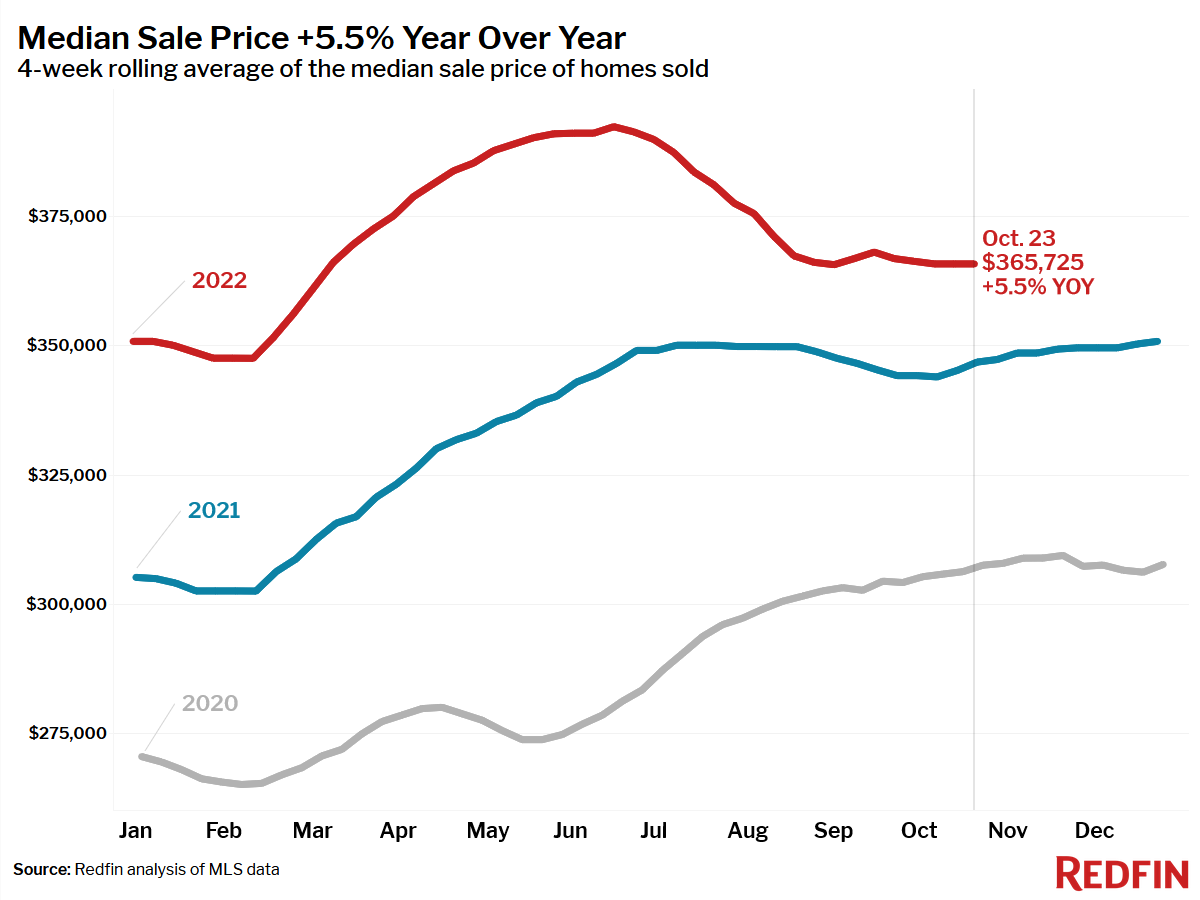

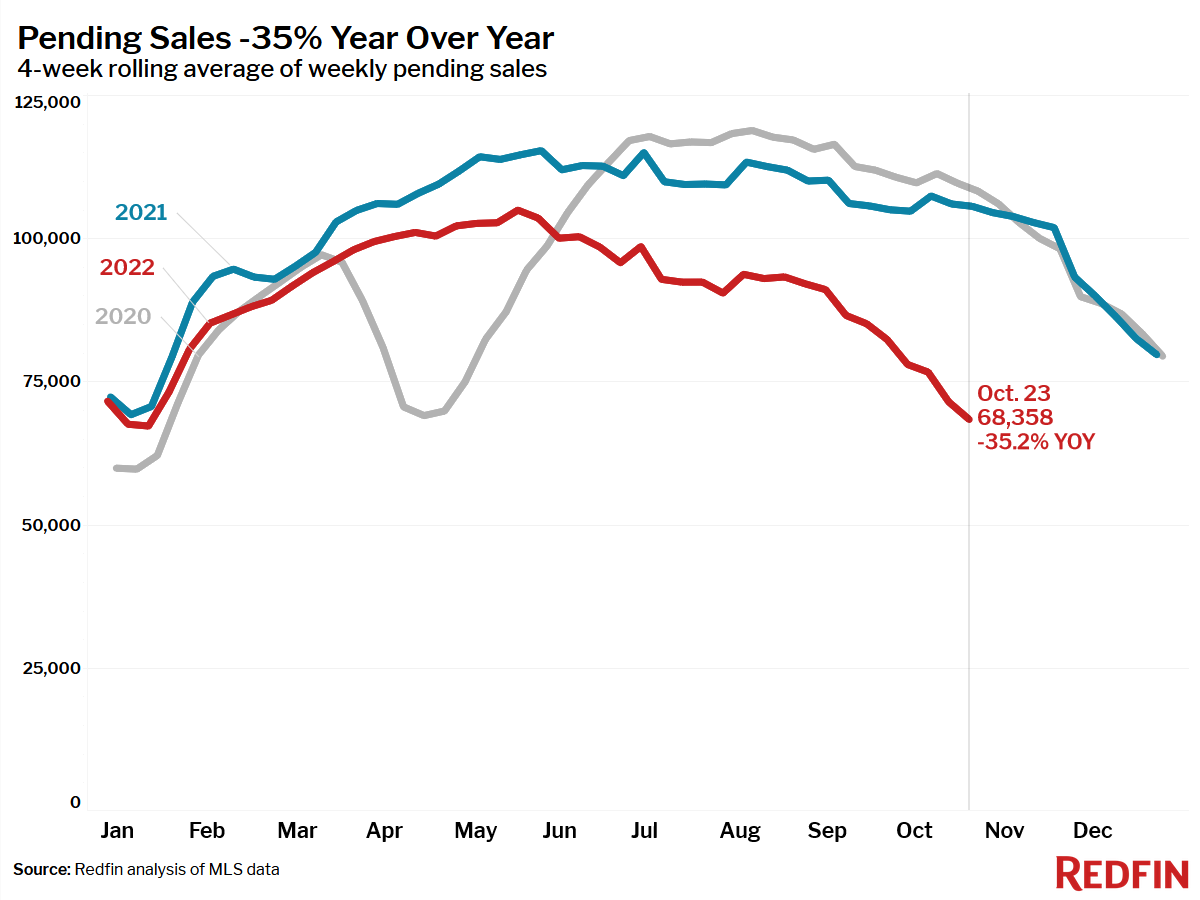

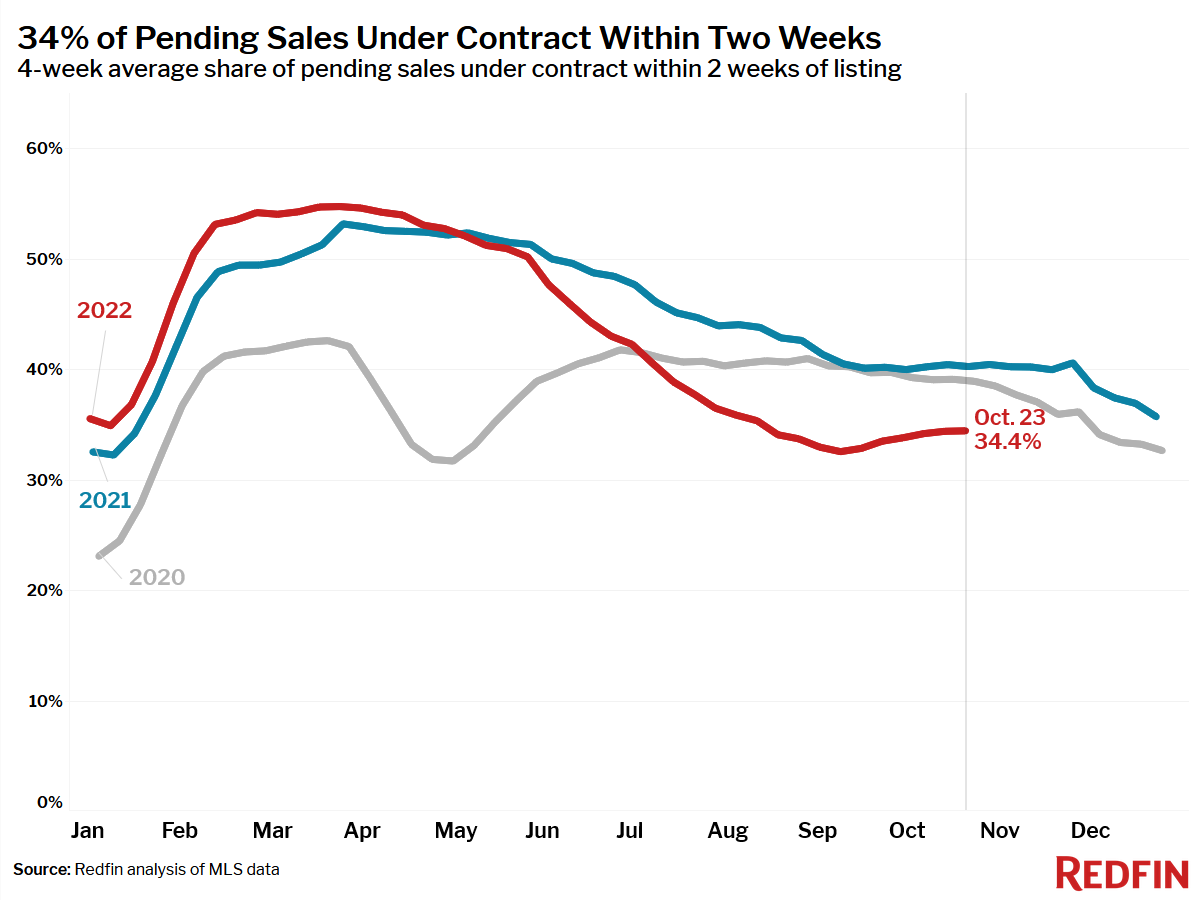

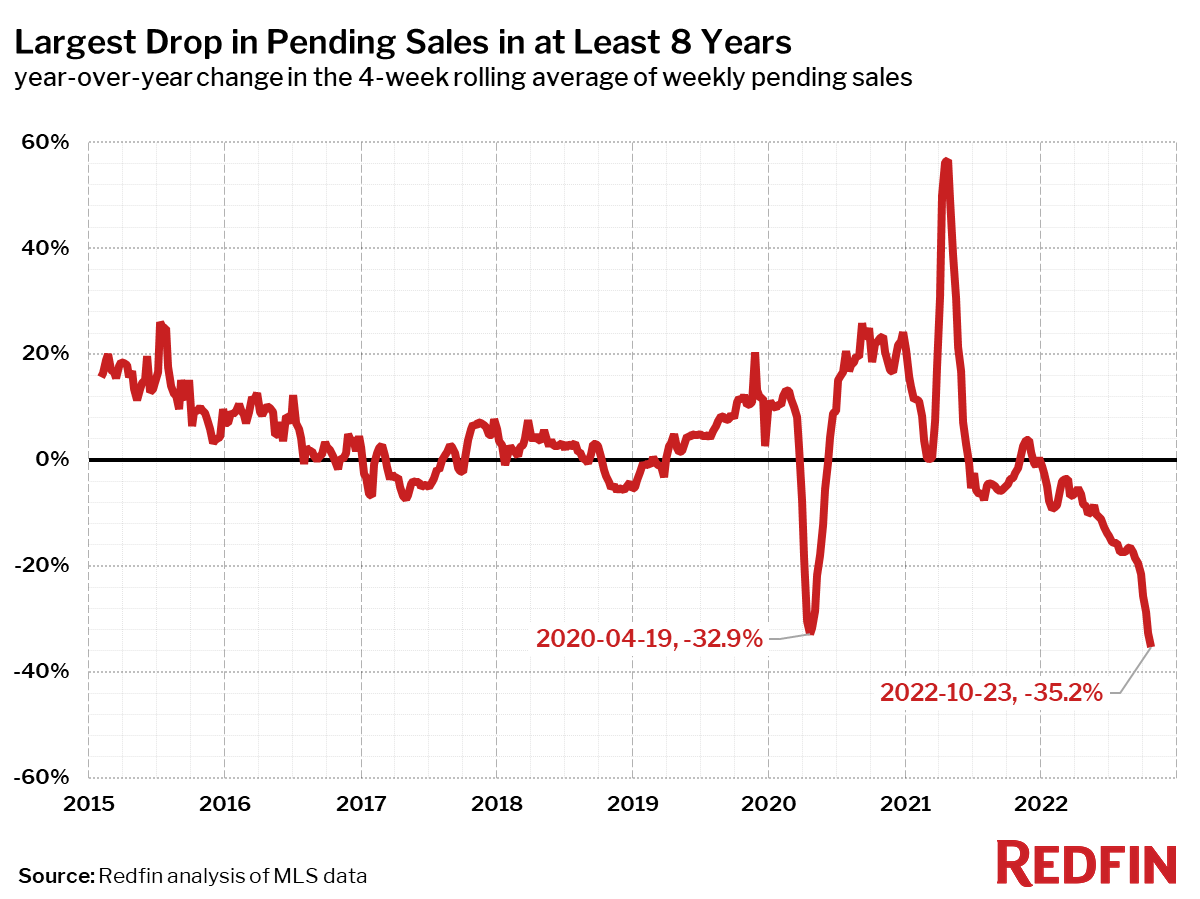

U.S. pending home sales fell 35% year over year during the four weeks ending October 23. That represents the largest annual decline and the fewest homes under contract in any October since at least 2015, when Redfin’s weekly housing market records began.

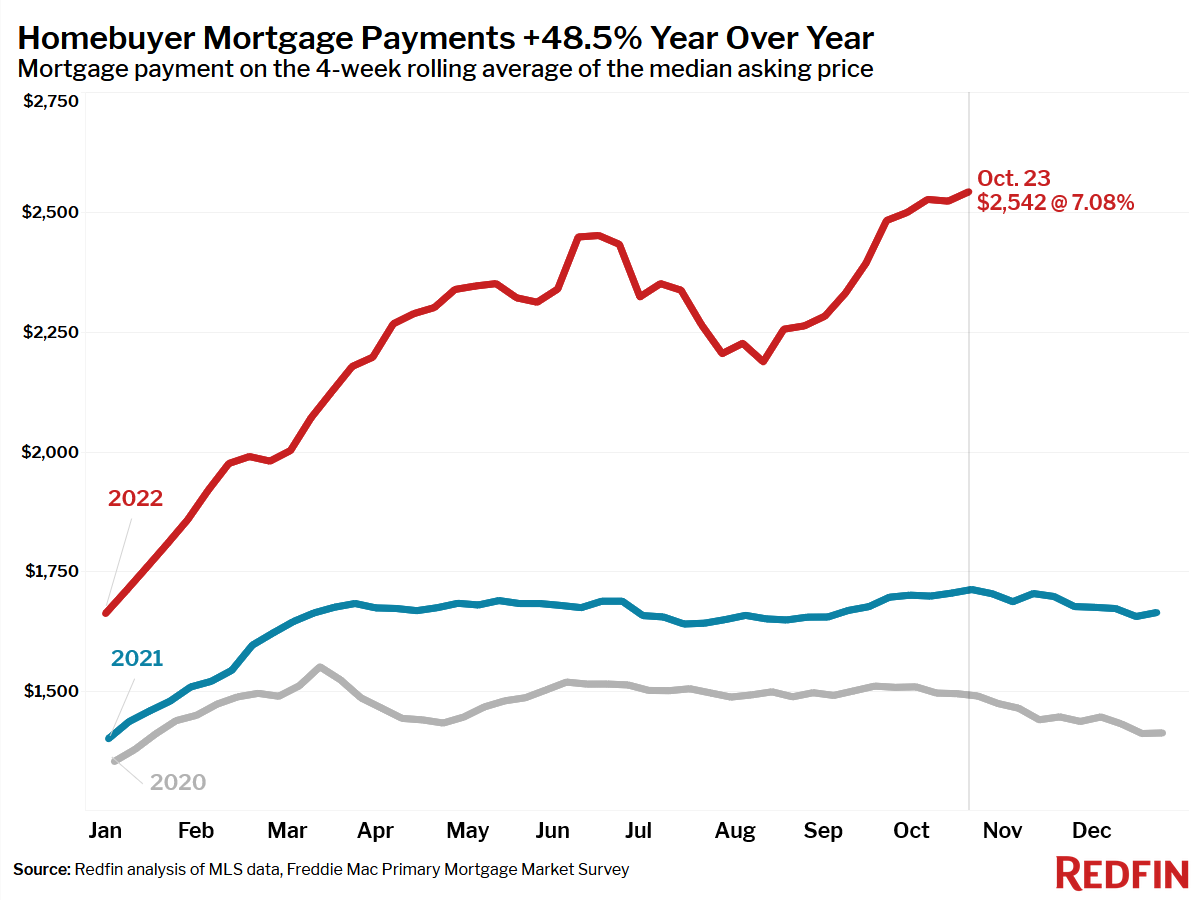

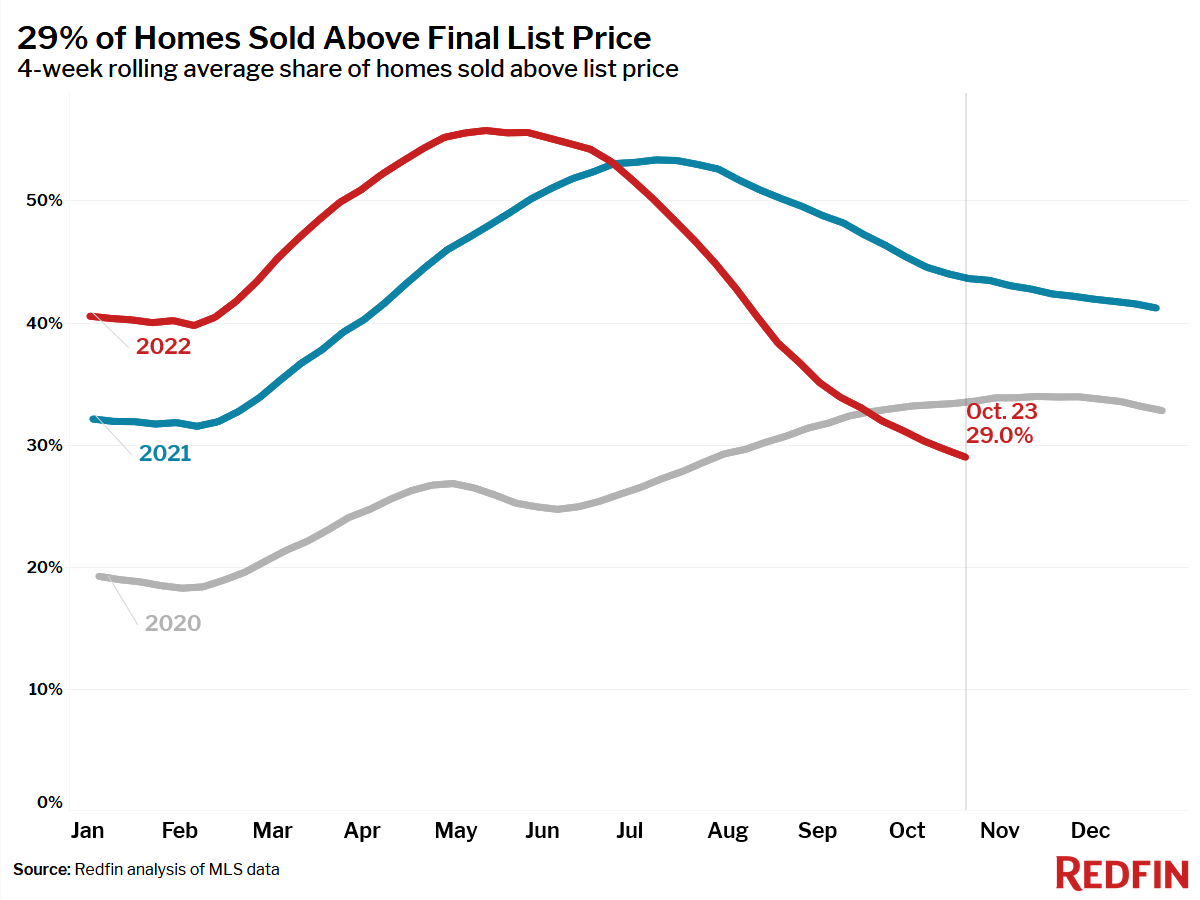

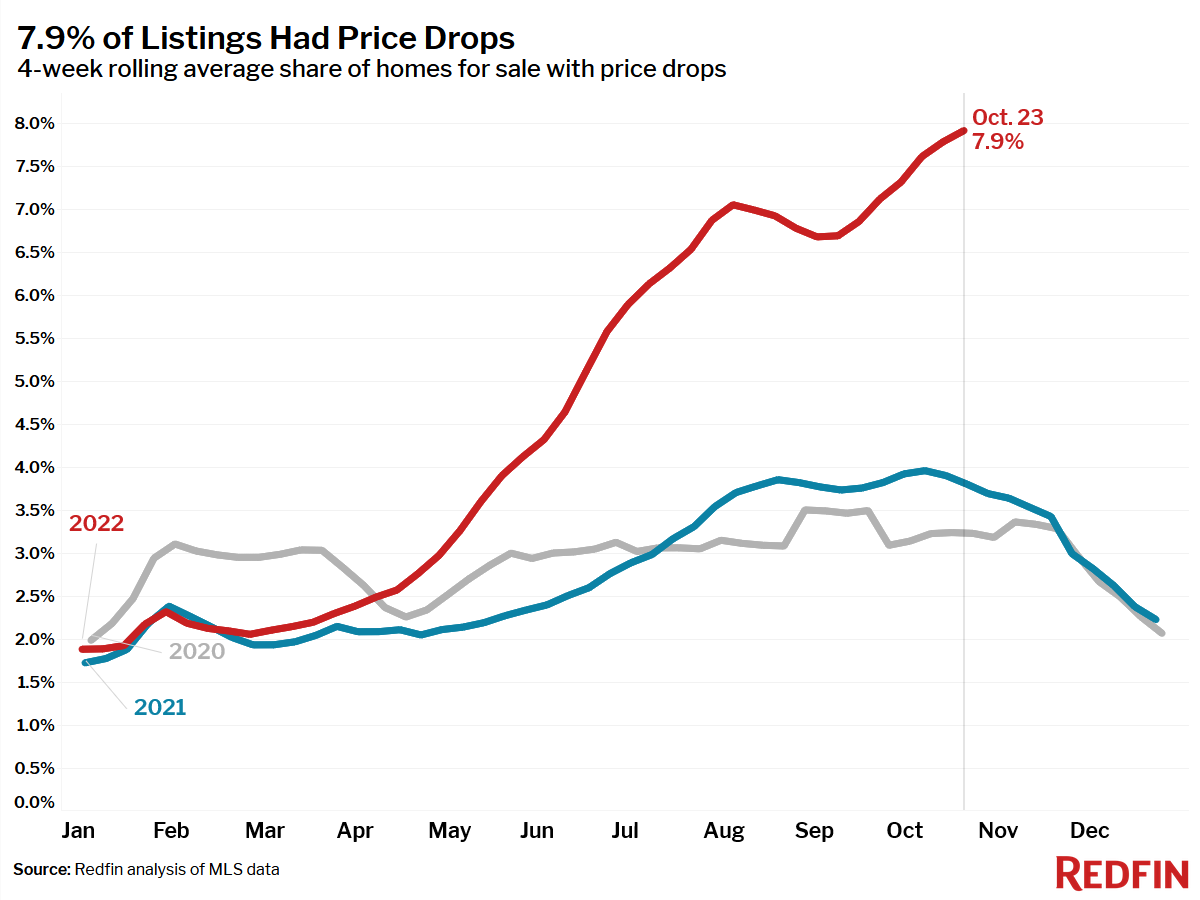

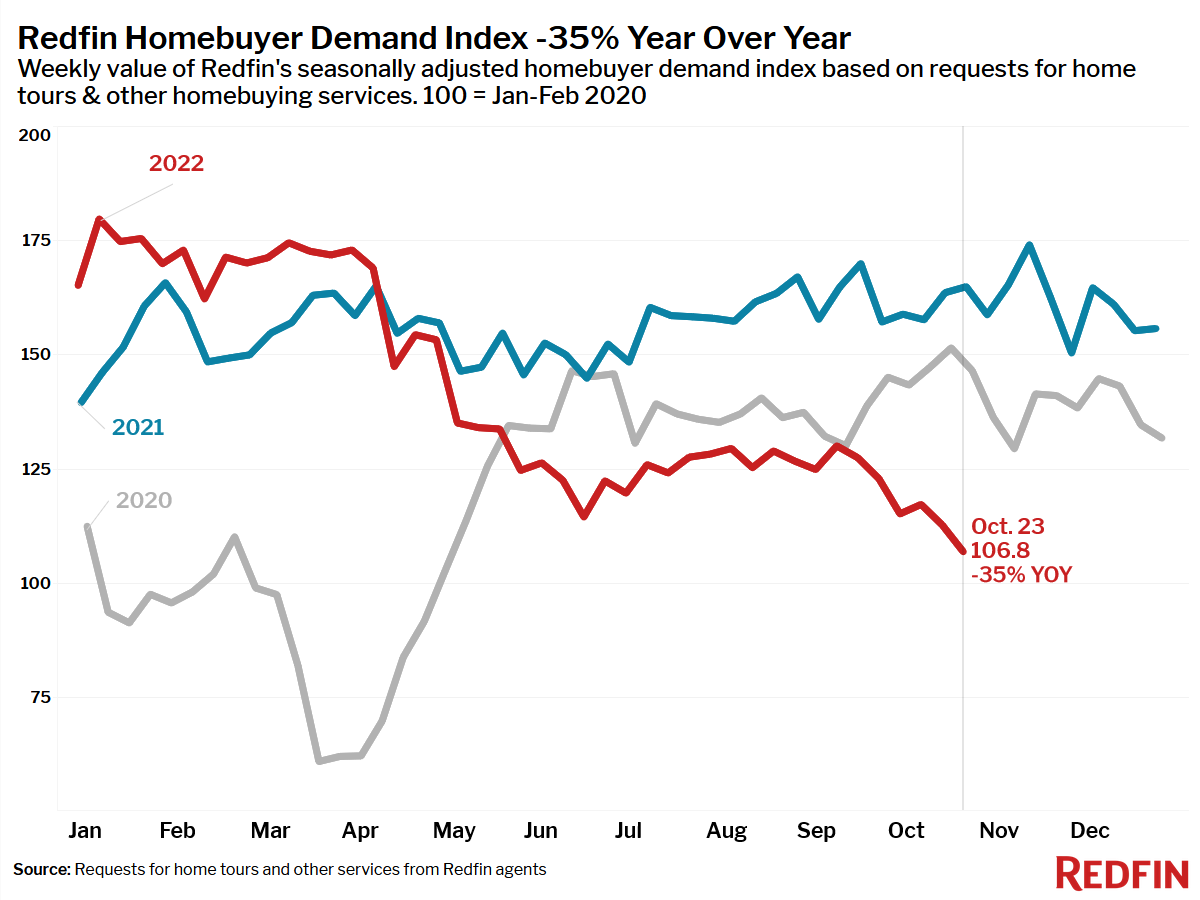

“Until this month, the pullback in the housing market could be described as something of a return to pre-pandemic conditions before sub-3% mortgage rates ignited a homebuying frenzy in 2020 and 2021,” said Redfin Deputy Chief Economist Taylor Marr. “But now both mortgage purchase applications and pending sales are below 2018 levels. A four-year setback is a serious correction. With mortgage rates still elevated, we are in for further sales declines, but those should eventually bring price relief to those who need to move this winter.”

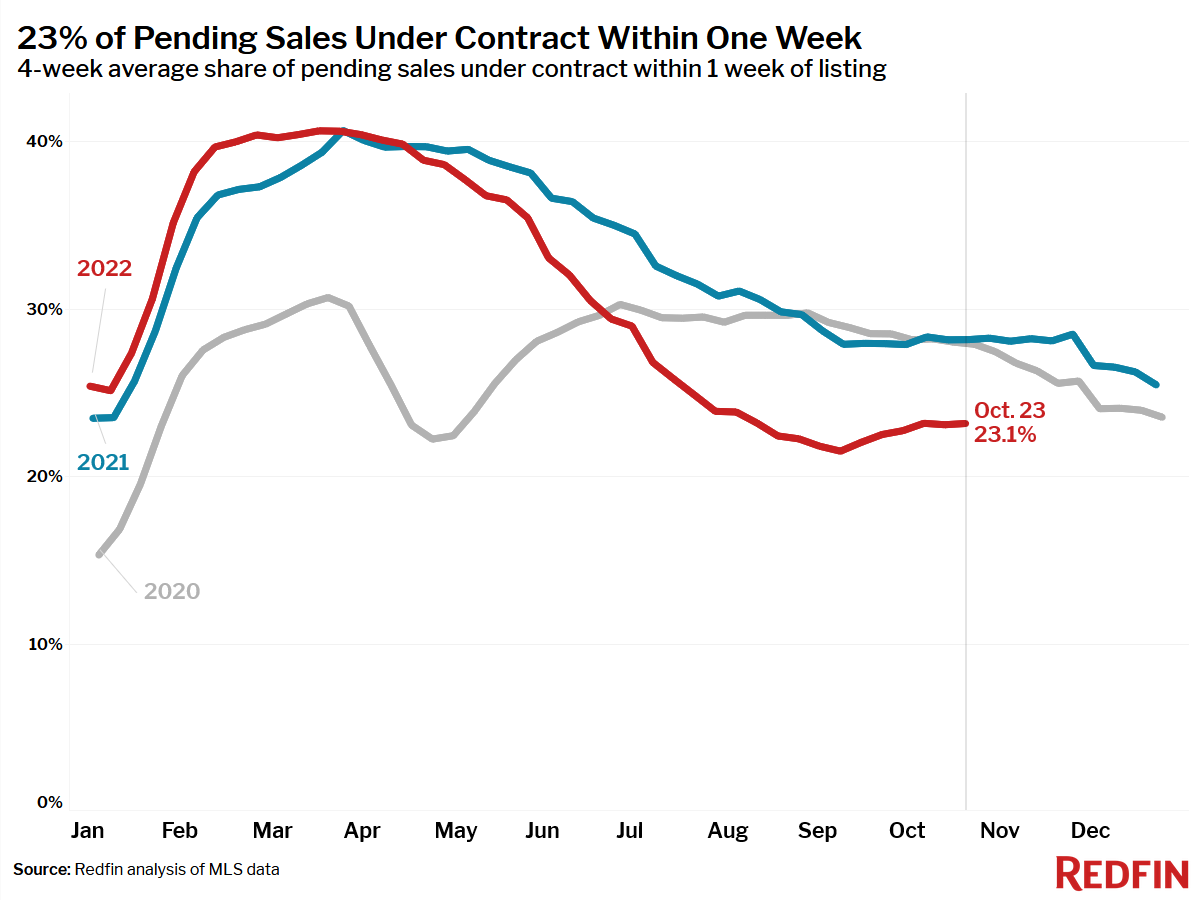

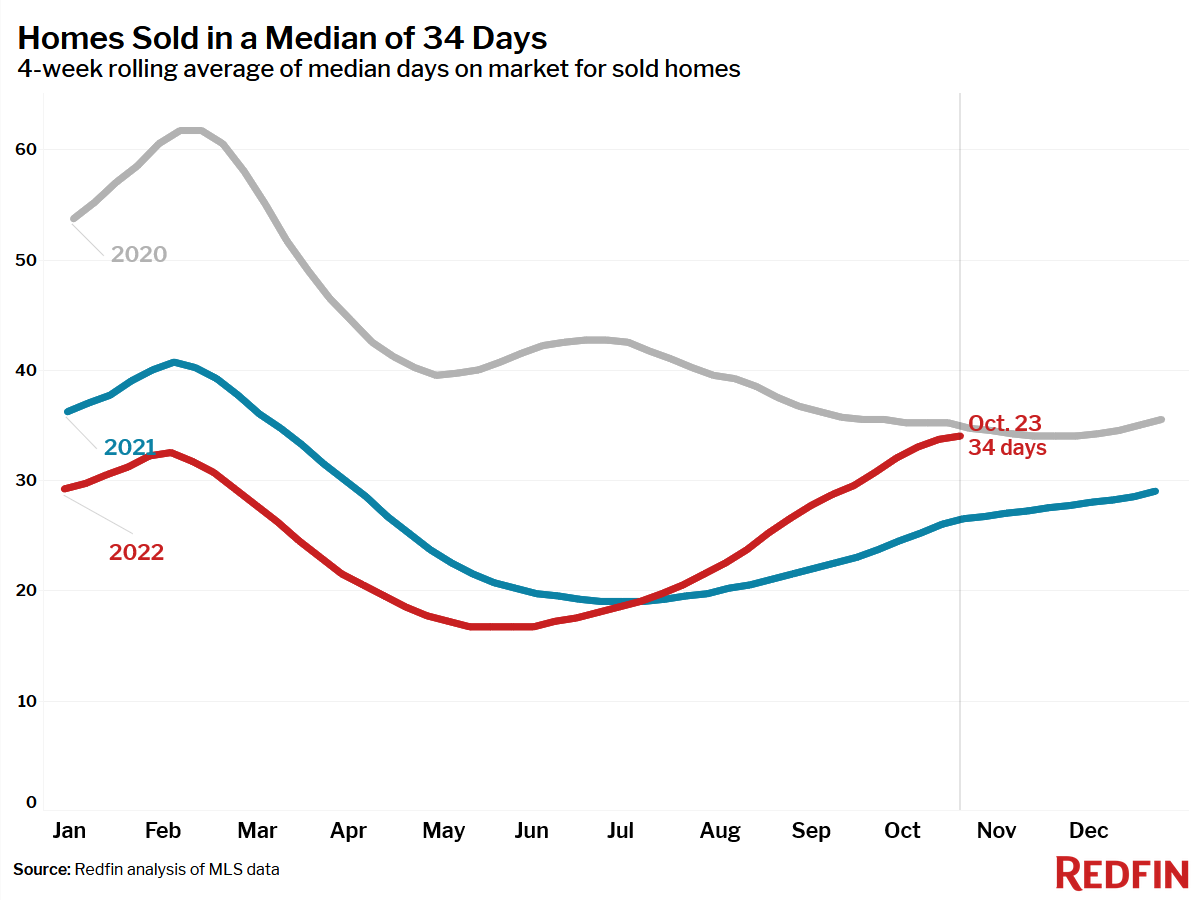

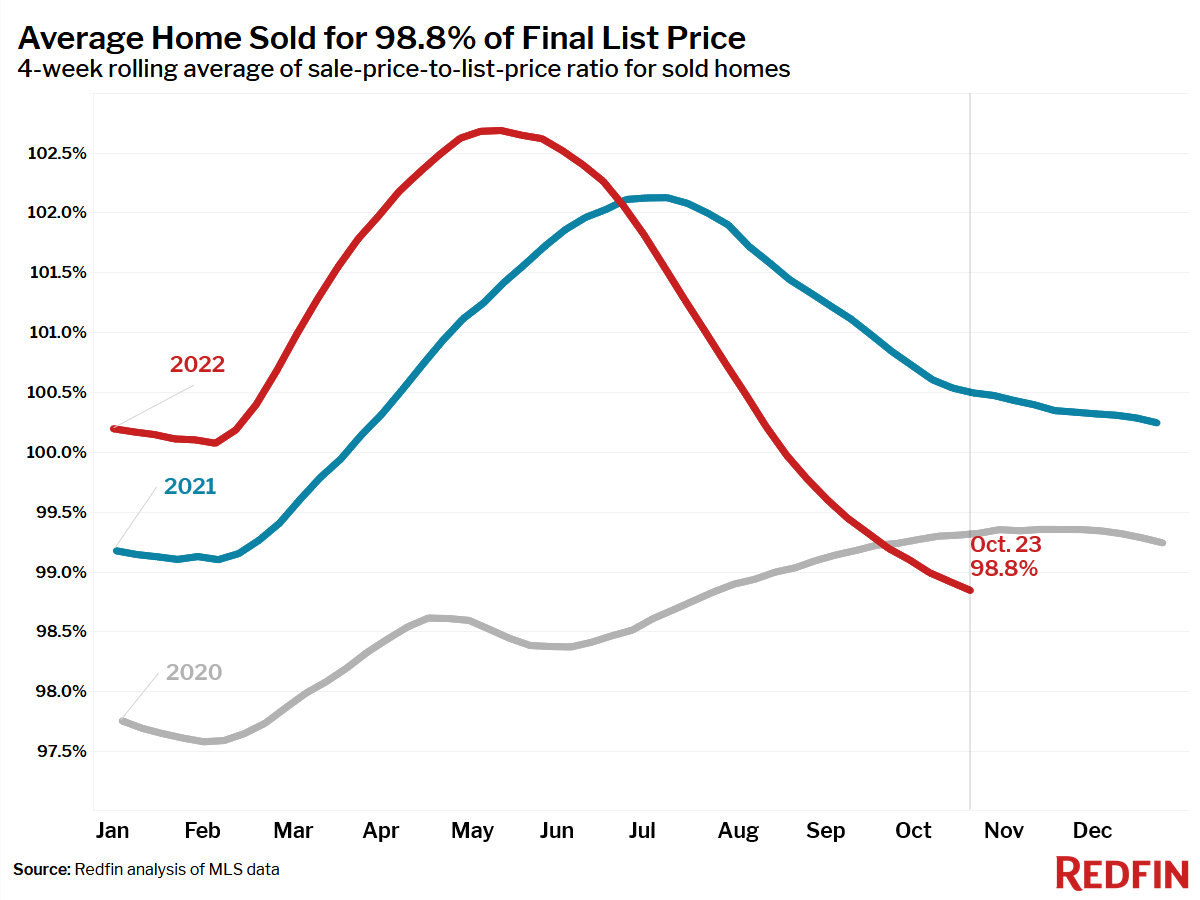

“Every set of market conditions comes with its own tradeoffs,” said Sacramento Redfin real estate agent Michael Cendejas. “In the spring, buyers had to race and wager over homes that flew off the market within a week. Today, many homes are staying on the market for a month or two. While mortgage rates are much higher now, buyers have the opportunity to negotiate. We’ve gotten sellers to agree to a lower price and to provide a credit, which enables the buyer to buy down their mortgage rate to below 6%.”

Unless otherwise noted, the data in this report covers the four-week period ending October 23. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.