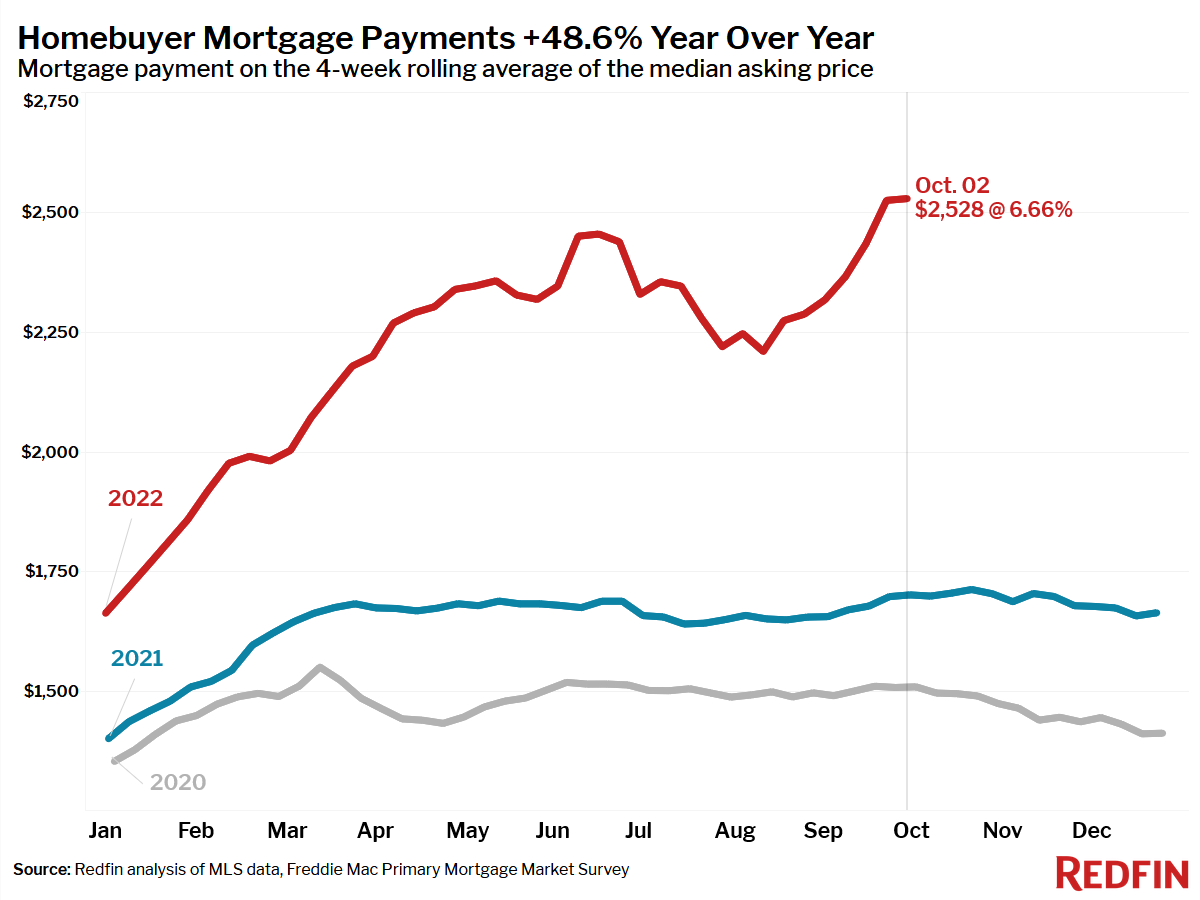

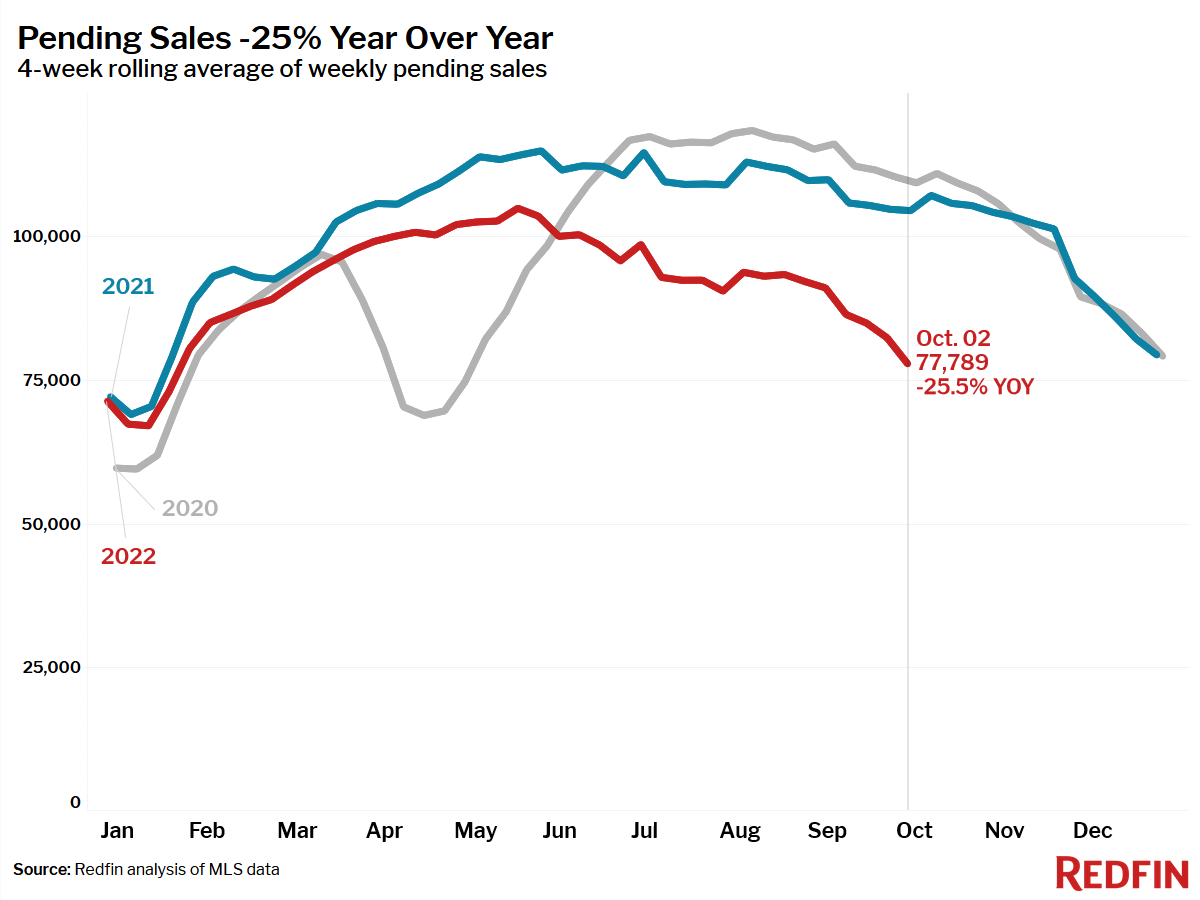

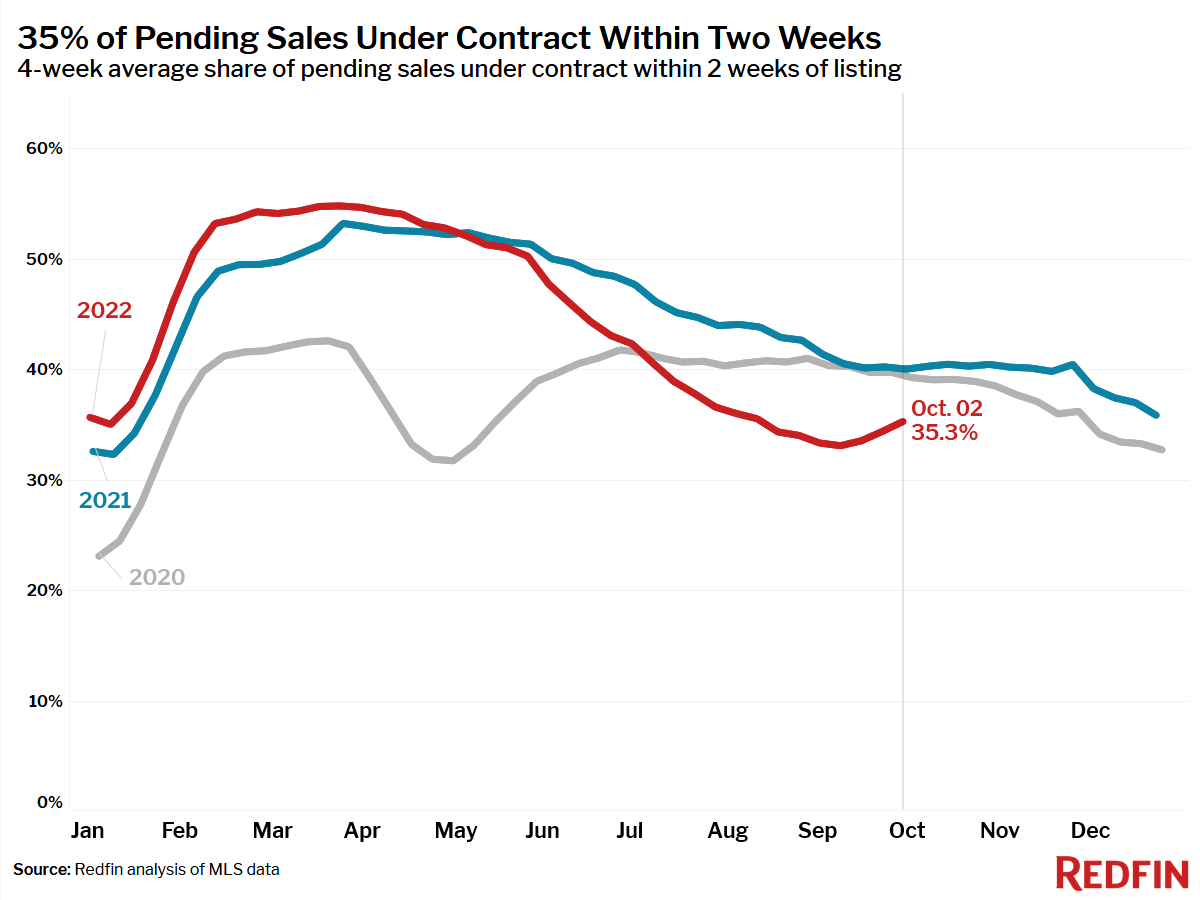

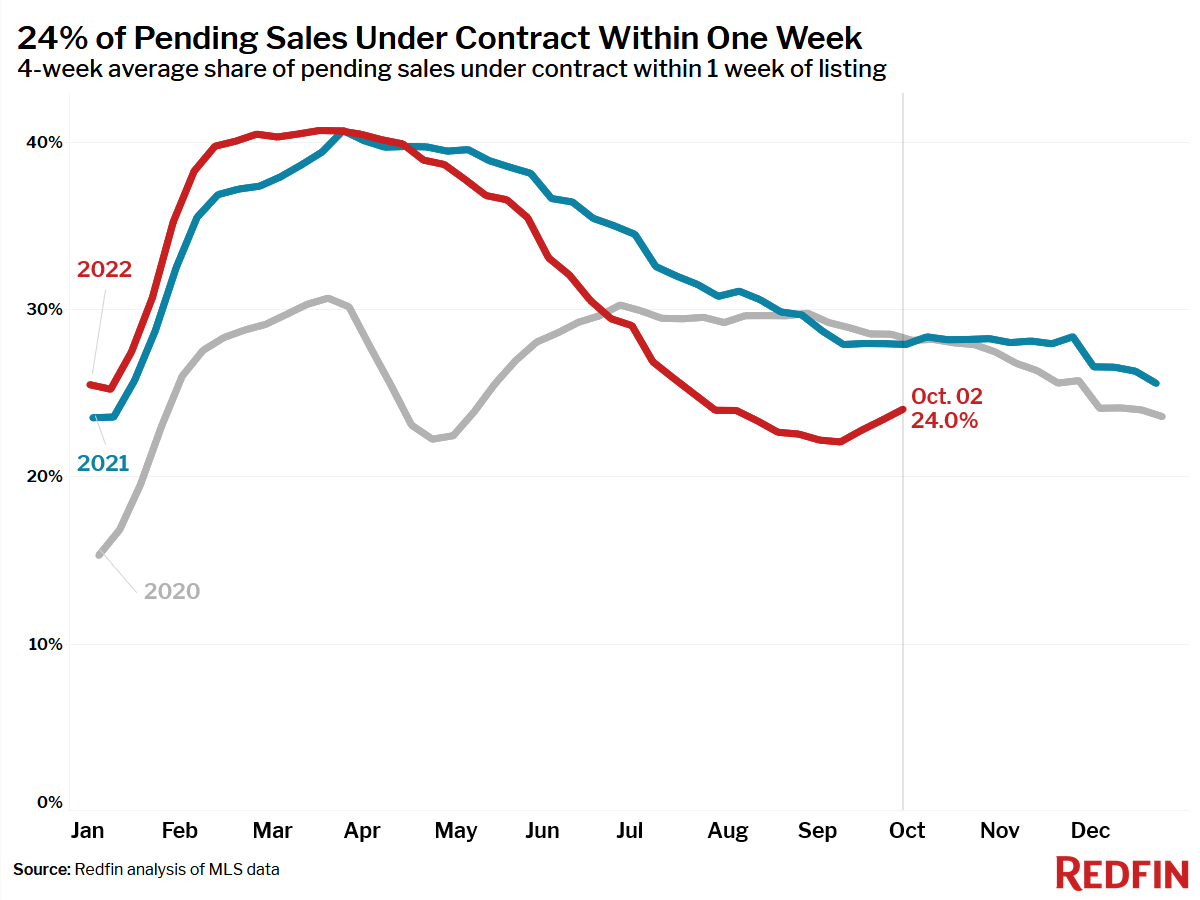

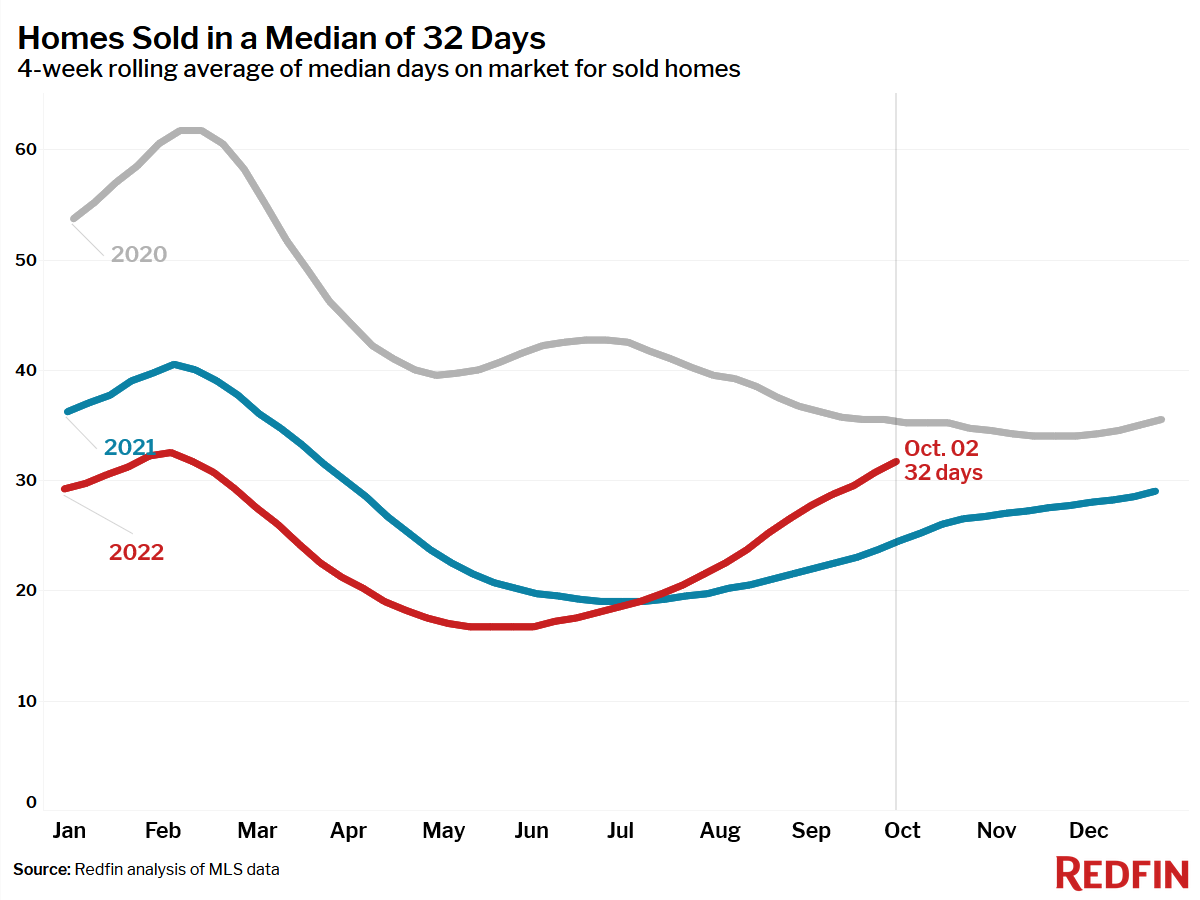

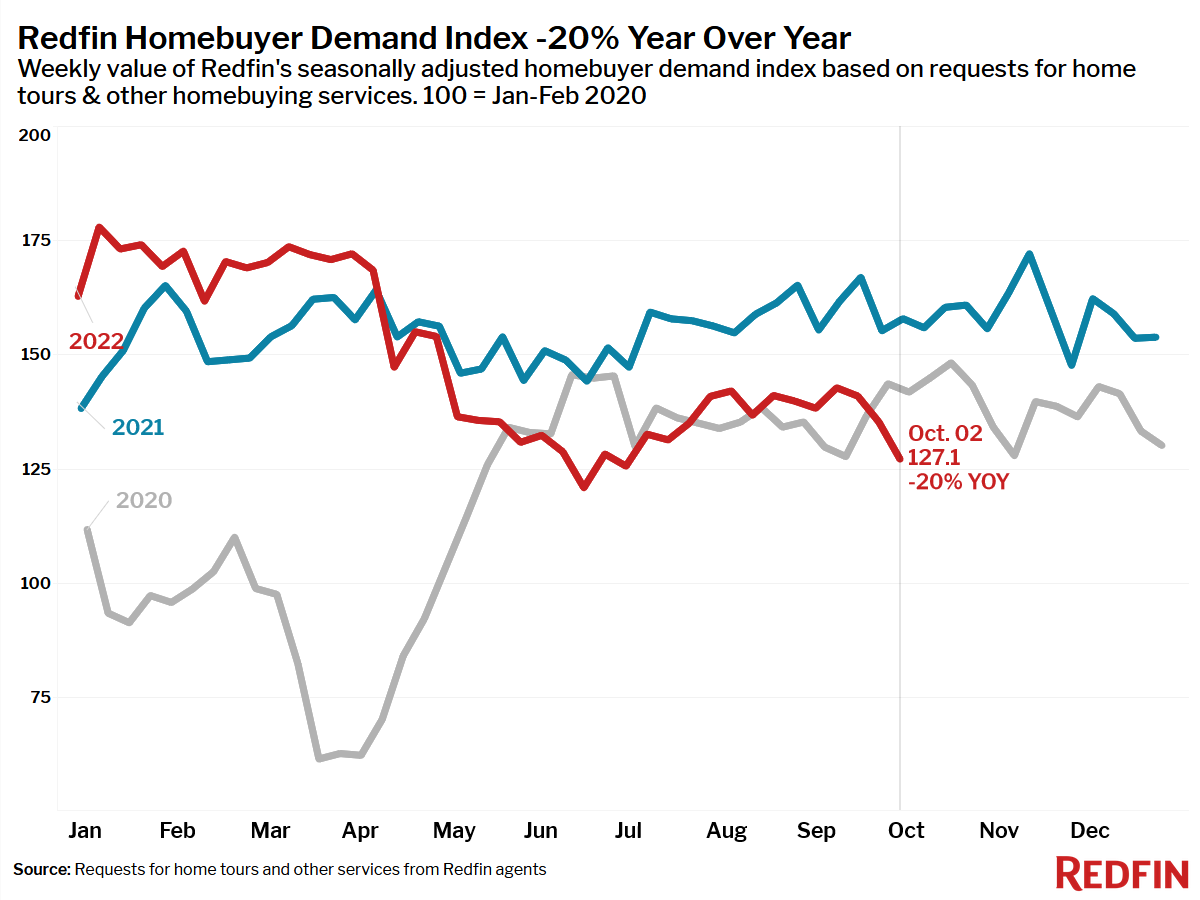

Early indicators of homebuying demand show an accelerated pullback last week as mortgage rates shot up to a 15-year high. Home tours fell 7% and mortgage purchase applications declined 13%. Redfin’s Homebuyer Demand Index, a measure of requests for home tours and other home-buying services, fell 6% last week to its lowest level since mid-June, when mortgage rates first jumped toward 6%.

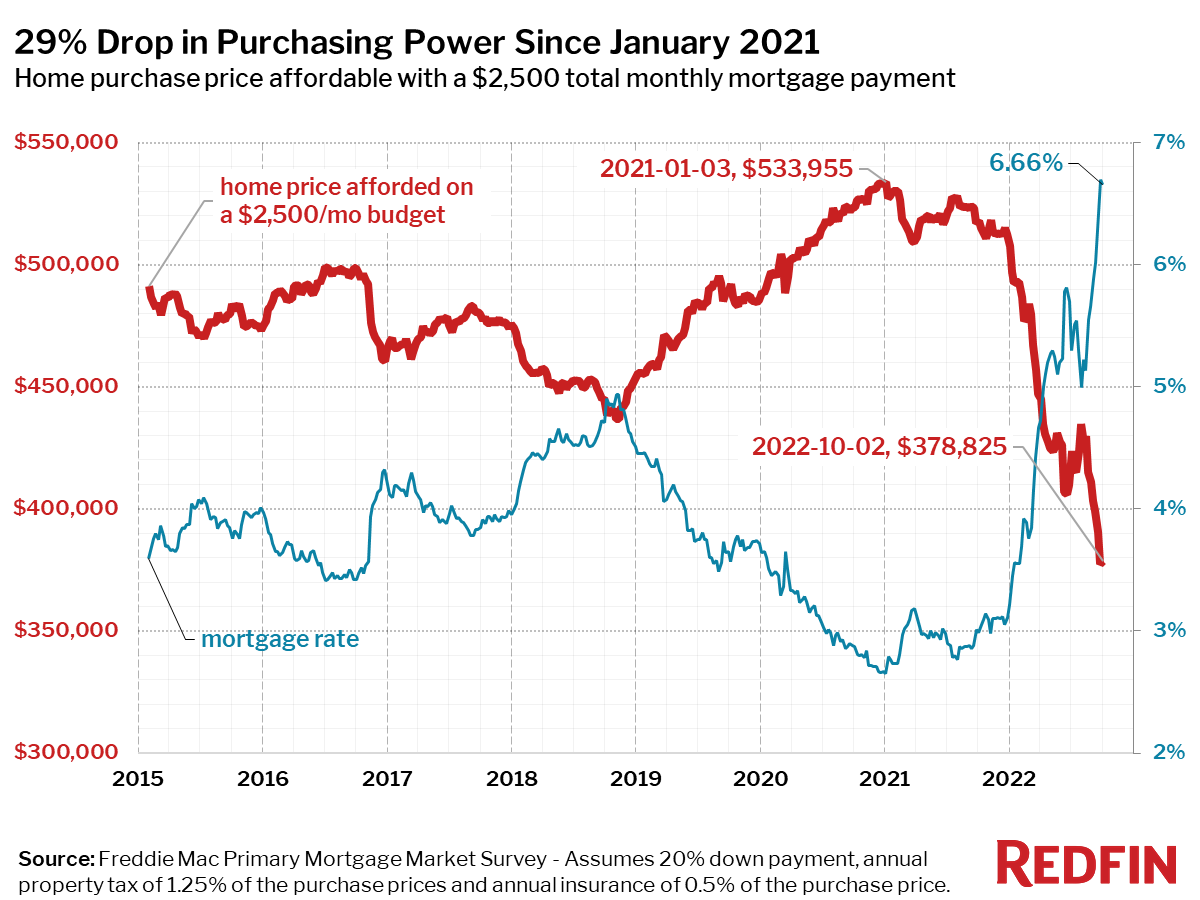

Homebuyers have lost 29% of their purchasing power as the average 30-year-fixed mortgage rate climbed from 2.65% at the start of 2021 to 6.66% today.

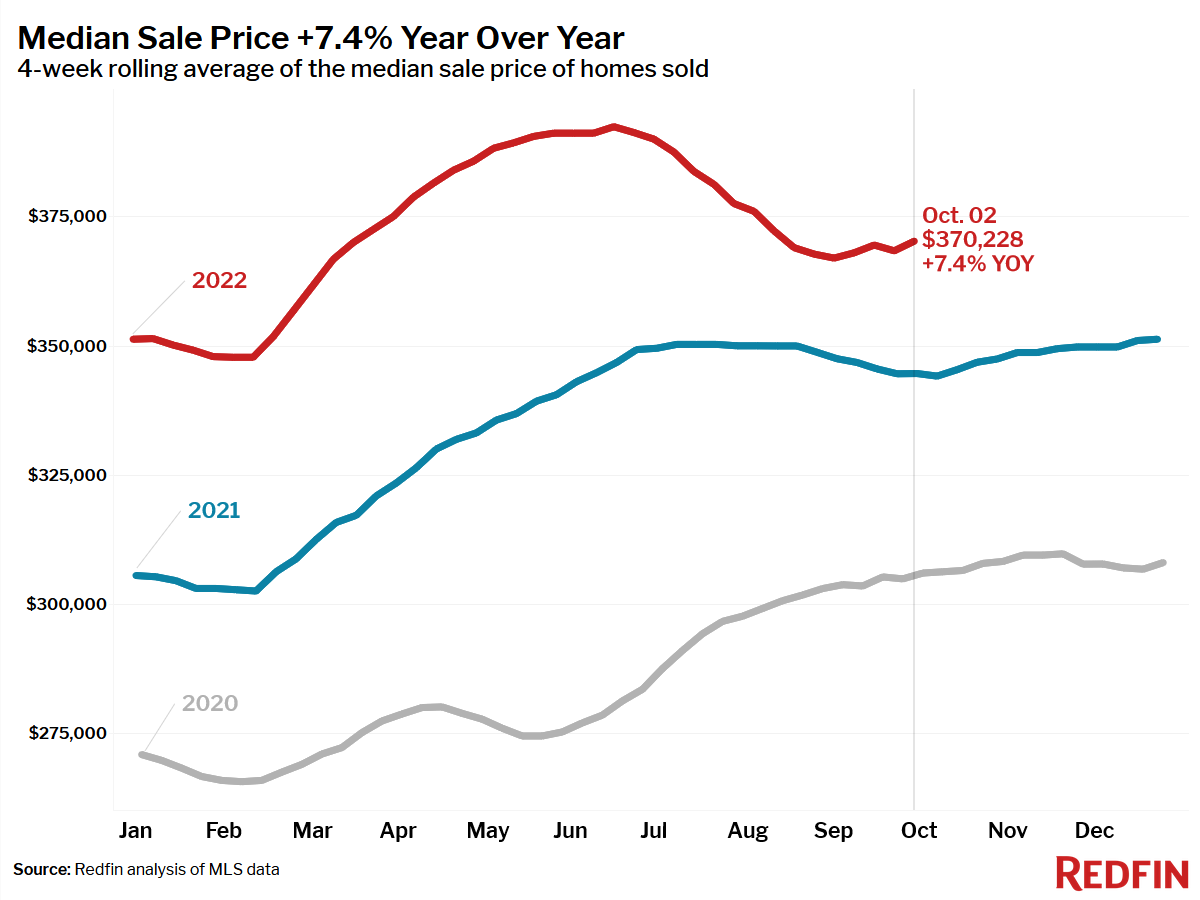

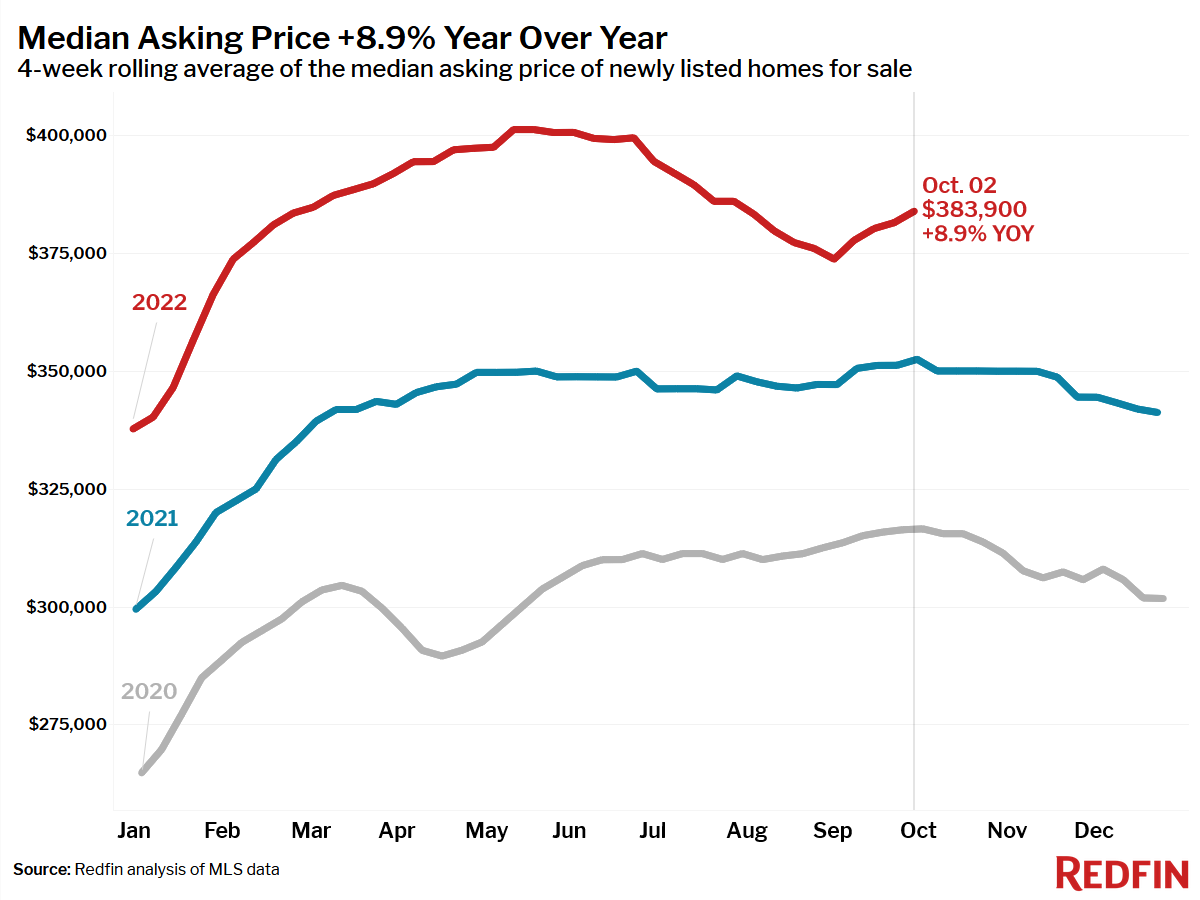

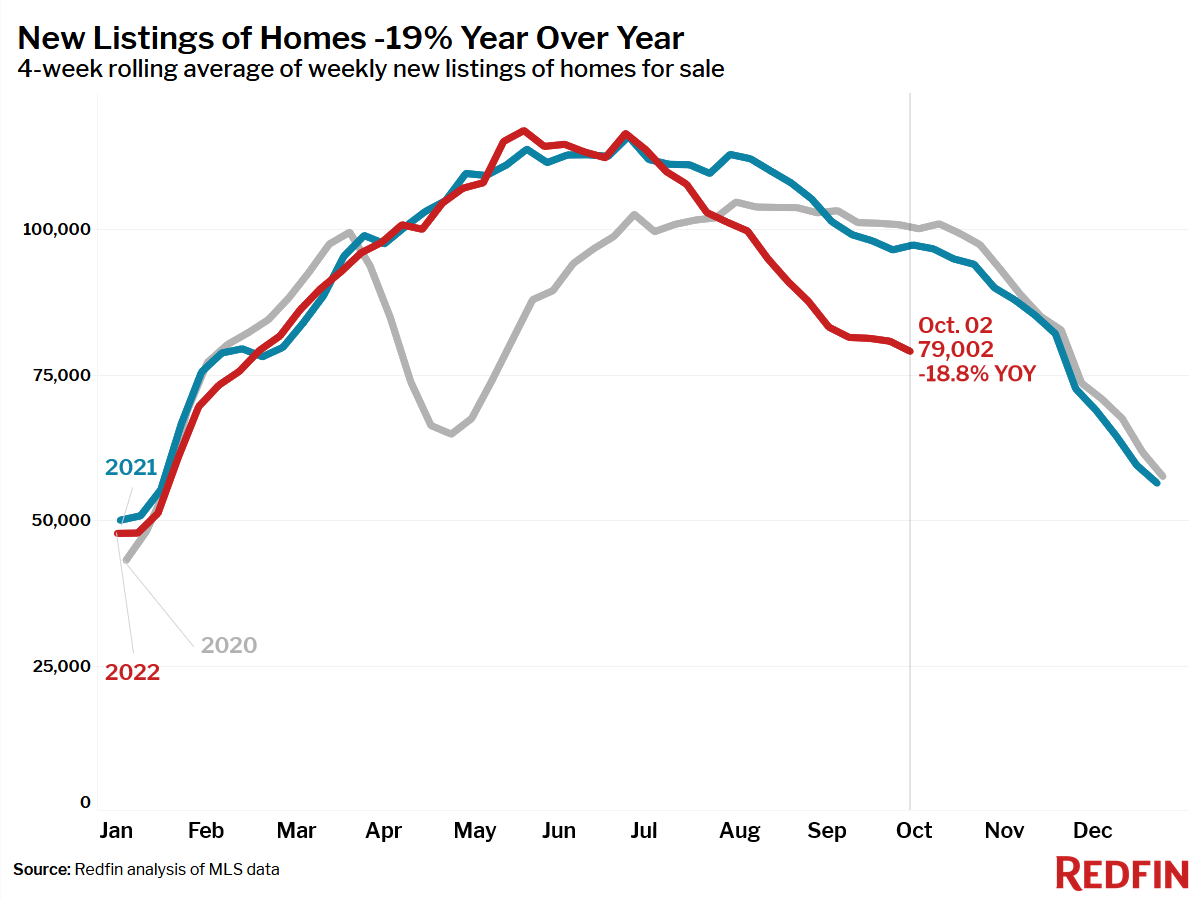

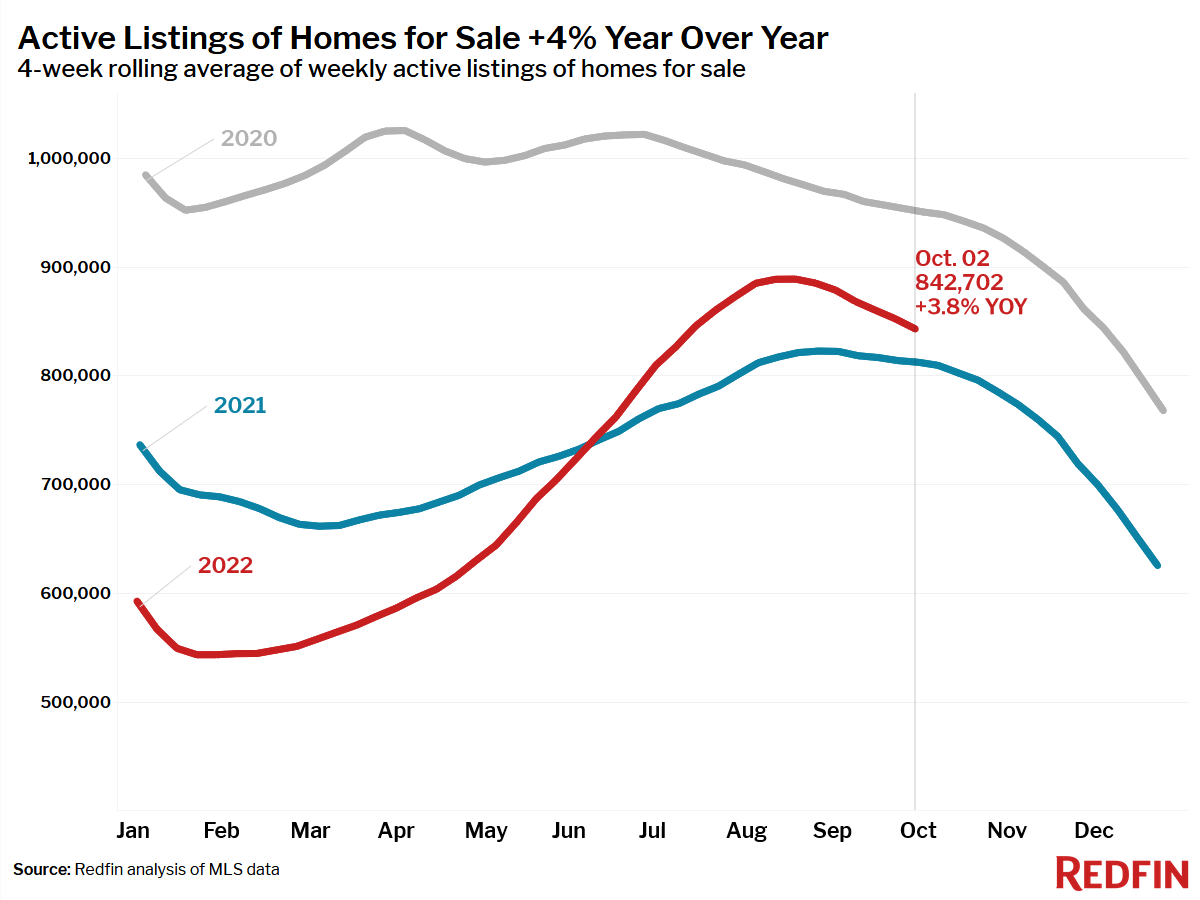

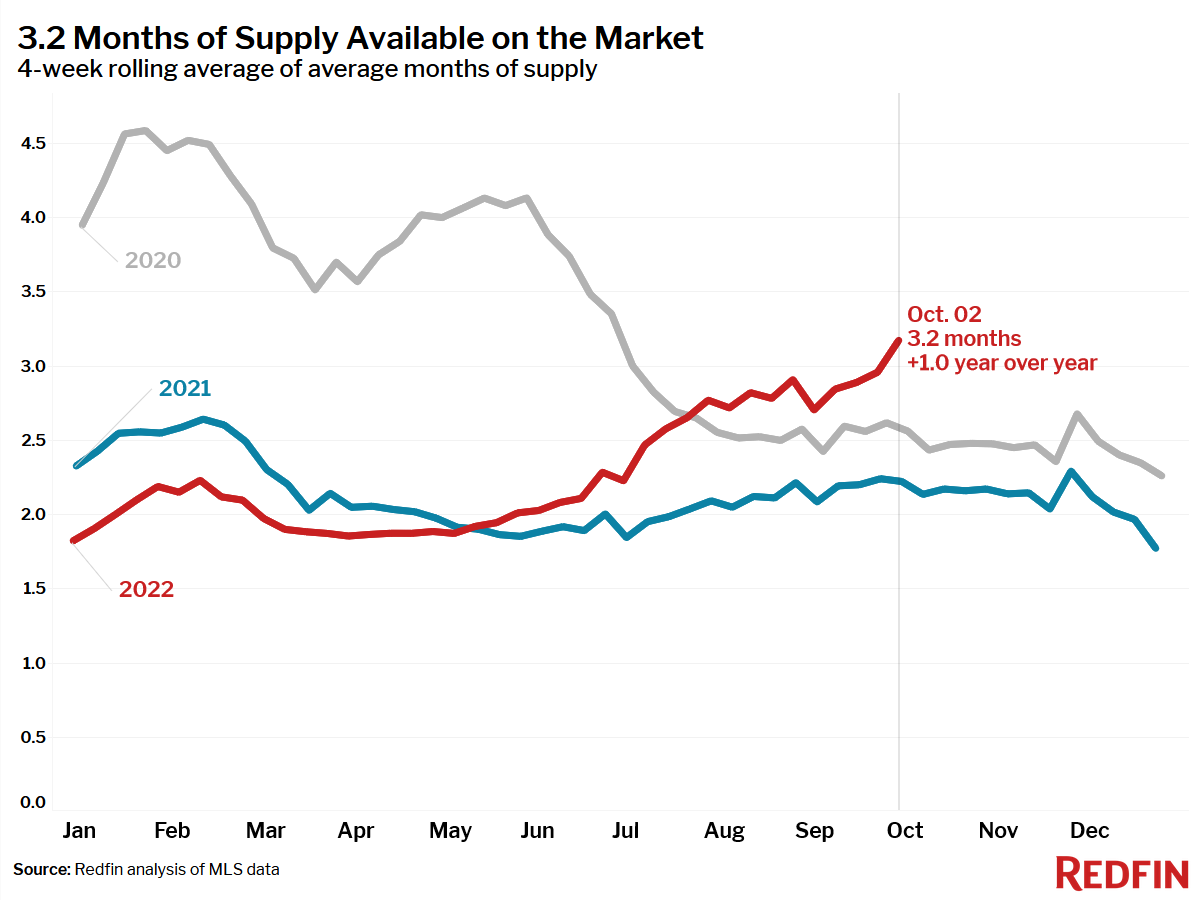

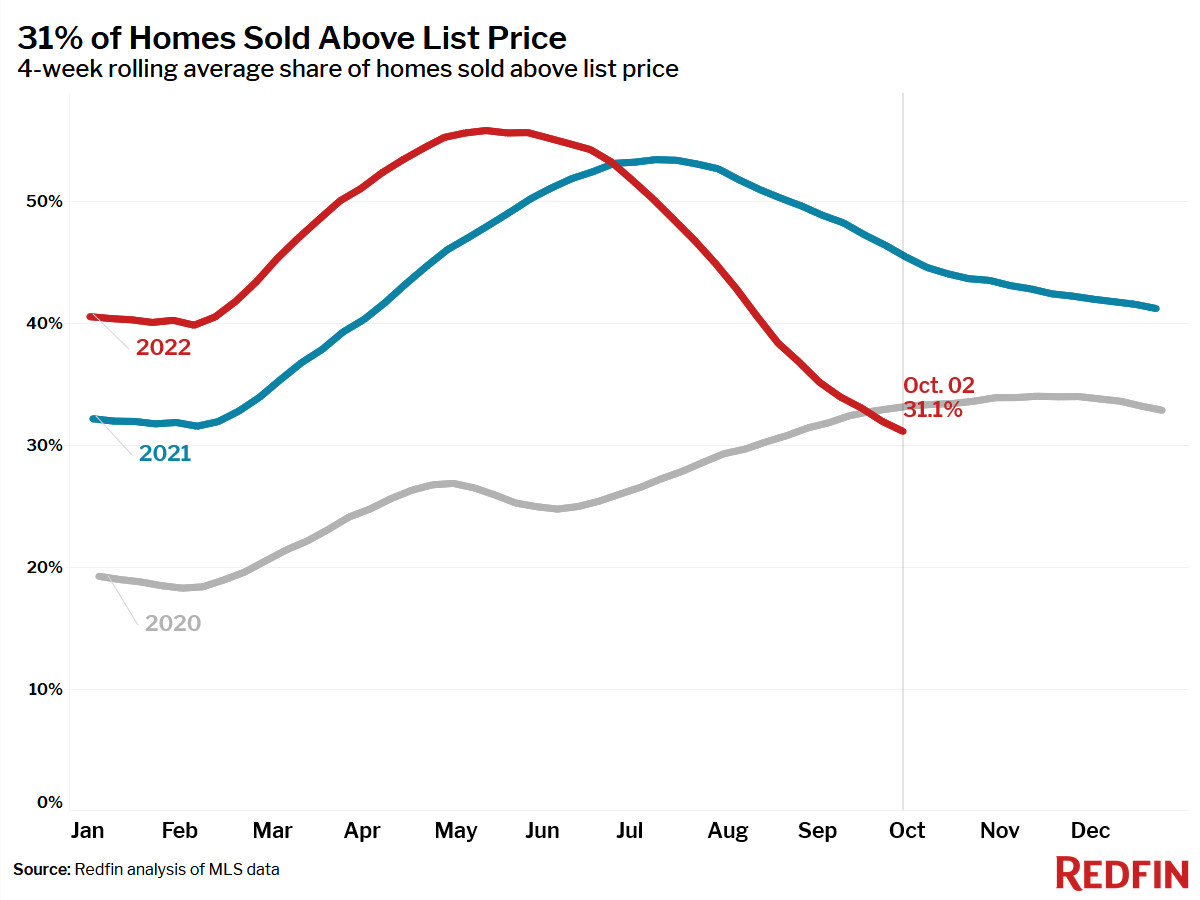

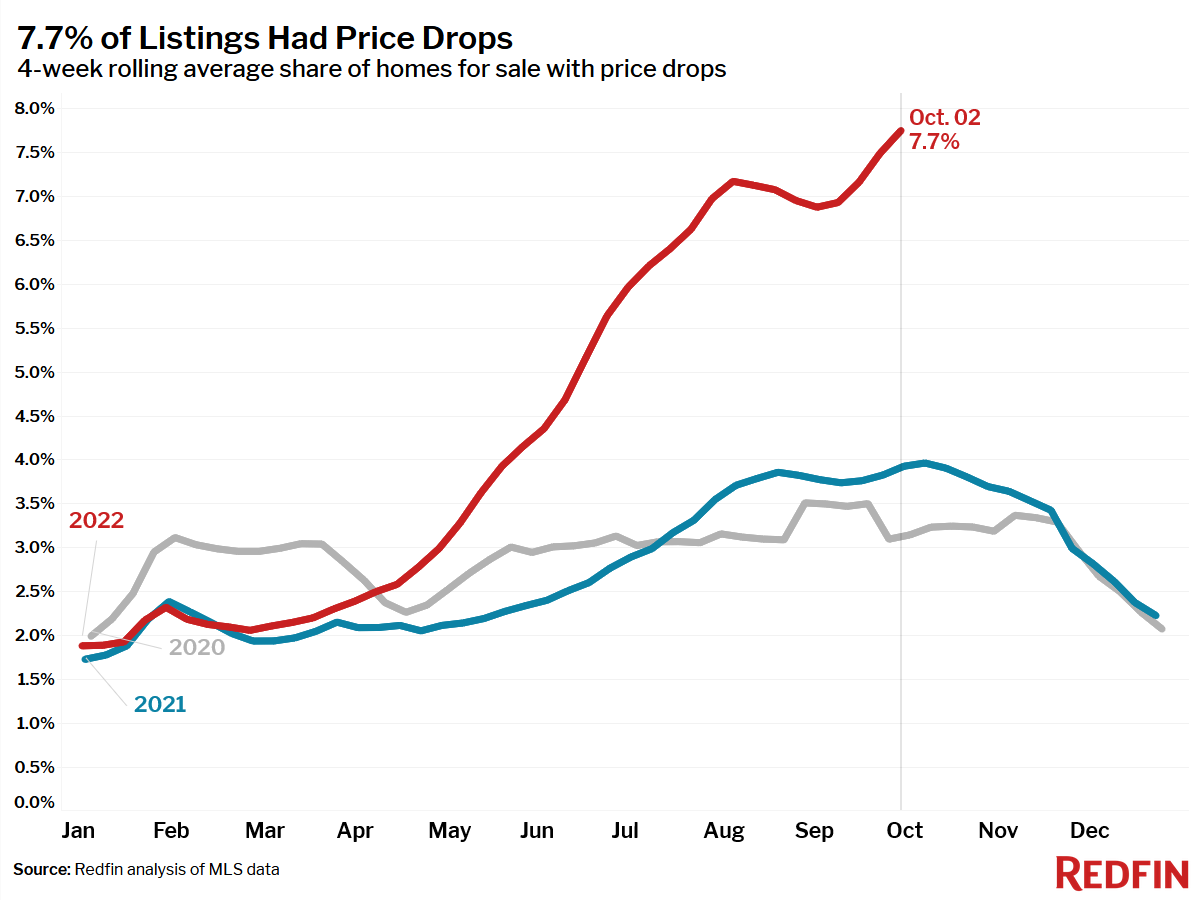

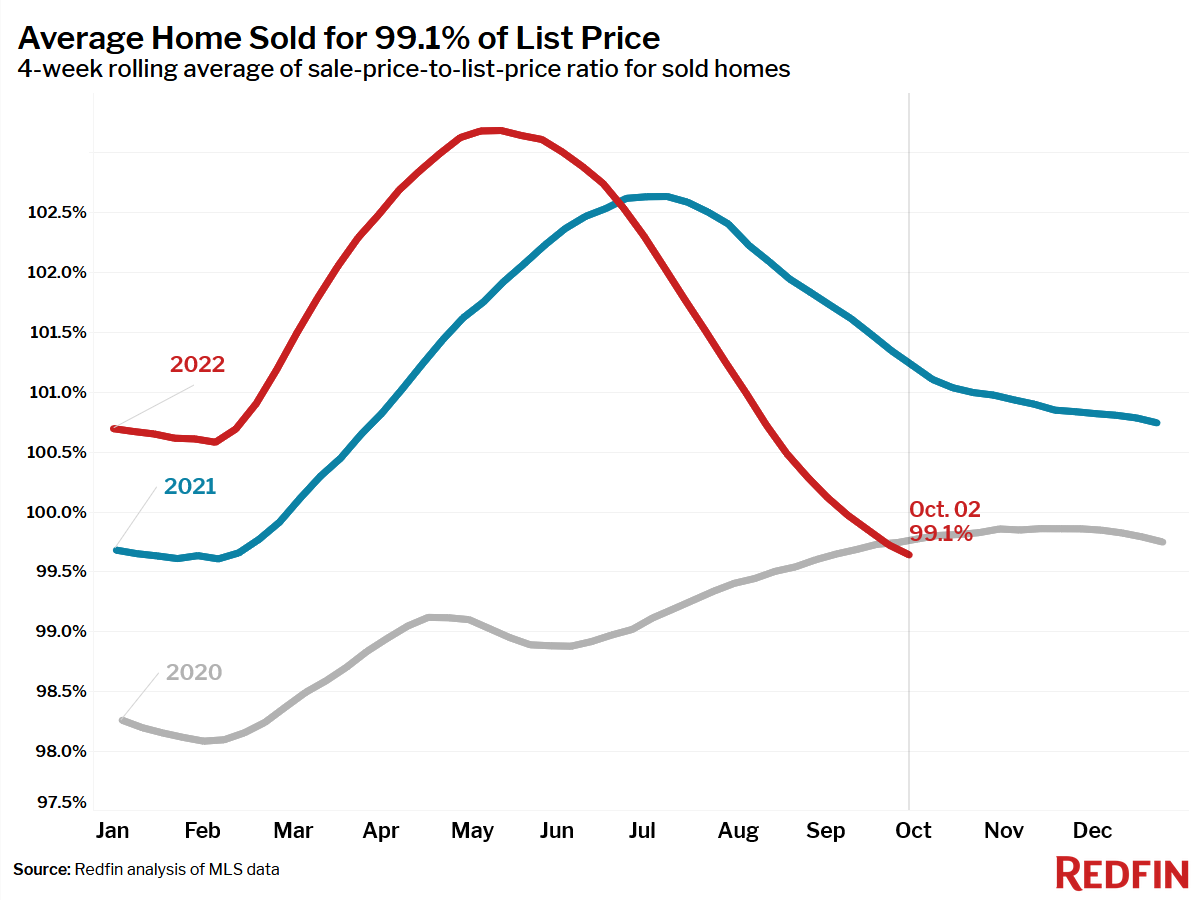

“Mortgage rates well over 6% are spooking homebuyers,” said Redfin Deputy Chief Economist Taylor Marr. “Sellers are pulling back in this market, but buyers are pulling back even more. Home prices are holding steady for now. It will take a few months before the prices of closed sales start to reflect this shock to the market. However, there is evidence of sizable price declines in parts of the market that aren’t accounted for by MLS data, such as home builders offloading homes in bulk at a 20% discount.”

Unless otherwise noted, the data in this report covers the four-week period ending October 2. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.