Inventory is below typical April levels, driving home prices up. Continually rising mortgage rates are further eroding affordability–and this week’s Fed meeting confirmed that mortgage rates are likely to hold steady for the foreseeable future.

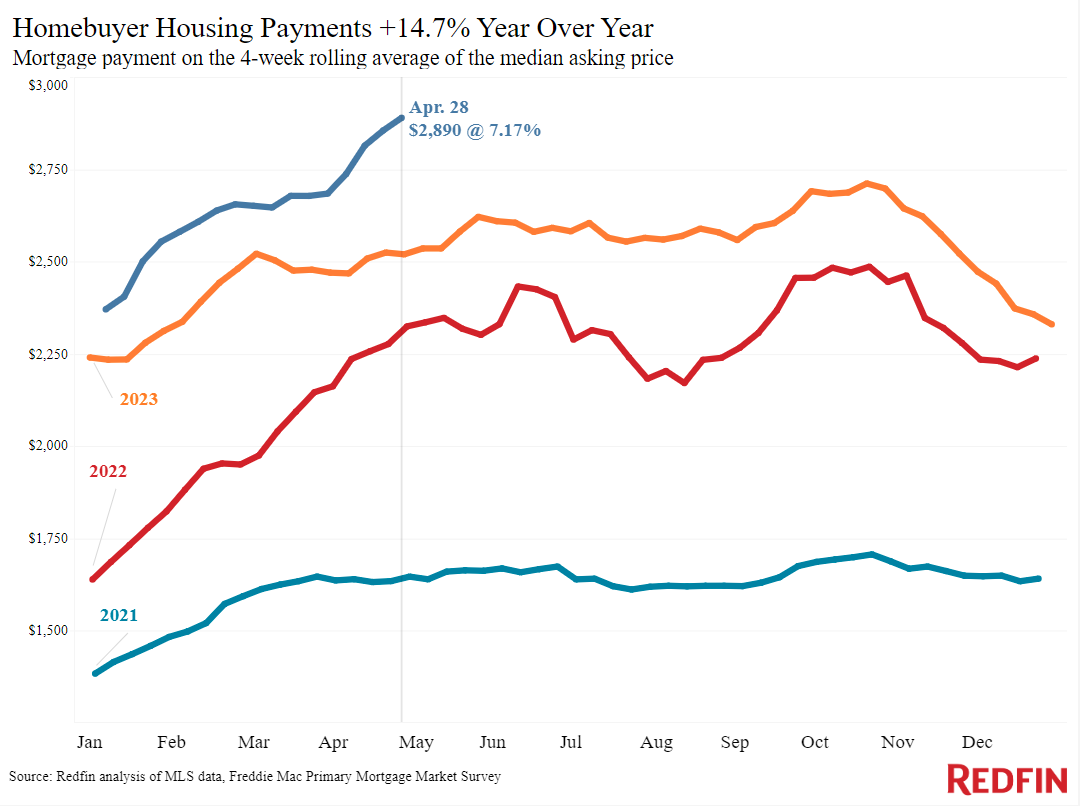

The median home-sale price rose from a year earlier or stayed the same in all 50 of the most populous U.S. metros during the four weeks ending April 28, the first time that has happened since July 2022. Nationwide, the median sale price rose to a near-record $383,188, up 4.8% year over year. Mortgage rates also continued climbing, with the weekly average hitting its highest level in five months. High prices and rates drove the median monthly housing payment to a record $2,890, up 15% year over year.

Home-price increases were driven by affluent metros and a pair of more affordable places: Anaheim, CA, where prices rose over 20% year over year, took the top spot. It’s followed by Detroit (14.9%), San Jose, CA (13.6%), West Palm Beach, FL (13.4%) and New Brunswick, NJ (12.8%). The metros with the smallest price increases were in Texas and Florida: Dallas (unchanged), Austin (0.3%), San Antonio (0.6%), Fort Worth (1.9%), and Tampa (2.2%).

Low inventory is driving up prices. New listings are up 15% year over year, but they’re still well below typical April levels: There were fewer new listings this April than any year on record except 2023 and 2020. The year-over-year increase is also inflated because of the Easter effect; Easter didn’t fall into the four weeks included in this year’s data, but the holiday did fall into last year’s comparable time period. Some homeowners are hesitant to list their homes because economic indicators point to interest rates staying higher for longer than expected, potentially exacerbating the mortgage-rate lock-in effect.

Homebuying demand is softening as rates rise. Some Redfin agents are reporting that the recent uptick in mortgage rates is scaring buyers away, and mortgage-purchase applications declined 2% week over week. Still, there are enough buyers out there to keep prices propped up: Redfin’s Homebuyer Demand Index–a measure of requests for tours and other buying services from Redfin agents–is up 3% from a month ago, sitting near its highest level since August.

This week’s economic news keeps mortgage rates in a holding pattern. At their May 1 meeting, the Fed held interest rates steady, as expected, but kept open the possibility of rate cuts later this year. “The Fed meeting is unlikely to push mortgage rates down–but the good news is that it won’t push them up, either, which could have happened if the Fed took 2024 rate cuts off the table,” said Redfin Economic Research Lead Chen Zhao. “Even though housing costs shouldn’t climb much more, they will remain elevated for the foreseeable future, which could push more buyers away. But for serious house hunters who can afford today’s mortgage rates and find a home they love, jumping on it now isn’t a bad idea, given the fact that inventory is low and costs aren’t dropping anytime soon.”

For more on Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit Redfin’s “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.