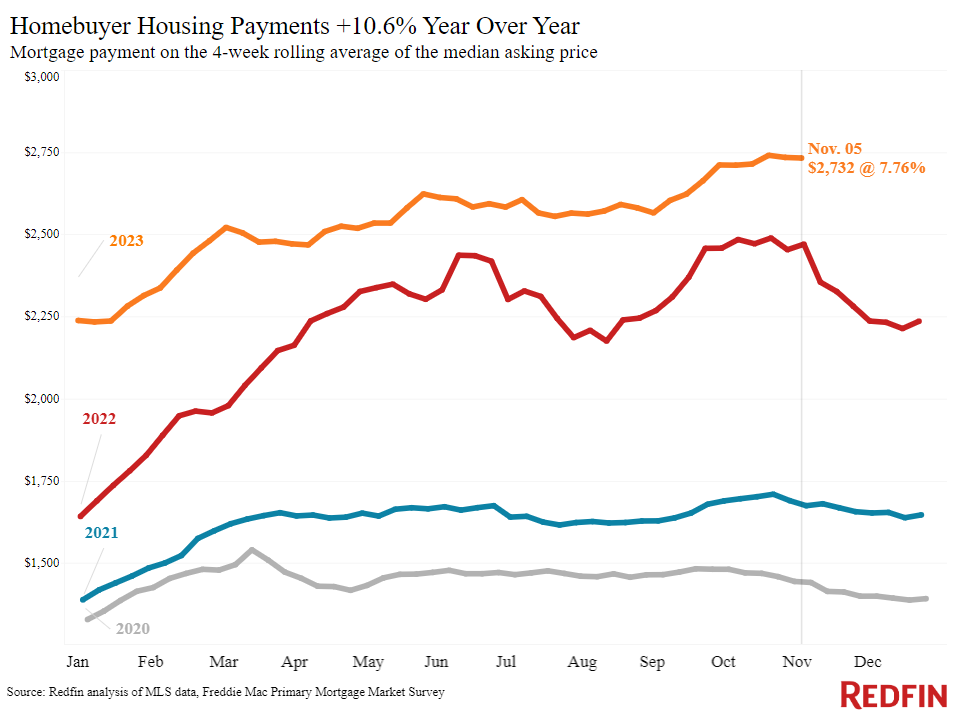

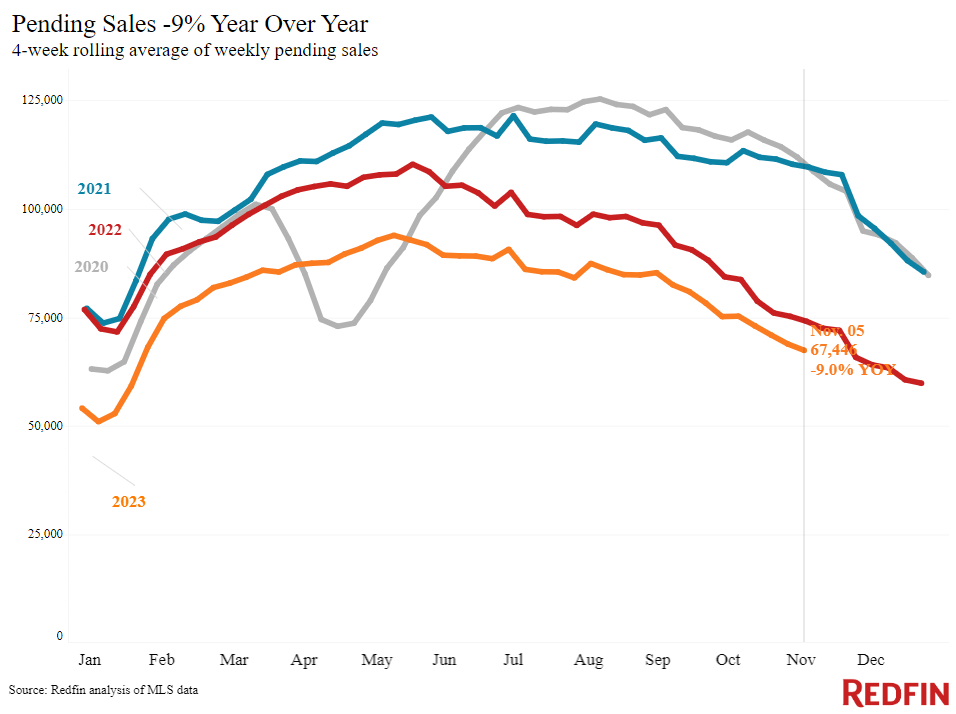

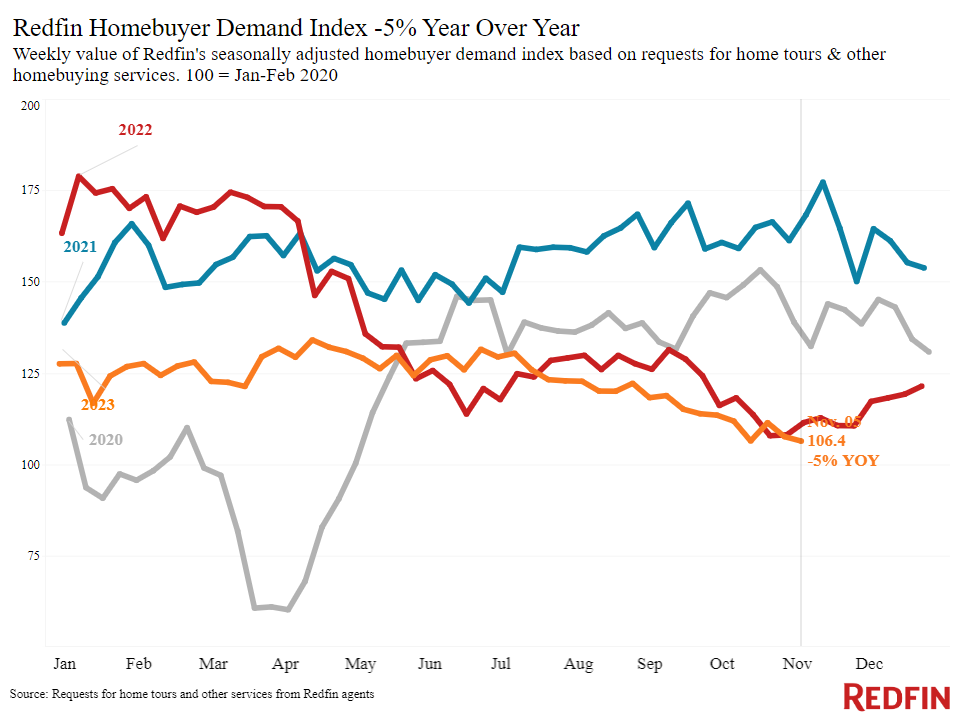

Mortgage-purchase applications are up 3% week over week as homebuyers act on a few pieces of buyer-friendly news: Mortgage rates have dropped from 8% to 7.4% in the last few weeks, there are more homes for sale than there have been all year, and price drops are at a record high.

Mortgage rates are falling quickly, dropping from a two-decade high of 8% to 7.4% in the last three weeks. A series of macro-economic events and indicators helped bring rates down last week: The Fed decided against another interest-rate hike, the Treasury announced plans to issue less long-term debt than expected and the job market is growing slower than expected.

Redfin economists recommend that serious homebuyers consider locking in a mortgage now, while average rates sit at their lowest level since mid-September. That’s because while rates could continue their downward trend, it’s also possible they will increase soon. The trend could reverse if this month’s economic news goes the other way; for instance, rates could increase if the November 14 CPI report shows higher-than-expected inflation.

Though rates are more than double pandemic-era levels and some homebuyers are still priced out of the market, rates going from 8% to 7.4% shaves a few hundred dollars off a monthly mortgage payment in many areas. A homebuyer in Seattle, for instance, would pay $4,984 per month for the median-priced home ($775,000) with a 7.4% mortgage rate, compared to $5,240 with an 8% rate.

“I’m advising buyers to lock in a mortgage rate as soon as they drop to a number where they can make the math work,” said Seattle Redfin Premier agent Hal Bennett. “Payments could go up hundreds of dollars overnight if the winds shift on mortgage rates, and all of a sudden you won’t be able to afford the home you want or you won’t qualify for a mortgage. This window of opportunity could be narrow.”

Buyers are already taking note: Mortgage-purchase applications are up 3% week over week.

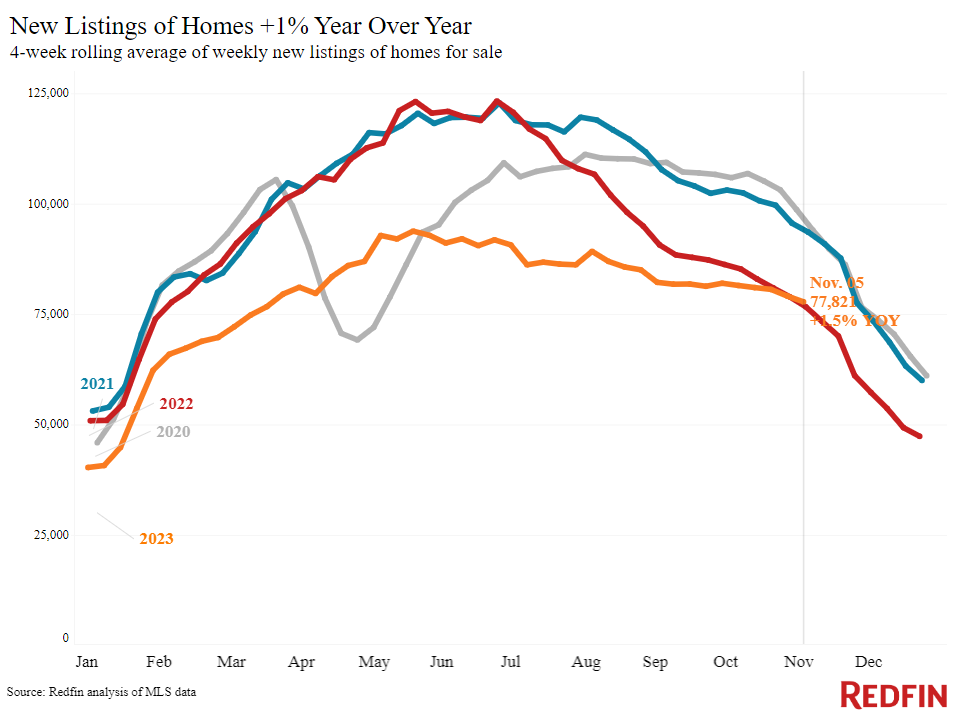

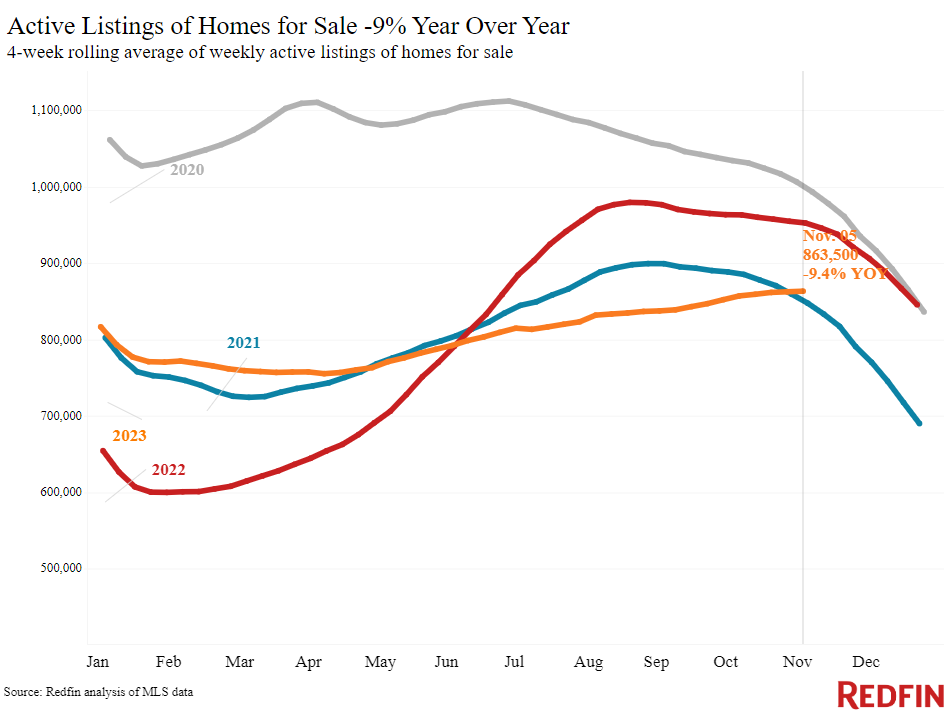

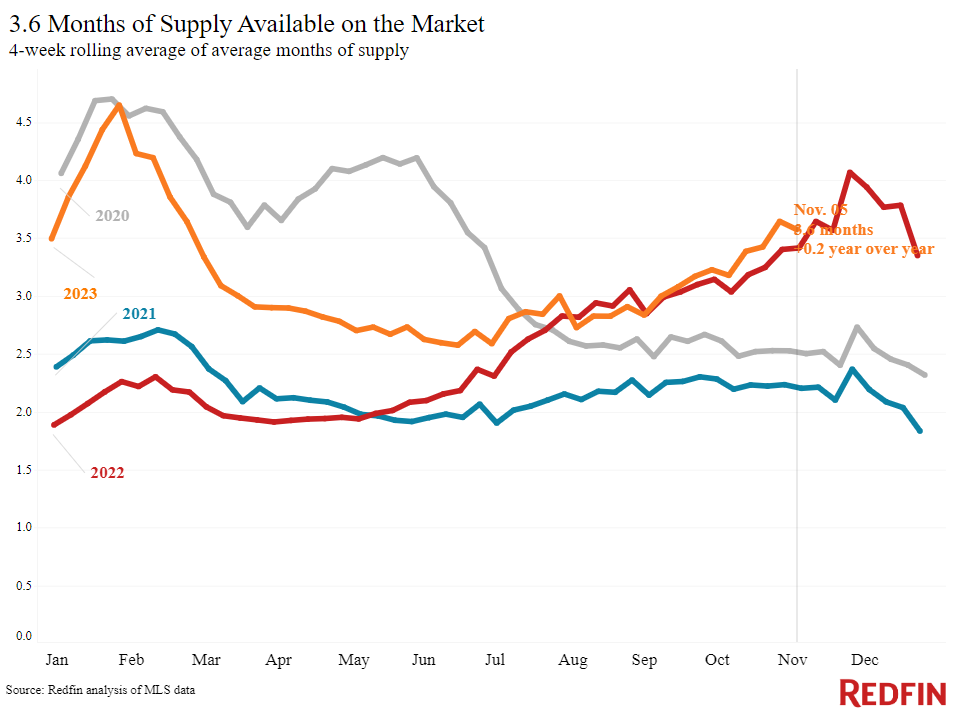

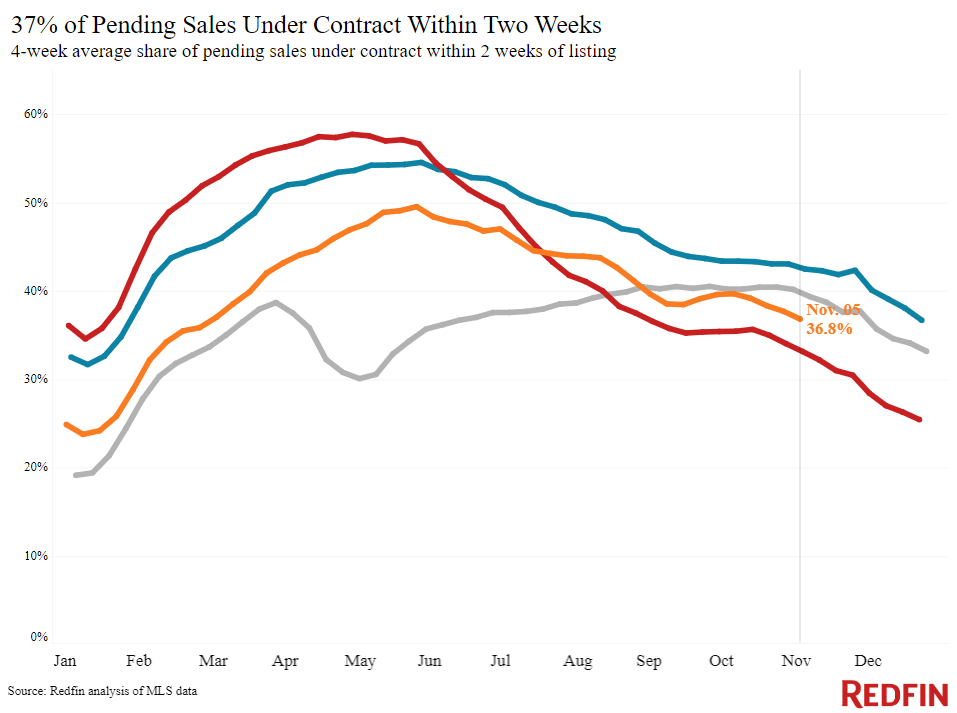

There are a few other glimmers of hope emerging for buyers, too. While inventory remains low, there has been an unseasonal uptick in the total number of homes for sale, which is at its highest level since the start of the year. New listings rose 1.5% from a year ago during the four weeks ending November 5, just the second increase since July 2022.

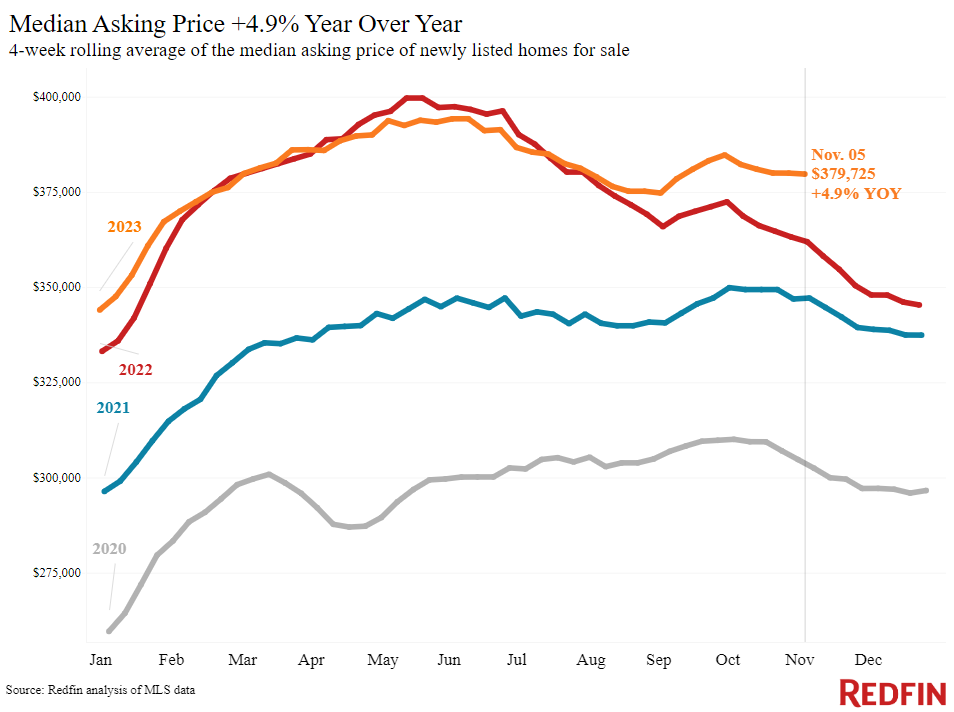

Additionally, nearly 7% of home sellers dropped their asking price–the highest portion on record.

Refer to our metrics definition page for explanations of all the metrics used in this report.