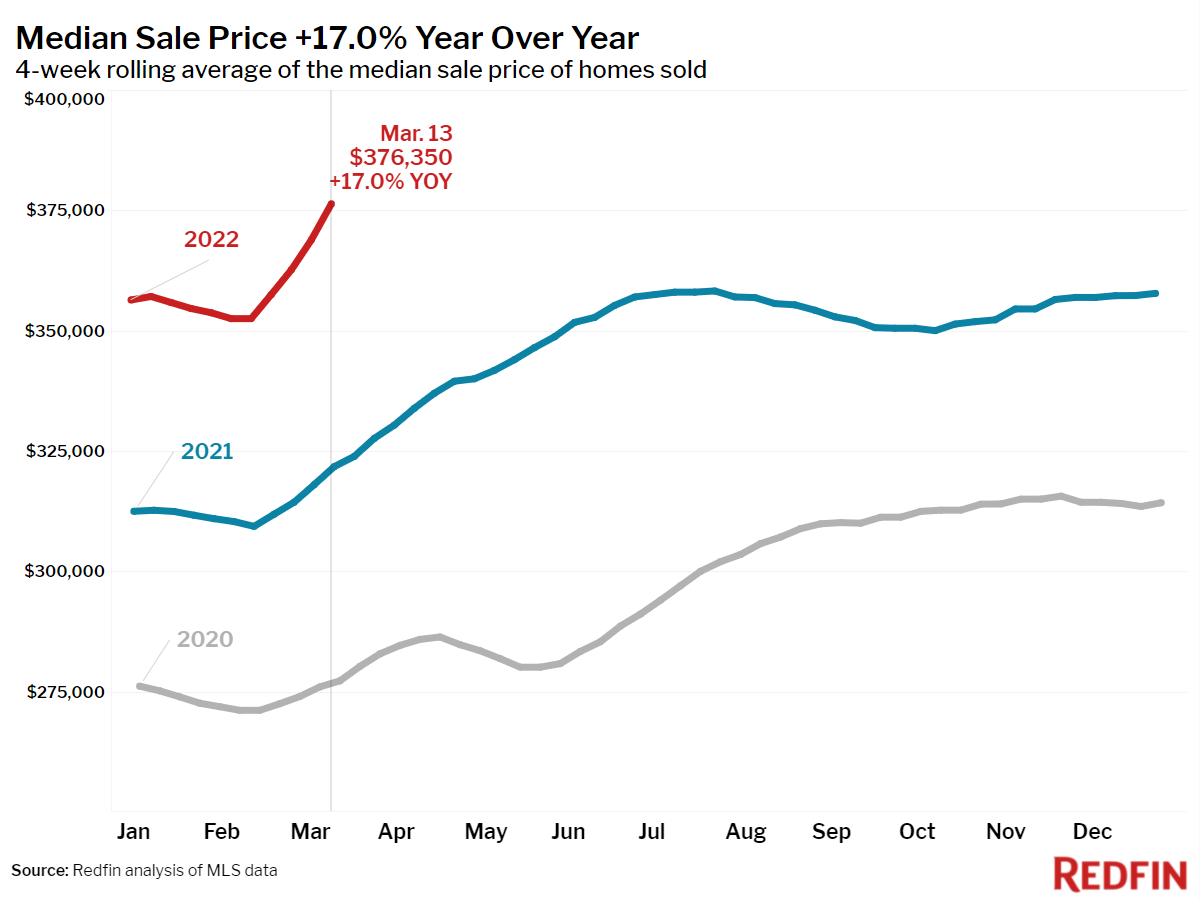

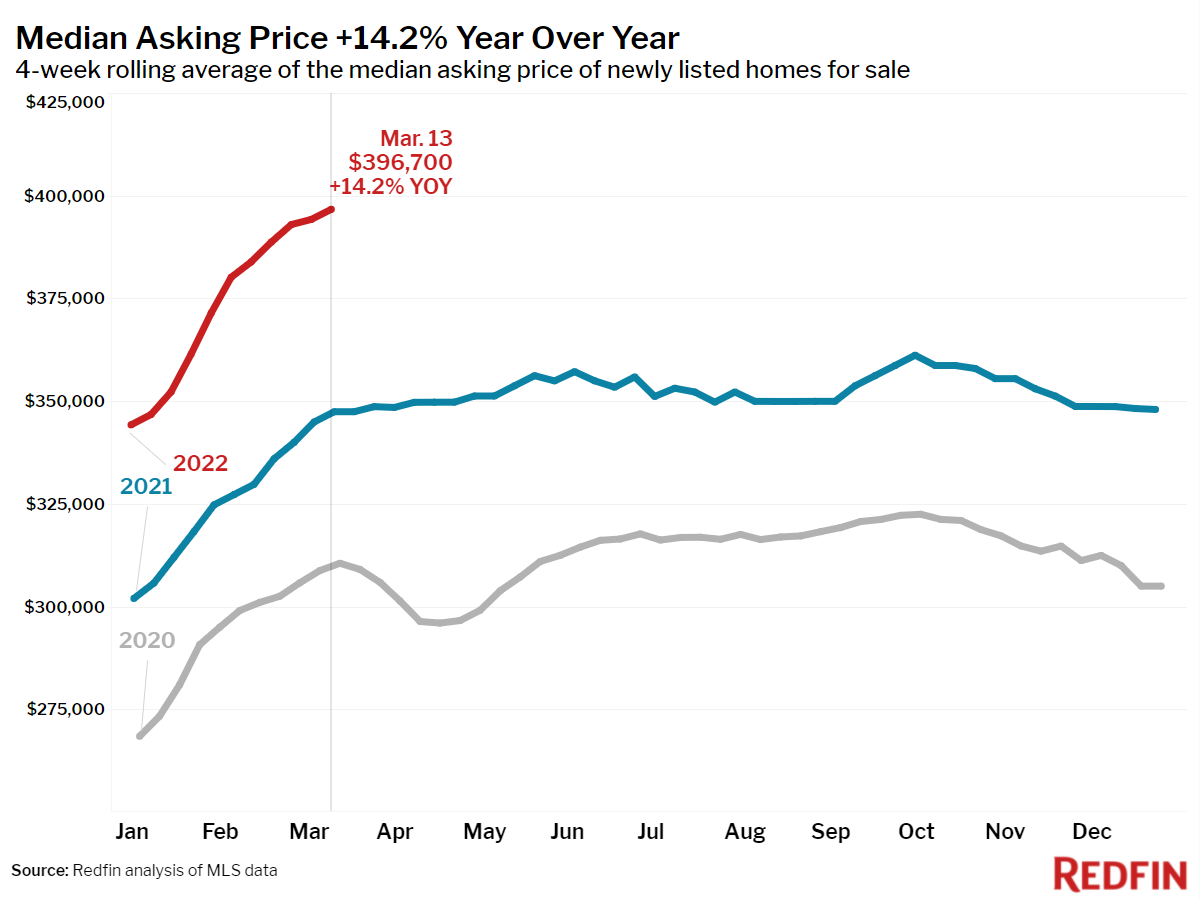

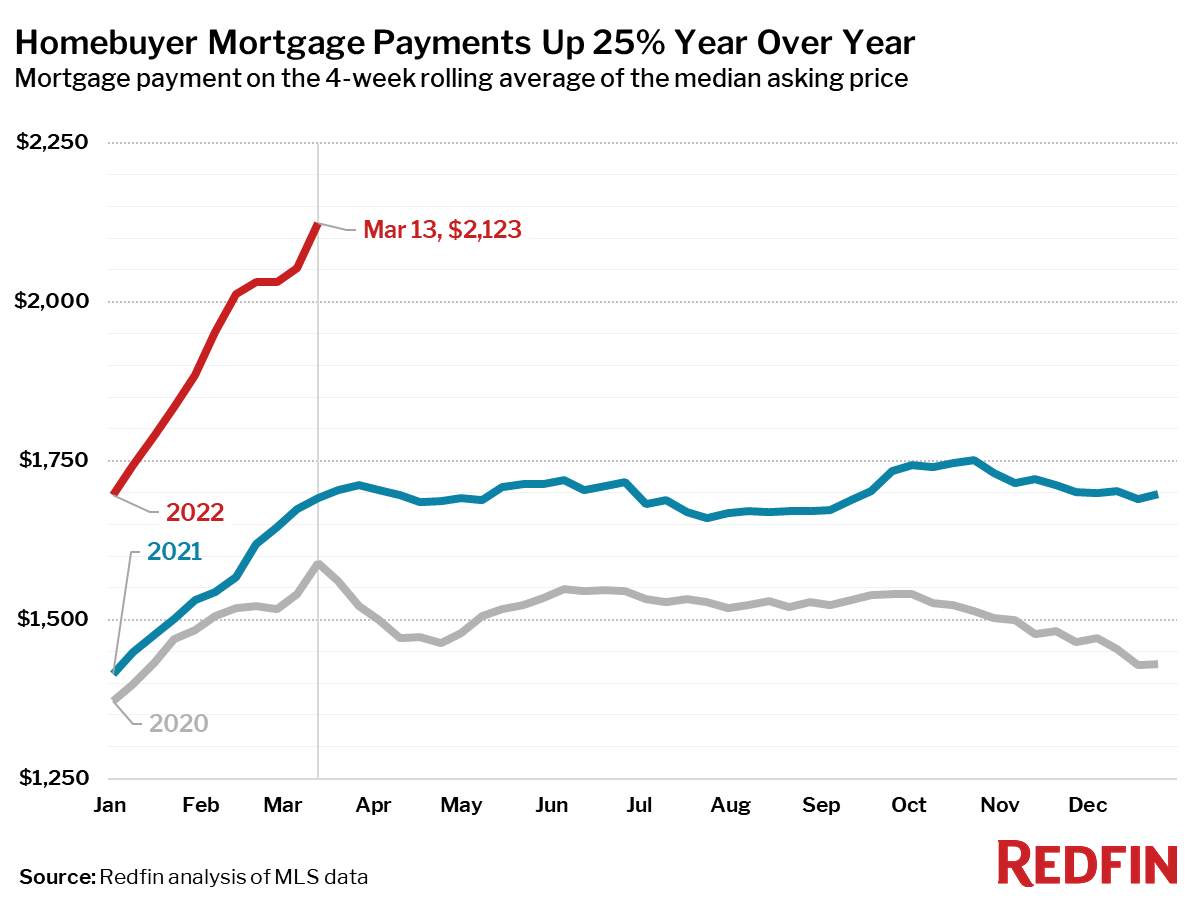

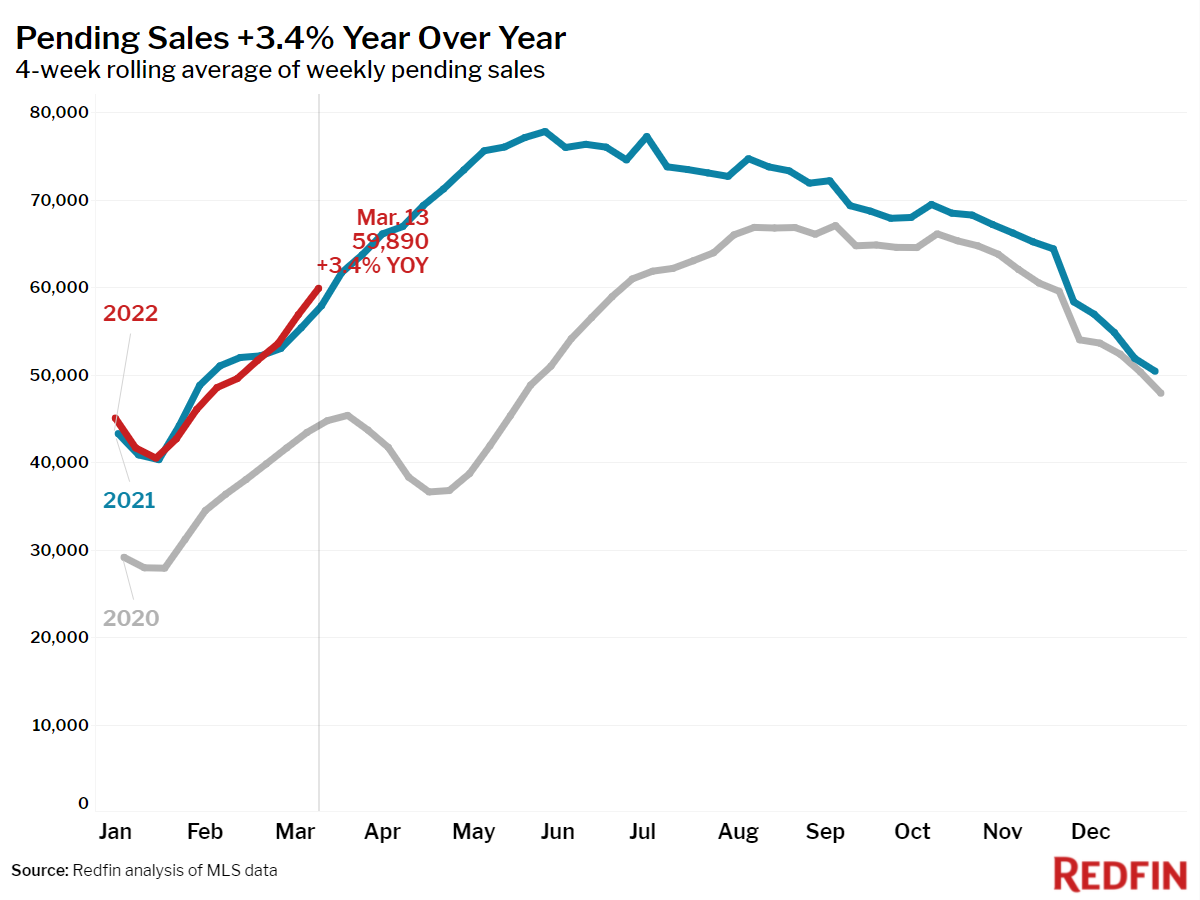

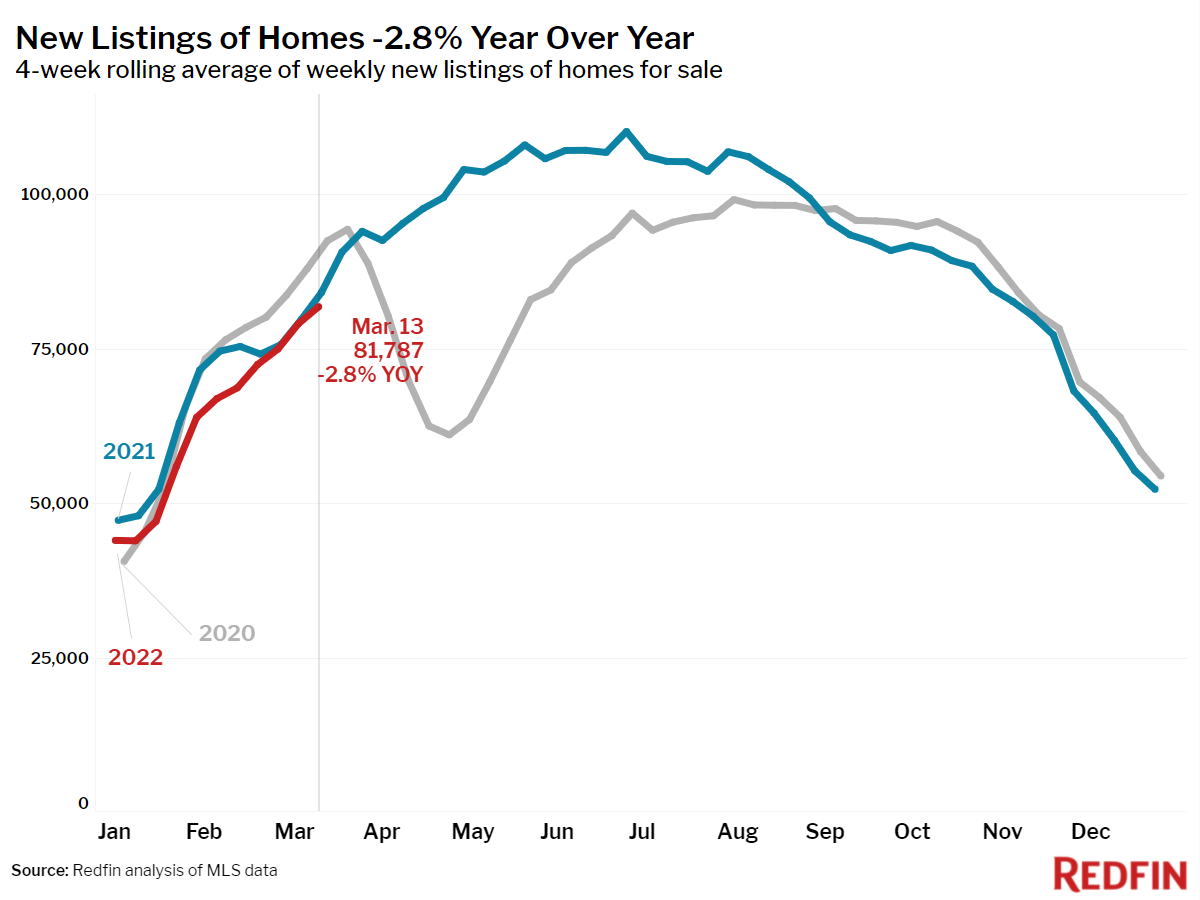

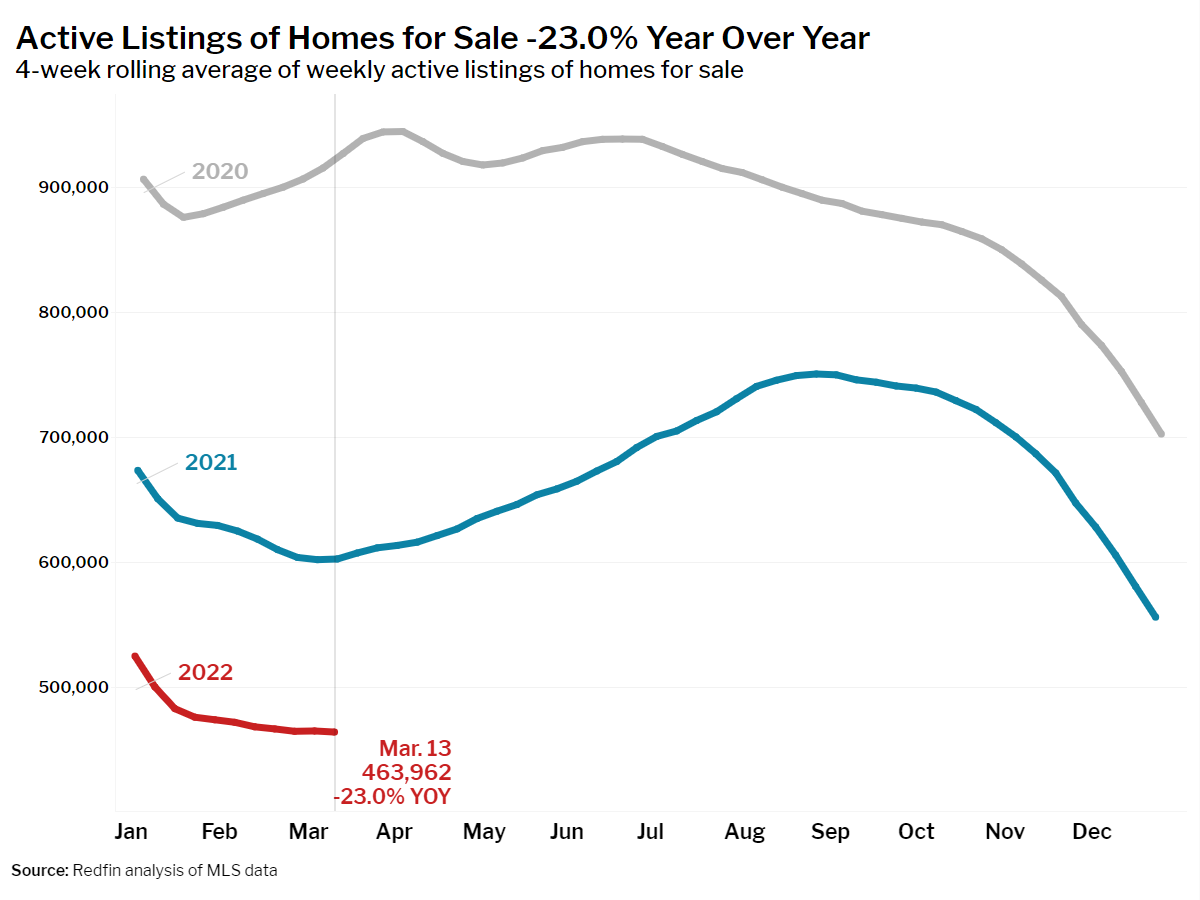

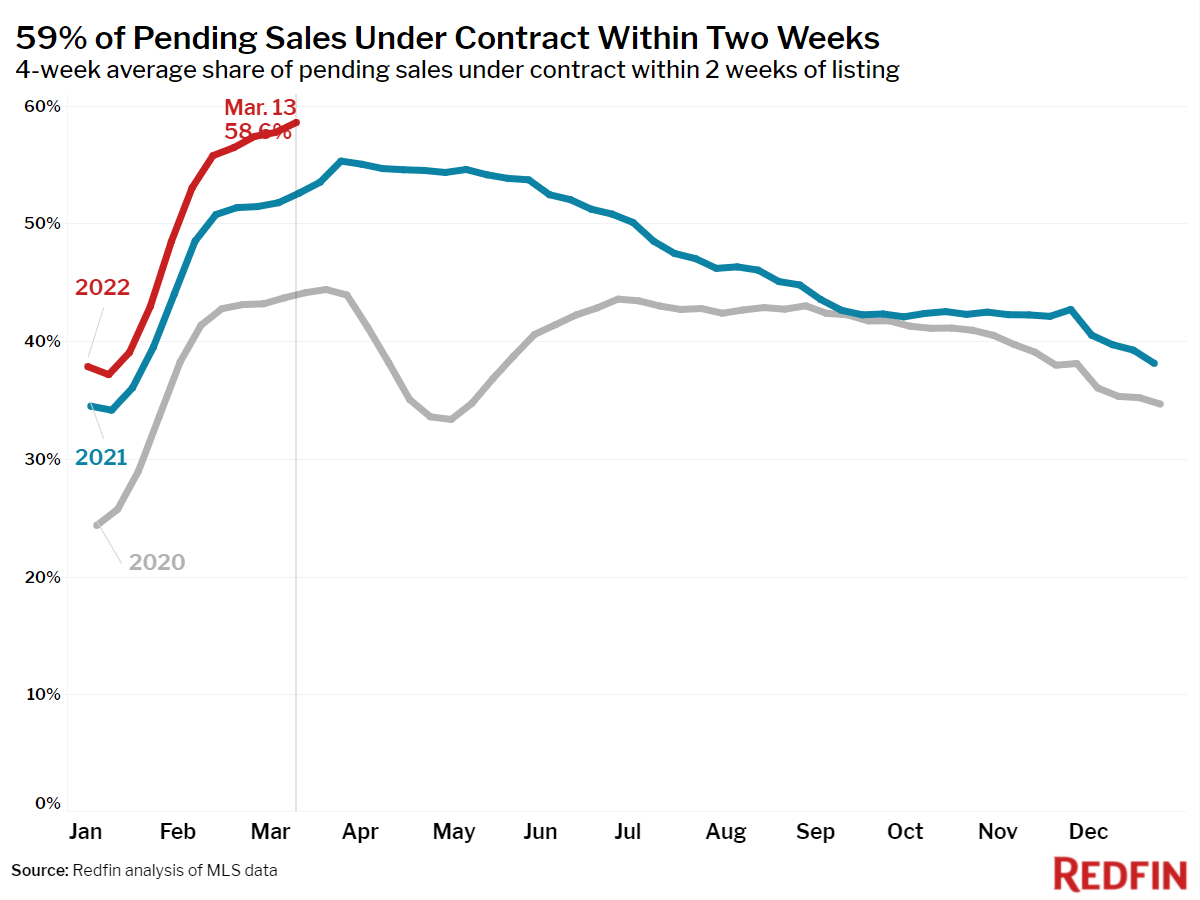

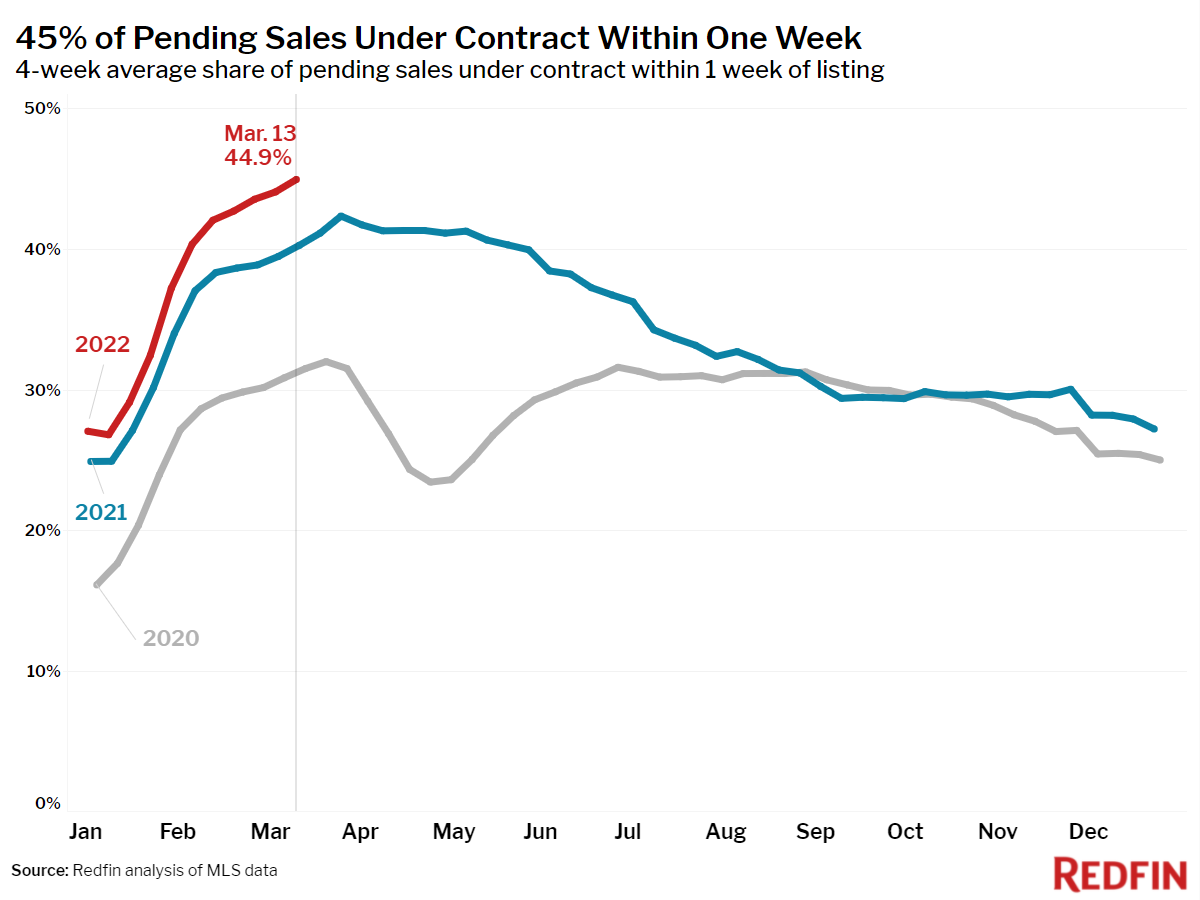

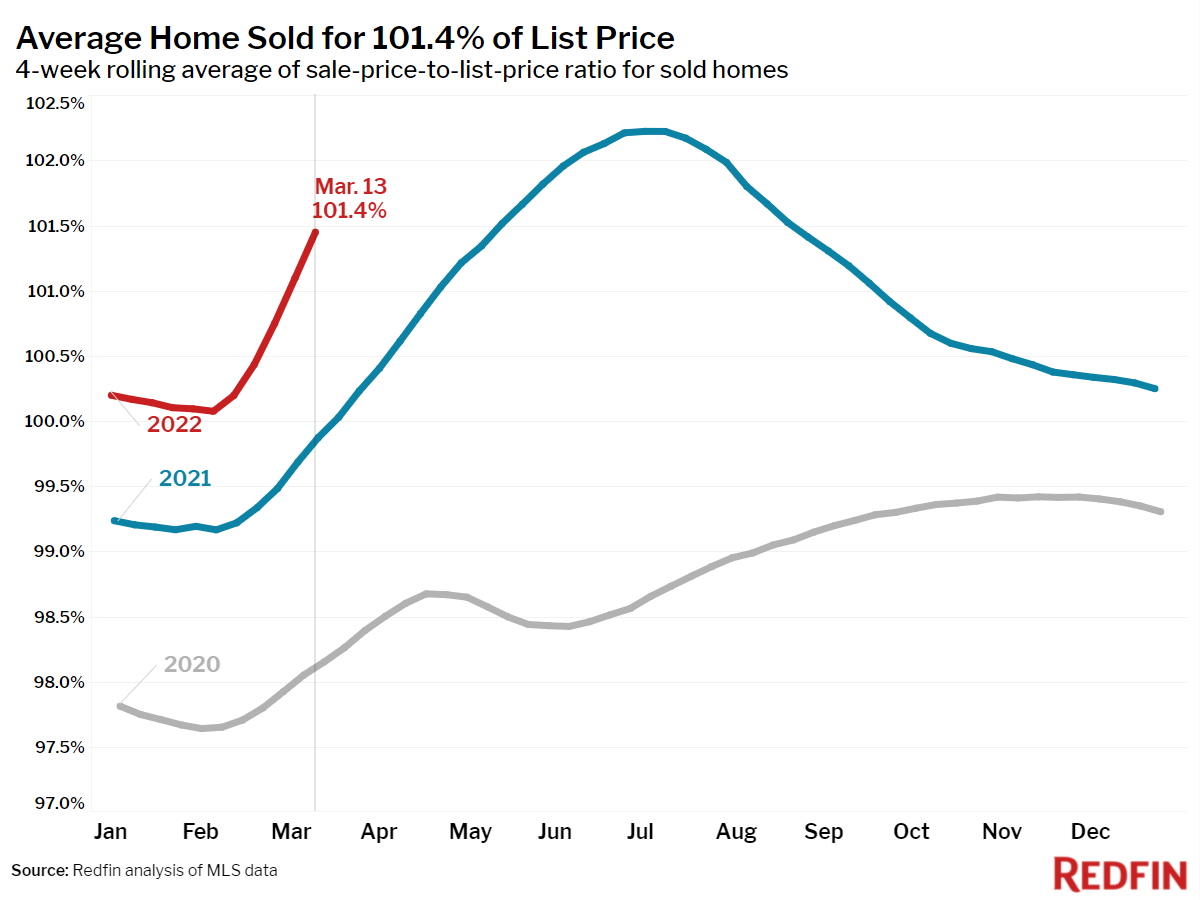

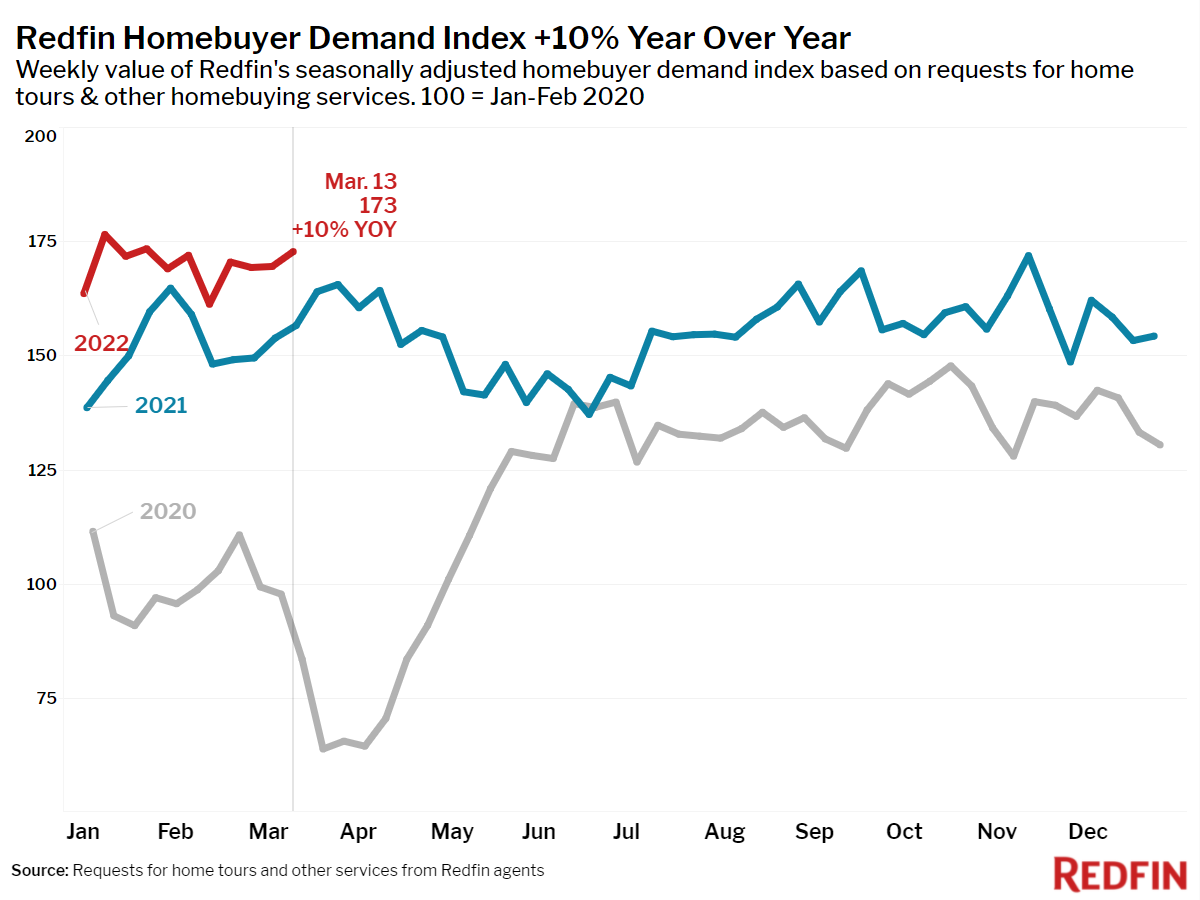

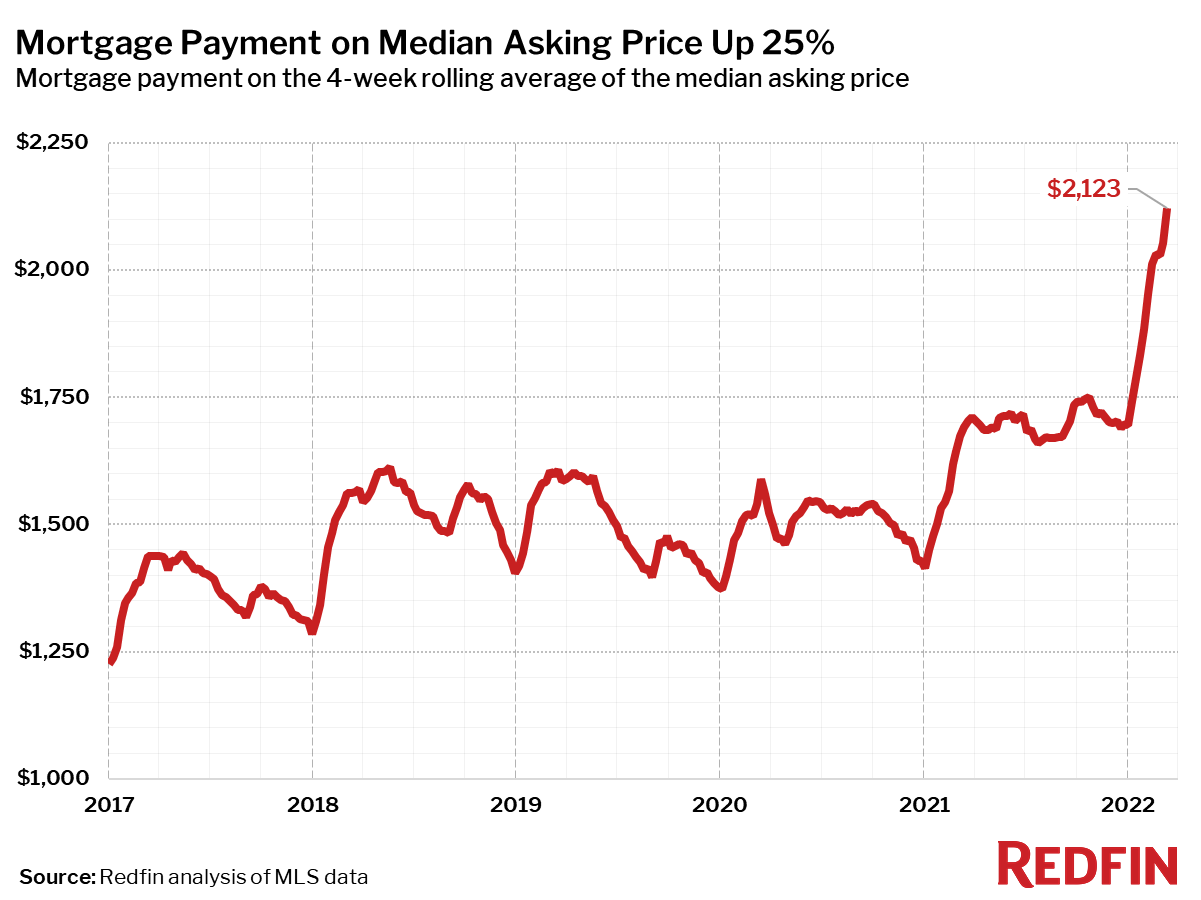

The U.S. median home sale price surged 7% during the four-week period ending March 13—the largest month-over-month increase on record in Redfin’s data, which goes back through 2017. With mortgage rates also soaring, the typical homebuyer’s monthly payment reached a new high of $2,123. That’s more than $530 more than the typical pre-pandemic homebuyer is paying. Pending sales climbed 3% year over year, despite new listings shrinking at the same rate.

“There are plenty of reasons to be worried about the economy, but demand for housing has so far remained strong,” said Redfin Chief Economist Daryl Fairweather. “Consumers continue to spend on housing even though gas prices are on the rise and supply-chain interruptions may lead to even more inflation. Homebuyers are betting that even as the economy twists and turns, owning a home will be a worthwhile investment. As mortgage rates continue to shoot up from historic lows at an unprecedented pace, they could prove to be the one force that can slow homebuying demand in the spring.”

Unless otherwise noted, the data in this report covers the four-week period ending March 13. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.