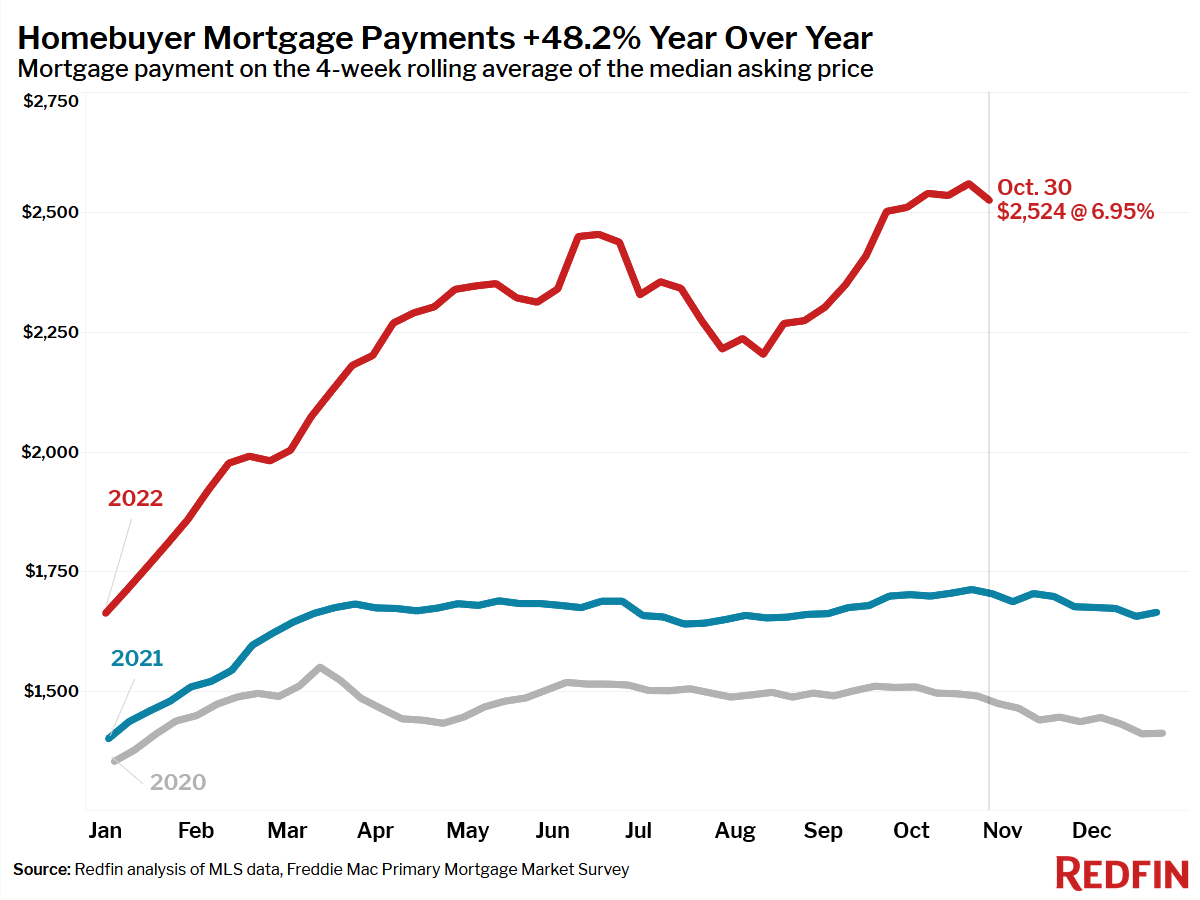

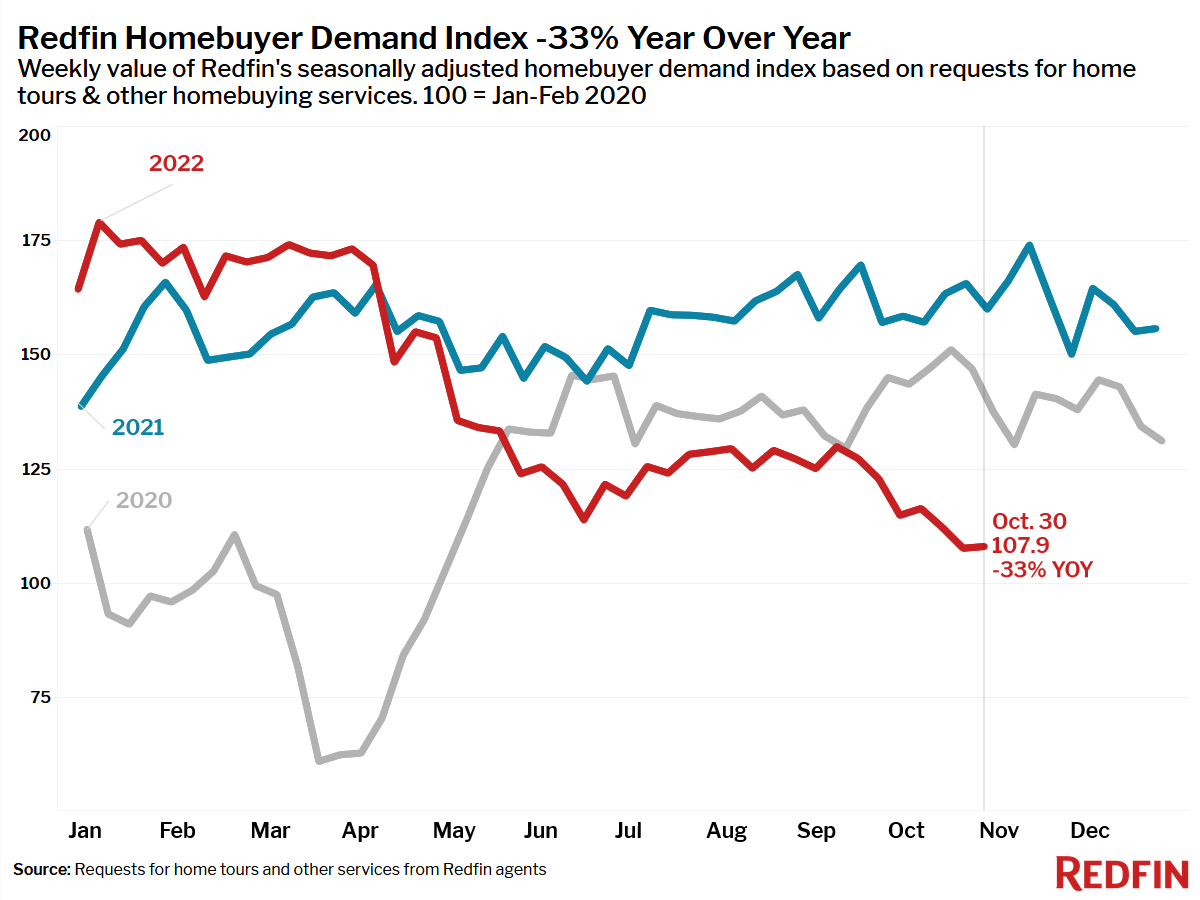

But as mortgage rates dipped below 7% in the final week of October, a handful of key measures of homebuying demand stabilized after several weeks of declines: Google searches of “homes for sale,” Redfin’s Homebuyer Demand Index, mortgage purchase applications and pending sales.

Redfin agents in the Midwest and Mountain West report that they have seen first-time and other budget-restricted buyers return to the market in recent weeks to take advantage of the opportunity to be choosy about home features, take their time to make sure they are offering on the right home at the right price, do thorough inspections, make below-asking offers and negotiate for concessions from sellers.

It’s too soon to say whether this is a momentary pause in the market’s cooling trend as buyers who have been watching and waiting seized a moment of stability in mortgage rates to make their bid, or if it’s the start of a broader leveling off in market activity as buyers adjust their budgets and expectations around a 7% mortgage rate.

“This week the Fed brought into view the light at the end of the tunnel for slowing the pace of interest rate hikes, but that the tunnel’s exit may be more dreadful than expected,” said Redfin Deputy Chief Economist Taylor Marr. “There is also a glimmer of hope in the data that buyers stopped leaving the market as mortgage rates leveled off this week, but we’re still deep in a market that is coping with the pains of higher mortgage rates. Mortgage rates may take longer to come down than many have expected, which means housing trends could continue to worsen as the economy adjusts to higher rates. If last year’s housing market was as overheated as Chair Powell stated on Wednesday, then record growth in rates was like a bucket of water poured on the flames to bring it into balance. It may take some time for the smoke to clear to see where things stand next year.”

Unless otherwise noted, the data in this report covers the four-week period ending October 2. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.