There are more homes for buyers to choose from, with new listings posting their biggest uptick in nearly three years.

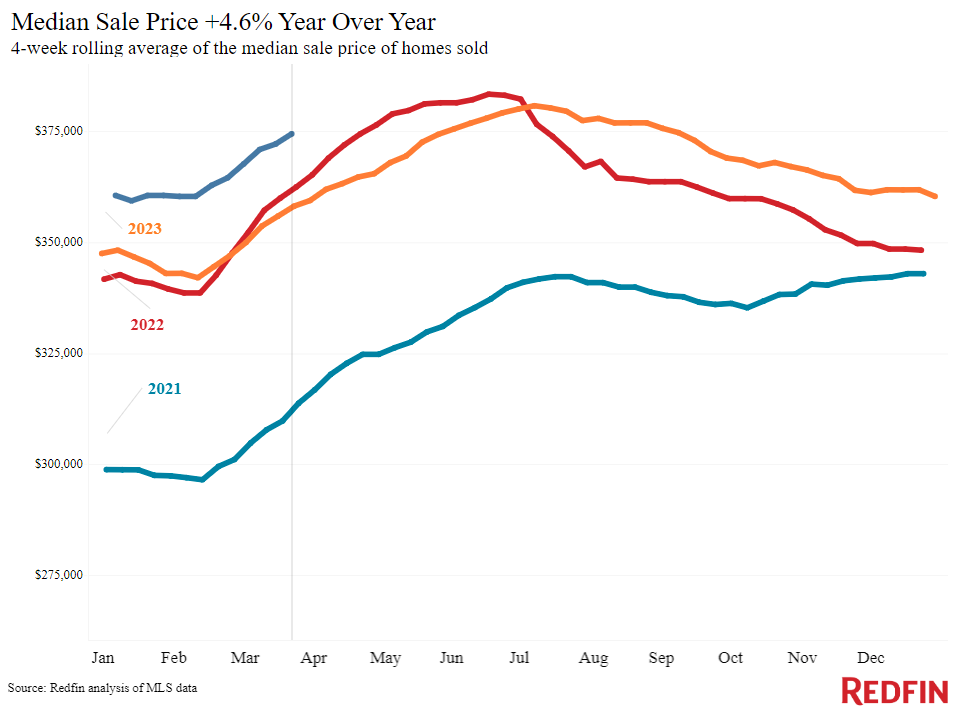

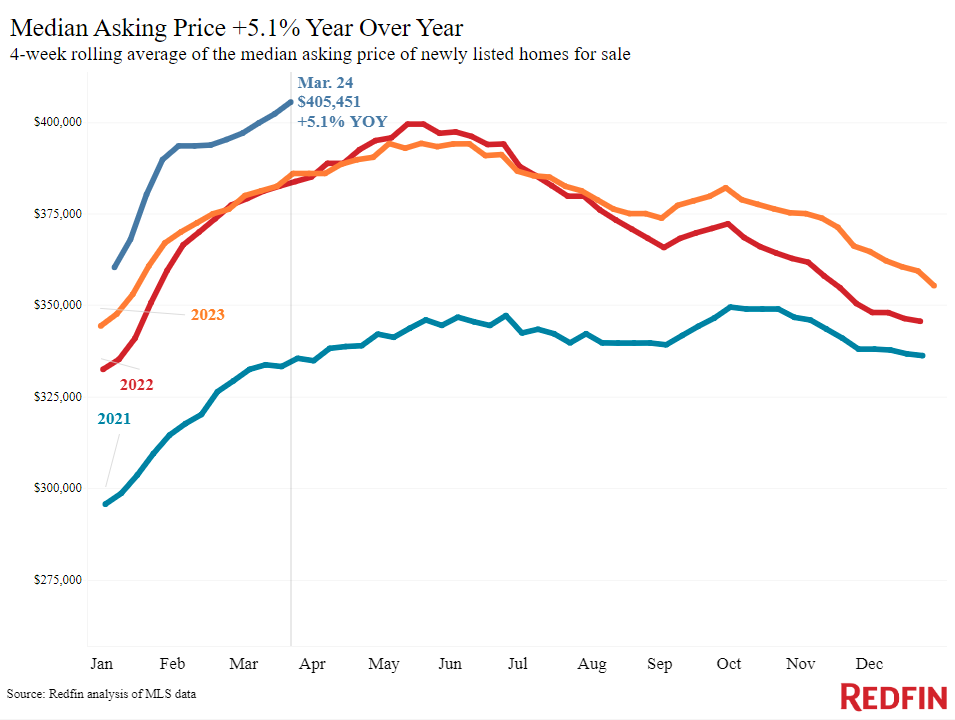

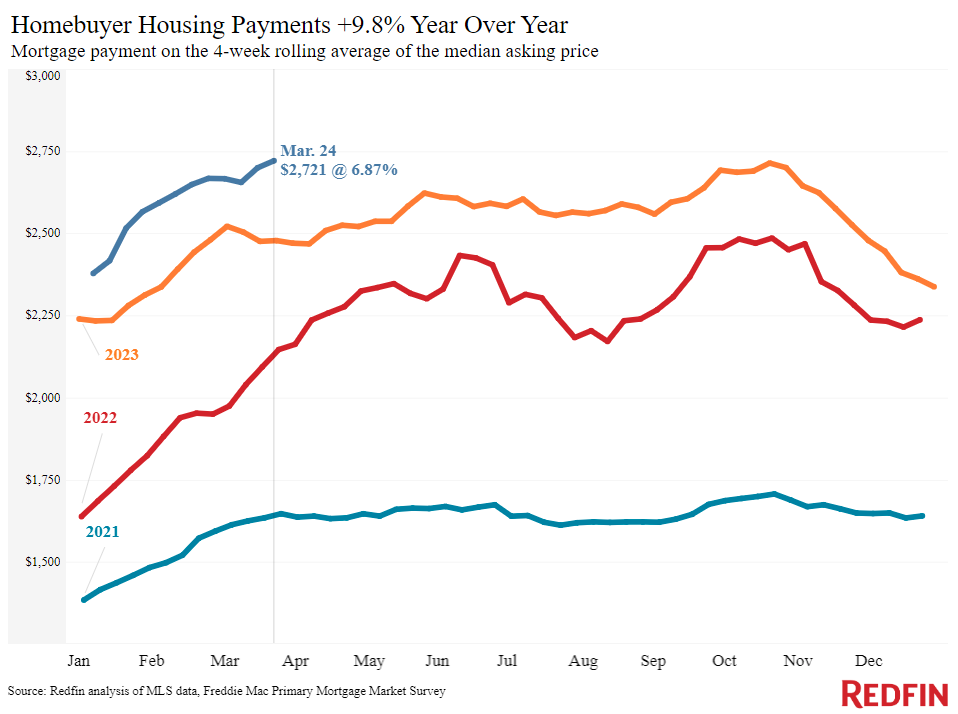

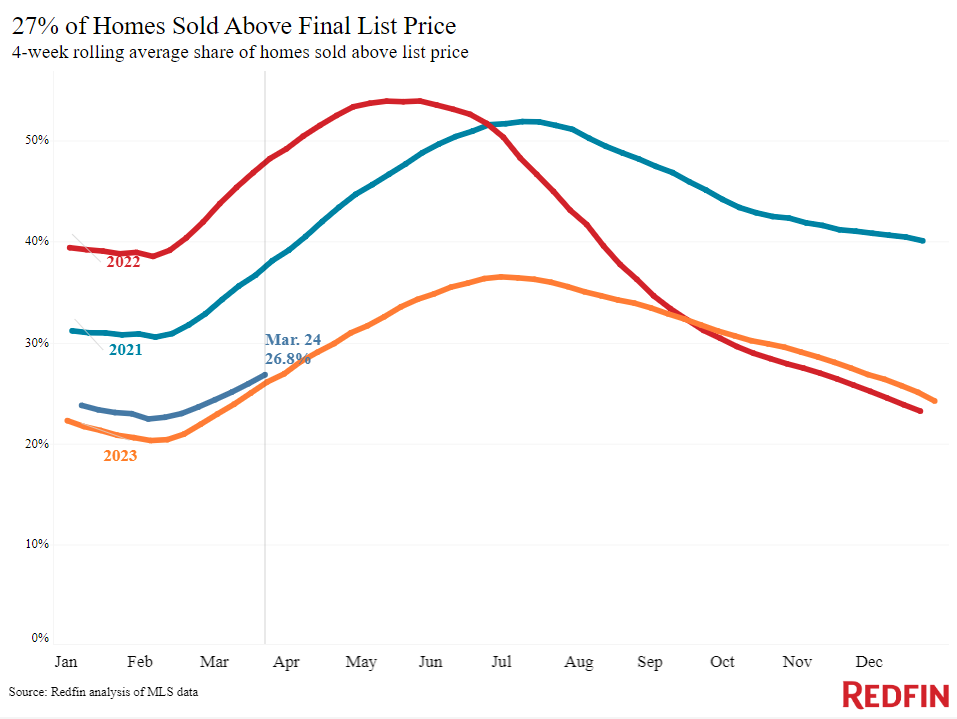

The typical U.S. monthly housing payment hit an all-time high of $2,721 during the four weeks ending March 24, up 10% from a year earlier. Housing payments are at a record high because of the one-two punch of elevated mortgage rates and rising home prices. Mortgage rates remain elevated near 7%, and the median home-sale price is up 5% year over year to roughly $375,000, just about $9,000 shy of June 2022’s record high.

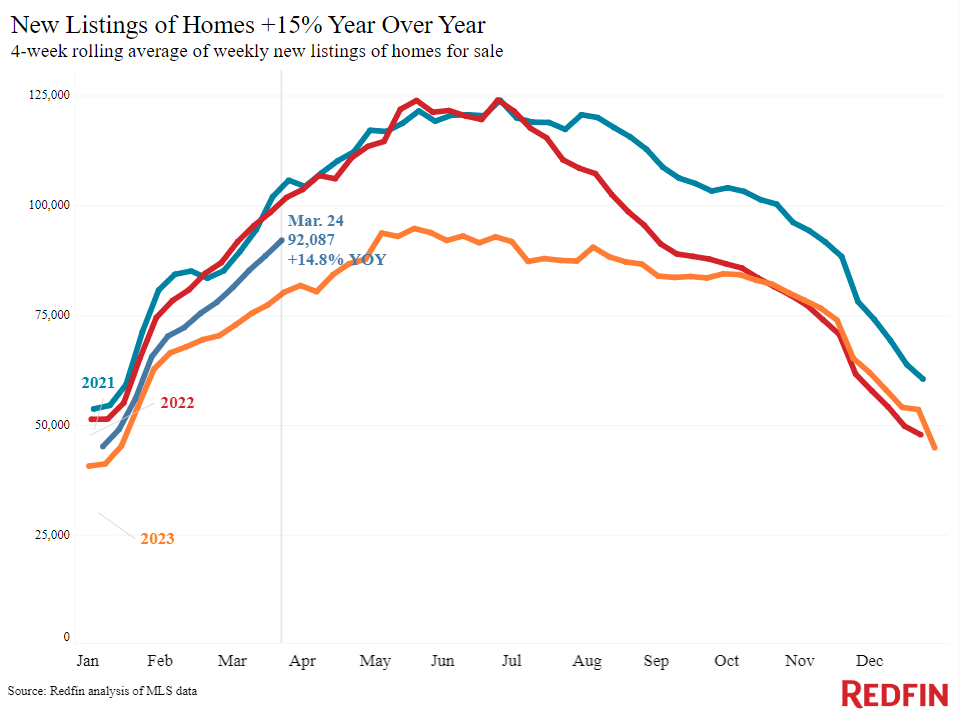

Many sellers are trying to take advantage of rising prices by listing their home. New listings are up 15%, the biggest increase in nearly three years, and the total number of homes for sale is up 6%, the biggest increase in nearly one year.

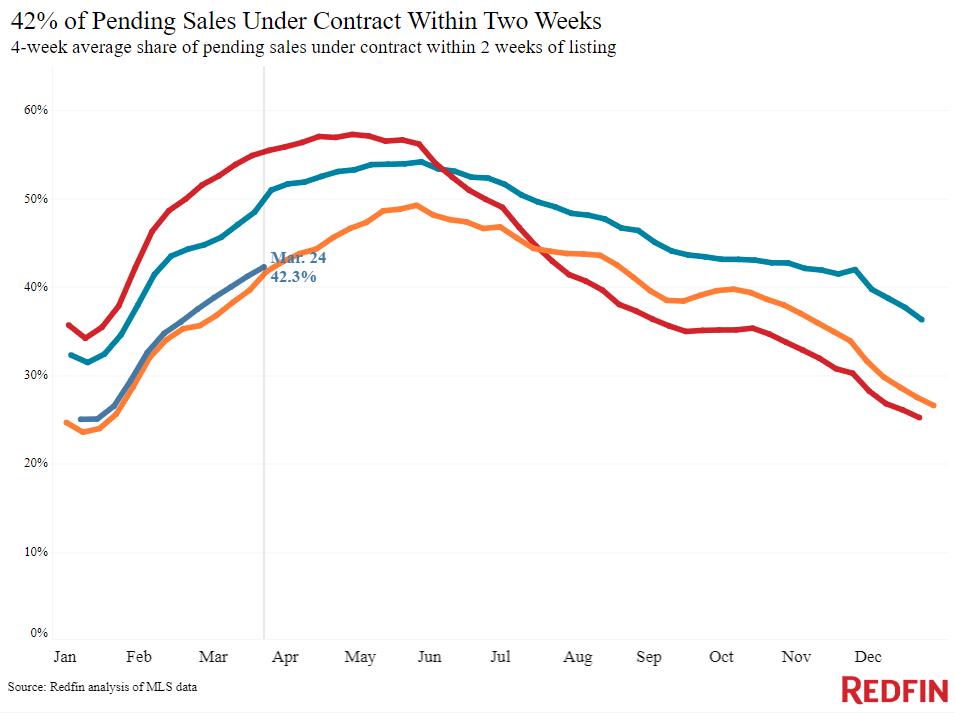

Increased supply is bringing back some demand, which is the main reason price growth remains robust. Mortgage-purchase applications are up 14% from a month ago, and pending home sales are just 1% lower than they were a year ago, the smallest decline since the beginning of the year.

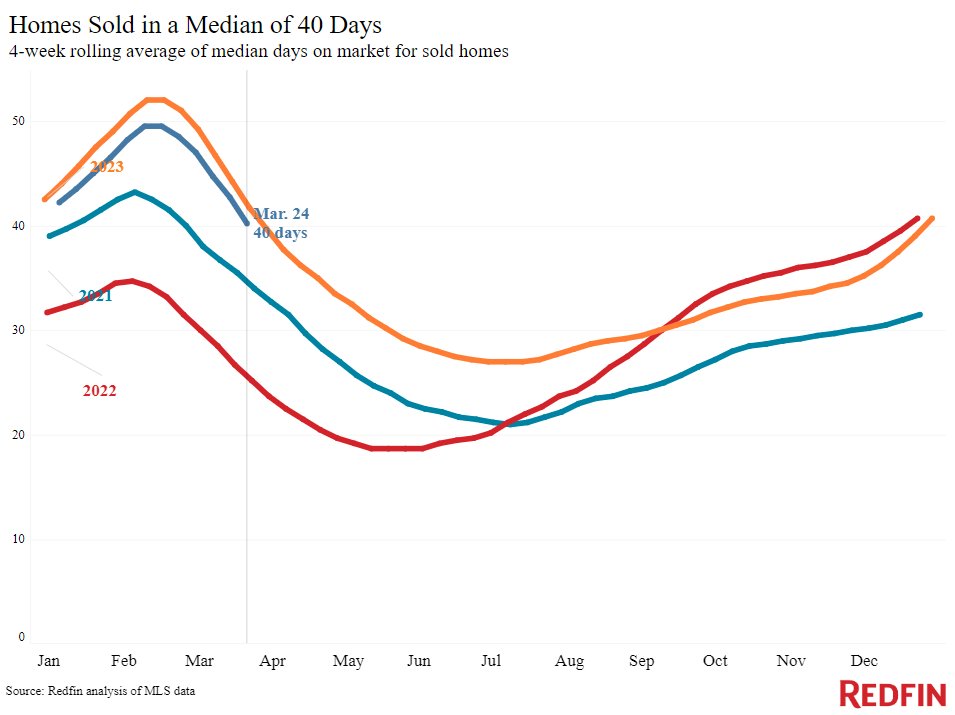

“High mortgage rates aren’t deterring buyers as much as they were last year; a lot of people want to get in now before prices go up more,” said Miami Redfin agent Rachel Riva. “All of my recent listings have gone under contract in under 10 days, and most of them have received multiple offers. Buyers are lessening the impact of elevated rates in a few ways: Some are making high down payments to lower their monthly payments, and some are willing to take on a high rate now in hopes of refinancing when and if rates come down.”

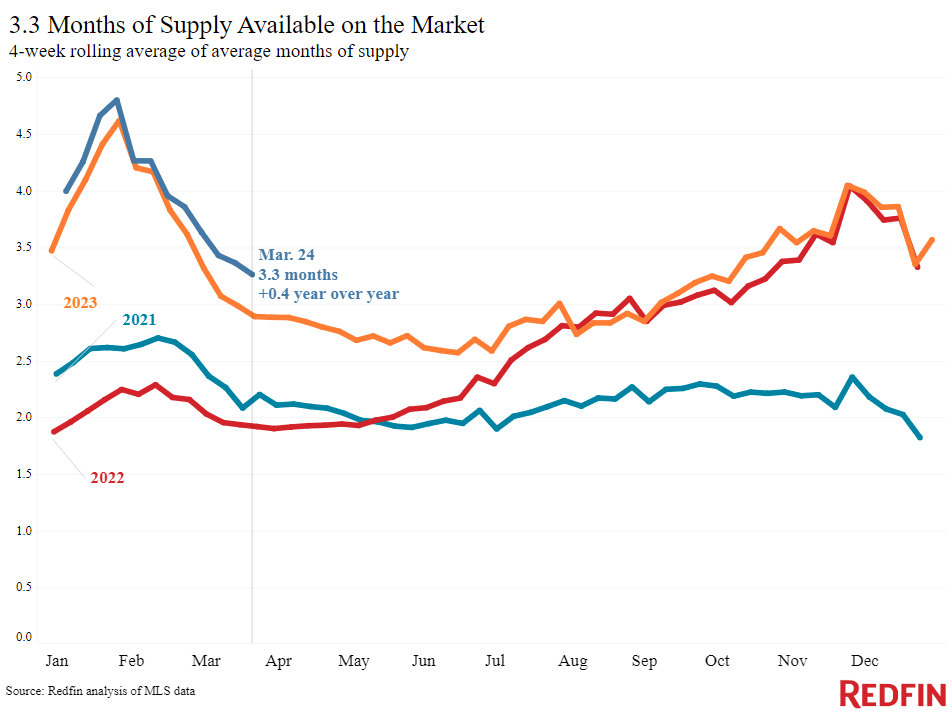

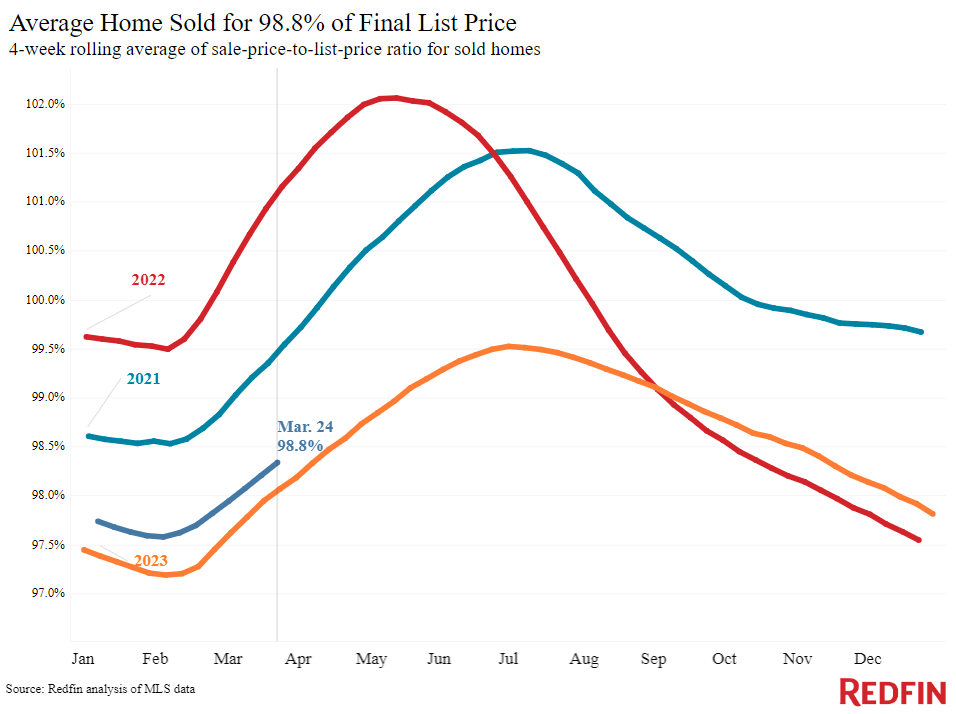

There are a few signs that price growth could soften a bit in the coming months. Nearly 6% of home sellers dropped their asking price this week, on average, the highest share of any March on record. Months of supply hit its highest level of any March since 2020–when the onset of the pandemic ground the housing market to a halt–indicating that the market is becoming more balanced.

Refer to our metrics definition page for explanations of all the metrics used in this report.