Growth in new listings slowed this week as some sellers pressed pause over Easter. Housing costs remain stubbornly high, deterring some buyers–but Redfin economists say costs could come down soon.

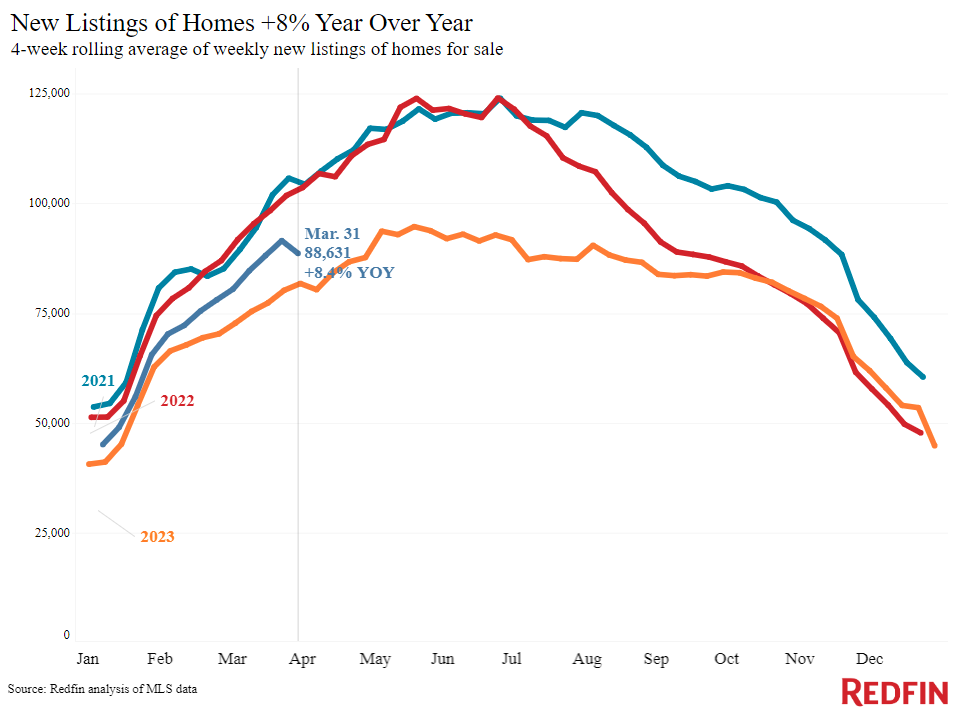

What sellers are doing: New listings of U.S. homes for sale rose 8.4% from a year earlier during the four weeks ending March 31, the smallest increase in about seven weeks. Year-over-year growth in new listings slowed because some sellers took a break over Easter, which fell over a week earlier in 2024 than in 2023. The slowdown is likely an Easter blip, but we’ll be keeping a close eye on selling data over the next few weeks to confirm it’s not the start of a larger trend.

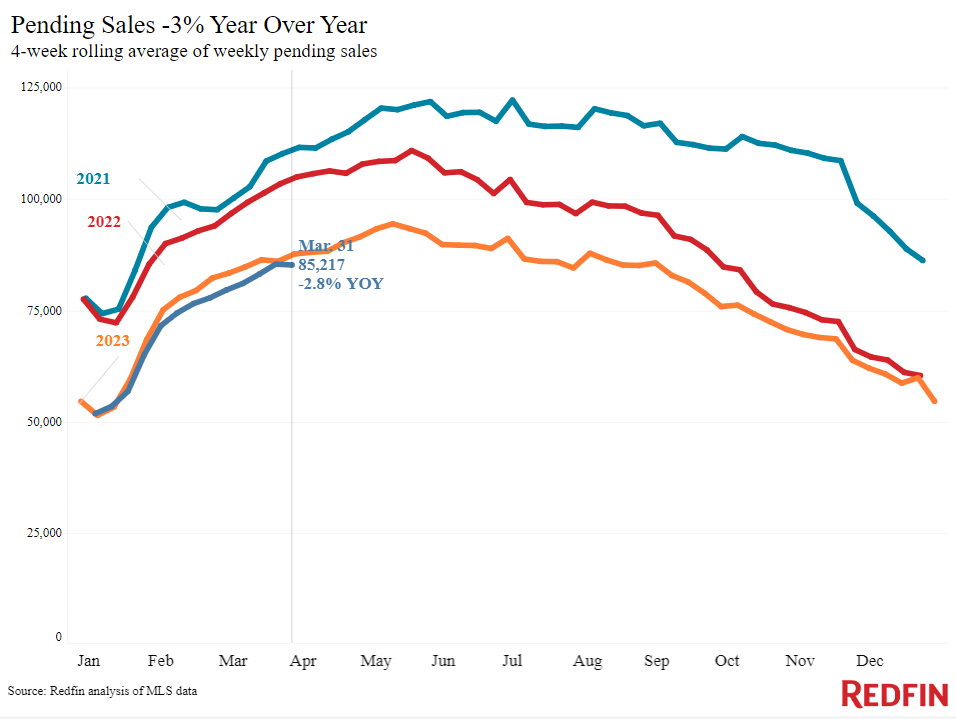

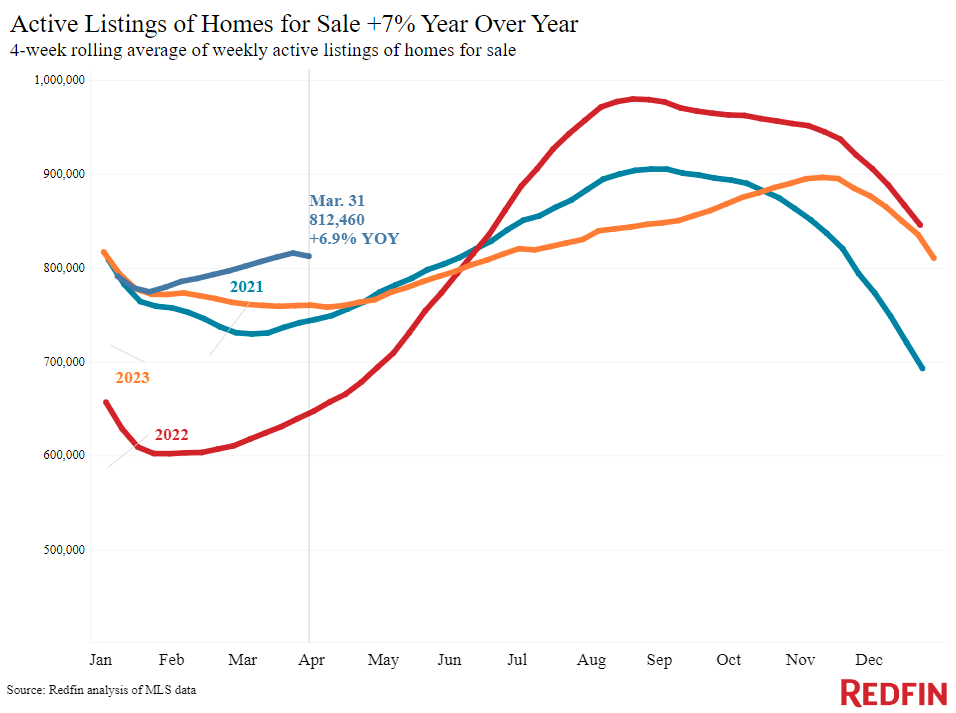

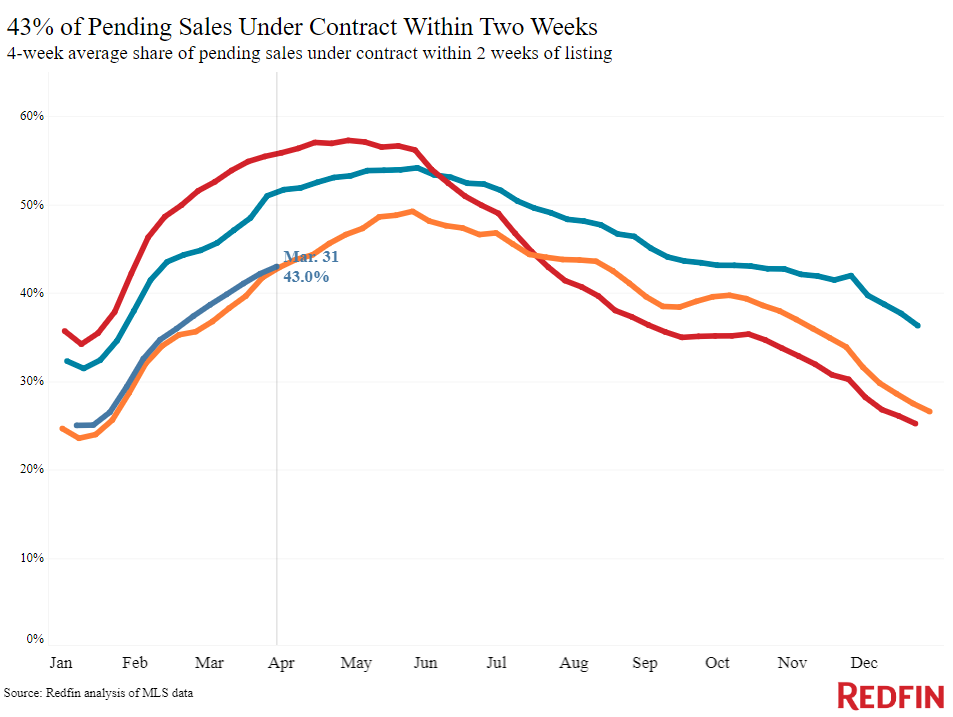

What buyers are doing: Homebuying demand was relatively soft this week, too. Home tours were up 15% from the start of the year, compared to a 21% increase at this time last year, and mortgage-purchase applications were flat this week. Pending home sales fell 2.8% from a year ago, and they posted an unseasonal decline during the last week of March. Some would-be buyers took a break from touring offers and making offers over Easter, and others are shying away due to high housing costs.

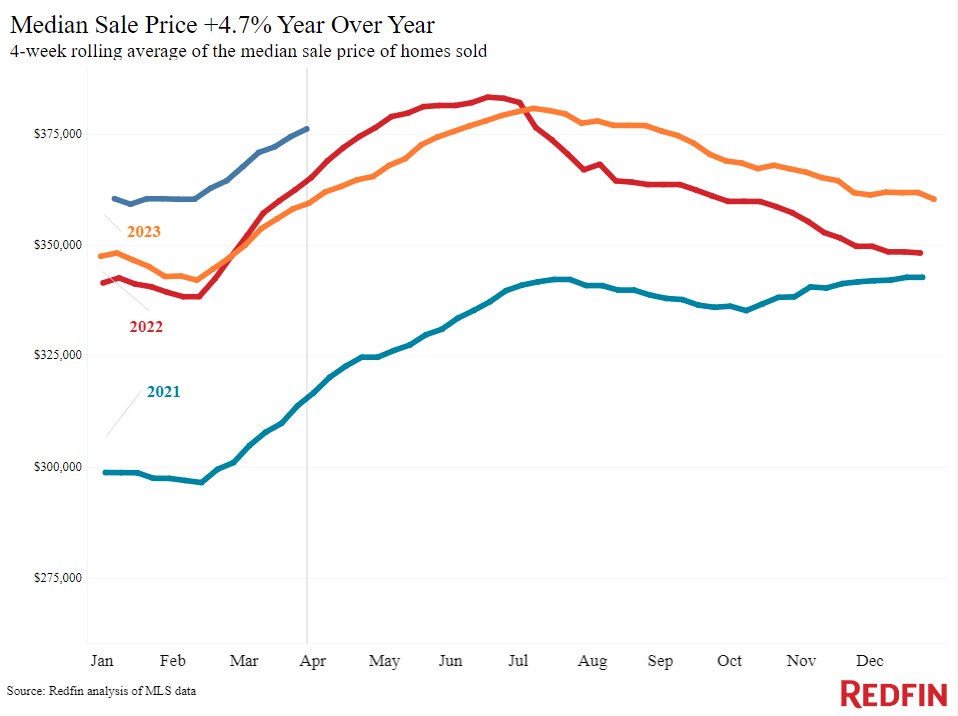

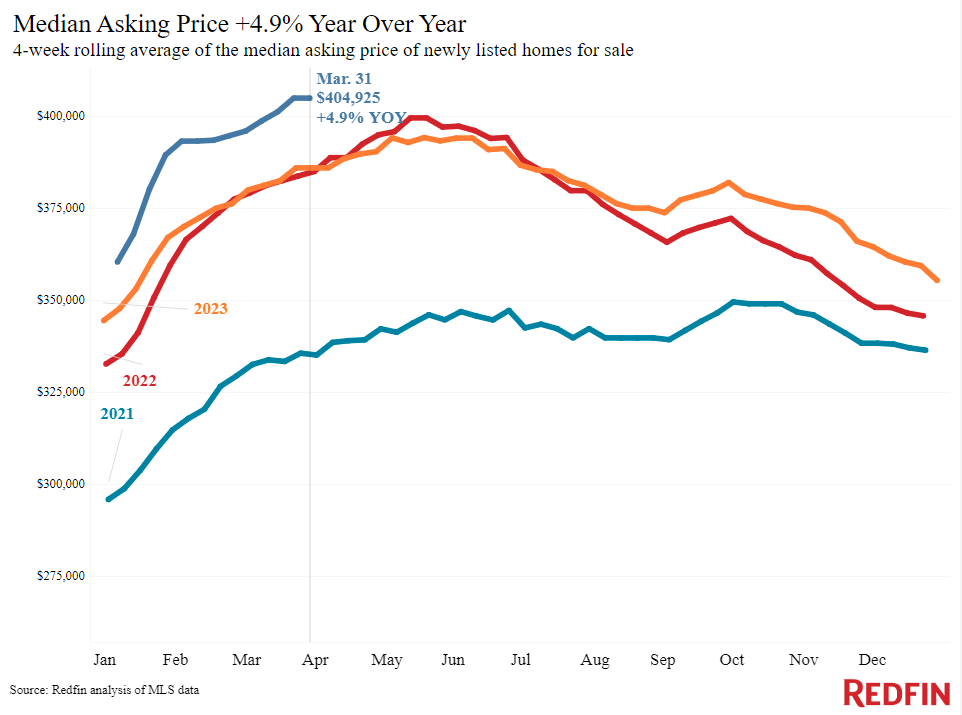

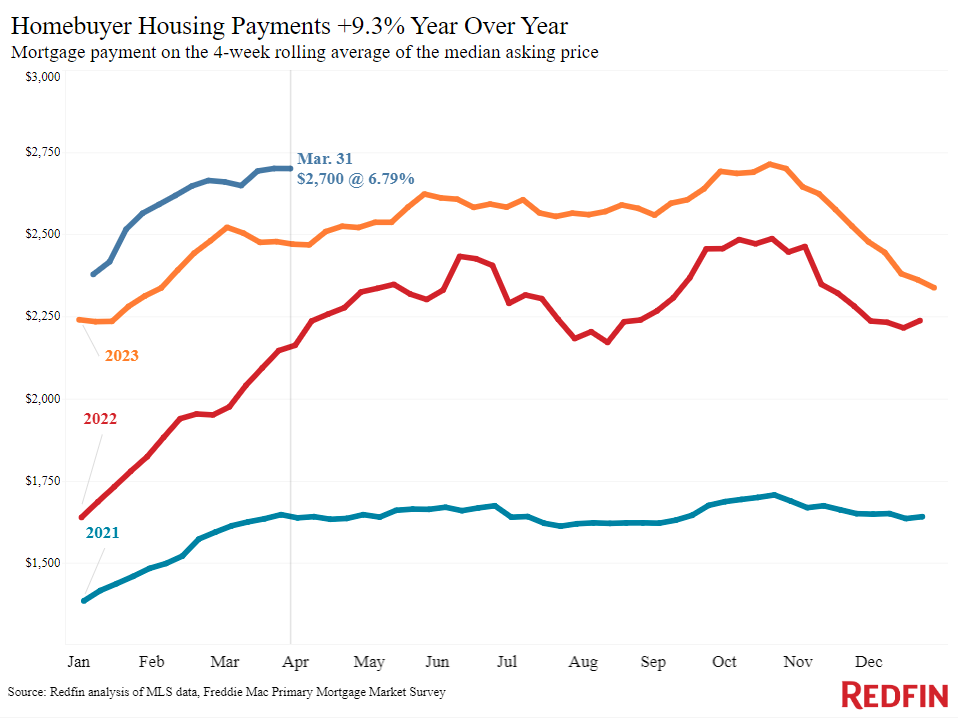

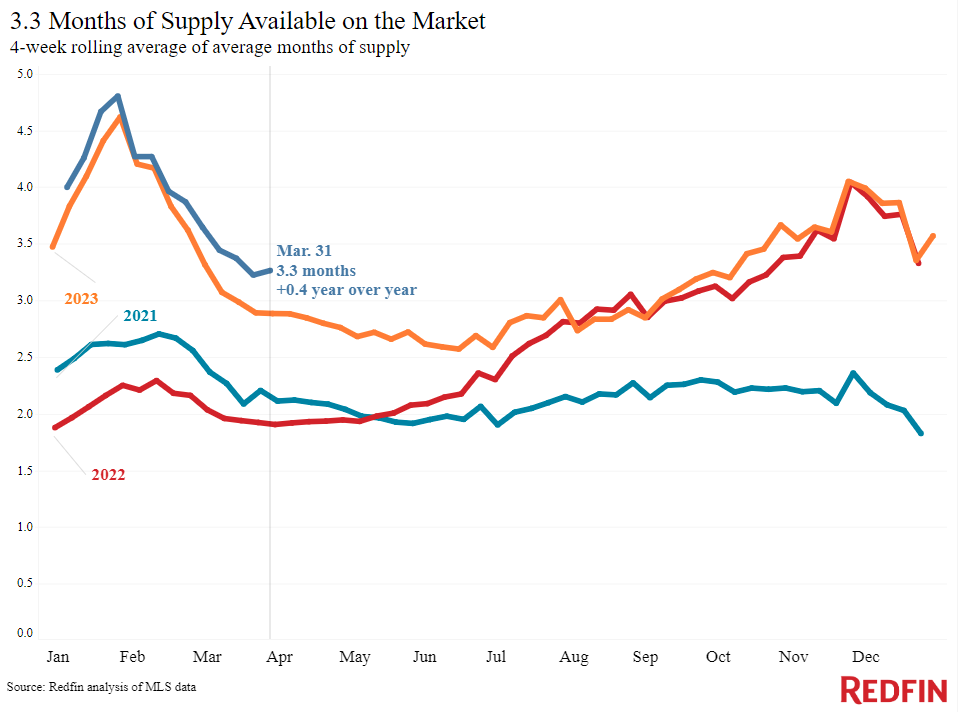

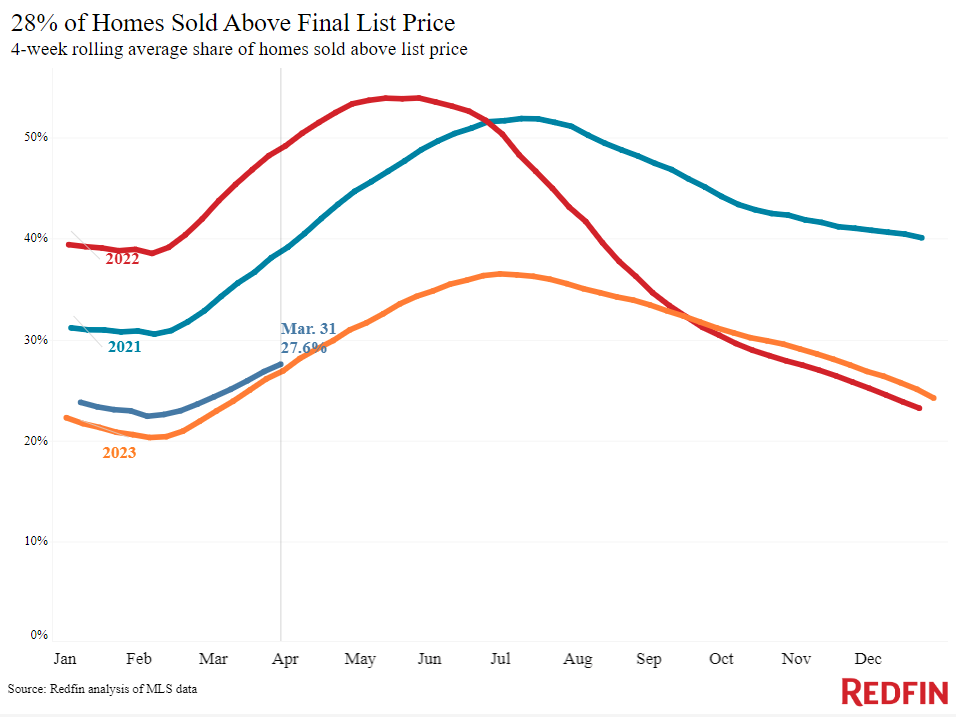

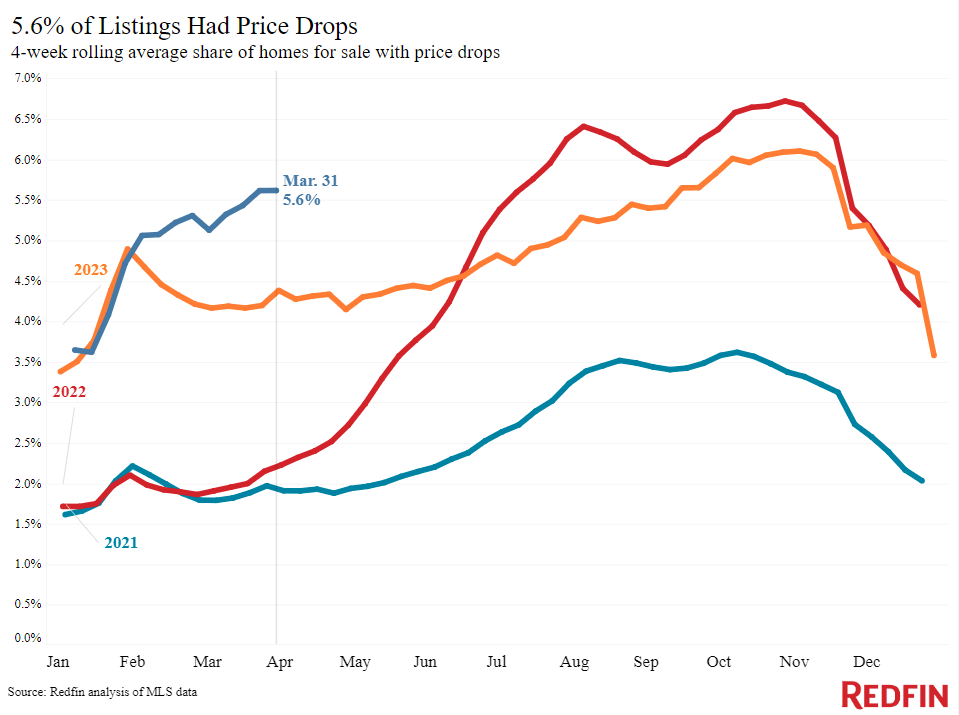

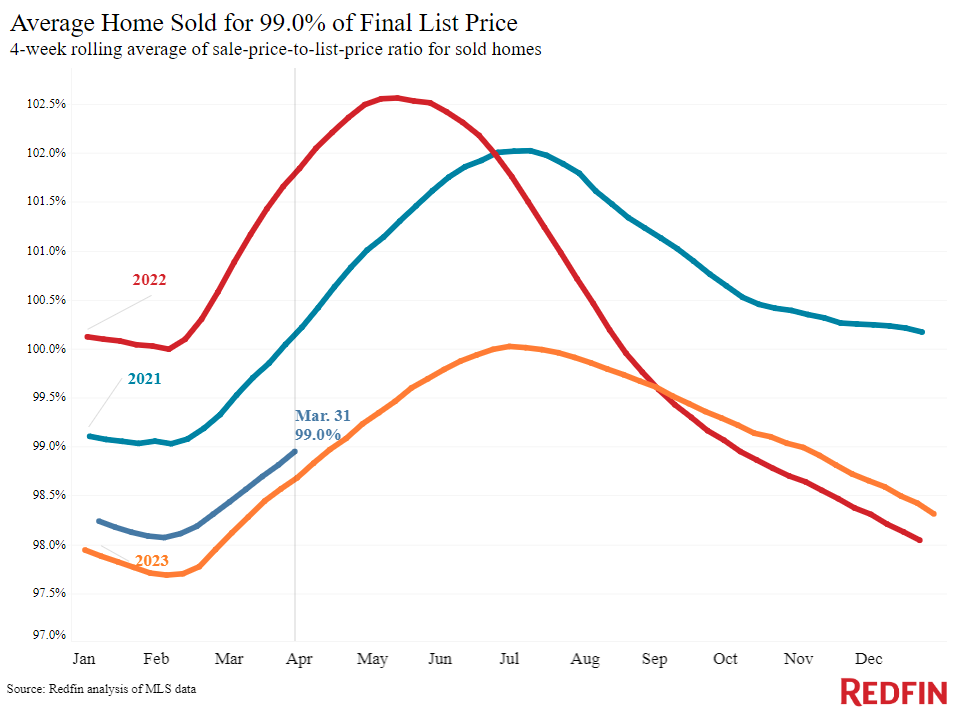

And what about prices? The median U.S. home-sale price was $376,223, up 4.7% from a year earlier. Median monthly housing payments were just $13 shy of the all-time high hit last October, when home prices were lower but mortgage rates were nearing 8%, versus just under 7% this week.

“Buyers may get a break on housing costs in the coming months,” said Redfin Economic Research Lead Chen Zhao. “Daily average mortgage rates rose this week because of some disappointing economic news. But if the upcoming job and inflation reports show that the economy is heading in the right direction, the Fed is likely to confirm they will cut interest rates in June, which would lower mortgage rates. Home-price growth could soften as spring goes on if new listings regain the momentum we saw before Easter.”

For more of Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit our “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.