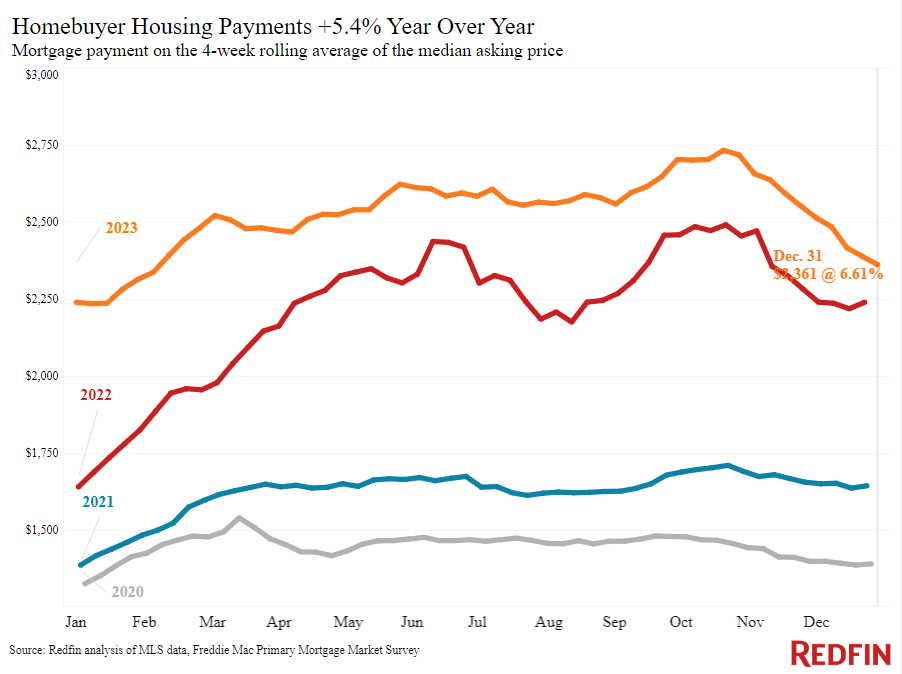

The median U.S. housing payment is down nearly $400 from its October peak, enticing some sidelined buyers to get back in the game. Redfin’s Demand Index, which measures early-stage demand, is up 10% from a month ago.

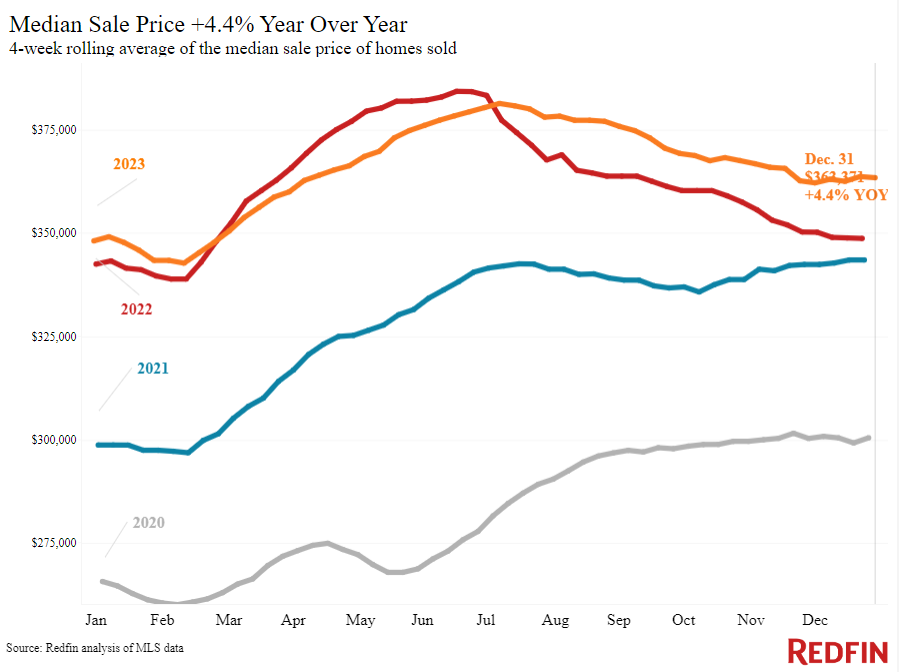

The median U.S. mortgage payment was $2,361 during the four weeks ending December 31, down $372 (-14%) from October’s all-time high to its lowest level in nearly a year. The weekly average mortgage rate dipped to 6.61% at the end of December, down from a 23-year high of 7.79% in late October.

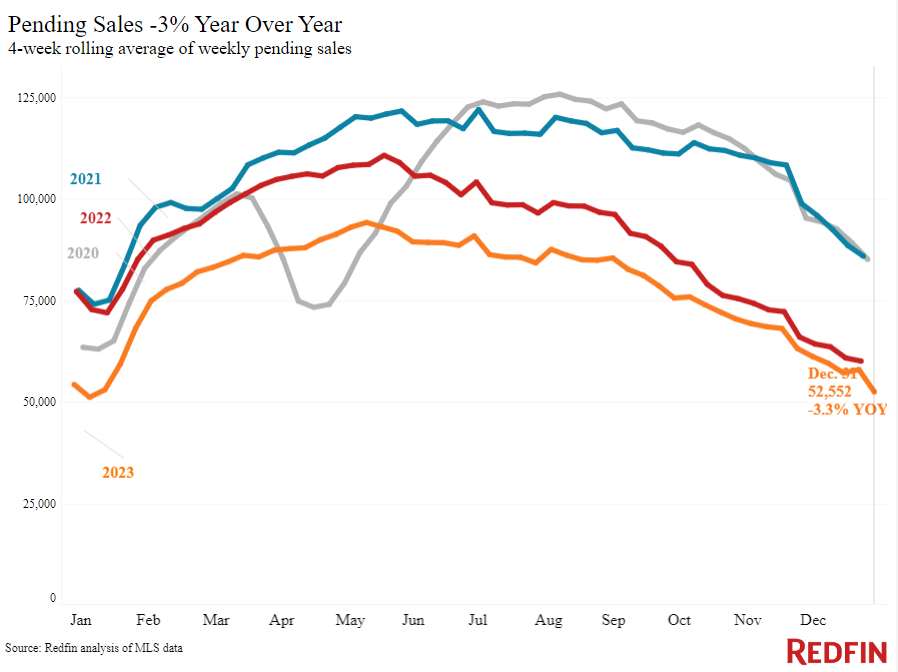

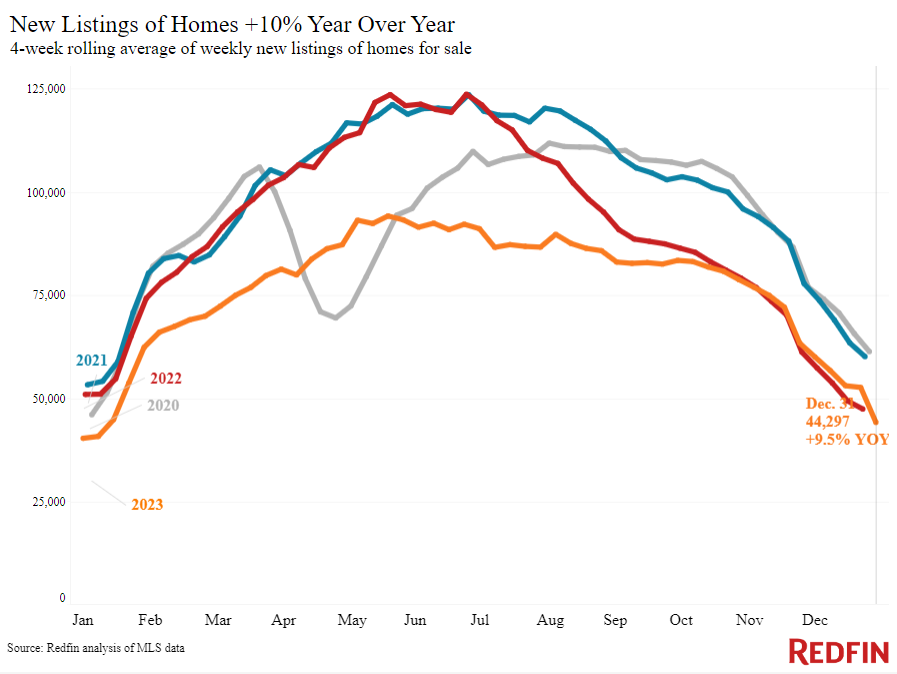

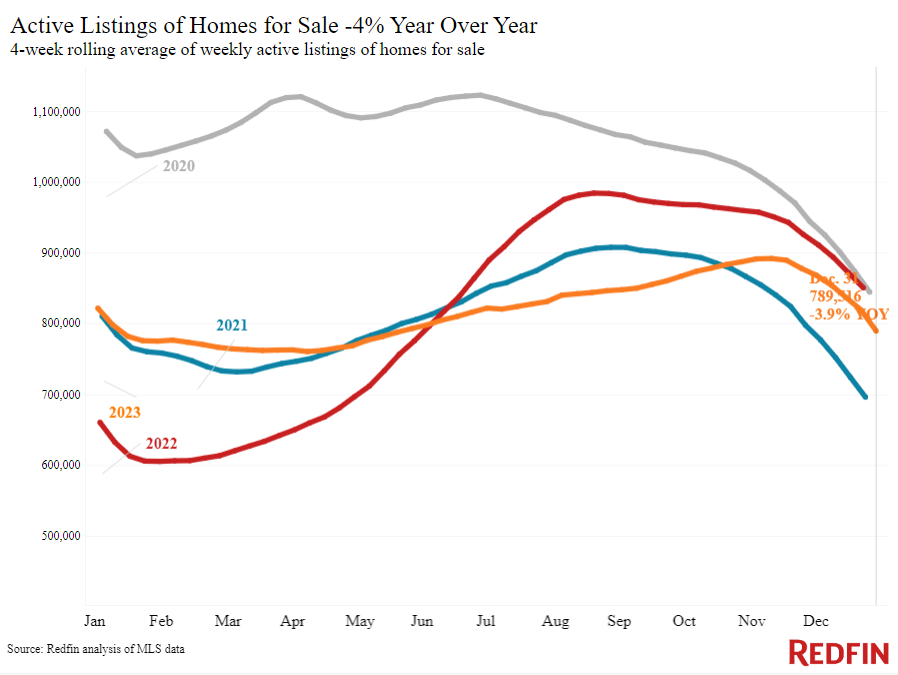

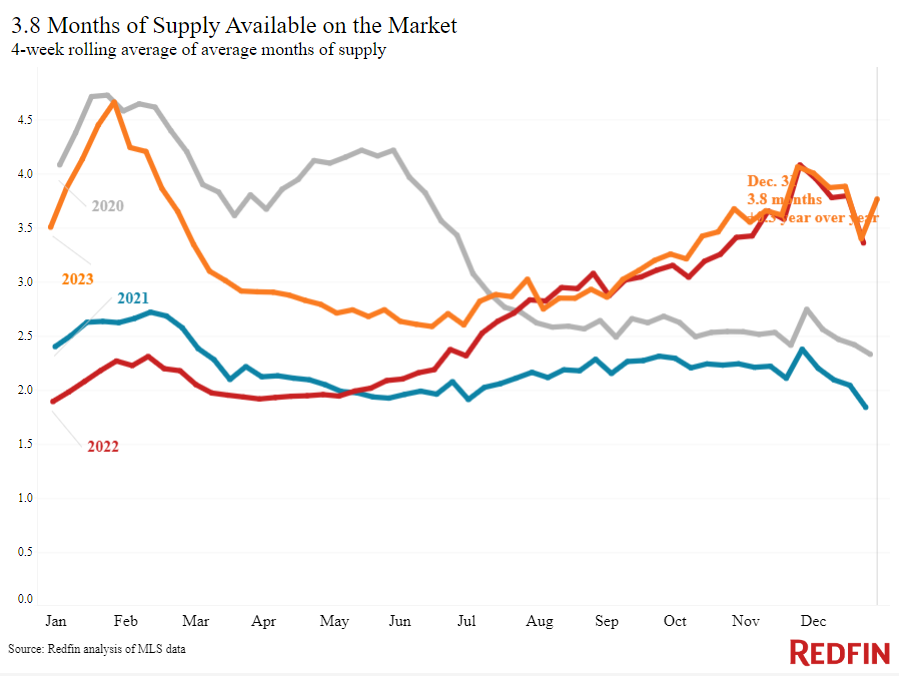

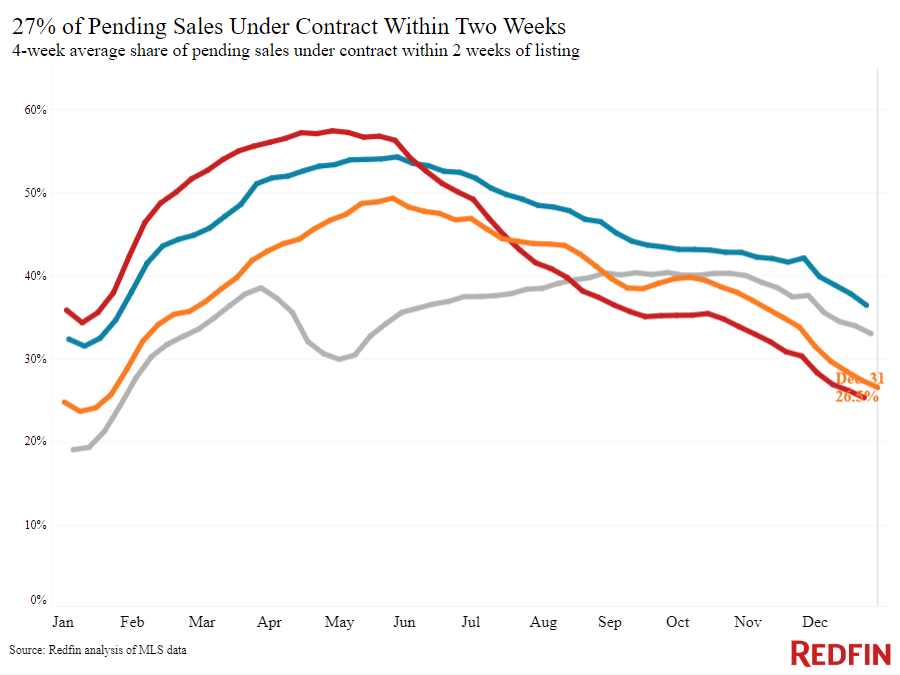

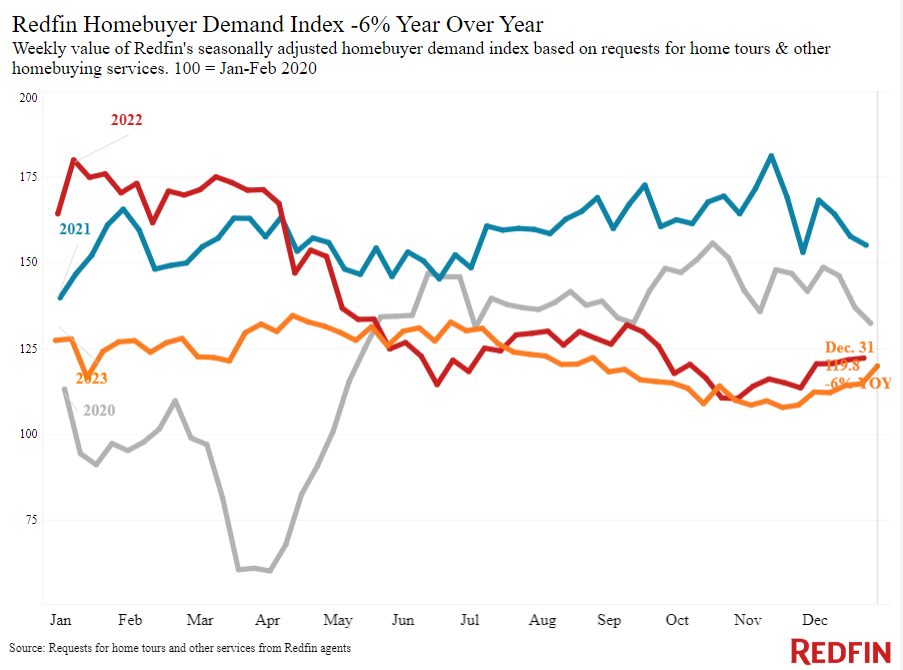

Early-stage homebuying demand is starting to pick up as buyers take advantage of lower rates and more homes to choose from (new listings are up 10% year over year). Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of requests for tours and other homebuying services from Redfin agents–is up 10% from a month ago to its highest level since August. Pending sales are down just 3% annually, the smallest decline in two years.

“There have been more tours and more offers on my listings since mortgage rates started declining,” said Las Vegas Redfin Premier agent Shay Stein. “It’s all about perspective: Two years ago, buyers would have cried about a 6% mortgage rate. Now, they’re happy they’ve dropped down to the mid-6’s.”

Refer to our metrics definition page for explanations of all the metrics used in this report.