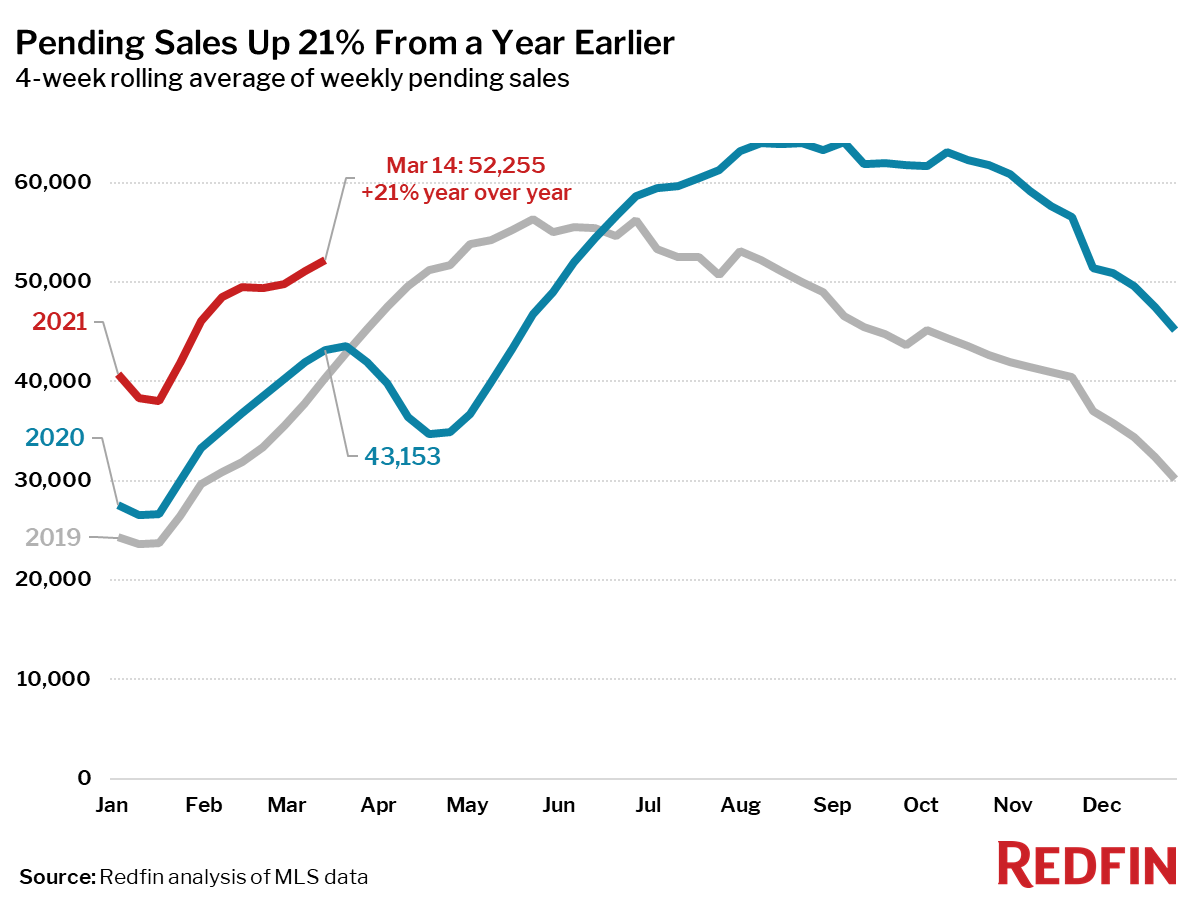

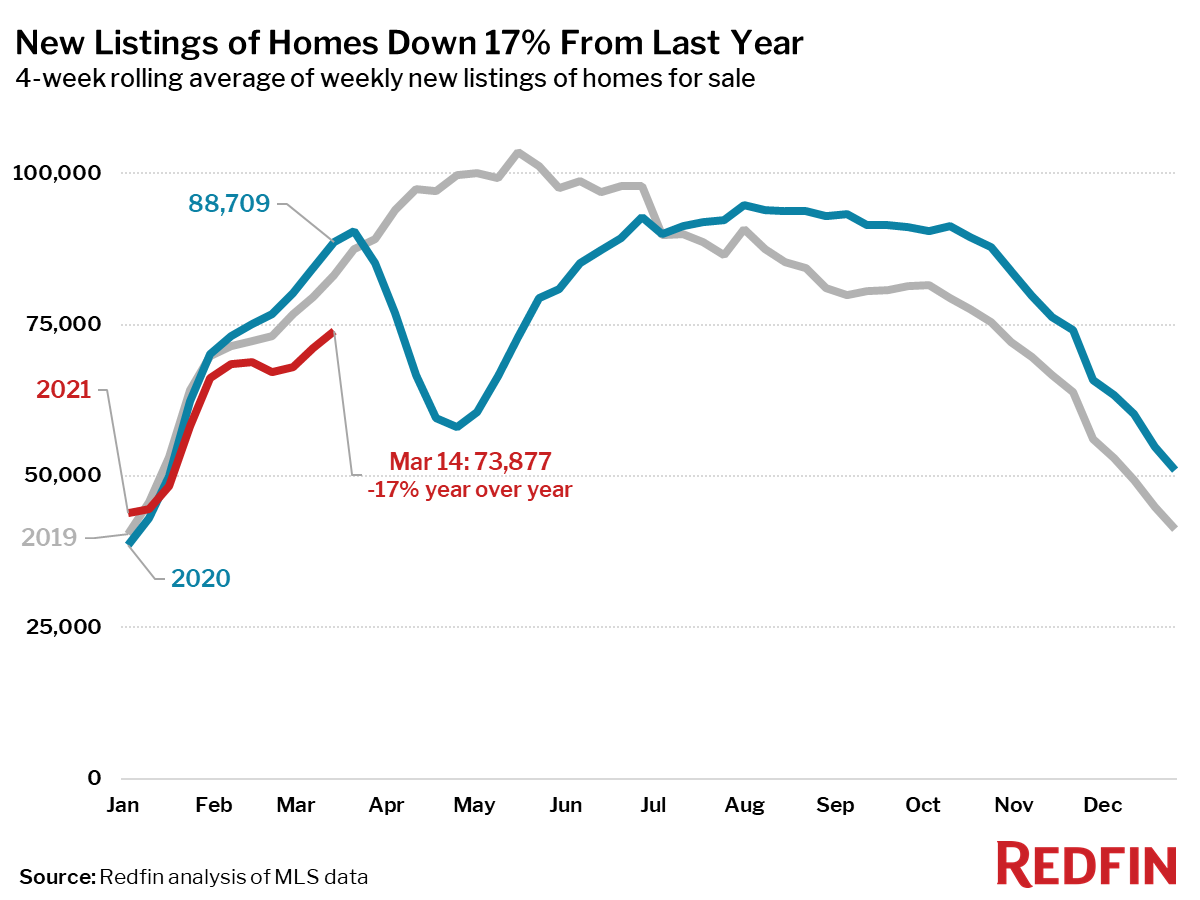

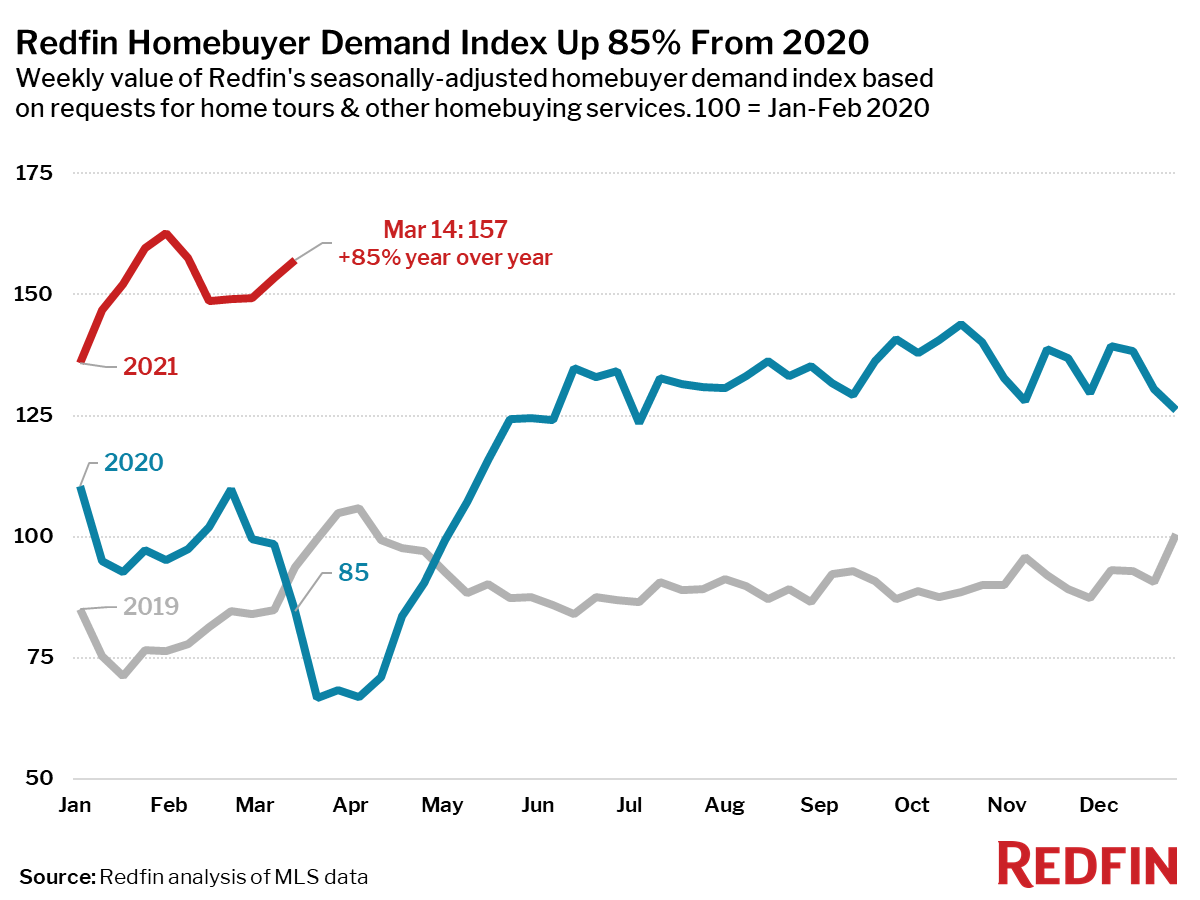

Note: We are now entering the period where our comparisons to a year ago are during the steep decline in homebuying demand at the start of the pandemic, so many housing demand measures will begin to show very large year-over-year increases in the coming weeks.

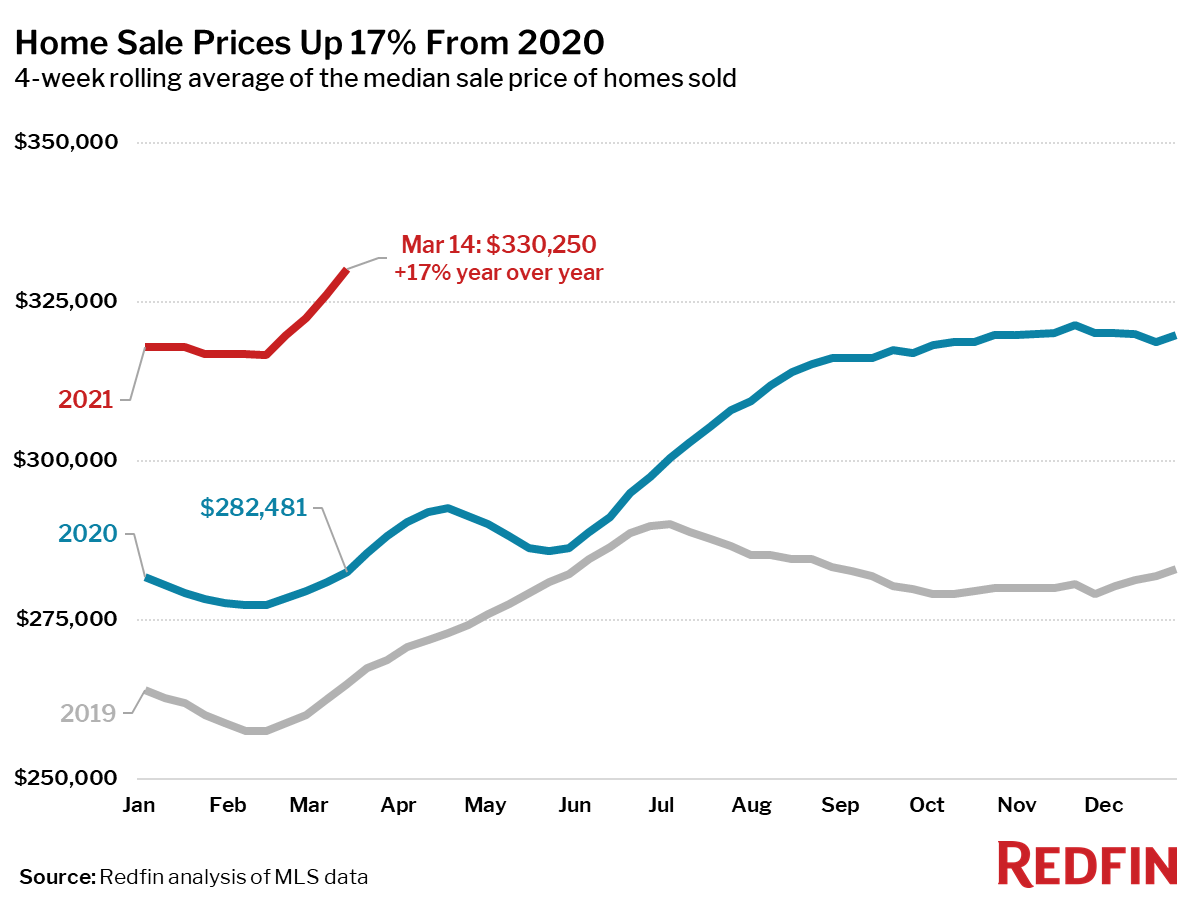

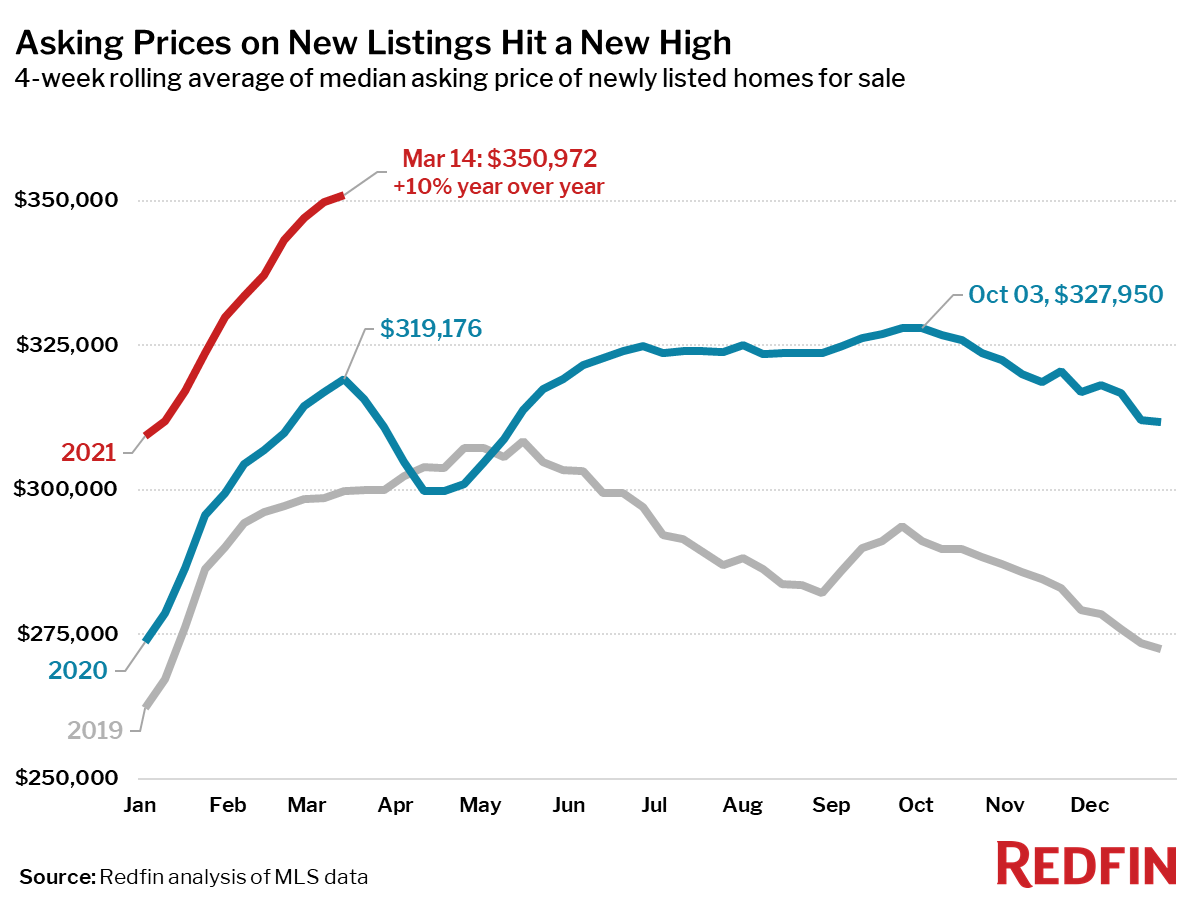

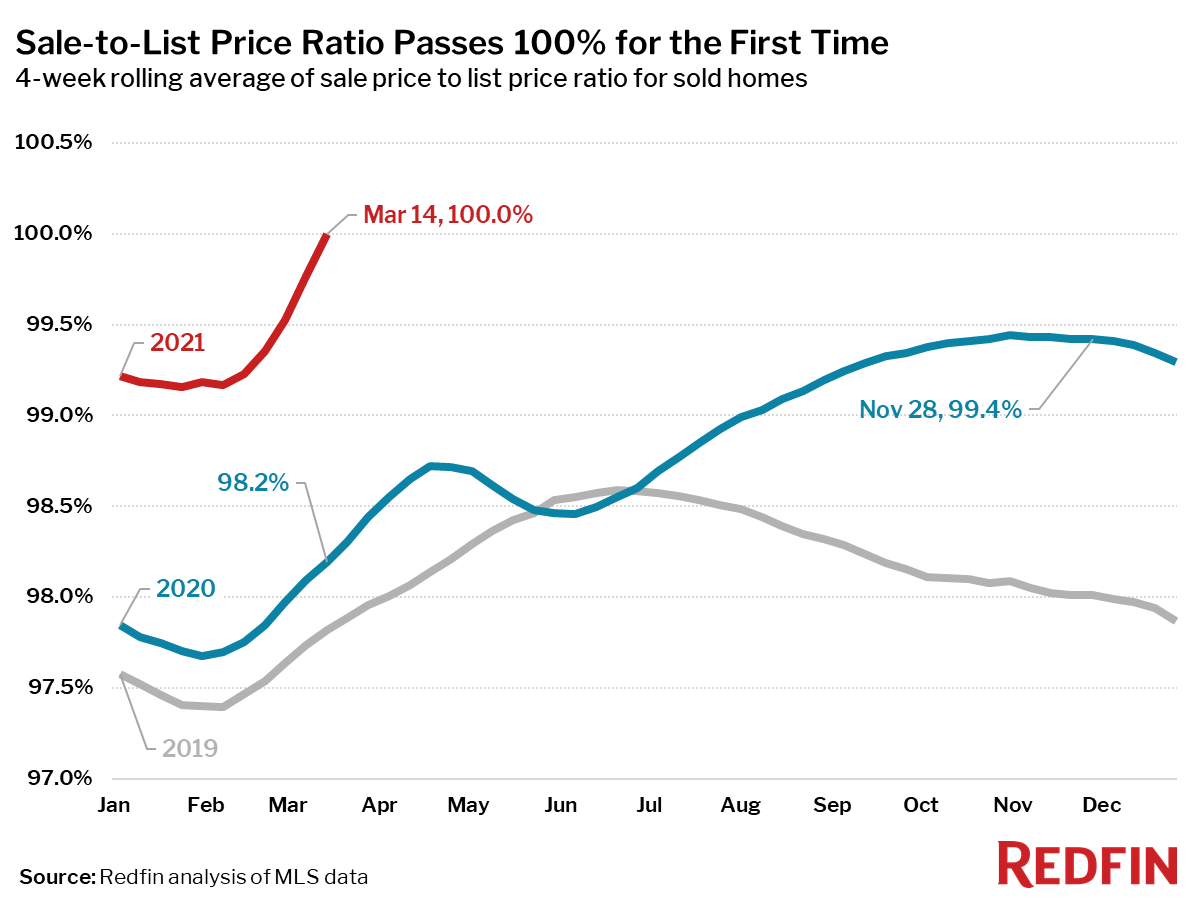

“This time last year, the housing market was shutting down as many cities implemented strict shelter in place orders. A year later the pandemic is still with us, but the housing market is red-hot. It’s so hot some buyers are acting irrationally,” said Redfin Chief Economist Daryl Fairweather. “Some people are willing to do whatever it takes to win a bidding war to the point they may be overpaying. Still, I wouldn’t call this a housing bubble because the demand for homes is truly there and the buyers can afford these high prices. Bubbles burst; I don’t see that happening. The best hope buyers have is that home prices start to grow at a slower pace, but I don’t expect prices to fall.”

Refer to our metrics definition page for explanations of all the metrics used in this report.