Pending home sales are down and new listings are flat during a time of year when they typically rise. But this week’s softer-than-expected inflation report sent mortgage rates down, which could bring back some homebuyers and sellers.

Pending home sales fell 4.3% from a year earlier during the four weeks ending May 12, the biggest decline in roughly three months. They also posted a week-over-week decline, unusual for early May. Inventory is losing momentum, too, as would-be sellers stay put to hang onto their low mortgage rate. New listings rose 10% year over year, but they were essentially flat from a week earlier, which is significant because listings typically increase this time of year.

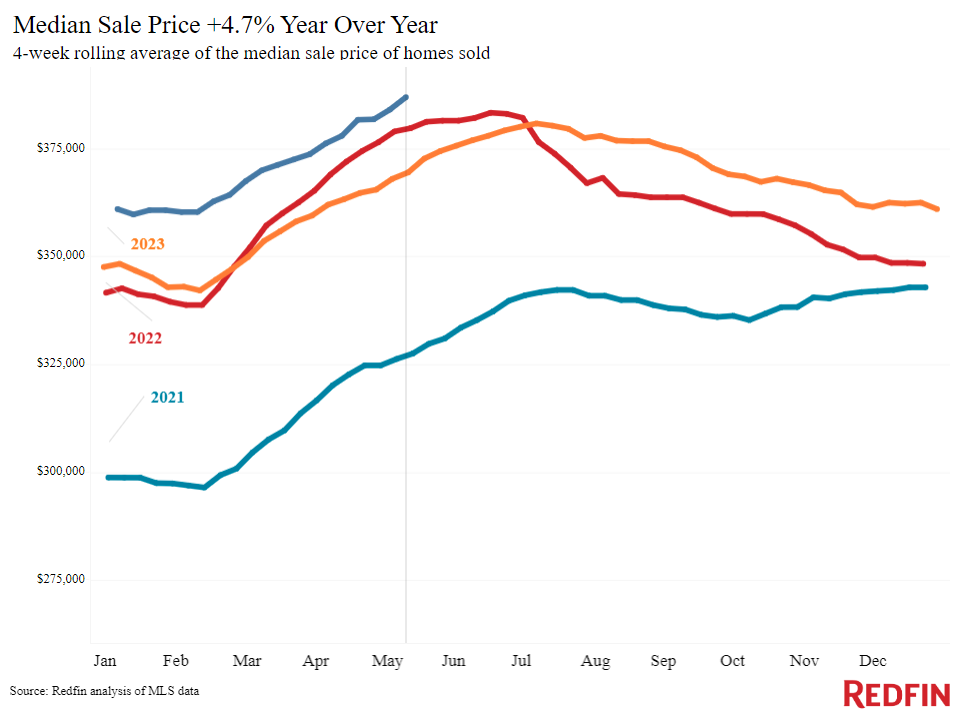

The housing market slumped because of sky-high housing costs. The median U.S. home-sale price is up 4.7% year over year to a record $386,951, and the median monthly mortgage payment is sitting at $2,858, just $26 shy of the all-time high set in April. But affordability is starting to improve a bit: Daily average mortgage rates have steadily declined since the start of May, and this week’s slightly softer-than-expected inflation report sent rates below 7% for the first time in over five weeks. And 6.3% of home sellers are dropping their price, on average, the highest share in a year and a half, which may mean price growth loses momentum soon.

“High prices and rates are challenging, but there are ways for buyers to take advantage of the somewhat slow market,” said Marsha McMahon-Jones, a Redfin Premier agent in Palm Springs, CA. “Sellers know that high mortgage rates mean they should expect negotiations, expect offers to come in under list price, and be ready for some back and forth on things like repairs and closing costs. Buyers may not be able to get a lower mortgage rate, but they’re often getting homes for slightly less than the asking price. It’s also a good time to buy a fixer-upper at a lower price point because those aren’t selling as quickly.”

For Redfin economists’ takes on the housing market, including how current financial events like the latest CPI report are impacting mortgage rates, please visit Redfin’s “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.