This week has brought a few pieces of good news to the housing market: Mortgage rates are dropping, new listings are rising and mortgage-purchase applications are up nearly 20% from their November low point.

Daily average mortgage rates have fallen to 6.82%, their lowest level since May. This marks the first time daily rates have dipped below 7% since July. Rates dropped after the Fed brought good news to homebuyers at its December 13 meeting, indicating they’re on a path toward lowering interest rates more and sooner than expected. That’s another piece of evidence that mortgage rates are likely to drop into the mid-6% range in 2024, consistent with Redfin’s housing-market predictions.

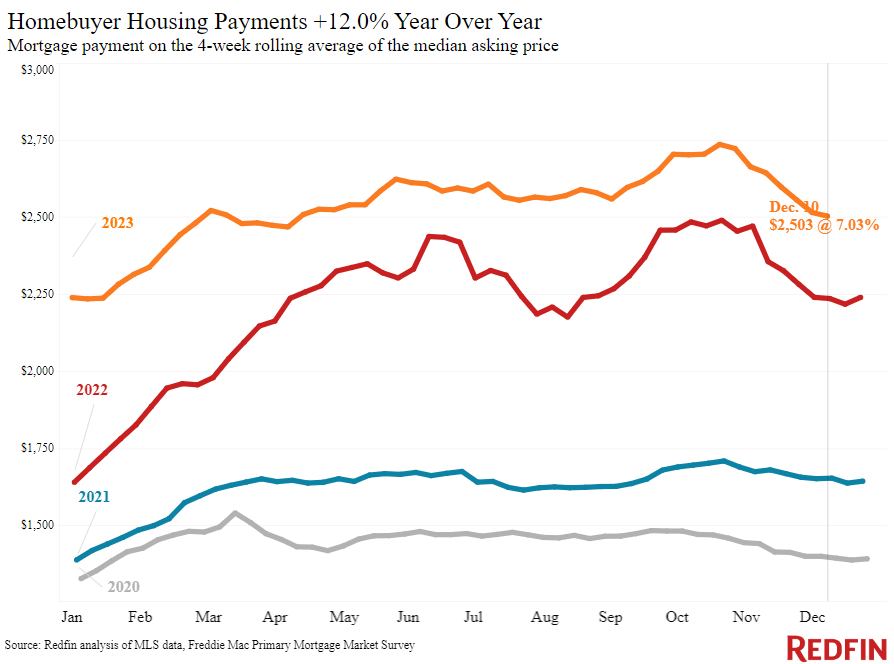

Mortgage payments are at their lowest level in eight months. Even before the Fed meeting, mortgage rates had declined substantially from their peak, bringing homebuyers some relief. The median U.S. housing payment is $2,503 as of the four weeks ending December 10, down $233 from October’s record high and its lowest level since April.

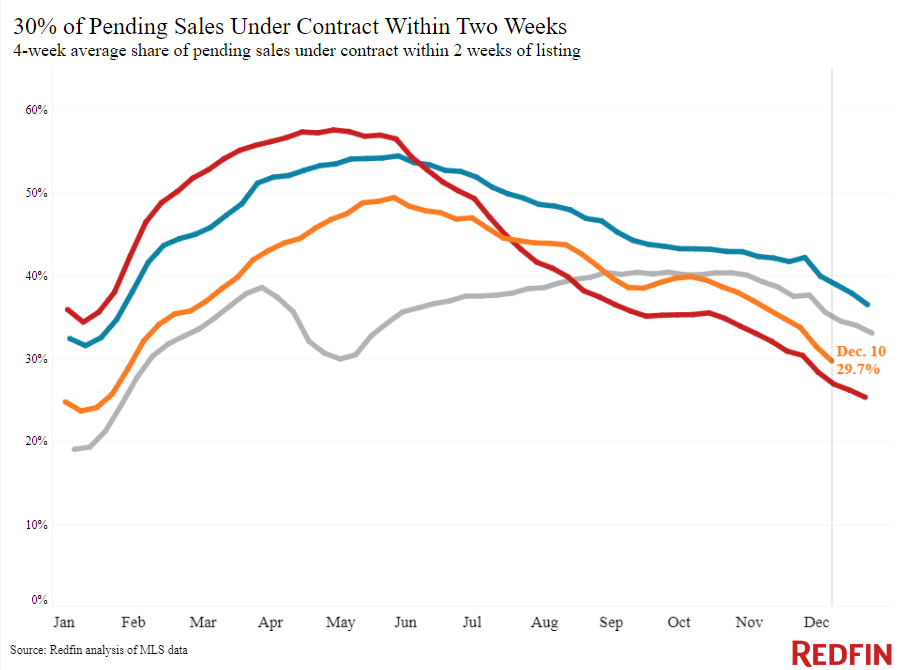

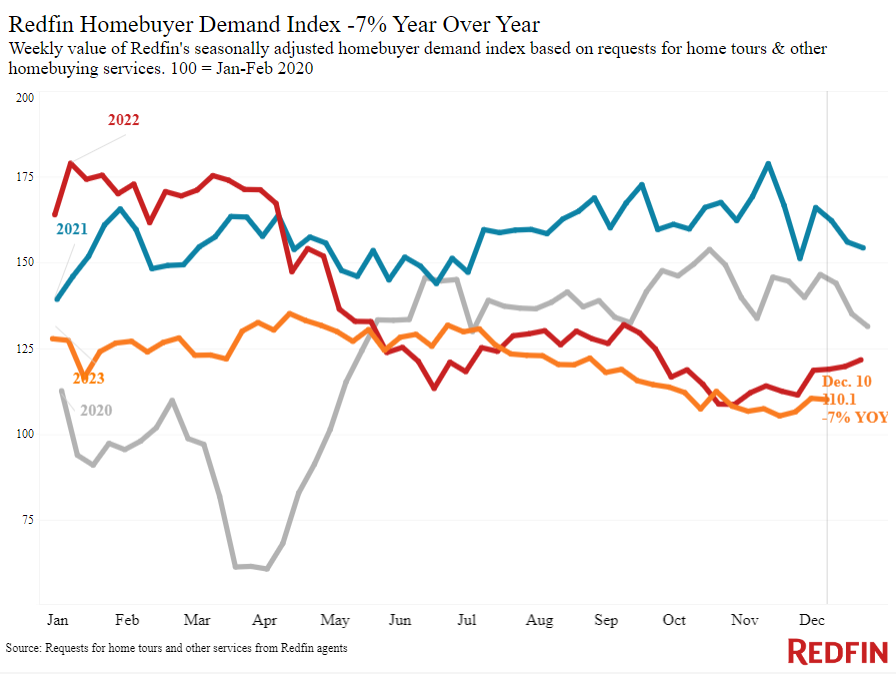

Declining costs are bringing homebuyers off the sidelines. Mortgage-purchase applications are up 19% from the three-decade low they dropped to at the start of November. And Redfin’s Homebuyer Demand Index–measure of requests for tours and other homebuying services from Redfin agents–is up 3% from a month ago.

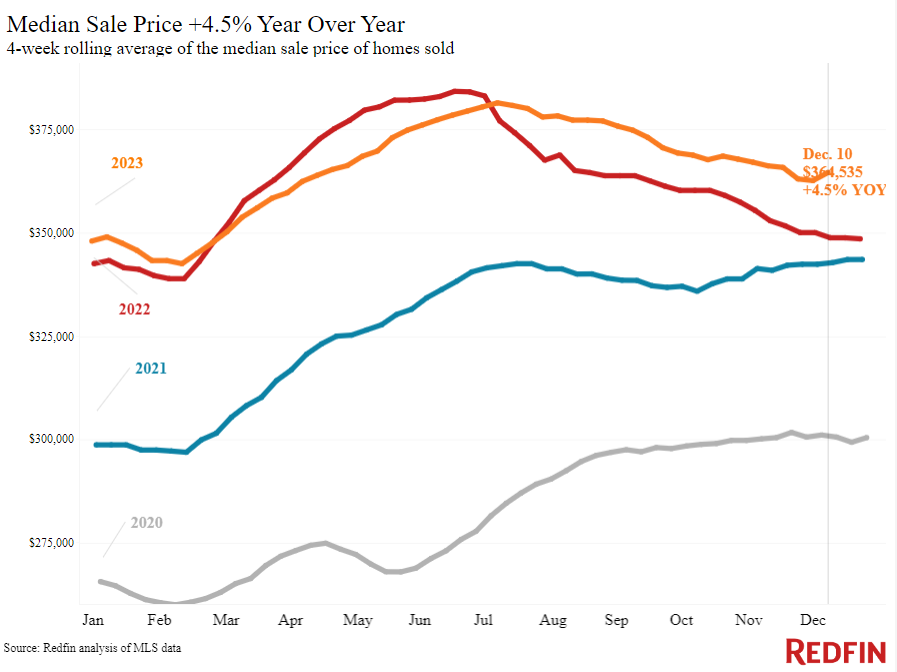

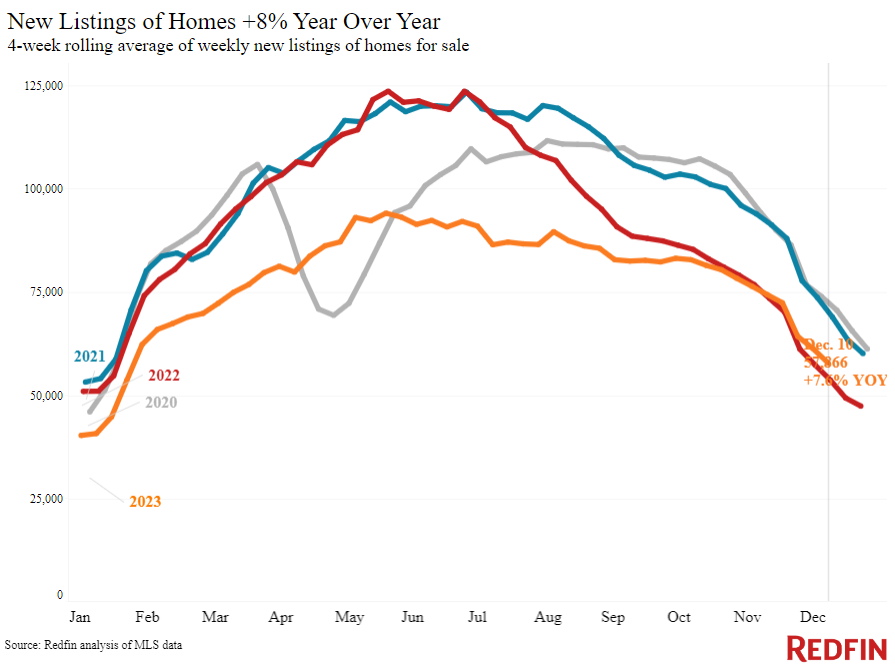

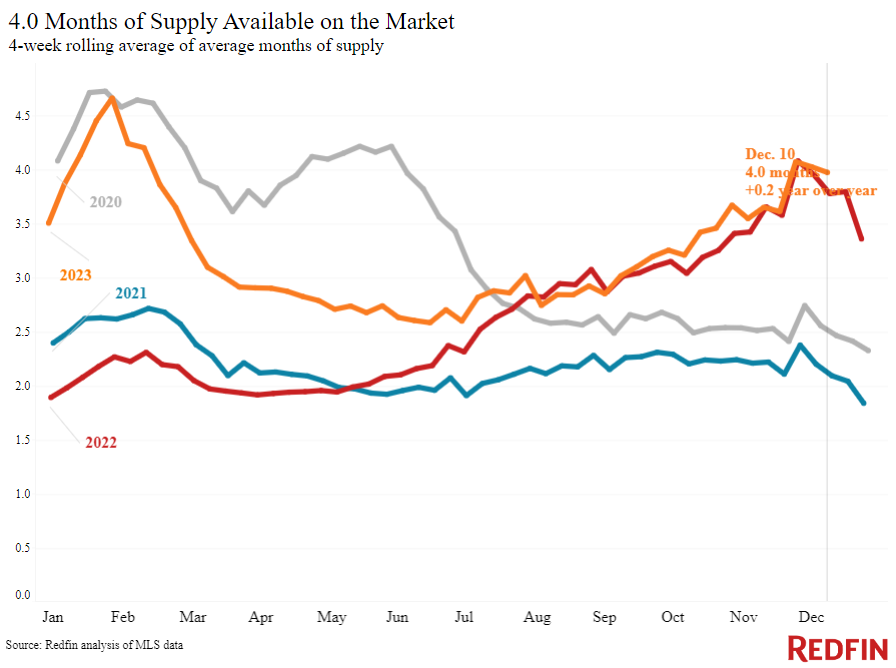

Prices and new listings rise. The median U.S. home-sale price is up 4.5% year over year, the biggest increase since October 2022. Prices are rising because demand is outpacing supply. Even though new listings are up 8% year over year–the biggest increase since July 2021–the total number of homes for sale is still down 5%.

Refer to our metrics definition page for explanations of all the metrics used in this report.