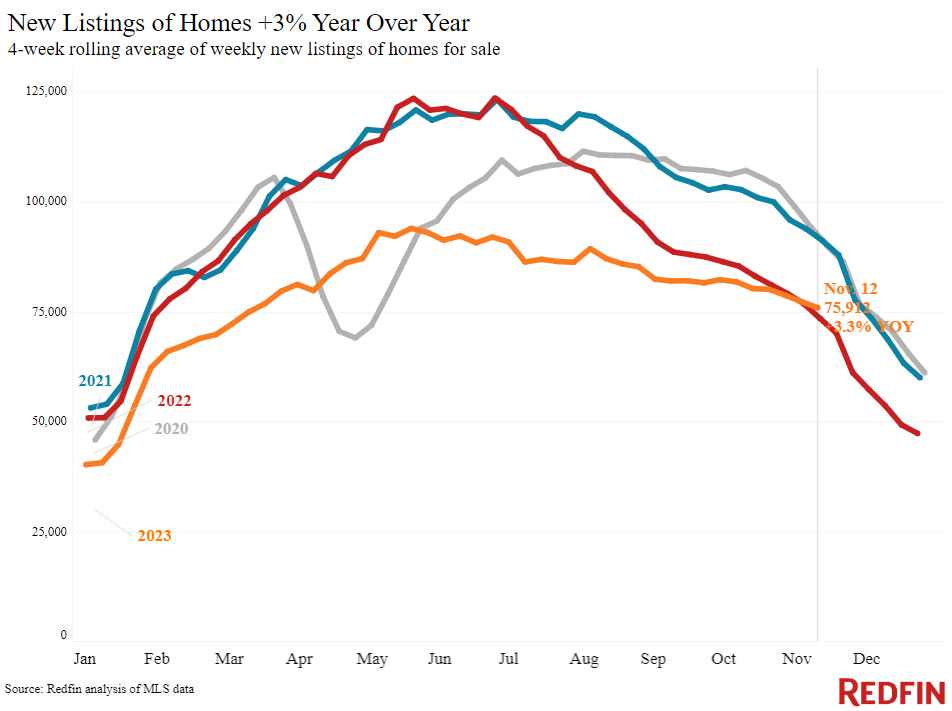

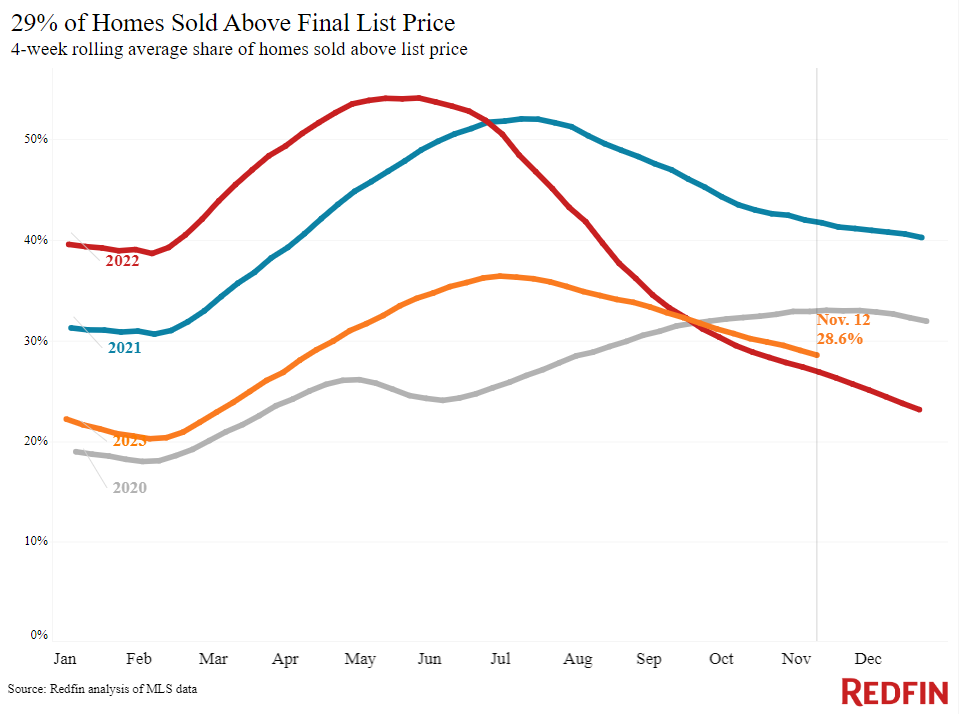

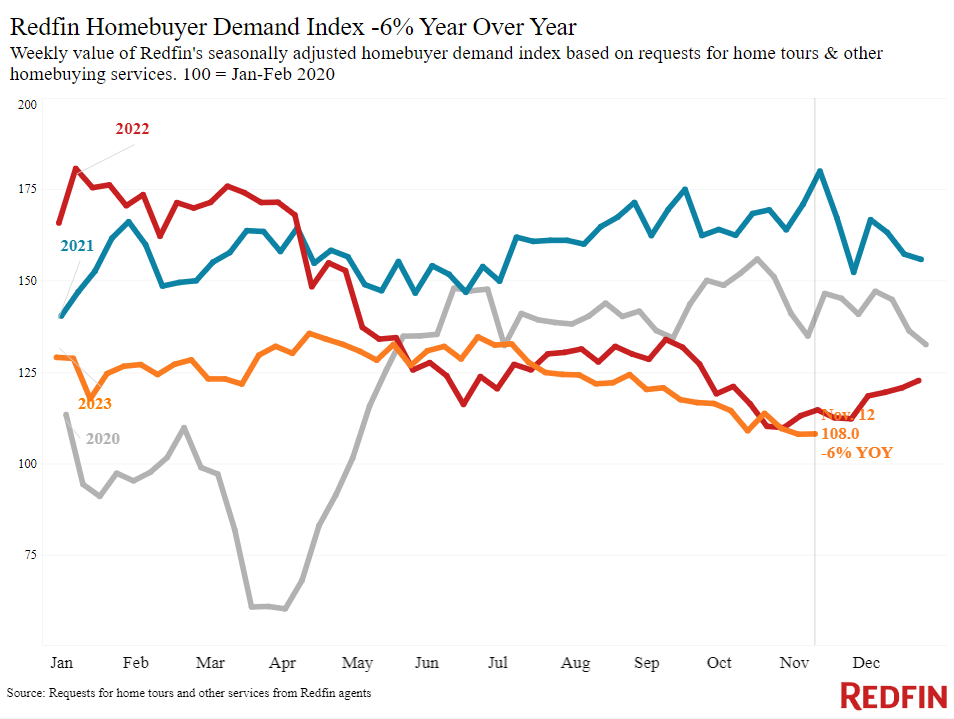

It’s a chicken-or-egg situation for homebuyers and sellers. Demand is rising partly due to an uptick in new listings, and listings are increasing partly because sellers are noticing more buyers enter the market.

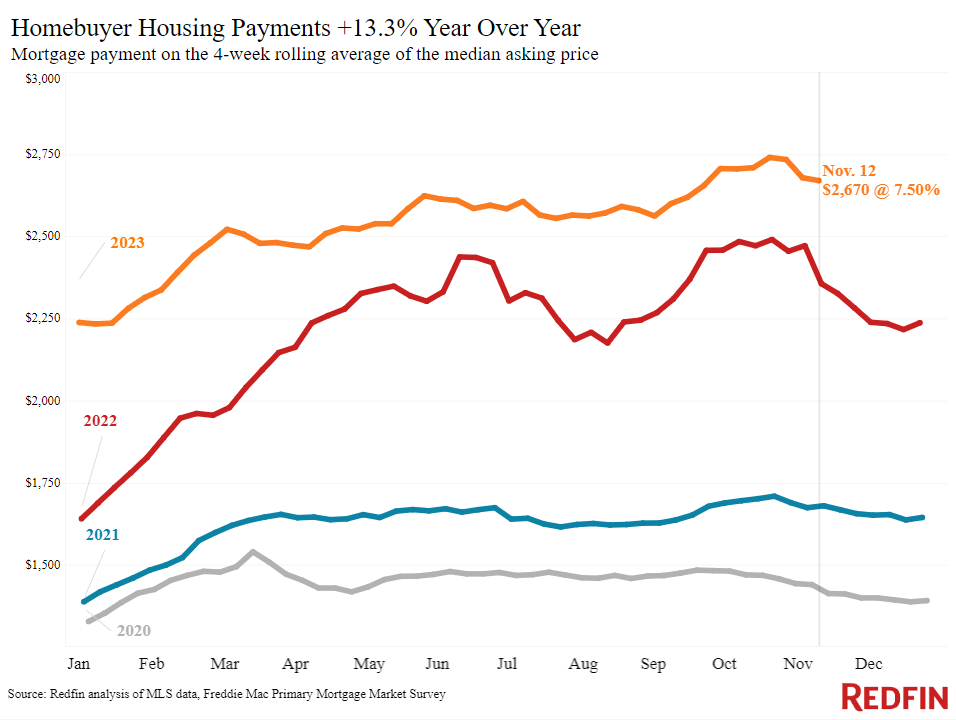

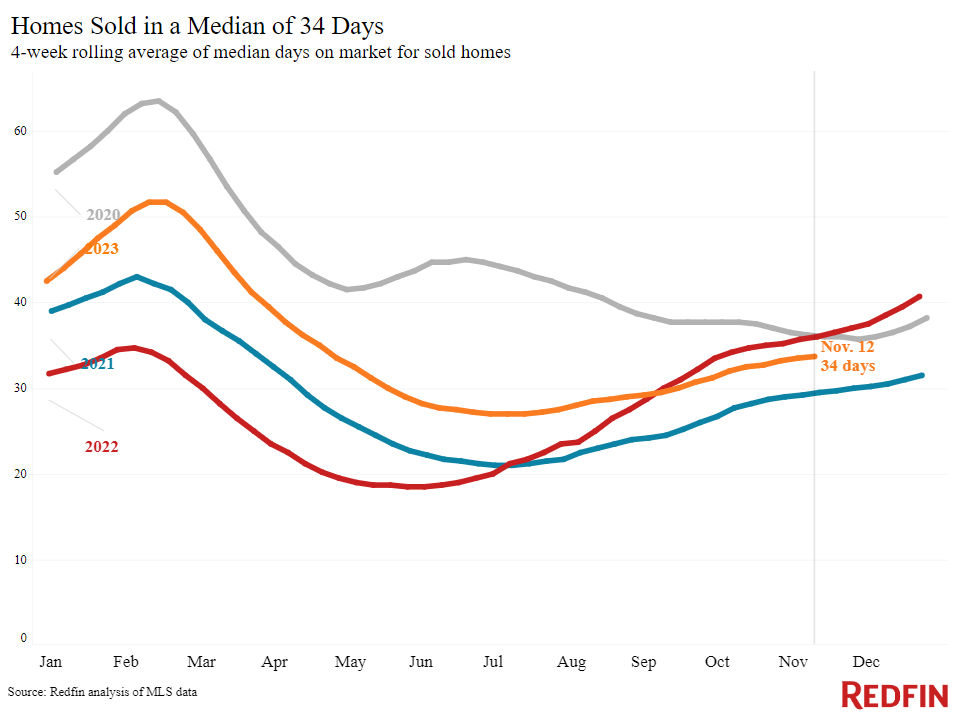

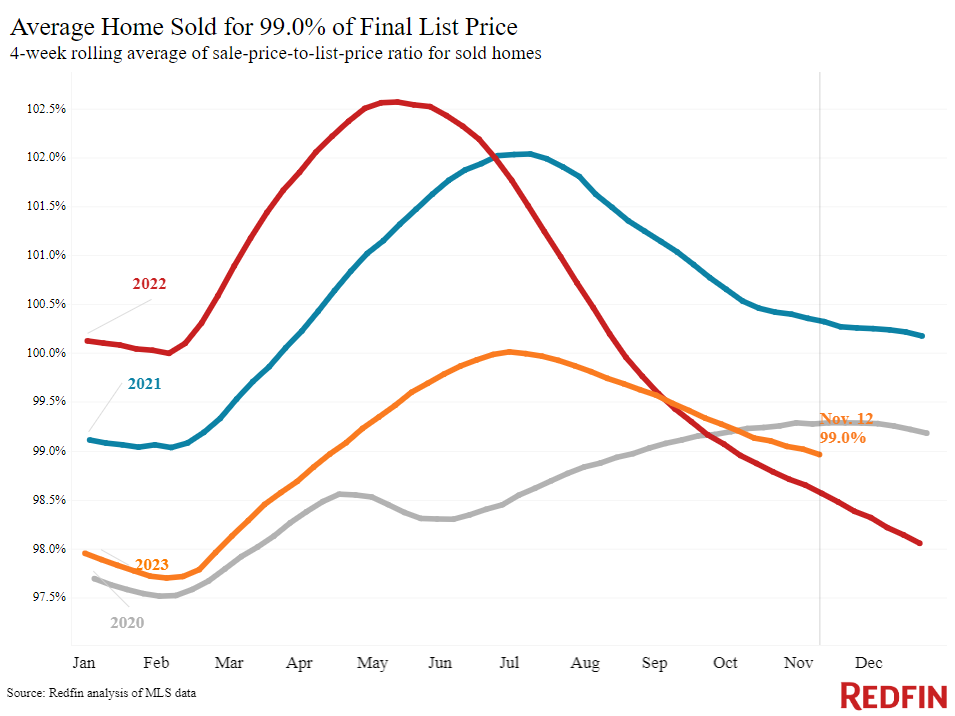

Mortgage-purchase applications are on the rise. Mortgage-purchase applications rose 3% from a week earlier during the week ending November 10, bringing them to their highest level in five weeks. That marks the second straight week of increases. And while pending home sales were down 8% year over year during the four weeks ending November 12%, that’s one of the smallest declines since April 2022. House hunters are coming off the sidelines because mortgage rates are dropping from their peak: Average rates have declined from a two-decade high of 8% to the 7.4% range in the last month.

Promising inflation report = good news for rates. Mortgage rates are declining partly because this week’s CPI report shows that inflation is easing. That means it’s almost certain the Fed won’t hike interest rates again this year–and they may start cutting rates earlier than expected.

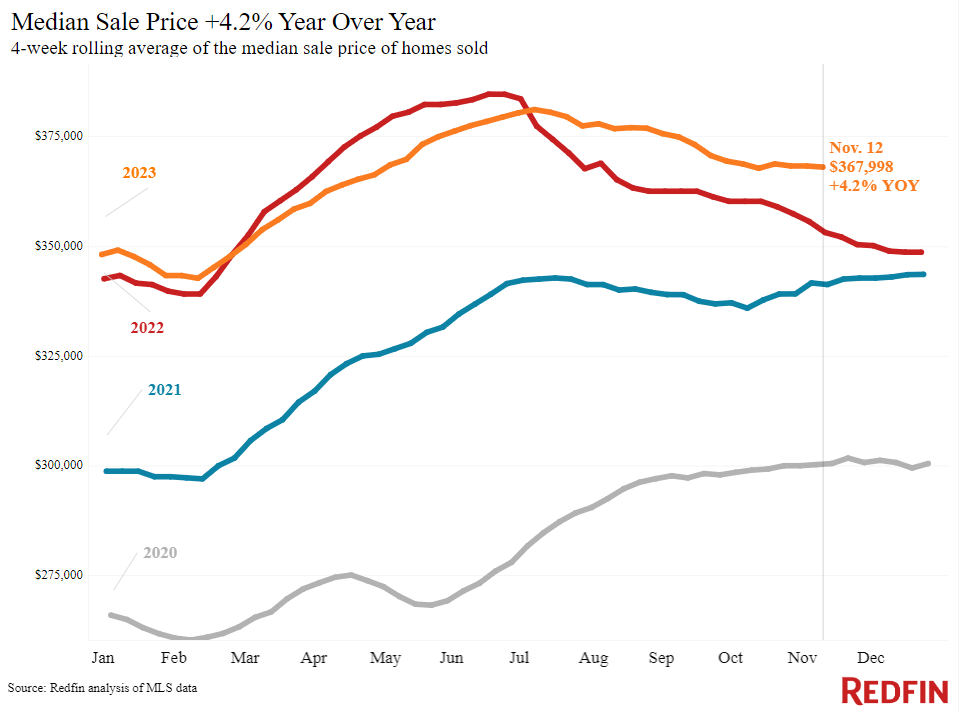

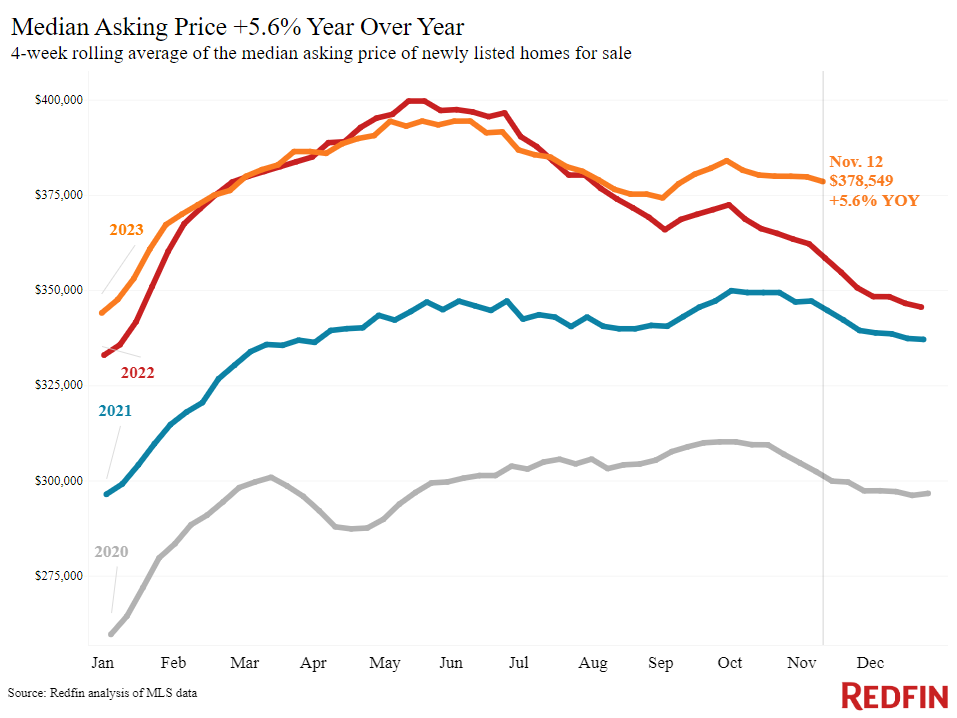

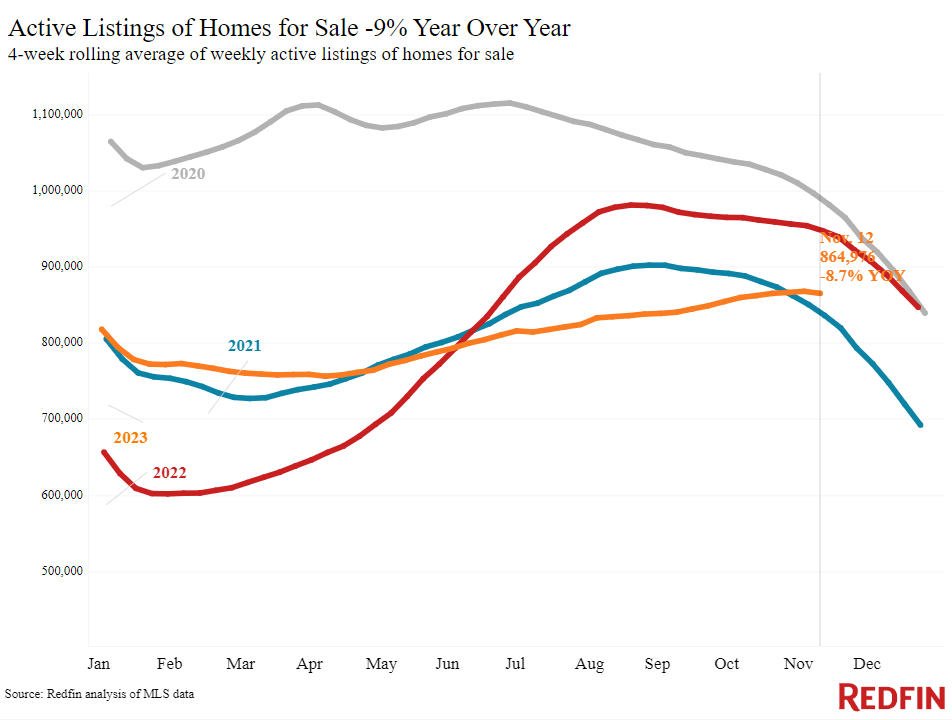

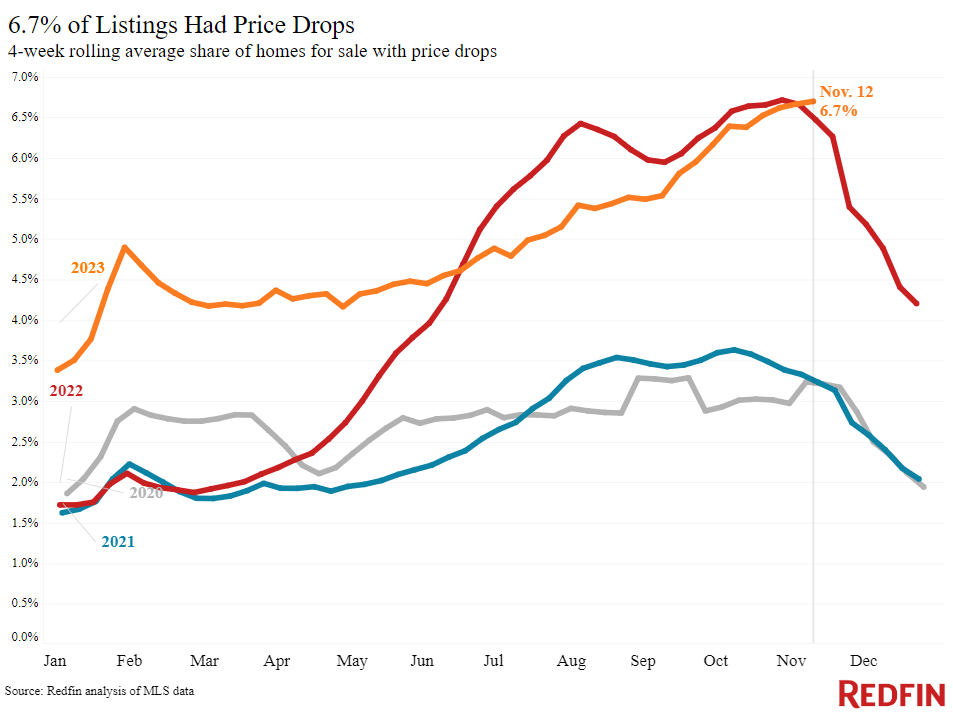

More sellers are jumping in, too. New listings of homes for sale are up 3% from a year earlier, the biggest increase in two years and just the second increase since July 2022 (the first was last week). The total number of homes for sale is near its highest level since the start of the year. There’s a variety of reasons why more homeowners are putting their homes on the market: Some are noticing the small uptick in homebuyer demand, some are worried home prices are going to decline if they wait any longer, and others are ready to give up their low mortgage rate after realizing rates are unlikely to drop back to pandemic-era levels anytime soon.

Refer to our metrics definition page for explanations of all the metrics used in this report.