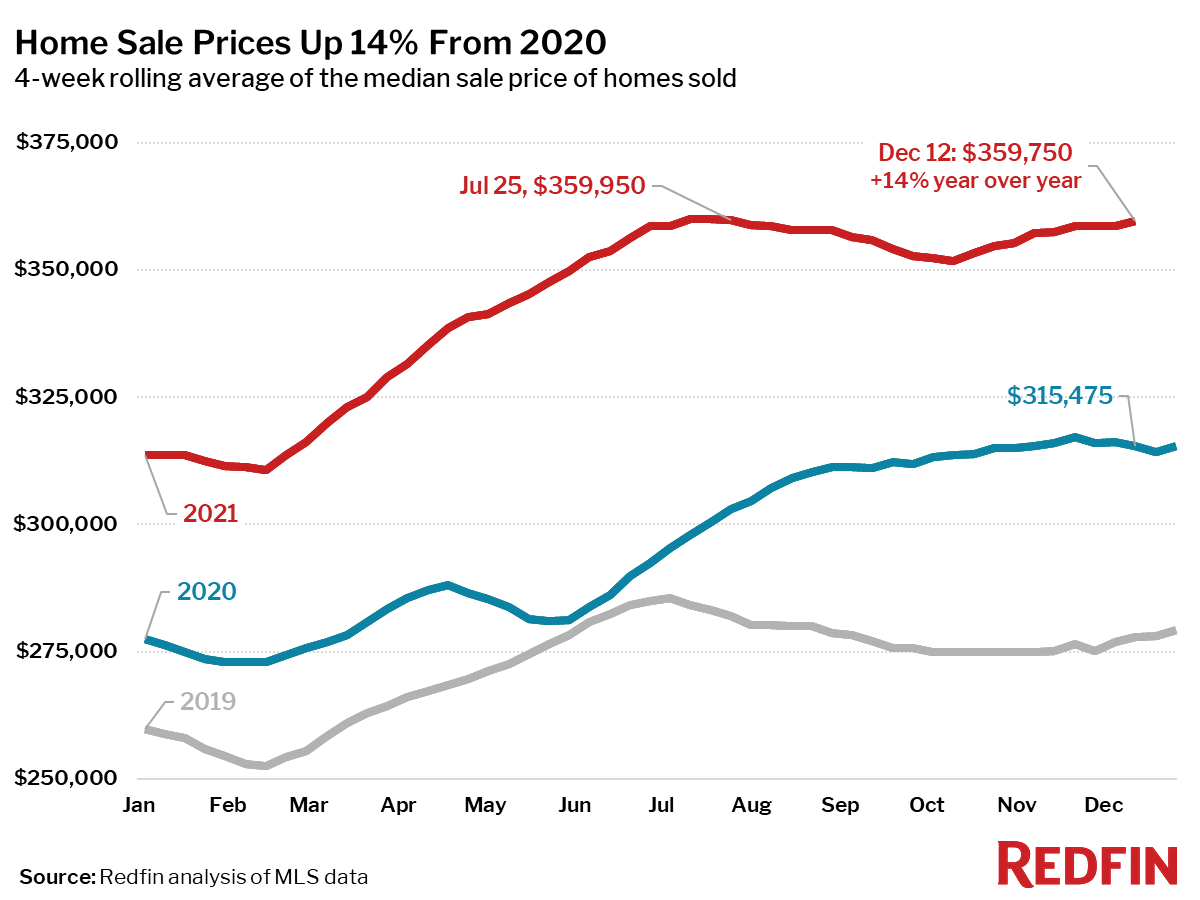

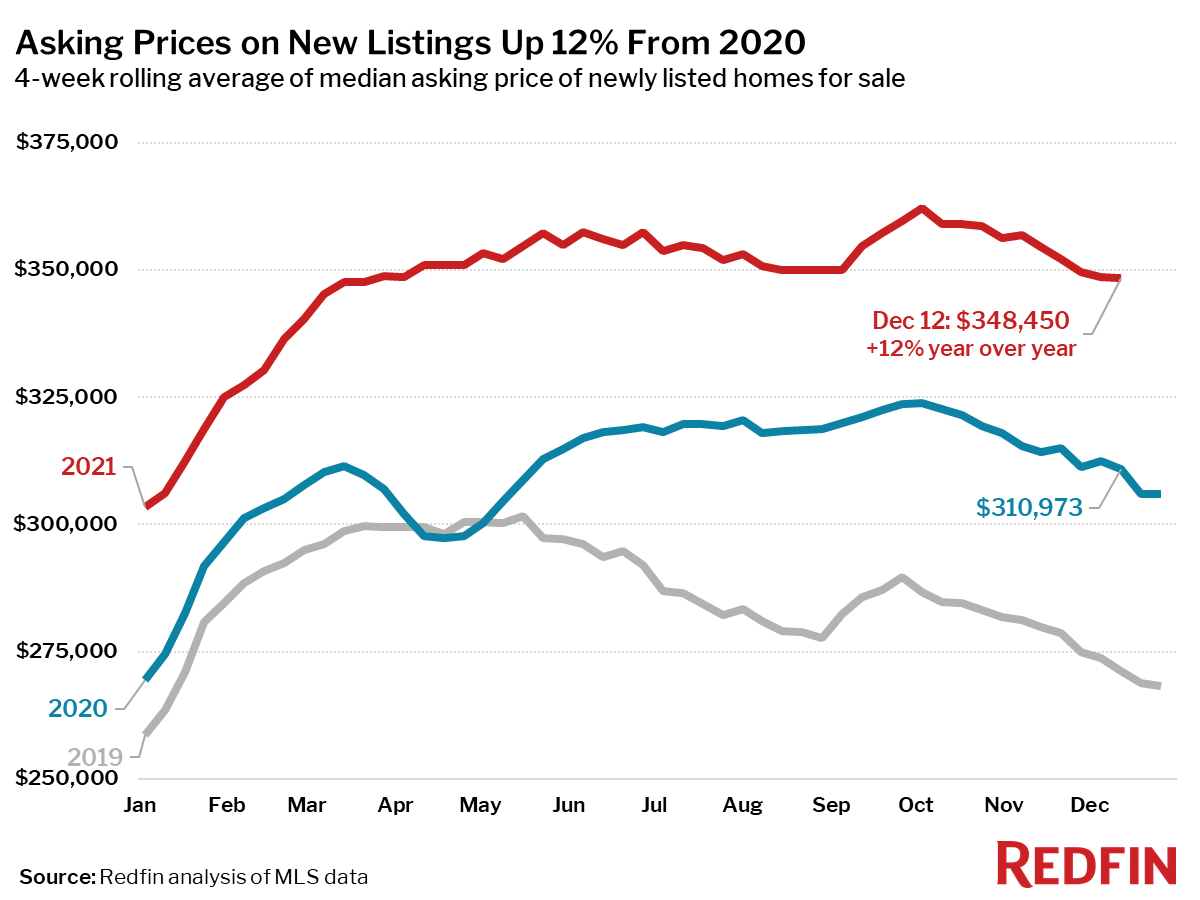

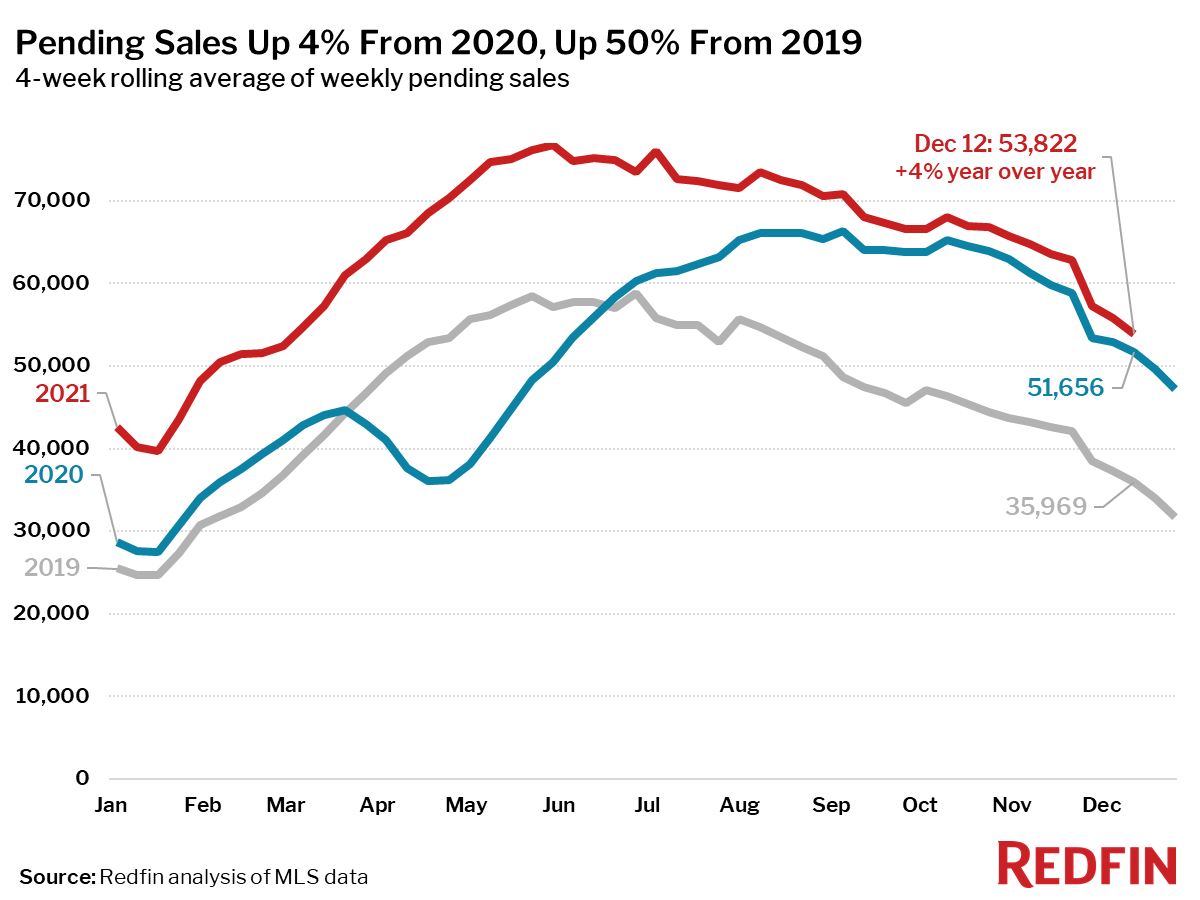

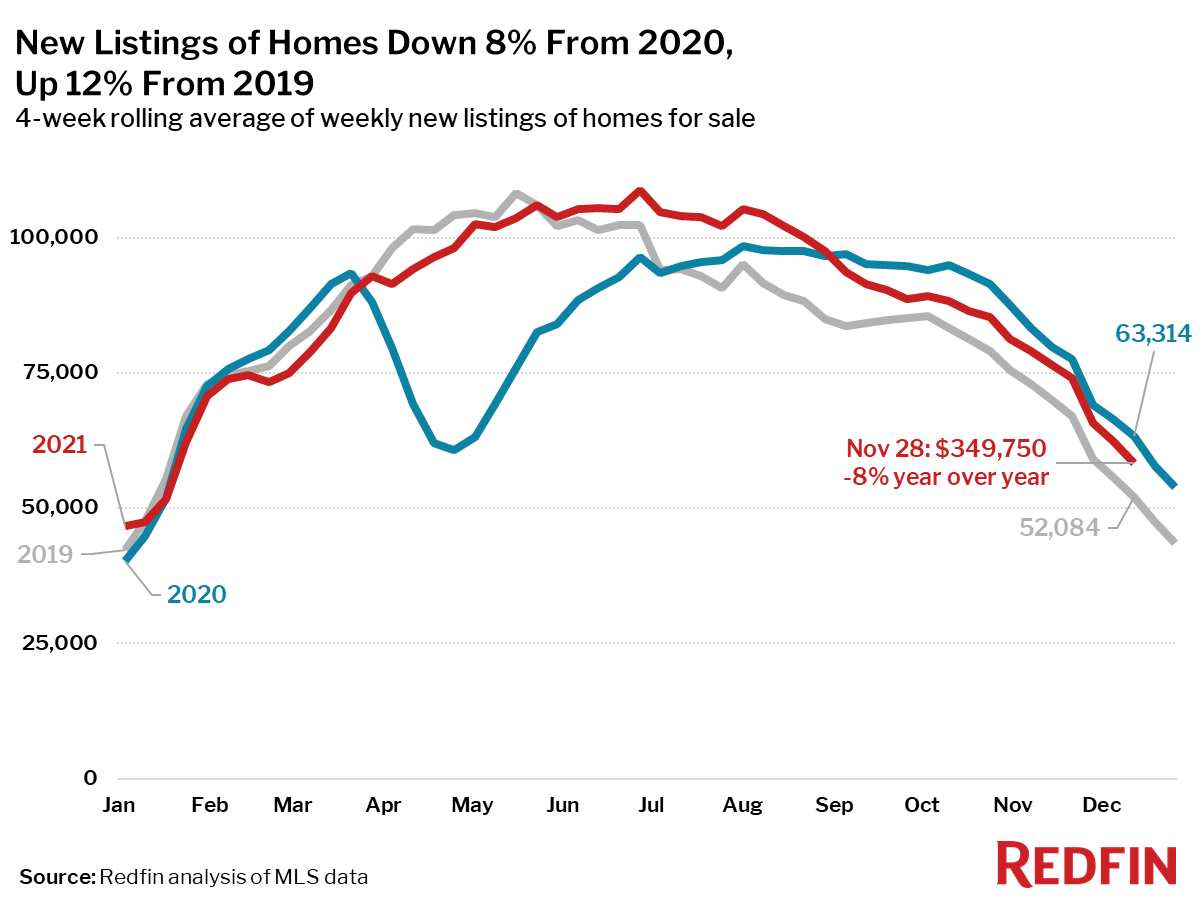

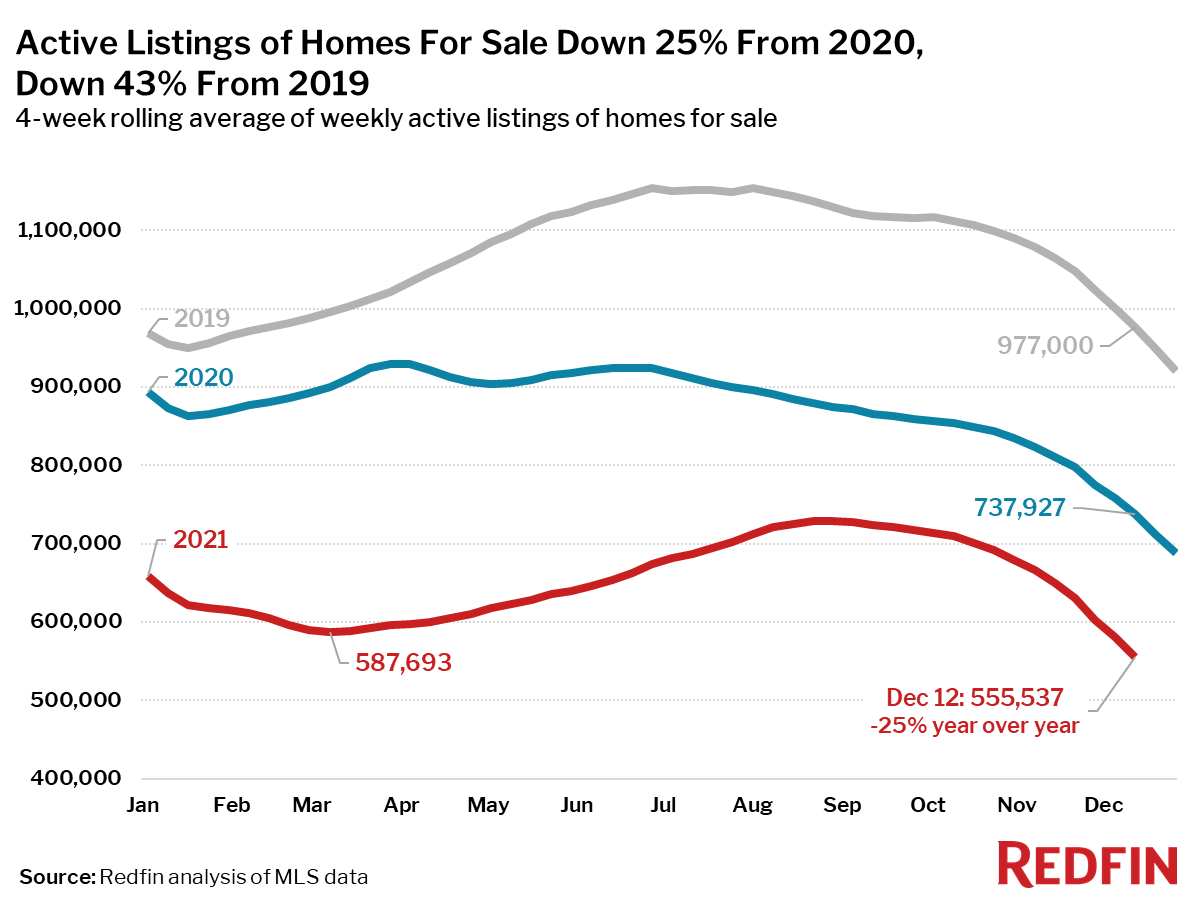

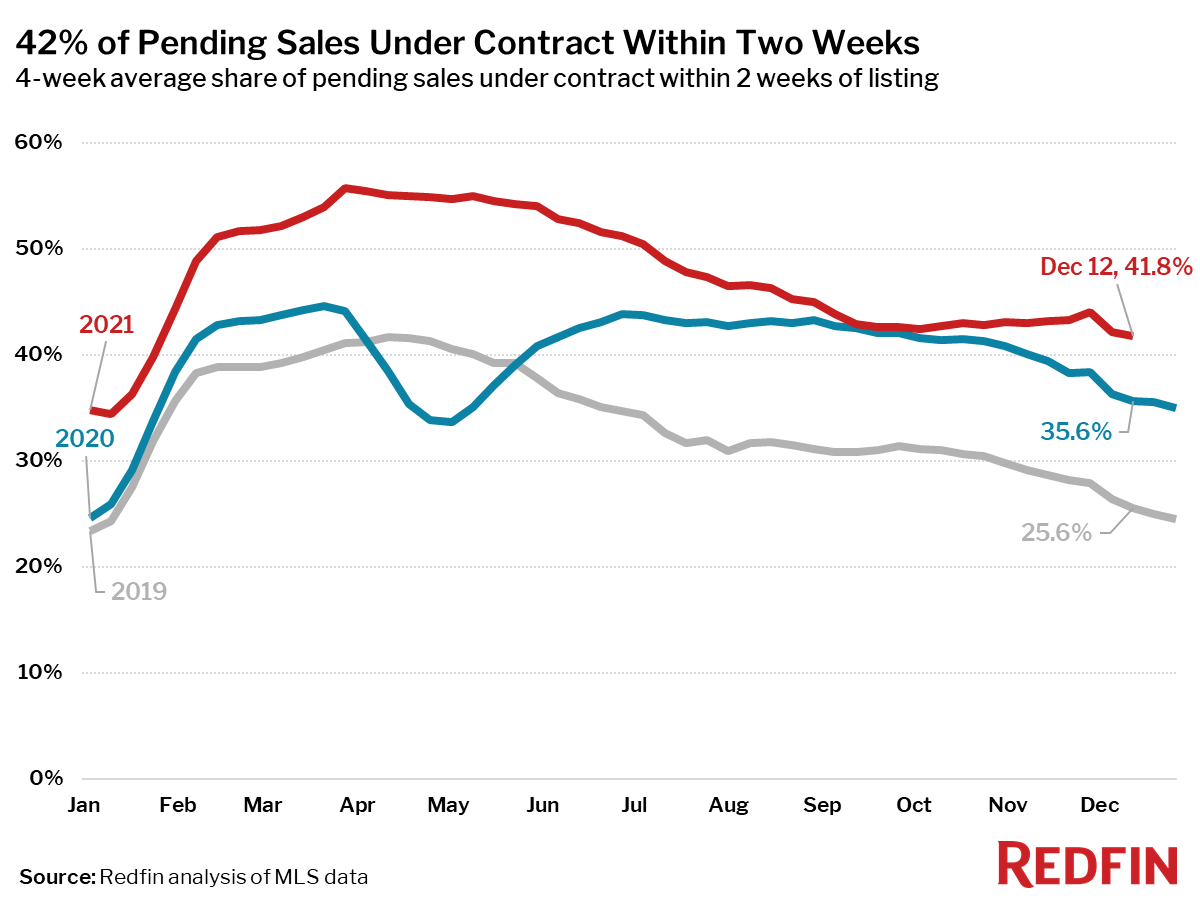

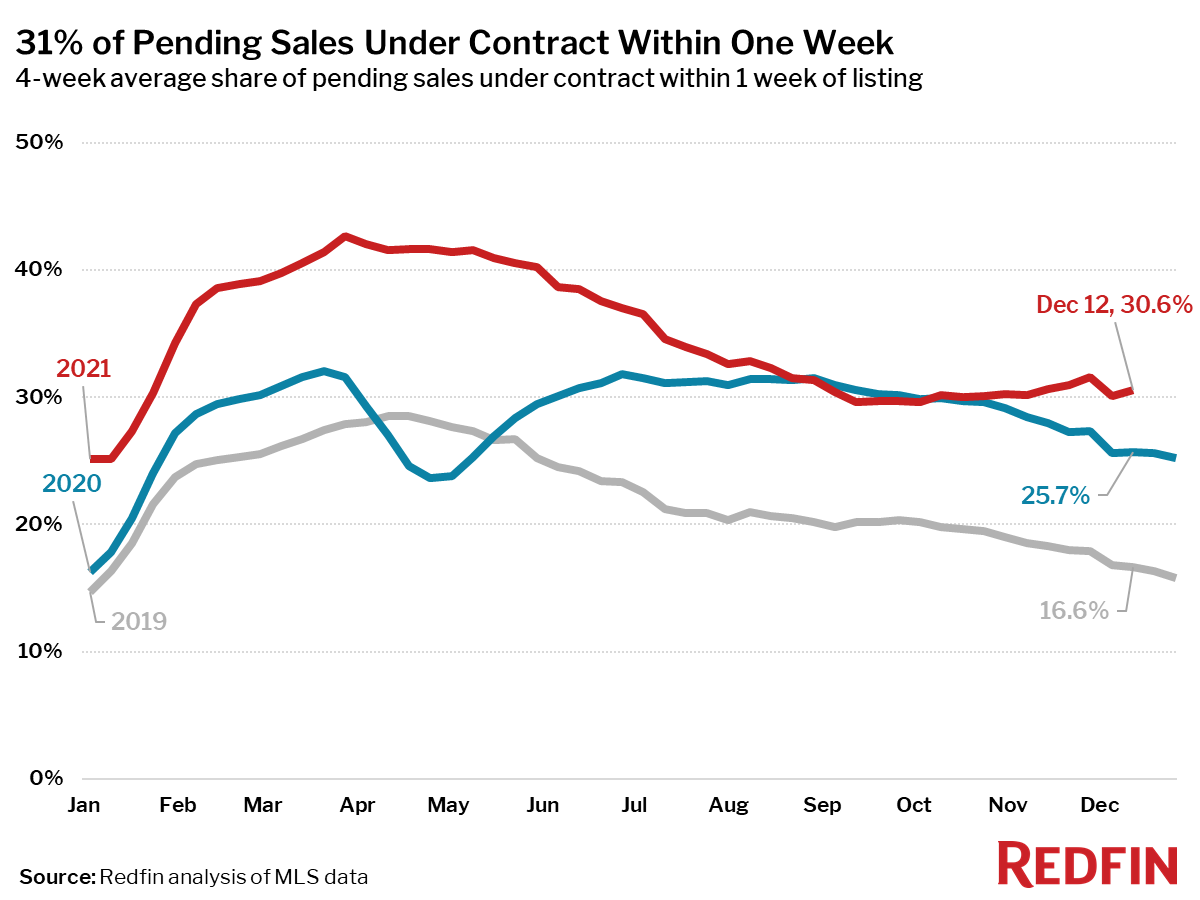

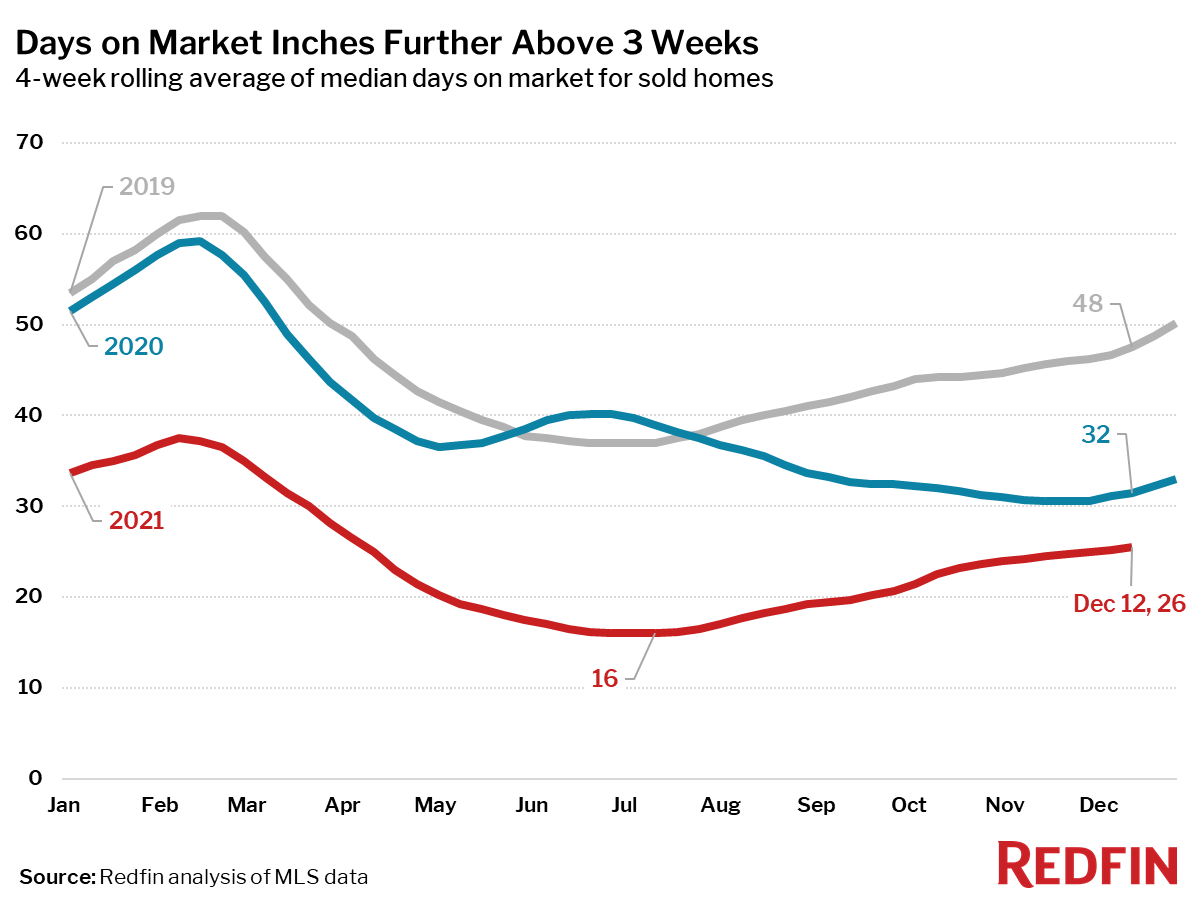

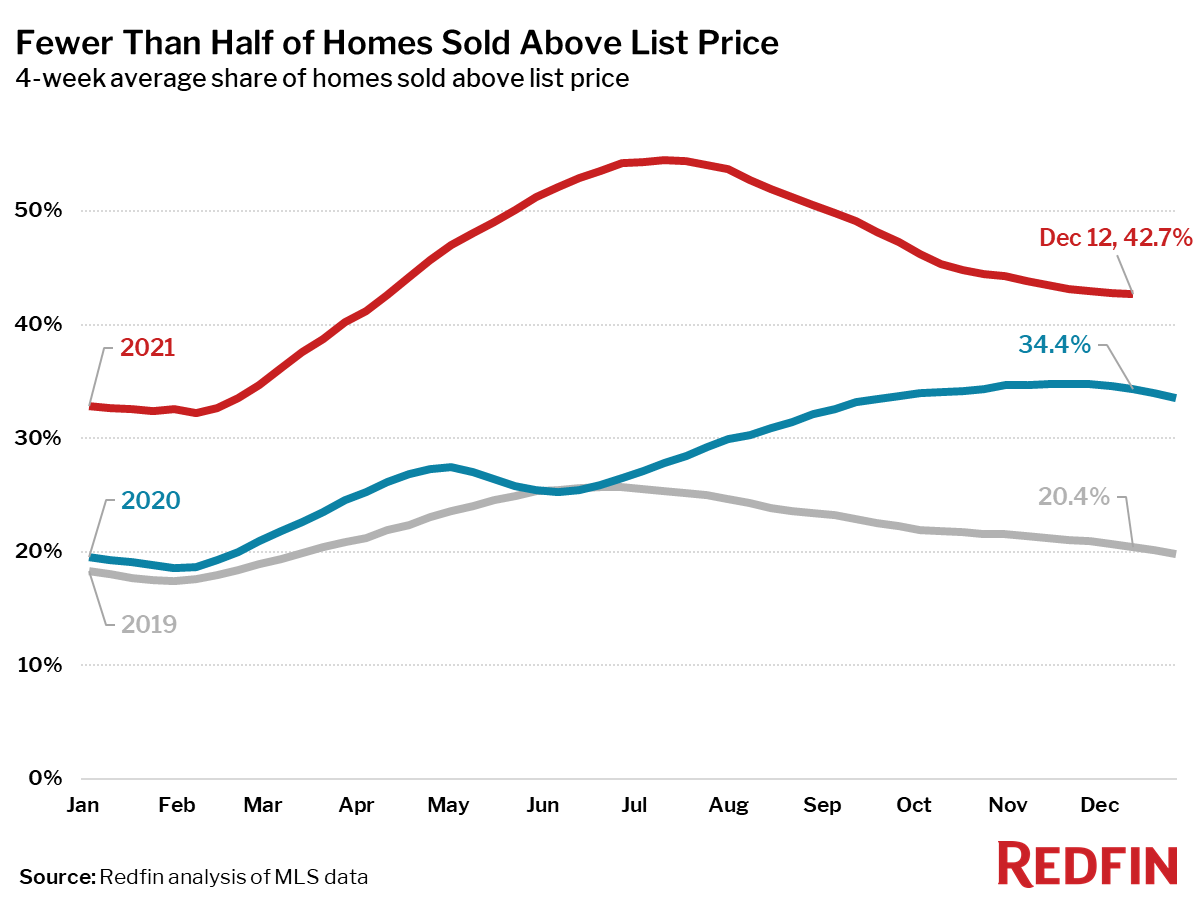

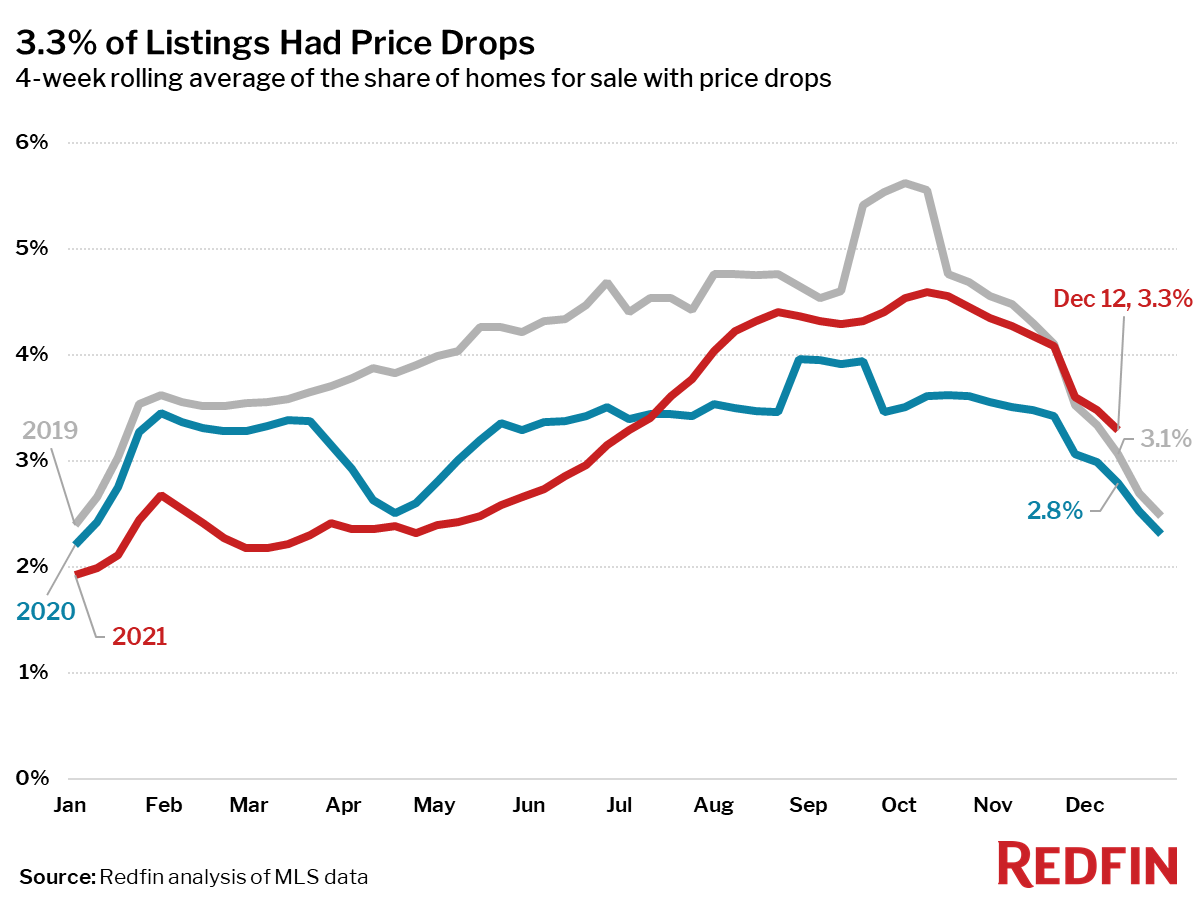

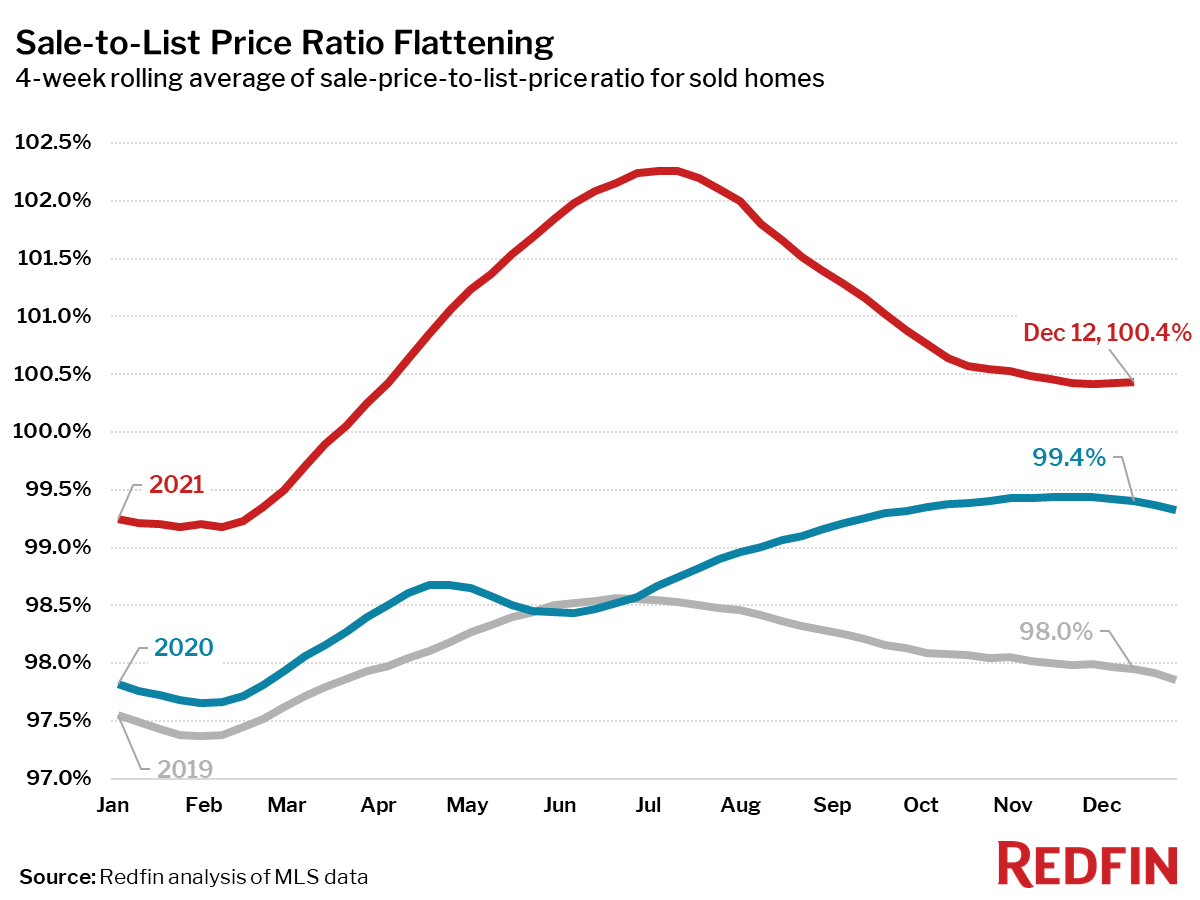

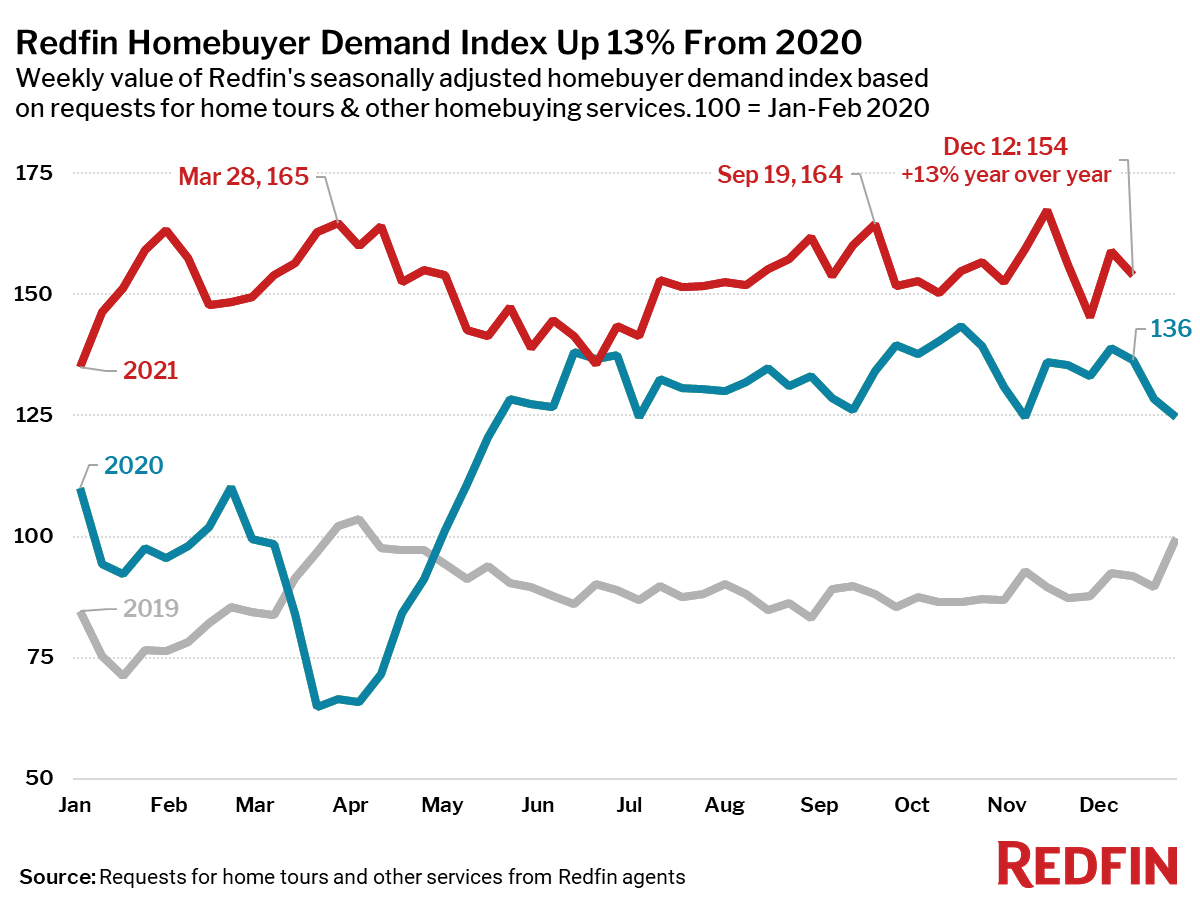

The median home sale price rose 14% year over year to $359,750, just shy of its all-time high, as the number of homes for sale fell to an all-time low during the four-week period ending December 12. Homebuying demand continued to outpace supply; the average home sold for more than its list price for the 39th straight week. Other housing market measures followed typical seasonal trends, slowing down as winter approaches. The median sale price in recent periods revised down slightly as more sales from those periods were recorded.

“Homebuyers are being hit particularly hard by this wave of inflation,” said Redfin Chief Economist Daryl Fairweather. “People who set out to buy a home in 2020 but delayed their plans or lost out in bidding wars may now find themselves priced out of homeownership. Right now the only thing likely to slow the rate of home-price growth is a mortgage-rate hike, which would be something of a Pyrrhic victory for homebuyers.”

Unless otherwise noted, the data in this report covers the four-week period ending December 12. Redfin’s housing market data goes back through 2012. Comparing today’s market with the pre-pandemic fall market of 2019 highlights how hot the market remains, even as most measures are settling into typical seasonal patterns.

Refer to our metrics definition page for explanations of all the metrics used in this report.