New listings have hit their lowest level of any early June on record, limiting home sales and keeping prices afloat. But many buyers are still touring homes, indicating that we’ll see pent-up demand when mortgage rates fall and supply improves.

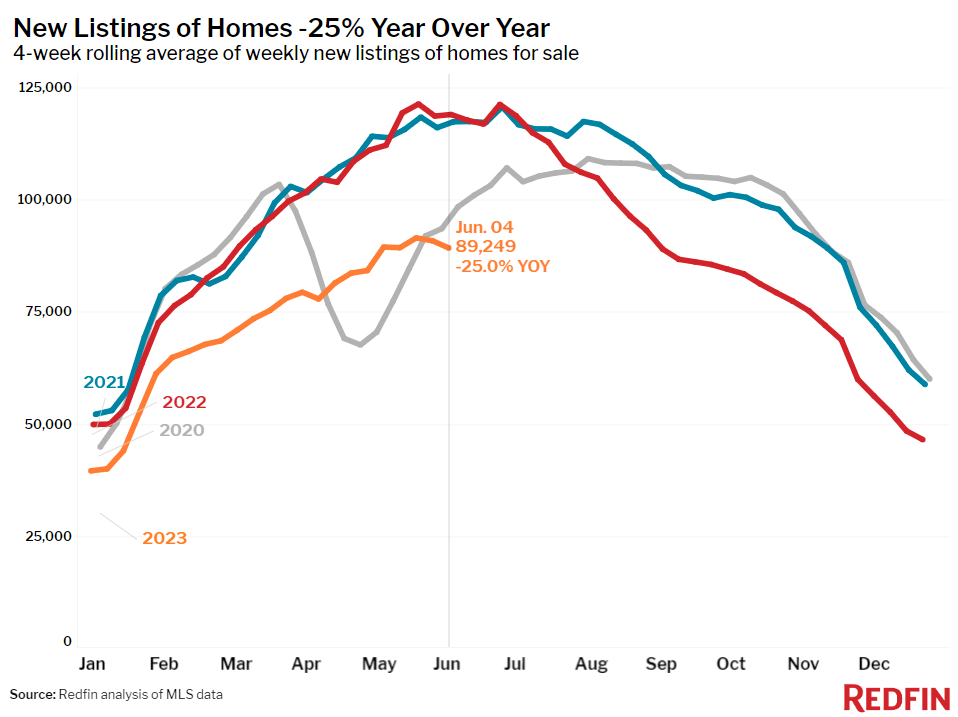

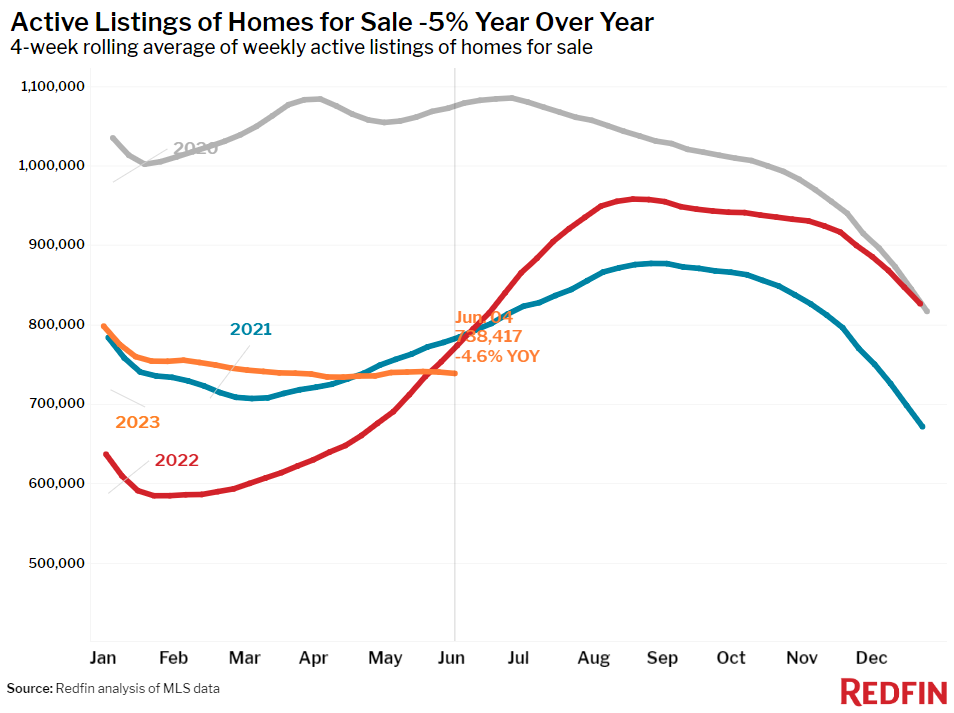

New listings of homes for sale fell 25% from a year earlier during the four weeks ending June 4 to their lowest level of any early June on record. The continued lack of new listings has pushed the total number of homes on the market down 5% year over year to its lowest level on record for early June.

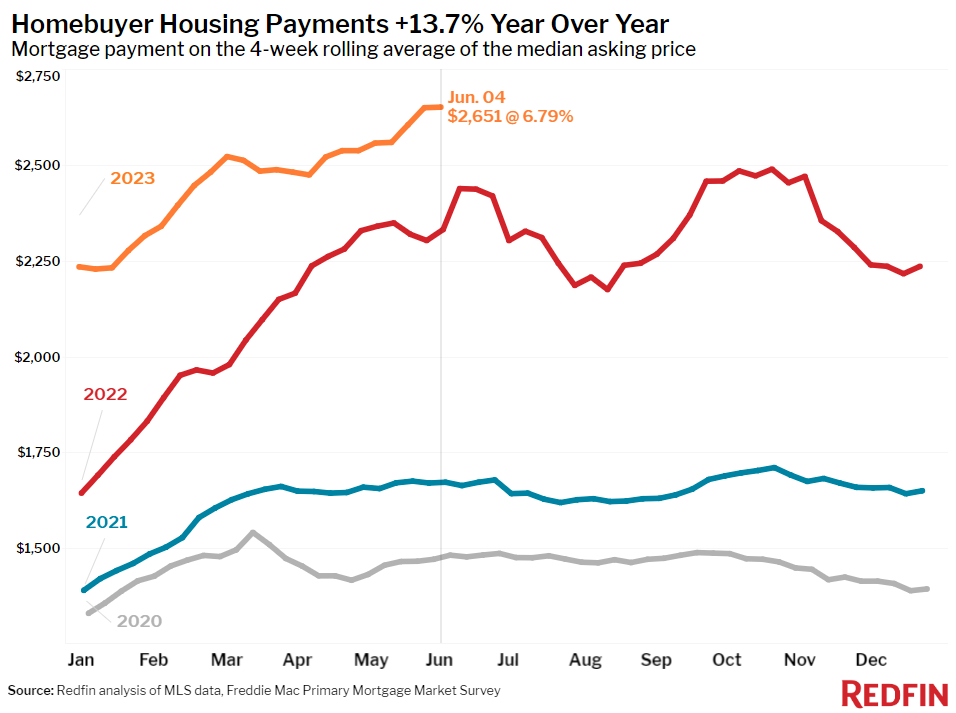

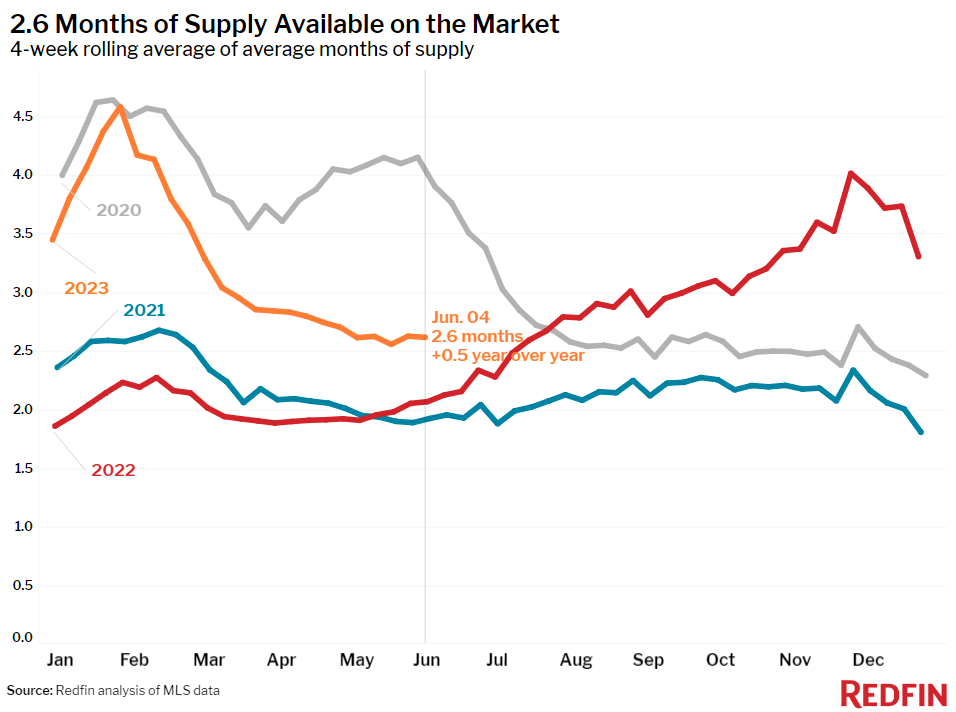

Elevated mortgage rates–the daily average was 6.94% on June 7, near its highest level in two decades–are driving the inventory shortage. The vast majority of homeowners have a mortgage rate below 6%, discouraging them from listing their home and giving up their relatively low rate.

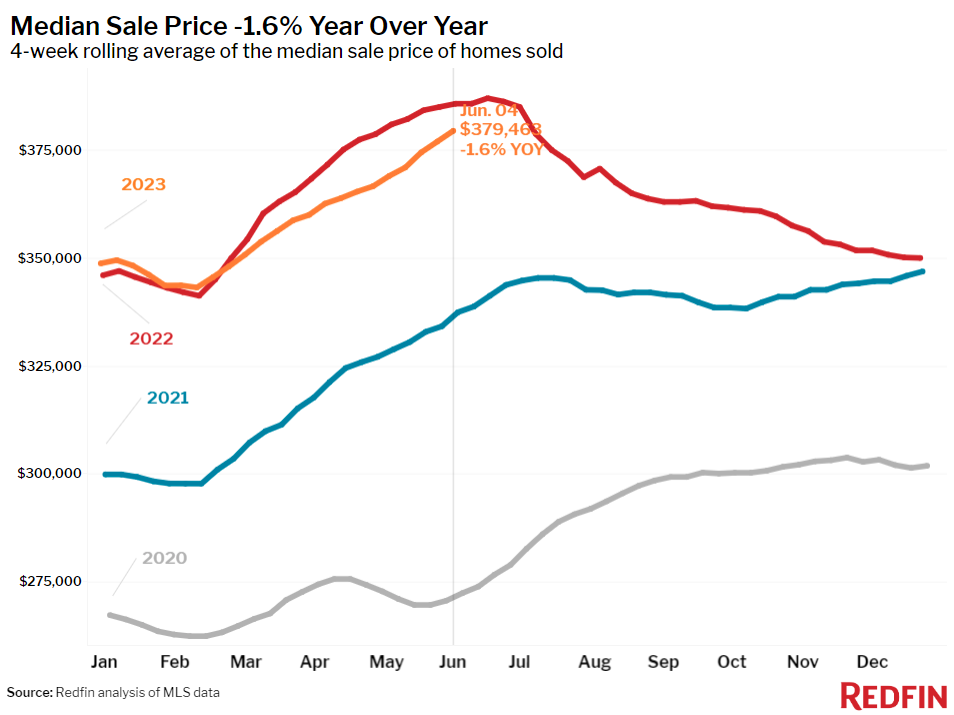

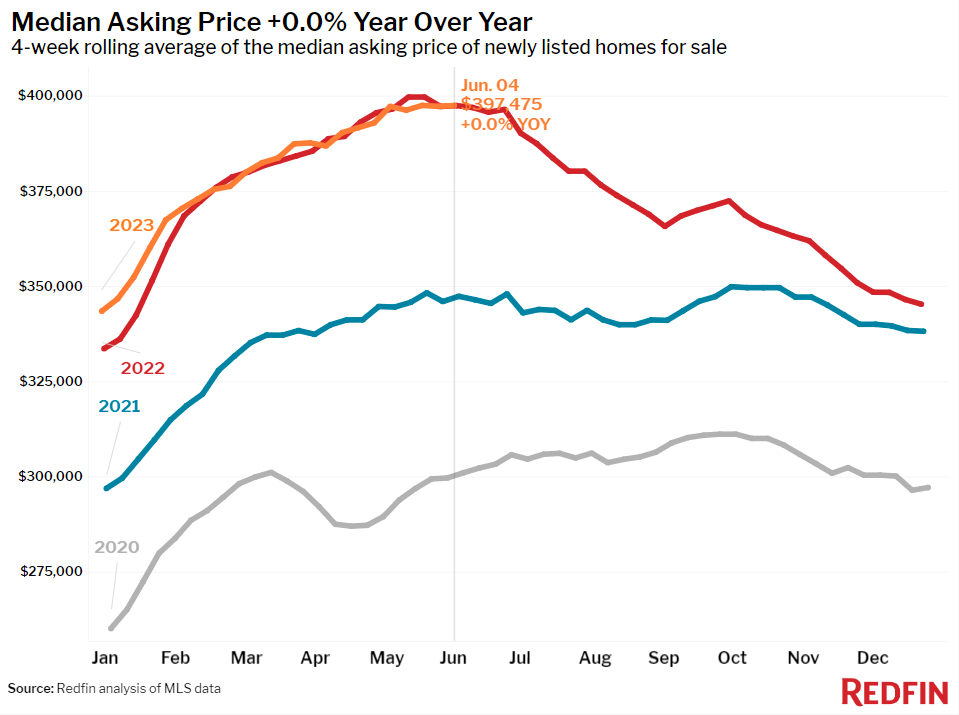

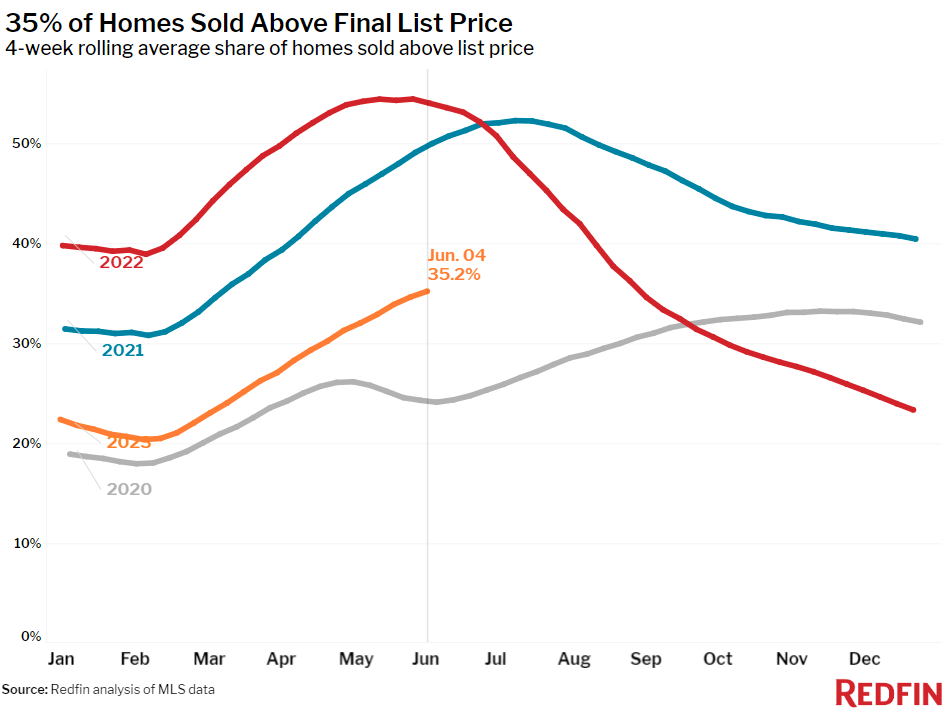

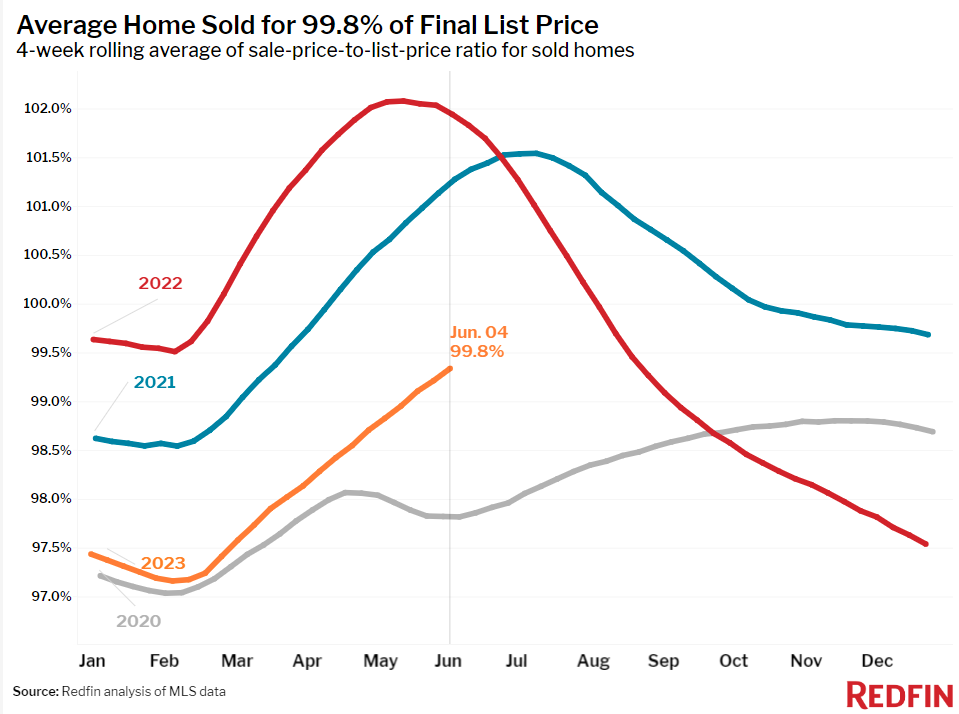

Limited inventory is keeping national home-price declines relatively modest, with the typical U.S. home price down 1.6% year over year. That’s the smallest dip in three months and half the size of April’s 3.2% drop, which was the biggest in at least a decade. Home prices are still increasing in some parts of the country. The median U.S. asking price is unchanged from a year ago after several weeks of declines, indicating that sellers in at least some metro areas are noticing that they can command favorable prices.

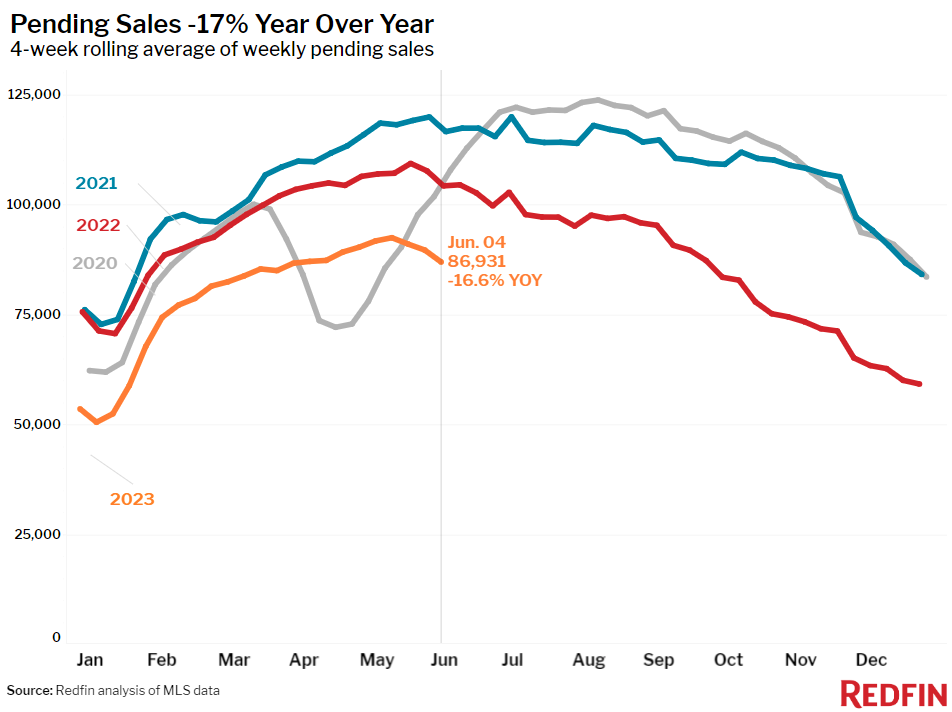

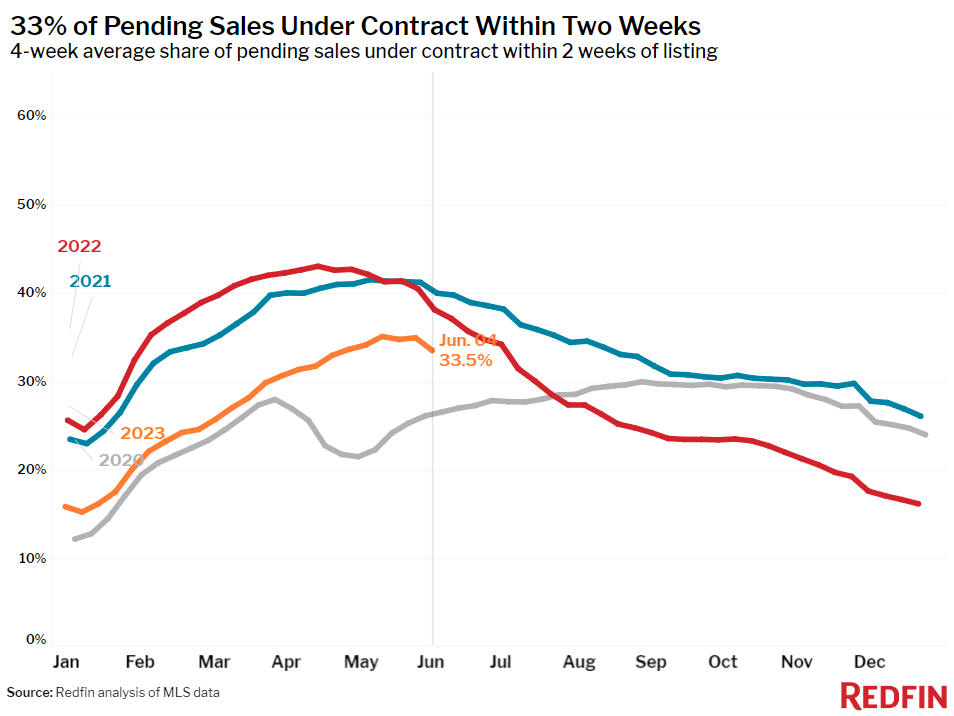

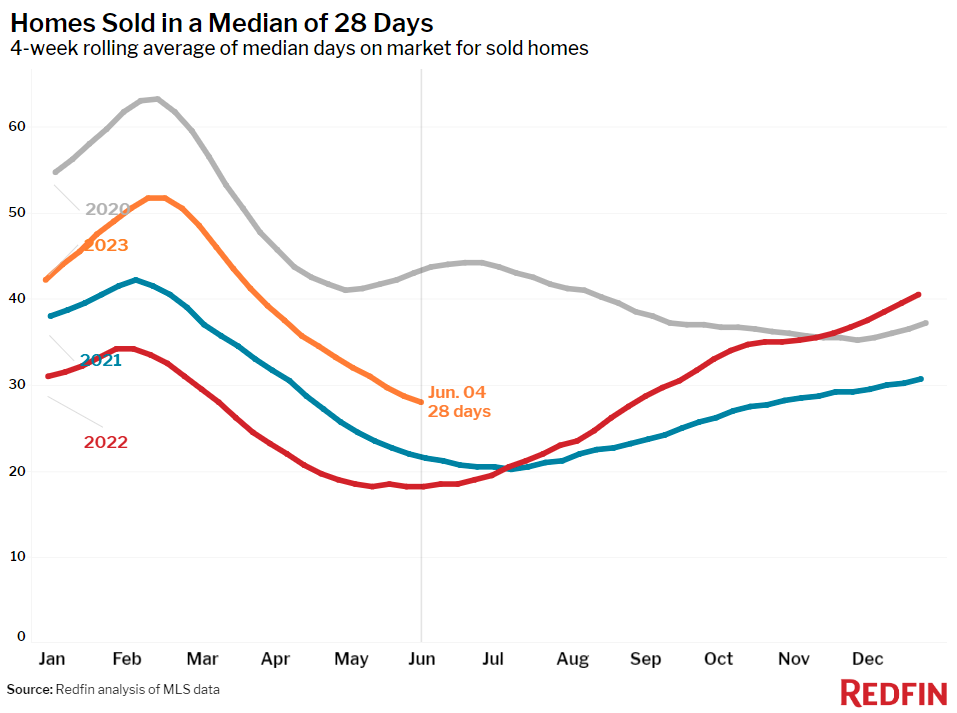

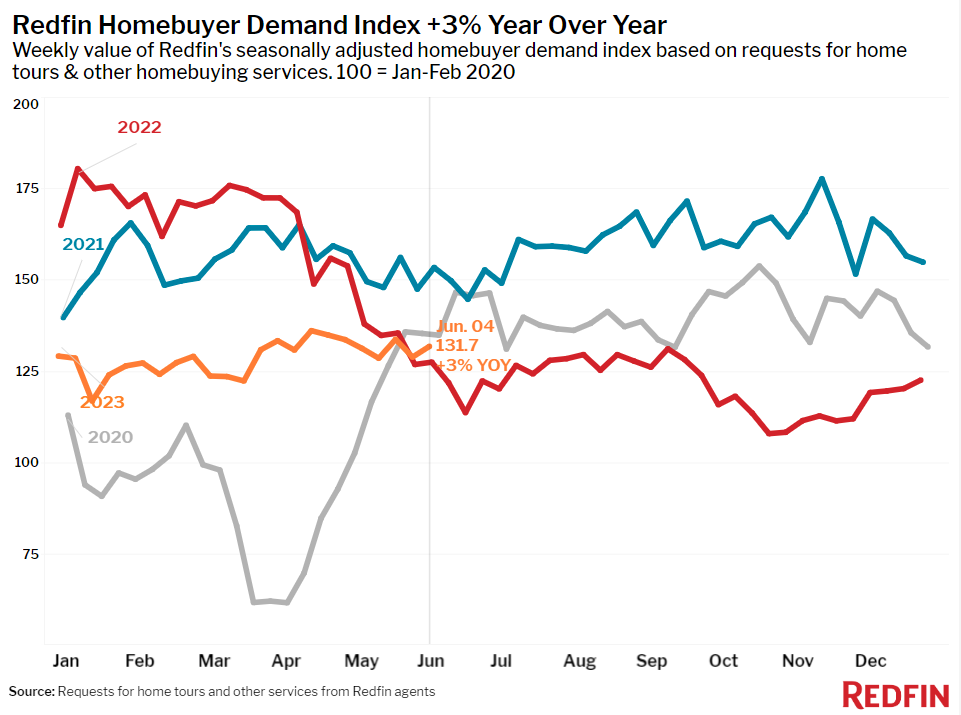

In addition to propping up prices, the scarcity of listings is limiting purchases; pending home sales are down 17%, continuing a yearlong streak of double-digit drops. But early-stage homebuying demand continues to hold up, with Redfin’s Homebuyer Demand Index–a measure of requests for tours and other services from Redfin agents–near its highest level in a year. That indicates that would-be buyers are out there and may make an offer when mortgage rates decline and/or more homes are listed.

“Homes priced under $500,000 are flying off the market because buyers in that price range don’t have many options,” said Sacramento Redfin Premier agent David Orr. “I’ve been working with one first-time homebuyer for about a year, and she’s adjusted her search as rates have risen. Now that mortgage rates are close to 7%, she’s looking at lower-priced, smaller homes. But the problem we’re facing now is competition: In that lower price range, it takes many misses before you get a hit. She just made an offer nearly $30,000 above asking price for a home listed at $429,000, but she lost out because it had four other offers. I’m advising buyers to get their loan pre-approved and look at homes under budget so they’re prepared to go above asking price.”

Unless otherwise noted, the data in this report covers the four-week period ending June 4. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.