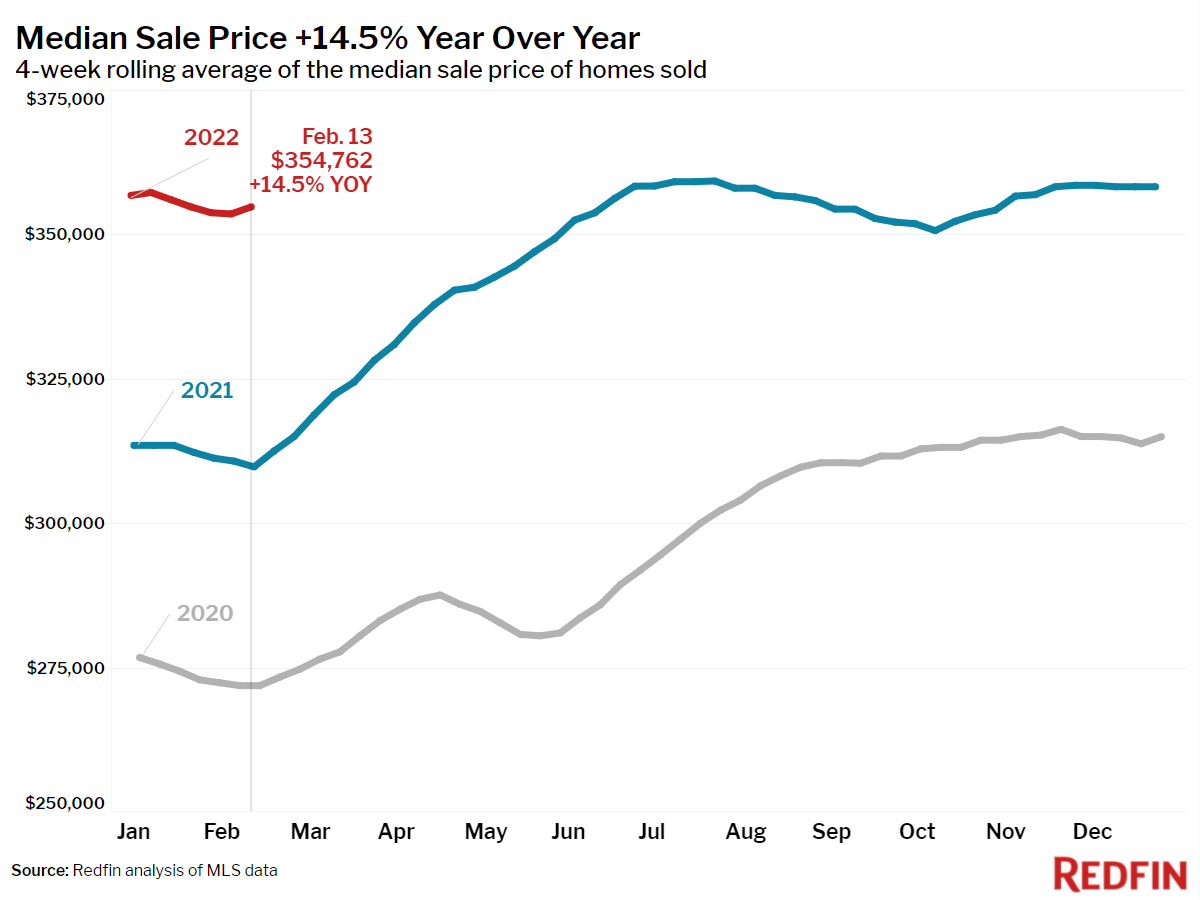

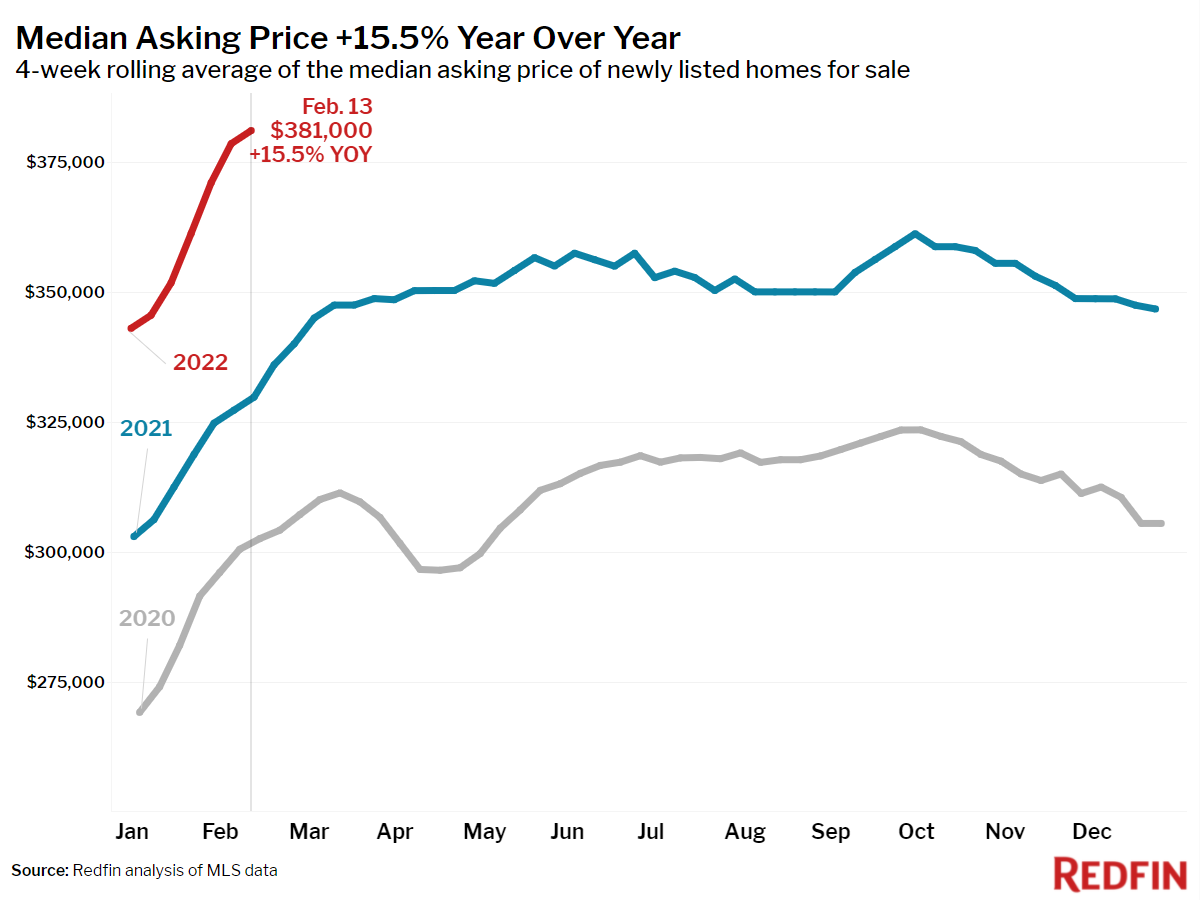

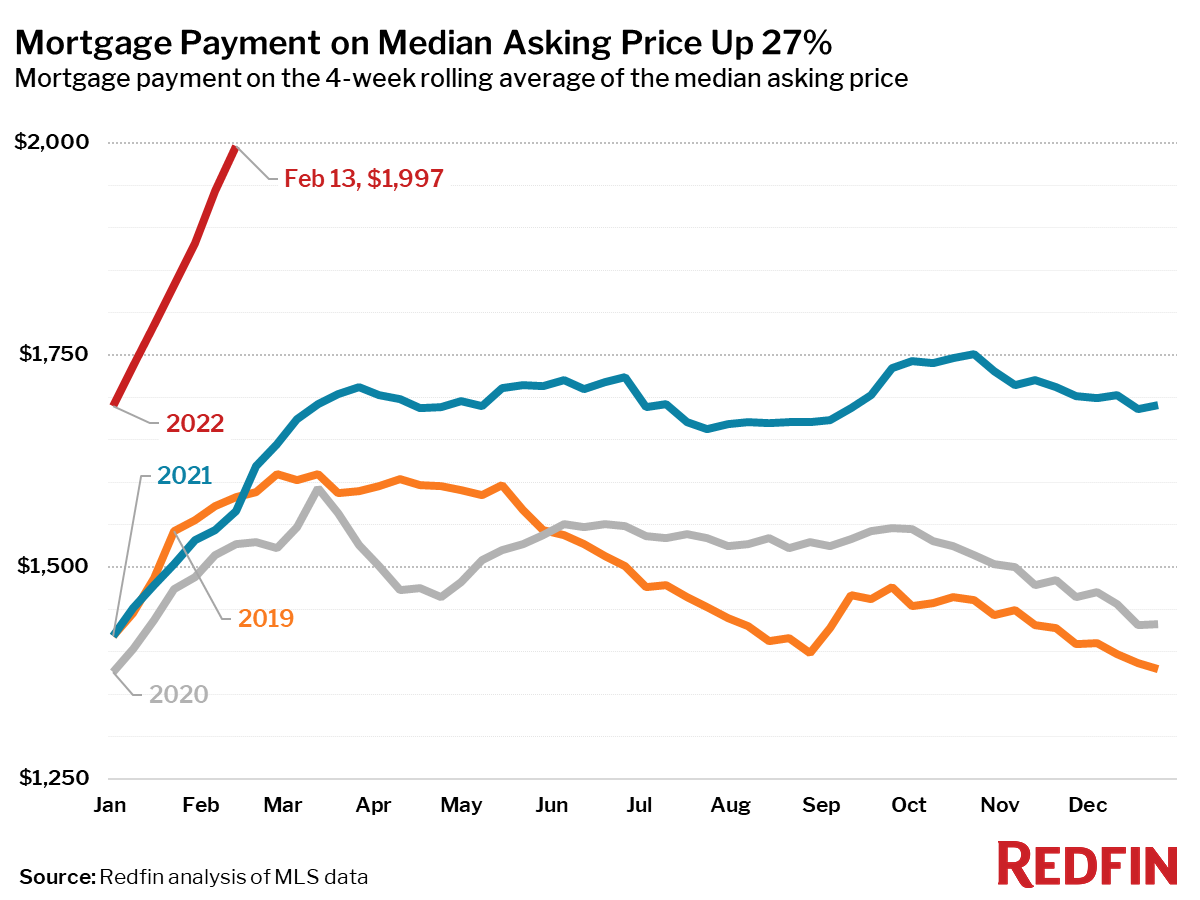

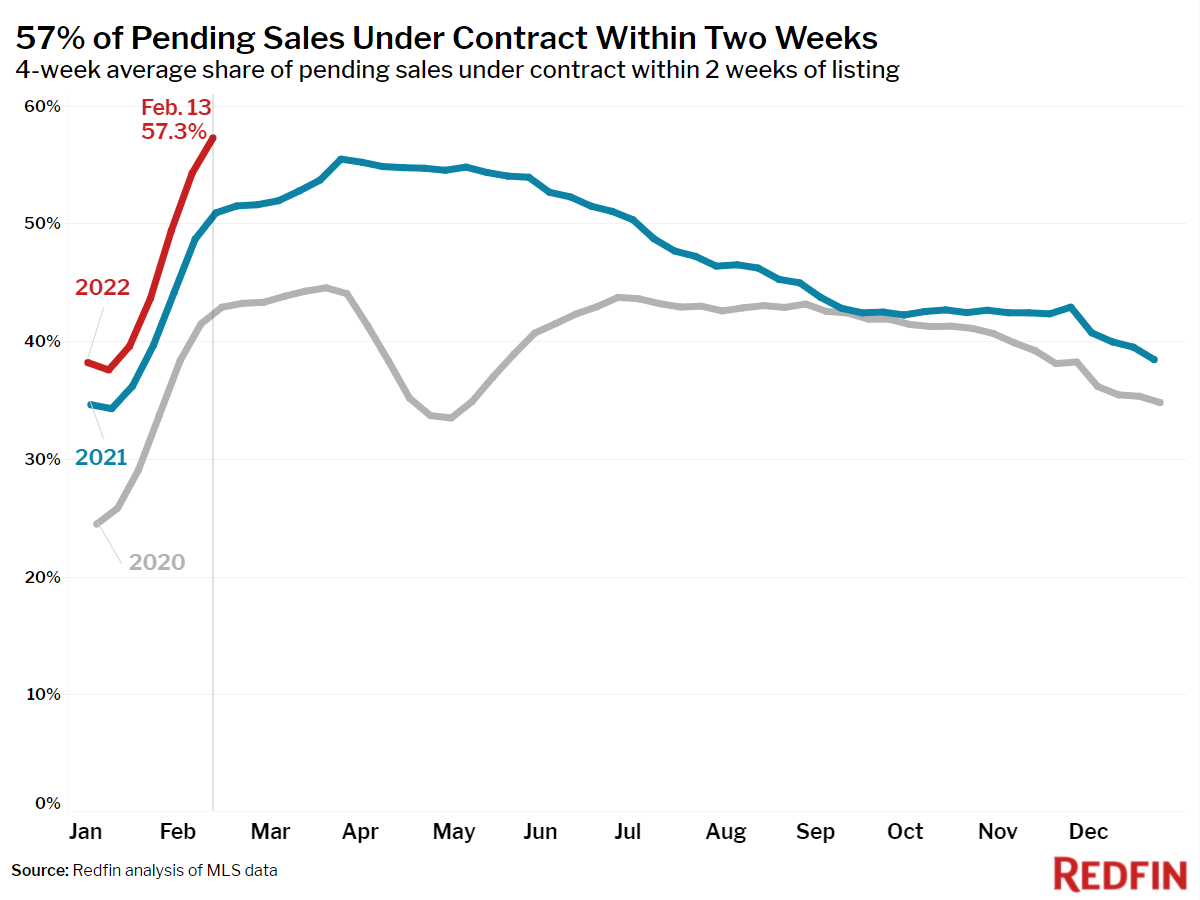

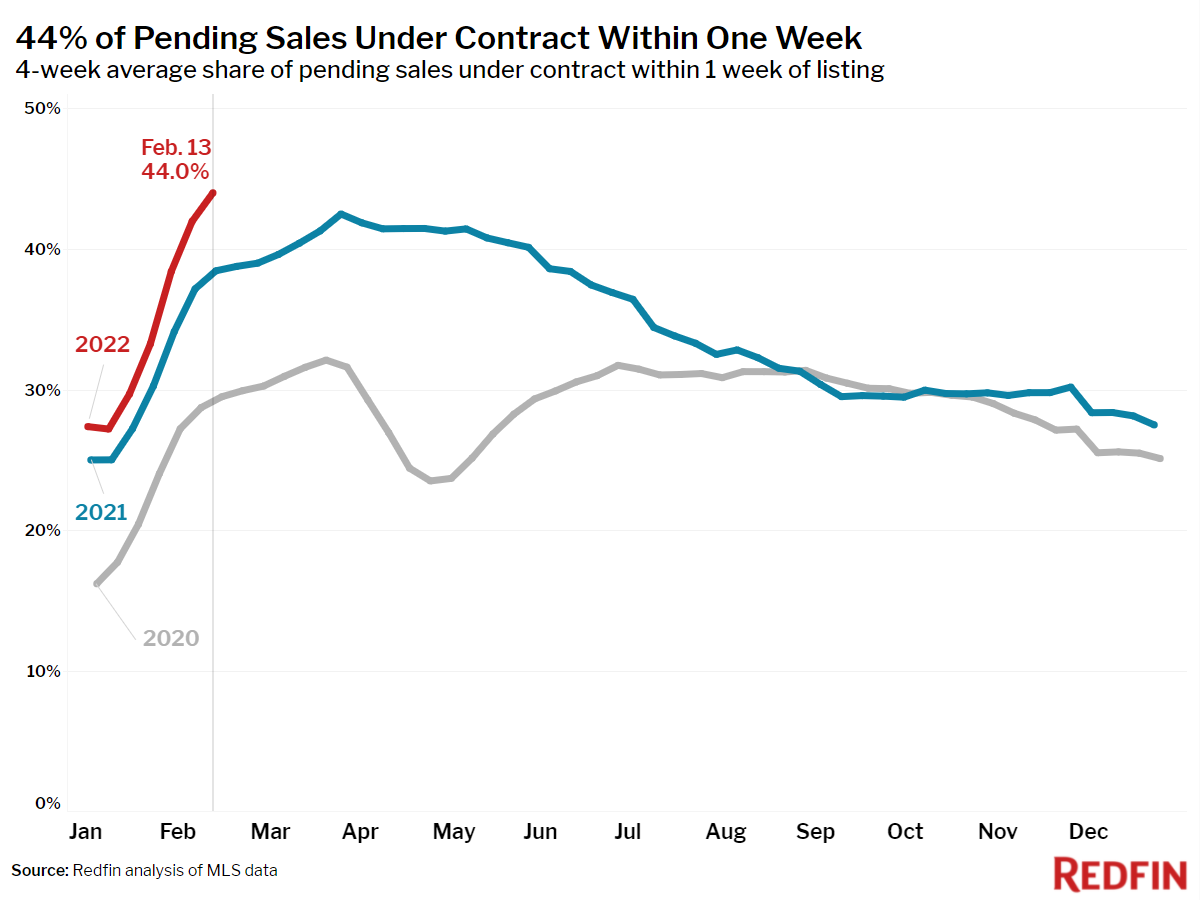

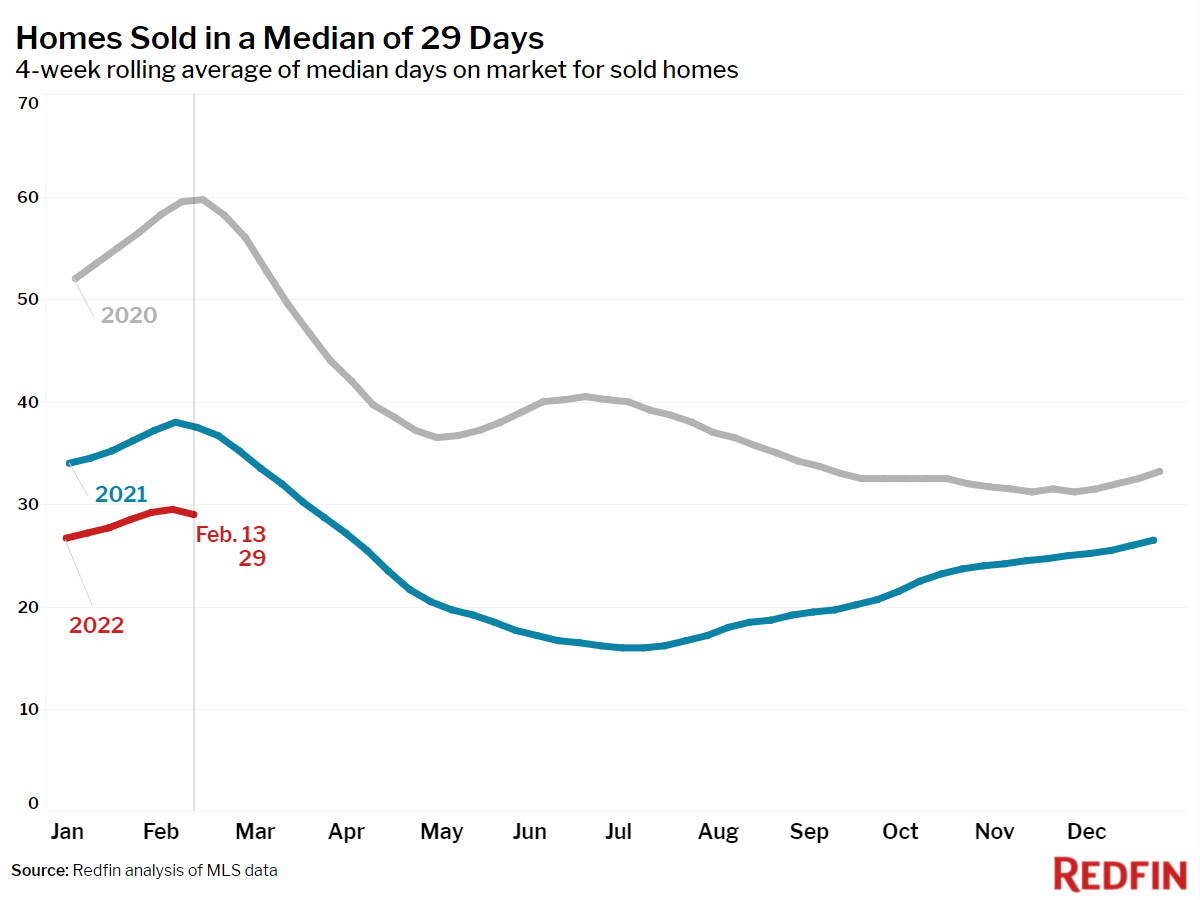

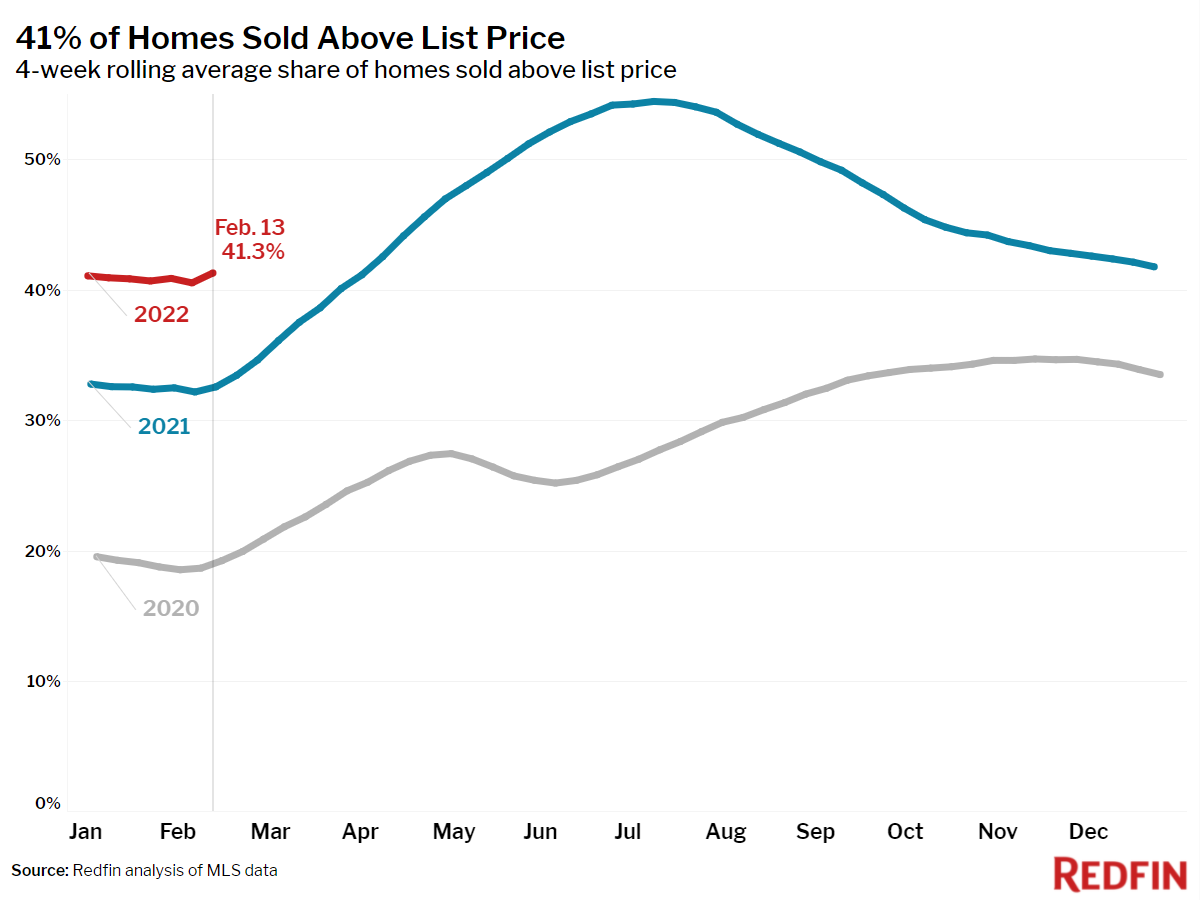

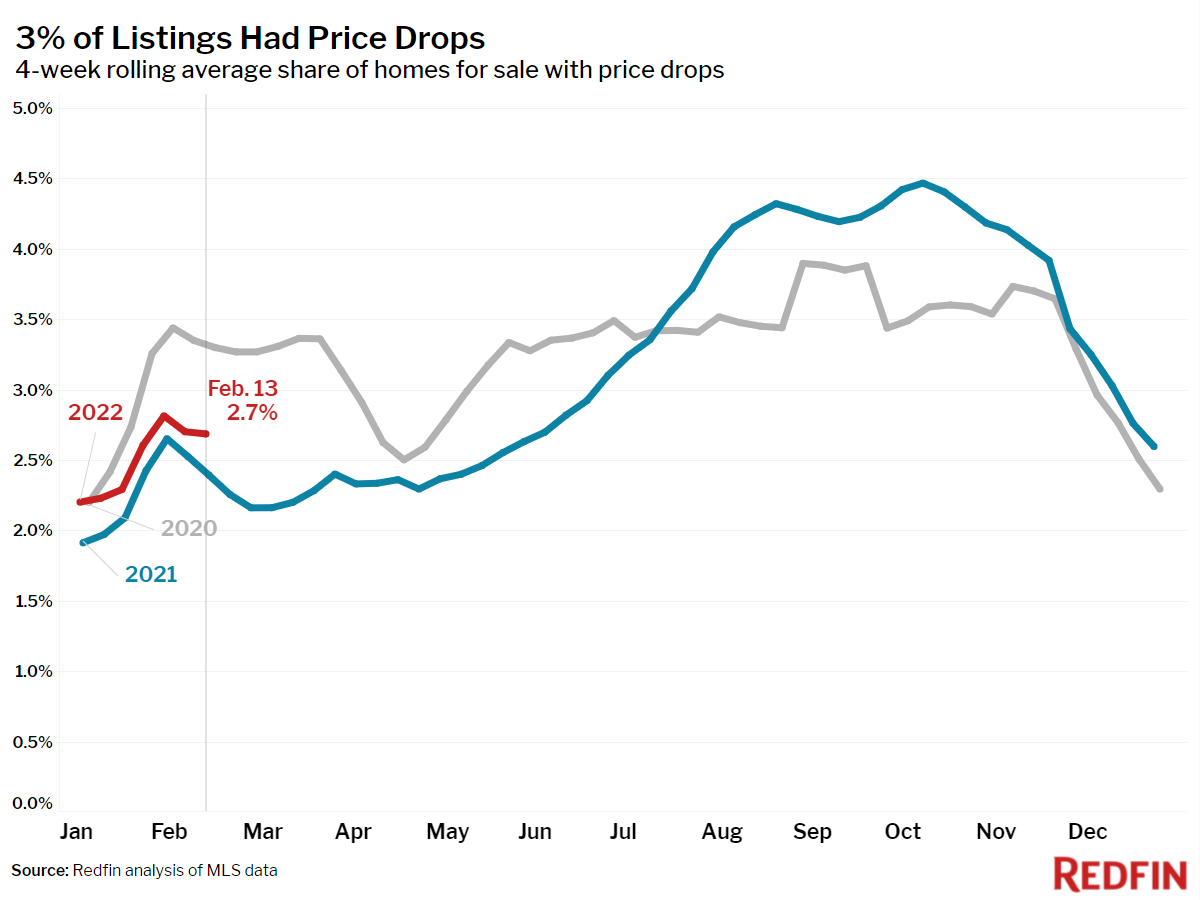

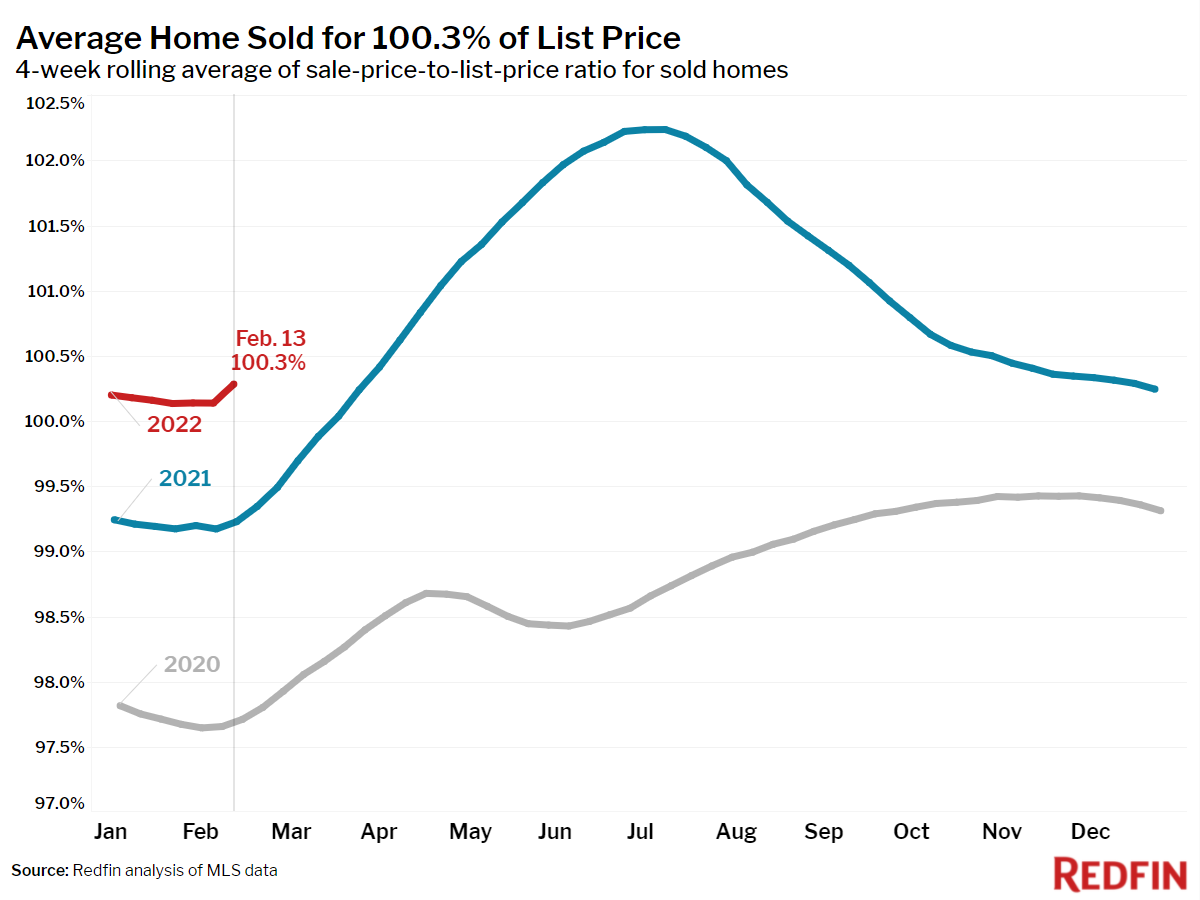

Homes sold faster than ever during the four weeks ending February 13, as a record 57% of homes that went under contract did so within two weeks of being listed. People buying homes now are paying more than ever before, too—a median $1,997 per month—as asking prices soared 16% year over year to a new high and mortgage rates shot up to their highest level since May 2019.

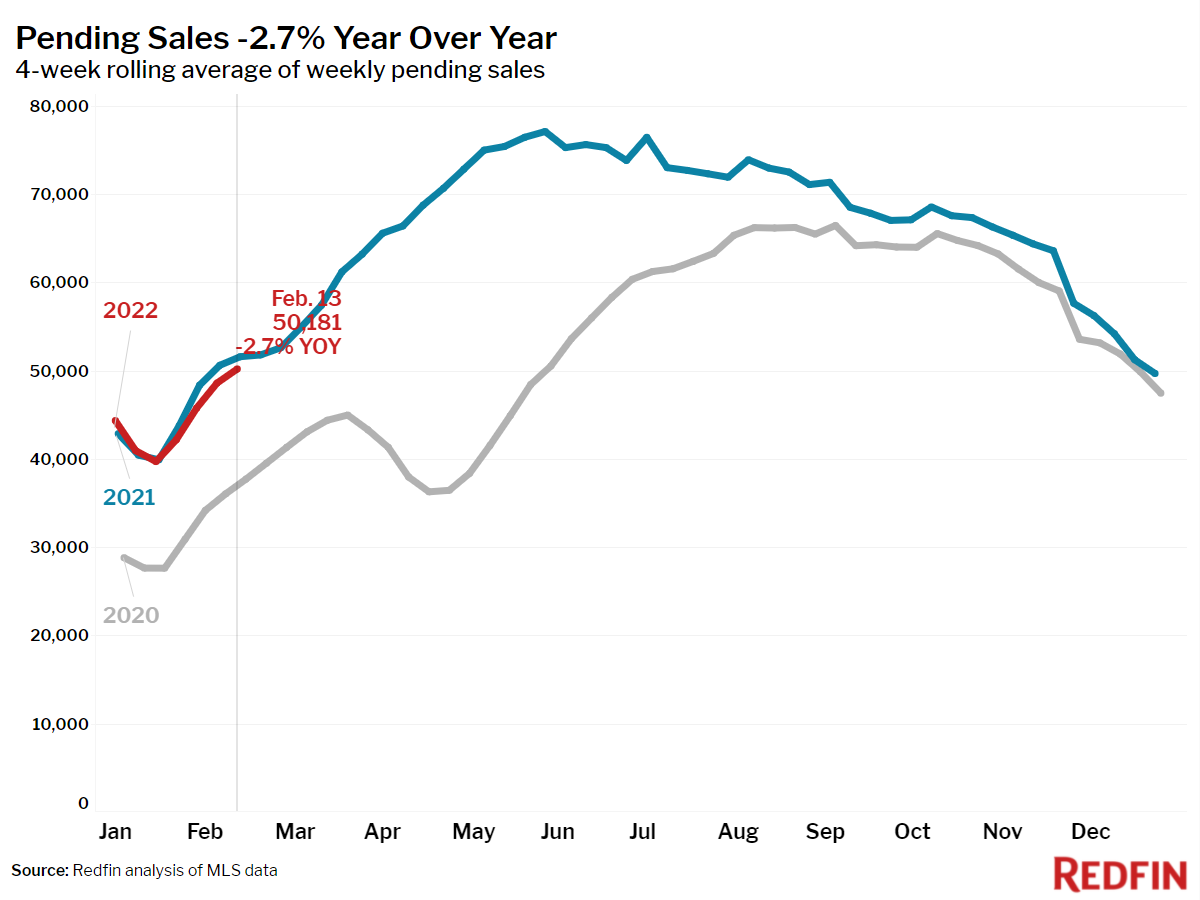

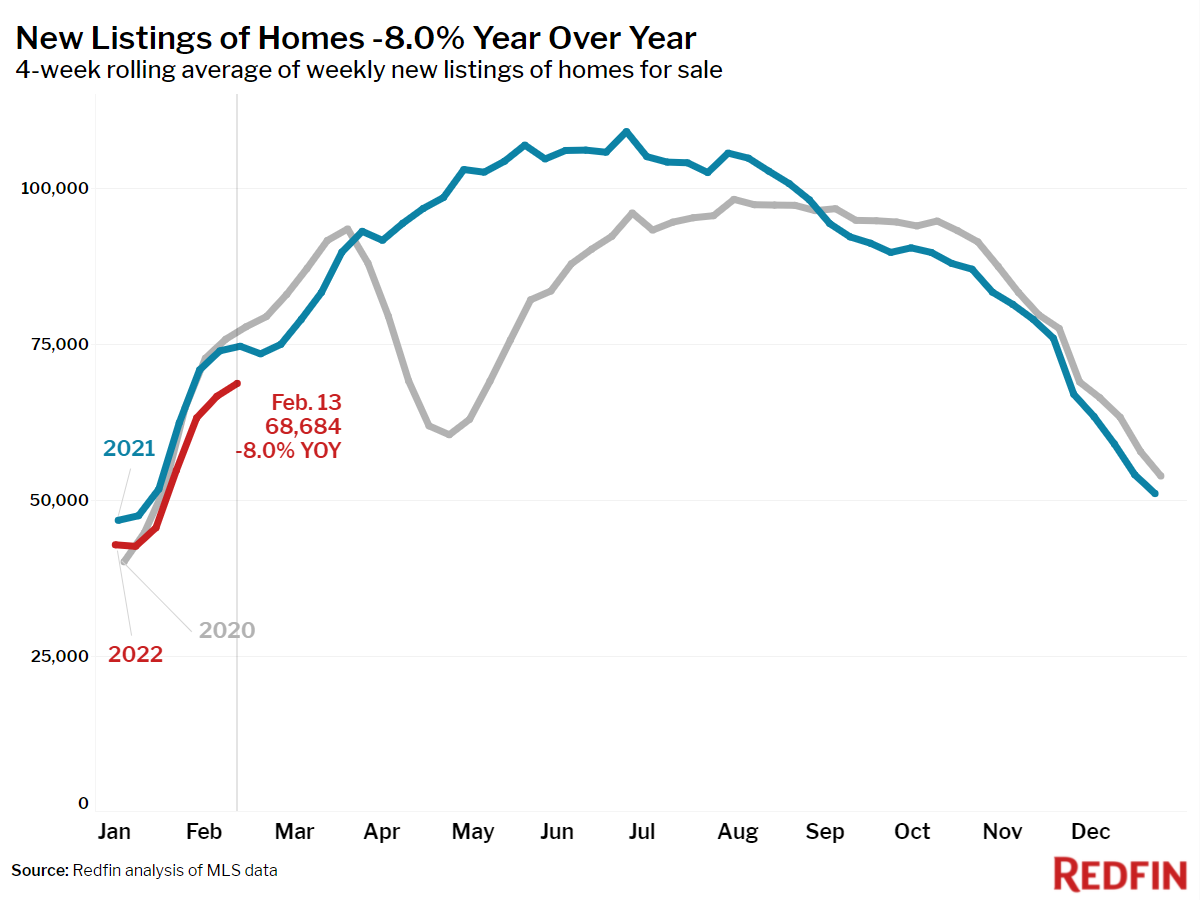

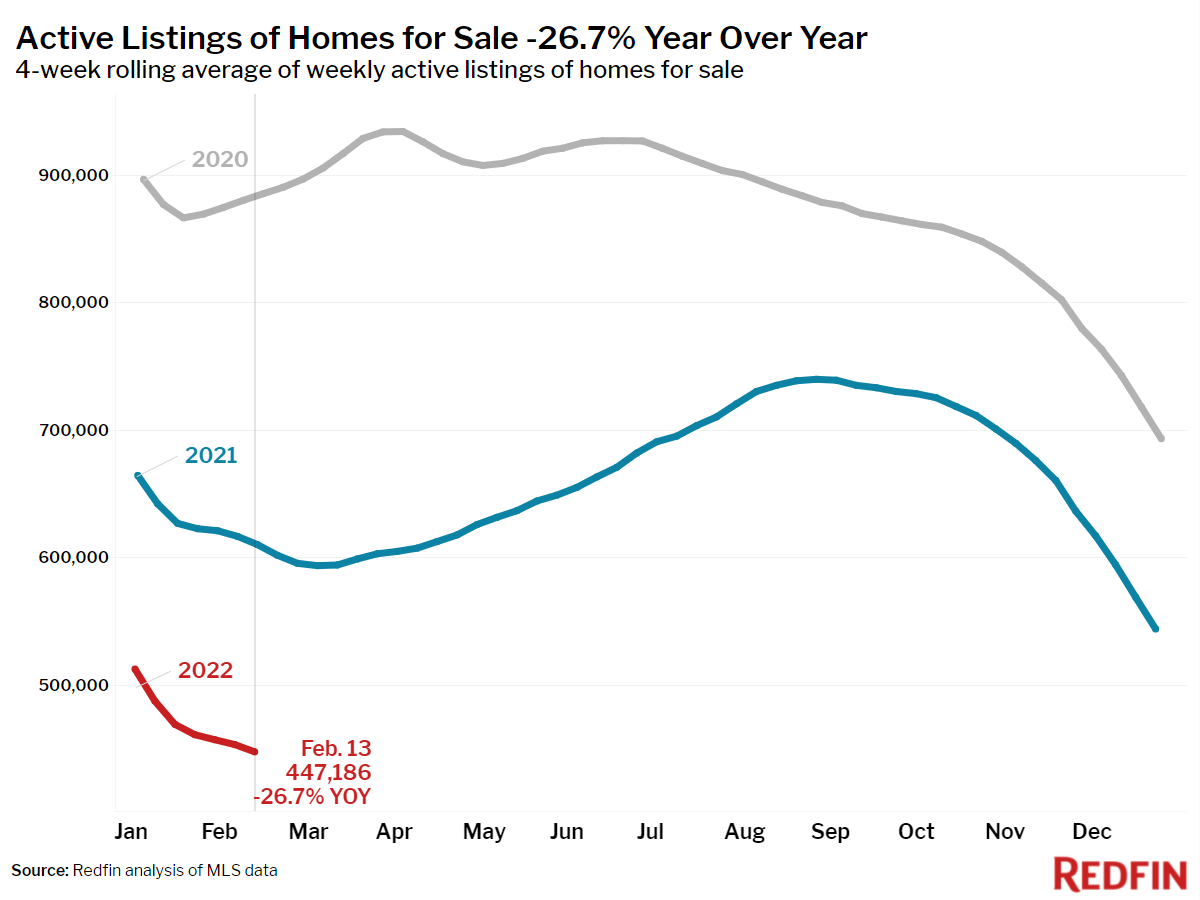

The pace and cost of homebuying are soaring largely because there is so little to buy. New listings fell 8% year over year, sending overall supply to a new low and putting a damper on pending sales, which fell 2.7%. “The acute shortage of new listings of homes for sale is the biggest problem the housing market faces right now,” said Redfin Deputy Chief Economist Taylor Marr. “If you think of the housing market like a bathtub, water (supply of homes for sale) is flowing down the drain (buyers sucking up supply) faster than new water (new listings) is coming in through the faucet. Rising mortgage rates may slow the drain down a bit (cool demand) as record-high monthly payments take a toll on buyers’ budgets. Bottom line: without a flood of new listings we will be sitting in a very shallow bath for a while.”

Unless otherwise noted, the data in this report covers the four-week period ending February 13. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.