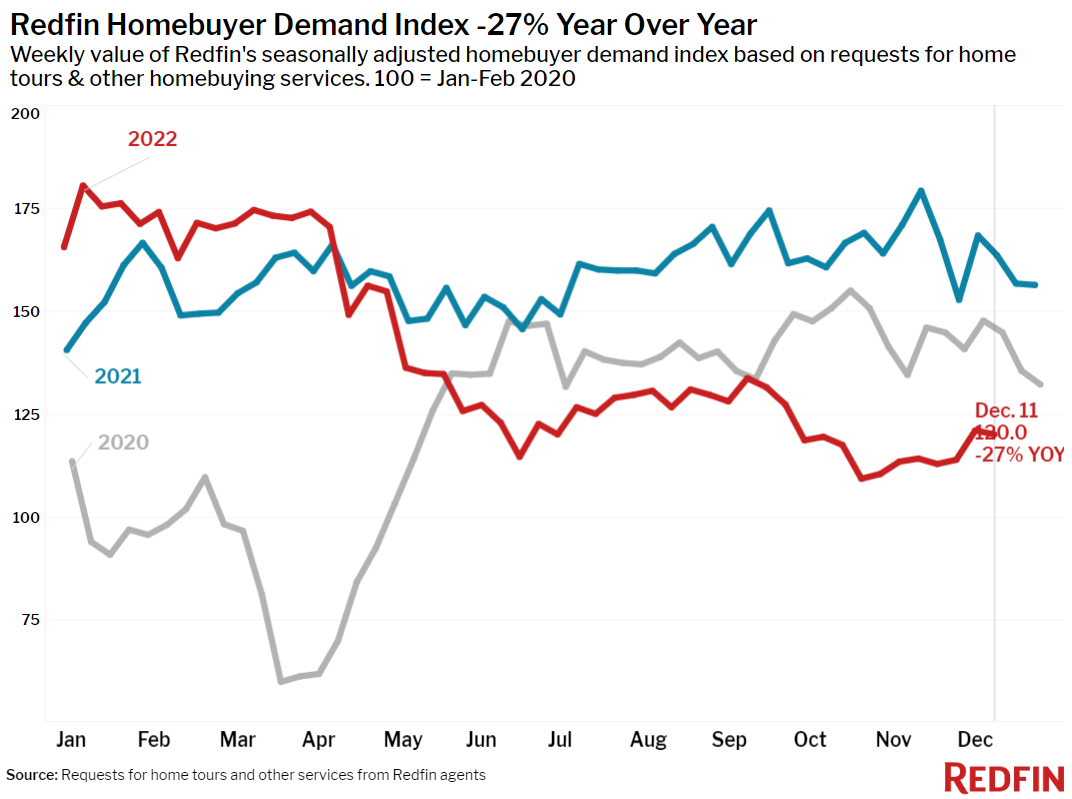

Mortgage-purchase applications and Redfin’s Homebuyer Demand Index are both up by double digits since bottoming out earlier this fall, but demand is still much lower than it was a year ago. This week’s positive inflation news could lead to mortgage rates declining further and a gradual home-sale recovery early next year, even with the Fed signaling continued rate hikes.

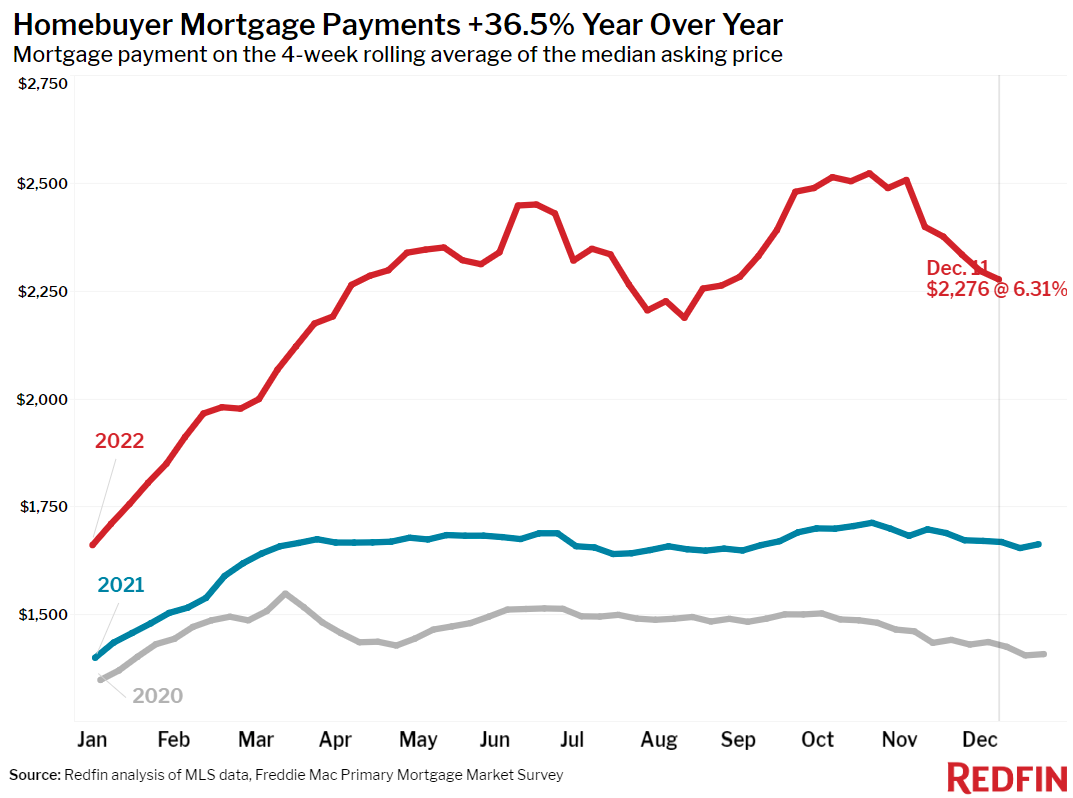

Measures of early-stage homebuying demand are up by double digits since hitting a low point at the end of October. Redfin’s Homebuyer Demand Index–a measure of home-tour requests and other services from Redfin agents–is up 10% and mortgage-purchase applications are up 14% from the end of October, when both hit their 2022 troughs. That’s largely because mortgage rates continue to steadily decline. The weekly average came in at 6.31% this week, down from a peak of 7.08% during the last week of October, saving the typical homebuyer more than $200 on their monthly payment.

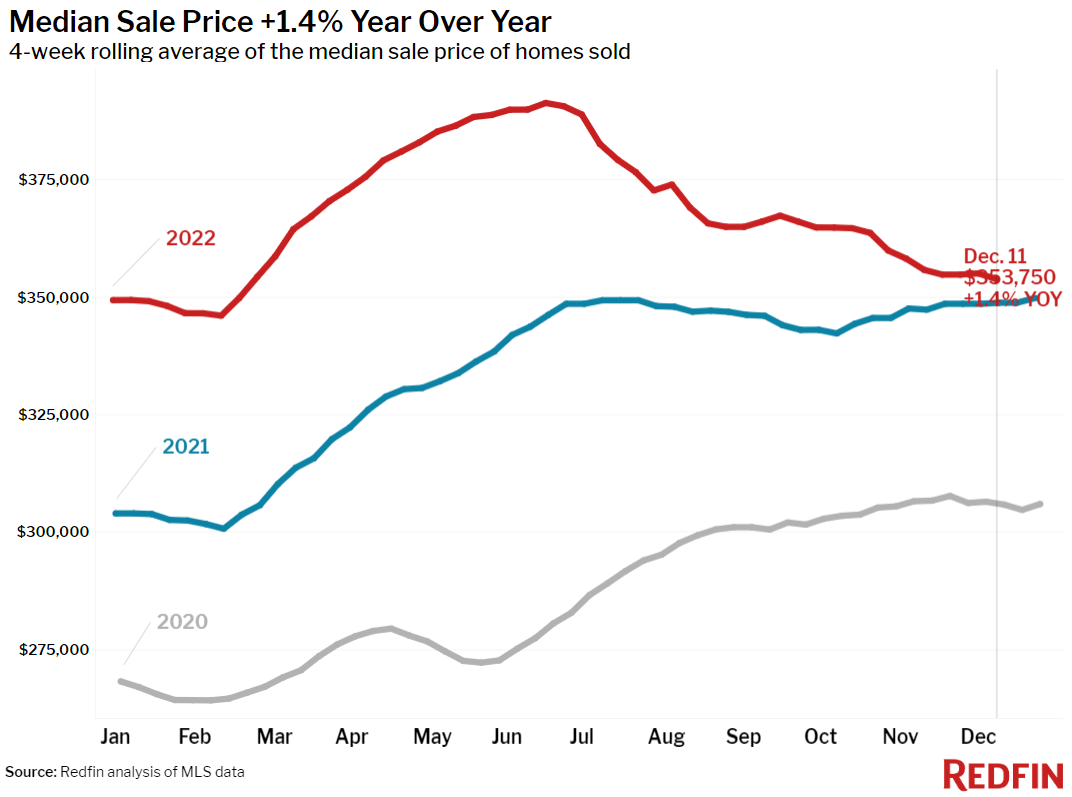

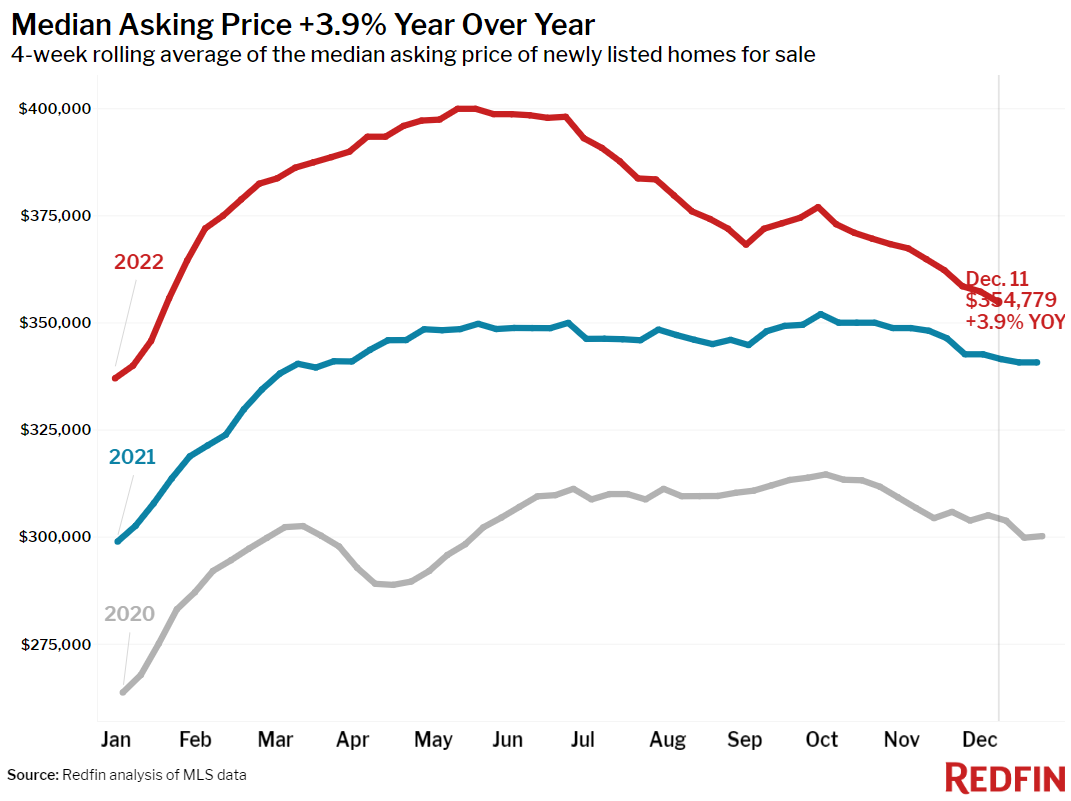

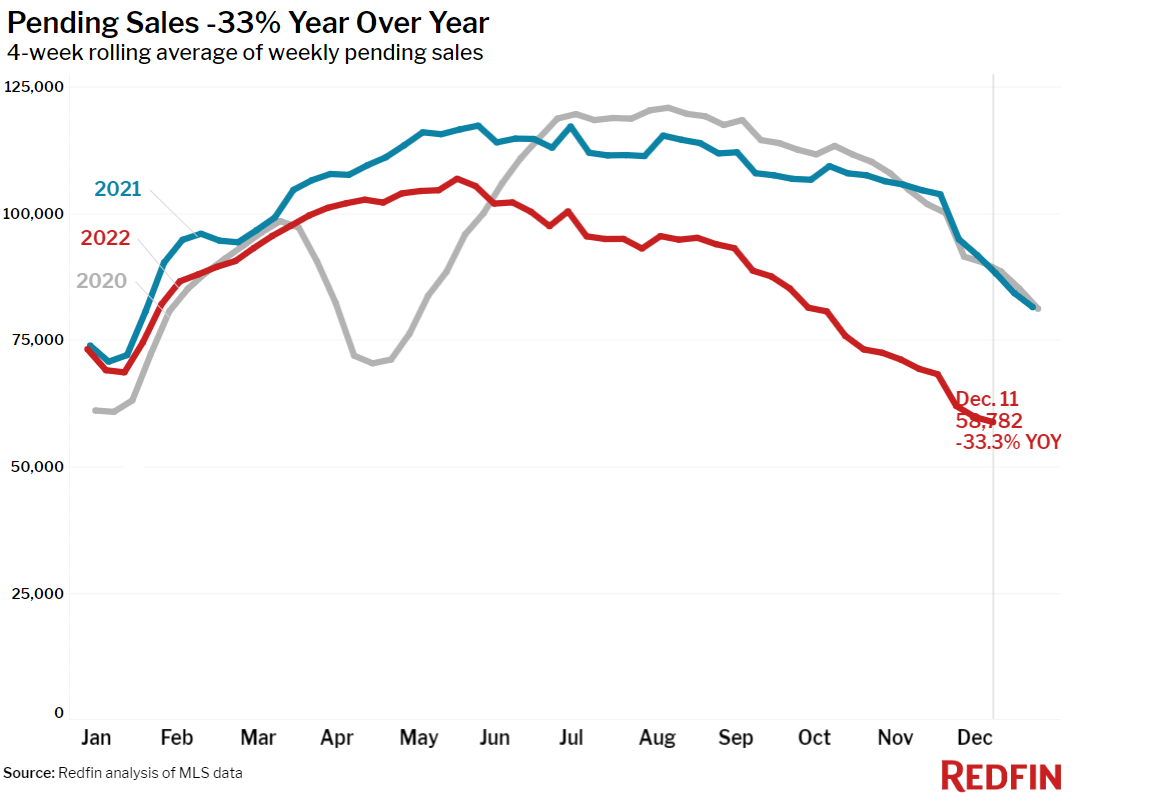

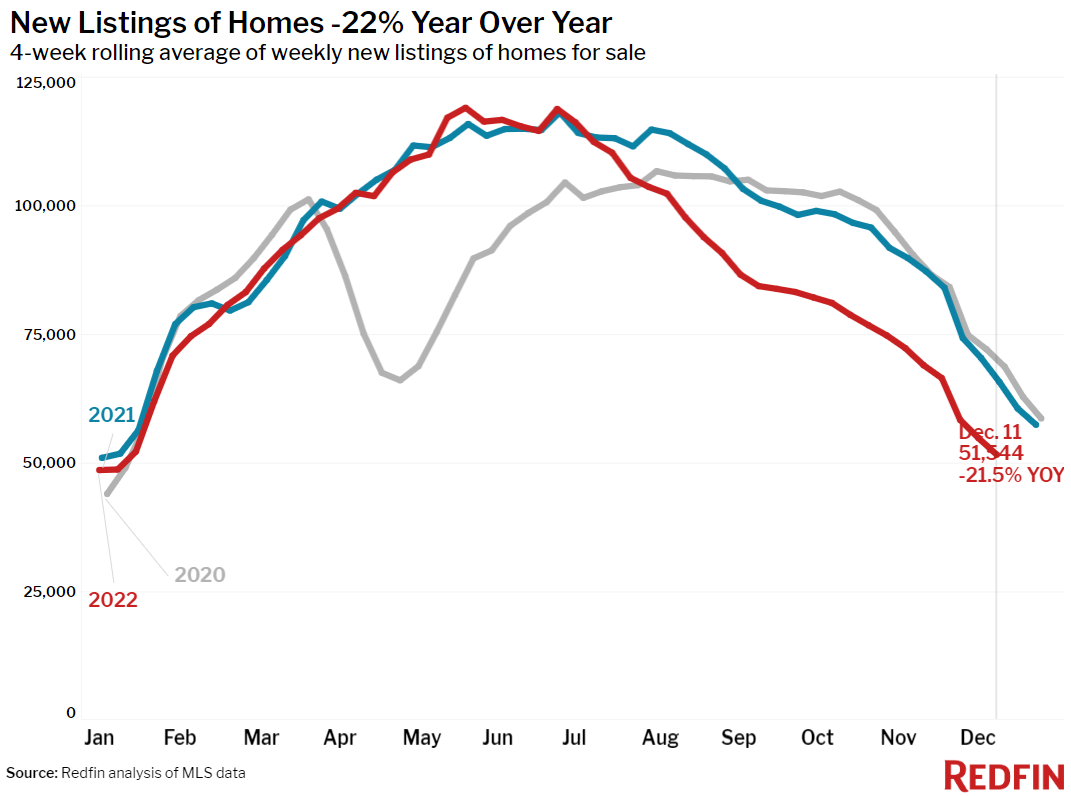

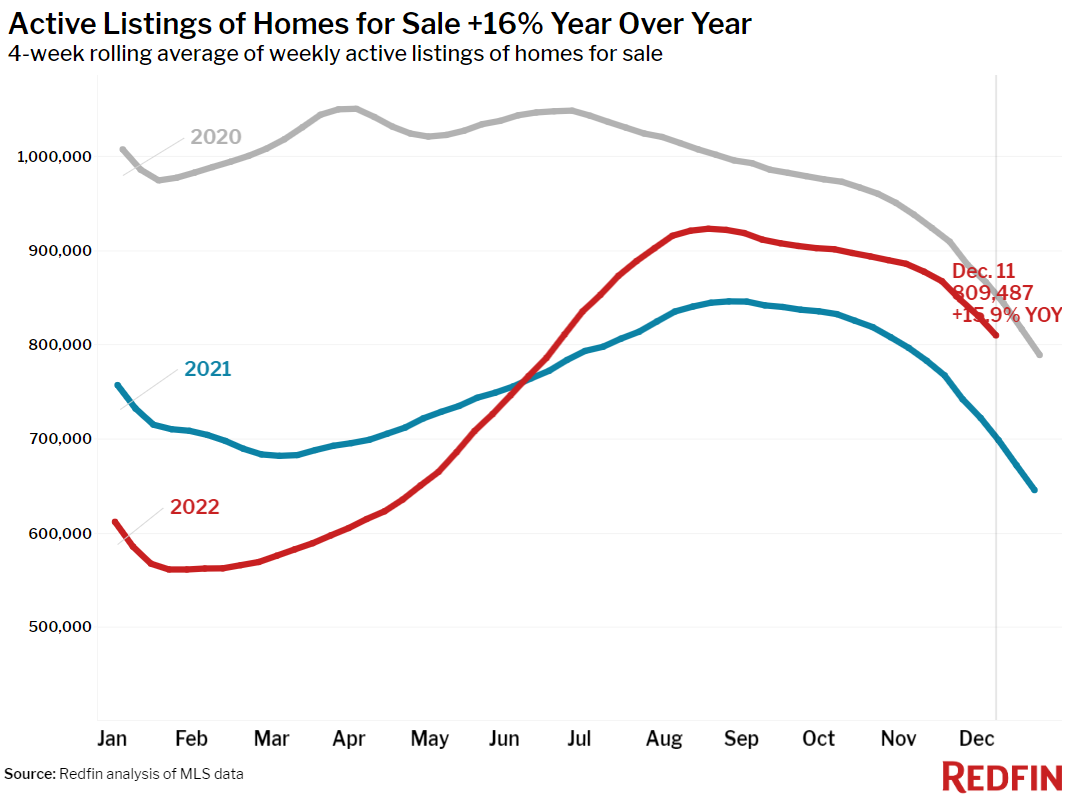

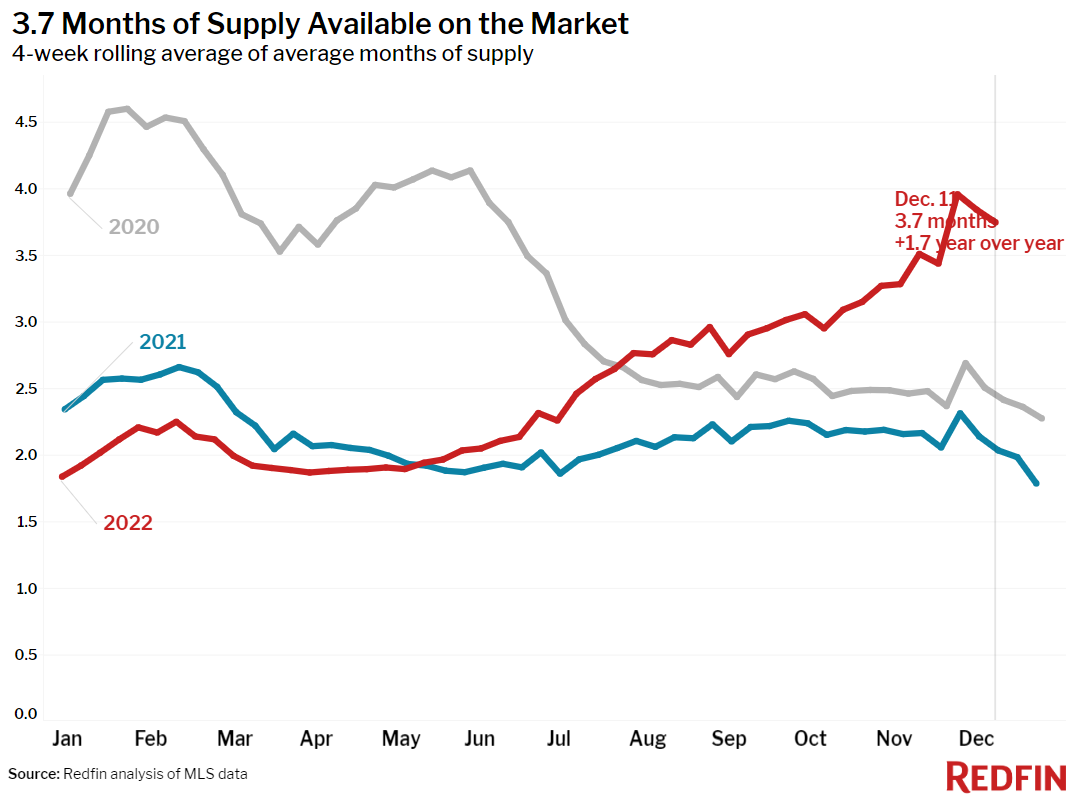

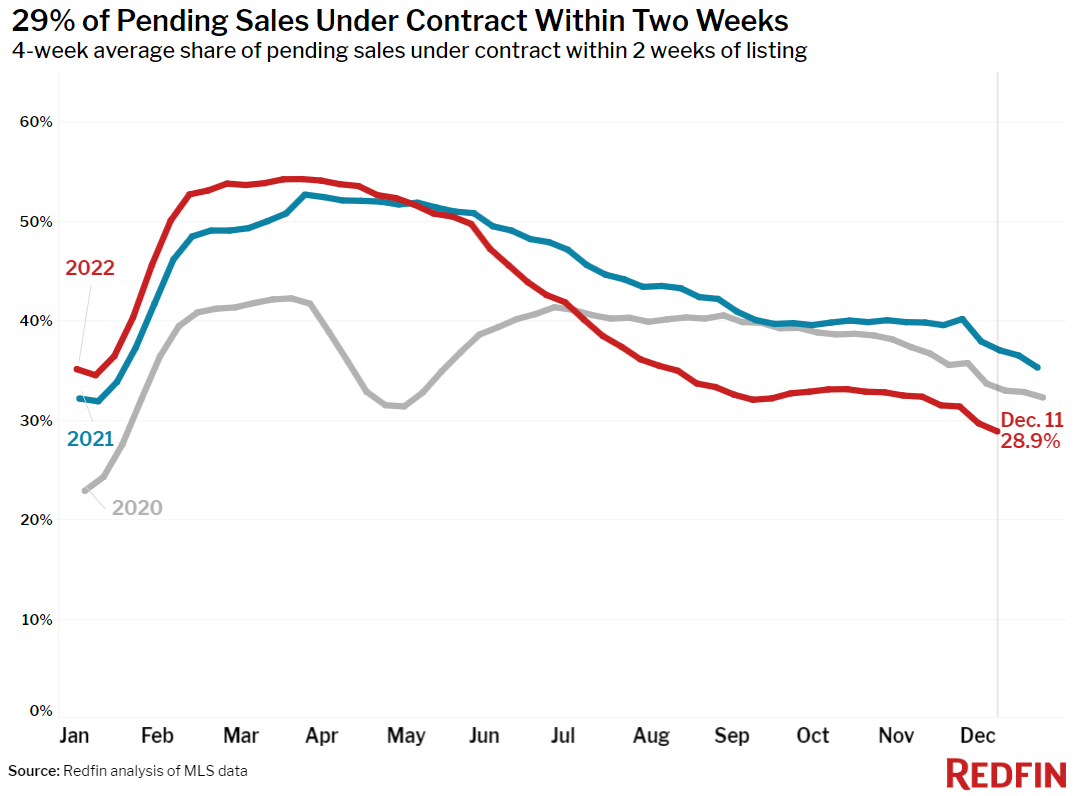

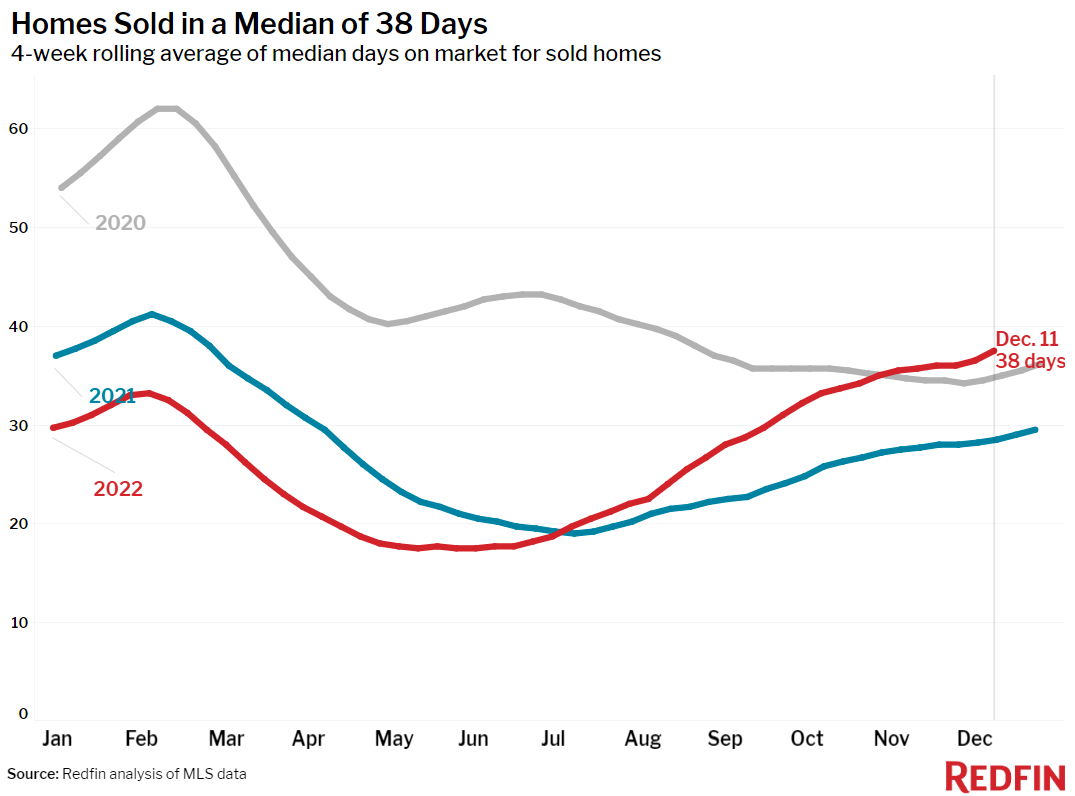

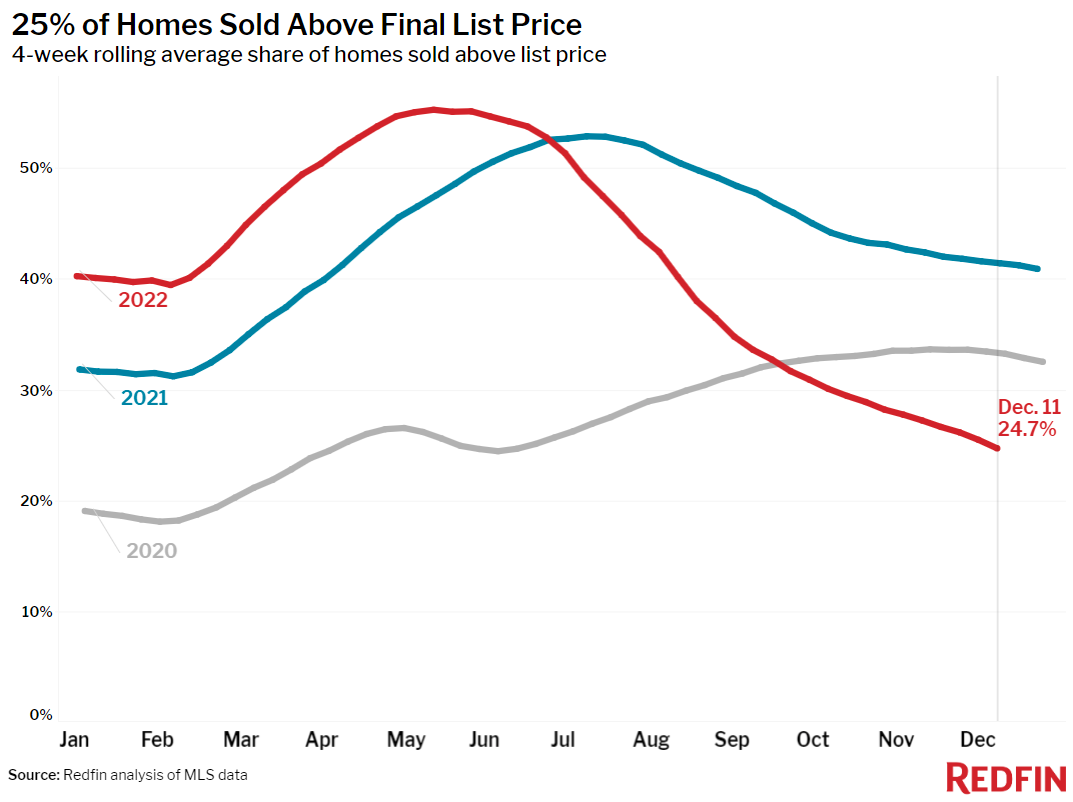

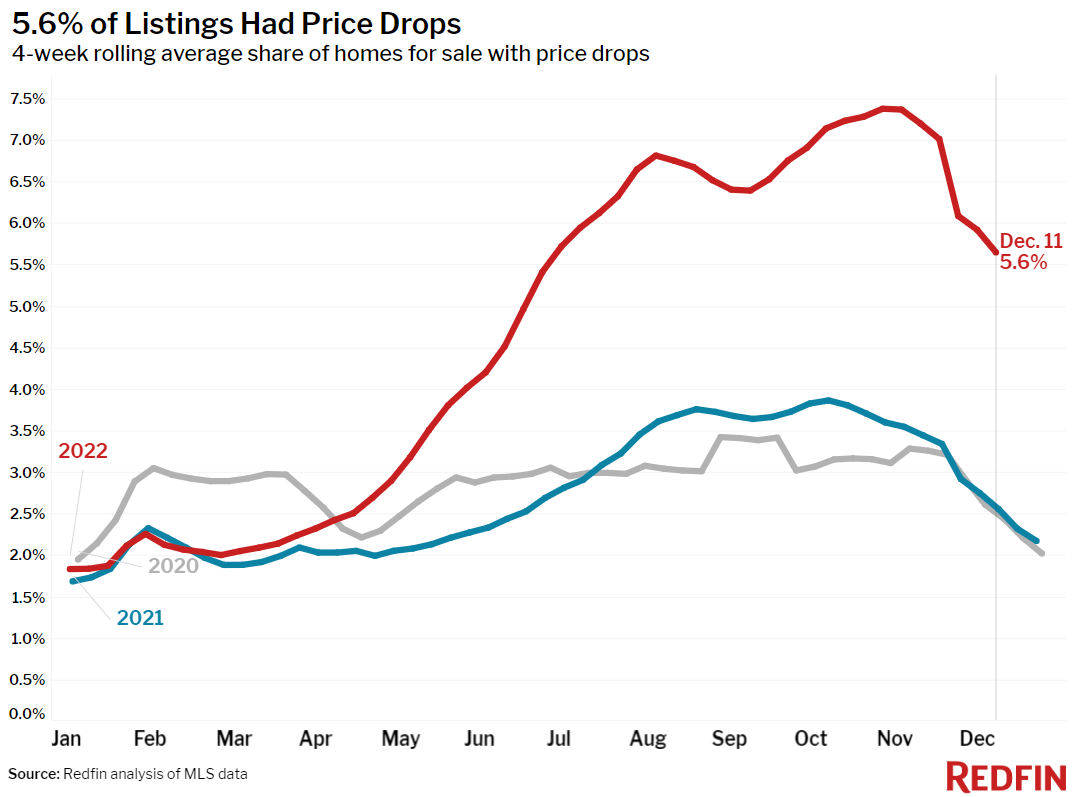

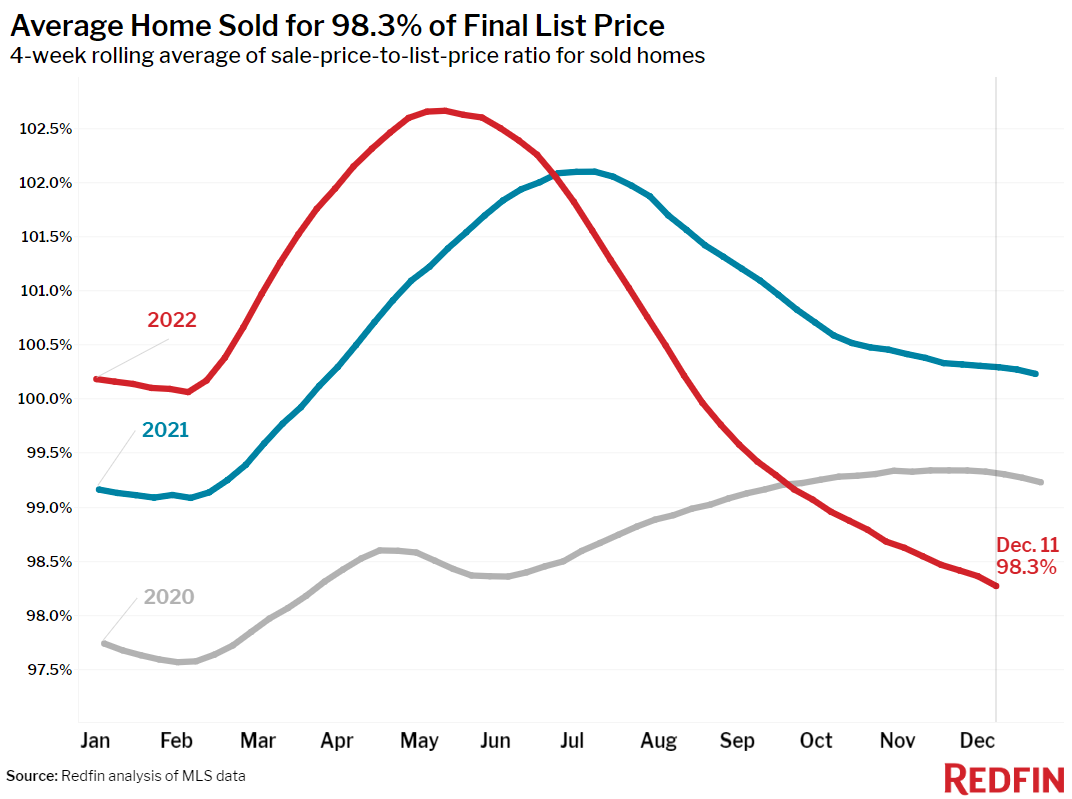

But while they’ve risen from the trenches, demand and purchase applications are still down sharply from a year ago. Additionally, pending home sales are down more than 30% year over year and homes are selling at their slowest pace in nearly two years–though it takes time for early indicators of demand to translate into pending sales. The nation’s median home-sale price rose just 1.4% year over year, the slowest growth rate since the start of the pandemic, reflecting still-cool homebuyer demand.

“Slowing inflation and the hope of the Fed easing rate hikes in the new year are likely to bring mortgage rates down further and thereby improve homebuying demand,” said Redfin Deputy Chief Economist Taylor Marr. “But don’t call it a comeback or even a recovery yet; demand is still way down from its peak. We’re keeping a close eye on the labor market for confirmation that inflation will continue slowing. A strong job market like the one we have now contributes to inflation because it pushes up wages and leads to higher prices. Though it seems counterintuitive, a slight uptick in unemployment and/or slower economic growth would likely help bring mortgage rates down further. If that happens, the increase we’re seeing in early-stage demand could translate to an uptick in pending sales in early 2023.”

The number of metros with declining sale prices is piling up. Home-sale prices fell year over year in 15 of the 50 most populous U.S. metros, many of them in California, compared with declines in 11 of the 50 a week earlier.

Prices fell 7.3% year over year in San Francisco, 5.8% in San Jose, CA, 3.3% in Los Angeles, 3% in Austin, 2.6% in Pittsburgh, 2% in Oakland, 1.9% in Detroit and 1.8% in Sacramento. They declined 1% or less in Anaheim, CA, Chicago, Philadelphia, Seattle, Riverside, CA, Phoenix and Las Vegas.

The Los Angeles and Austin price declines are the biggest since at least 2015, as far back as this data goes.

Although the declines were small, this marks the first time Las Vegas and Riverside home prices have fallen on a year-over-year basis since at least 2015.

Unless otherwise noted, the data in this report covers the four-week period ending December 11. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.