High mortgage rates and harsh weather are pushing down home sales, but some house hunters are touring and getting a feel for the market.

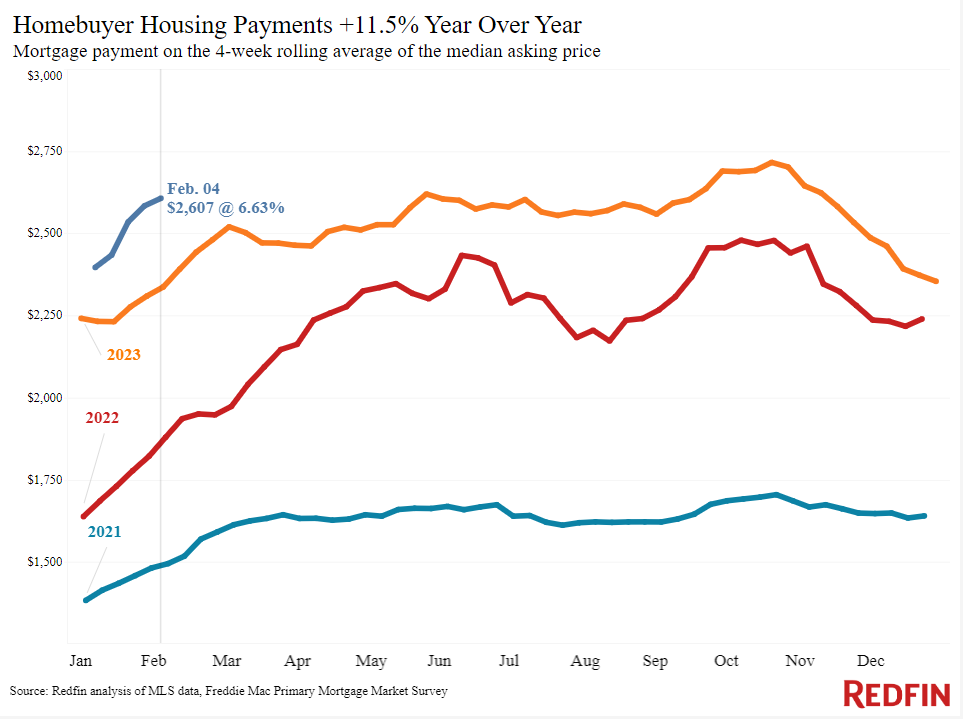

The bumpy start to 2024’s housing market continues, with daily average mortgage rates posting their biggest one-day increase in over a year on February 2. The jump came after a hotter-than-expected January jobs report and the Fed’s confirmation that they’re unlikely to cut interest rates in the next two months, which means mortgage rates will probably remain elevated near their current level for at least that long.

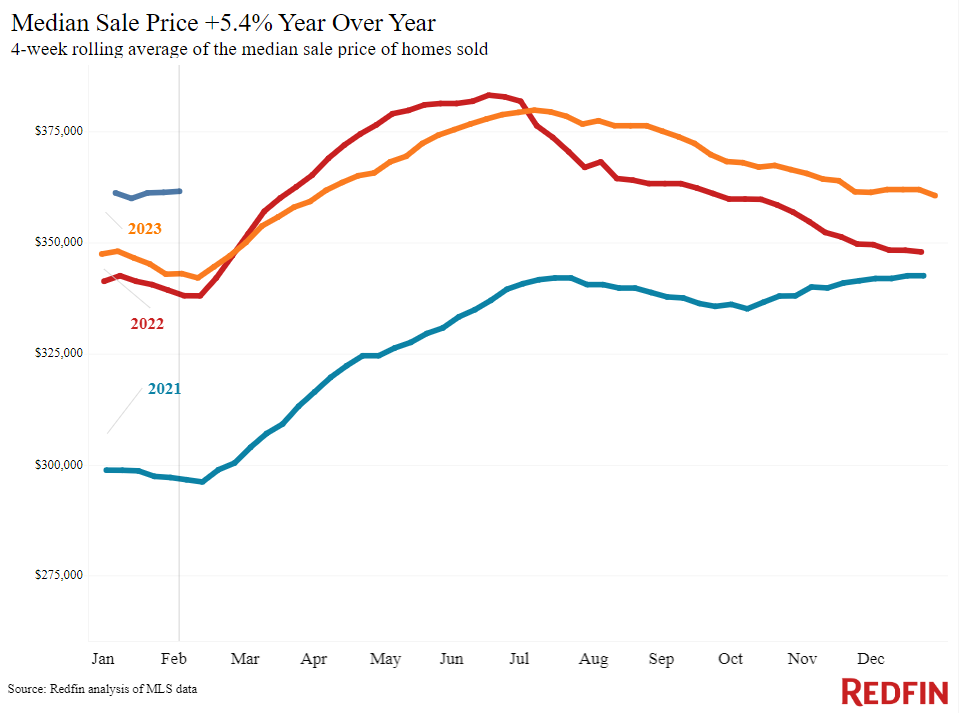

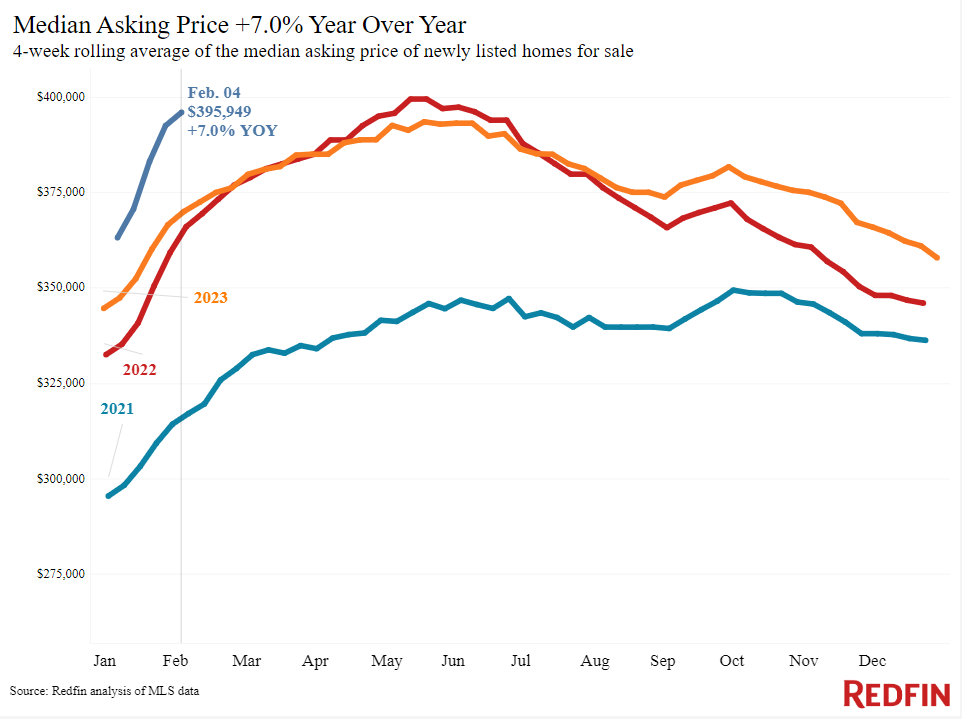

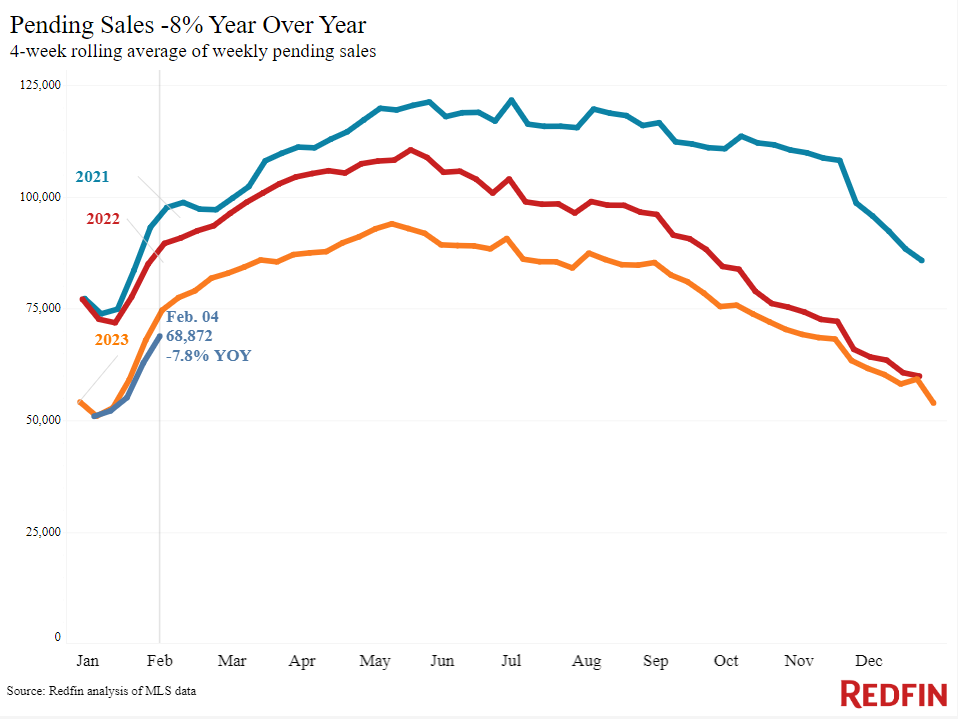

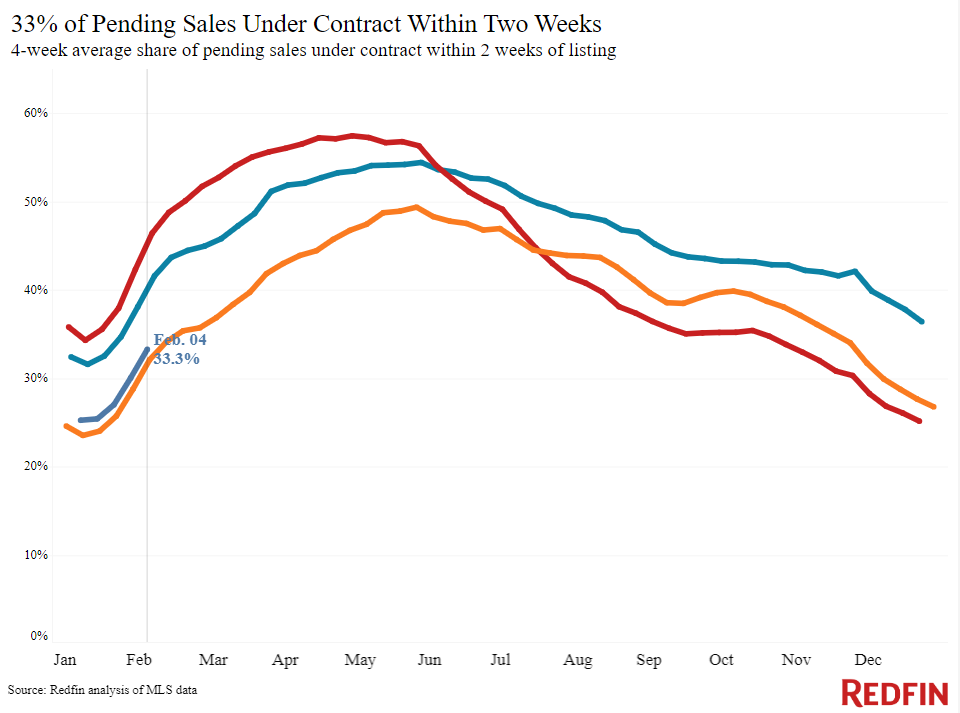

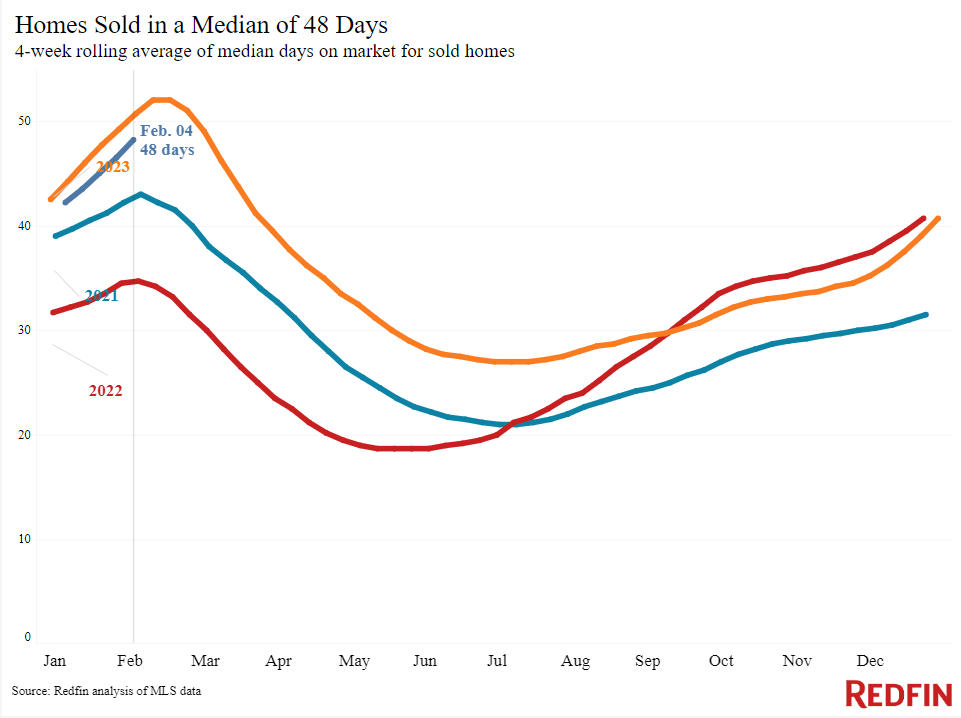

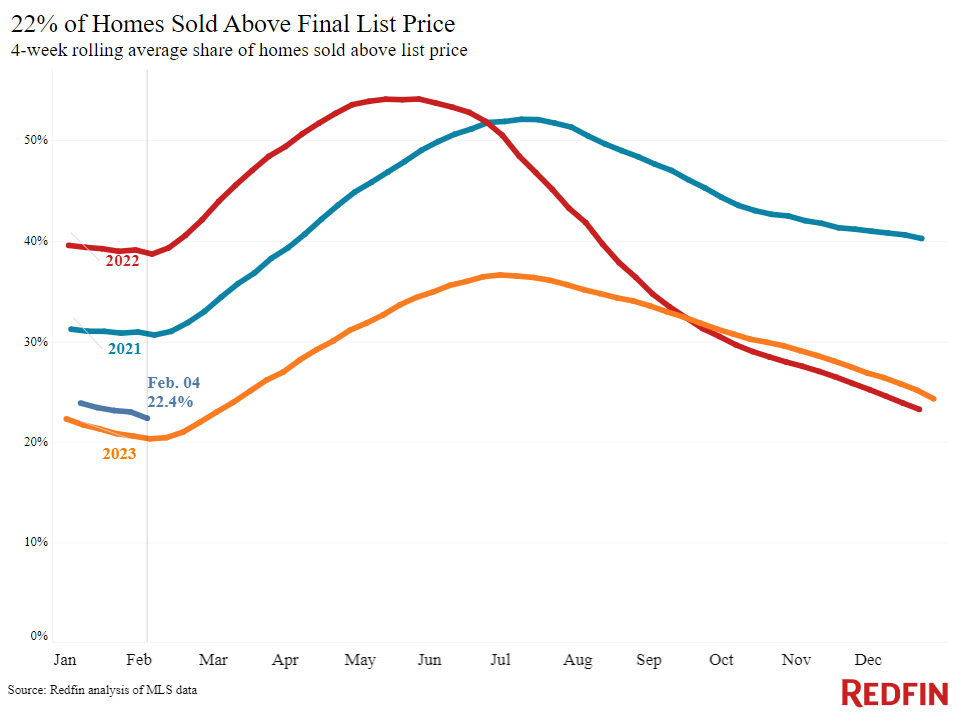

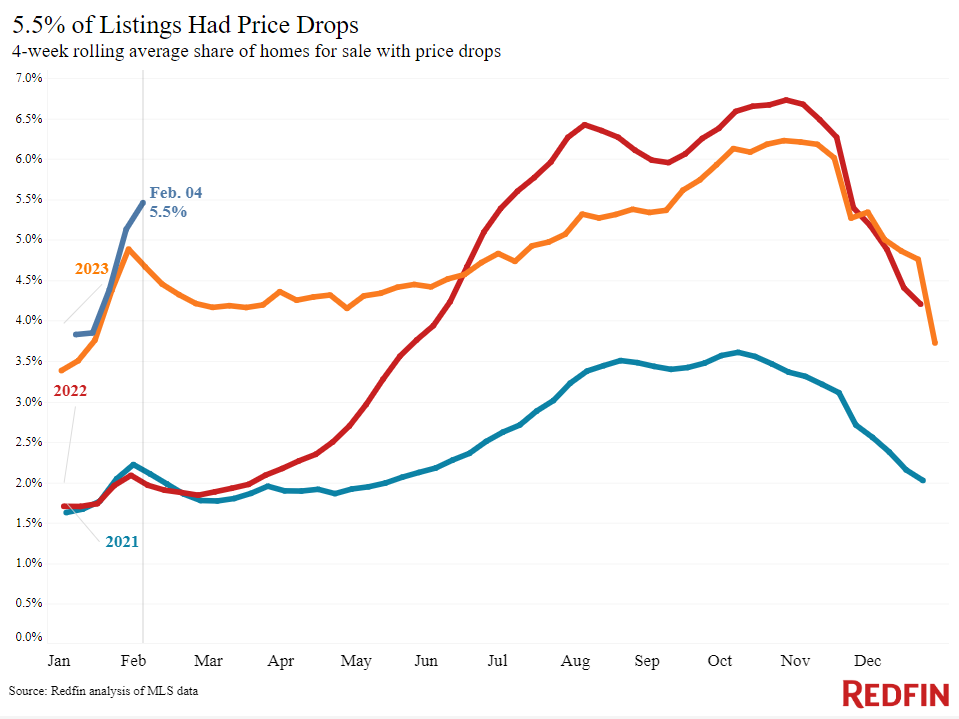

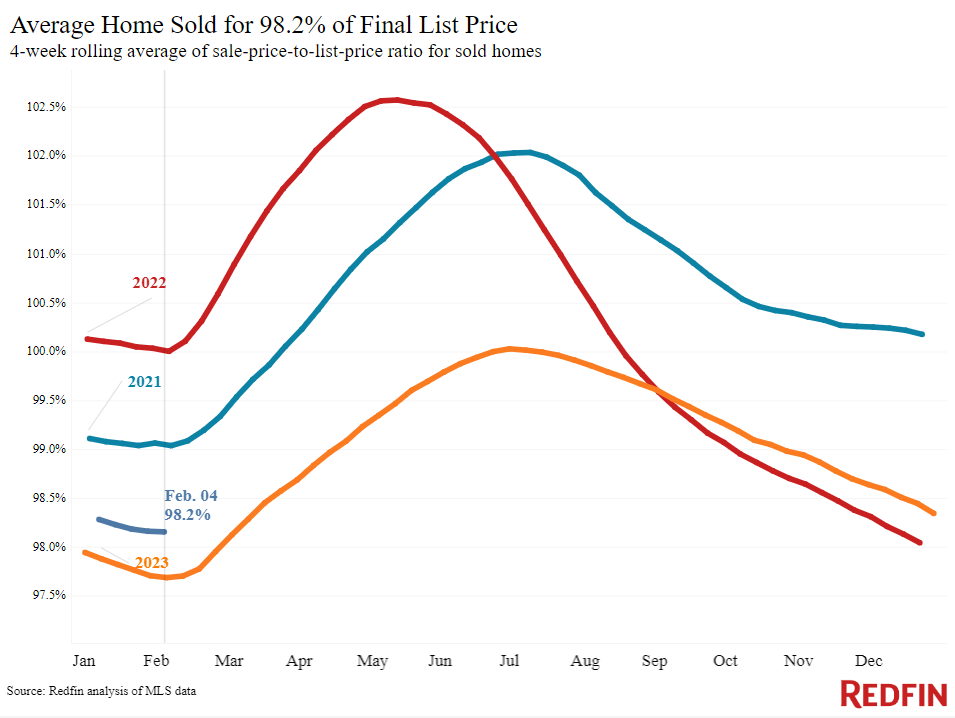

Rising home prices are exacerbating rising rates, with the typical monthly mortgage payment just about $100 shy of October’s all-time high. The median U.S. sale price rose 5.4% year over year during the four weeks ending February 4, the biggest increase in over a year. High housing costs are pricing out many would-be homebuyers; pending sales are down 8%, the biggest decline in four months. There are also a few other contributors to sales falling: Harsh winter weather in the first half of January delayed a lot of homebuying deals, and pending sales were improving at this time last year as mortgage rates temporarily dropped.

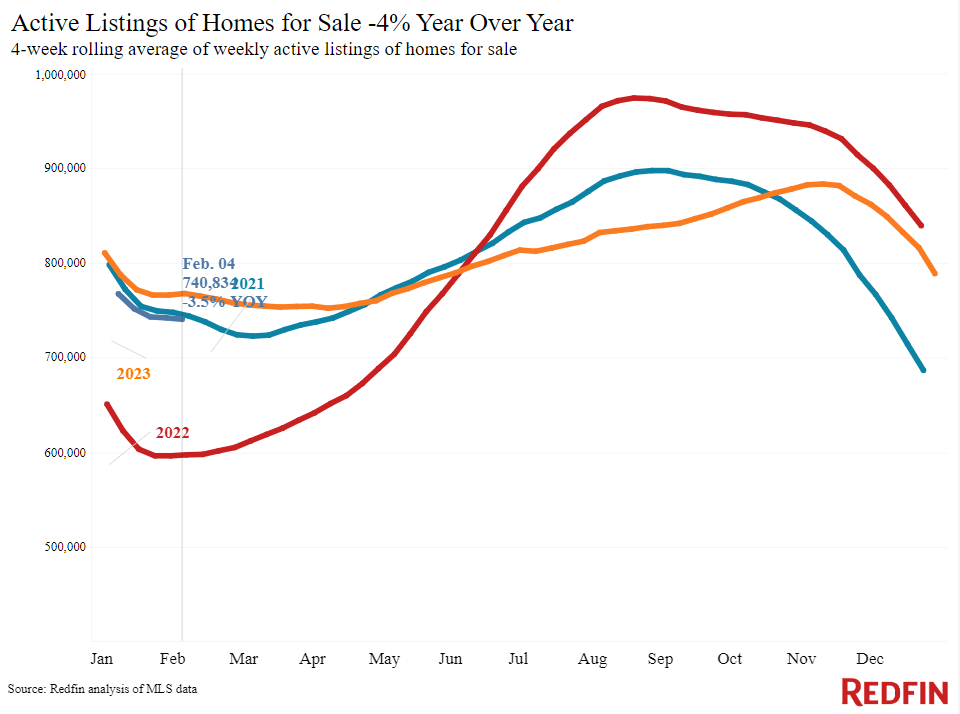

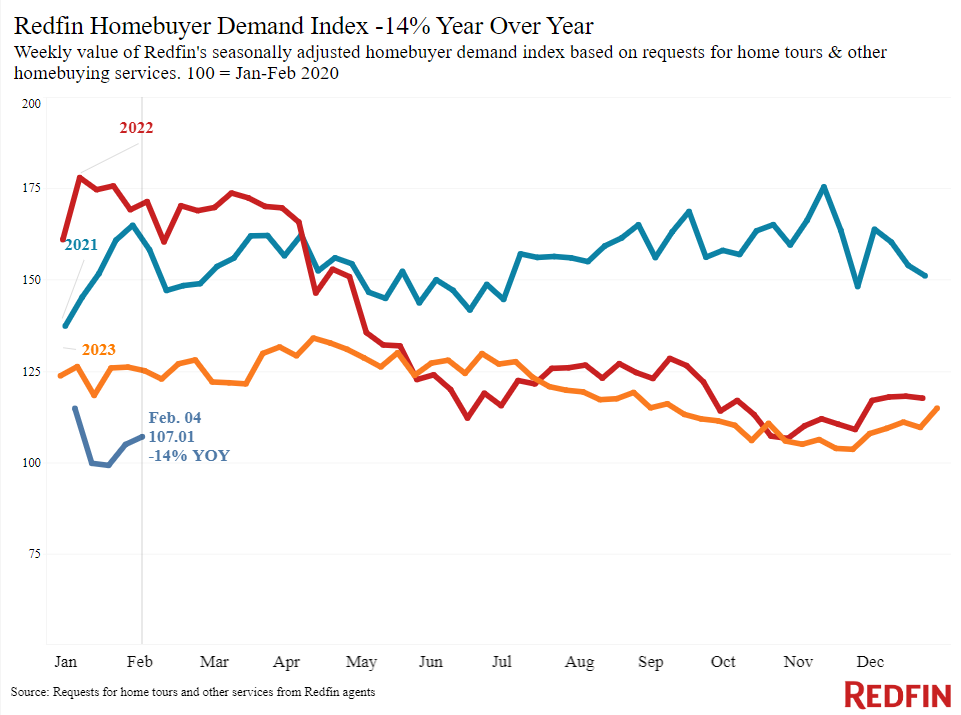

Still, some house hunters are at least getting a feel for the market. Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of requests for tours and other buying services from Redfin agents–has steadily risen since mid-January, and a separate measure of home tours shows they’ve increased 16% since the start of the year, compared with a 10% rise at this time last year. Some sellers are jumping in, too, with new listings up 7% year over year.

“We’re seeing a bit of recovery with house hunters touring homes, but even demand at the earliest stages isn’t up as much as we would expect at this time of year,” said Chen Zhao, Redfin’s economic research lead. “That’s because mortgage rates are climbing again and winter weather has been harsher than usual in much of the country, keeping some house hunters at home.”

Luis Rojas, a Redfin Premier agent in the Viera West, FL area, said today’s housing market is touch and go. “High mortgage rates brought the local market to a near-standstill from August through November, activity picked up when rates dropped a bit in mid-December, and now it’s slowing down again as rates rise,” Rojas said. “I’m advising buyers–especially first-timers–that the mortgage rates they see in the news aren’t the be-all and end-all. Some local lenders are willing to give rates in the 5% range for new construction projects because any business is better than no business.”

Refer to our metrics definition page for explanations of all the metrics used in this report.