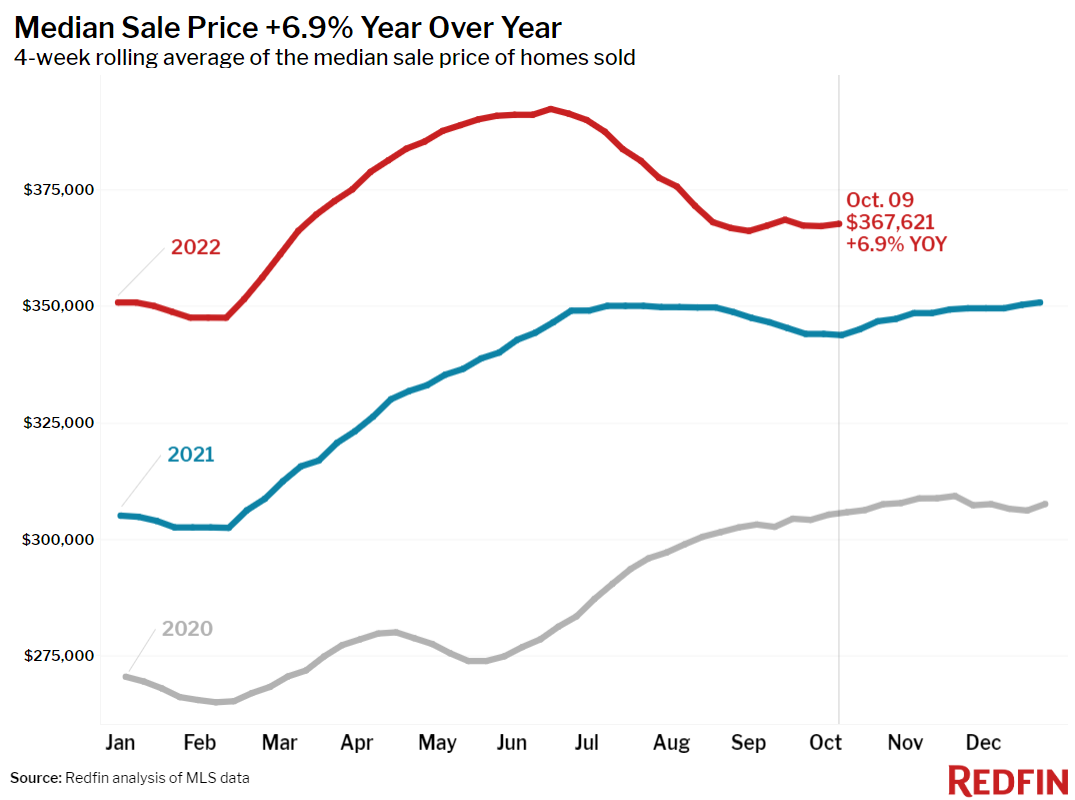

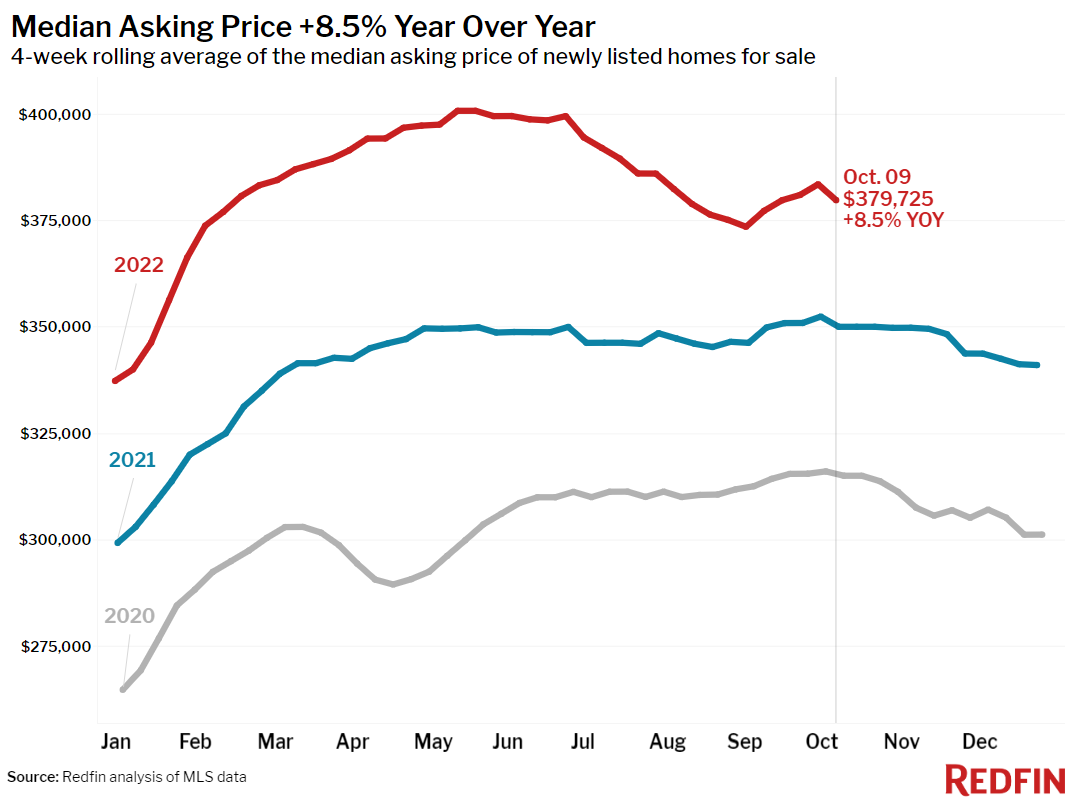

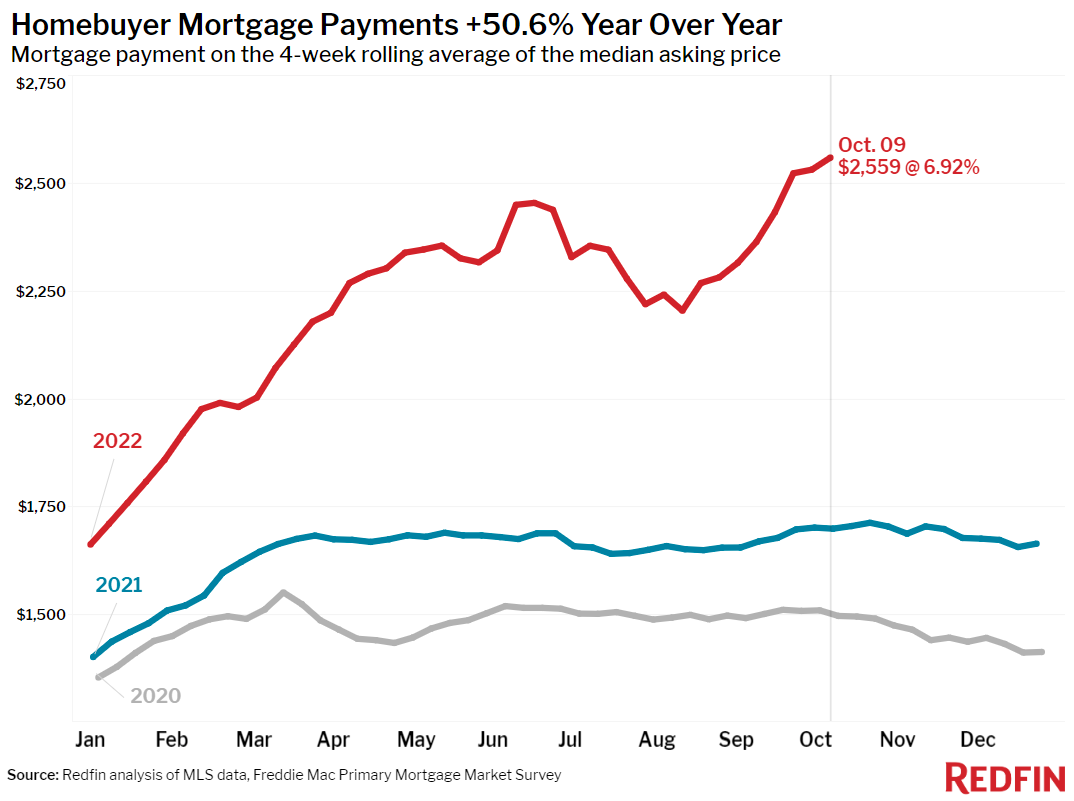

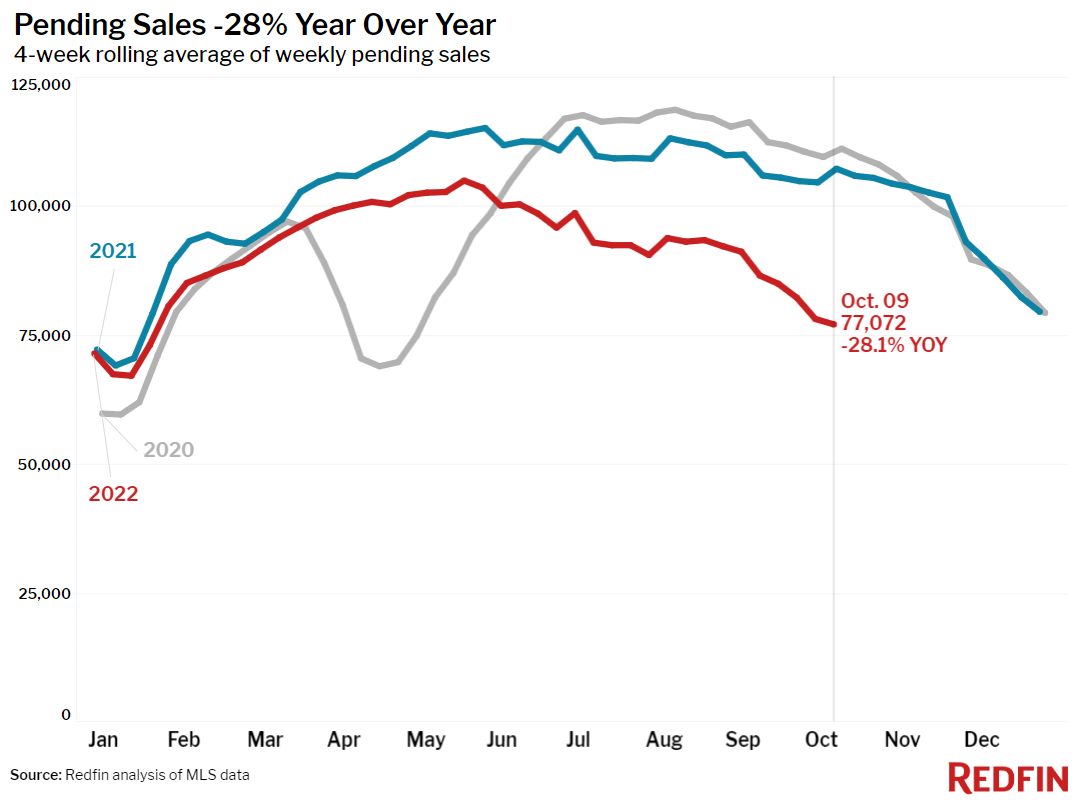

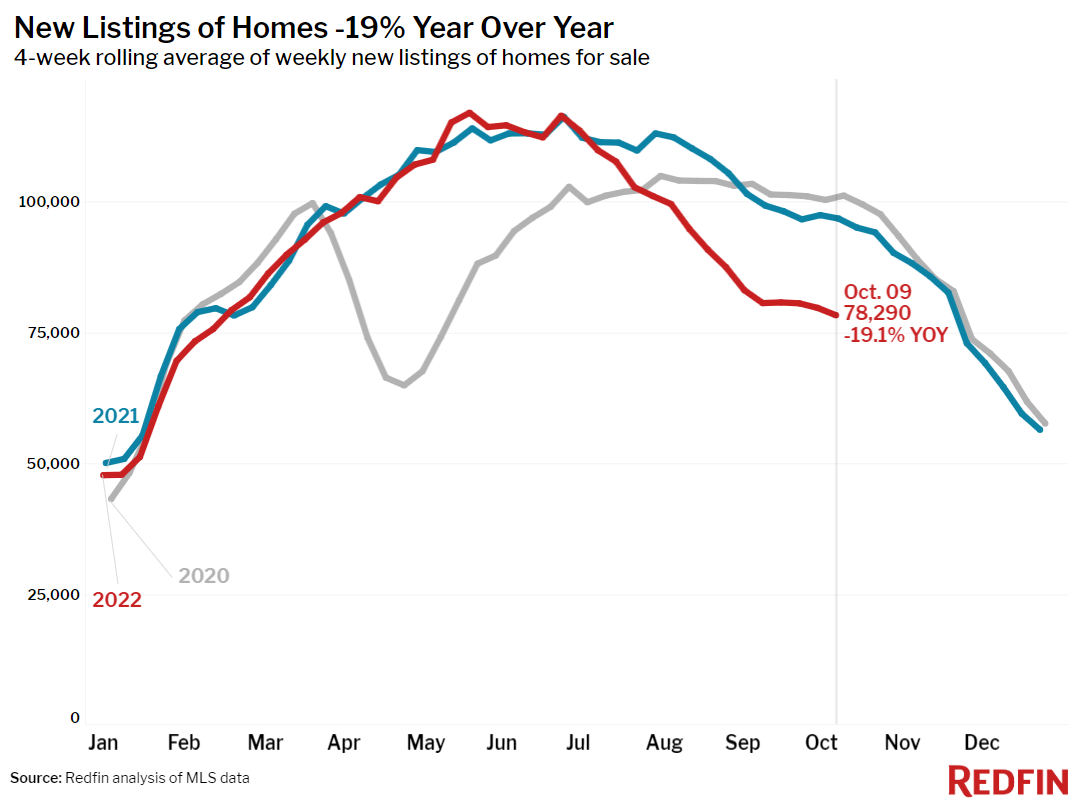

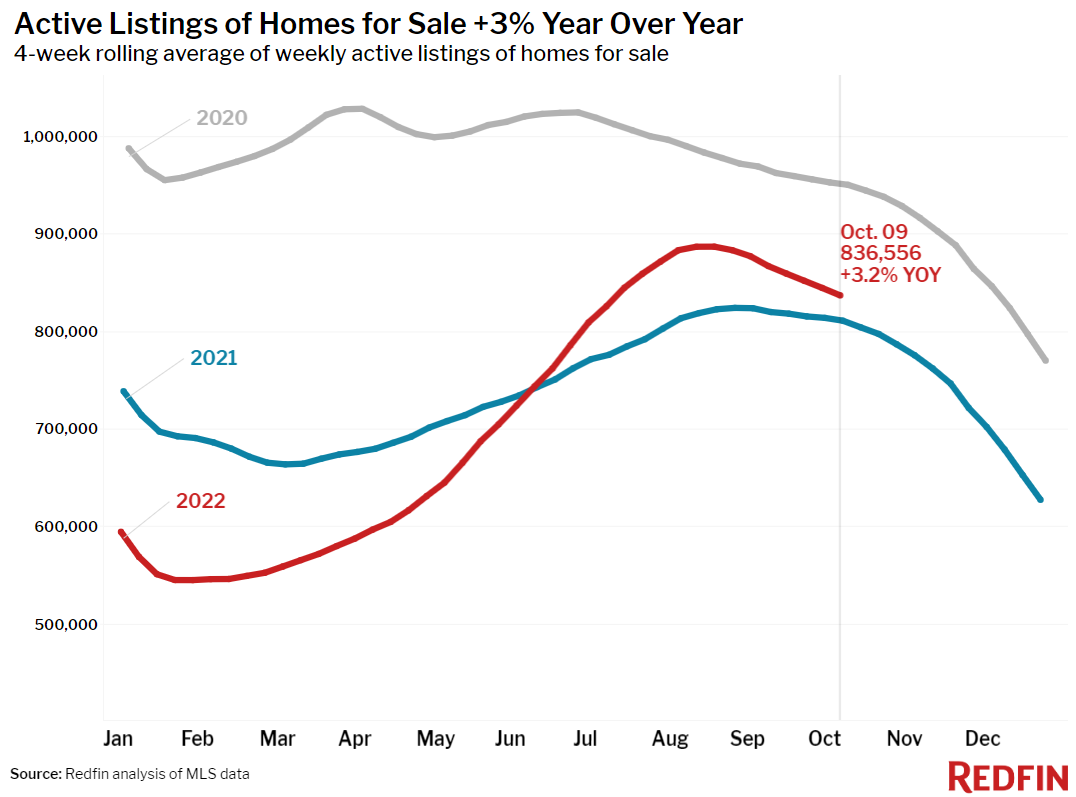

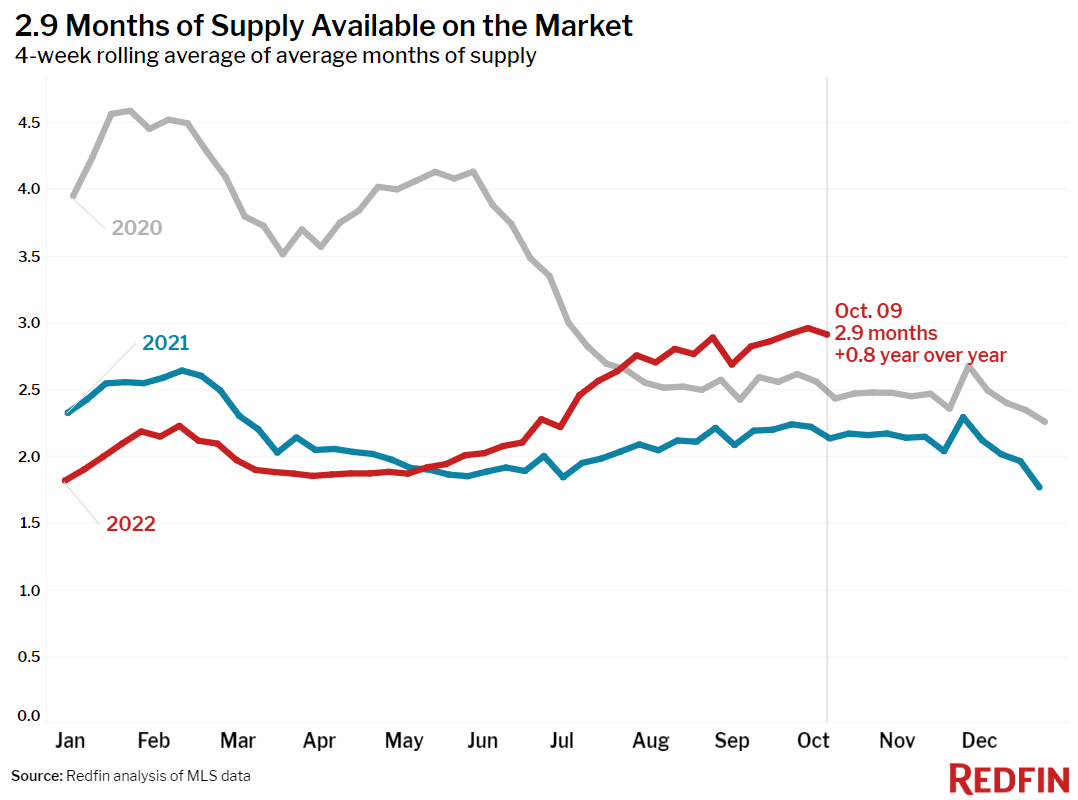

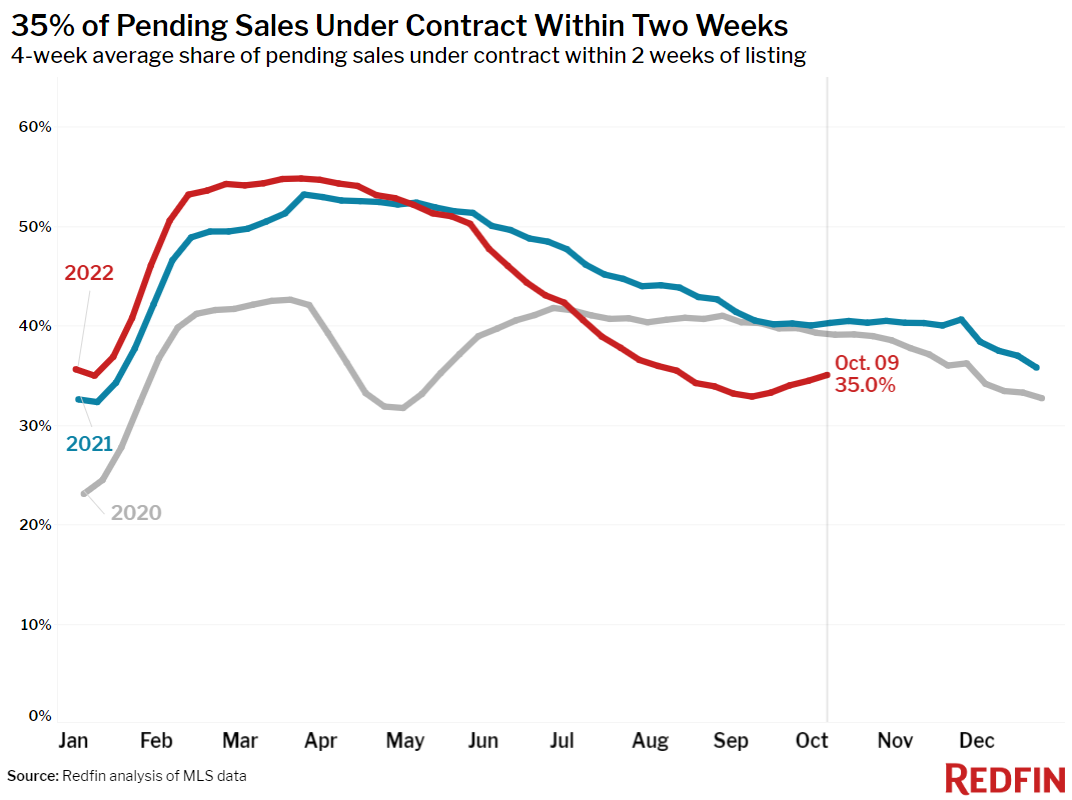

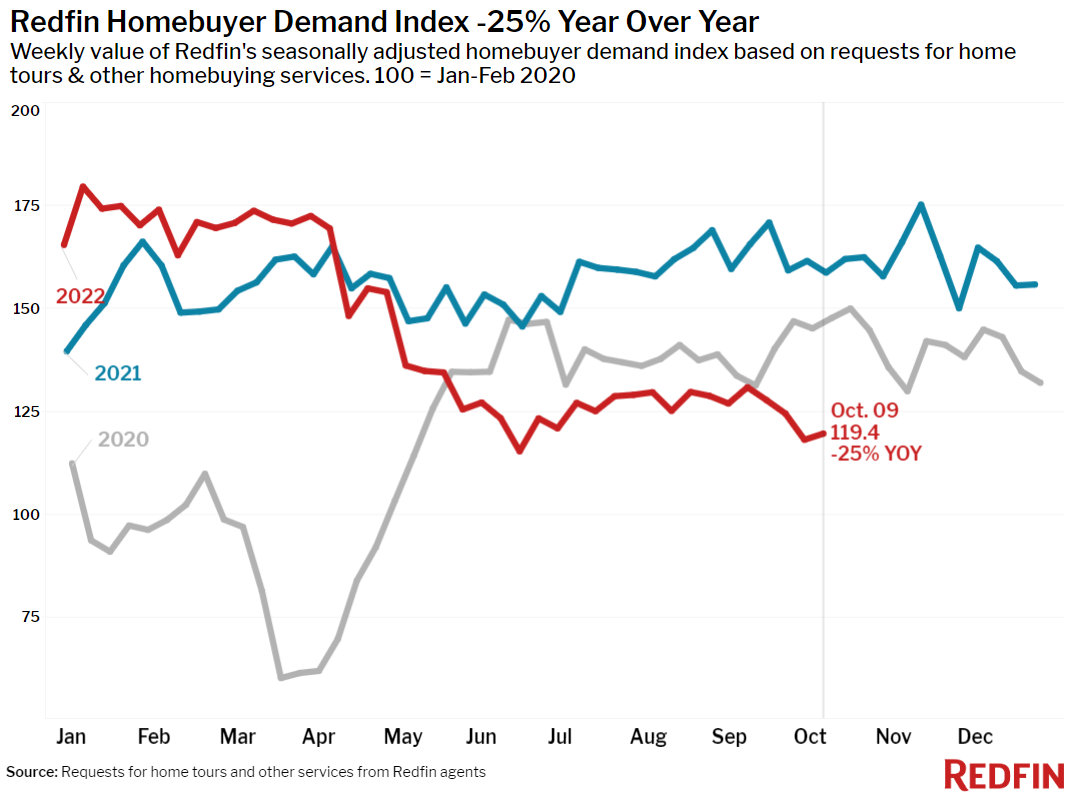

Housing-market activity is plunging further this fall than it did over the summer as mortgage rates near 7% and the topsy-turvy economy deters would-be buyers and sellers. Price drops have reached a record high, and home sales and new listings are dropping.

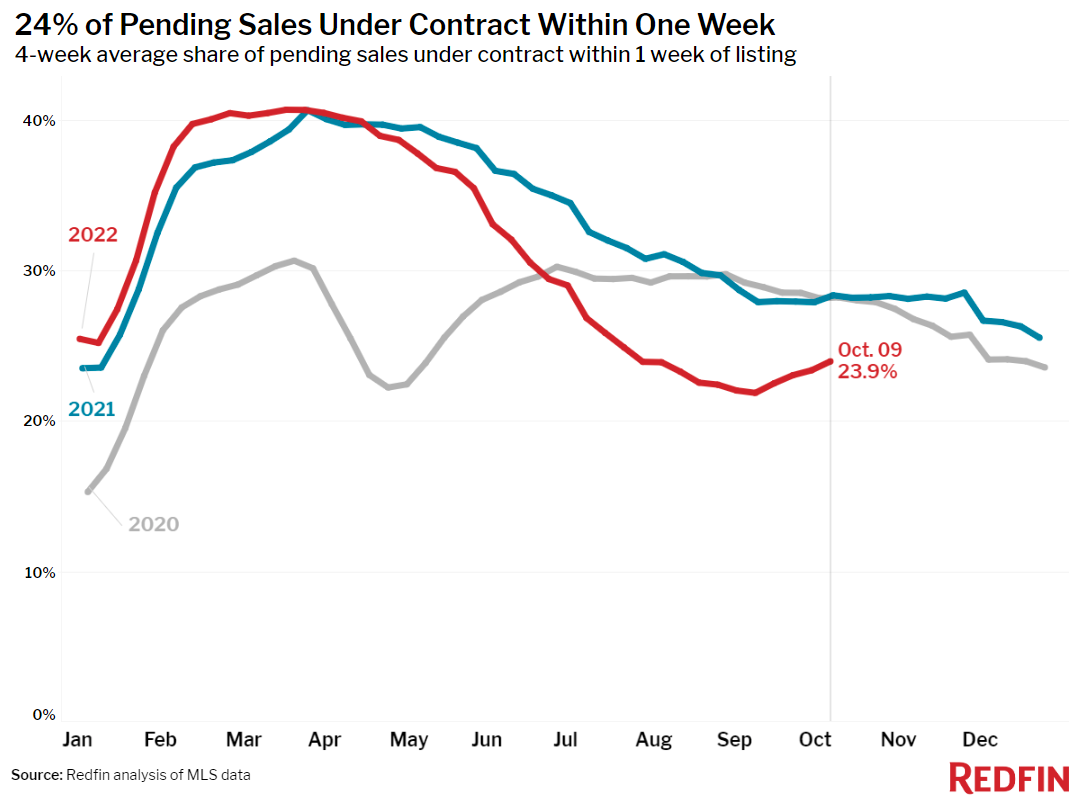

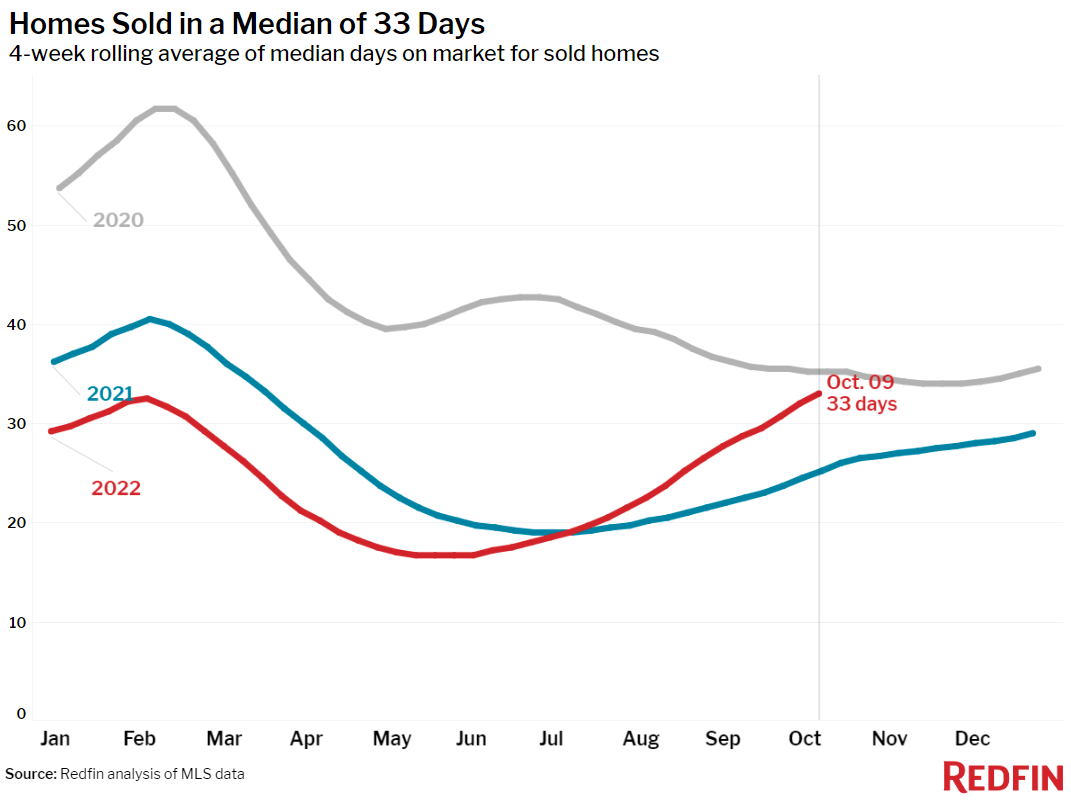

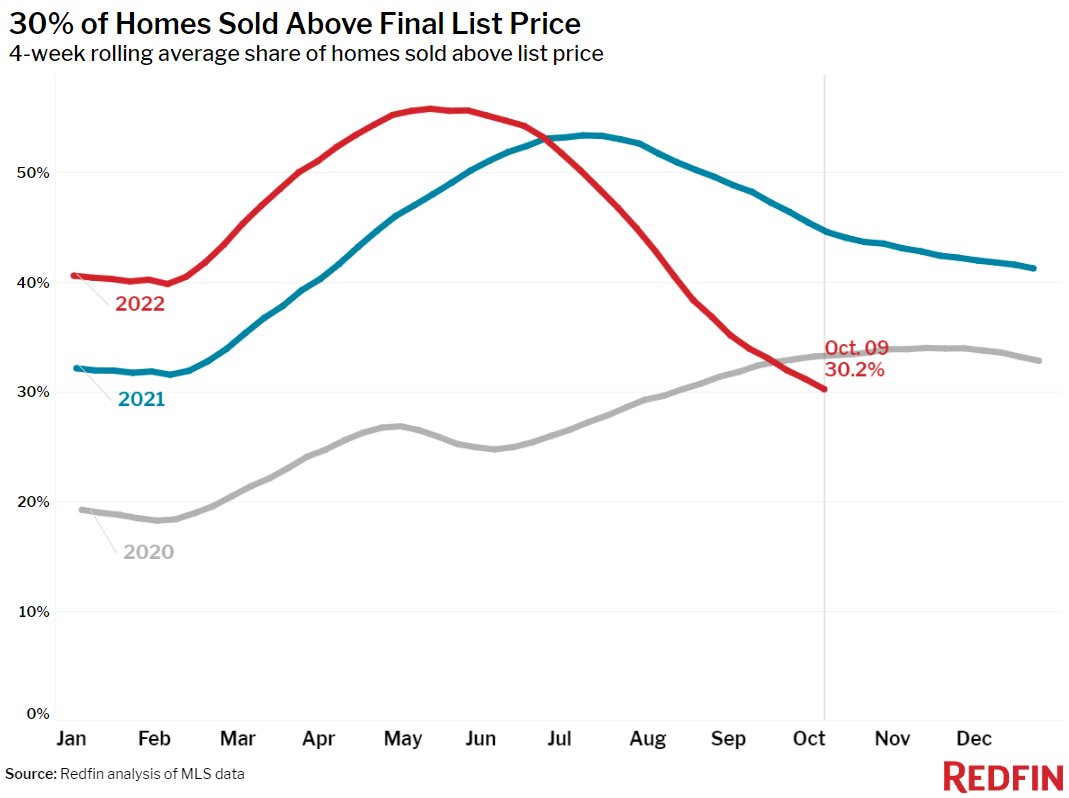

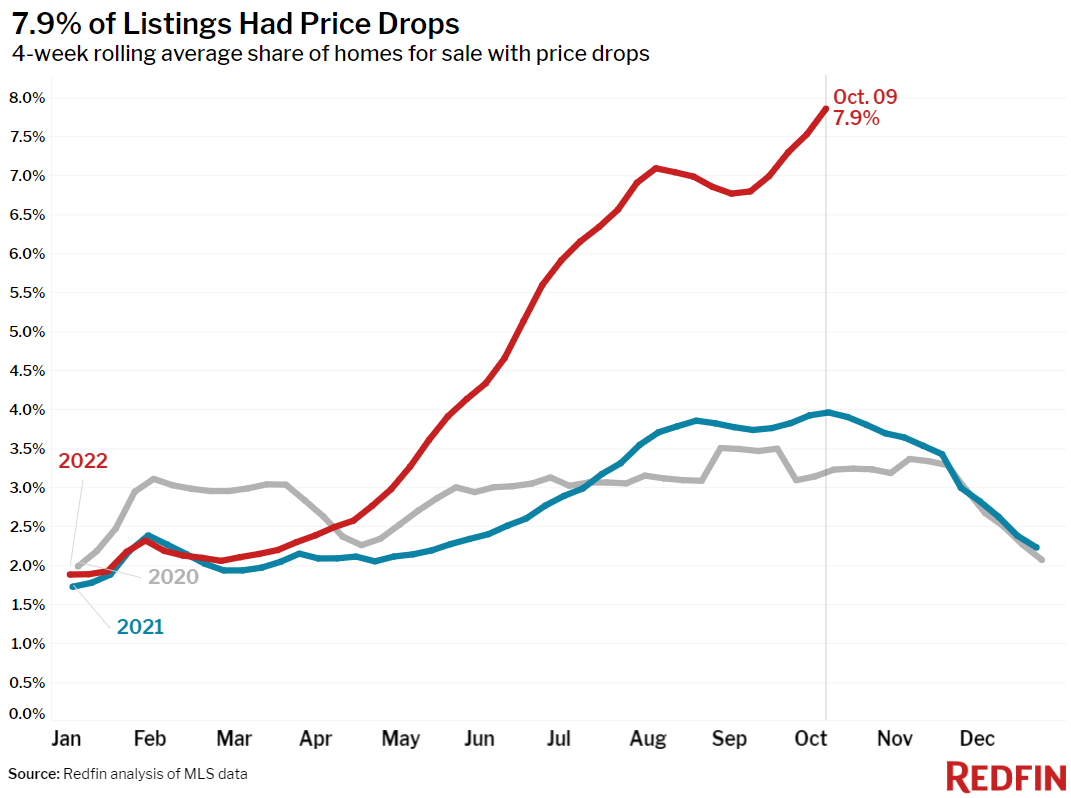

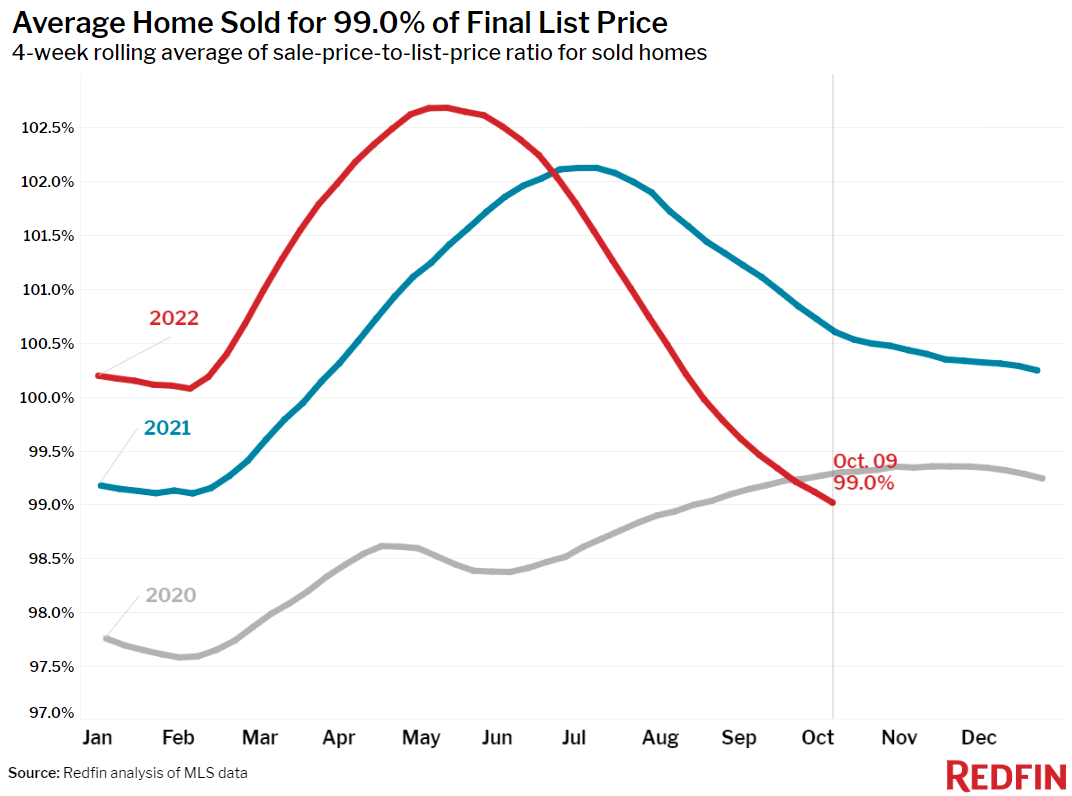

The housing market is taking a second hit this month as increasing economic volatility and persistent inflation pile on top of 6.5%-plus mortgage rates to further deter would-be homebuyers and sellers. Pending home sales and new listings both posted even bigger annual declines than we saw throughout the summer when buyers and sellers initially reacted to rapidly rising rates. Data on sale prices, which typically lags a couple months behind other demand indicators, is also weaker than it was over the summer when the pandemic homebuying boom ended. The share of home listings with a price drop rose to its highest level on record, and the portion of homes sold above final list price dropped to its lowest rate since the early days of the pandemic.

“Prospective homebuyers and sellers barely had time to get used to 5.5% mortgage rates over the summer before they rose to nearly 7% this month,” said Redfin Deputy Chief Economist Taylor Marr. “The second sharp rate increase this year, together with nerves about inflation and the direction of the economy, is dragging home-sale activity down further than it was over the summer and pushing homebuyer sentiment down near its all-time low. The combination is also unnerving for homeowners who don’t want to list their home when demand is weak or give up their own low mortgage rate.”

Demand has increased slightly from last week, as Hurricane Ian was an additional deterrent to some homebuyers and sellers at the end of September.

Unless otherwise noted, the data in this report covers the four-week period ending October 9. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.