Daily average mortgage rates reached their highest level in nearly five months following Wednesday’s hotter-than-expected inflation report, which will likely keep mortgage rates elevated for the foreseeable future.

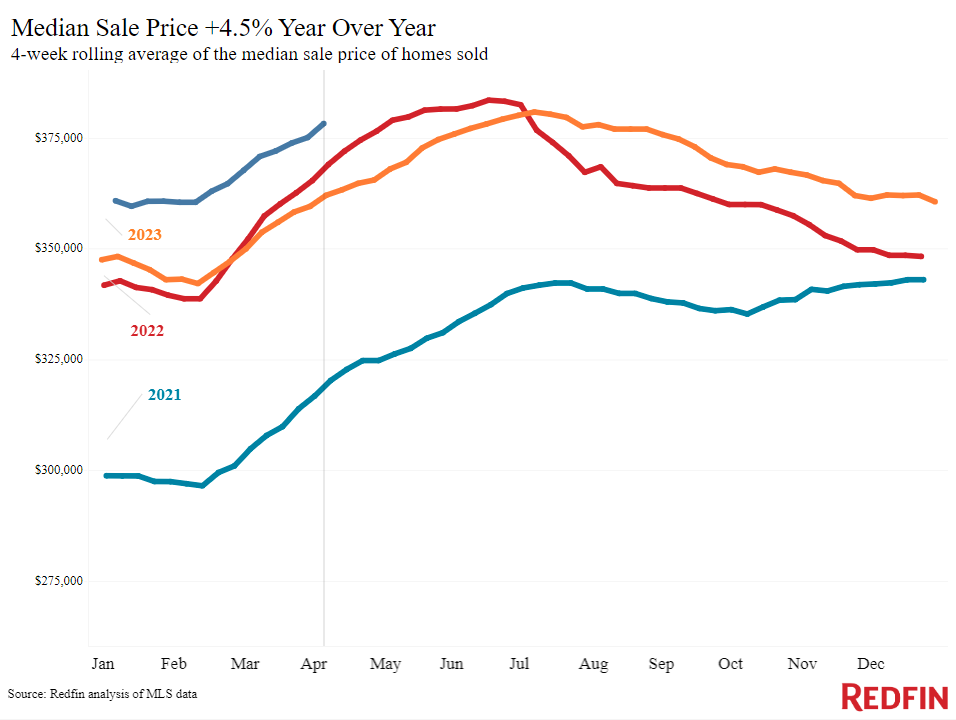

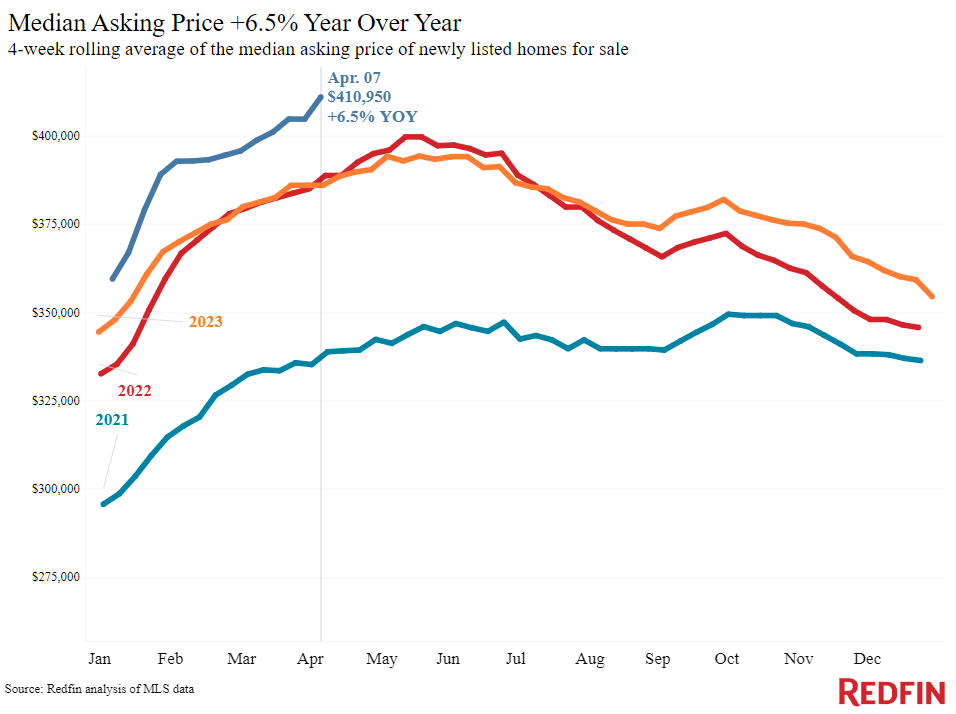

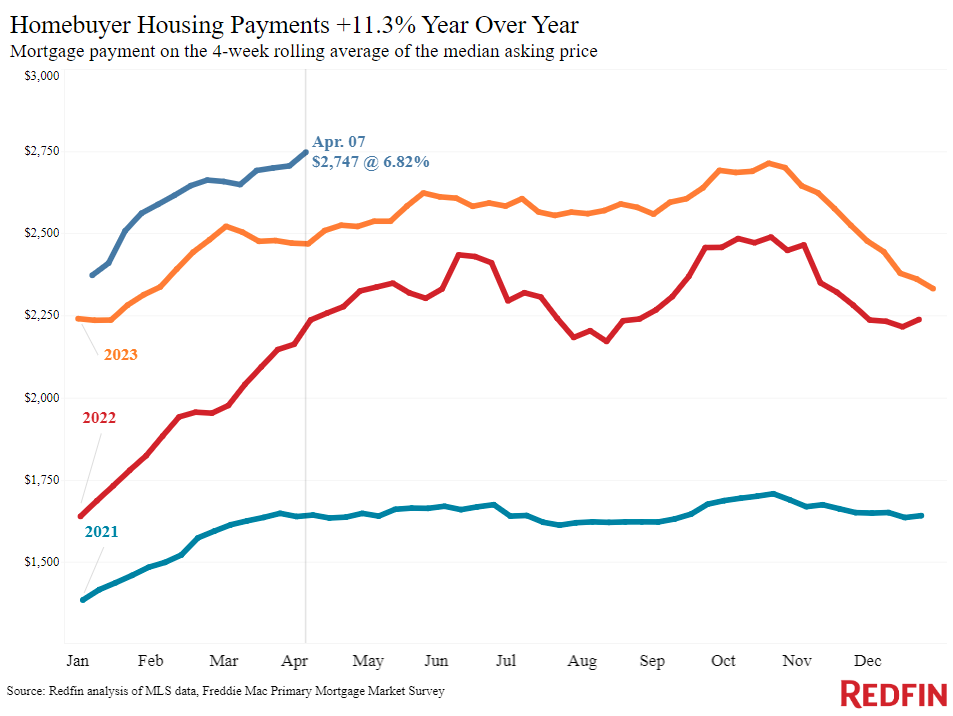

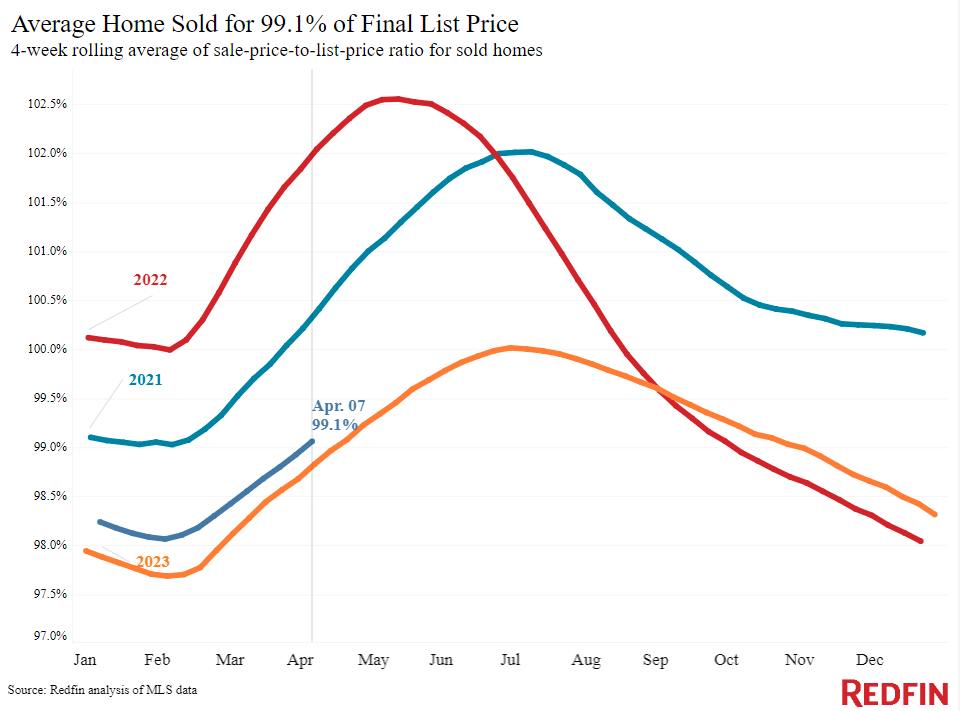

The median monthly U.S. housing payment hit an all-time high of $2,747 during the four weeks ending April 7, up 11% from a year earlier. Housing payments are soaring because home prices and mortgage rates are high. The median home-sale price is $378,250, up 4.5% year over year and just about $5,000 shy of the record high hit in June 2022. The average 30-year fixed mortgage rate is 6.82%, below the near-8% rates hit last October but still more than double pandemic-era lows.

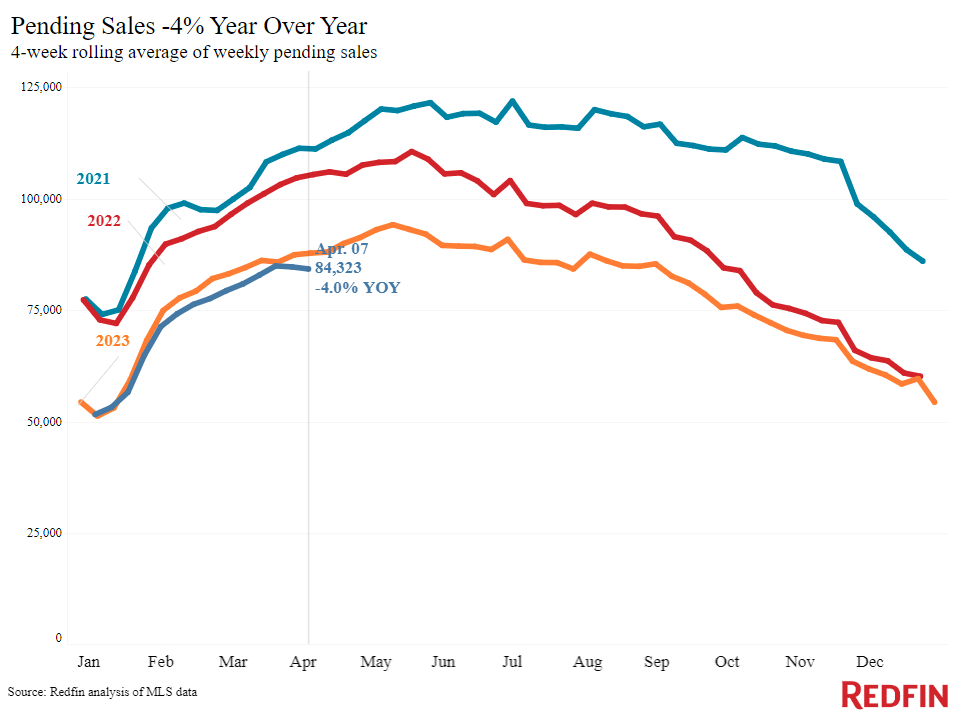

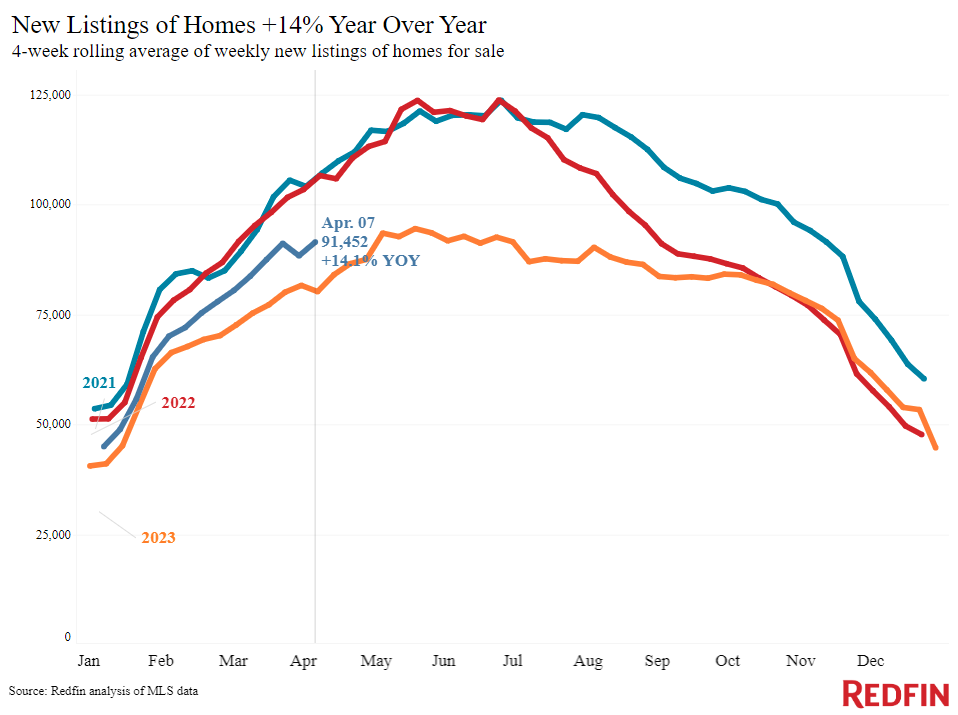

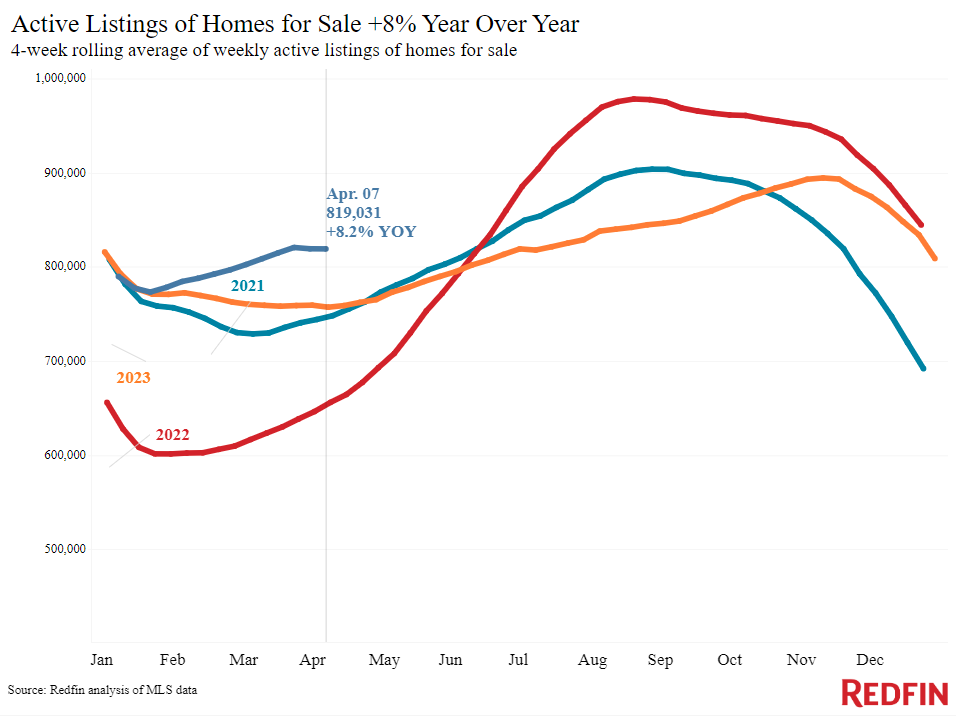

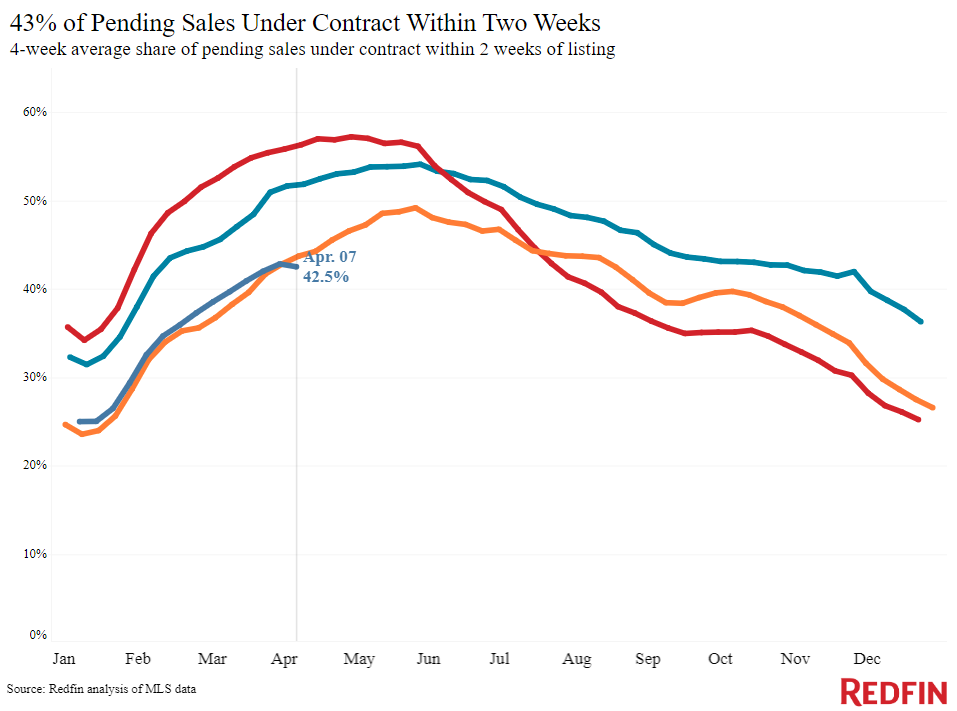

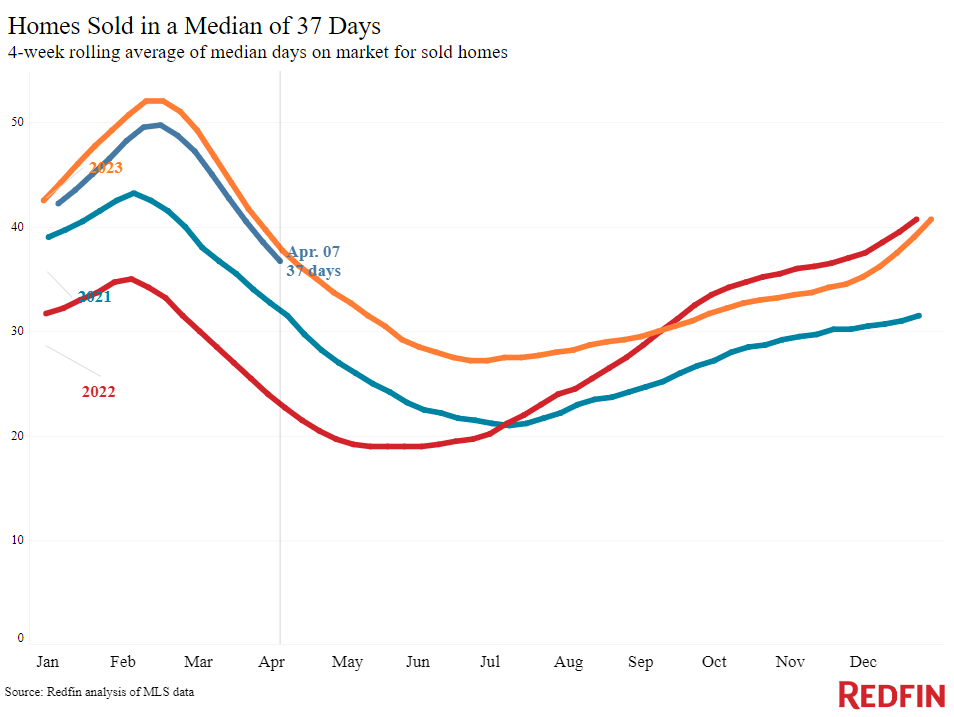

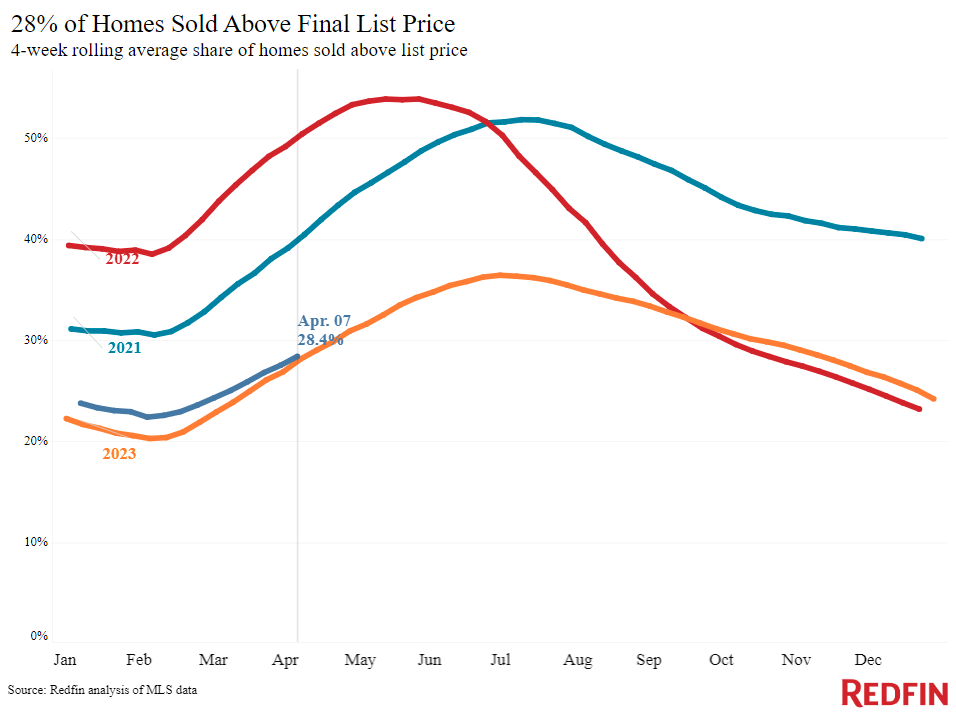

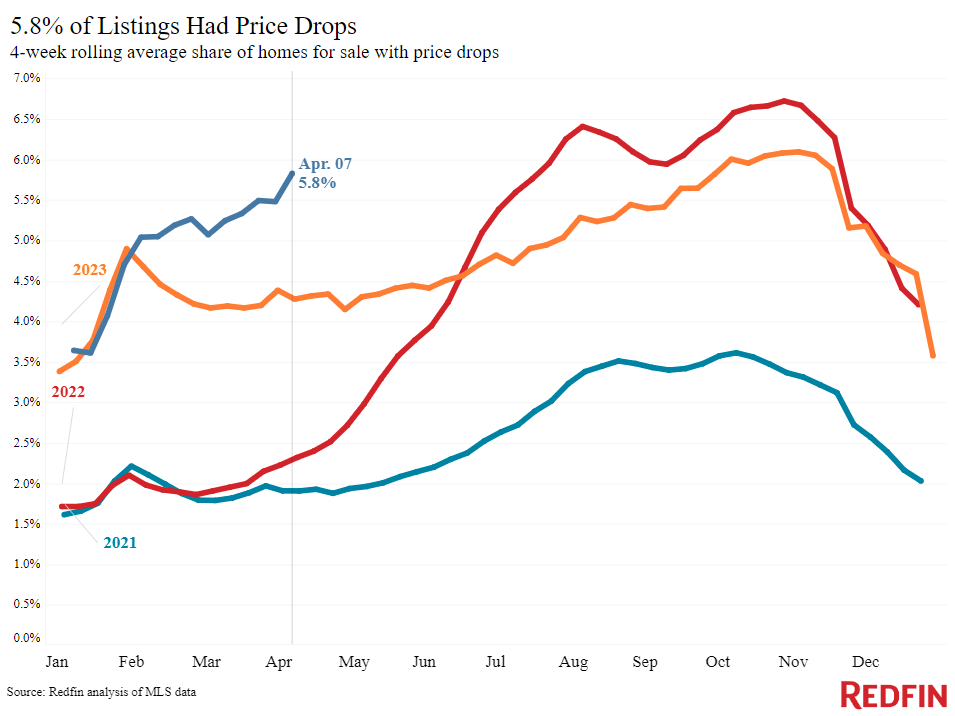

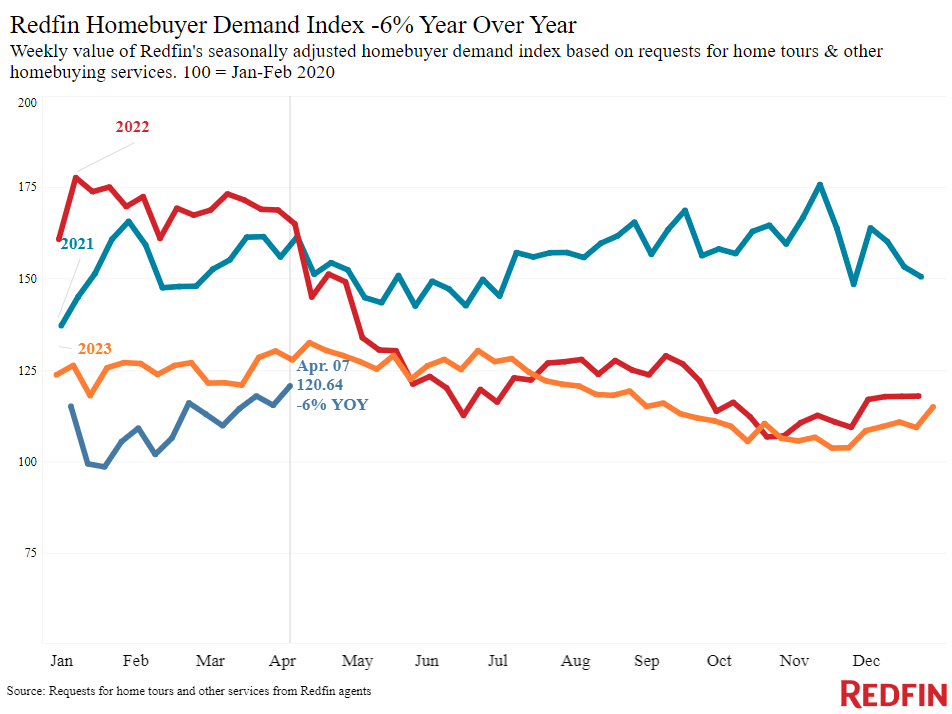

Prices are staying stubbornly high because there’s enough homebuying demand to prop them up. Redfin’s Homebuyer Demand Index–a measure of requests for tours and other buying services from Redfin agents–is at its highest level since last July, and a separate measure of tours shows they’ve increased 33% since the start of 2024, much bigger than last year’s increase over the same period (that’s partly because Easter fell during this week last year). And even though supply is picking up–new listings rose 14% year over year–inventory is still low compared to typical spring levels, meaning there’s competition for many of the homes that are on the market.

Mortgage rates, the other factor driving up monthly housing payments, remain elevated because the Fed has kept interest rates high so far this year. Daily average mortgage rates jumped to their highest level since last November this week because the March inflation report was hotter than expected, after rising last week because the latest jobs report showed a stronger-than-expected economy.

“For homebuyers, the latest CPI report means mortgage rates will stay higher for longer because it makes the Fed unlikely to cut interest rates in the next few months,” said Redfin Economic Research Lead Chen Zhao. “Housing costs are likely to continue going up for the near future, but persistently high mortgage rates and rising supply could cool home-price growth by the end of the year, taking some pressure off costs.”

For more of Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit our “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.