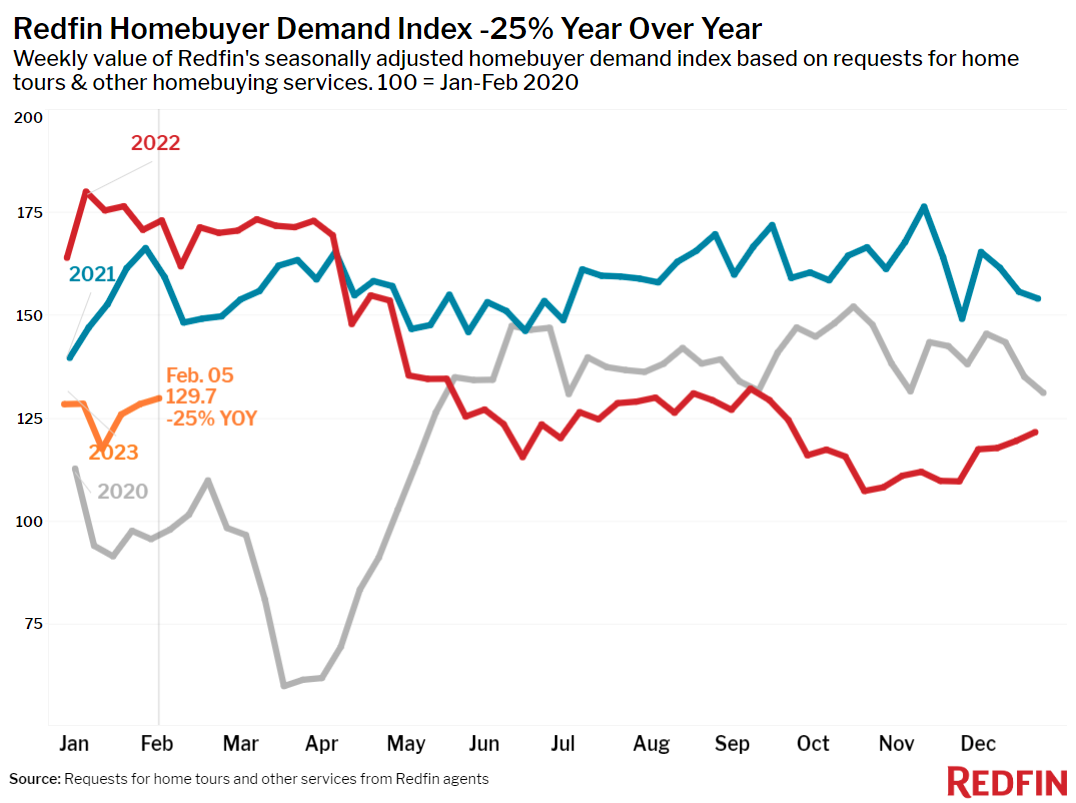

Homebuyer demand continues to increase from its fall low point despite mortgage rates ticking up this week. Seller activity is also picking up.

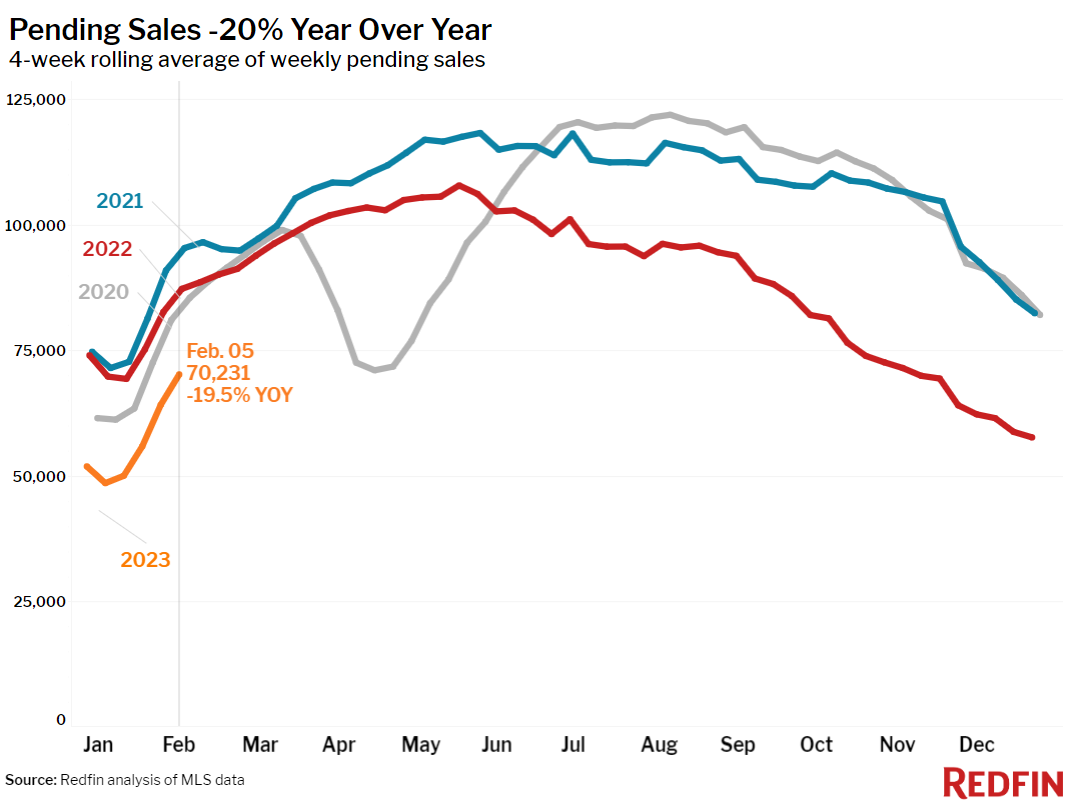

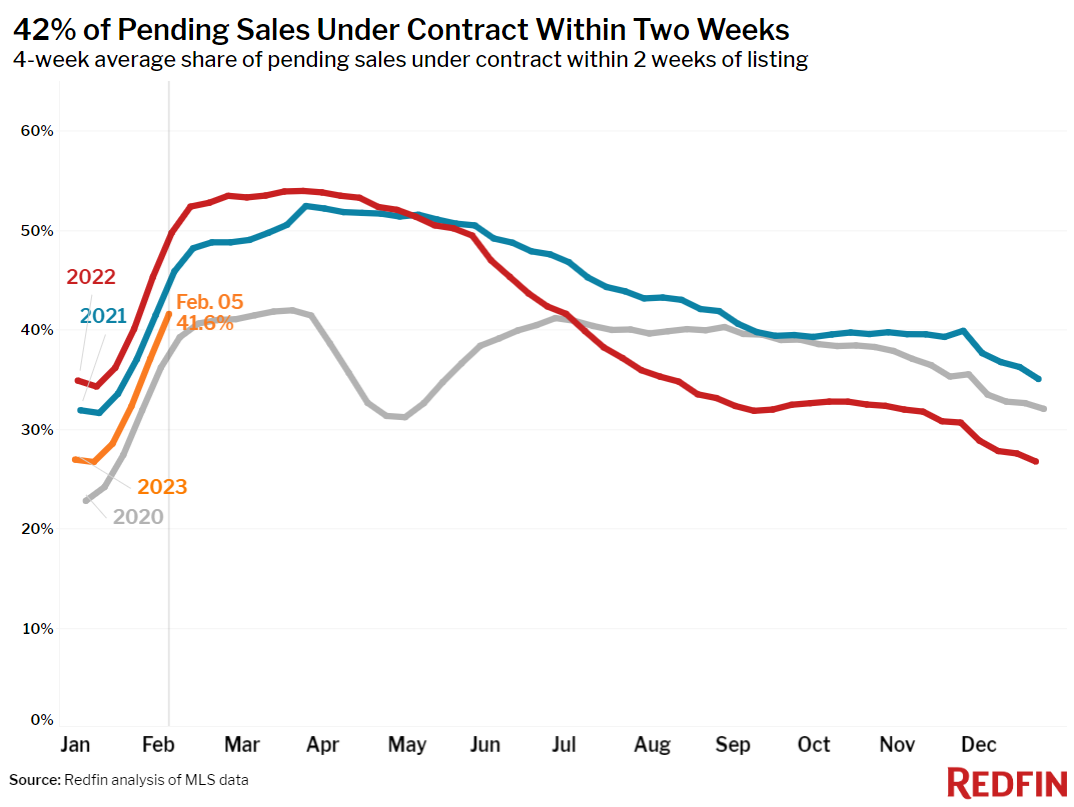

Pending home sales posted their smallest decline since September during the four weeks ending February 5, falling 20% from a year earlier, and mortgage-purchase applications rose 3% from a week earlier. Redfin’s Homebuyer Demand Index–a measure of requests for tours and other services from Redfin agents–hit its highest level since September.

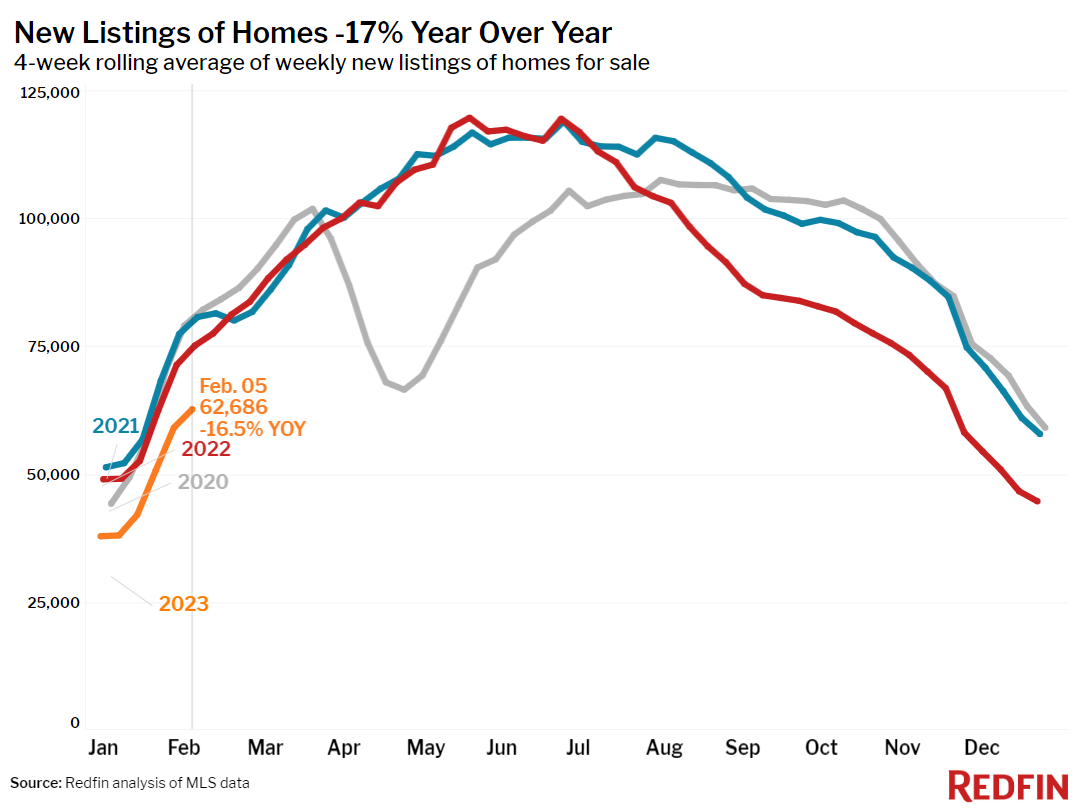

More homes are hitting the market to meet increasing demand; new listings dropped 17% from a year earlier, but that’s the smallest decline in over four months.

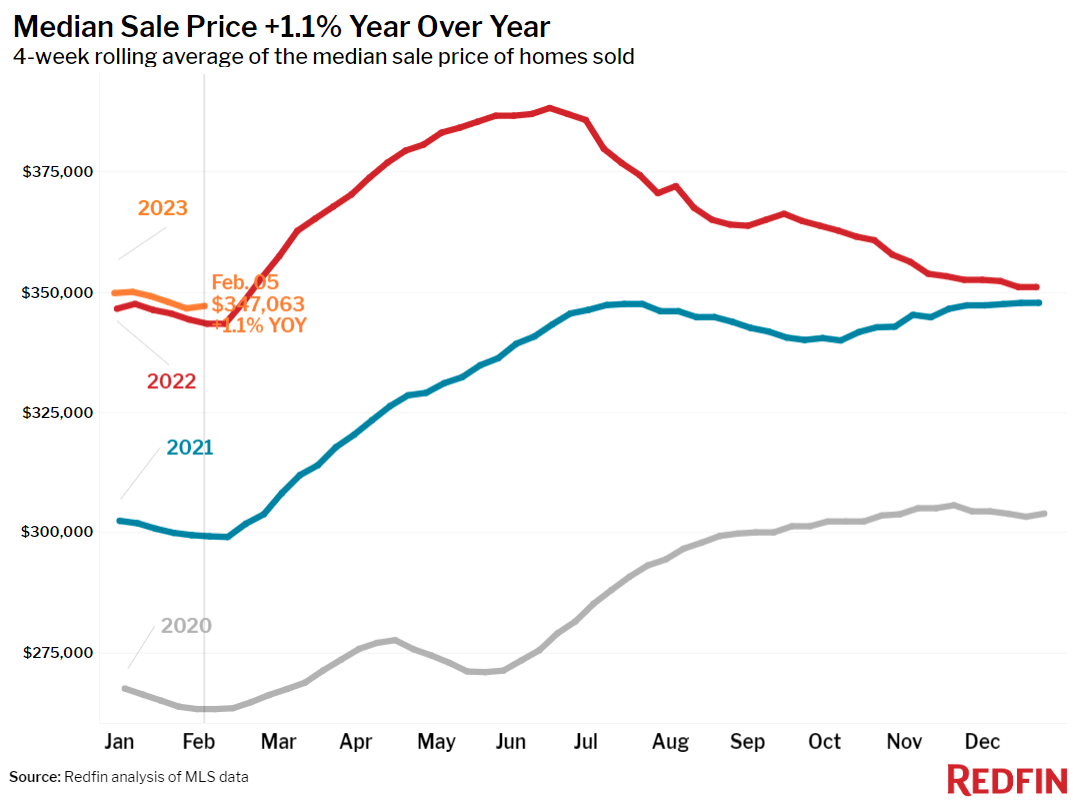

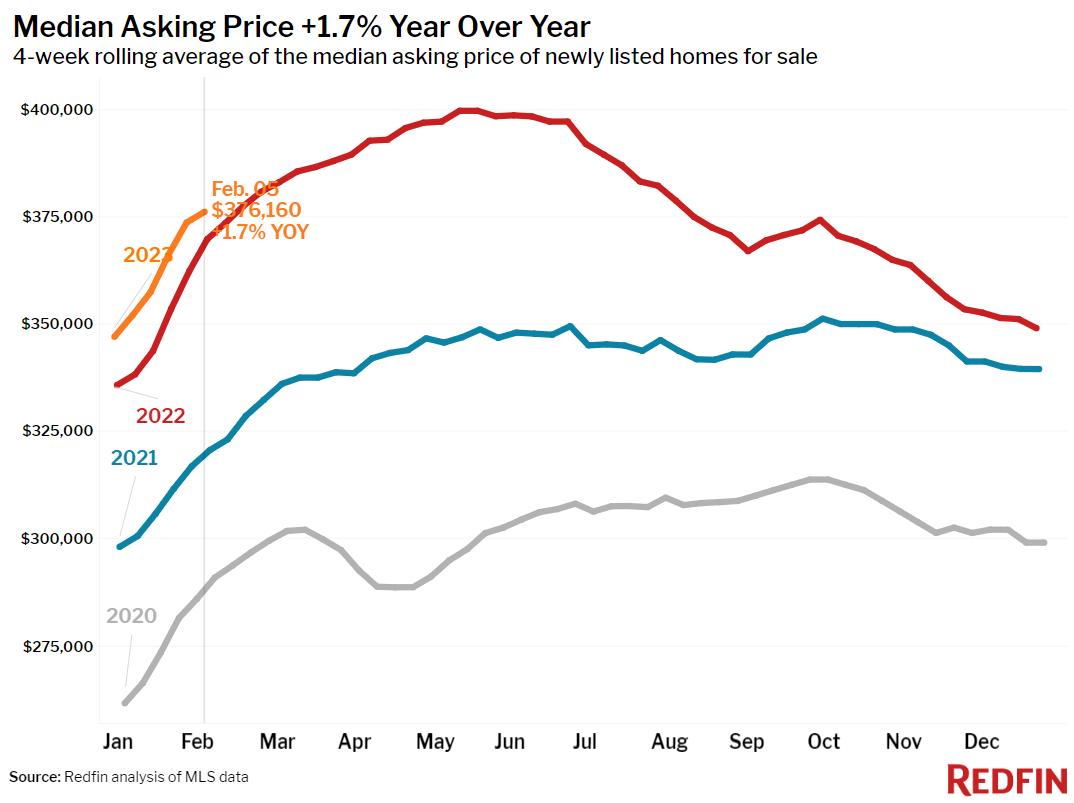

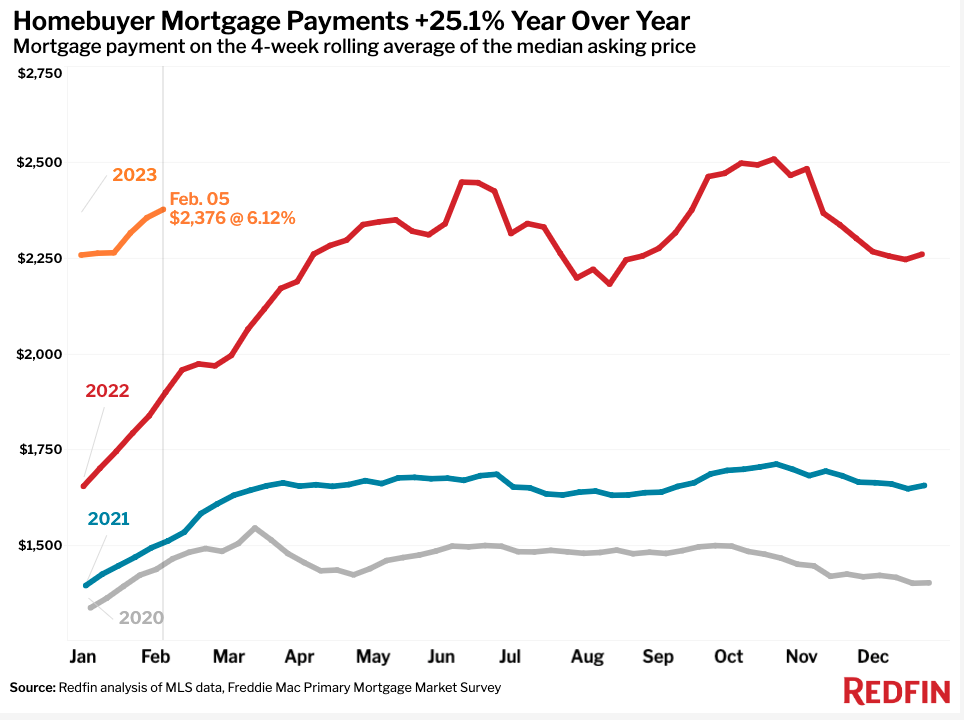

Although mortgage rates increased this week, they’re still down roughly a full percentage point from the peak they reached at the end of 2022. Rates coming down from their peak–along with home prices coming down from theirs–is the main reason buyers and sellers have started coming off the sidelines.

“By Super Bowl weekend, we usually have a good idea how a given year’s housing market will play out. But this year is anything but typical,” said Redfin Economics Research Lead Chen Zhao. “This year is more uncertain than most because the effects of last year’s rapid rate hikes are still flowing through the economy, and we’re not sure how much more the Fed will raise rates this year. So even after the Super Bowl comes and goes, we’ll be closely monitoring the Fed’s words and actions, along with inflation rates and indicators about the health of the labor market for signals that could affect homebuyer demand.”

Google searches for “homes for sale” were up about 38% from their November low during the week ending February 4, but down about 23% from a year earlier.

Unless otherwise noted, the data in this report covers the four-week period ending February 5. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.