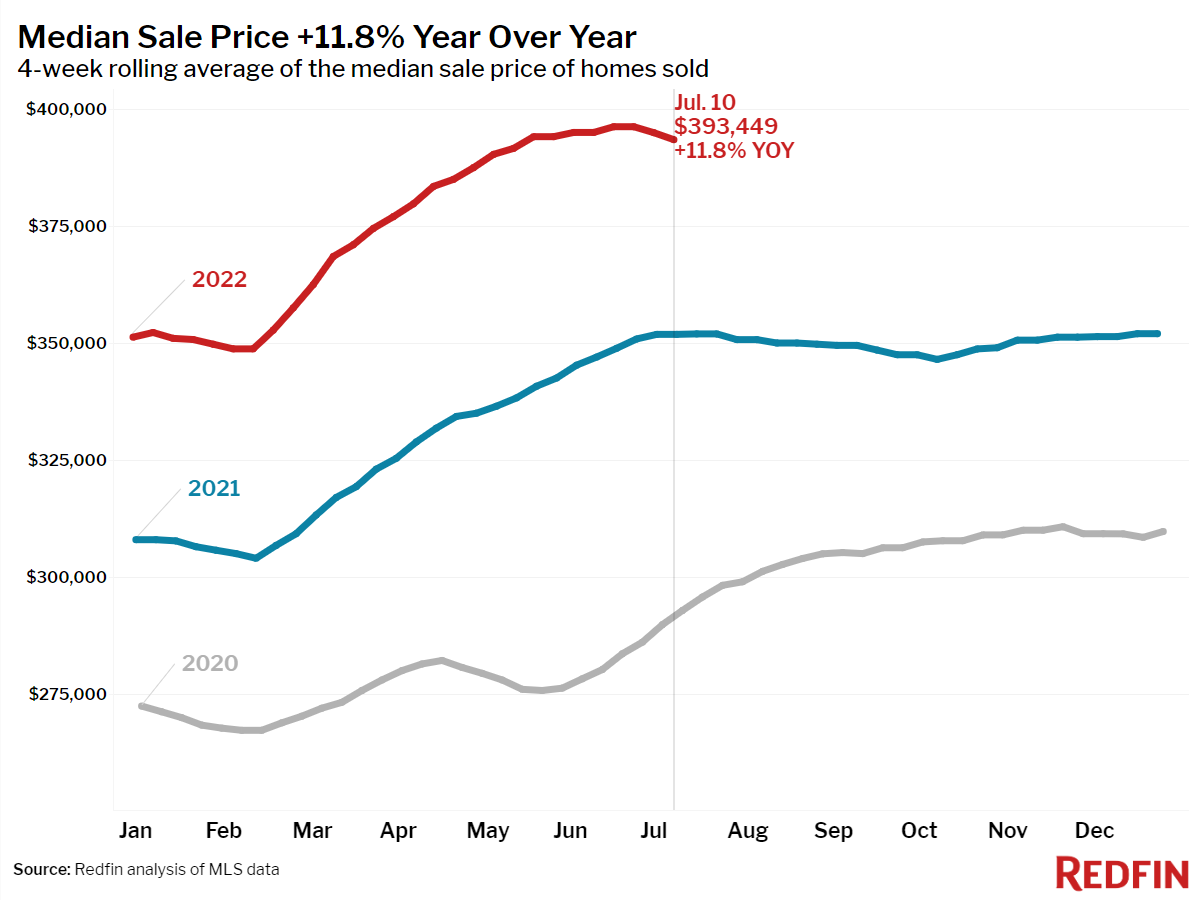

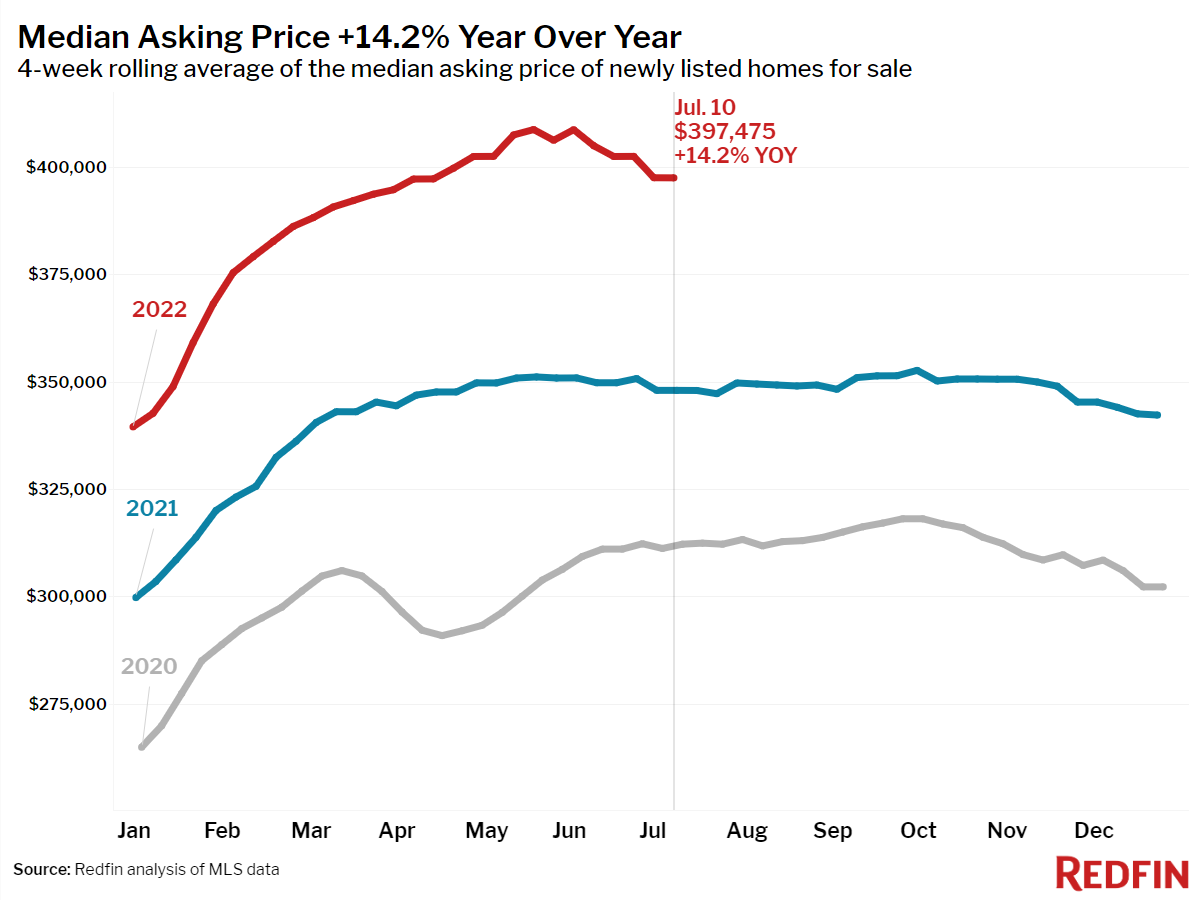

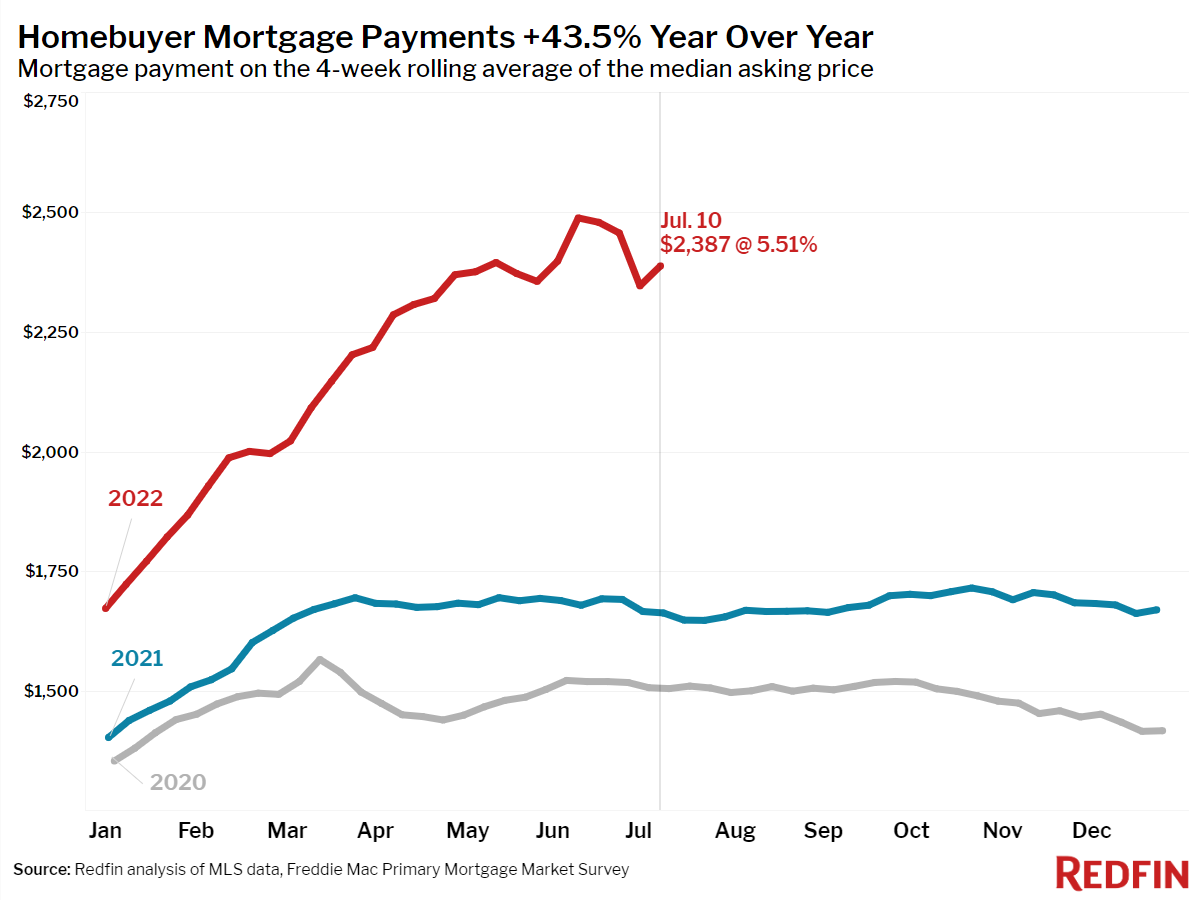

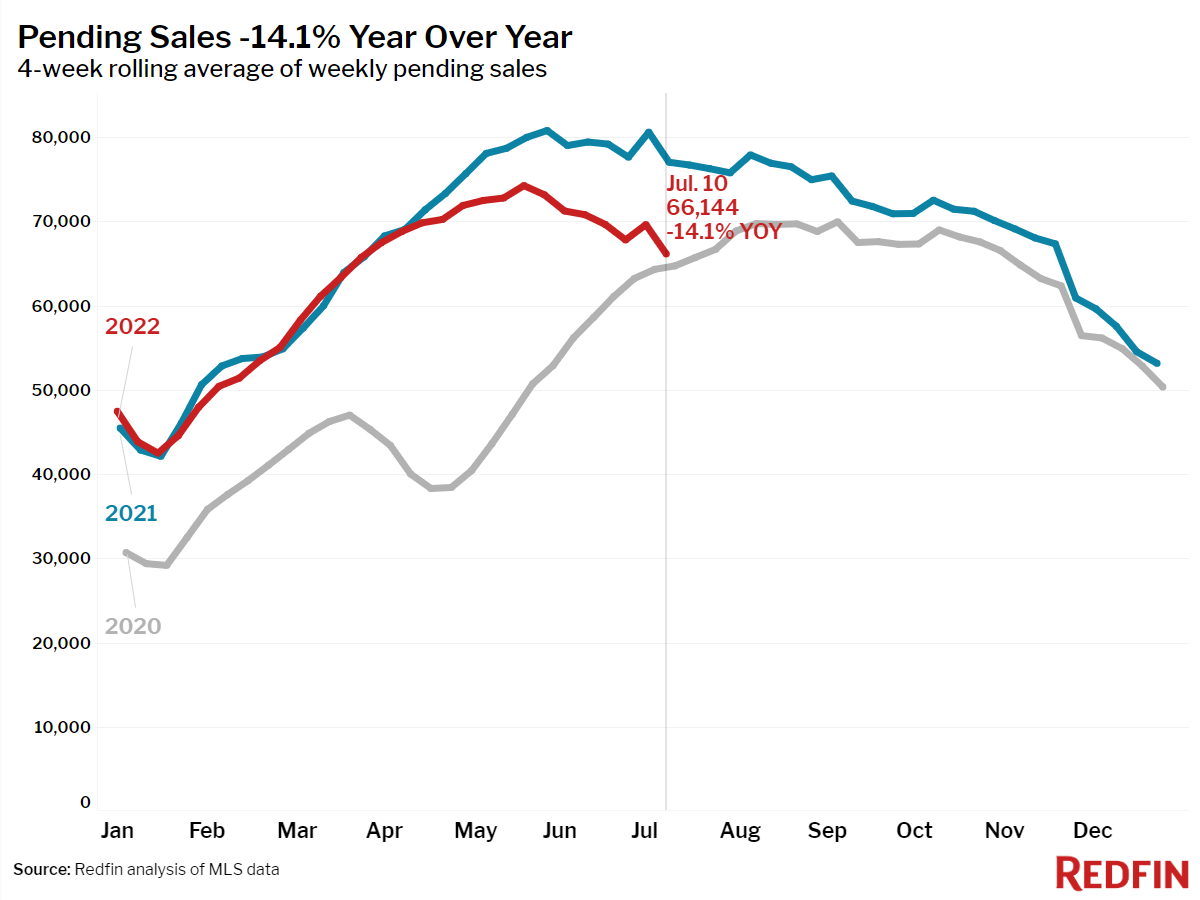

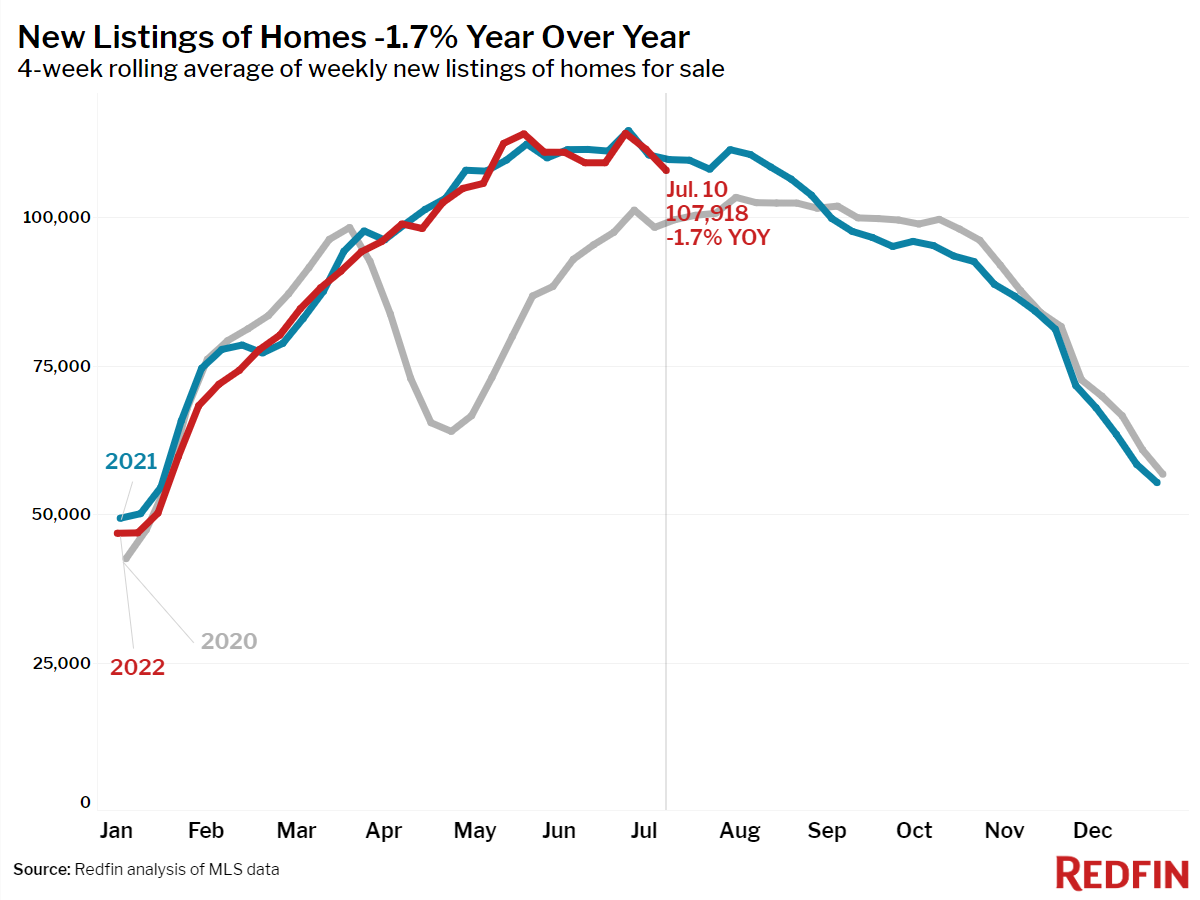

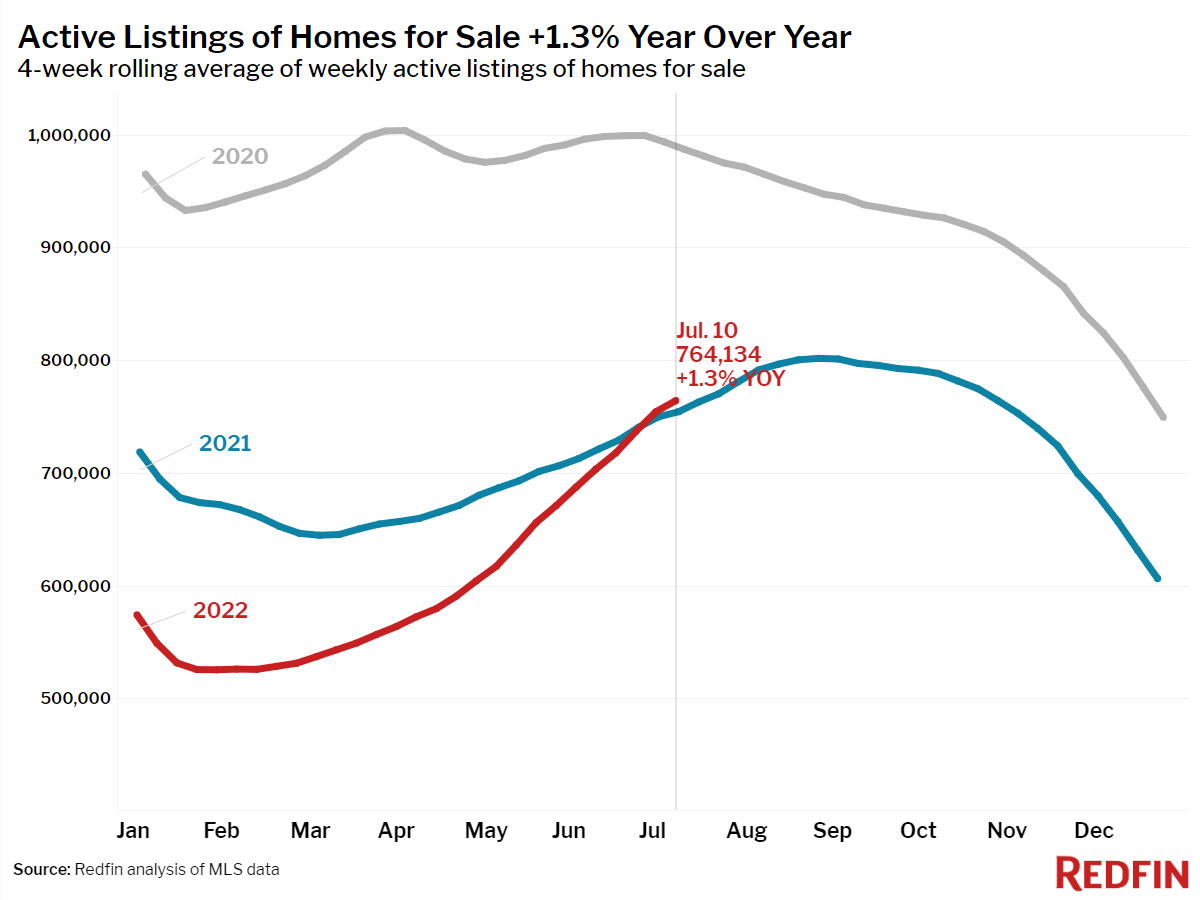

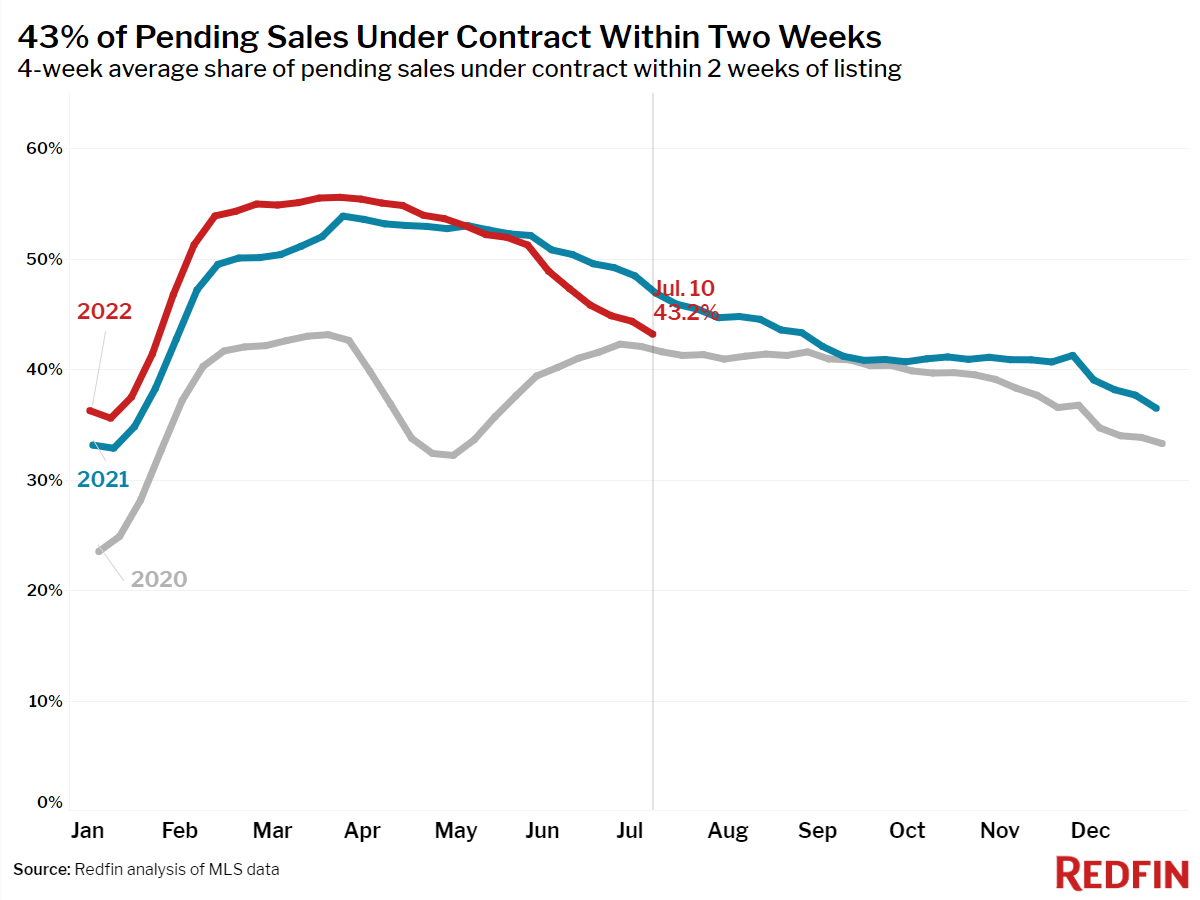

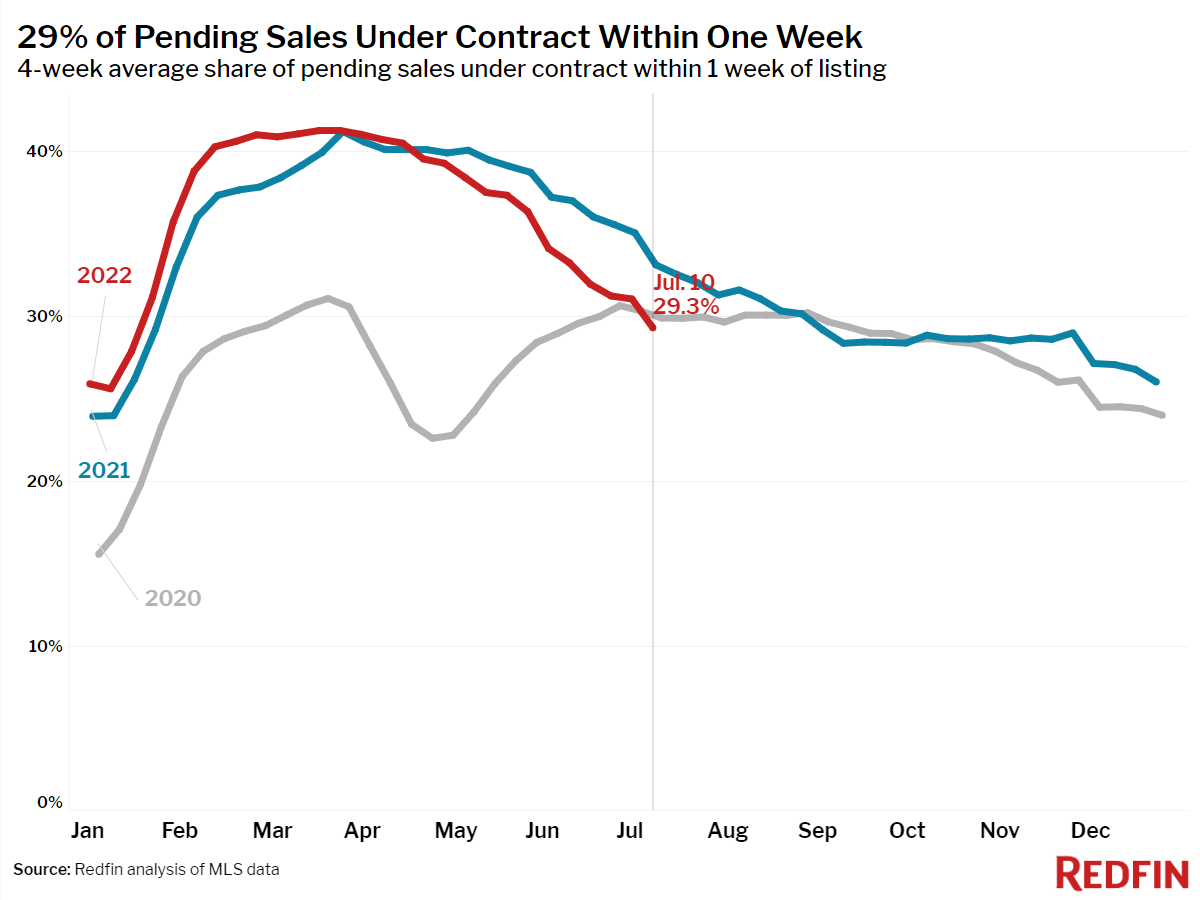

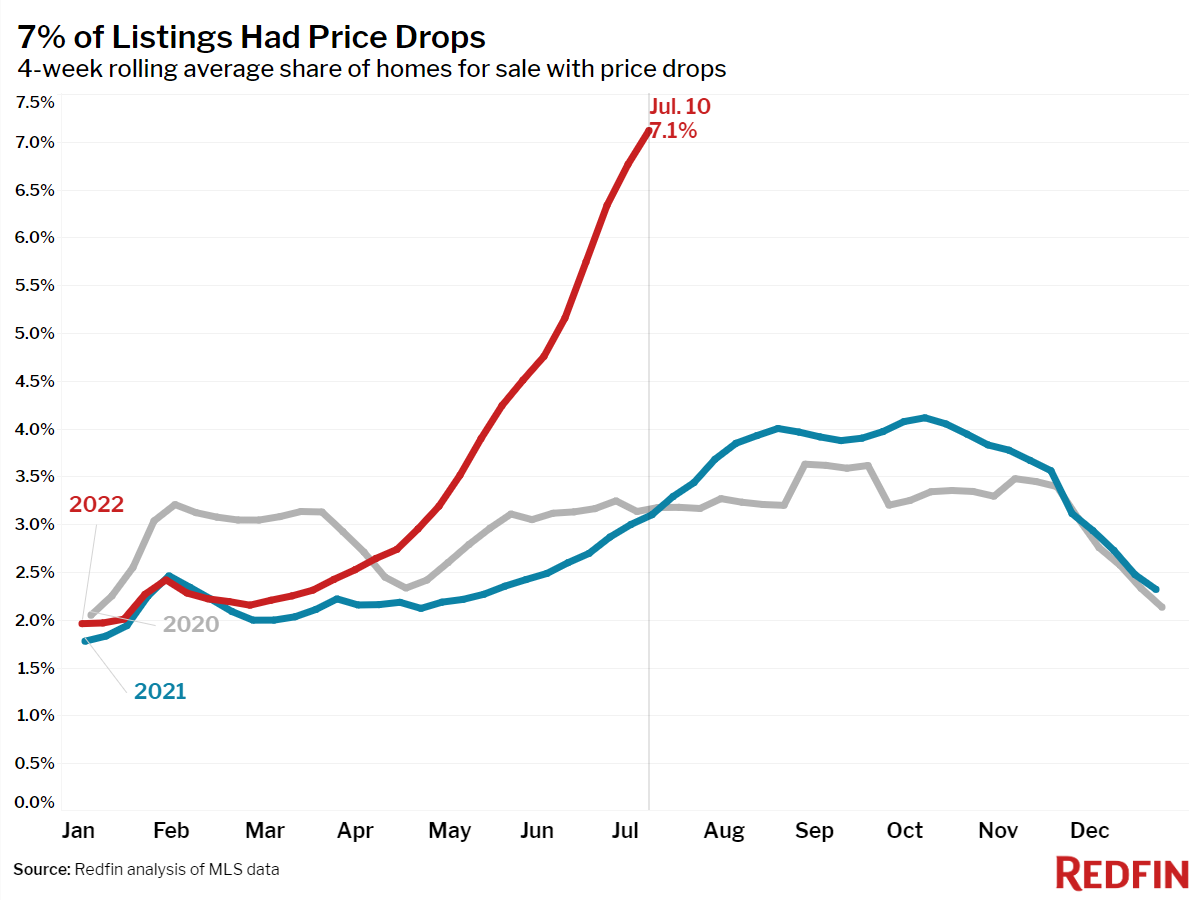

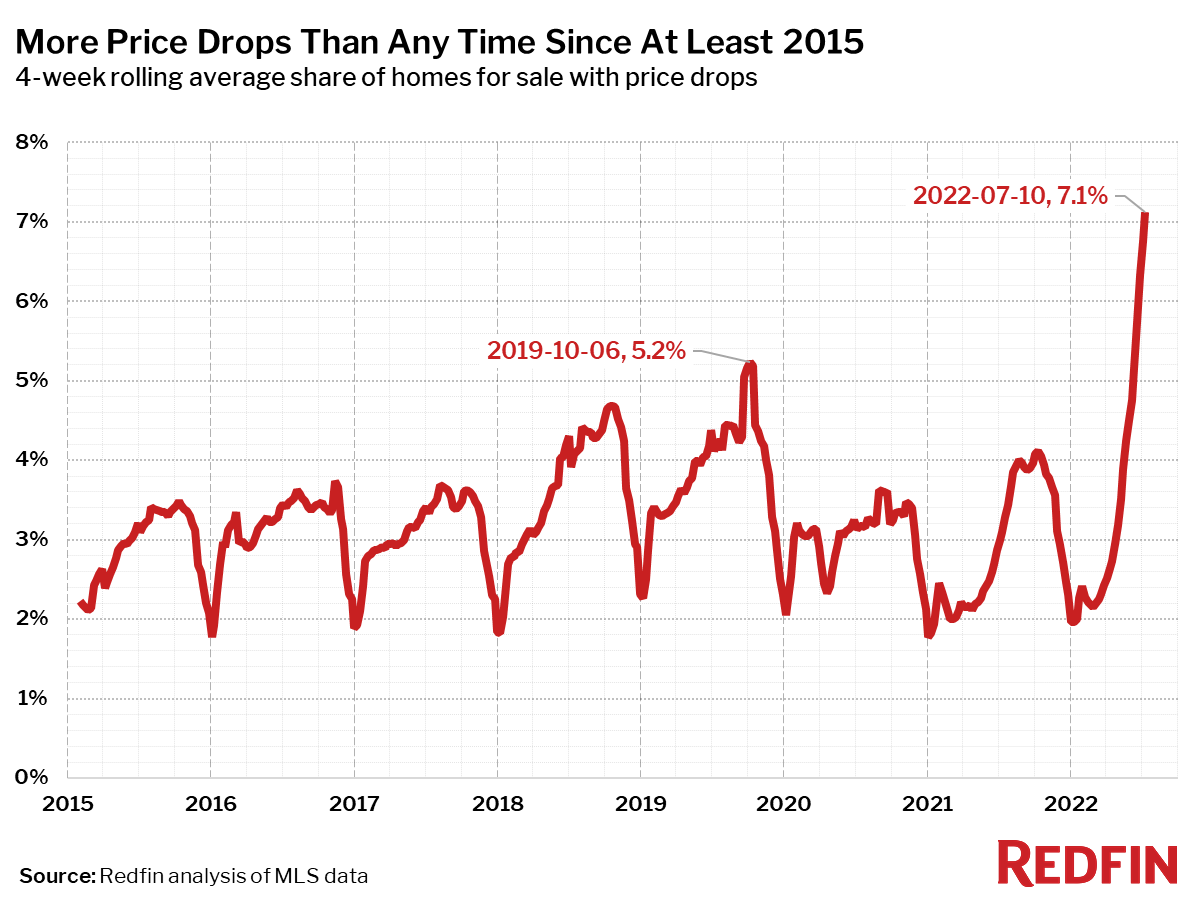

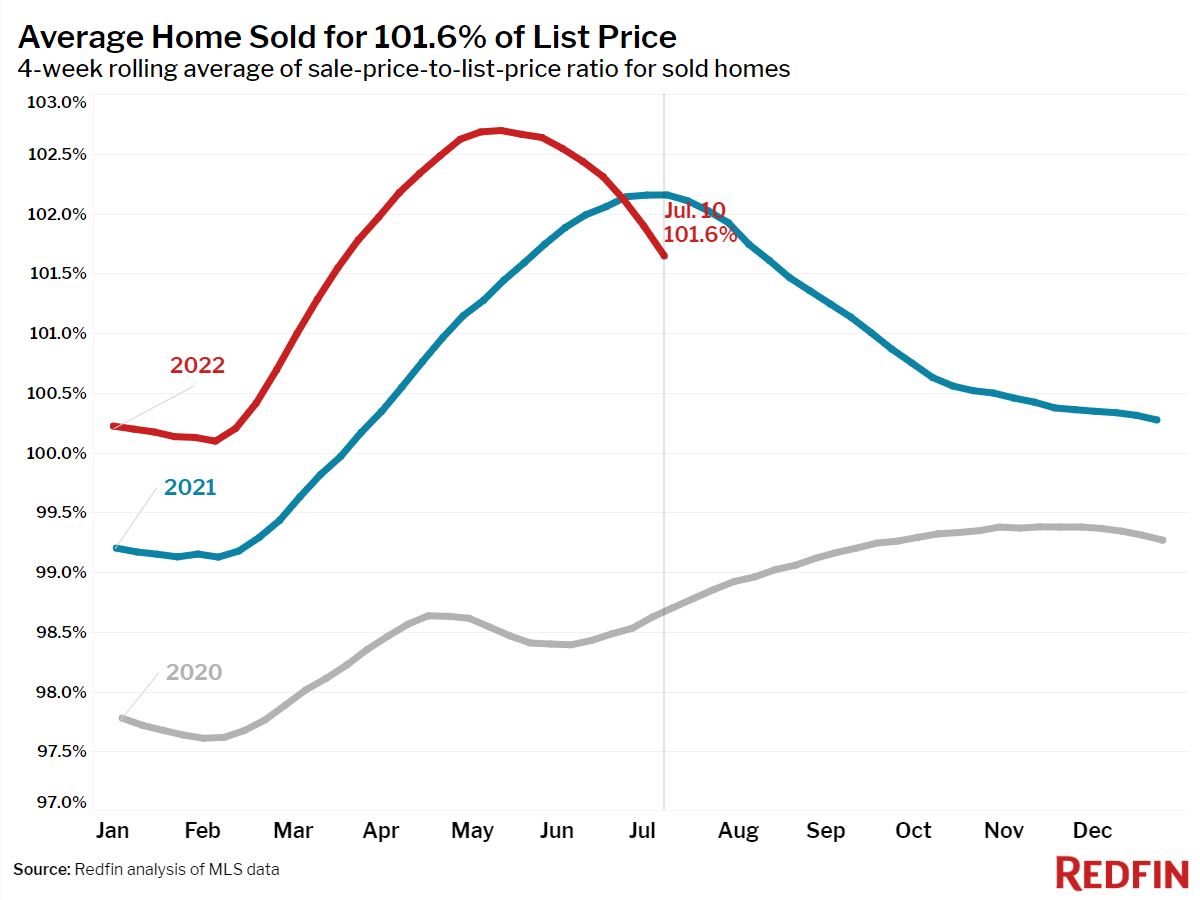

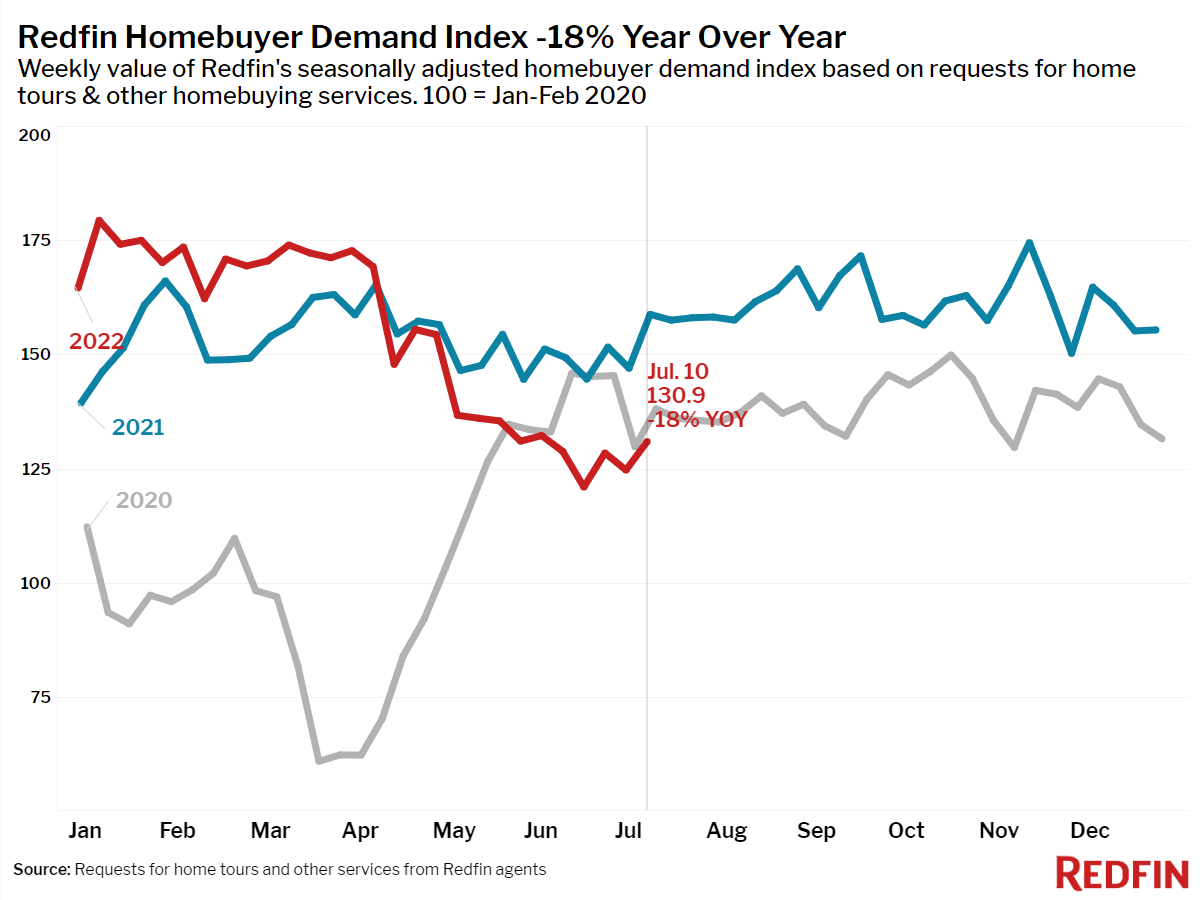

The median sale price for U.S. homes came down 0.7% from its record-breaking June peak during the four weeks ending July 10. Sellers’ asking prices also came down 3% from their May peak as the share of homes with price drops hit another new high. Home supply posted its first year-over-year increase since August 2019 as pending sales continued to slide. These changes in the housing market can be attributed to buyers reaching their limit on costs—not just of homes and mortgages, but also food, transportation and energy.

”Inflation and high mortgage rates are taking a bite out of homebuyer budgets,“ said Redfin chief economist Daryl Fairweather. “Few people are able to afford homes costing 50% more than just two years ago in some areas, so homes are beginning to pile up on the market. As a result, prices are starting to come down from their all-time highs. We expect this environment of reduced competition and declining home prices to continue for at least the next several months.”

Unless otherwise noted, the data in this report covers the four-week period ending July 10. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.