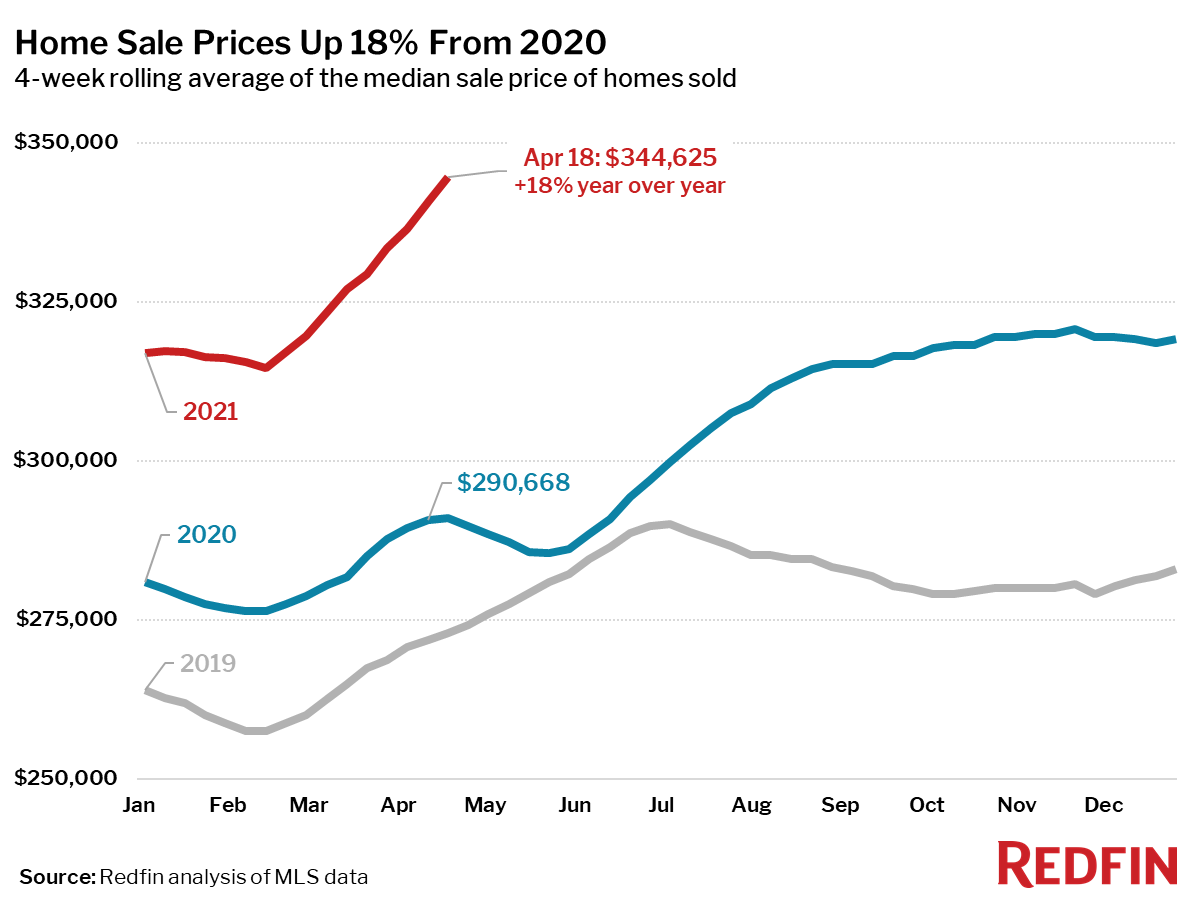

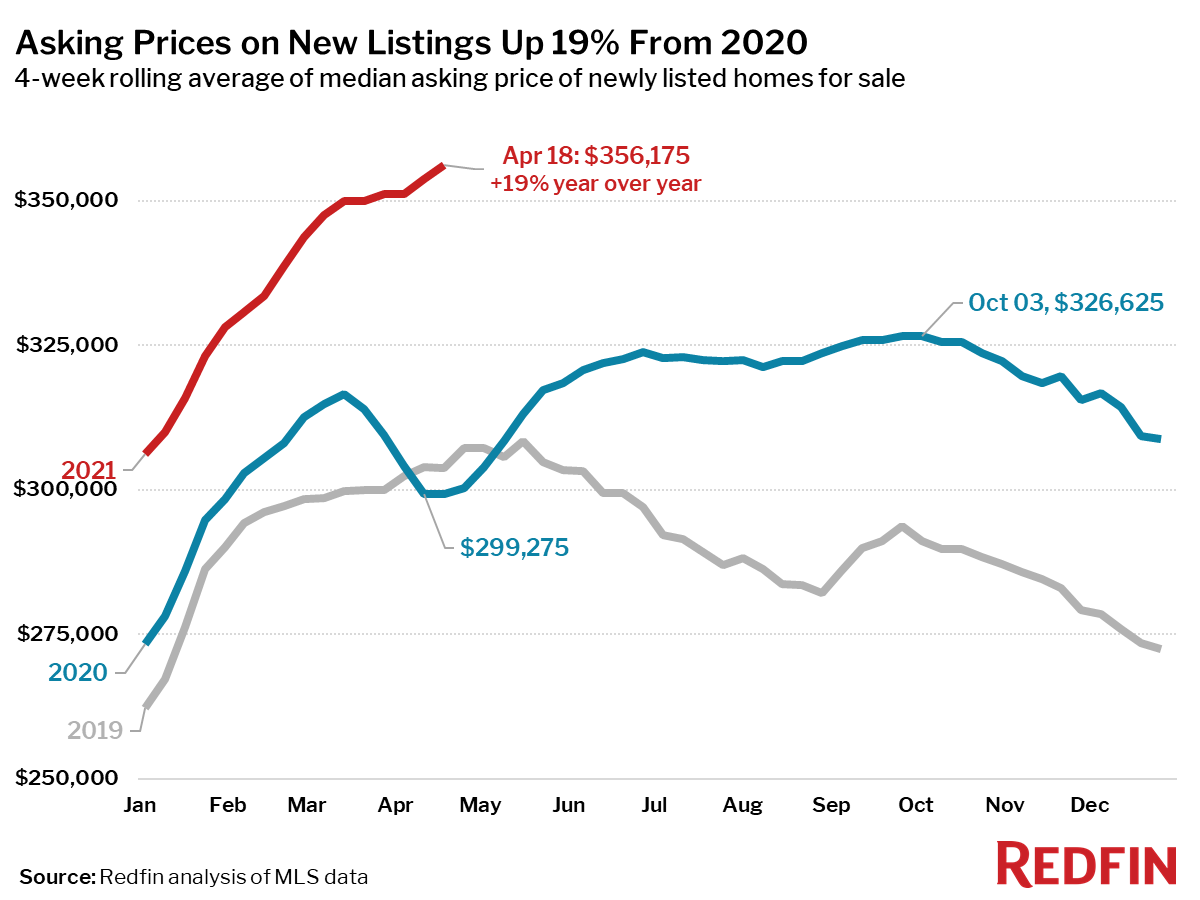

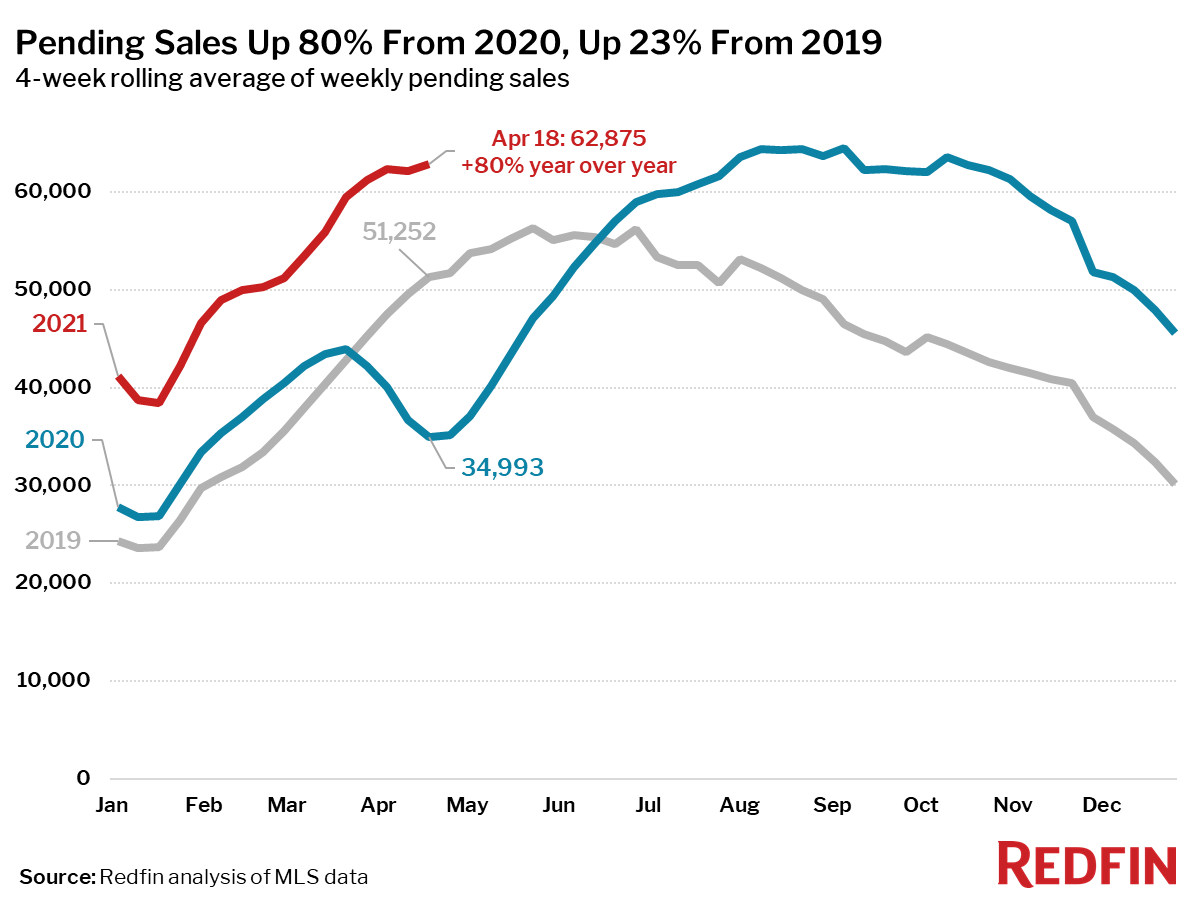

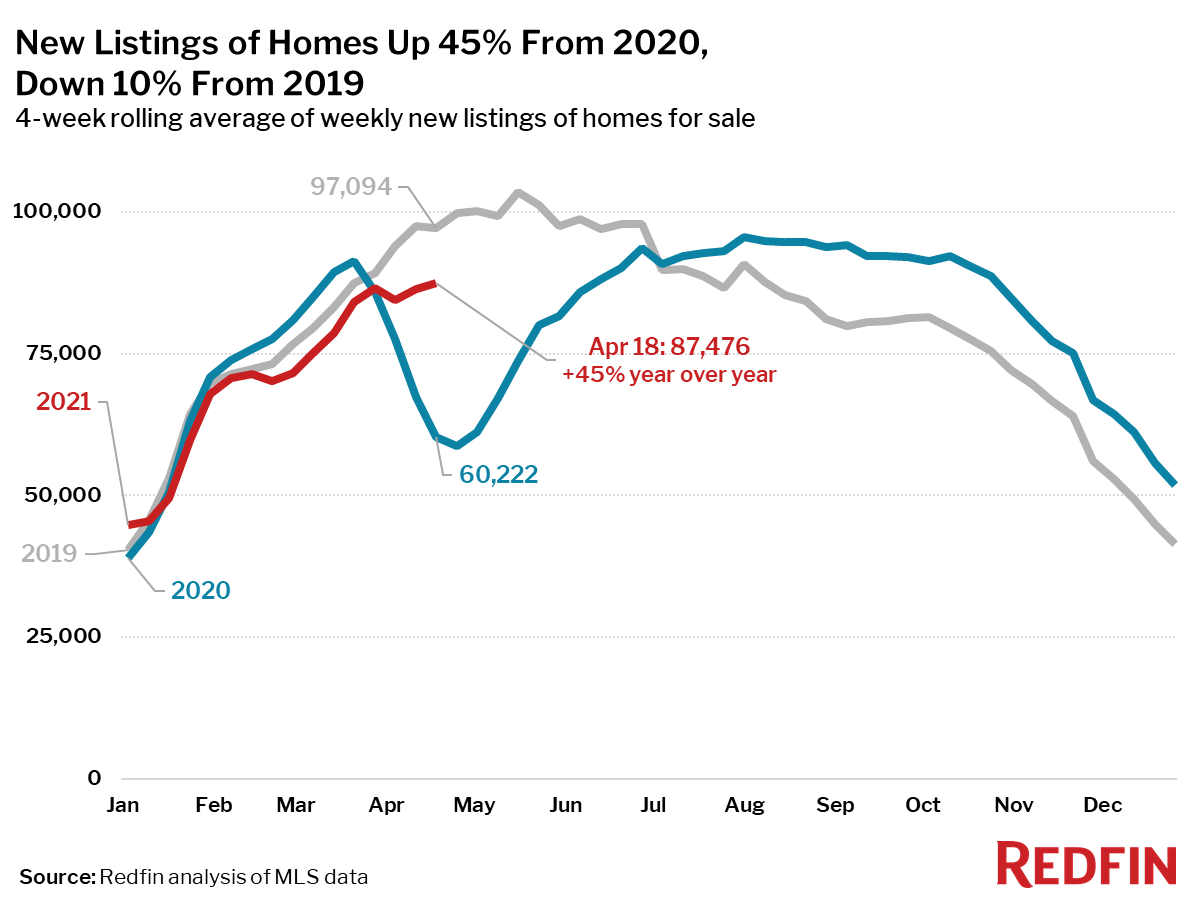

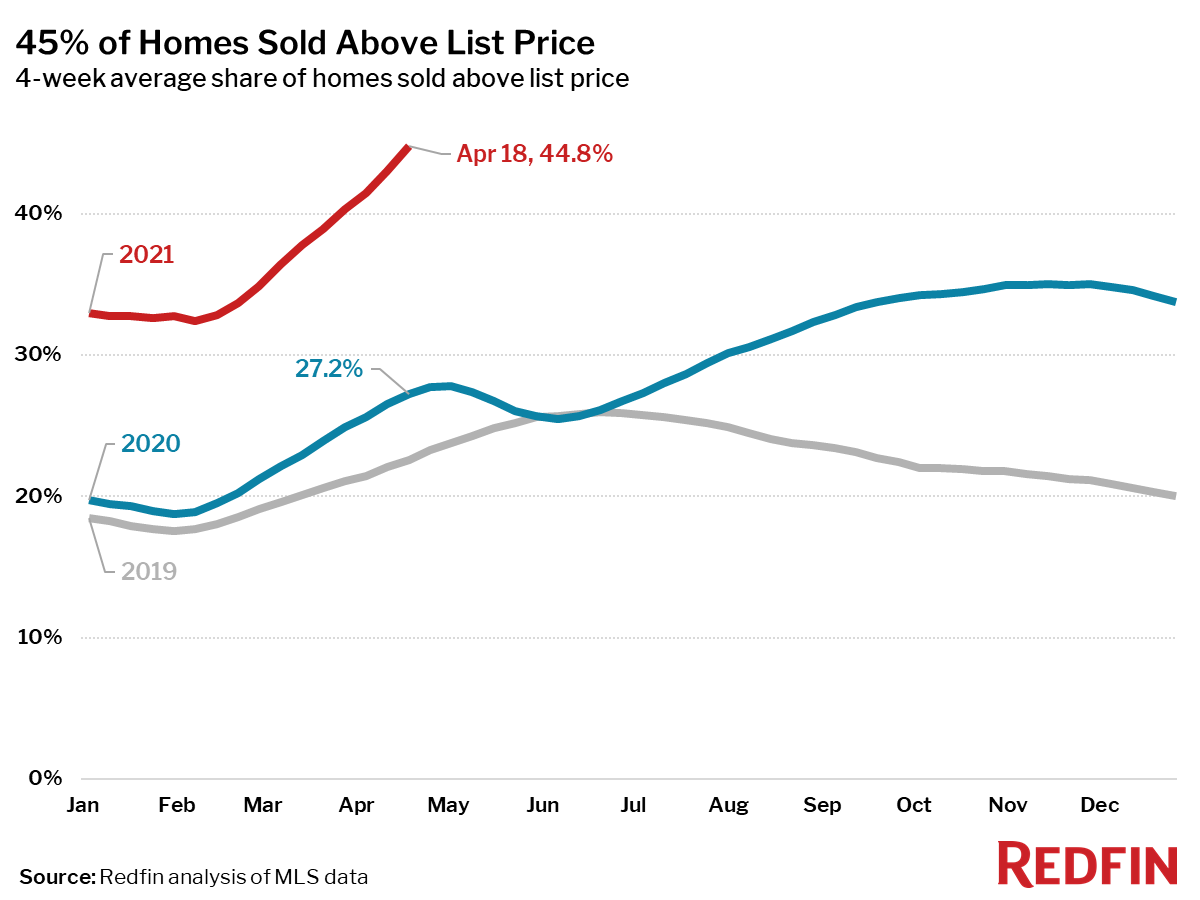

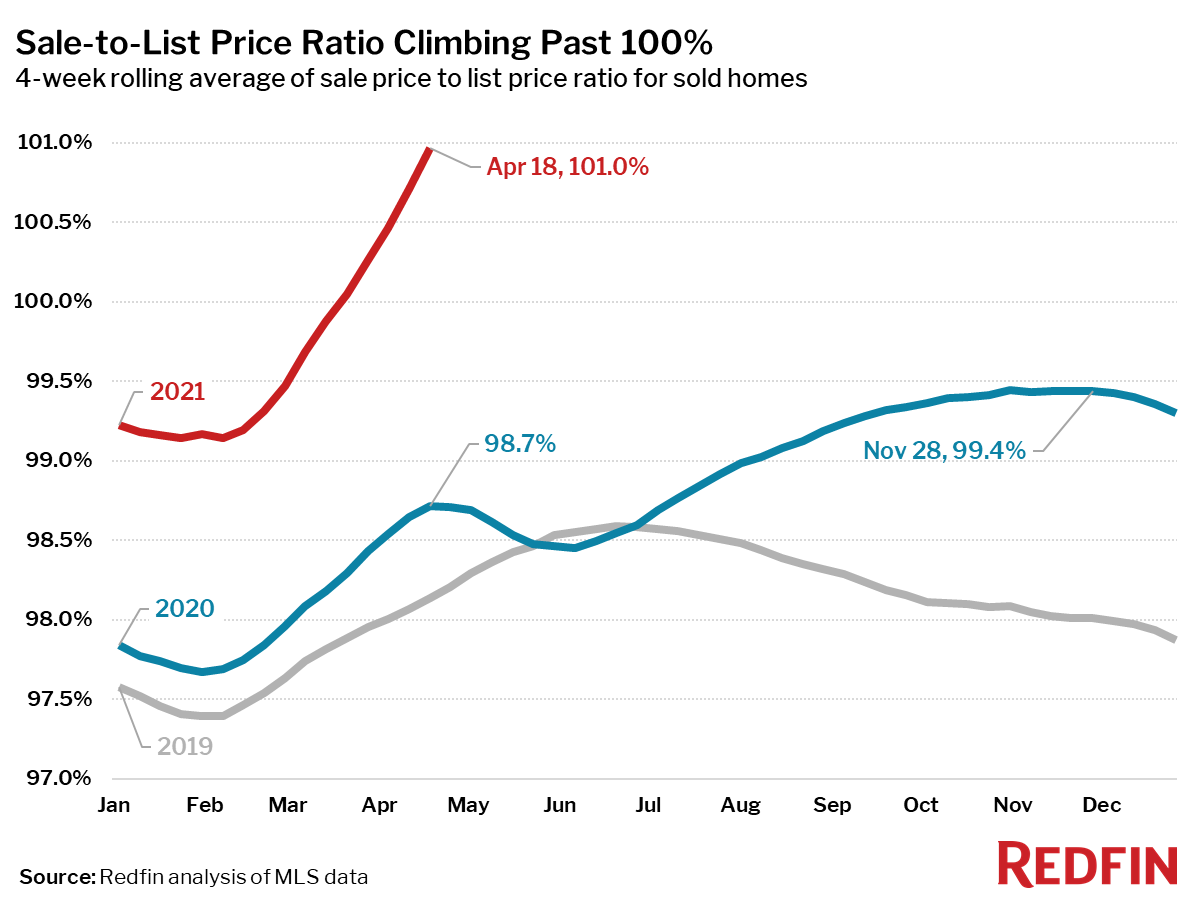

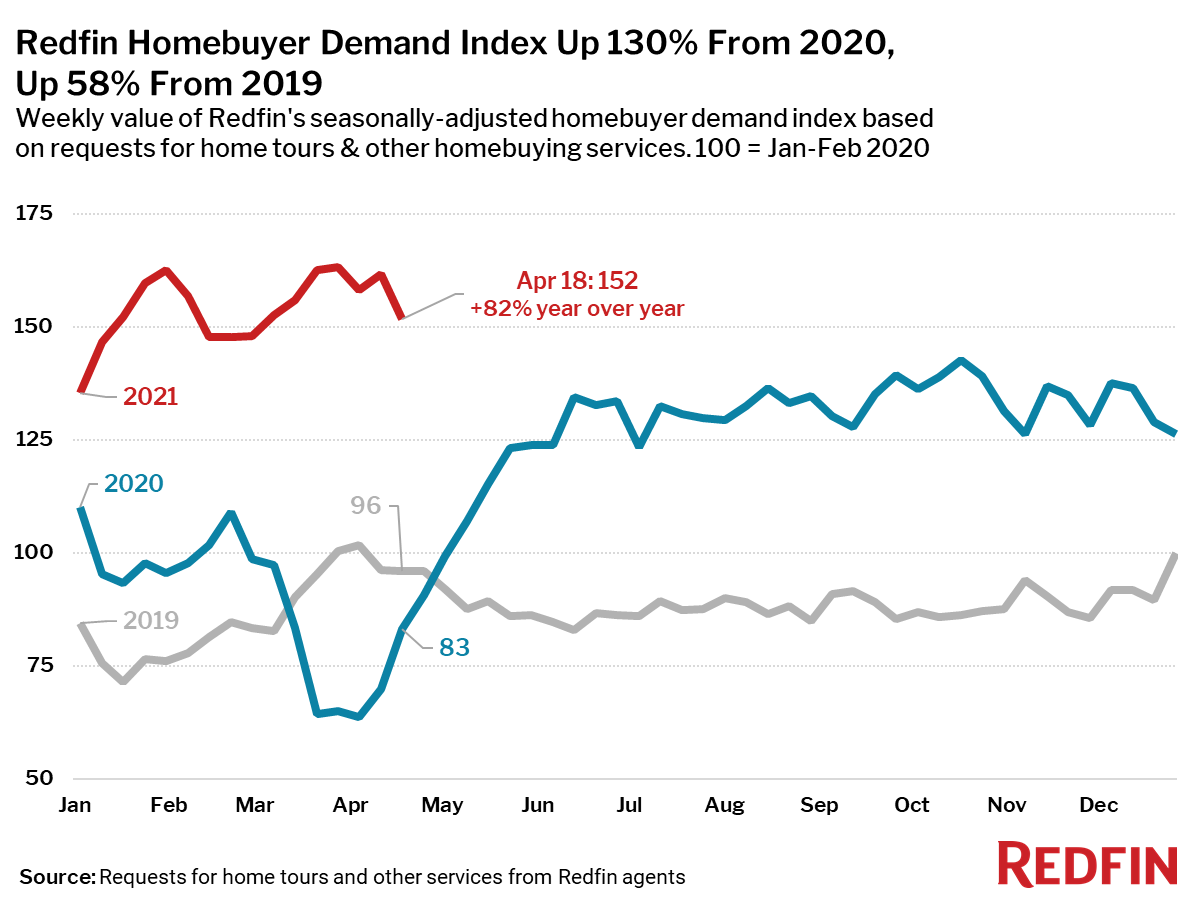

Unless otherwise noted, this data covers the four-week period ending April 18.

Note: At this time last year, pandemic stay-at-home orders halted homebuying and selling, which makes year-over-year comparisons unreliable for select housing metrics. As such, we have broken this report into two sections: metrics that are OK to compare to the same period in 2020, and metrics for which it makes more sense to compare to the same period in 2019.

Mortgage purchase applications increased 6% week over week (seasonally adjusted). For the week ending April 22, 30-year mortgage rates fell to 2.97%, the lowest level since the week ending February 25.

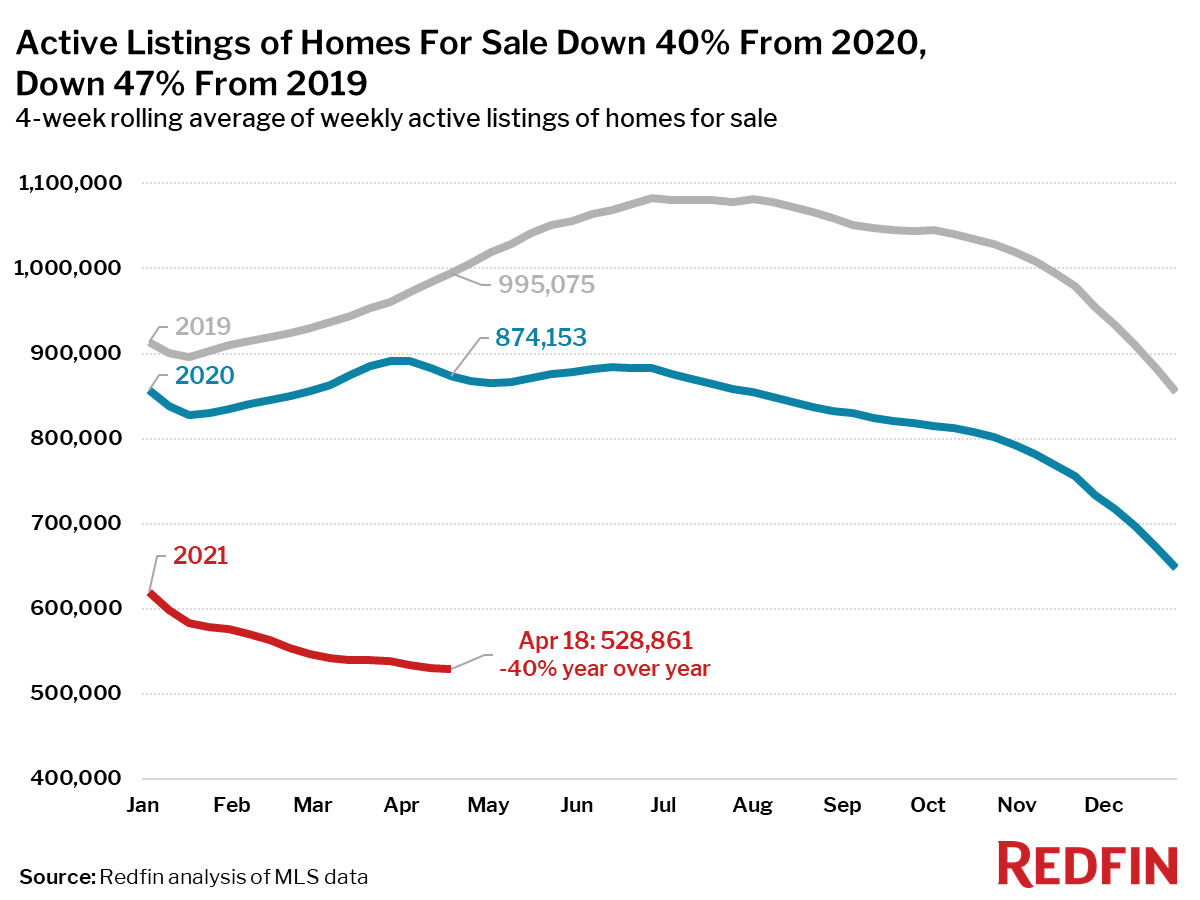

“There has been an ongoing debate at Redfin about whether fear of coronavirus infection was keeping homeowners from selling. With a third of American adults now fully vaccinated and still hardly any homes being listed for sale, we’re close to settling that debate,” said Redfin Chief Economist Daryl Fairweather. “Homeowners are staying put because if they move and buy another home they will face a very competitive housing market as buyers, and they don’t need to sell to take advantage of record low mortgage rates. They can just refinance their current home. On top of that, builders are struggling to construct new homes given an ongoing lumber shortage. Without more homeowners listing, buyers are scrambling to compete for the limited number of homes on the market, which continues to drive prices up to new heights.”

Refer to our metrics definition page for explanations of all the metrics used in this report.