Daily average mortgage rates jumped to their highest level since last November after last week’s disappointing inflation report. Persistently high home prices are exacerbating affordability challenges for buyers.

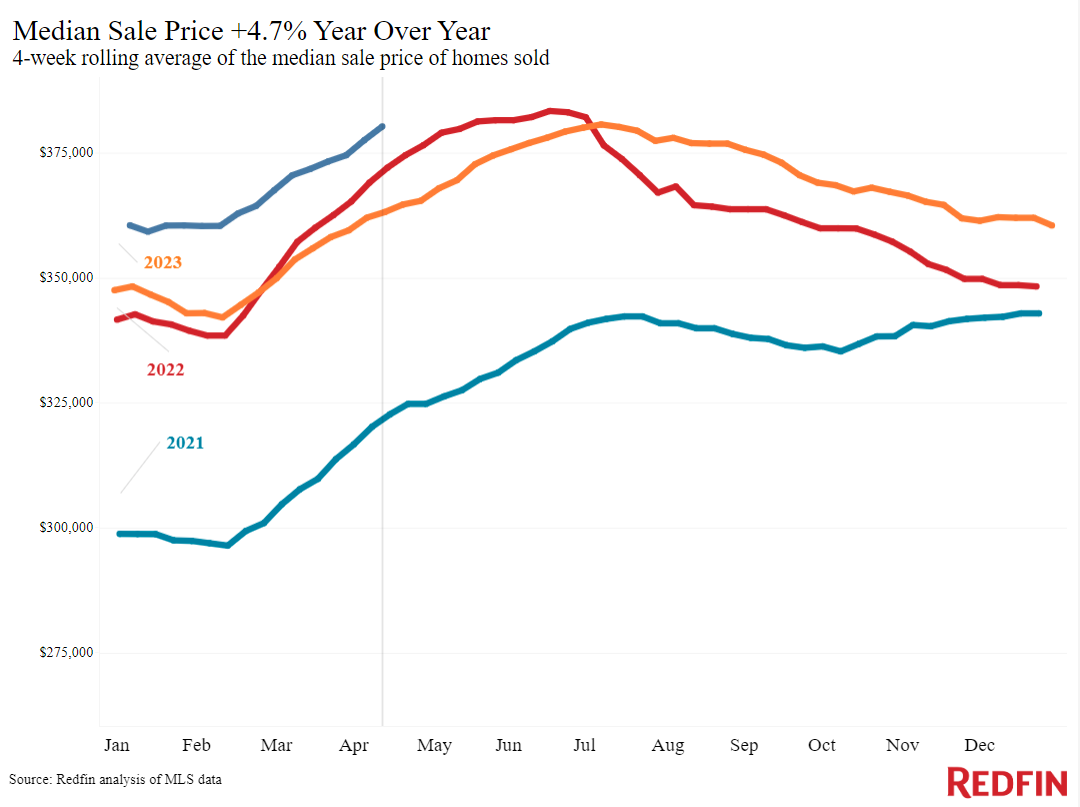

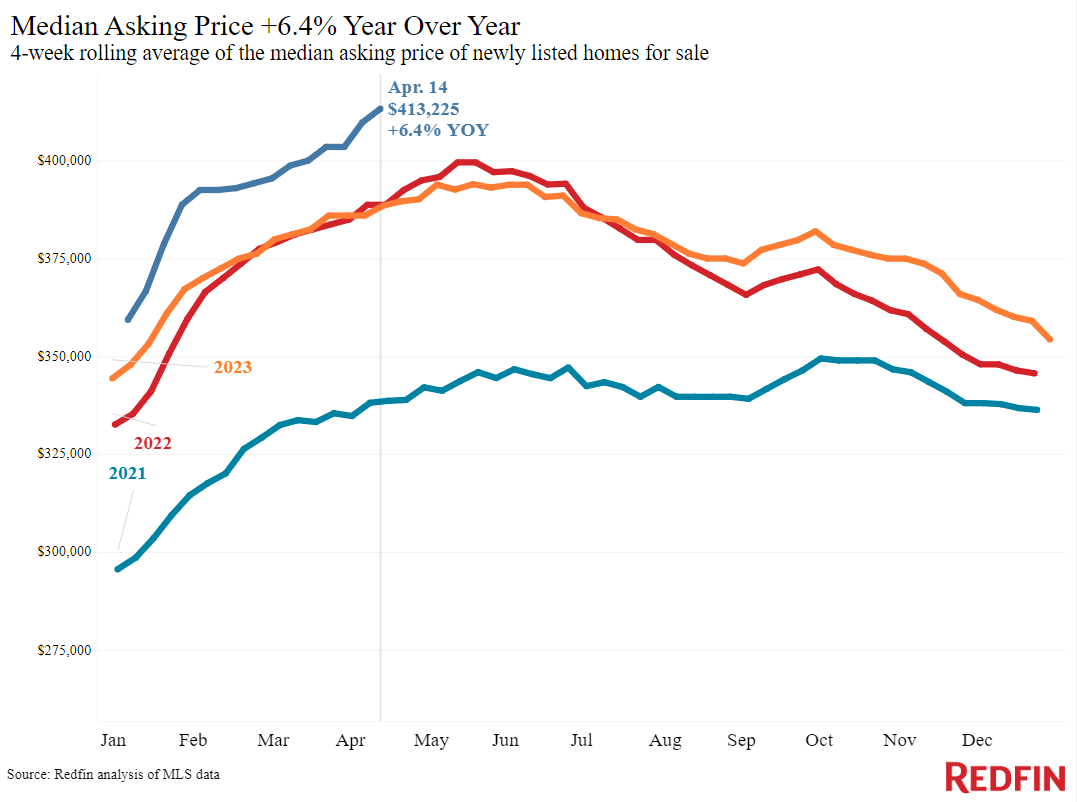

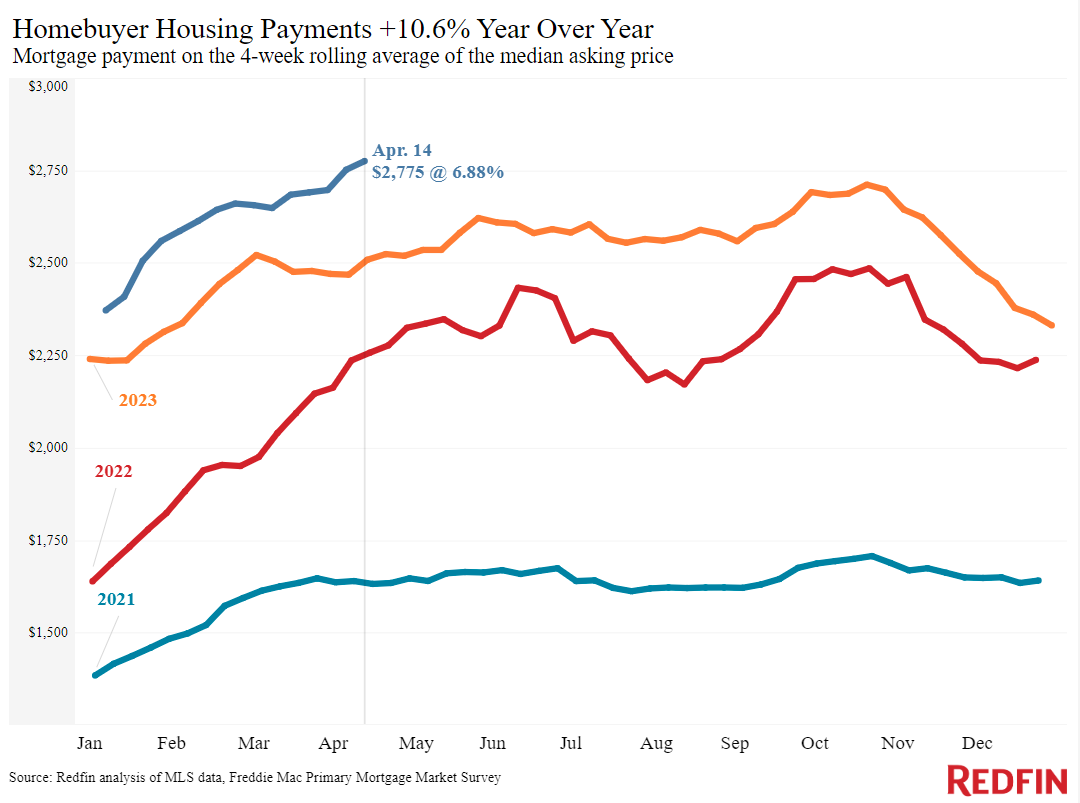

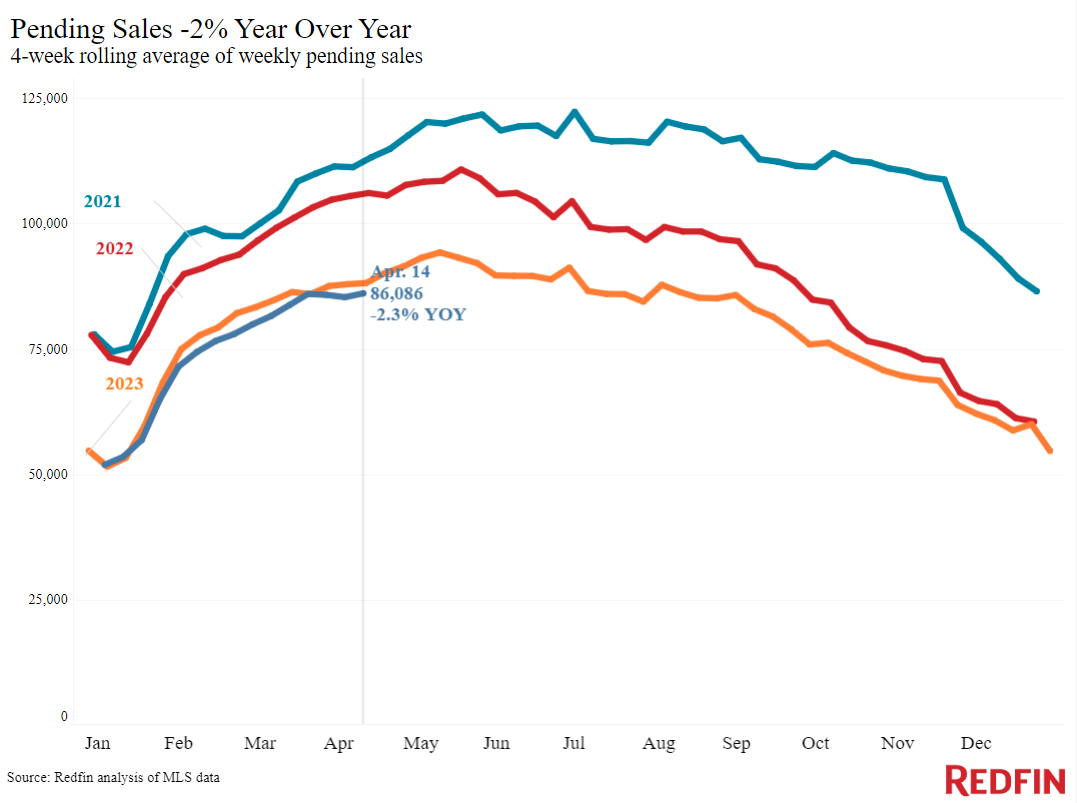

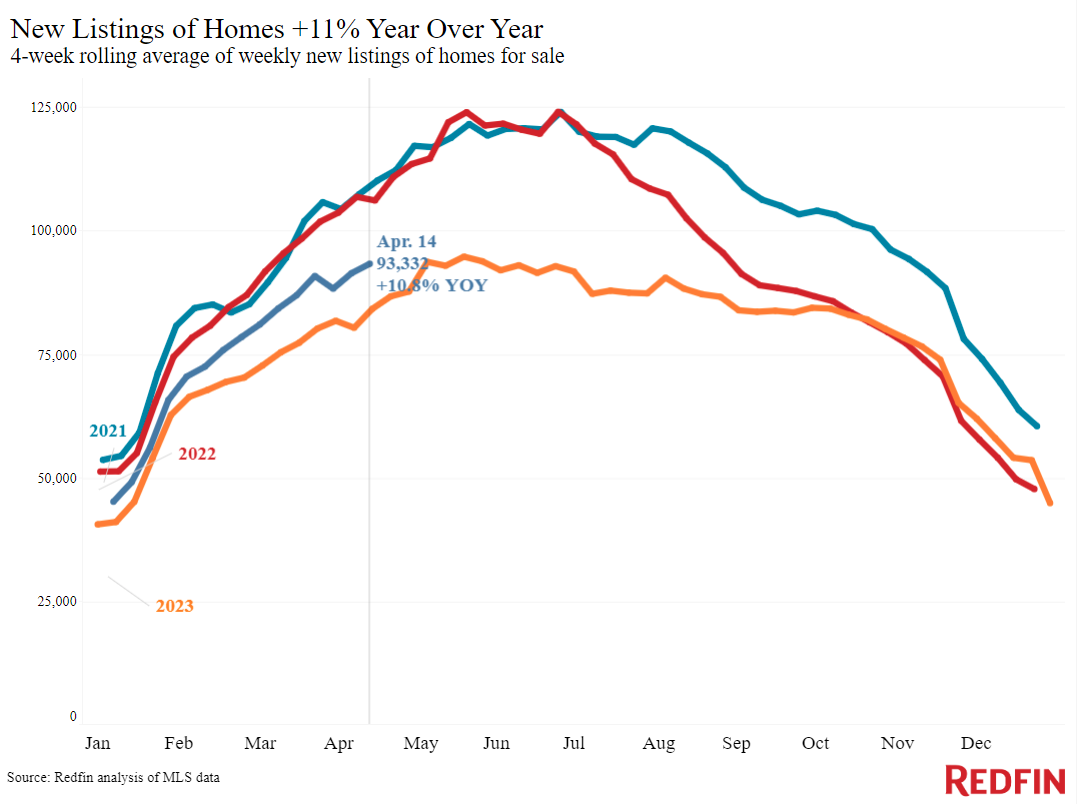

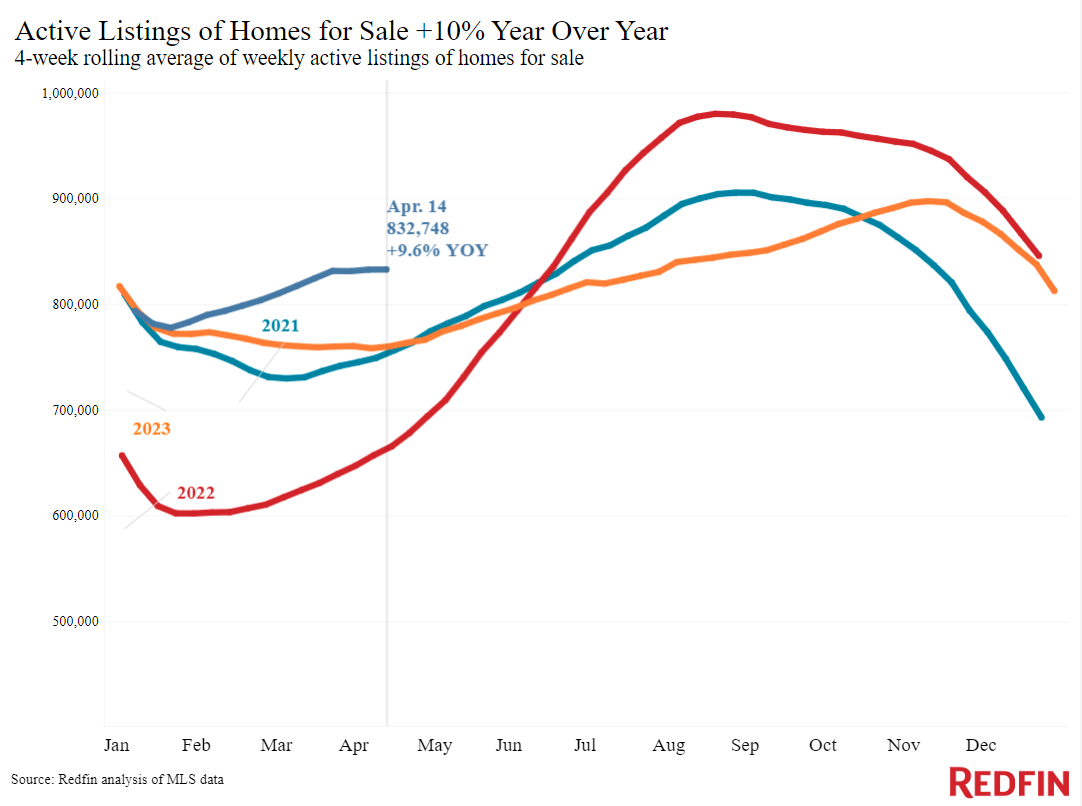

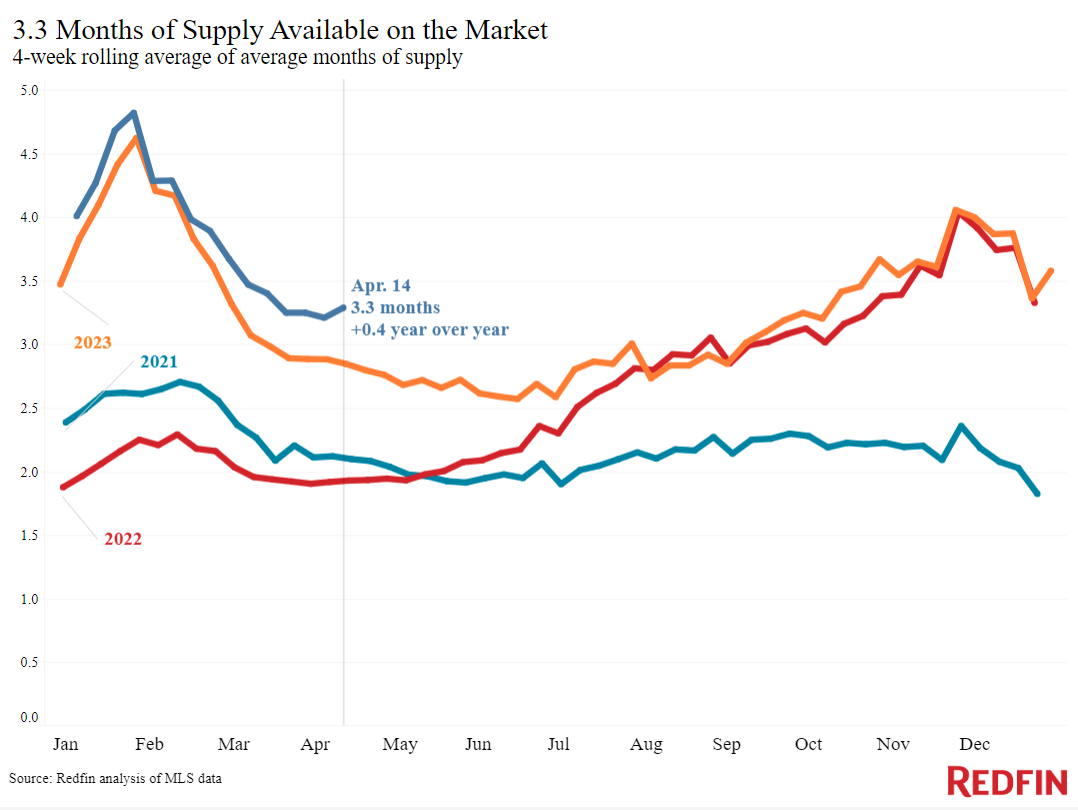

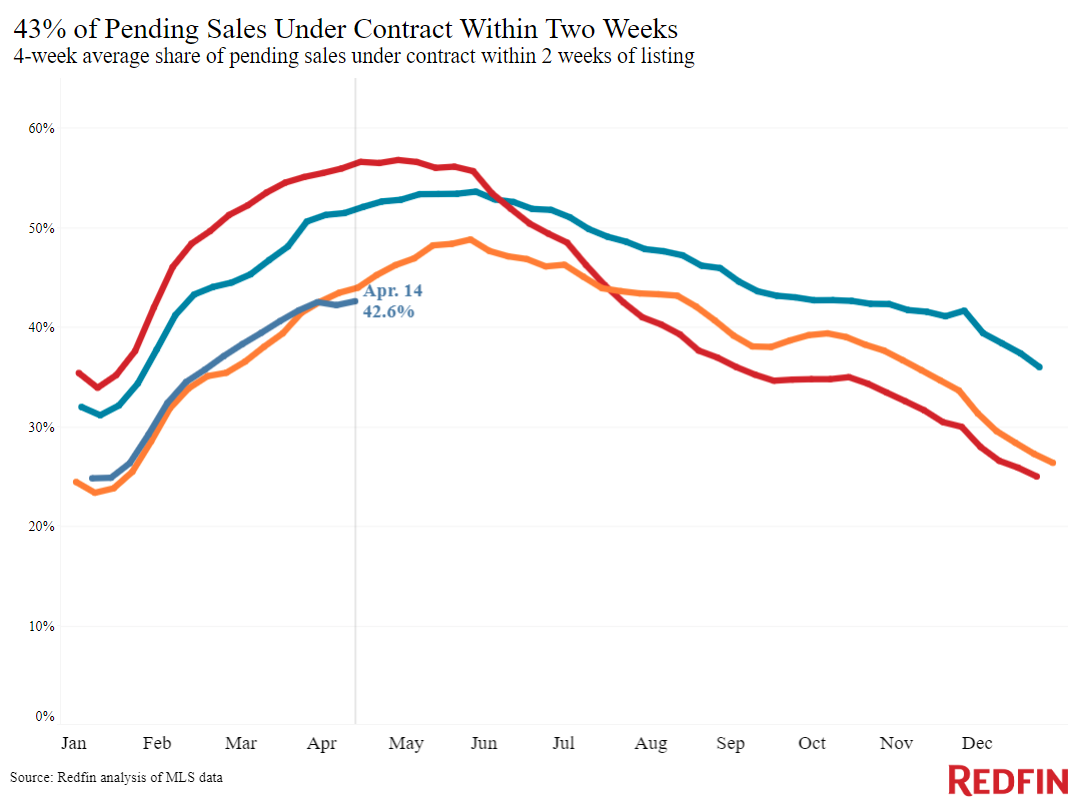

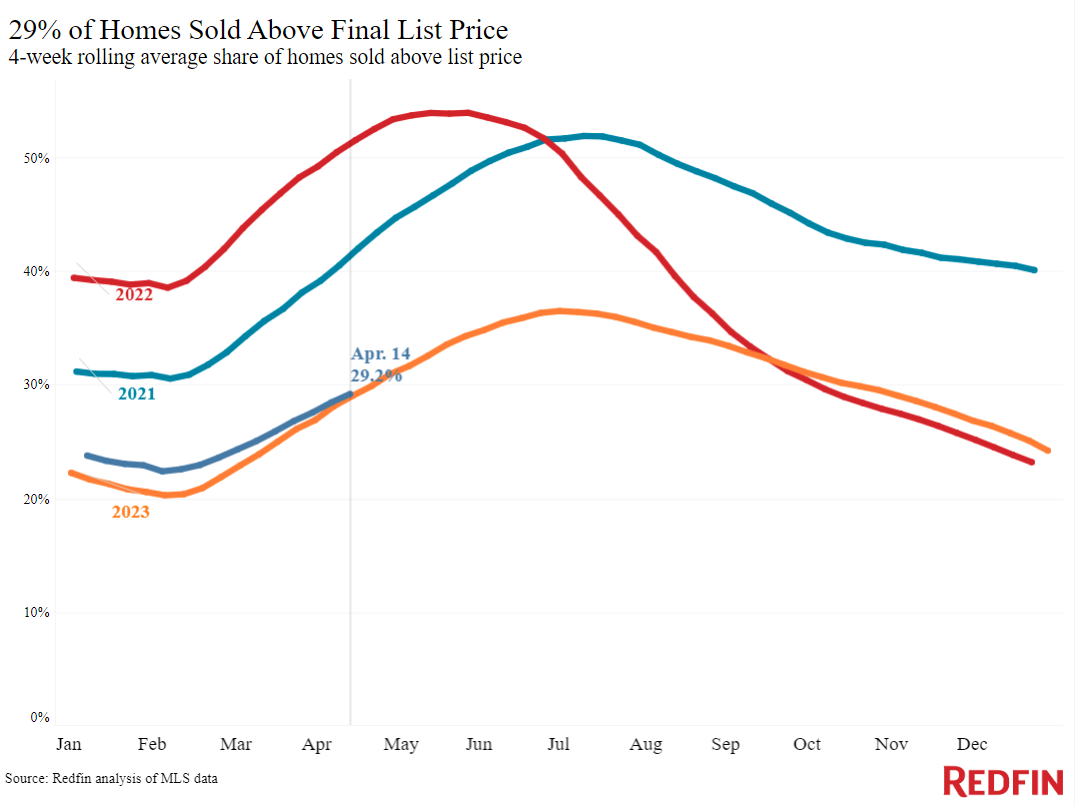

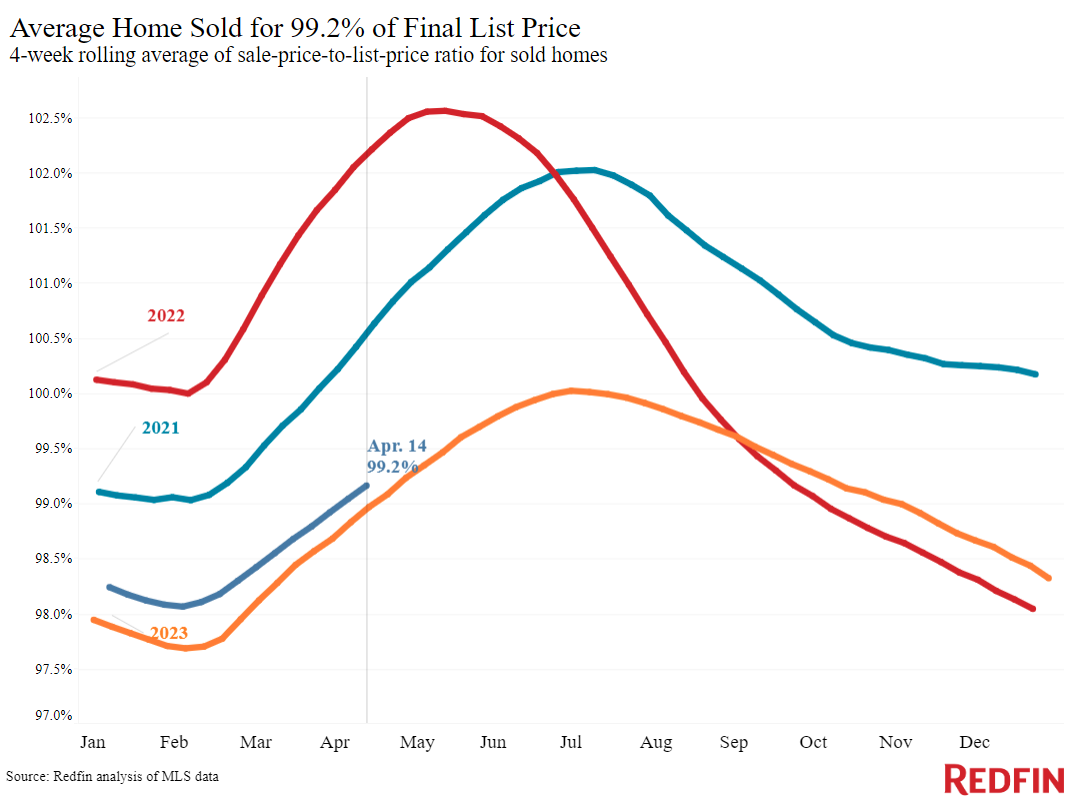

The average daily mortgage rate this week surpassed 7.4%, the highest level since last November, after a hotter-than-expected inflation report and the Fed’s confirmation that interest-rate cuts will be delayed. Home prices are rising, too: The median U.S. home-sale price increased 5% from a year earlier during the four weeks ending April 14, bringing it to $380,250—just $3,095 shy of June 2022’s all-time high. The combination of high mortgage rates and prices have brought homebuyers’ median monthly housing payment to a record $2,775, up 11% year over year.

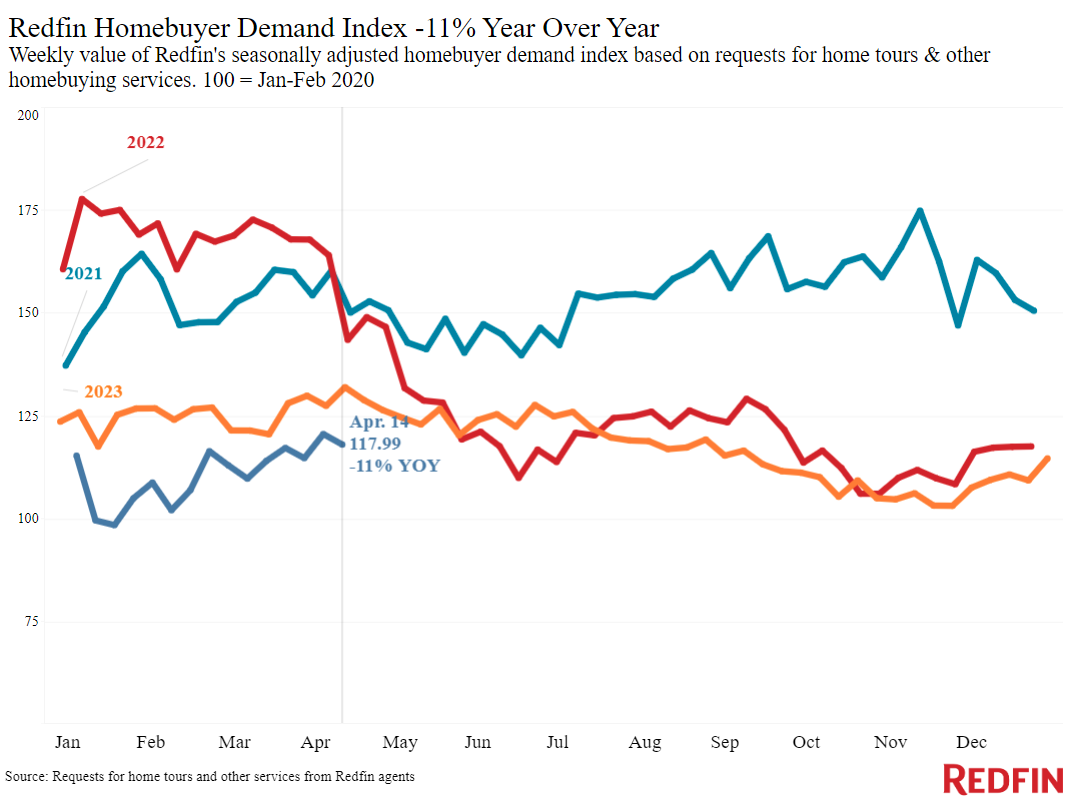

There are signals that buyers are out there touring homes despite rising rates. Mortgage-purchase applications are up 5% week over week, and Redfin’s Homebuyer Demand Index–a measure of requests for tours and other buying services from Redfin agents–is near its highest level in seven months. Chen Zhao, Redfin’s economic research lead, said some house hunters are hoping to buy now because they’re concerned rates could rise more, and others have grown accustomed to elevated rates and pushed down their home-price budget accordingly.

“Home sales are slower than usual, but there are still people buying and selling because if not now, when?” said Connie Durnal, a Redfin Premier agent in Dallas. “I’ve had a few prospective buyers touring homes for the last several years, since mortgage rates started going up, and they wish they would have bought last year because prices and rates are even higher now. My advice to them: If you can afford to and you find a house you love, buy now. There’s no guarantee that rates will come down soon.”

For more of Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit Redfin’s “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.