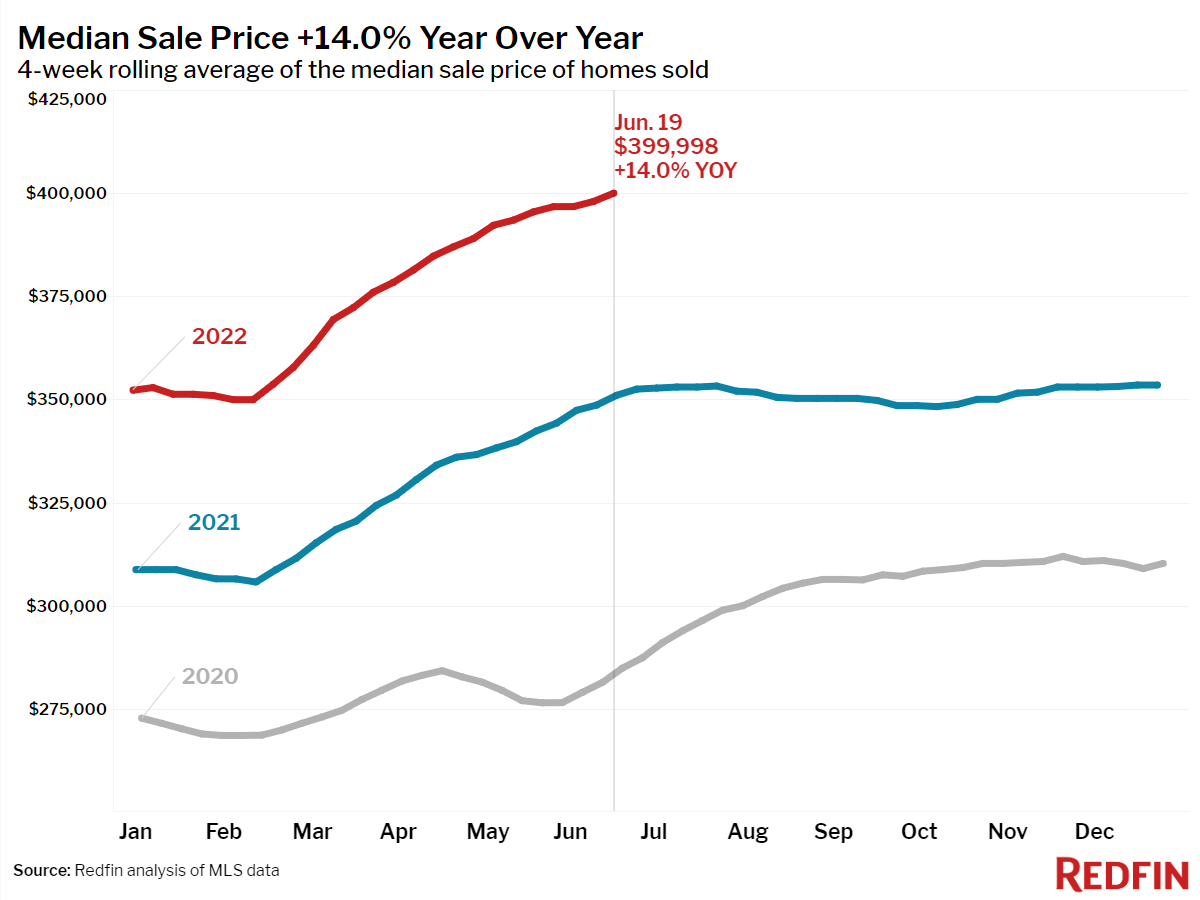

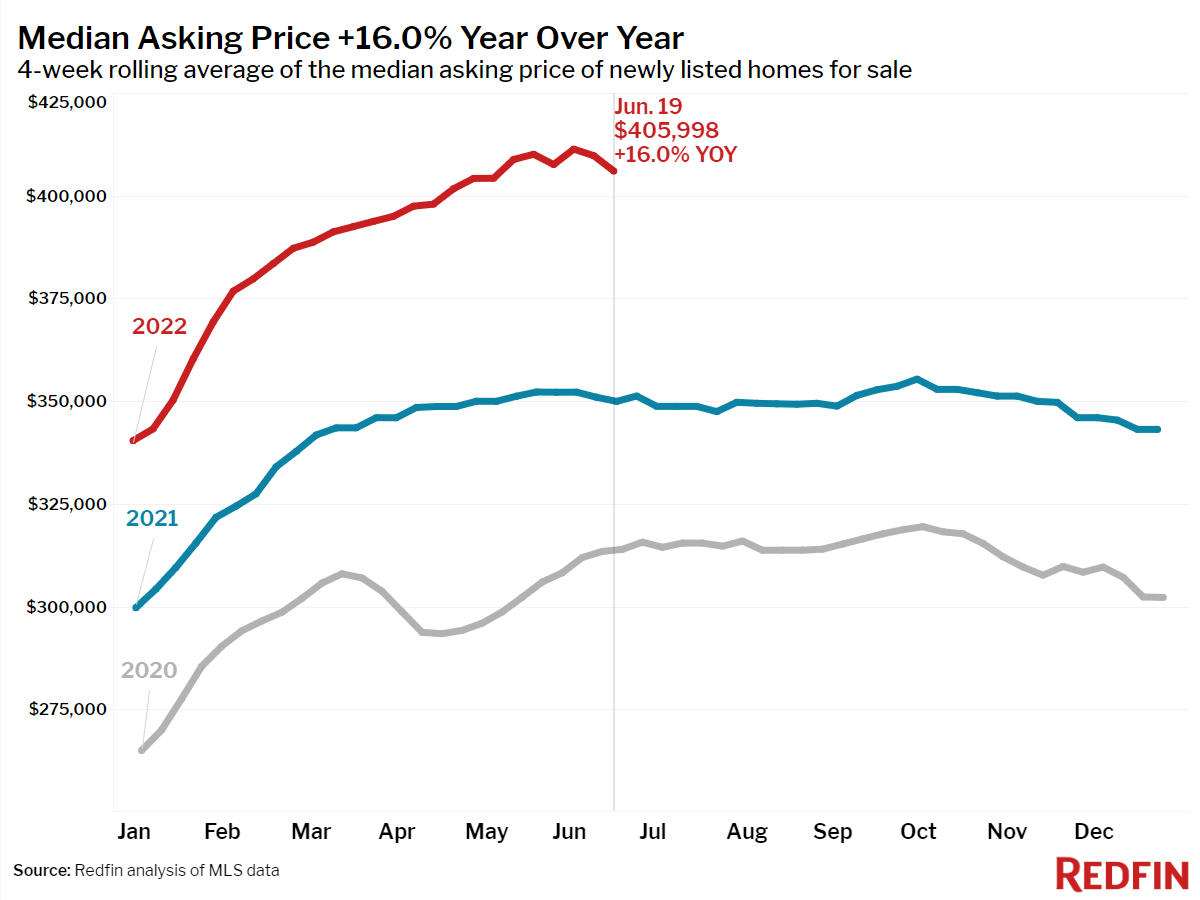

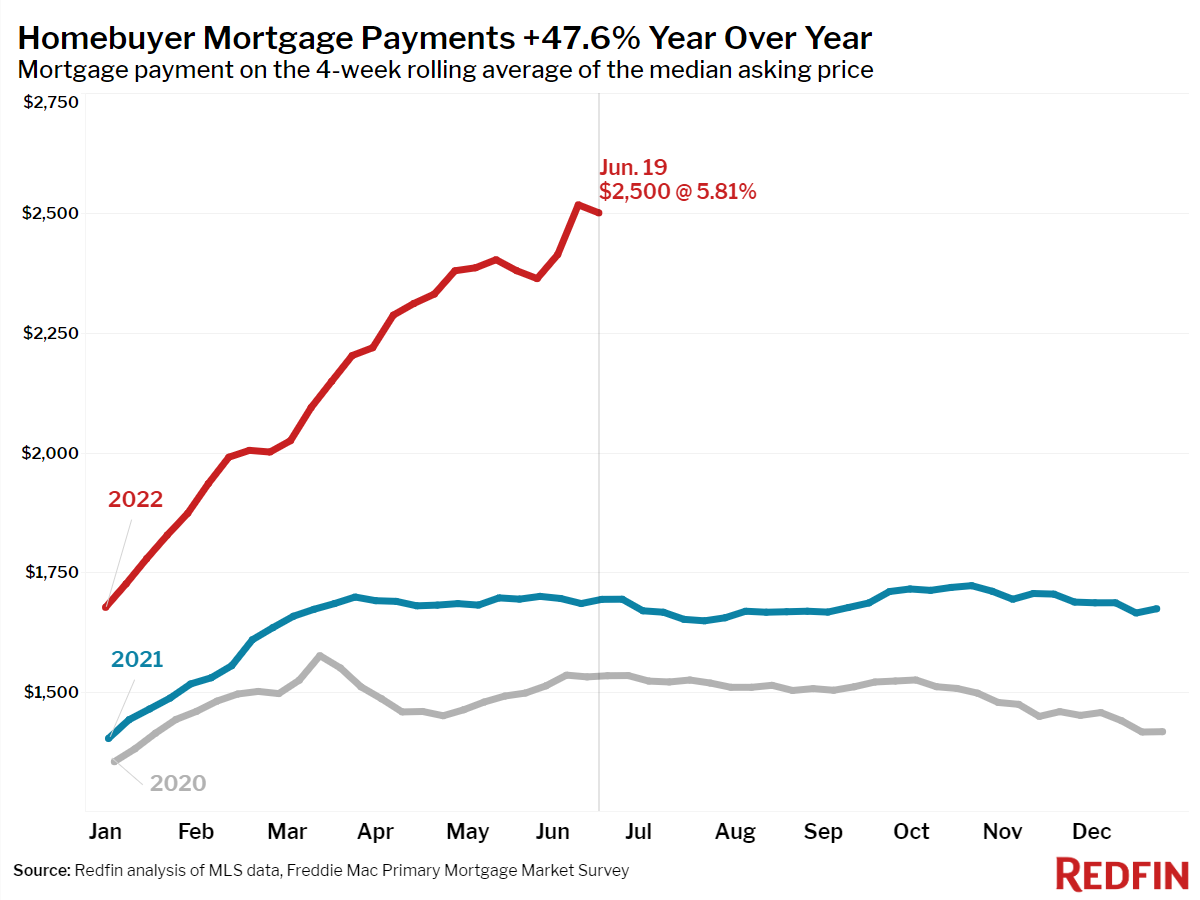

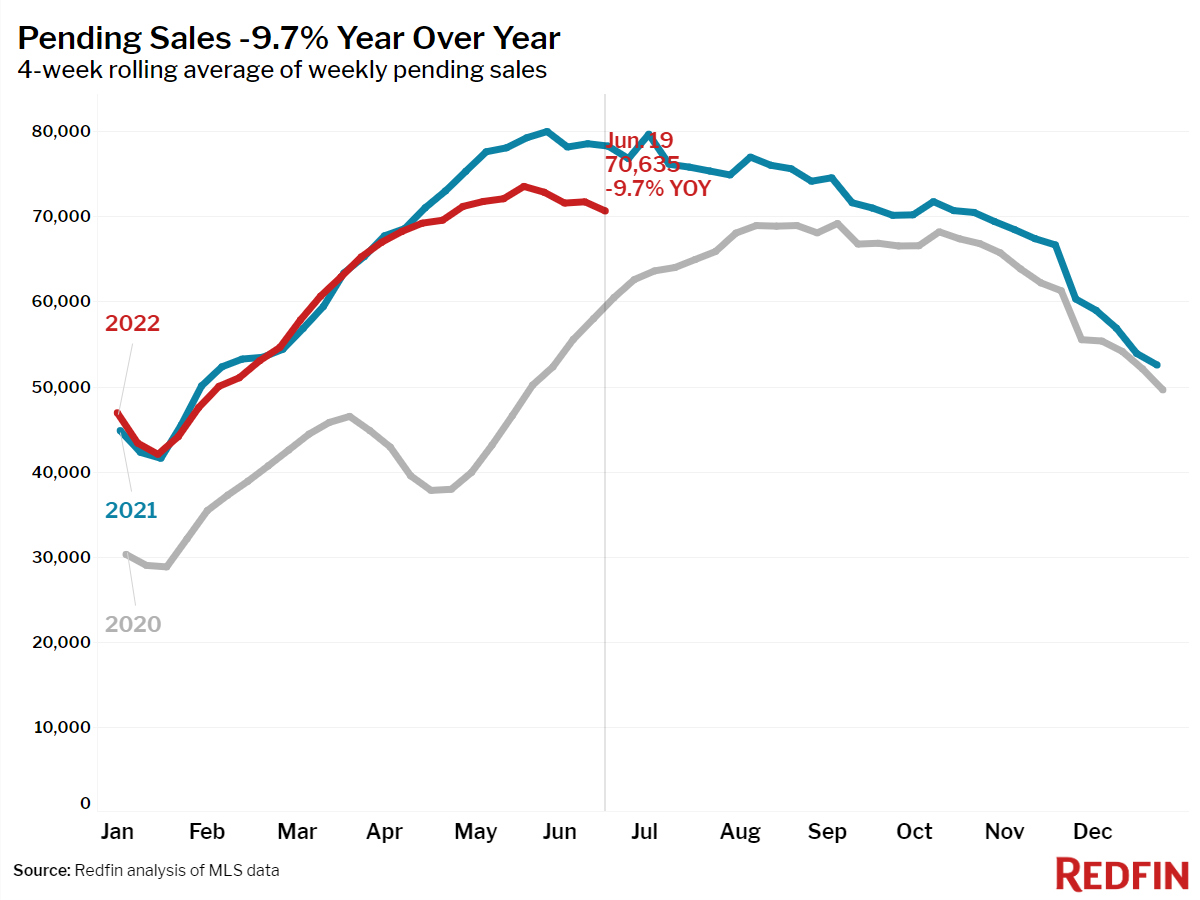

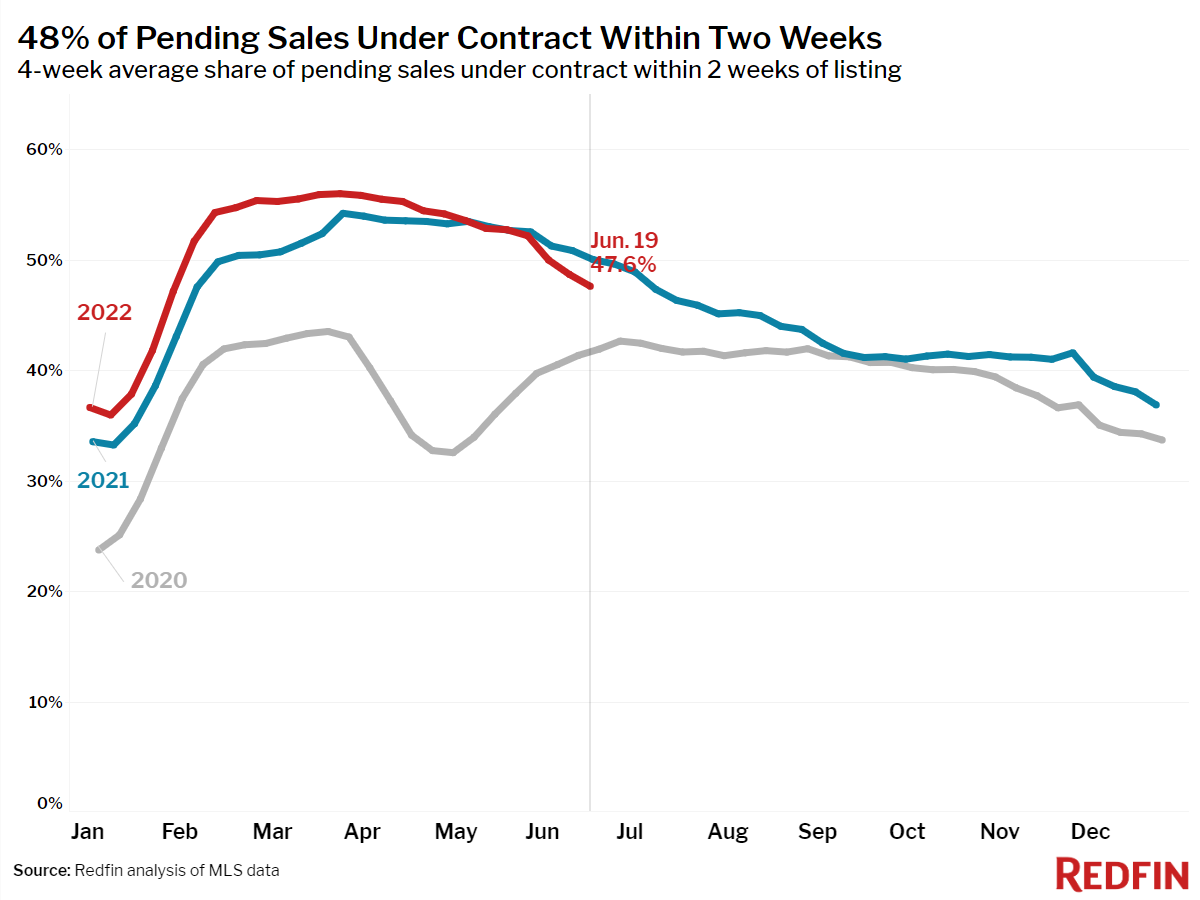

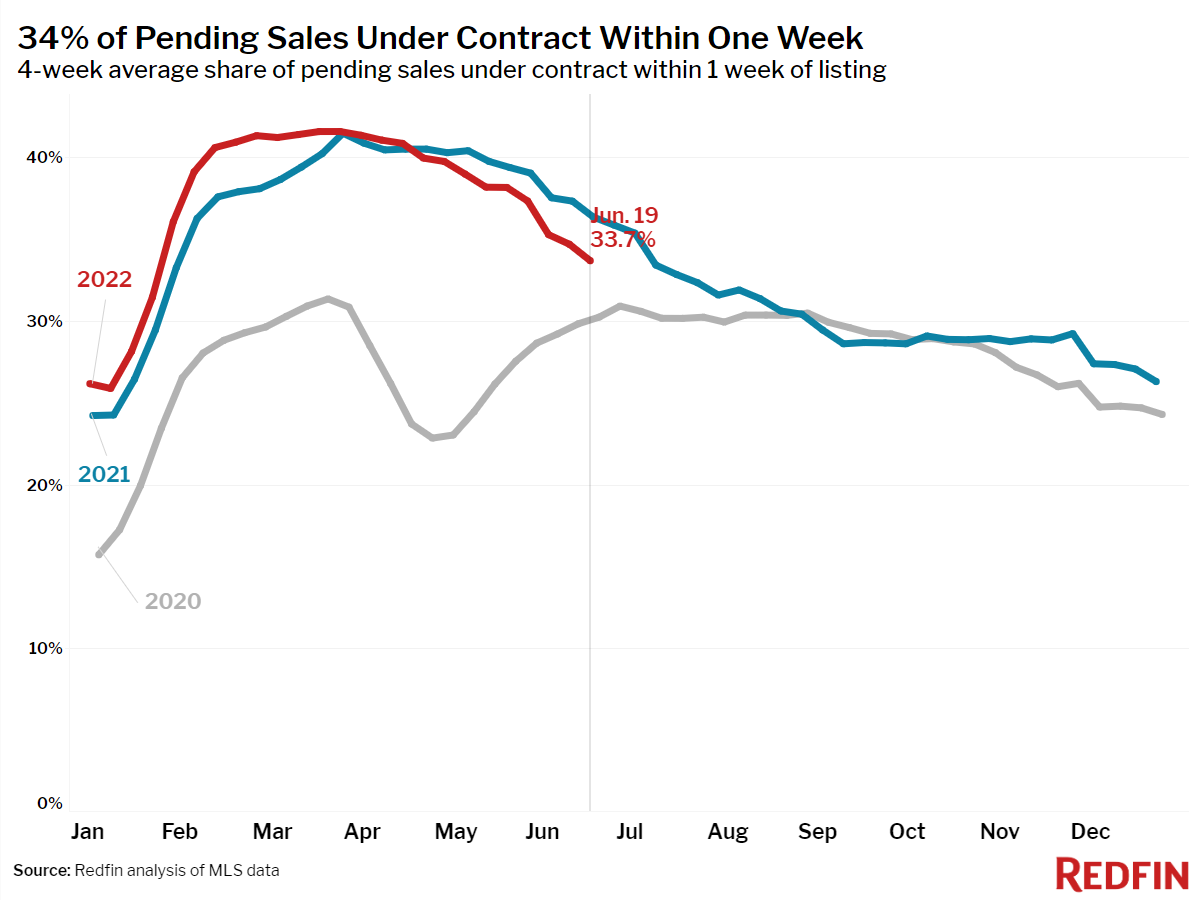

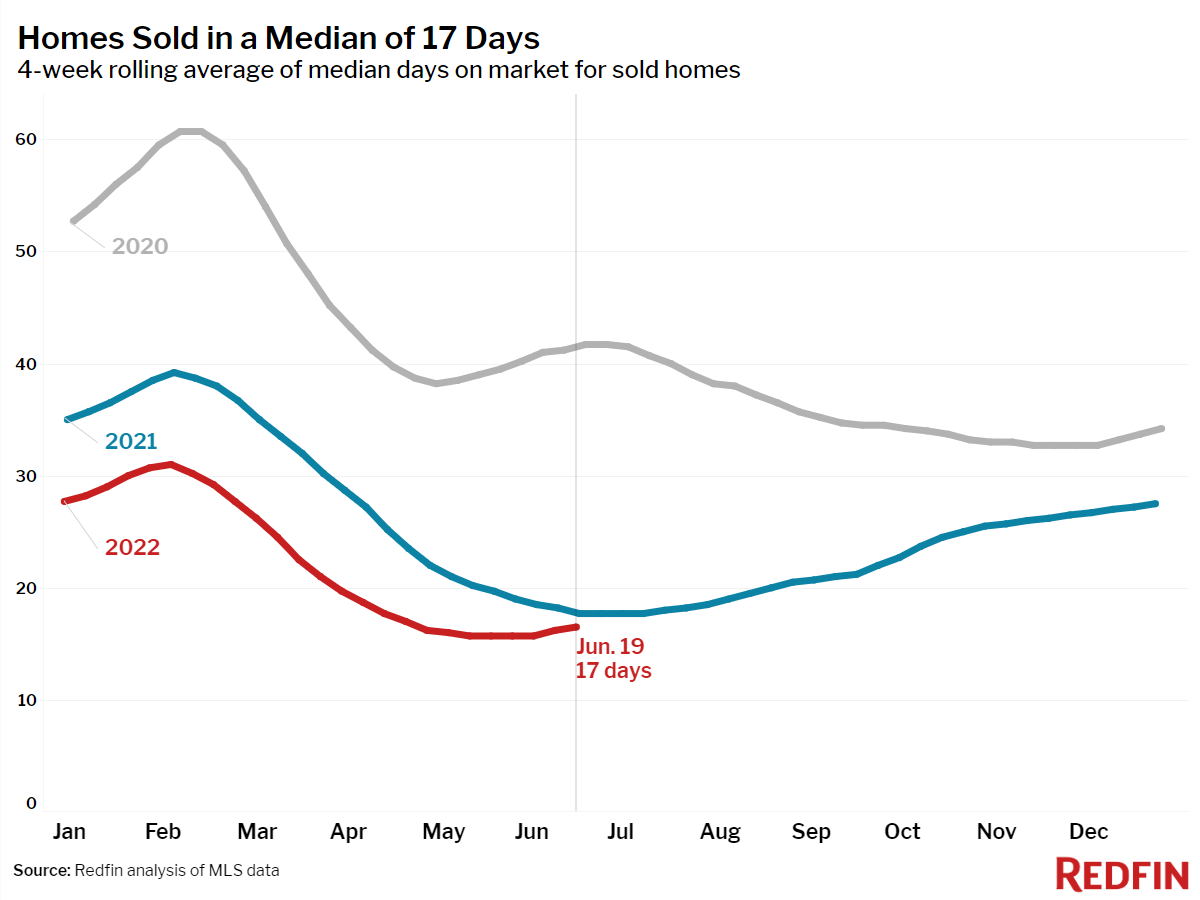

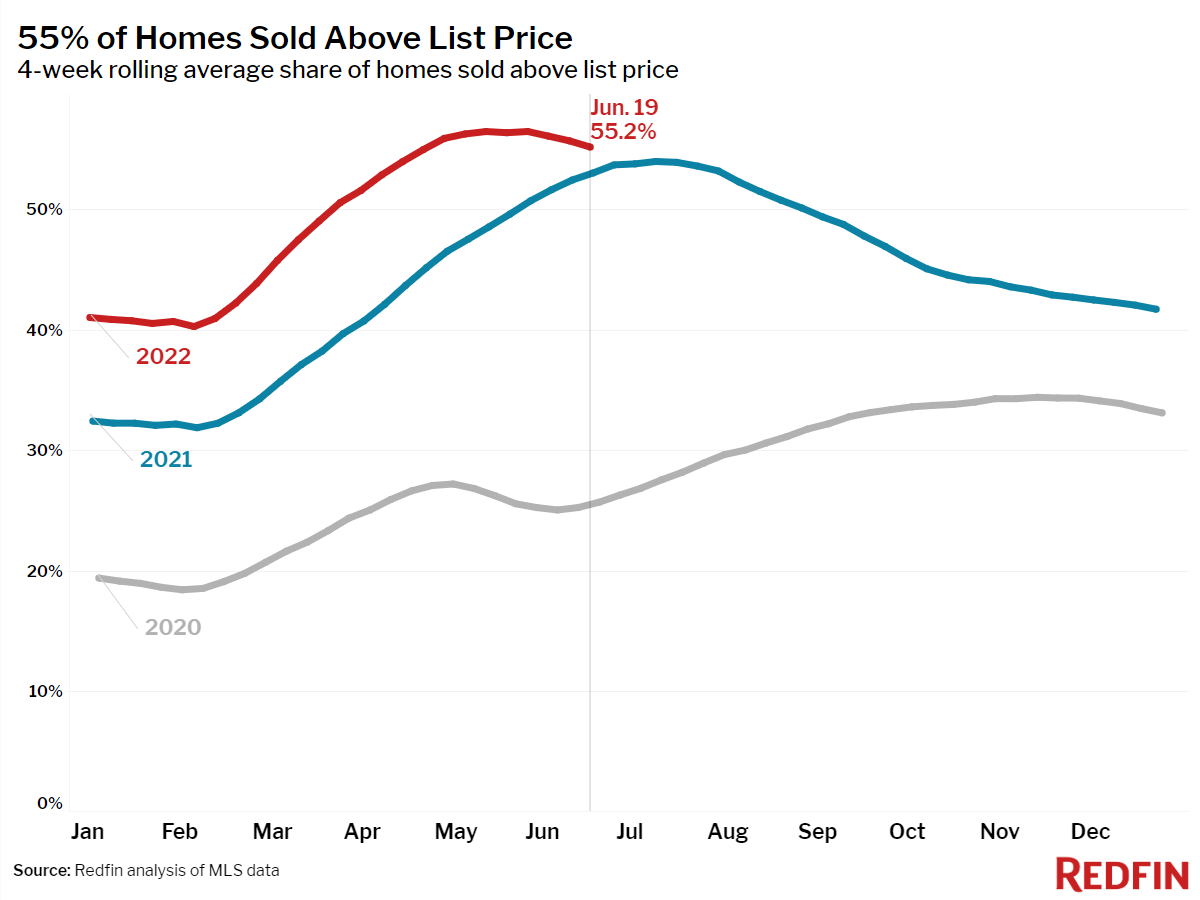

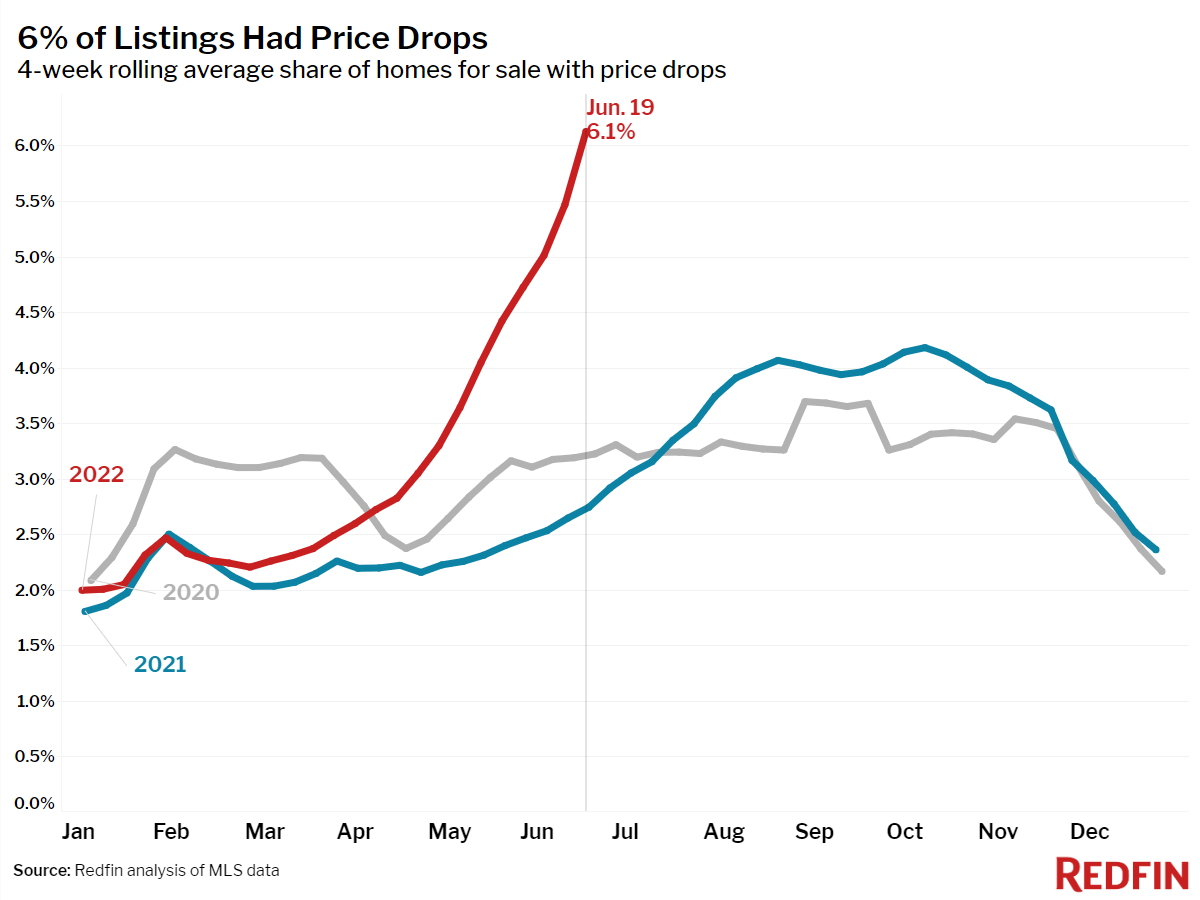

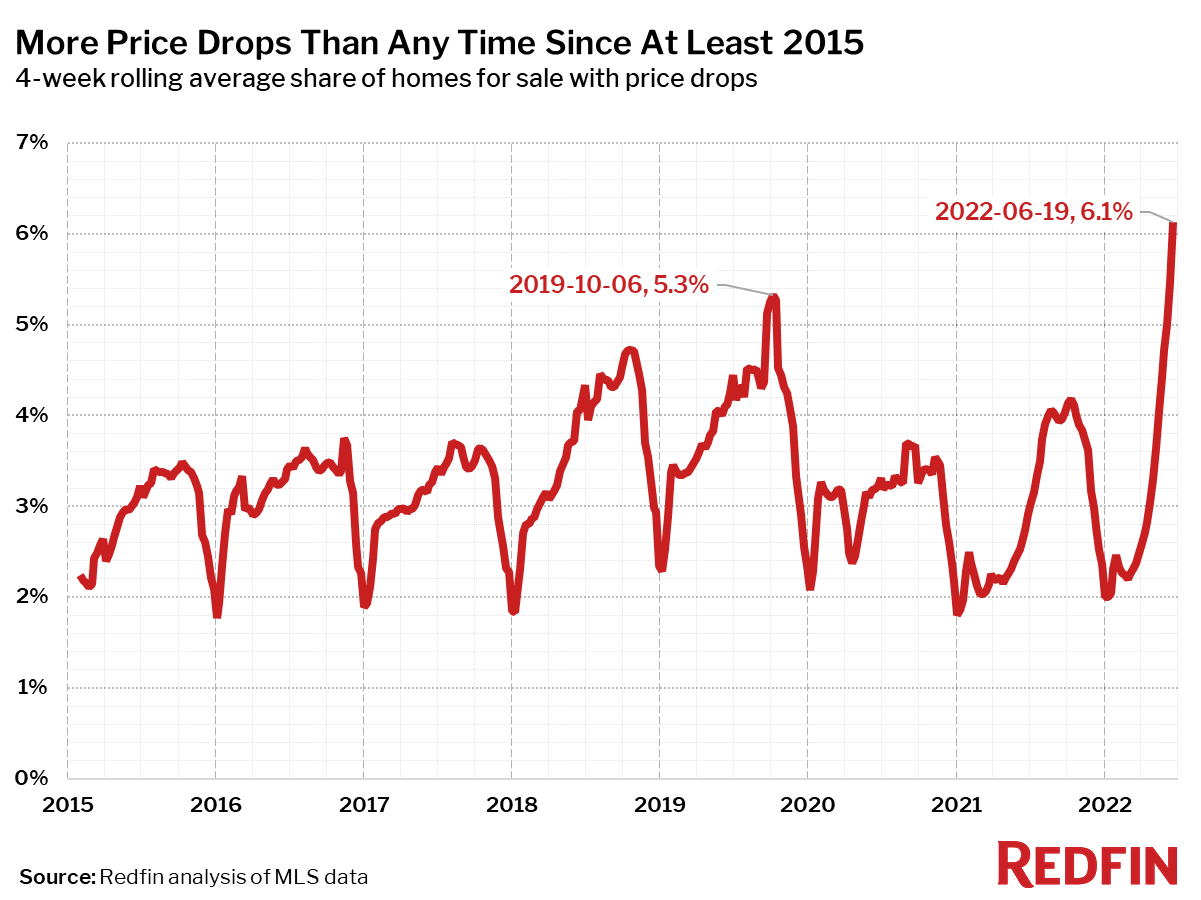

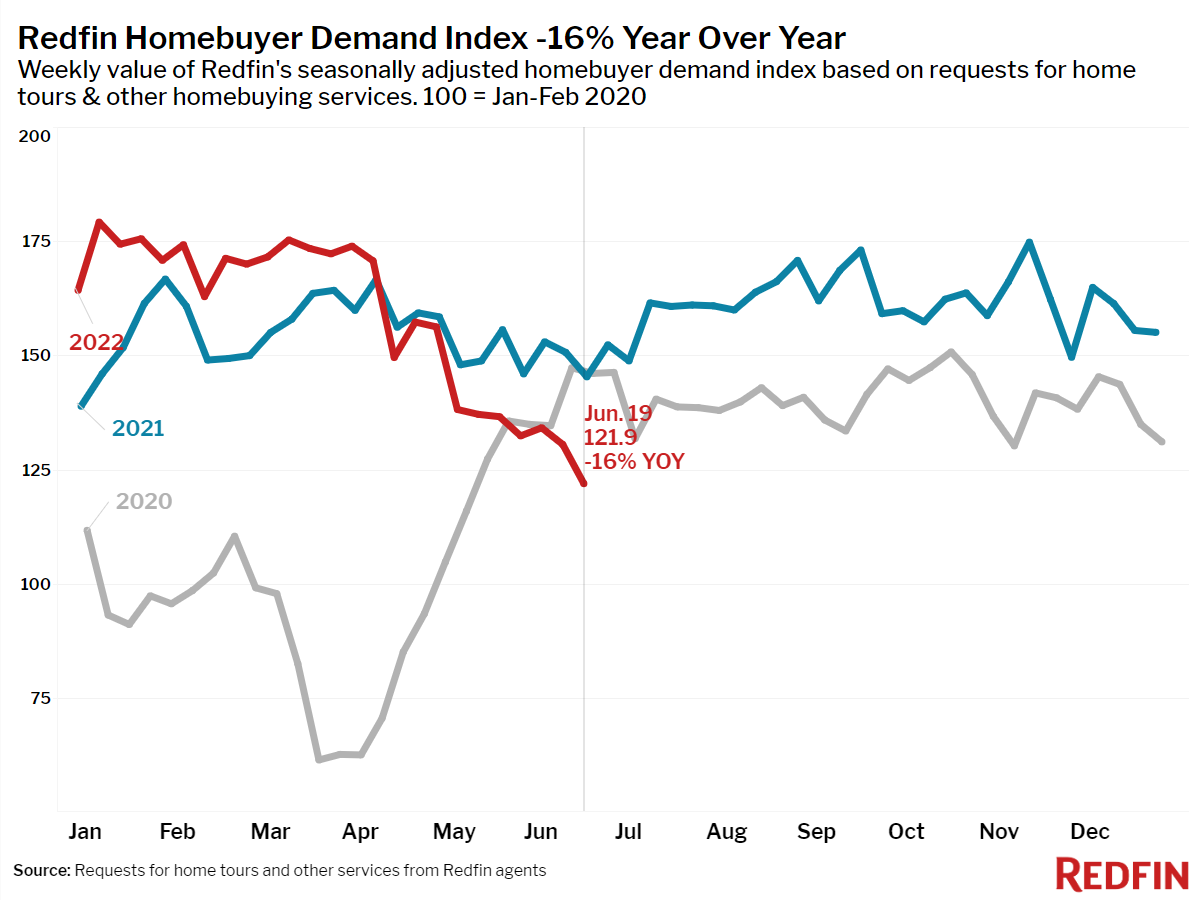

Homebuying demand pulled back further as mortgage rates reached their highest level in over 13 years. Home tours, offers and other requests for agents’ help, as measured by The Redfin Homebuyer Demand Index, posted their largest annual decline in over two years. Sellers are not holding out. The weekly share of listings with a price drop reached a new high during the four weeks ending June 19.

“Mortgage rates near 6% have put a big chill on demand for homes,” said Redfin chief economist Daryl Fairweather. “With home prices still at record highs, the affordability crisis has been dialed up to an 11 out of 10. Home sellers are aware of this as well; a record share are dropping their asking price. Even though there are fewer home sales, prices have not declined any significant amount yet. But if the housing market continues to cool, prices could fall in 2023.“

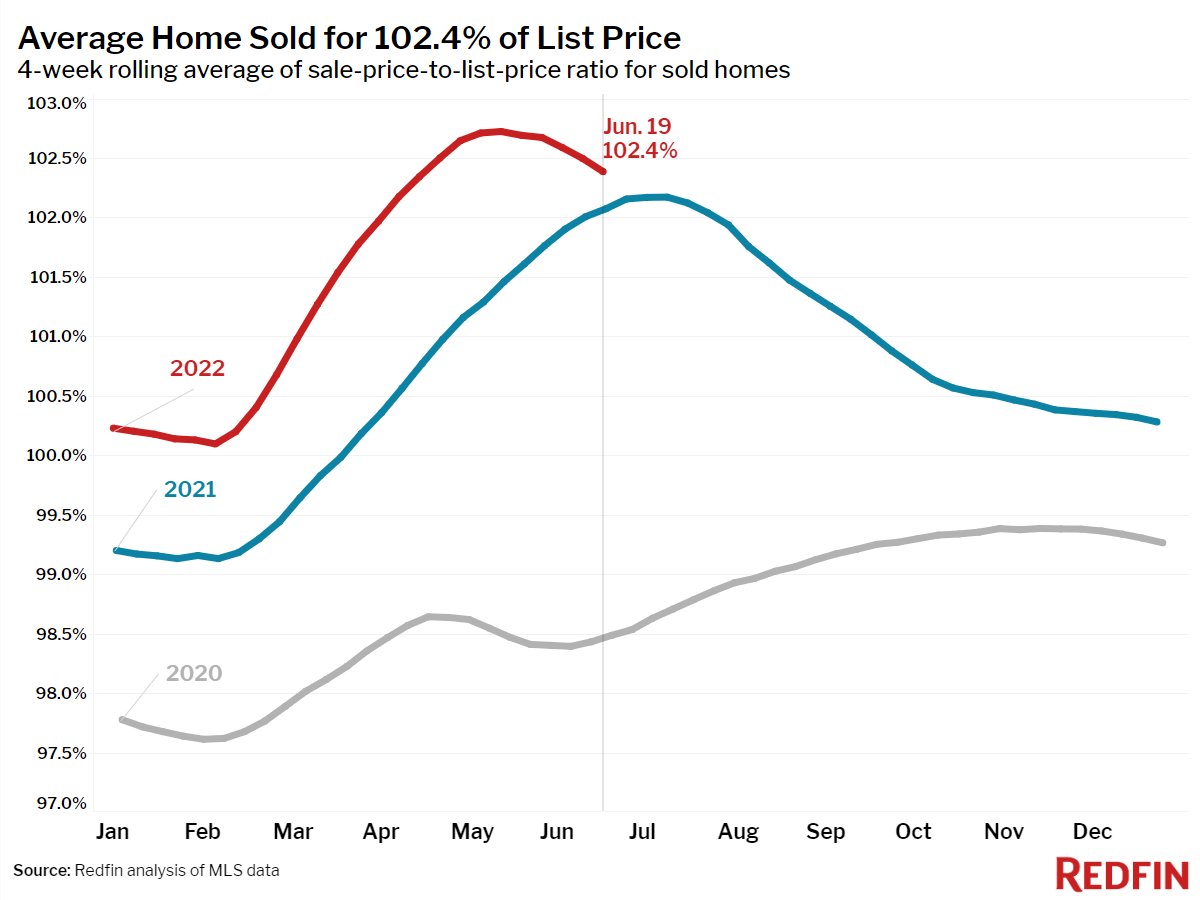

“Many home sellers have it stuck in their head that homes are selling a certain amount above asking, or that they can under-price their home to try to generate a bidding war, but that strategy isn’t working anymore,” said Boston Redfin real estate agent Robin Spangenberg. “High mortgage rates have kicked a lot of buyers right out of the market. This means sellers need to price their home at whatever they are okay walking away with, because they might only get one or two offers now.”

Unless otherwise noted, the data in this report covers the four-week period ending June 19. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.