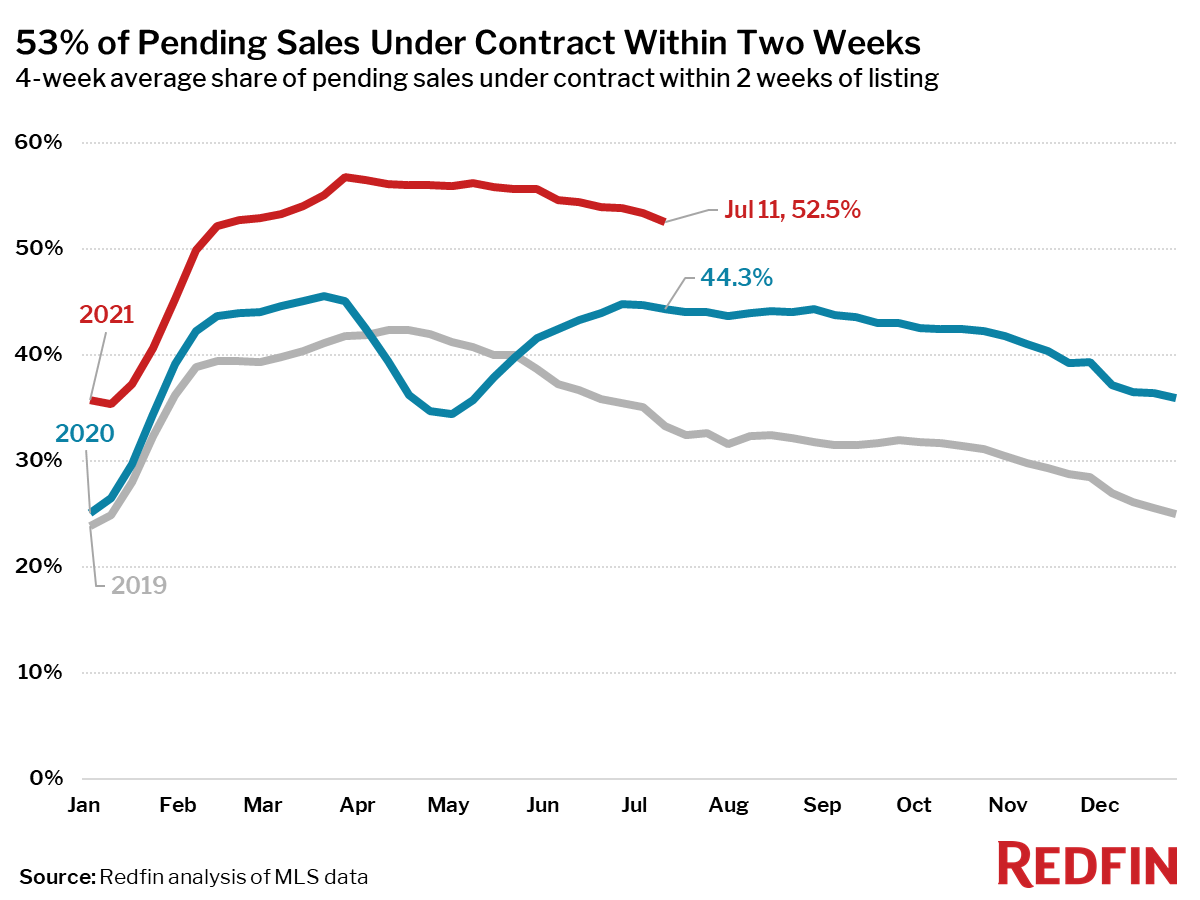

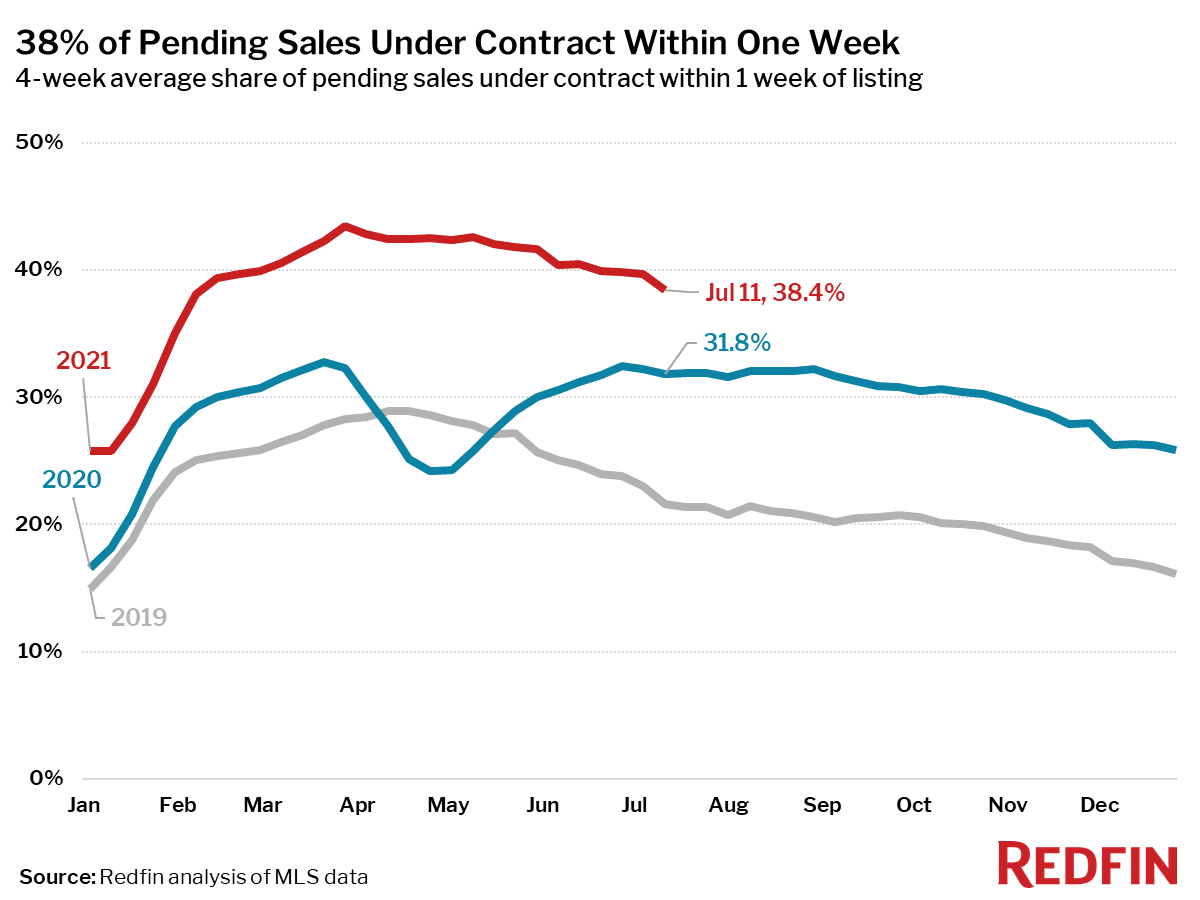

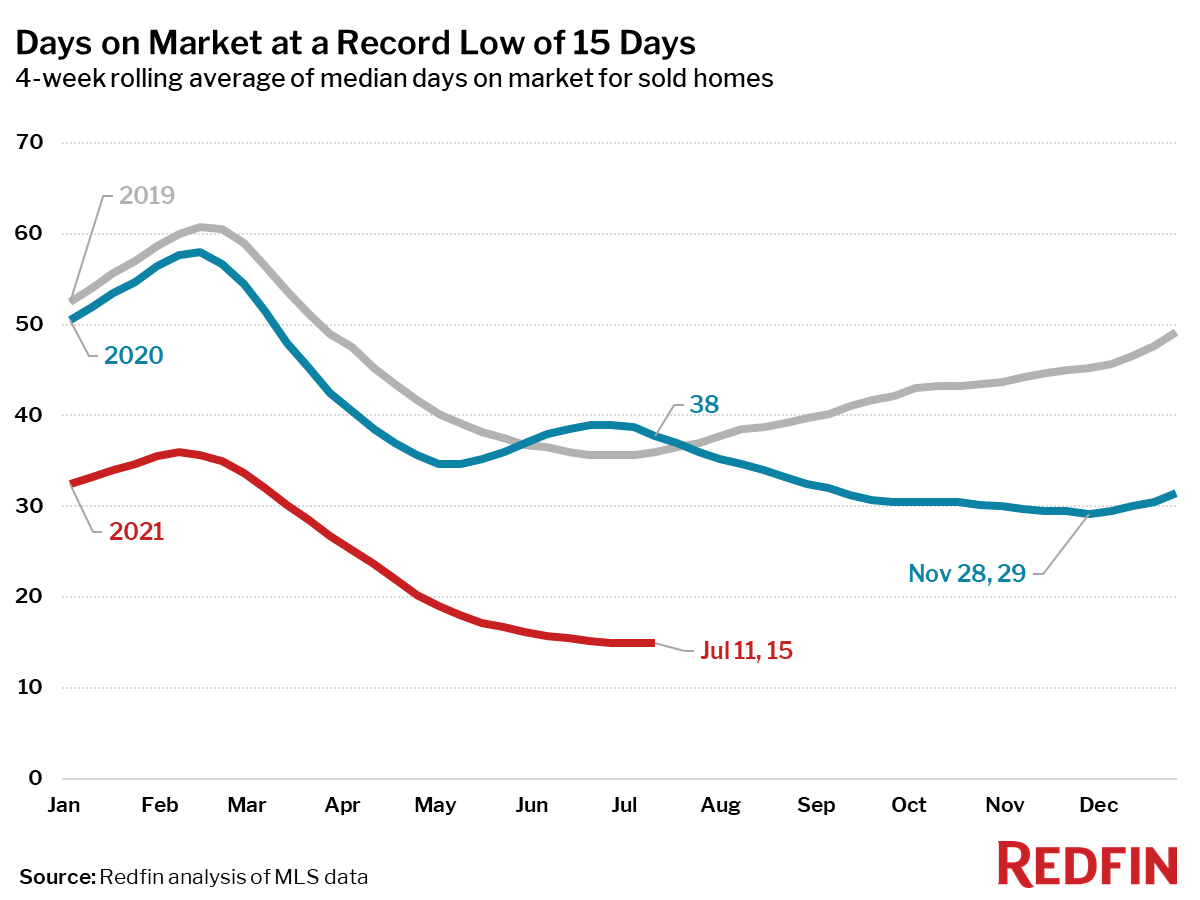

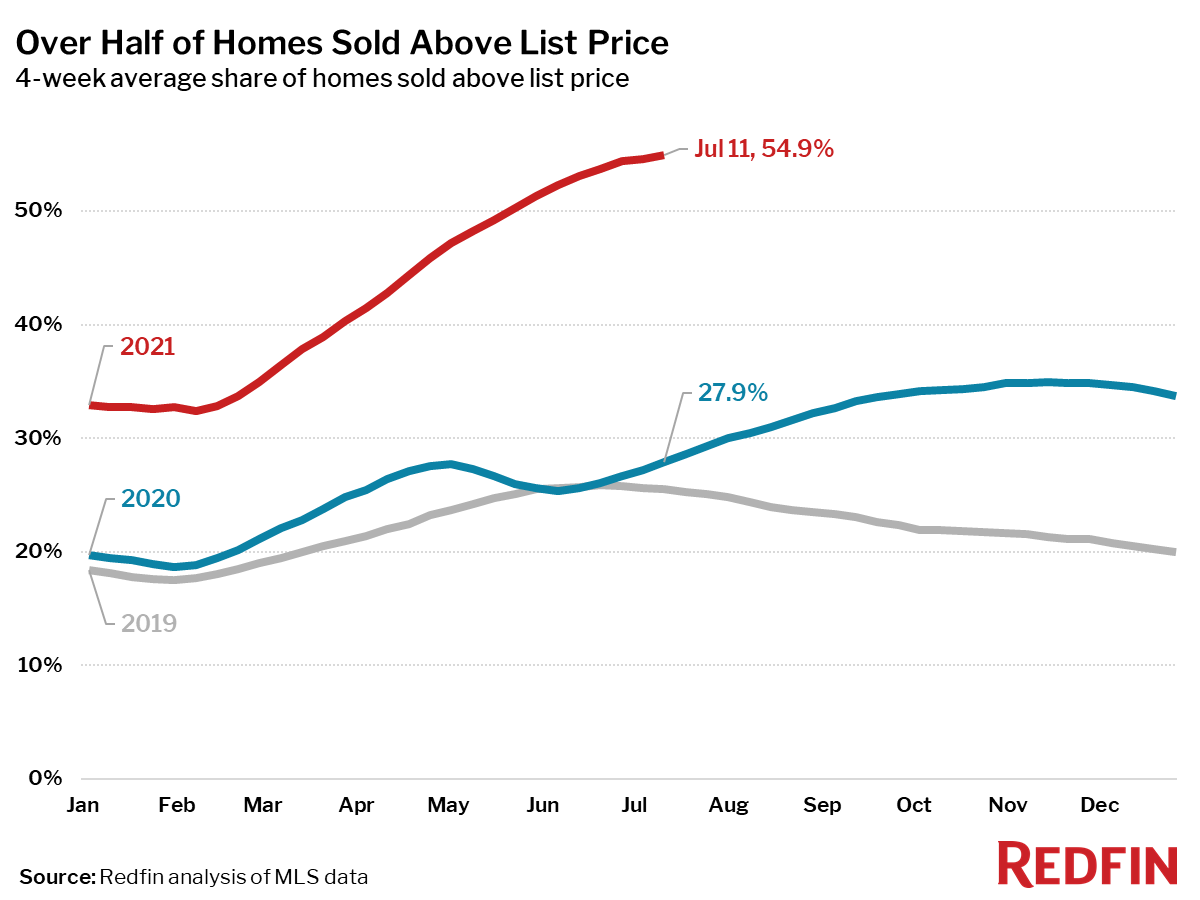

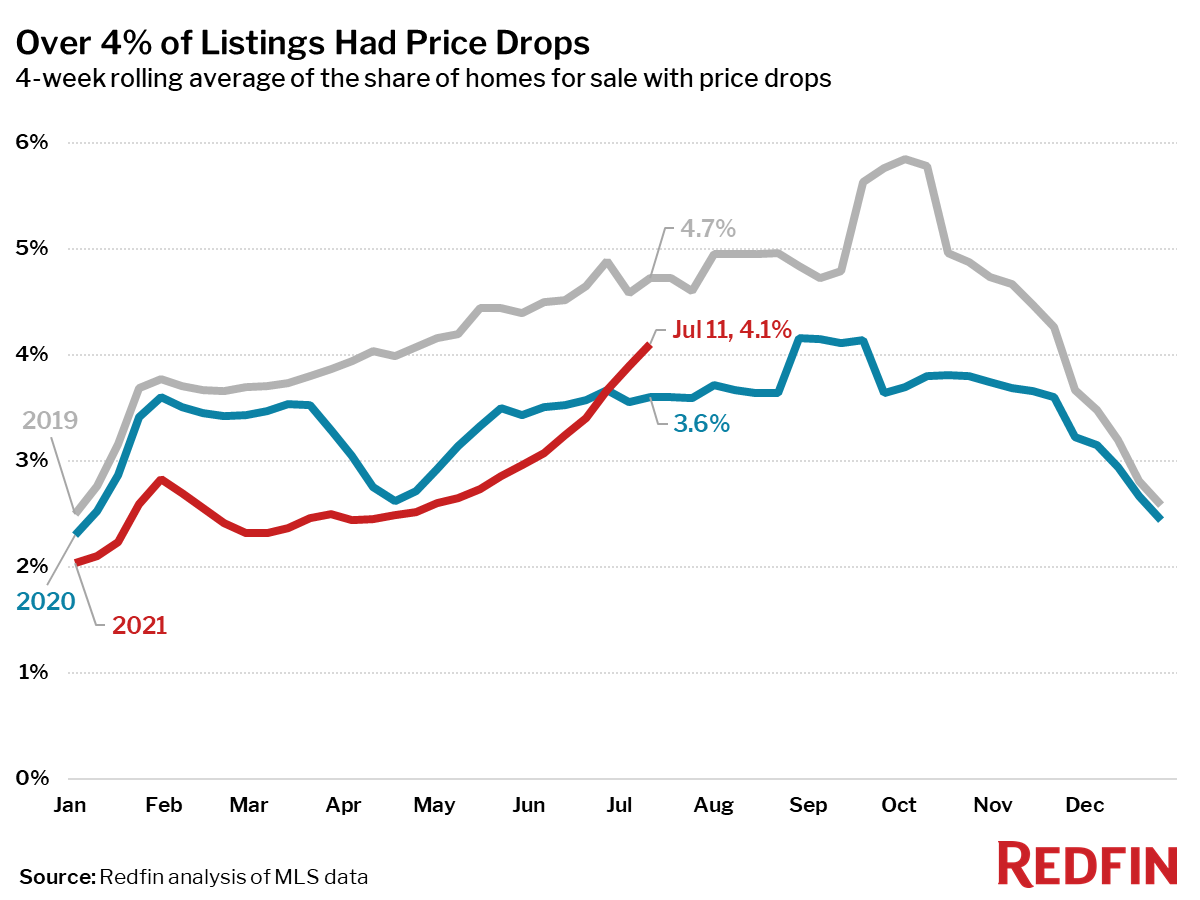

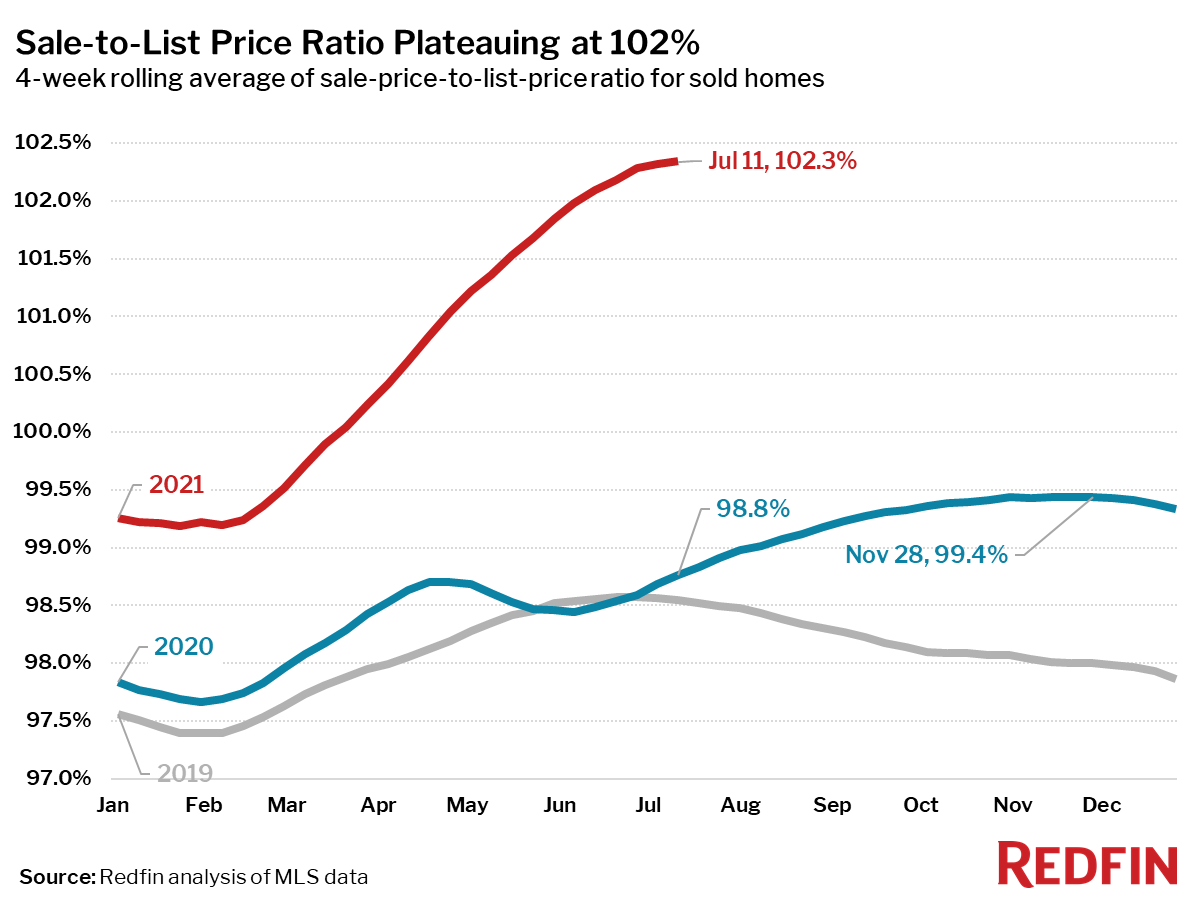

The average weekly share of homes for sale with a price drop passed 4% for the first time since September, another signal that the hyper-competitive housing market is cooling. Other indicators corroborate the slowdown: the share of homes sold over list price, the share of homes sold within a week and median days on market are all also either cooling off or plateauing.

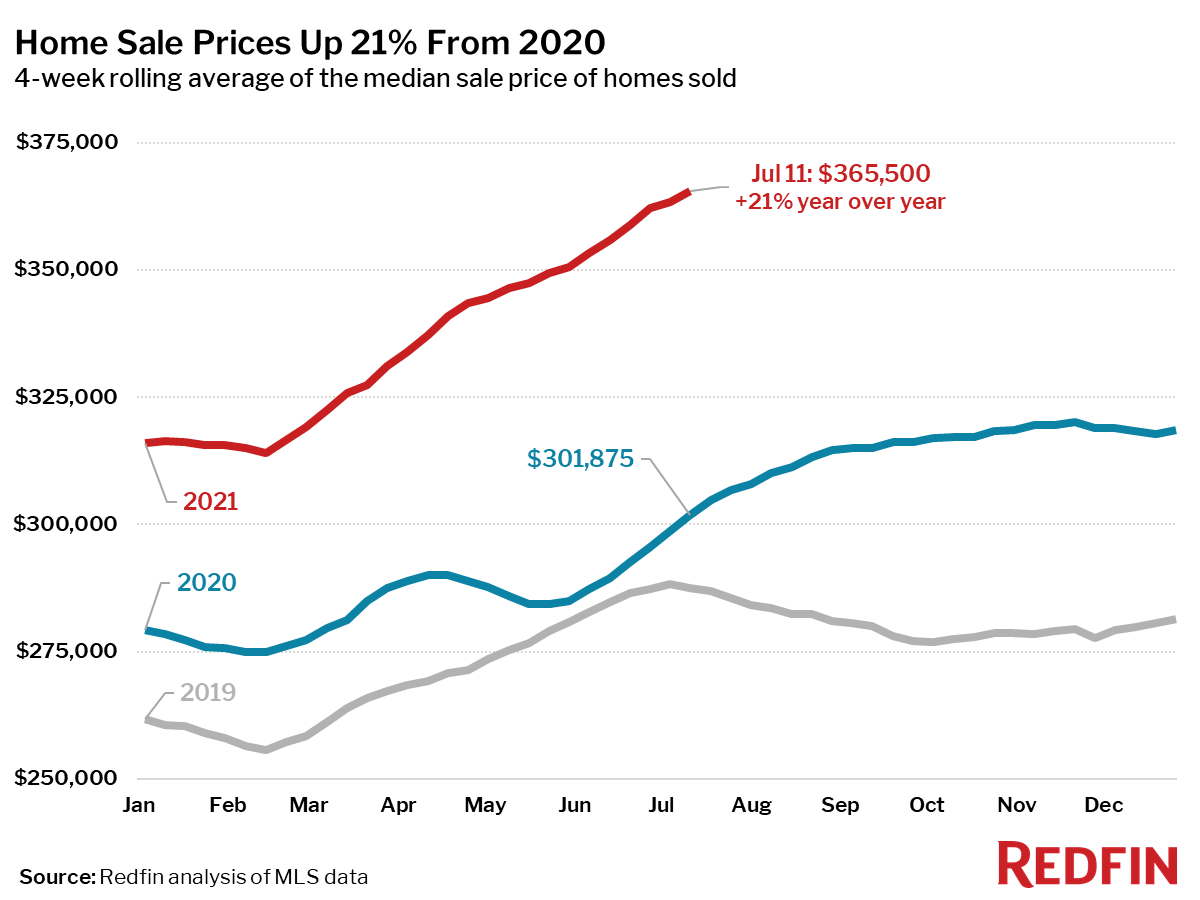

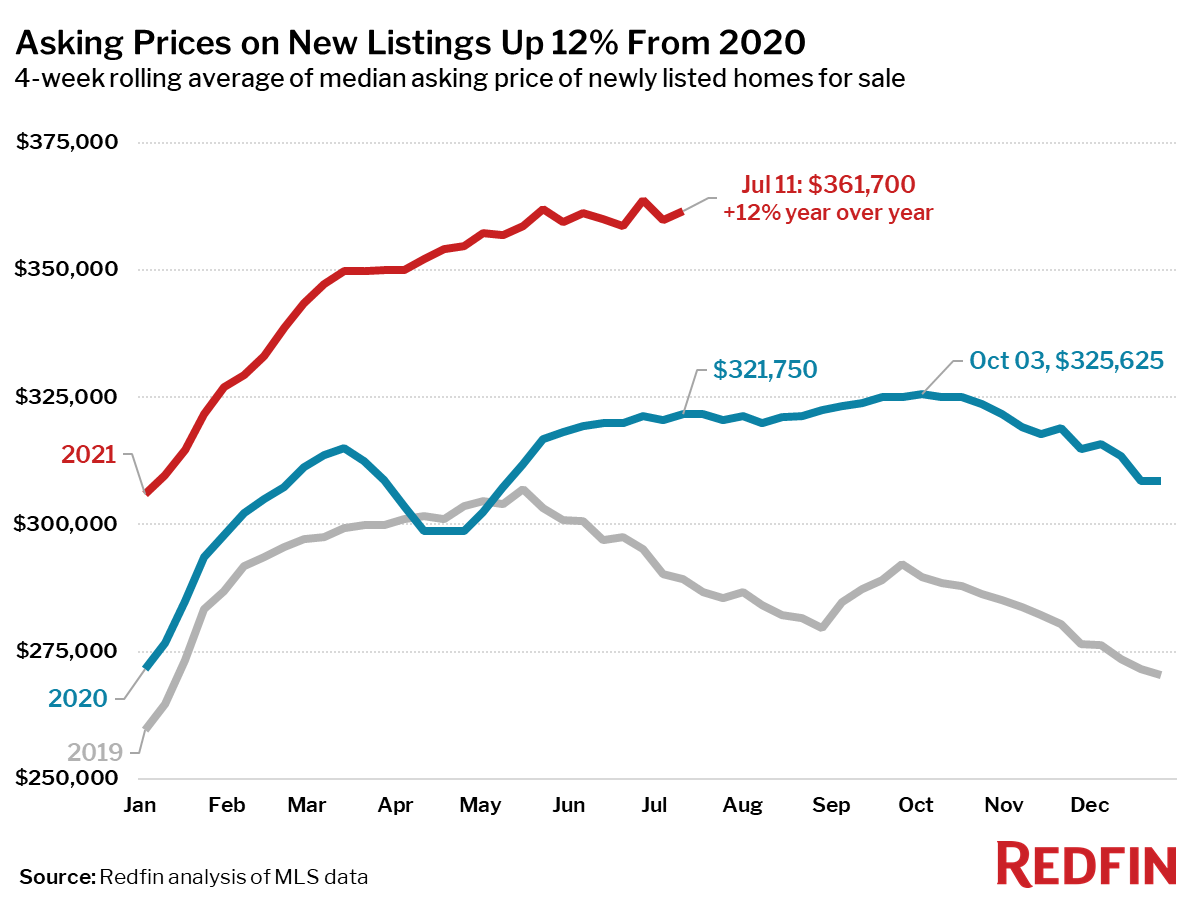

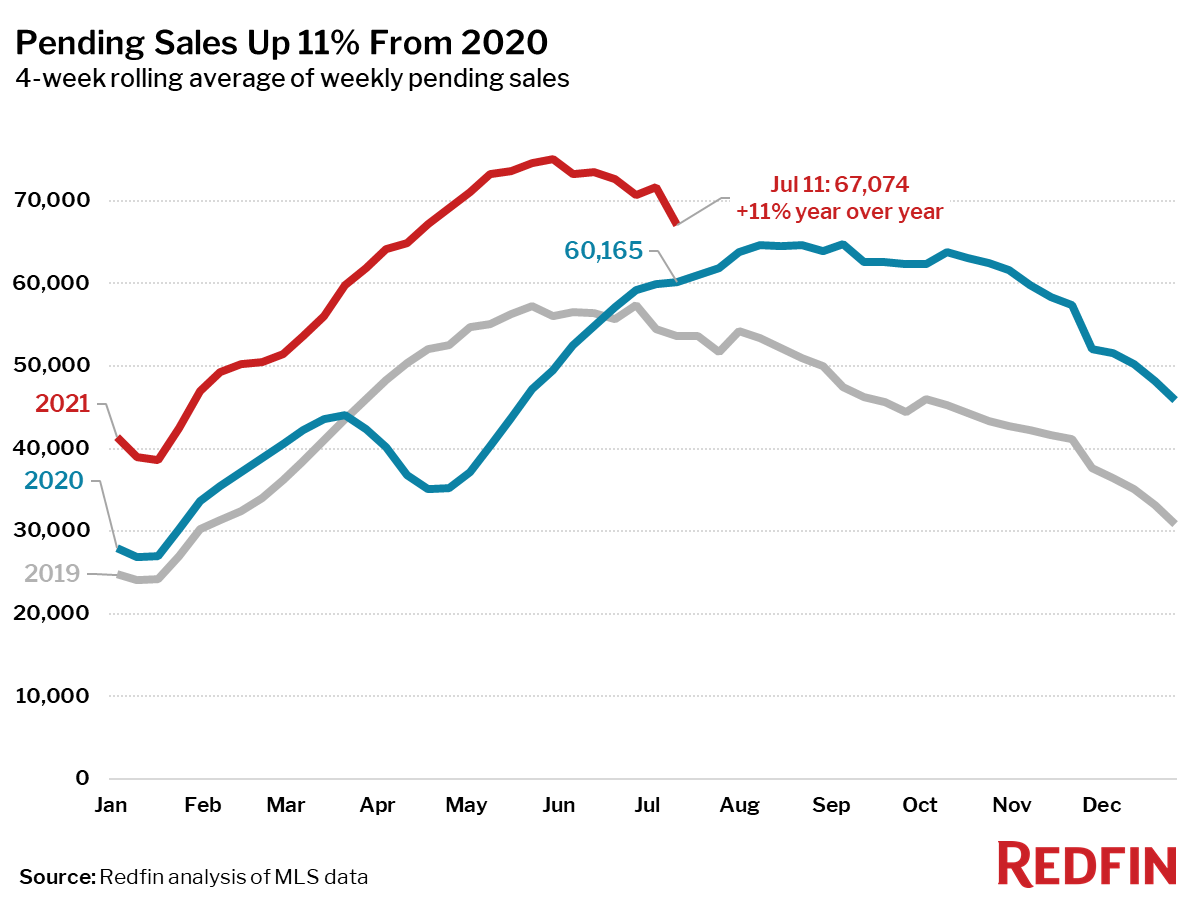

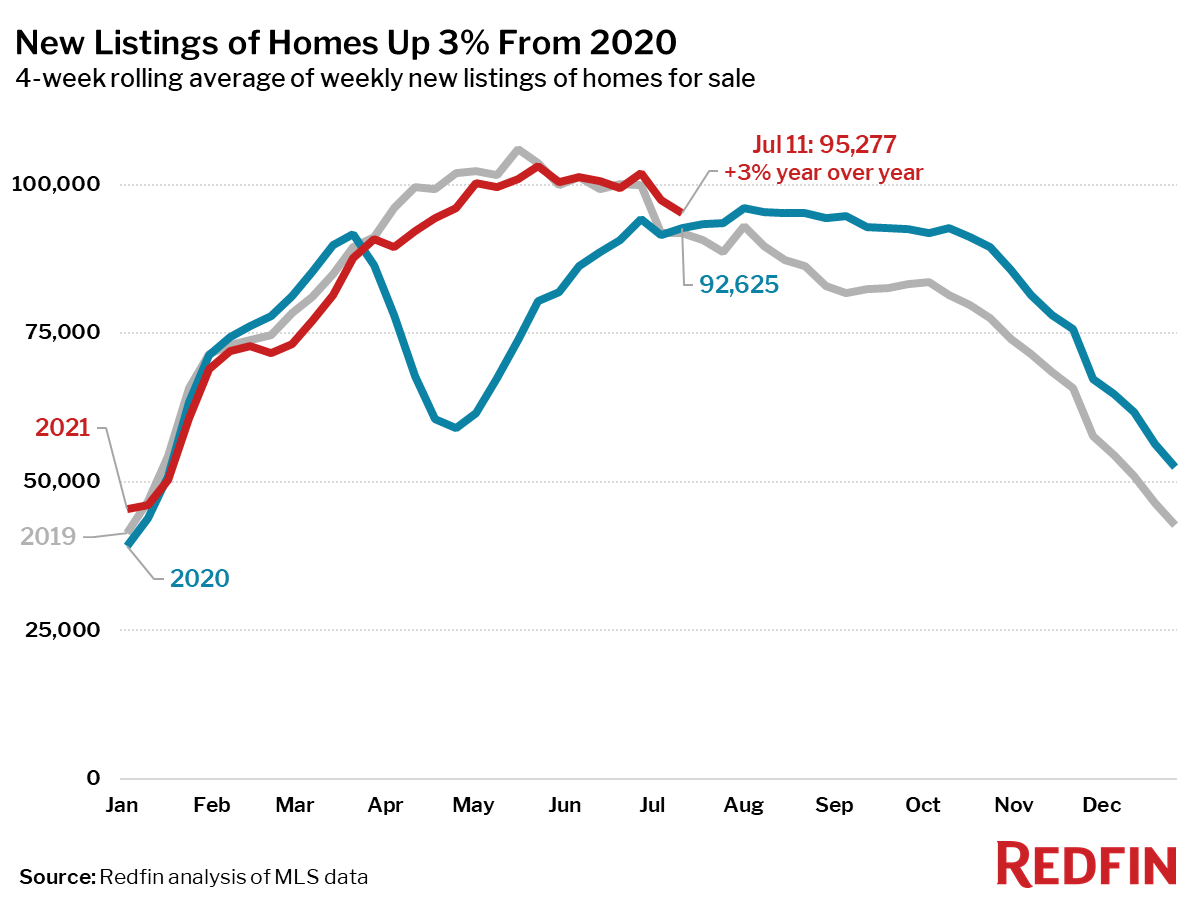

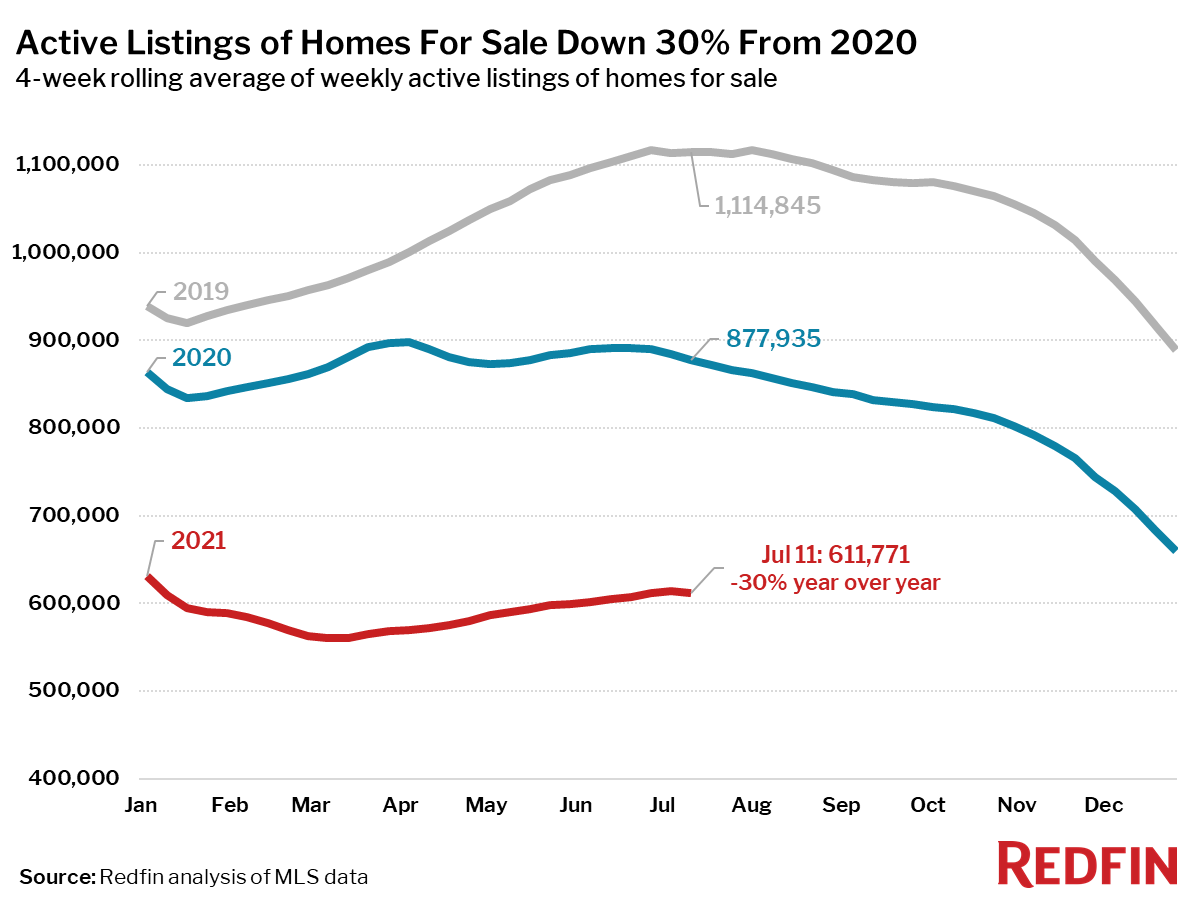

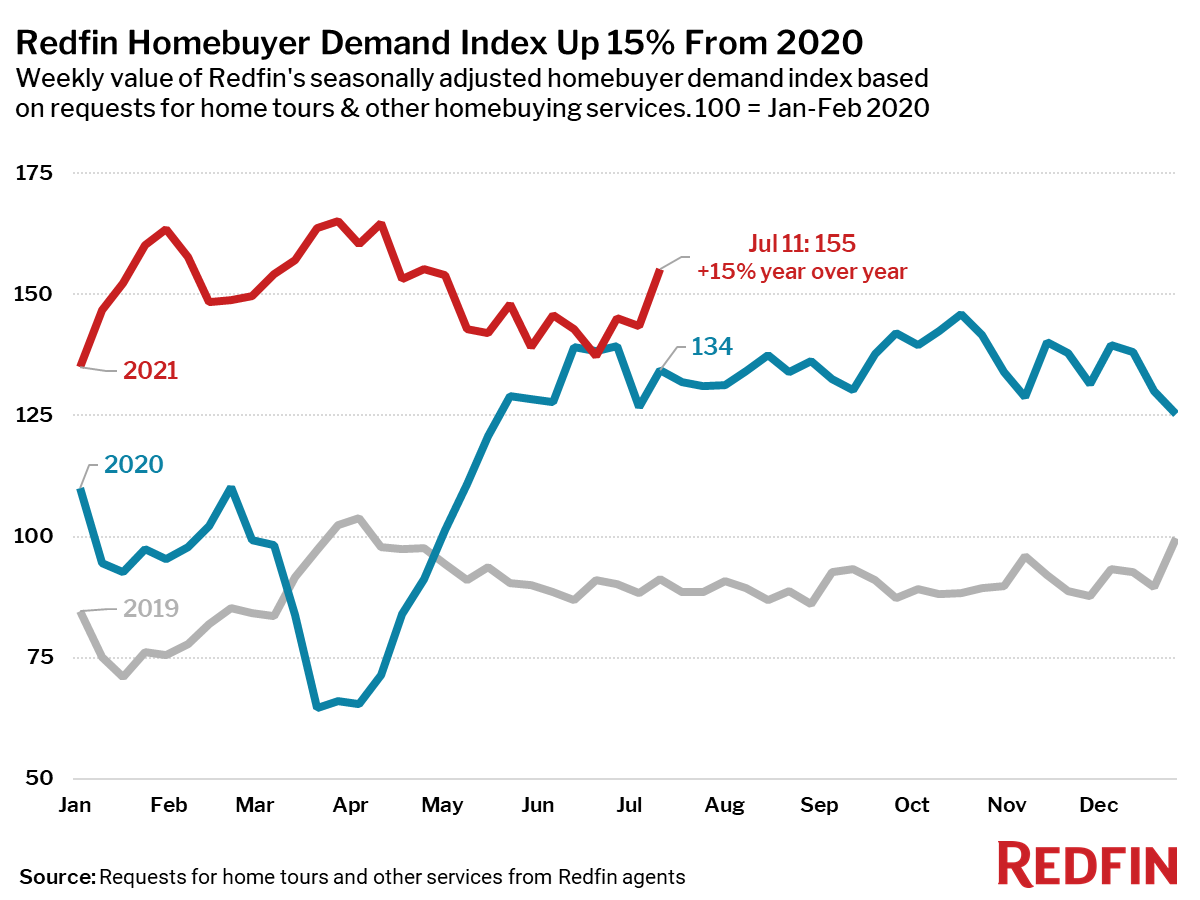

Pending sales were up 11% from a year ago, but down 11% from the 2021 peak, and asking prices have been relatively flat since late May. Even amid this shift, sellers remain in the driver’s seat, as home prices continued to rise more than 20% from a year ago and the number of homes for sale sits 30% below the same time last year.

Looking ahead, some indicators of early-stage homebuyer interest like tour activity, mortgage purchase applications and requests for service from Redfin agents have shown signs of picking back up. It’s too early to call it a trend, but we’ll continue to track whether this continues and leads to sales and competition heating back up.

Unless otherwise noted, the data in this report covers the four-week period ending July 11. Redfin’s housing market data goes back through 2012.

“Asking prices are still high, but the share of listings with price drops is rising steadily and could soon reach pre-pandemic levels,” said Redfin Chief Economist Daryl Fairweather. “That’s an early indication that we are past the peak for this intense seller’s market. Buyers may begin to regain some negotiating power on properties that have been on the market for more than a week.”

Refer to our metrics definition page for explanations of all the metrics used in this report.