New listings rose 13% from a year earlier, their biggest increase in nearly three years, but home prices and mortgage rates remain elevated.

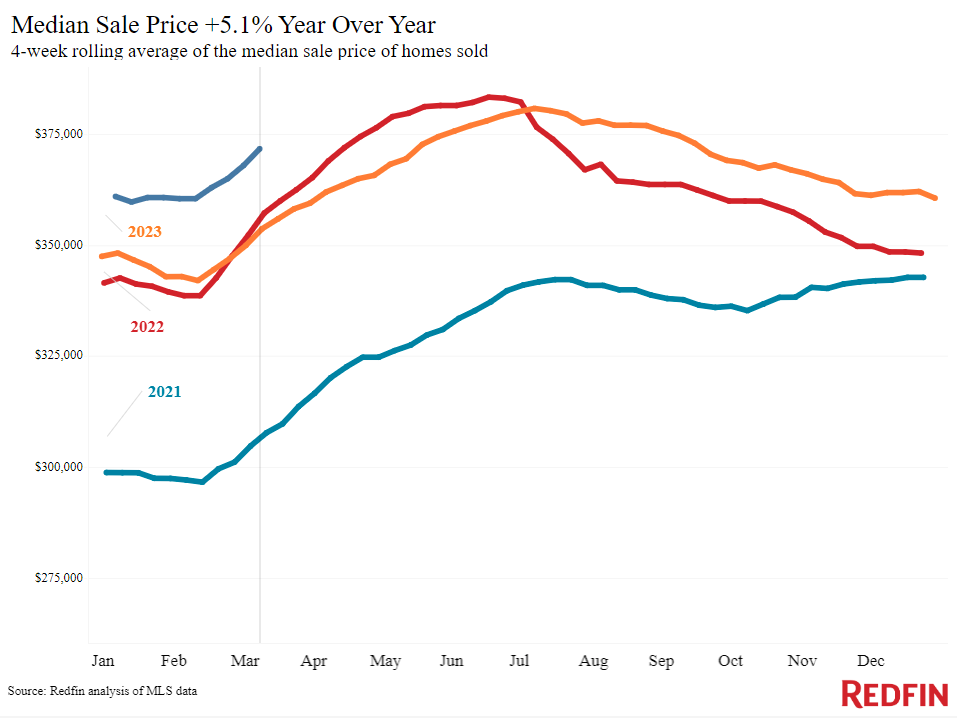

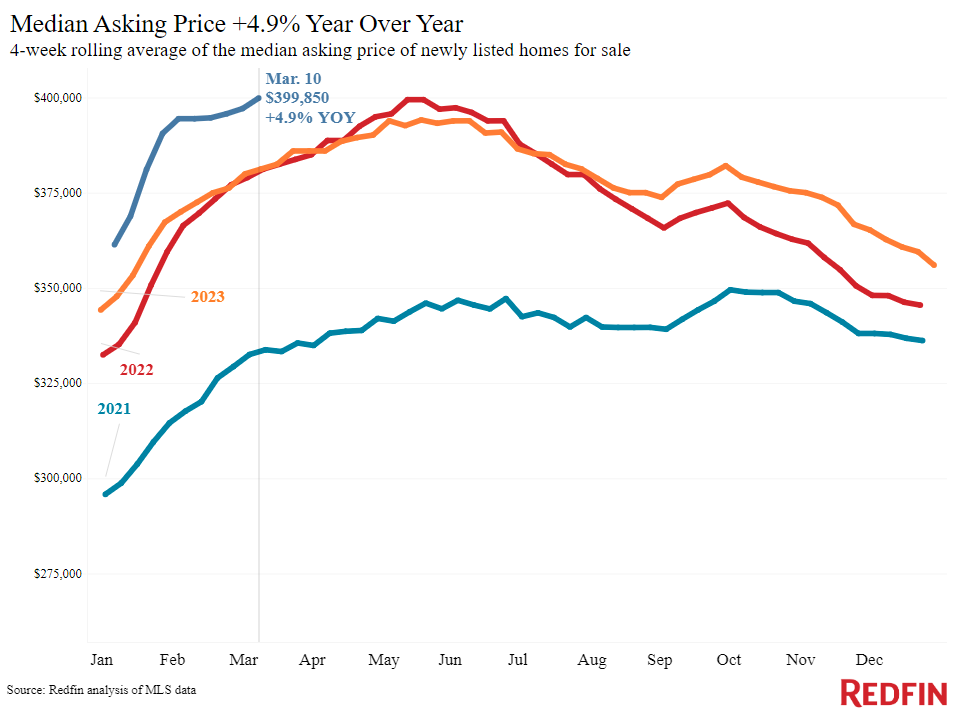

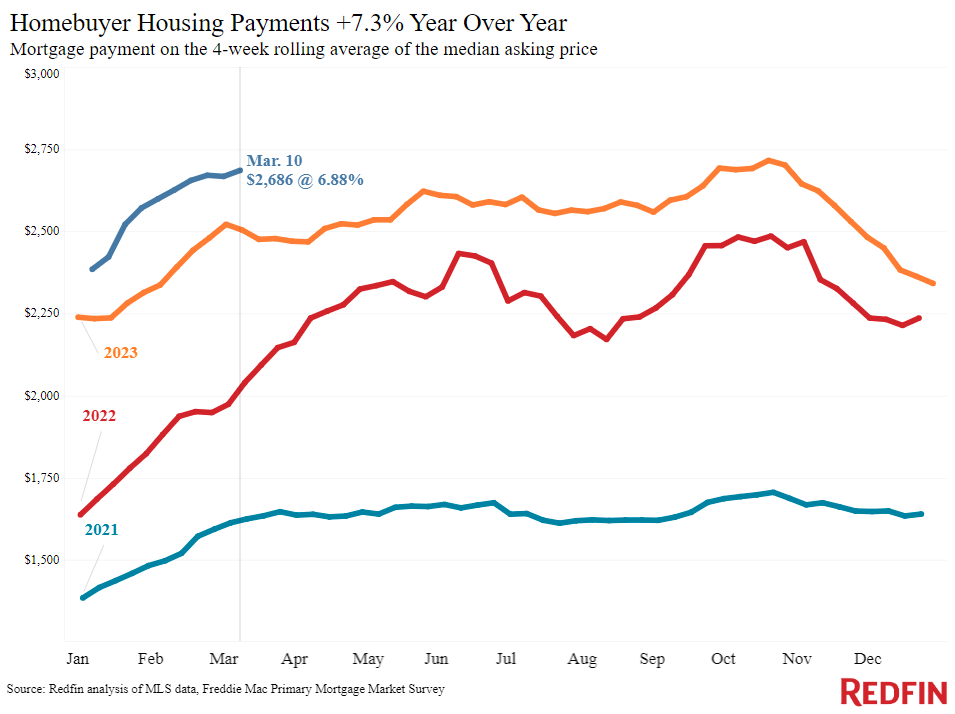

The median U.S. monthly housing payment was $2,686 during the four weeks ending March 10, just $30 shy of last October’s all-time high. That’s due to a combination of still-high mortgage rates and rising prices. While mortgage rates came down slightly this past week after increasing for four straight weeks, they’re still near 7%, and sale prices are up 5% year over year nationwide. On a local level, prices increased in all 50 of the most populous U.S. metros, the first time that has happened since July 2022.

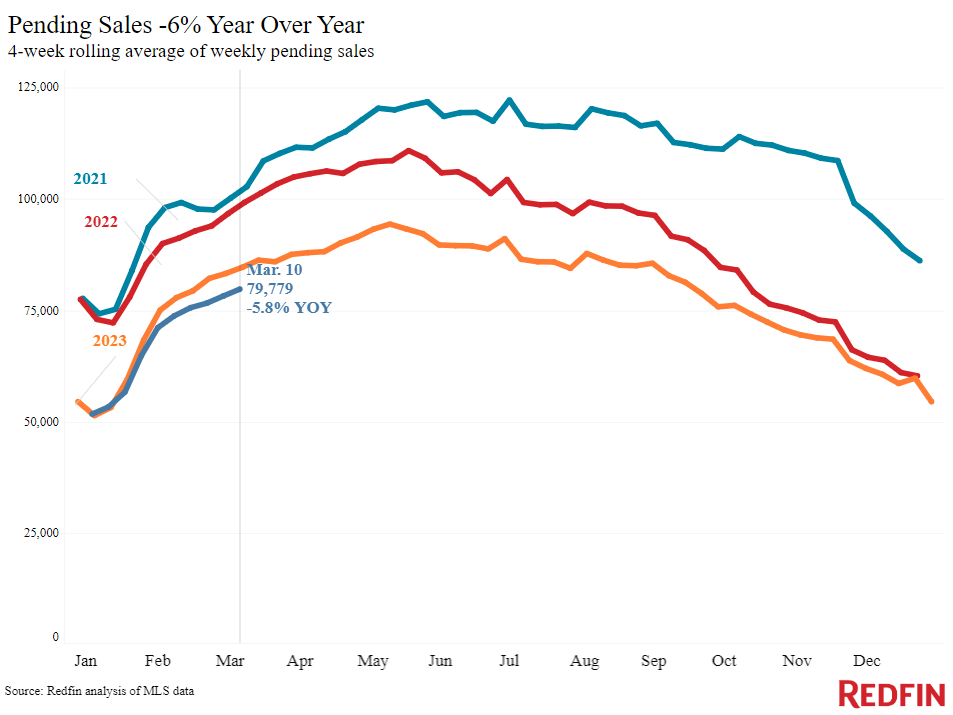

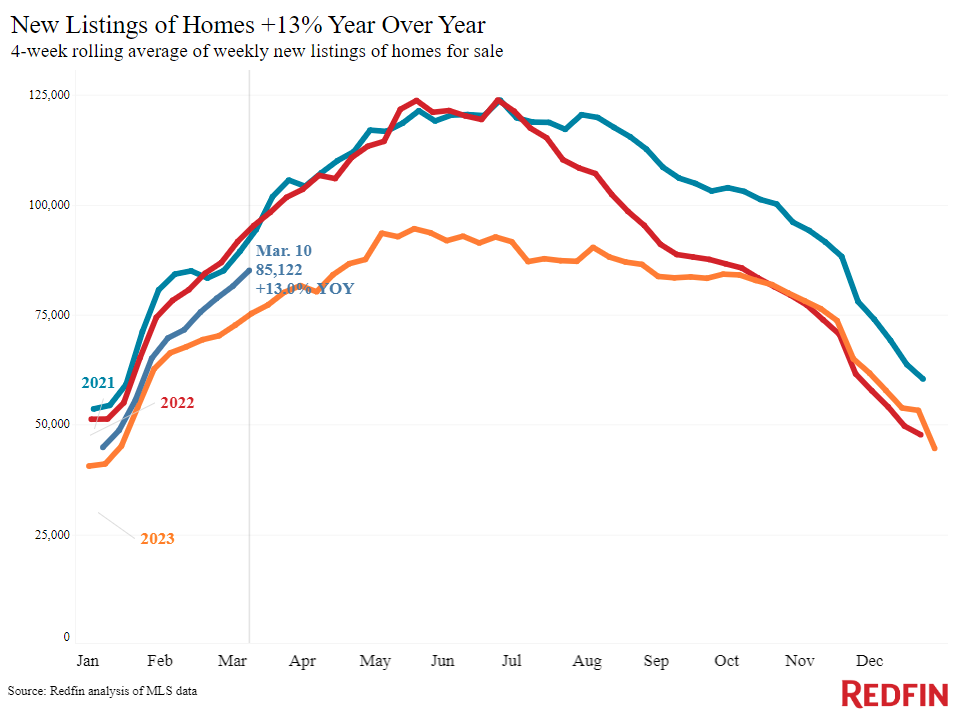

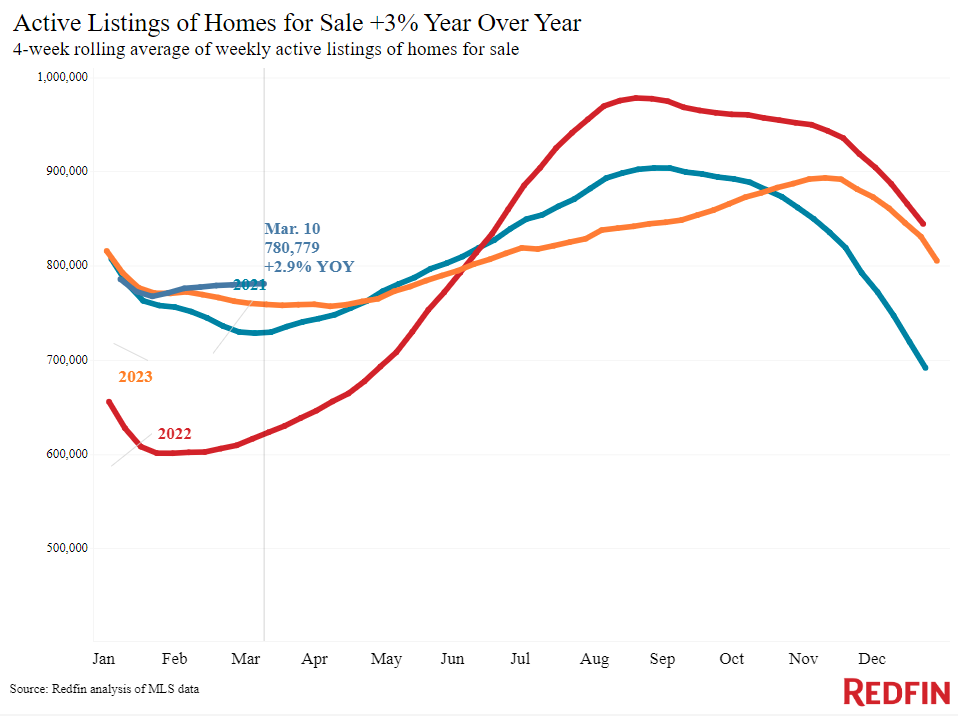

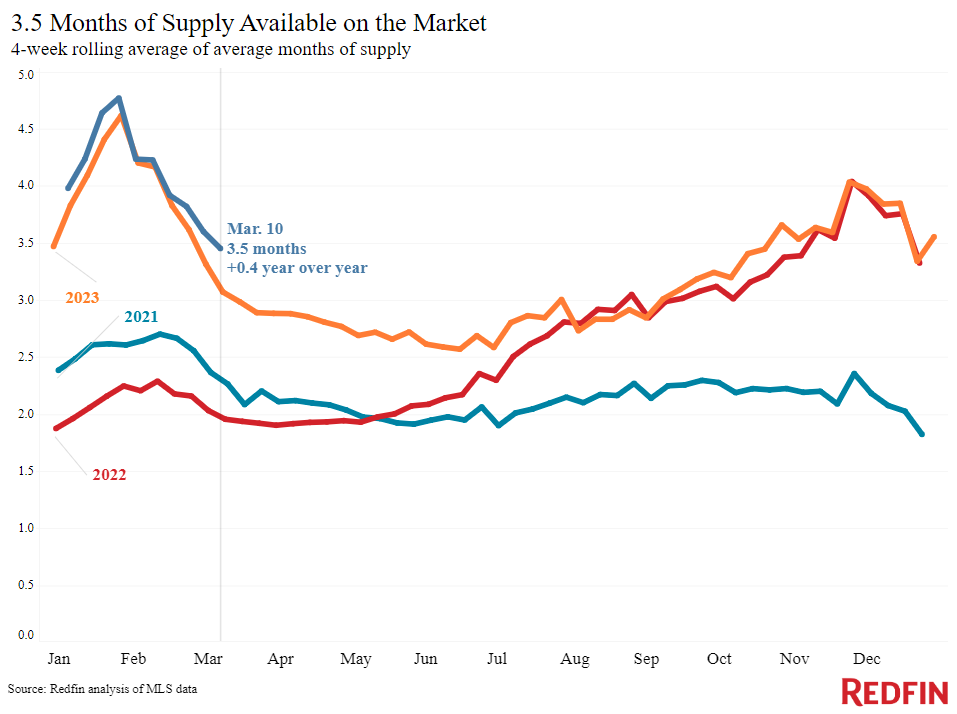

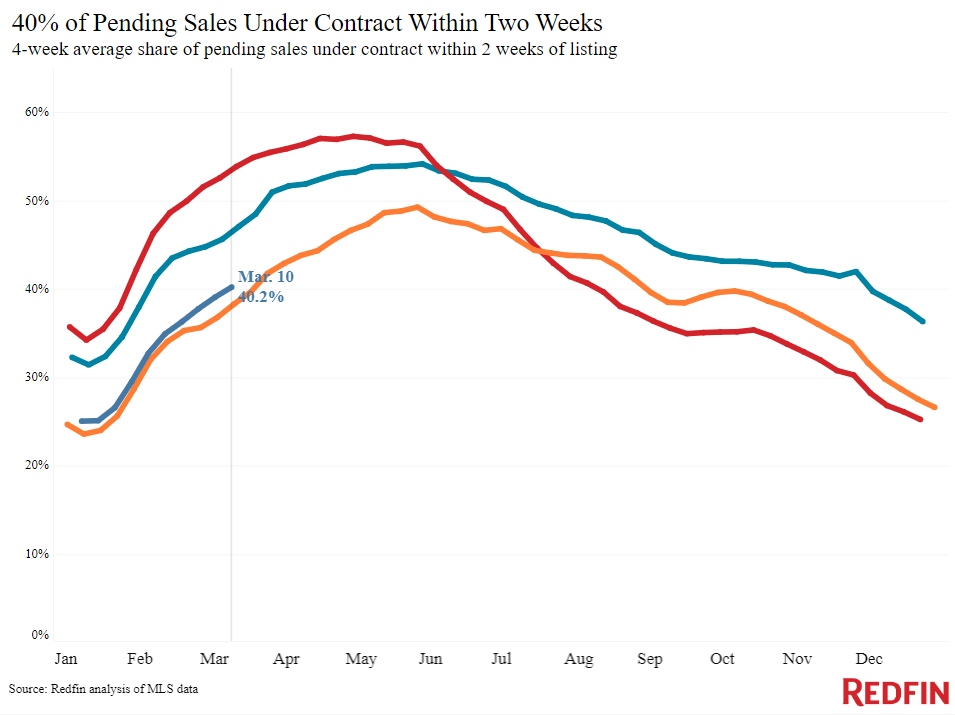

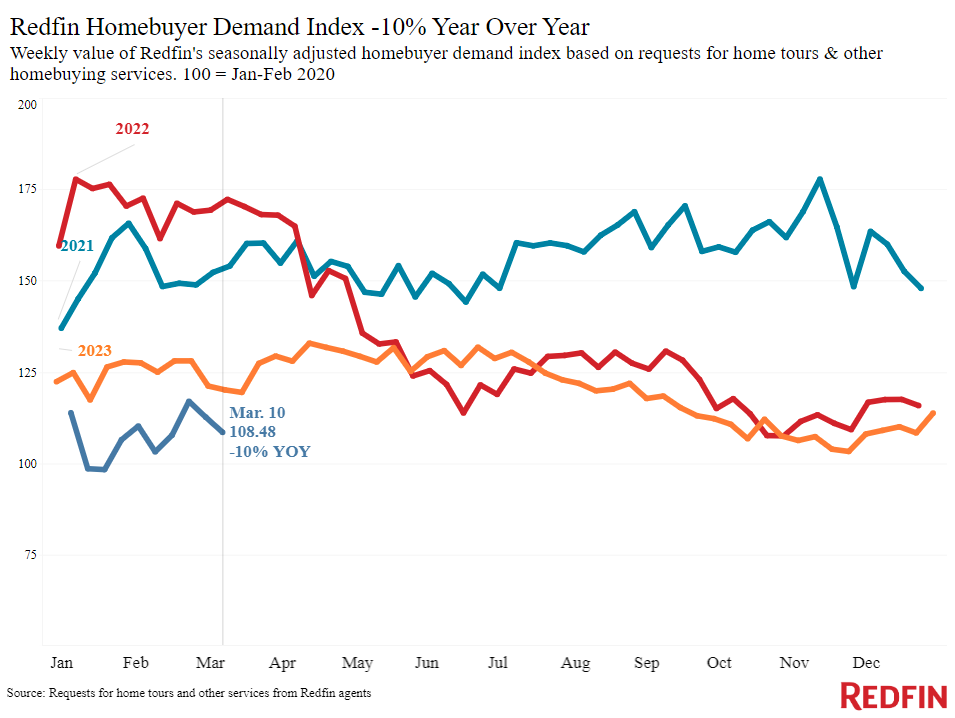

High housing costs are still pricing out some would-be homebuyers, with pending sales down 6% from a year earlier. But more house hunters are wading into the market; mortgage-purchase applications rose for the second week in a row. That’s partly because supply is steadily improving, giving buyers who can afford elevated prices and rates more homes to choose from. New listings are up 13%, the biggest annual increase in nearly three years, and the total number of homes for sale is up 3%, the biggest increase in nine months.

“Mortgage rates are likely to stay high a little longer than expected, with the latest inflation report essentially eliminating any chance of the Fed cutting interest rates before June,” said Redfin Economic Research Lead Chen Zhao. “Buyers who can afford to may want to get serious about their home search now, as housing costs are unlikely to fall anytime soon. The uptick in listings should be another motivator for buyers: There’s more to choose from, and improving inventory may bring out more competition from other buyers as we get further into spring. Some buyers have already gotten the memo, with mortgage applications finally increasing after weeks of declines.”

For more on Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit our “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.