Mortgage rates dropped from over 7% to 6.6% this week on better-than-expected inflation news, bringing some hope to prospective buyers.

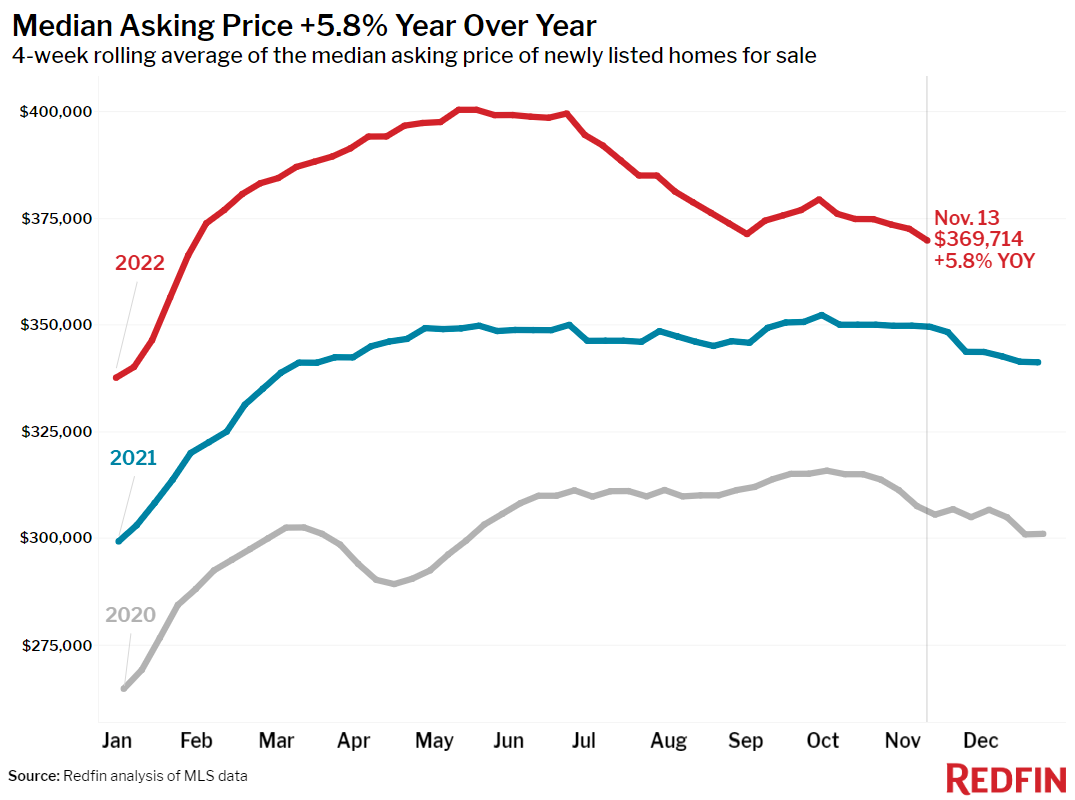

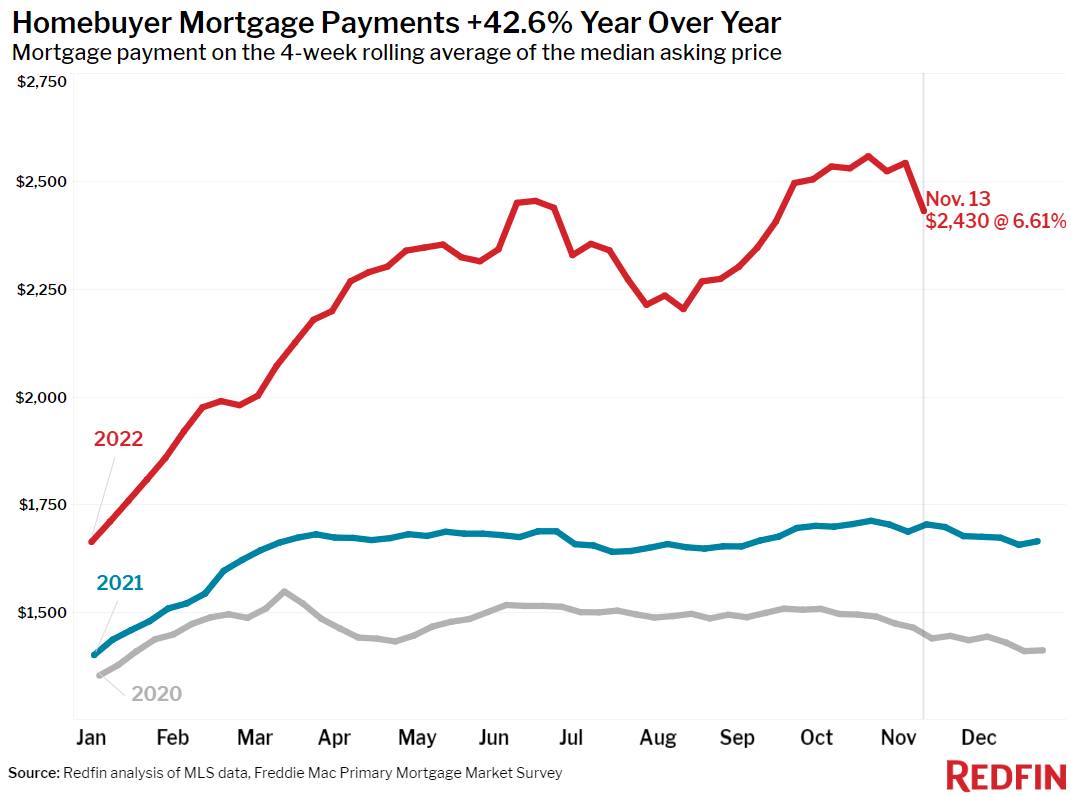

The largest weekly drop in mortgage rates in four decades, along with the slowest annual home-price growth since the start of the pandemic, is providing some relief for would-be homebuyers’ budgets.

Last week’s better-than-expected inflation report led to the biggest single-day mortgage-rate drop on record and the largest weekly drop since 1981, with rates declining from 7.08% to 6.61% during the week ending November 17. Declining rates are bringing some buyers back to the market; mortgage-purchase applications shot up 4% from the week before during the week ending November 11.

The typical monthly mortgage payment nationwide is now $2,430, down from $2,542 with last week’s 7% rates. To look at it another way, a homebuyer on a $2,500 monthly budget can afford a $380,750 home with today’s 6.6% rates, giving them $12,000 more purchasing power than they had a week ago. That same buyer could have bought a $368,750 home with last week’s 7% rates.

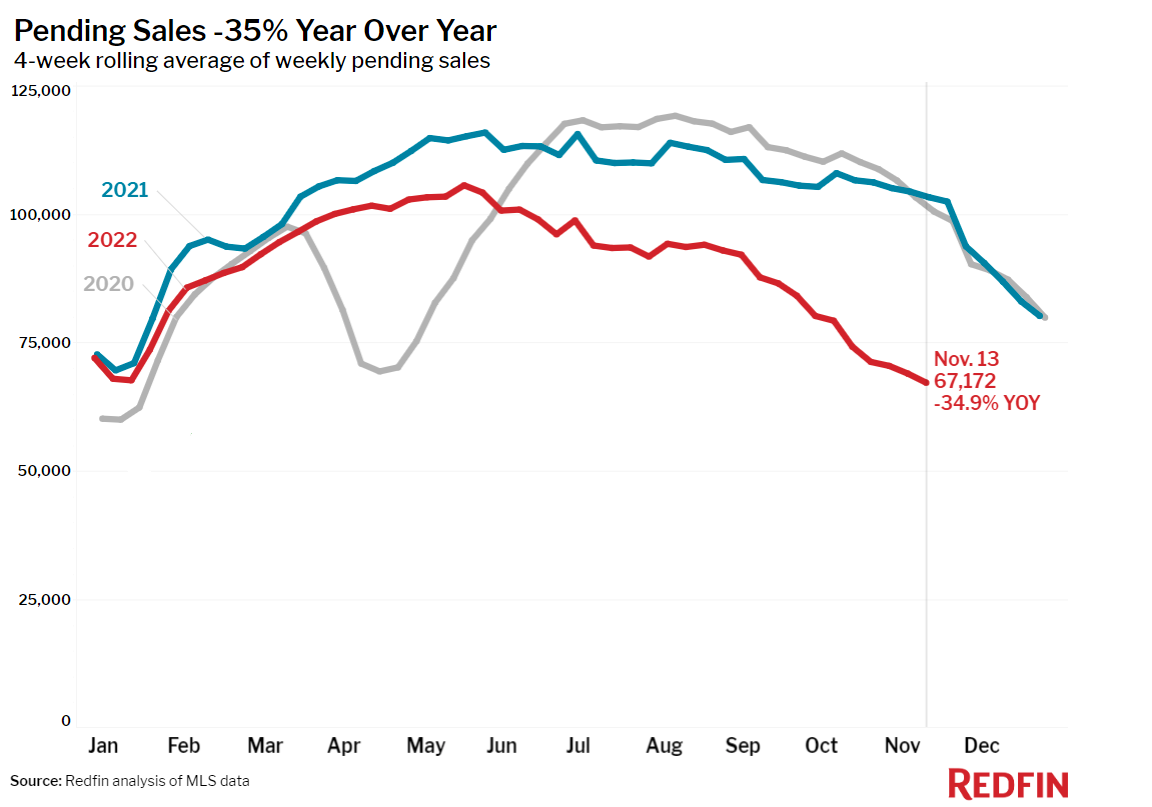

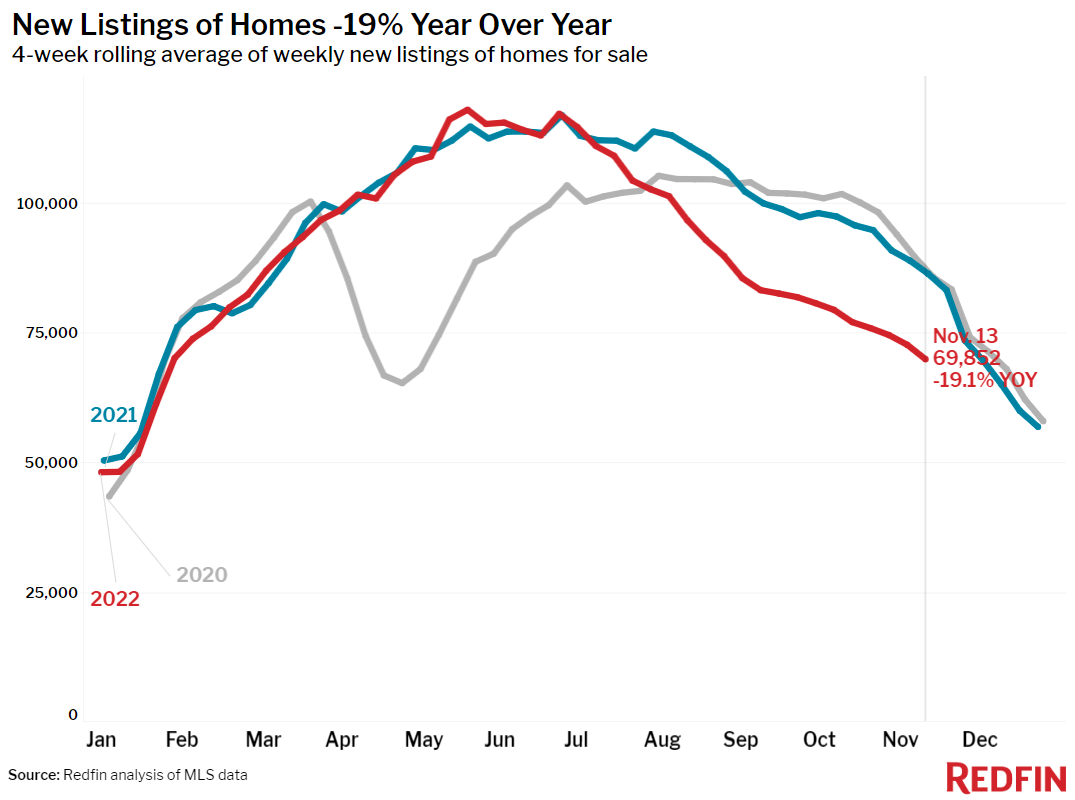

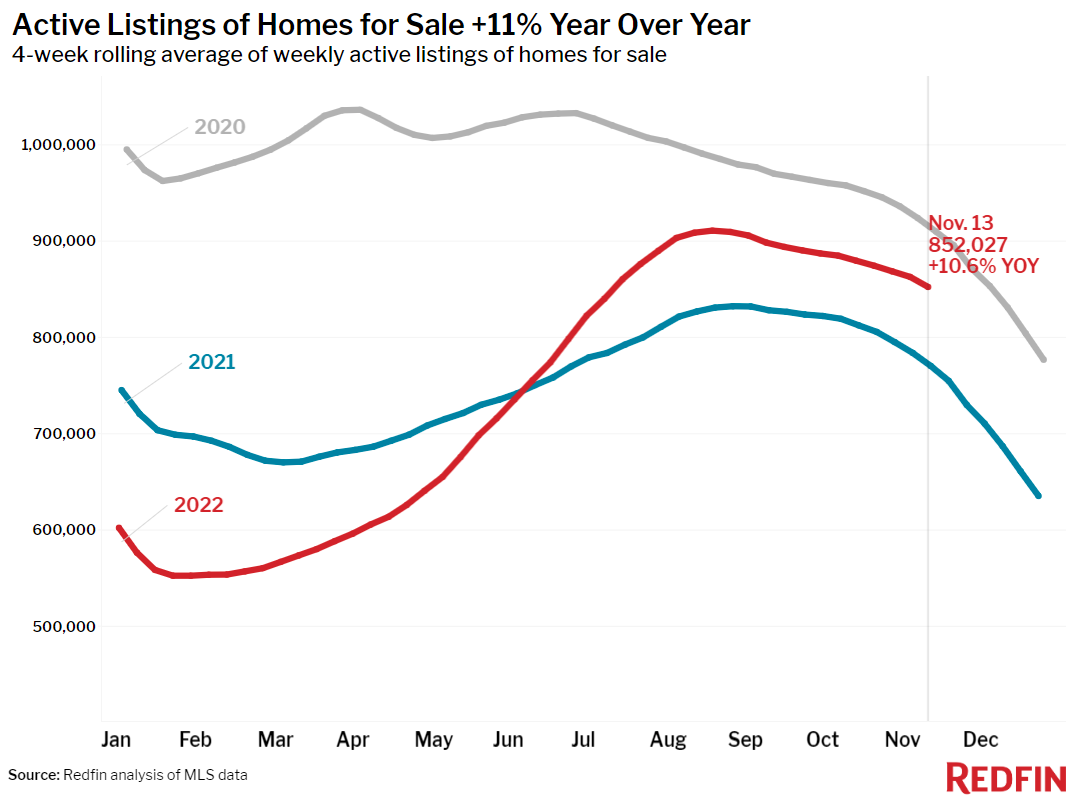

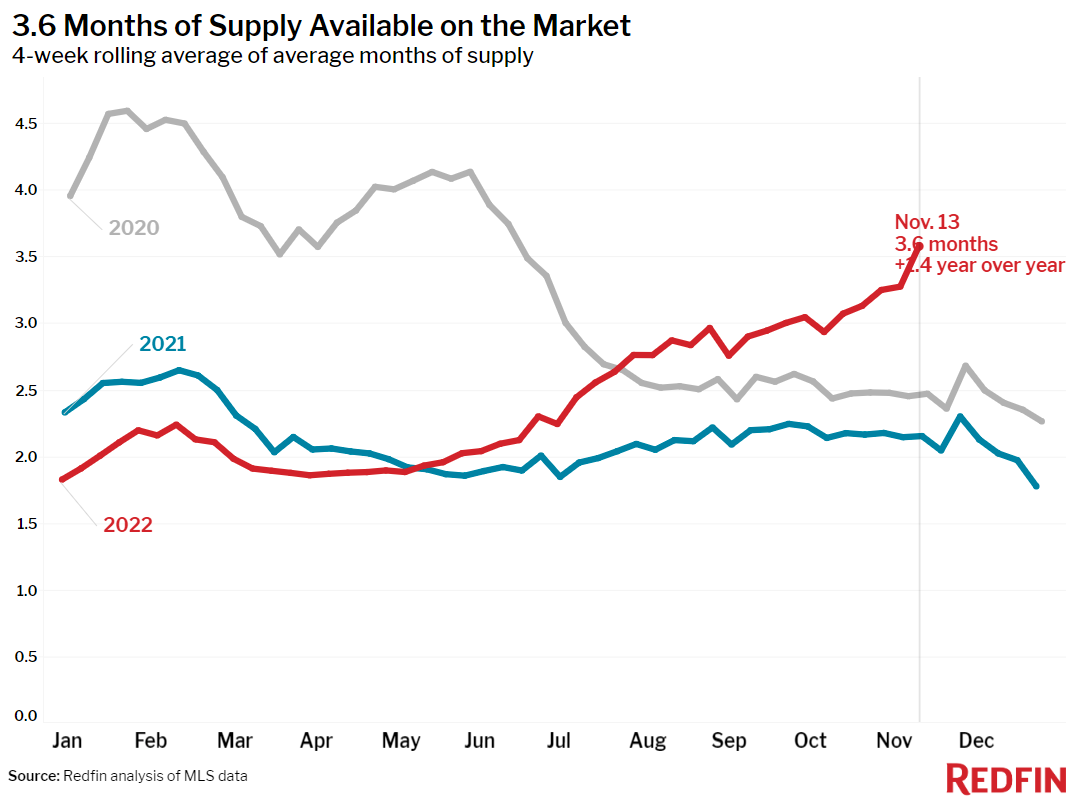

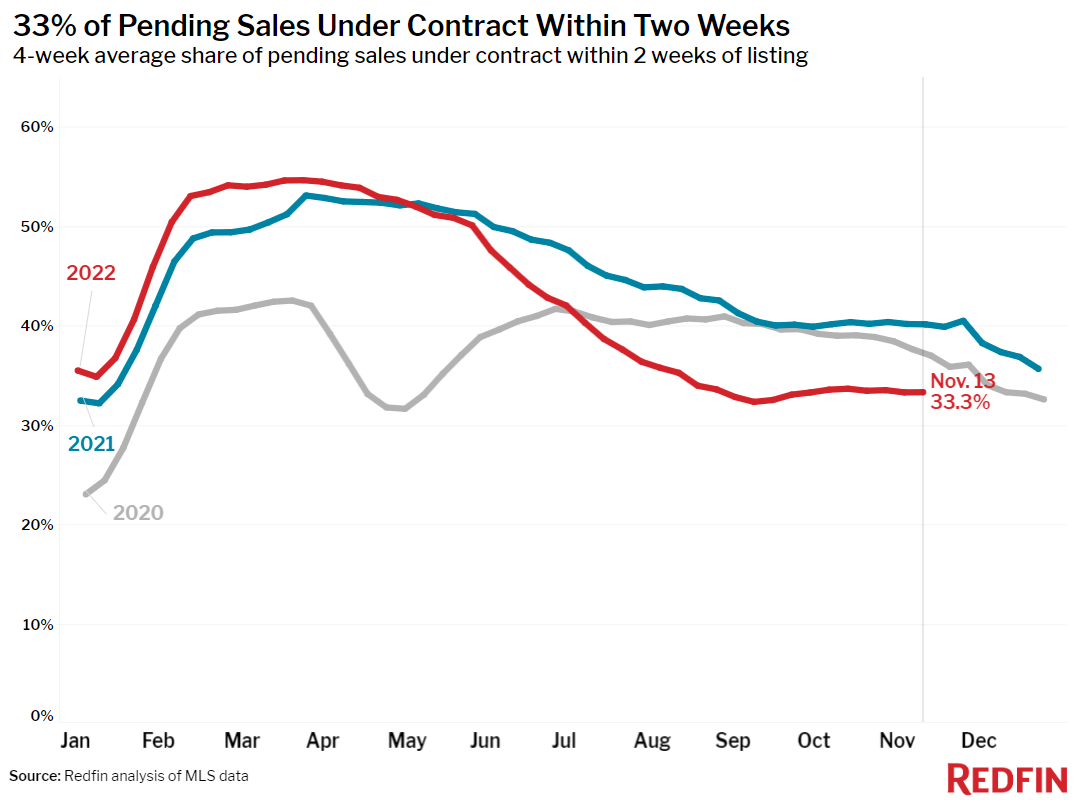

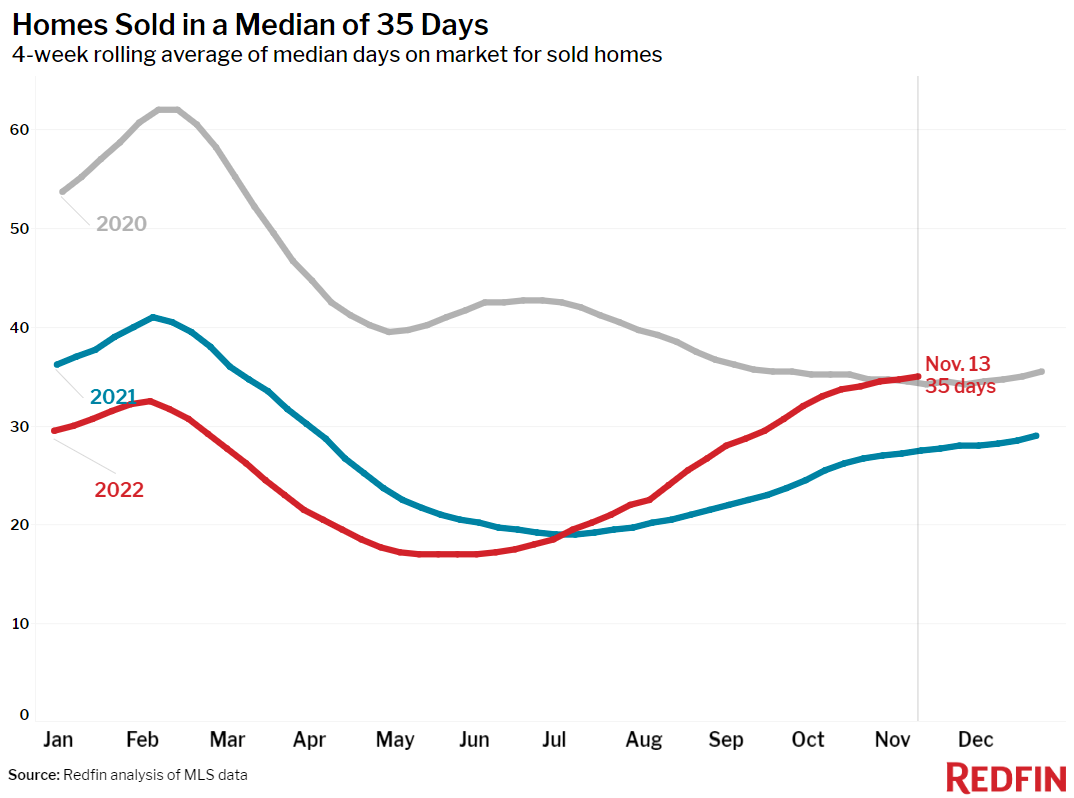

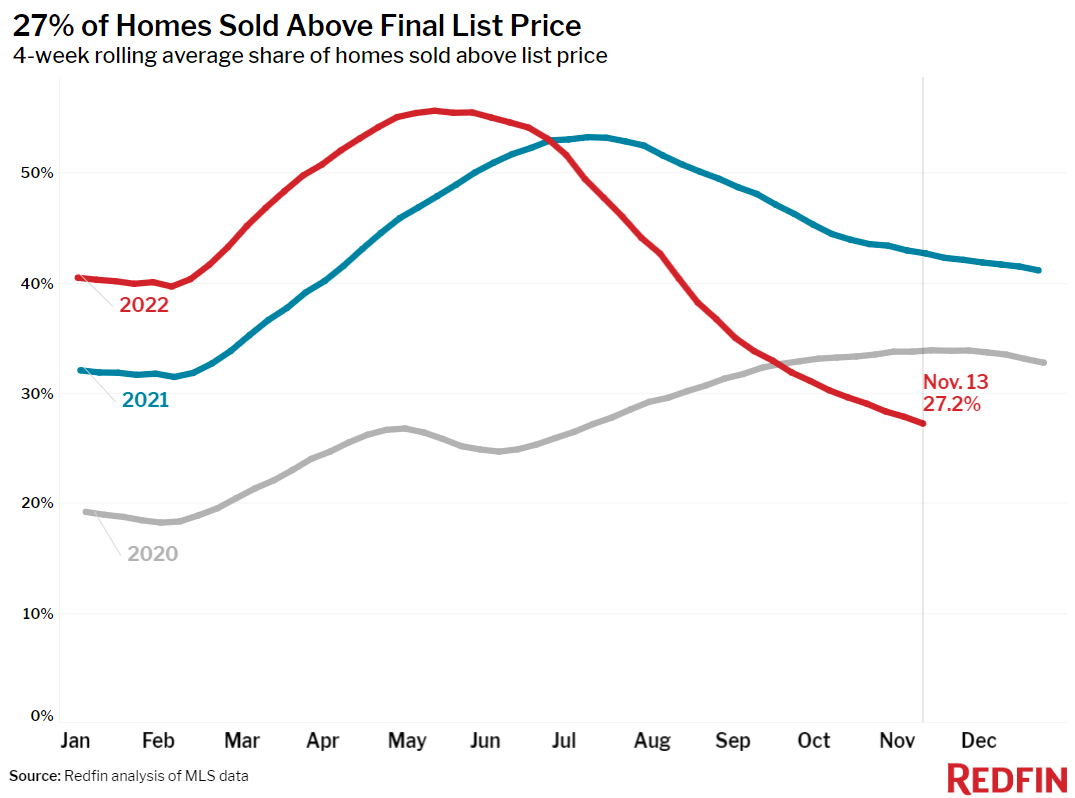

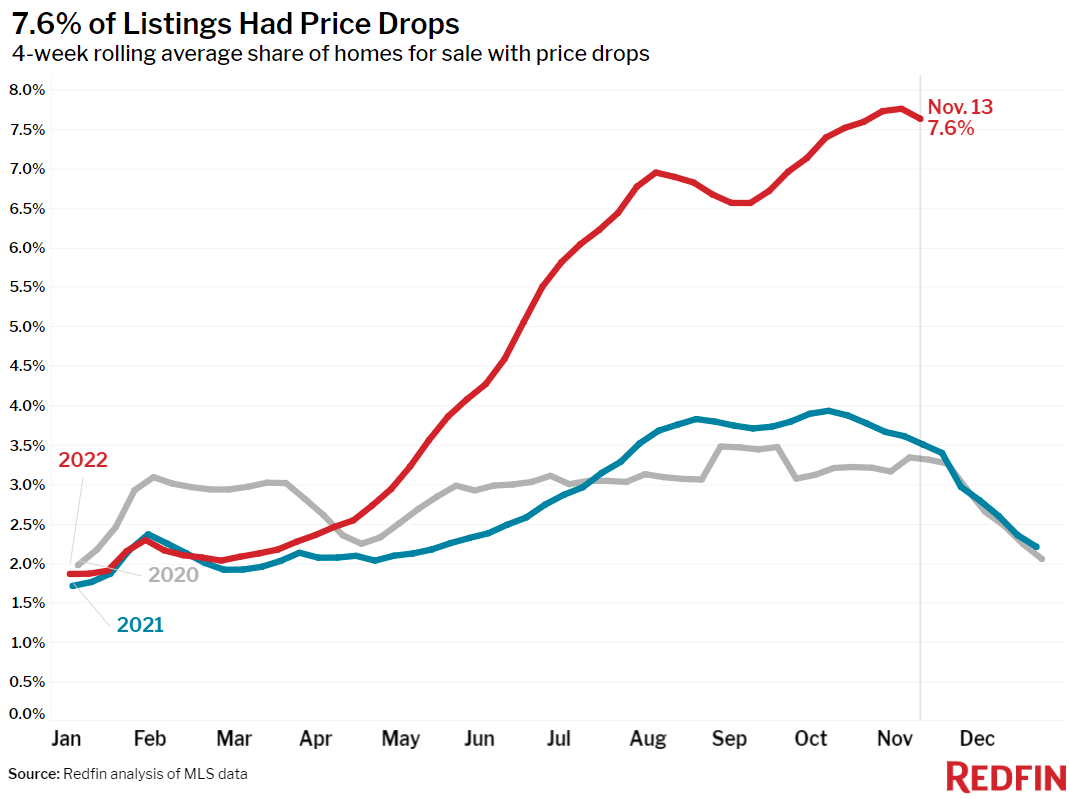

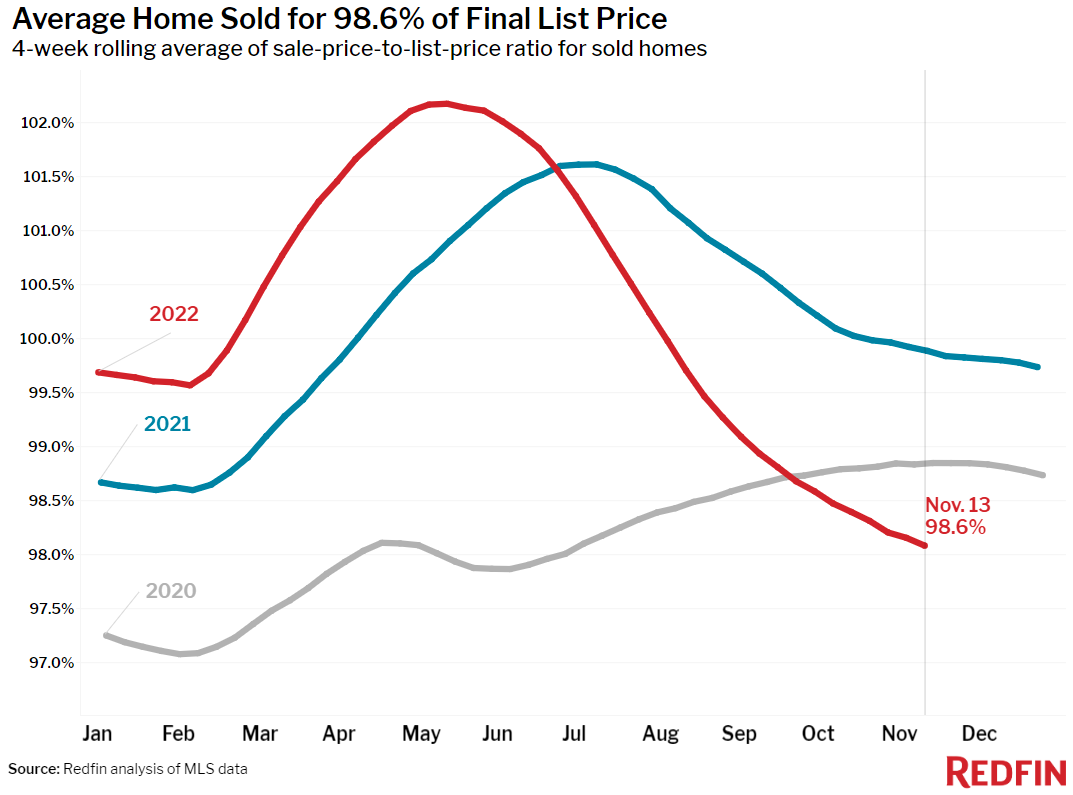

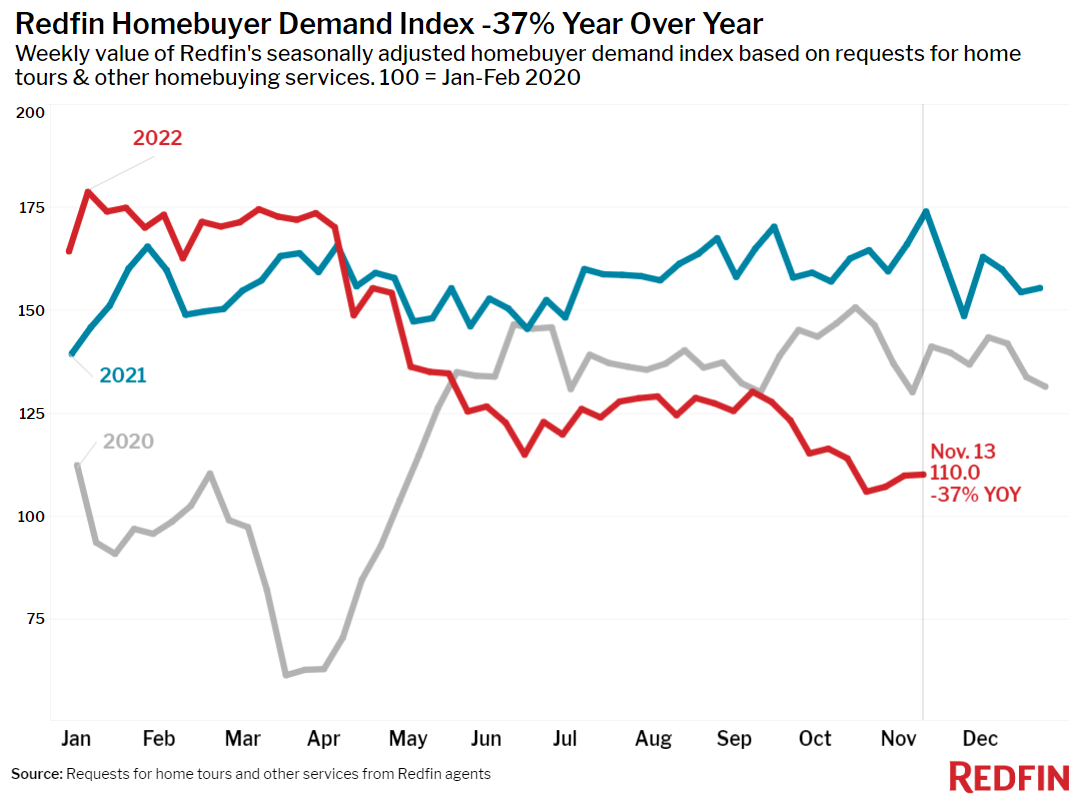

But rates are still more than double where they stood a year ago and Redfin’s housing-market data hasn’t shown an uptick in homebuying or selling interest yet–though we wouldn’t expect to see an increase until next week at the earliest, when buyers and sellers have had a chance to react to lower rates. Pending home sales were down 35% year over year during the four weeks ending November 13, the biggest annual decline on record. Redfin’s Homebuyer Demand Index–a measure of requests for home tours and other homebuying services–was unchanged from the week before but down significantly from earlier this year and last year.

“The historic drop in mortgage rates is a tick in the ‘good news’ box for the housing market, as lower rates deliver an immediate win for prospective buyers’ pocketbooks,” said Redfin Deputy Chief Economist Taylor Marr. “Until we see more consistent evidence over time of slowing inflation and a bigger, steadier decline in mortgage rates, we expect the impact to be muted. Pending sales and new listings may stop declining, but they aren’t likely to see a major boost until there’s more certainty that the Fed’s efforts to curb inflation are working.”

“Serious buyers who need to purchase a home as soon as possible can feel good about pouncing on a home this week, knowing it could cost them upwards of $100 less per month than the same home would’ve cost if they’d signed the deal a week earlier,” Marr continued. “More casual buyers may want to wait a few more months, as there’s reason to be cautiously optimistic that the worst of inflation and high rates are behind us and monthly payments could come down more.”

Unless otherwise noted, the data in this report covers the four-week period ending November 13. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.